Microeconomics

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

The law of demand

generally speaking and all other things being kept equal, the demanded quantity for a good decreases along its price. aka if the price increases the quantity demanded for a product decreases

Substitutes

when an increase in the price of A leads to an increase in demand for product B

Complimentary goods

it is when the increased price of A leads to a decrease in the demand for product B

normal goods

an increase in a consumers income leads to an increase in the goods demand

inferior good

when the increase in a consumers income leads to a decrease in the goods demand (eg bus trips, instant noodles, ect)

Giffen goodss

they are inferior goods whose demand increases along price (in violation of the law of demand). Those are typically goods which represent a large share of poor consumers budget and which do not have any substitutes.

The law of supply

everything else being kept the same and equal, the supply of a good or service is increasing along the price. There is a positive relashionship between the quantity supplied and the price

perfectly competitive markets

it can be described with the word atomicity which is that the market must be made up a very large number of buyers and sellers

homogeneity

when the exchanged goods and services are all identical

perfect information

it guarantees that the buyers know the price and all the relevant characteristics of the affected good.

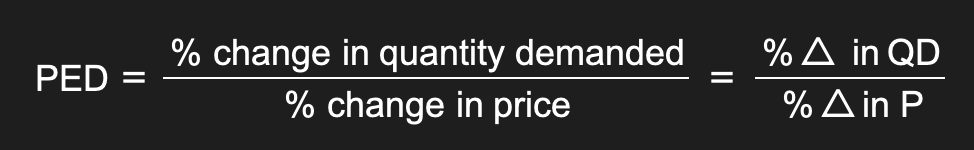

Price elasticity

it measures the relative variation of the demanded quantity in reacon to a relative ariation in the price of the good

price elasticity of demand

it measures how responsive the change in quantity demanded is to a change in price.

price elasticity of demand equations

when the price elasticity is 0

This means that the demand is totally inelastic to the price. the demand is totally independent of the price, and remains constant whatever happens. Example insulin for diabetic patients

when price elasticity is 1

this means that it is unit elastic, the demand variation is perfectly proportional to the price variation

the price elasticity is infinite

this means that demand is completely elastic and that the consumer is only willing to pay a unique price for the product

income elasticity

it measures the relative variation of the demanded quantity following the relative variation of the consumer income. This means by how many % points does a consumers demand vary when their income varies by 1%.

budget share

this is when a share of an agents total expenditures are devoted to buying a given good. The budget share of a inferior good decreases, but the budget share of a normal good decreases if the good’s income-elasticity is inferior to 1, remains constant is the good’s income-elasticity is equal to 1, and increases if the good’s income-elasticity is superior to 1

Demand cross elasticity

It is when a goods prices are relative to the quantity of another given good.The cross-elasticity of a given good i to another good j’s price is : negative if i and j are complements positive if i and j are substitutes

Supply Cross elasticity

It measures the relative variation of the supplied quantity in reaction to a relative variation in the price of the good. By how many percentage points does the supplied quantity vary when the price varies by 1% ?

Consumer Surplus

It basically means the price that a consumer is willing to pay for a good or service - the price that was actually paid for the good or service

producer surplus

it is a concept that aims at measuring the benefits realised by the sellers on the trading markets. Producer surplus = selling price - producer costs

efficiency of competitive markets

a resource allocation is efficient if it maximises the total surplus. In other words, the market equilibrium maximises the total surplus (the consumer and producer surplus)

price control

it is used by governments to influence the levels of production or consumption. there are two types of price controls: maximum prices (price ceiling) and minimum prices (price floors)

price ceiling or maximum prices

they are set by the government below the free market equilibrium and producers cannot legally sell the good or service at a higher price.

price floor (minimum price)

It is set by the government above the existing free market equilibrium price and sellers cannot legally sell the good/service at a lower price. Governments will often use price floors in order to help producers or to decrease consumption of a demerit good e.g. alcohol.

price floors or minimum wage

it is set by the government above the existing free market equilibrium and sellers cannot legally sell the good or service at a lower price

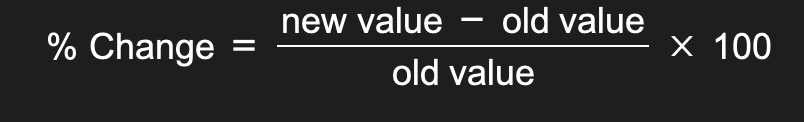

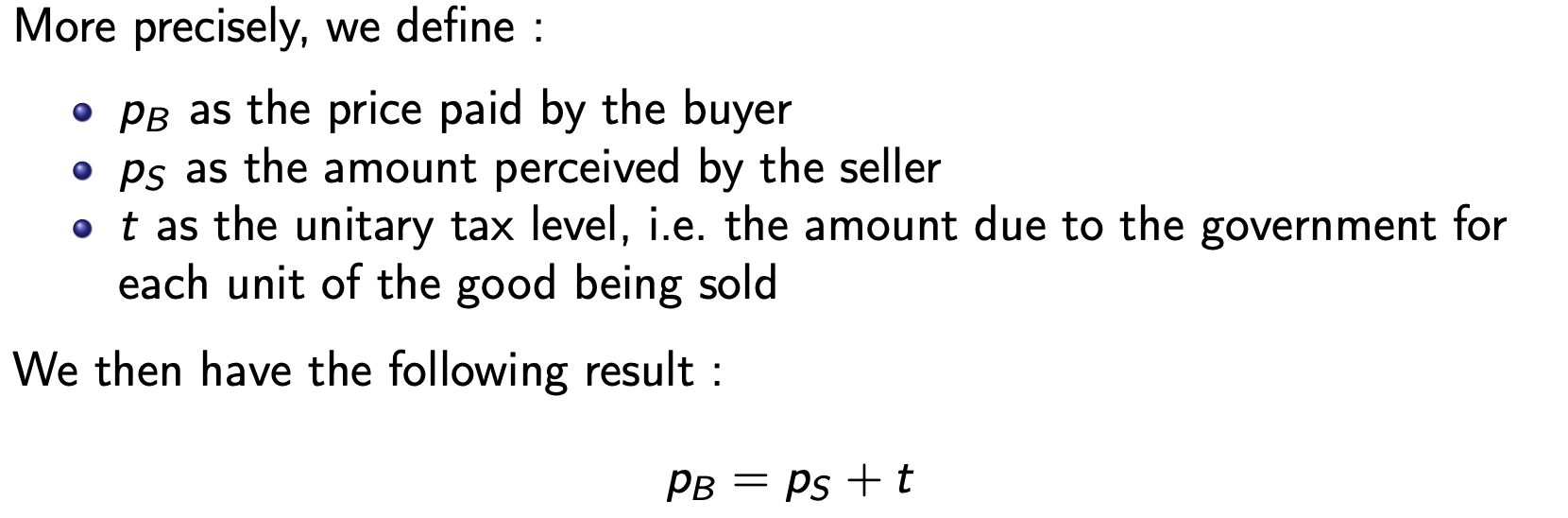

unitary tax

it is a tax by which a given amount of money is paid to the government for each unit of the good or service sold

unitary tax equation

fiscal wedge

It is the difference between the equilibrium price and quantity as a result of a tax that is placed on a good or service. Because of the tax, consumers pay more for the good and suppliers receive less for the good.

tax revenue

in order to calculate the tax revenue you need to multiply the “size” of the tax (which is calculated by t=Pb-Ps) by Qt (which is the quantity exchanged on the market featuring a unitary tax - Qt is less than Q*). the formula would be: tax revenue = t x Qt

price incidences (inelastic market)

when it is an inelastic market, this means that consumers find it very difficult to leave the market when prices increase. this means that consumers have to carry a greater share of the tax burden.

price incidences (inelastic market)

when a market is more elastic (i.e consumers can easily leave the market by restoring to substitutes) and/or supply is very rigid (i.e producers don’t want to leave the market incase of strong price variations) producers have to carry most of the tax burden

externality

there is an externality when the action of an agent impacts the welfare of another agent, and when this impact is left uncompensated by the market

negative externalities

occurs when an agents actions imply a welfare loss for other agents without compensation

production externalities

the negative or positive impact stemming from the production of a good or service

consumption externalities

a negative or positive impact from the consumption of a good or service

positive externalities

it occurs when agents actions imply a welfare gain for other agents, without the initial agent being compensated in any way.

negative externality of production

it is when the private cost of an action is inferior to its social costs

negative consumption externalities

it is when the social value of an action is inferior to its private value

free rider problem

when it comes to public goods, is that the supply of such a good is desirable to all but not necessarily profitable when there is no possibility to exclude people from consumption.