non current assets

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

what does PPE stand for?

property, plant, and equipment

(tangible things)

examples of PPE?

land, property, machines, natural resources like oil, timber, and minerals

how is PPE measured in the balance sheet?

total cost to purchase the asset (PPE net) - accumulated depreciation. The resulting value is called PPE net and that is reported on the balance sheet.

how does PPE exit the balance sheet?

when it is no longer being used because we sell it or throw it away

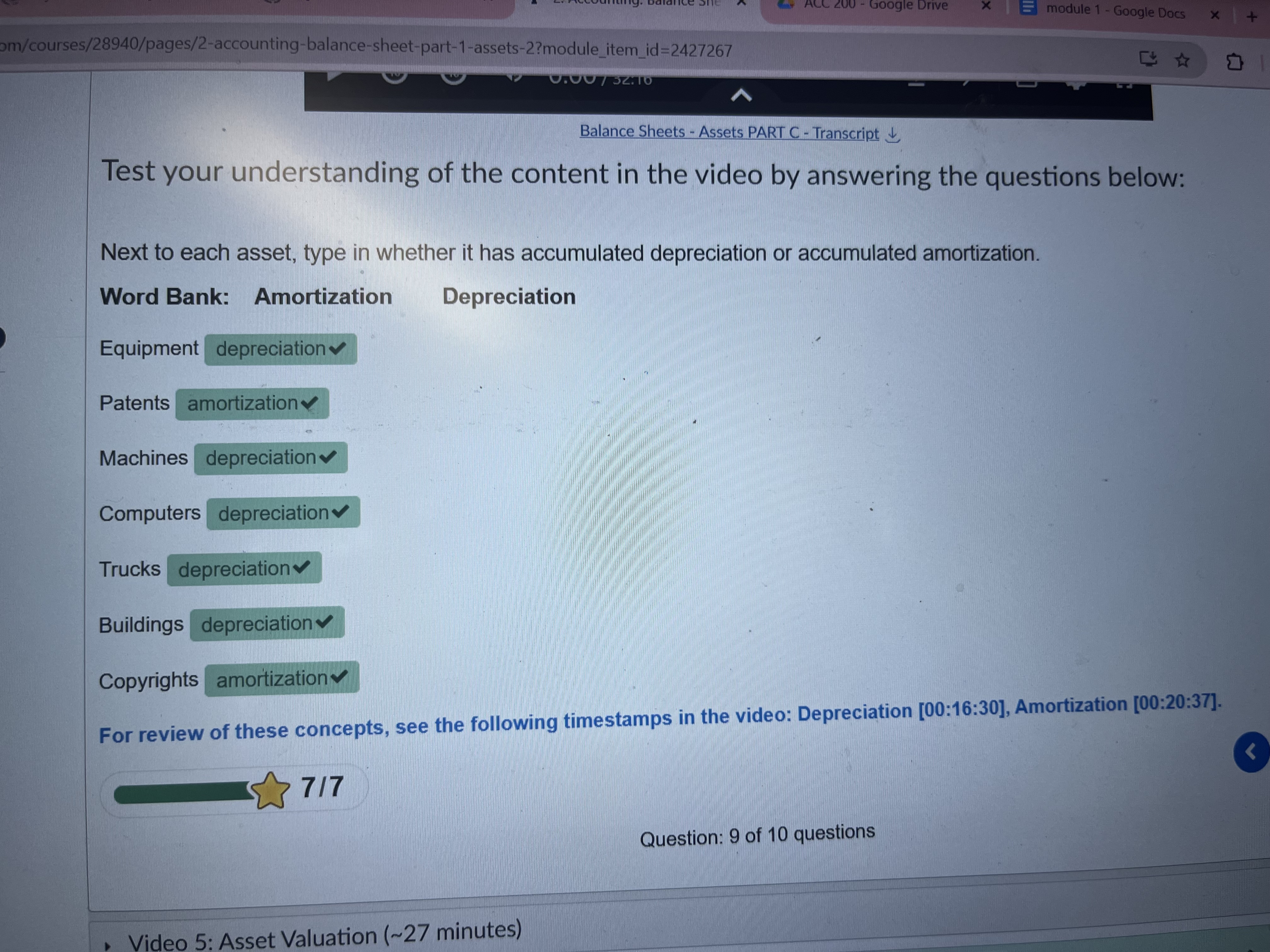

what is depreciation?

everyday conversations: decrease in value or selling price

accounting: the allocation of an asset’s cost to an expense over the period the asset is expected to be used by the company. depreciation is a cost reported on the income statement.

what does ratably mean?

evenly spread

when applied to depreciation it is called “straight-lined depreciation”

true or false: accumulated depreciation is a contra-asset

true. because it decreases the value of the asset (PPE)

how would you calculate the annual depreciation cost?

total cost/time=annual depreciation cost

how would you calculate the annual depreciation cost of the PPE still has value at the end??

(total cost - end value)/time= annual depreciation cost

in land depreciated?

NOOOO

what are operating leases?

the legal right to use an asset for a specified period of time, i.e., rent of warehouse

how are operating leases measured on the balance sheet?

it’s complicated. present value of all future lease payments. (not learned in this class)

how are operating leases exit the balance sheet?

the lease ends

what are intangible assets?

CONTRACTS: like patents, copyrights, trademarks

how are intangible assets measured on the balance sheet?

total cost to purchase the asset - accumulated amortization. the resulting value is called intangible assets, neg and that is used on the balance sheet.

how does the intangible assets exit the balance sheet?

it is sold or deemed as worthless

what is “straight-lined depreciation” called when talking about intangible assets?

amortization

true/false: non current assets are expected to be used for more than one year

true

true/false: equipment is reported on the balance sheet at the cost to purchase the asset

false

to an accountant the word “less” means…

minus or subtraction

what is another name for PPE net?

book value

because it’s value is reported on the books or on the balance sheet

are ALL assets recognized in the balance sheets?

no