Financial Accounting

1/124

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

125 Terms

Accounting

Providing information to external users.

External Users

Lenders (creditors), Shareholders (investors), External auditors, Non Managerial and non executive and labor unions, regulators, voters, gov officials, contributors, suppliers, customers.

Internal Users

managers

Financial accounting

Needs of external users

Managerial accounting

focus on needs of internal users

Tax accounting

focus on tax filing, planning, and compliance

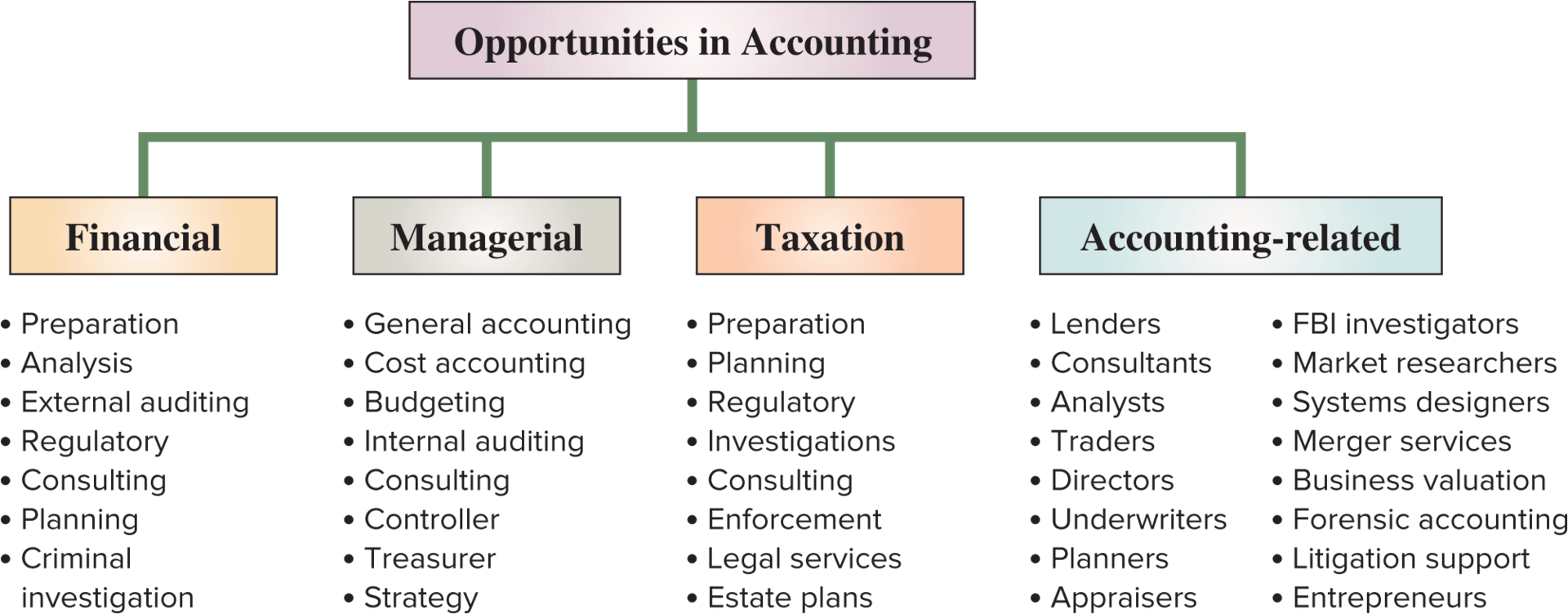

Financial Accounting opportunities

Financial, Managerial, Taxation, Accounting related.

Private accounting

Employees working businesses, internal users.

Public accounting

auditing, taxation, and advisory services. External users.

CPAs (Certified Public Accountants)

Accountants that must meet education and experience requirements, pass an exam, and be ethical.

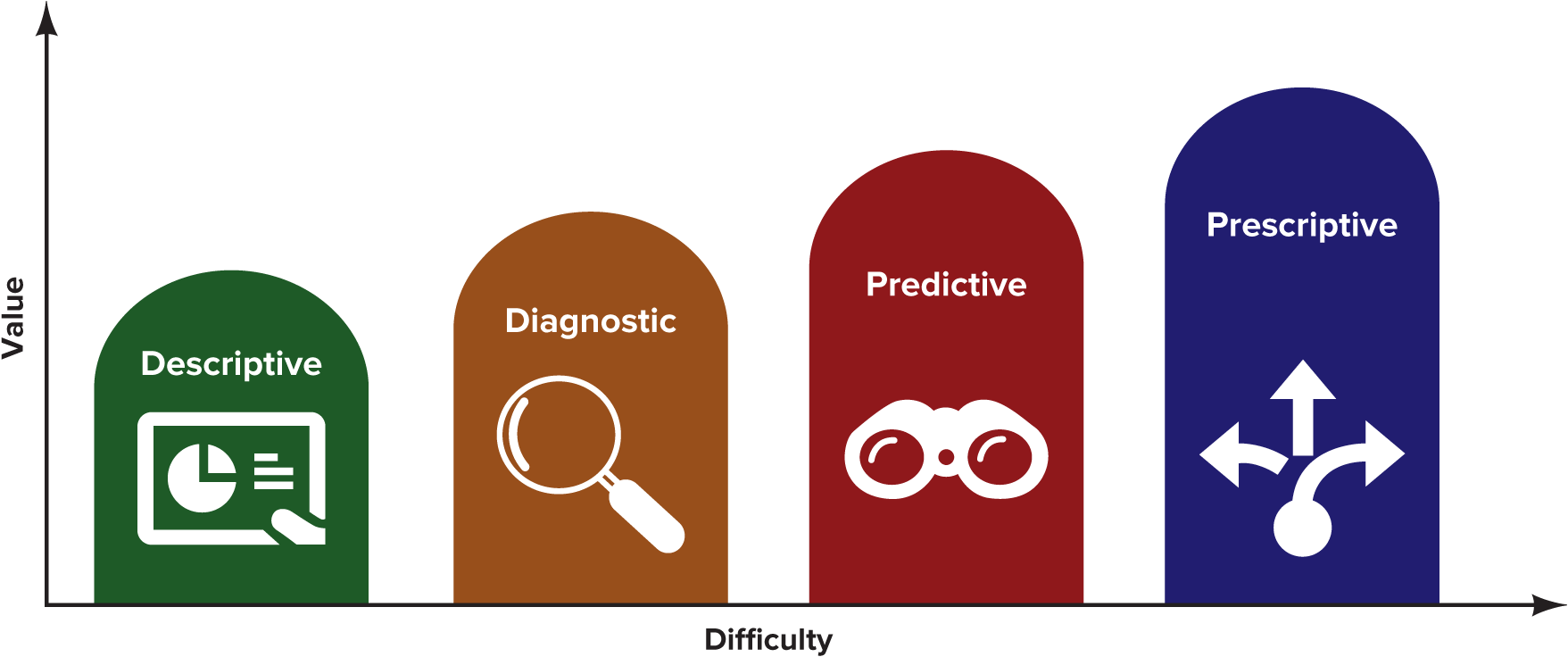

Data analytics

A process of analyzing data to identify meaningful relations and trends.

There are four types of analytics.

Descriptive, Diagnostic, Predictive, Prescriptive

Descriptive analytics

Summarizes and describes events from the past

Diagnostic analysis

reveals causes of events from the past

Predictive analytics

predicts likely events for the future

Prescriptive analytics

creates action plans to achieve a desired future

Data visualization

A graphical presentation of data to help people understand its significance and draw reliable inferences.

Ethics

Codes of conduct by which actions are judged as right or wrong, fair or unfair, honest or dishonest.

Three step process in making ethical decisions?

Identify ethical concerns, analyze options, and make a ethical decision.

Fraud triangle

(ORP)

Opportunity: must be able to commit fraud with a low rish of getting caught

Pressure: person must feel pressure or have incentive to commit fraud

Rationalization: person justifies fraud or doesn’t see it’s criminal behavior.

To help companies prevent fraud, companies set up…

internal controls

Internal controls or internal control system

All policies and procedures used to protect assets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies.

Auditors

Individuals hired to review financial reports and information systems. Internal auditors of a company are employed to assess and evaluate its system of internal controls, including the resulting reports. External auditors are independent of a company and are hired to assess and evaluate the “fairness” of financial statements (or to perform other contracted financial services).

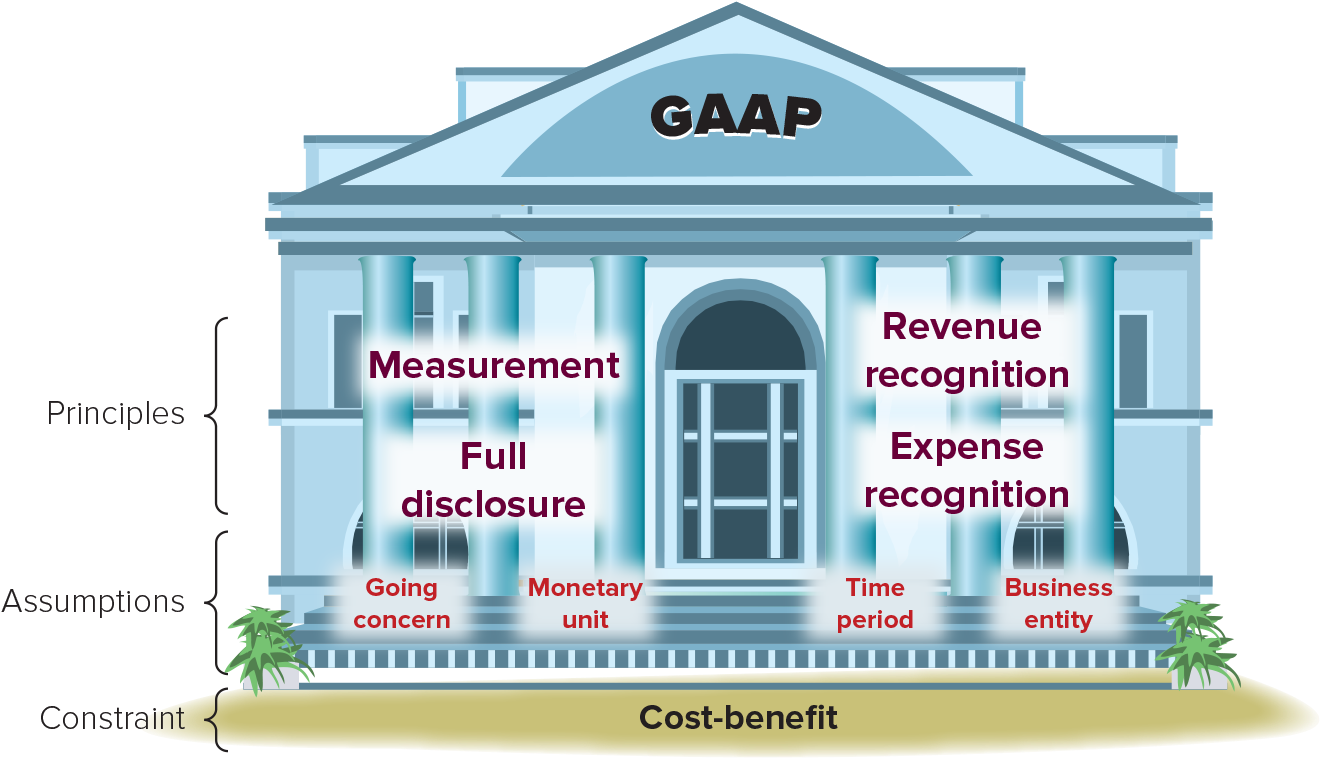

Generally accepted accounting principles (GAAP)

Rules that specify acceptable accounting practices.

Financial Accounting Standards Board (FASB)

Independent group of full-time members responsible for setting accounting rules (GAAP).

Securities and Exchange Commission (SEC)

Federal agency Congress has charged to set reporting rules for organizations that sell ownership shares to the public. They oversee proper use of GAAP

Audit

Analysis and report of an organization’s accounting system, its records, and its reports using various tests.

International Accounting Standards Board (IASB)

Group that identifies preferred accounting practices and encourages global acceptance; issues International Financial Reporting Standards (IFRS).

International Financial Reporting Standards (IFRS)

Set of international accounting standards explaining how types of transactions and events are reported in financial statements; IFRS are issued by the International Accounting Standards Board.

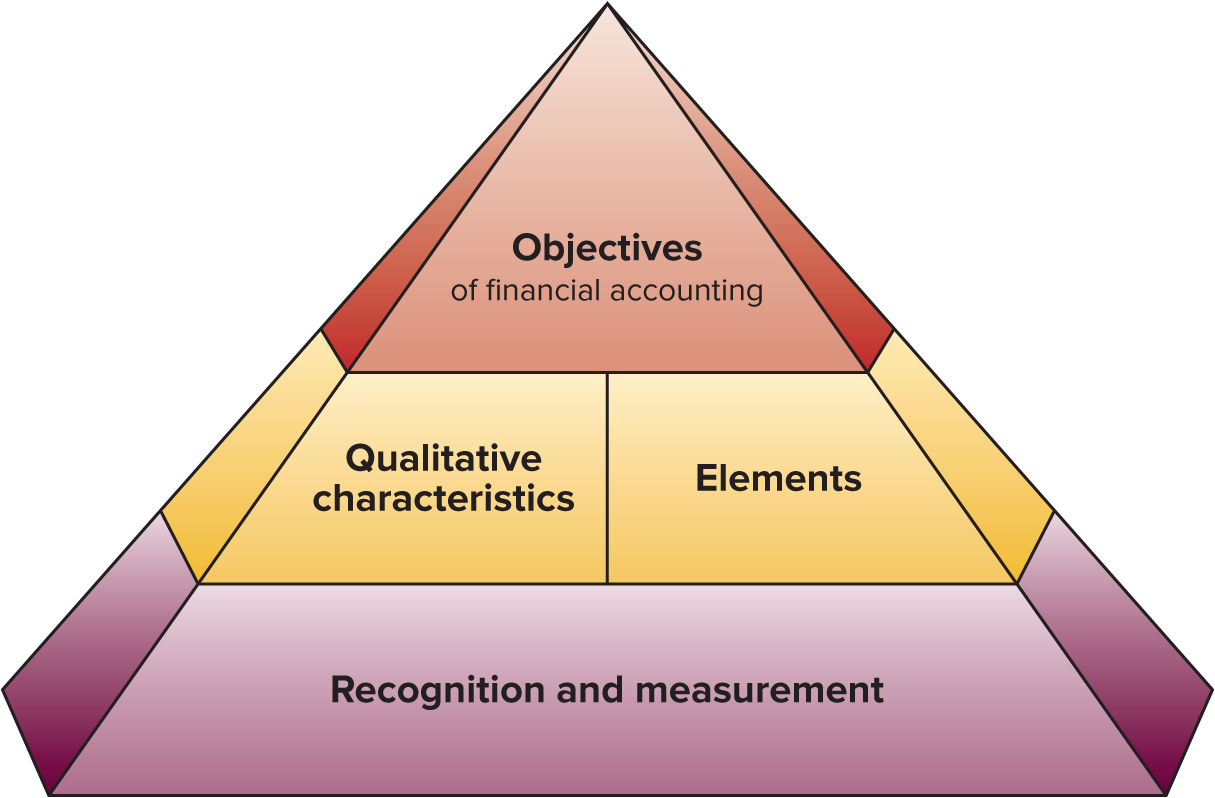

FASB conceptual framework (aka how they prep financial statements for external users)

Objectives, Qualitative characteristics, Elements, and Recognition/Measurement

Objectives in FASB framework

to provide into useful for investors, creditors, and others.

Qualitative characteristics for FASB framework

to require info that has relevance and faithful representation

Elements in FASB framework

to define items in financial statements

Recognition and measurement in FASB framework

to set criteria for an items to be recognized as an element; and how to measure it.

General principles vs Specific principles

General: the assumptions, concepts, and guidelines for preparing financial statements.

Specific: detailed rules used in reporting business transactions and events; they are described as we encounter them.

What are the four types of accounting principles?

Measurement (Cost), Revenue recognition, Expense recognition, and full disclosure principle.

Measurement principle

Principle that prescribes financial statement information, and its underlying transactions and events, be based on relevant measures of valuation; also called the cost principle.

Revenue recognition principle

The principle prescribing that revenue is recognized when goods or services are delivered to customers.

Expense recognition (or matching) principle

Prescribes expenses to be reported in the same period as the revenues that were earned as a result of the expenses.

Full disclosure principle

Principle that prescribes financial statements (including notes) to report all relevant information about an entity’s operations and financial condition.

What are the four types of accounting assumptions?

Going-concern assumption, Monetary unit assumption, Time period assumption, and Business entity assumption.

Going-concern assumption

Principle that prescribes financial statements to reflect the assumption that the business will continue operating.

Continuity

Goes with going-concern.

Monetary unit assumption

Principle that assumes transactions and events can be expressed in money units.

Time period assumption

Assumption that an organization’s activities can be divided into specific time periods such as months, quarters, or years.

Business entity assumption

Principle that requires a business to be accounted for separately from its owner(s) and from any other entity.

Cost-benefit constraint

The notion that the benefit of a disclosure exceeds the cost of that disclosure.

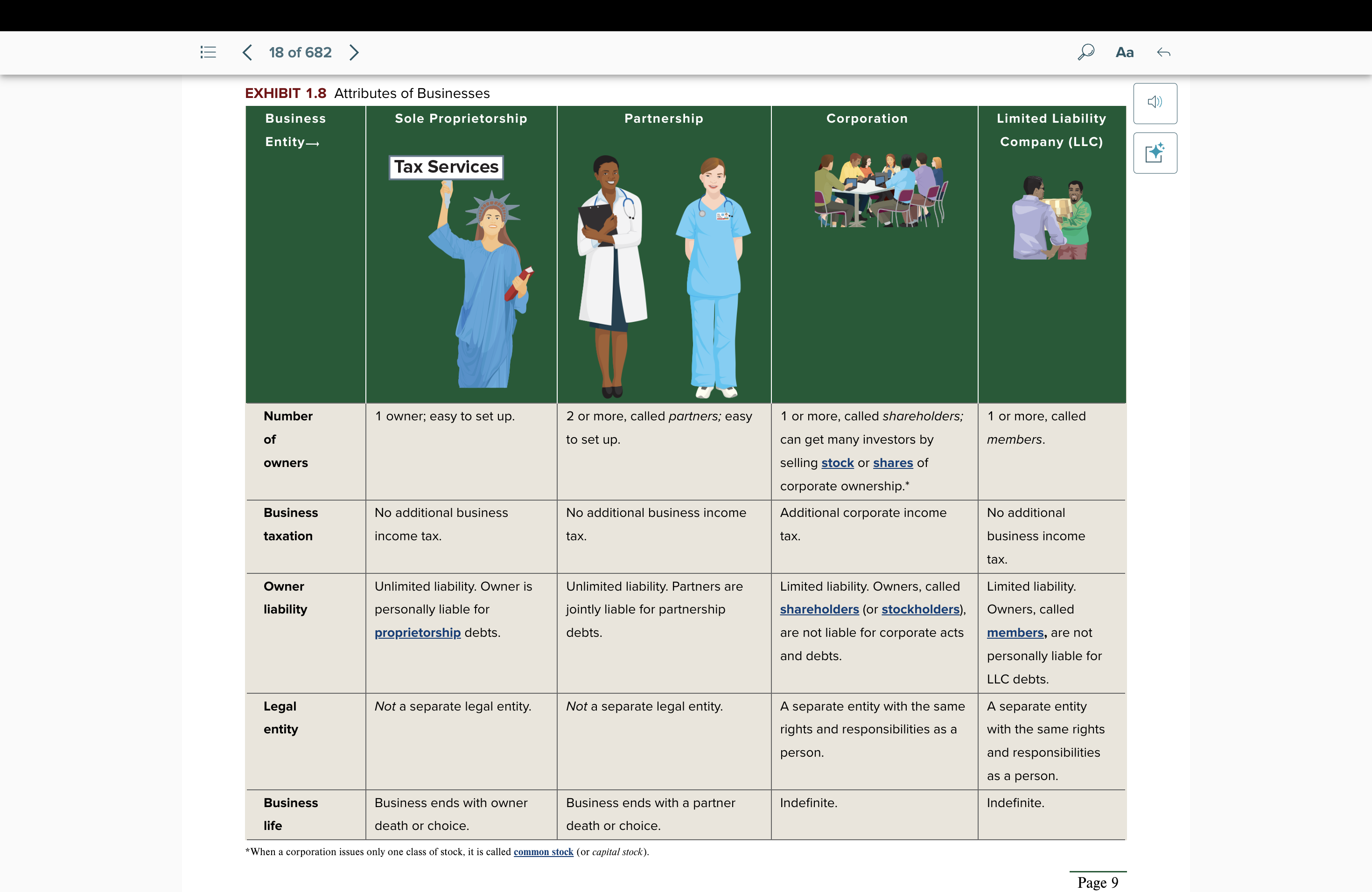

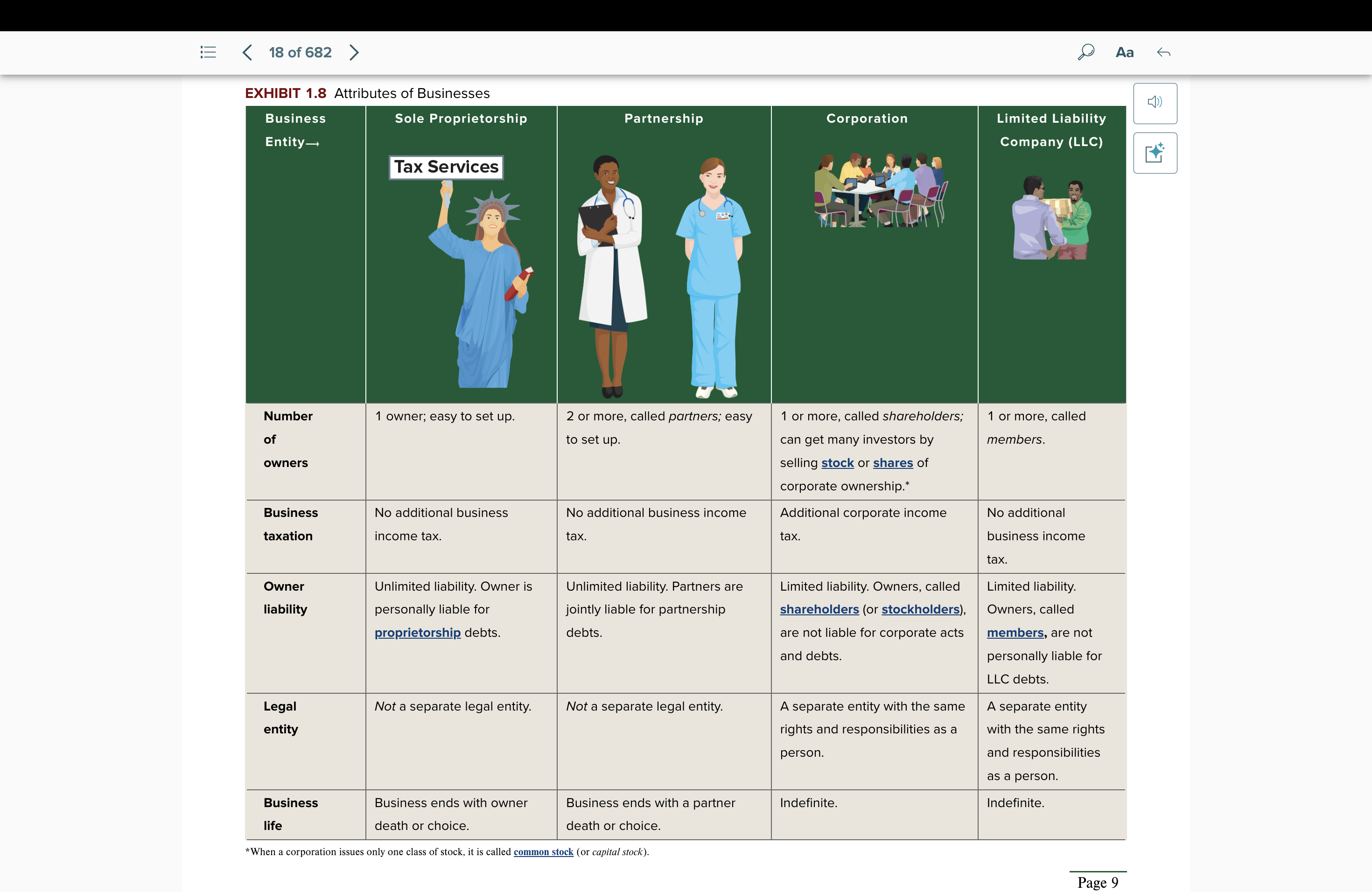

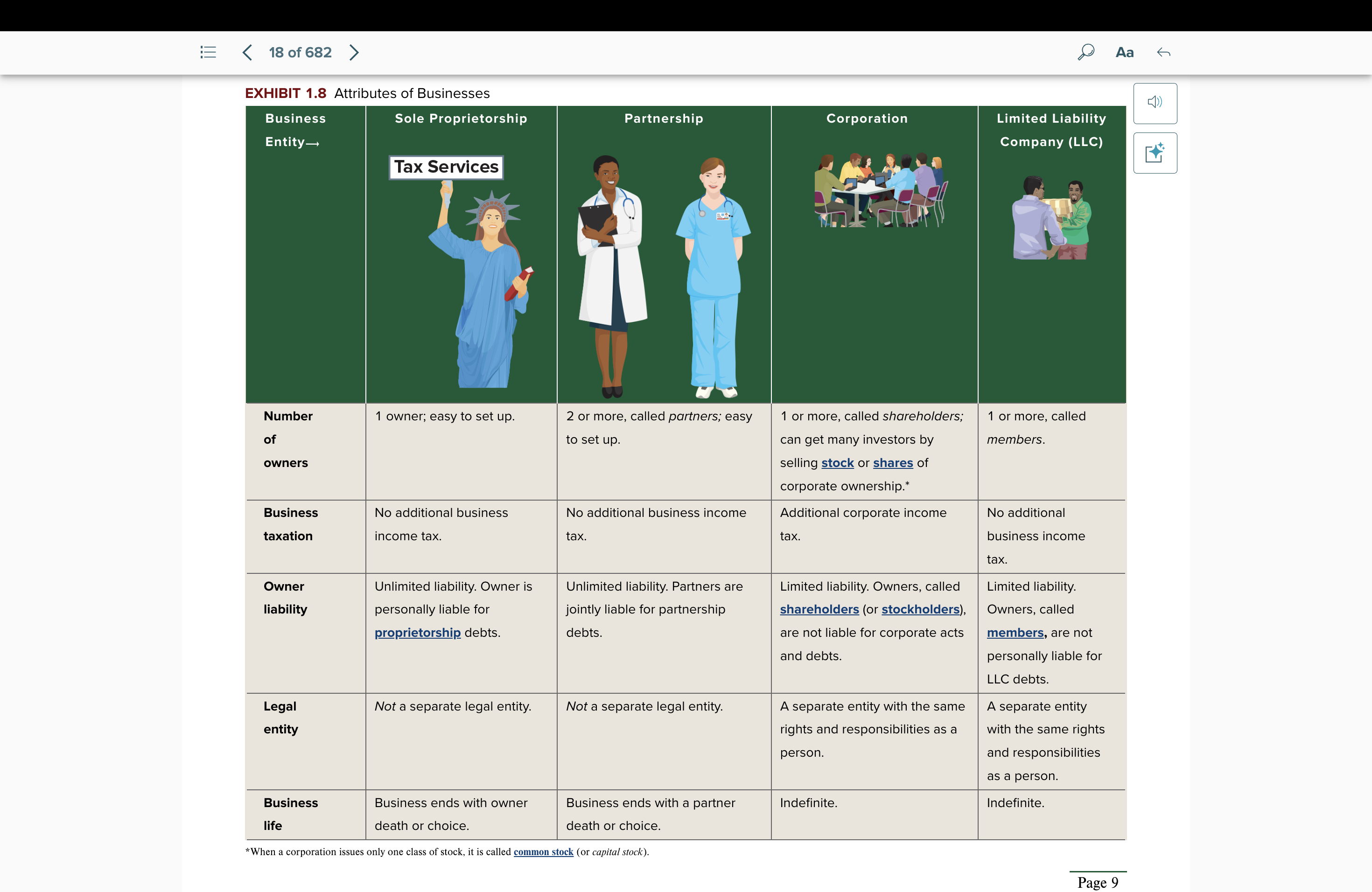

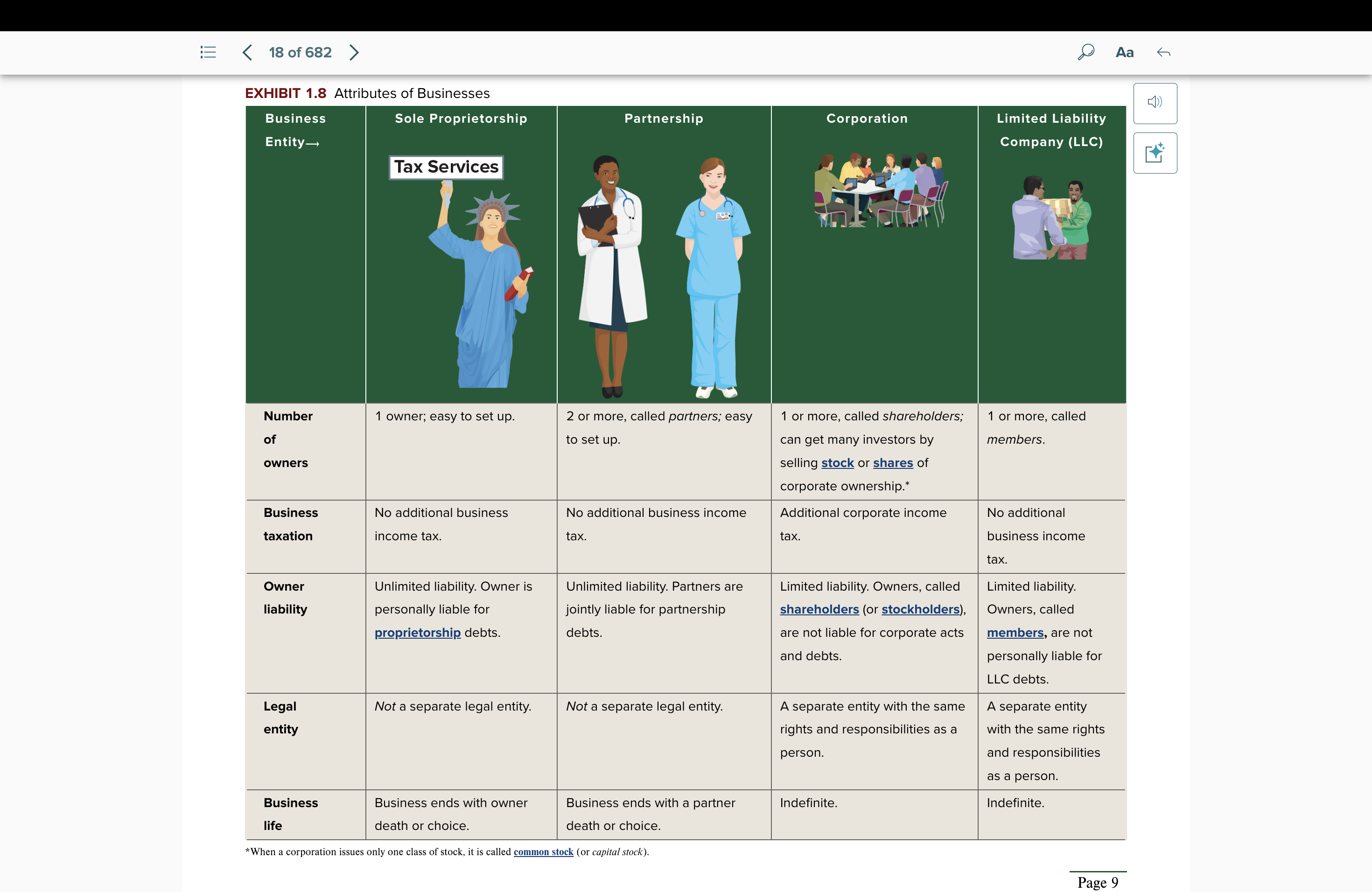

Attributes of Businesses: Sole Proprietorship

no. of owners: 1 owner, ez to set up

business tax: none

owner liability: unlimited liability. personally liable.

legal entity: not a separate legal entity

business life: ends with owner’s death or choice

Partnership

no. of owners: 2 owners or more, ez to set up

business tax: none

owner liability: unlimited liability. joint liableness.

legal entity: not a separate legal entity

business life: ends with a partner death or choice

Corporation

no. of owners: 1 or more, shareholders; can get many investors by selling stock or shares of corporate ownership

business tax: additional corporate income tax

owner liability: limited liability. not liable.

legal entity: a separate legal entity

business life: indefinite

Limited Liability Company (LLC)

no. of owners: 1 or more, members

business tax: no additional business income tax

owner liability: limited liability. not liable.

legal entity: a separate legal entity

business life: indefinite

Assets

Resources a business owns or controls that are expected to provide current and future benefits to the business.

Recievable

an asset that promises a future inflow of resources.

Liabilities

Creditors’ claims on an organization’s assets; involves a probable future payment of assets, products, or services that a company is obligated to make due to past transactions or events.

Equity

Owner’s claim on the assets of a business; equals the residual interest in an entity’s assets after deducting liabilities; also called net assets or owner’s equity.

Accounting equation

Equality involving a company’s assets, liabilities, and equity; Assets = Liabilities + Equity; also called balance sheet equation.

Expanded accounting equation

Expanded version of: Assets = Liabilities + Equity. For a noncorporation: Equity = Owner’s capital − Owner’s withdrawals + Revenues − Expenses. [For a corporation: Equity = Contributed capital + Retained earnings + Revenues − Expenses − Dividends.]

Owner investments

Assets put into the business by the owner.

Whats in a Income statement

Revenues - Expenses = Net income.

Net income

Amount earned after subtracting all expenses necessary for and matched with sales for a period; also called income, profit, or earnings.

Net loss

Excess of expenses over revenues for a period.

Retained Earnings

Retained earnings, start date.

+ Net income

- Dividends

Retained earnings, end date

Balance sheet

Assets and total assets, Liabilities and total liabilities, and Equity: Common stock, Retained earnings, Total equity, and total liabilities and equity.

Cash flows

operating activities, investing activities and financing activities

Source documents

Source of information for accounting entries that can be in either paper or electronic form; also called business papers.

Account

Record where increases and decreases are entered and stored in a specific asset, liability, equity, revenue, or expense.

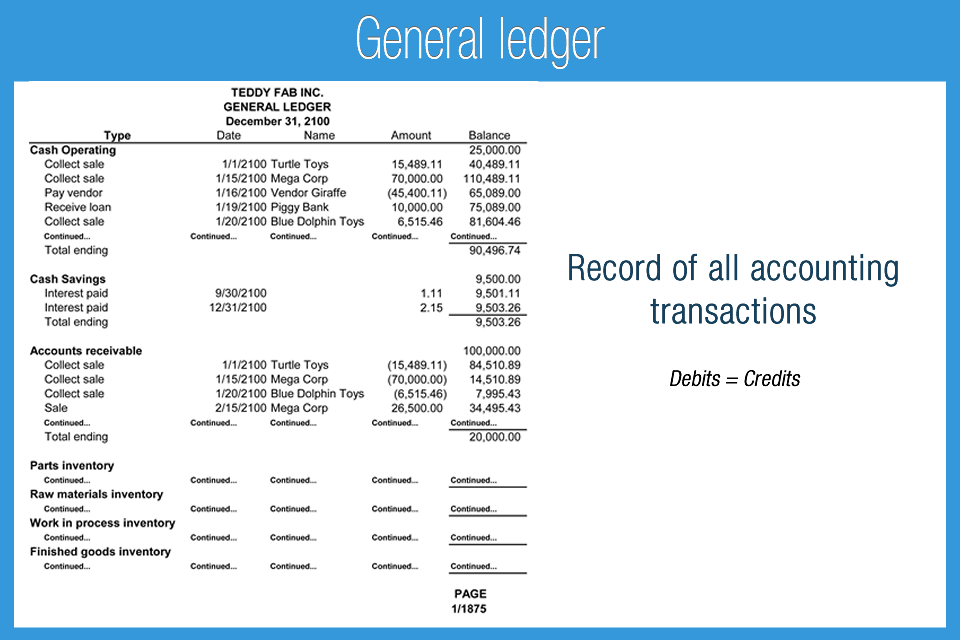

General ledger

Record containing all accounts (with amounts) for a business; also called ledger. You post your info for each account here.

Most accounting systems include ____ accounts for assets, liabilities, equity.

separate

Notes recievable: assets

a written promise of another entity to pay a specific sum of money on a specified future date to the holder of the note. Usually require interest, whereas accounts receivable doesn’t.

Prepaid Accounts (expenses): assets

assets from prepayments of future expenses. (prepaid rent, insurance, etc.)

unearned revenue: liability

Liability created when customers pay in advance for products or services; earned when the products or services are later delivered.

Accrued liabilities

amounts owed that are not yet paid

Owner Investments are…

Common stock

Owner Distributions is…

Dividends

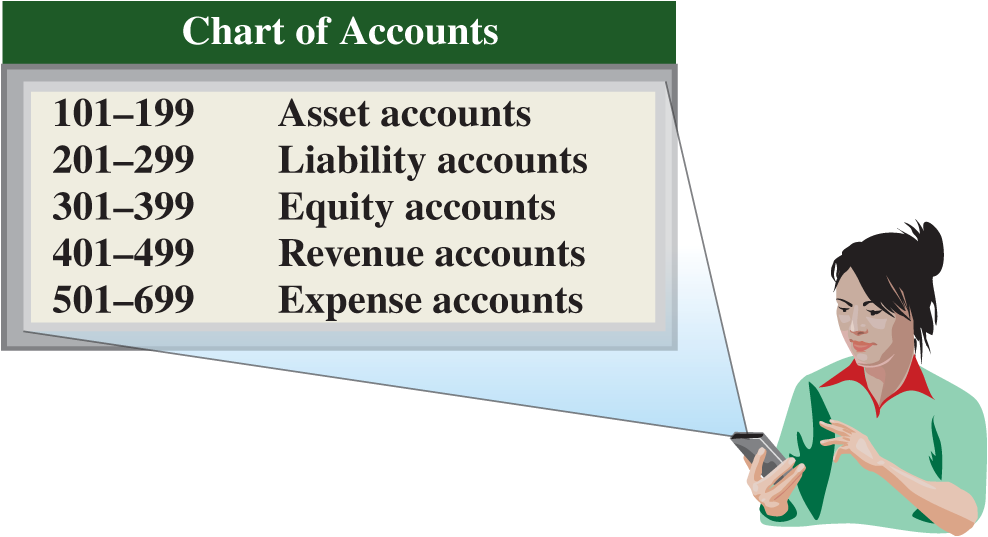

Chart of accounts

List of accounts used by a company; includes an identification number for each account.

Key words: Prepaid, Recievable

Asset

Key words: Payable, Unearned

Liability

T-Account

Tool used to show the effects of transactions and events on individual accounts; shaped in the form of a T.

T-Account: Debit side

Recorded on the left side; an entry that increases an asset or expense account, or decreases a liability, revenue, or equity account; abbreviated Dr.

T-Account: Credit side

Recorded on the right side; an entry that decreases an asset or expense account, or increases a liability, revenue, or equity account; abbreviated Cr.

Account balance

Difference between total debits and total credits (including the beginning balance) for an account. There’s debit and credit balance.

Double-entry accounting

Accounting system in which each transaction affects at least two accounts and has at least one debit and one credit. Both should be equal.

Assets increase on the…

left

Liabilities and Equity increase on the…

right

Posting

Process of transferring journal entry information to the ledger; computerized systems automate this process.

General journal

All-purpose journal for recording the debits and credits of transactions and events.

Posting reference (PR) column

A column in journals in which individual ledger account numbers are entered when entries are posted to those ledger accounts.

Trial balance

List of ledger accounts and their balances (either debit or credit) at a point in time; total debit balances equal total credit balances.

Periodicity

We break time down into specific periods.

Annual financial statements

Financial statements covering a one year period; often based on a calendar year, but any consecutive 12-month (or 52-week) period is acceptable.

Interim financial statements

Financial statements covering periods of less than one year; usually based on one-, three-, or six-month periods.

Fiscal year

Consecutive 12-month (or 52-week) period chosen as the organization’s annual accounting period.

Accrual basis accounting

Accounting system that recognizes revenues when goods or services are provided and expenses when they happen; the basis for GAAP.

Cash basis accounting

Accounting system that recognizes revenues when cash is received and records expenses when cash is paid. Doesn’t account for prepaid or unearned things.

Adjusting entry

Journal entry at the end of an accounting period to bring an asset or liability account to its proper amount and update the related expense or revenue account.

Deferred expenses equals…

prepaid expenses/assets

Plant assets

Tangible long-lived assets used to produce or sell products and services; also called property, plant and equipment(PP&E) or fixed assets.

Depreciation

Expense created by allocating the cost of plant and equipment to periods in which they are used; represents the expense of using the asset.

Accumulated depreciation

Cumulative sum of all depreciation expense recorded for an asset.

Contra account

Account linked with another account and having an opposite normal balance; reported as a subtraction from the other account’s balance.

Ex: Accumulated Depreciation