Theme 6 II F: Firms and Decisions

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

State command and market-orientated policies

Command measures | Market-oriented Measures |

|

|

Describe MonoC, Oligo, Mono on whether need GI

MonoC |

Overall: Benefits > costs -> no GI |

Oligo and mono |

Overall:

|

Define market dominance

Market dominance (Def.): Extent to which the total output in a market is produced by one firm

Describe aim of CCCS

Aim of CCCS: Ensures firms battle on a level playing field and compete through greater efficiency, lower pricing, and improved products so that consumers benefit from lower pricing, new products, and greater choices

State regulations government can impose

Disallowing mergers / acquisitions that lead to a significant concentration of market power by a single firm

Making price-fixing (where firms agree to sell their product at a specific price) and predatory pricing illegal

Breaking up monopolies

Explain Making price-fixing (how it works)

Firms must pay fines if they get caught -> disincentivises firms from engaging in anti-competitive agreements -> less supernormal profits

Less market power + more competition -> improve AE

Governments use loss aversion to nudge firms against anti-competitive behavior -> firms want to avoid loss from fines

Explain Making price-fixing (limitations)

Difficult to prove that firms collude or engage in anti-competitive actions (Especially tacit collusion)

Small fine may not be sufficient to disincentivise firms from engaging in anti-competitive behaviour -> loss aversion on firm limited -> reduce effectiveness of fine as deterrent

Explain Making price-fixing (example)

In 2018, after Grab acquired Uber’s Southeast Asia operations, Grab was fined about $6.4 million while Uber was fined $6.58 million by CCCS as the merger was deemed to have significantly reduced competition in the ride-hailing market in Singapore (As it removed Grabs closest rival)

Explain breaking up monopolies (how it works)

Governments can file lawsuits against large firms that abuse their market power to break them up into smaller firms

Firms are forced to divest, selling off a portion of their assets to increase competition -> improve AE

Explain breaking up monopolies (limitations)

Rival firms may abuse anti-trust laws to retaliate against successful firms who captured a large part of the market because they were able to provide consumers with a better product

Prevent firms from reaping the benefits of mergers (EOS -> lower costs and prices)

Explain breaking up monopolies (examples)

In 2022, the US Federal Trade Commission filed an antitrust lawsuit against Facebook (now Meta) -> targeting the takeover of Instagram and WhatsApp, to break up the monopoly power

Describe deregulation

Governments can also ‘open up’ markets by reducing BOE -> increase supply, competition and innovation -> lower prices for consumers

With a reduction in market power of dominant firms, the market moves towards a more efficient and equitable outcome

Describe electricity market in Singapore

Natural monopoly due to high BOE (high cost of setting up generators, purchasing specialised equipment and laying cables)

Since 2001, the Singapore government has progressively opened up the electricity market

The potentially competitive functions of generation and retail have been separated from functions such as the transmission and distribution of electricity, which exist as natural monopolies

Starting from 2018, households can choose to buy electricity from a retailer at a price plan that best suits their needs

At its peak, households and businesses can choose to purchase electricity from around 12 active and licensed electricity retailers, compared to just from SP Group (back then was a monopoly)

Describe entities involved in bringing electricity to consumers

Generation companies manage the power plants that generate electricity

Grid company manages the transmission and distribution network

Retailers and Market Support Services Licensee (MSSL) sell electricity to consumers

In Singapore, SP Services serves as the MSSL

It provides services such as retail settlement and meter reading, facilitates customer transfers between retailers for all consumers and supplies electricity at the regulated tariff (pre-determined fixed price) to consumers who have not appointed an electricity retailer

4. Energy Market Authority (EMA) regulates the market to ensure that Singaporeans have a secure, sustainable and affordable energy supply (NOT bring electricity to consumers)

Describe regulate pricing

Monopoly has significant EOS -> case for continuation of monopoly is strong as consumer get lower prices

BUT firms with market dominance restrict output and produce less than AE output

Government can regulate monopoly/oligopoly pricing

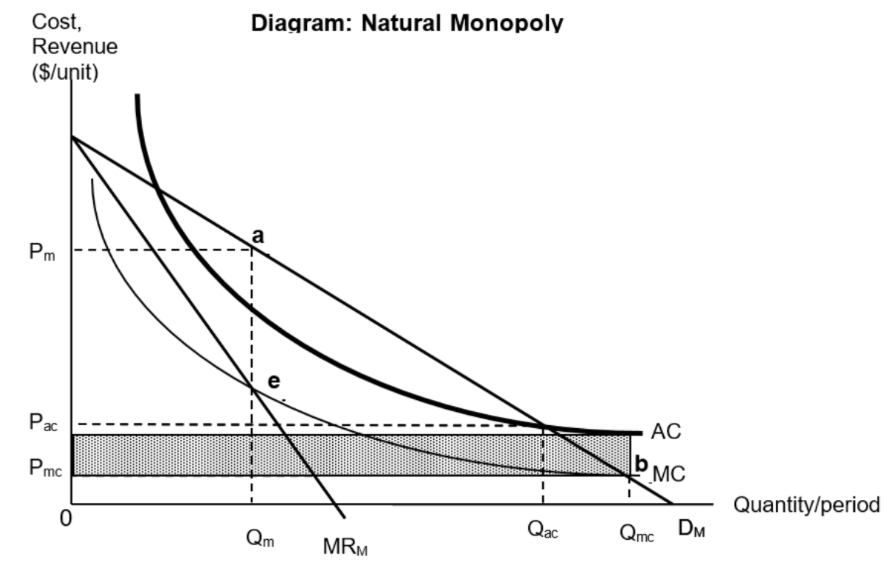

Describe natural monopoly

Market can only support 1 firm

Characterised by falling AC and MC throughout whole range of output level for market

Arises from significant EOS + high set-up costs

Eg. Railroads

Deregulation is not an option since only one firm can produce the good/service profitably

AND better for industry to remain a monopoly for lower prices (can supply a good or service to an entire market at a lower unit cost than could two or more firms)

Describe MC pricing on natural monopoly

Original welfare loss: area abe

Government uses MC pricing -> compel monopolist to charge Pmc and produce Qmc where MC = AR

Firm will earn subnormal profits of (Pac-Pmc) x Qmc (shaded area)

To solve this:

Government would have to subsidise the natural monopolist for the loss (shaded area) so that the monopoly earns at least normal profits

In order for the monopoly to be able to continue production

OR

Natural monopolist is allowed to levy a fixed initial charge for access to the service such that this fixed charge = shaded area to offset the loss due to pricing the goods below the AC

Charge = registration fees, connection fees, administrative charges

This is ‘two-part tariff’ system

Draw MC pricing on natural monopoly graph

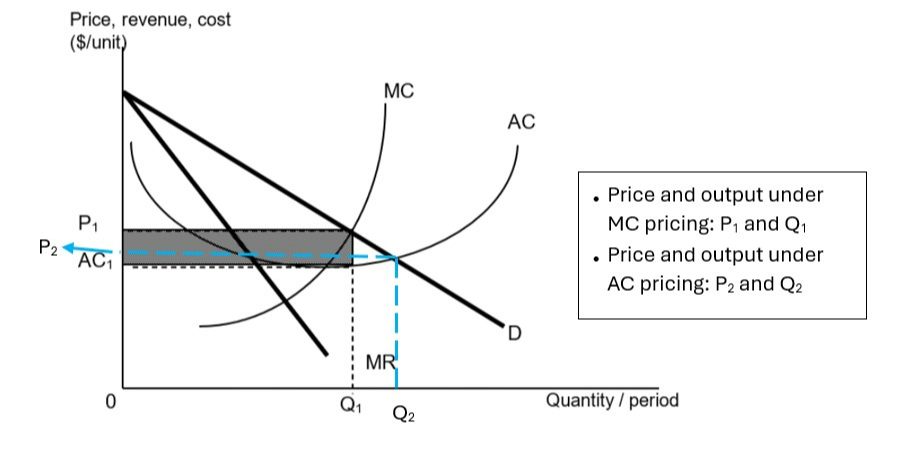

Draw MC pricing on normal monopoly/oligopoly graph

MC pricing: earn supernormal profits if P1 = MC > AC1

AC pricing: earn normal profits

Describe AC pricing on natural monopoly

If the government is not willing or unable to subsidise the monopoly, then the next best alternative is to implement AC pricing

Make the natural monopolist charge Pac and produce Qac so monopolist makes normal profits

Improve AE (but still have a little welfare loss) without government incurring expenditure from subsidy

State limitations of MC/AC pricing

Due to imperfect information, regulators do not know the demand and cost curves of the monopoly

In order to maximize profits, the monopolist has incentive to provide regulators with inaccurate information so that they can produce less and charge higher prices for more profits.

Describe nationalisation and its limitation

Governments take over the natural monopoly and become the producer of the good -> nationalised firm will produce the allocative efficient output and charge the price, P = MC (funded by tax revenue)

OR

Government to build and manage the network and allowing private profit-maximising firms to rent the network to supply the product and services directly to consumers

Eg. The government could own and operate the cable network for cable TV and different private cable TV firms can pay the government for the use of the network while competing against each other in supplying cable TV programmes to consumers.

Limitation:

Government lacks incentive to minimise costs -> X-inefficiency

If the government covers the losses of the natural monopoly, it may result in opportunity cost

Describe subsidy and limitation

Government could provide the monopolist with a per unit production subsidy that lowers MC so MC (that is inclusive of the subsidy) = MR @ AE output

Limitation:

Such subsidies lower the firm’s AC -> increase supernormal profits -> more inequitable income distribution

Describe tax and limitation

Government could tax the monopolist’s supernormal profits -> improve income distribution (taxes redistributed to the poor in society)

Limitation:

Reduces the incentive for the firm to invest in R&D -> no DE