DCF Valuation Modelling

1/76

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

77 Terms

Compact DCF Model and Utility of DCFs

Useful to construct compact DCFs as they:

help learn the main features of a DCF Model w/o the complexity

assist in decision making in situations where quick analysis is needed

DCF Models are used to value businesses

Business value depends on the quantity and timing of expected future cash flows

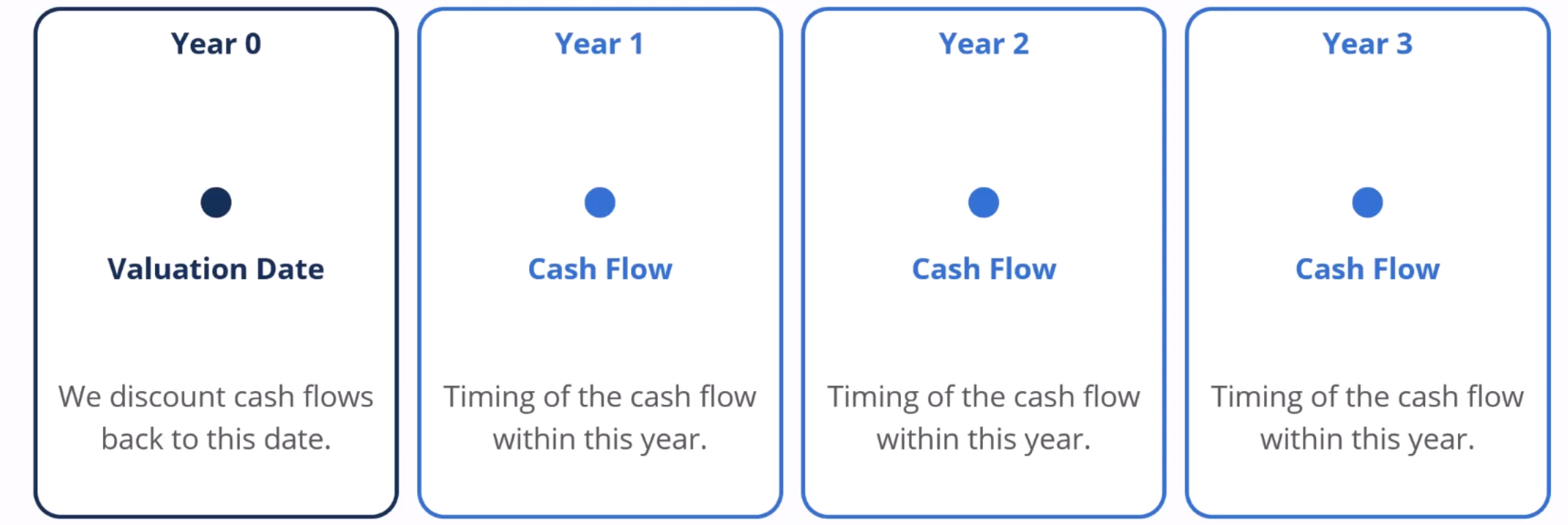

Important Dates

Cash Flow Timing

dates within each year that case flows occur (middle, end)

simplified model typically uses EOY for simplicity however in a complete DCF cashflows can occur at ¼ of the year, ½ through the year, EOY

Valuation Dates

Date that is set and used for valuation, all cash flow quantities will be adjusted for this date

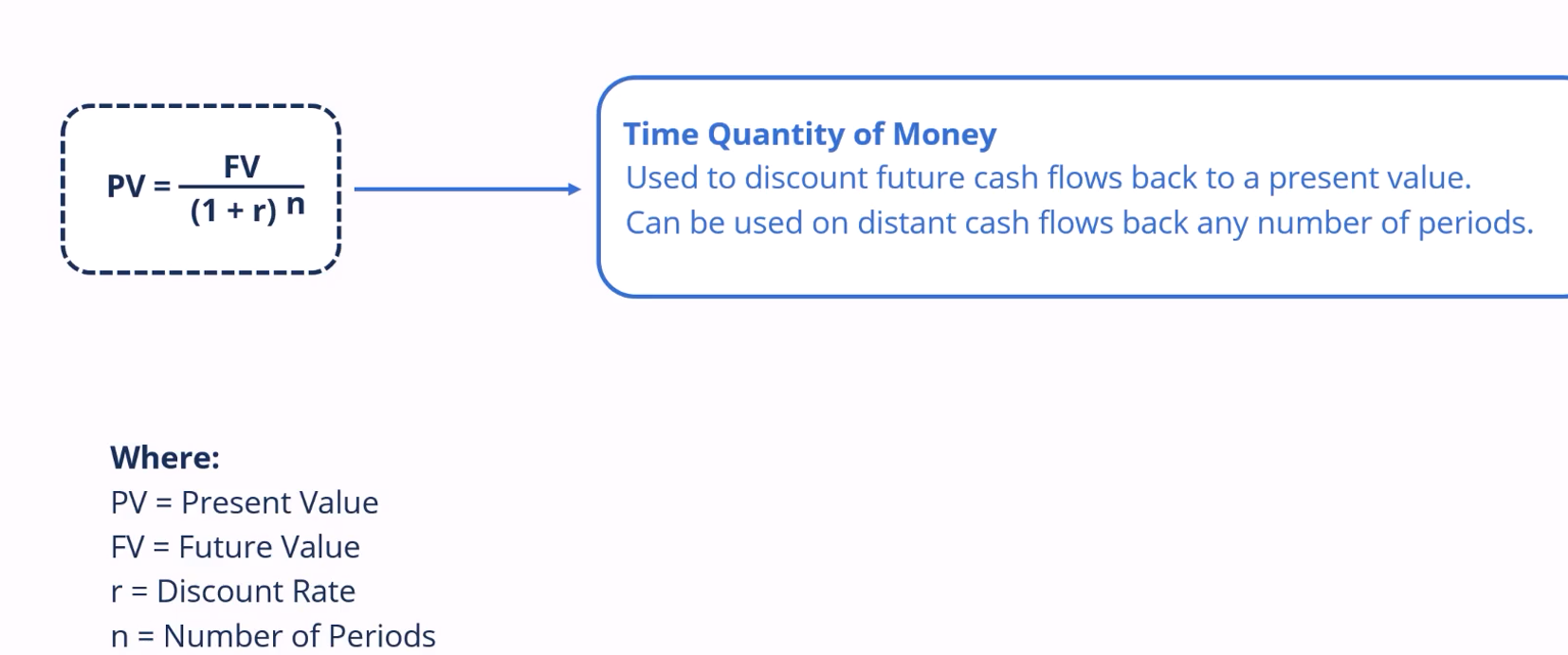

Time quantity of money

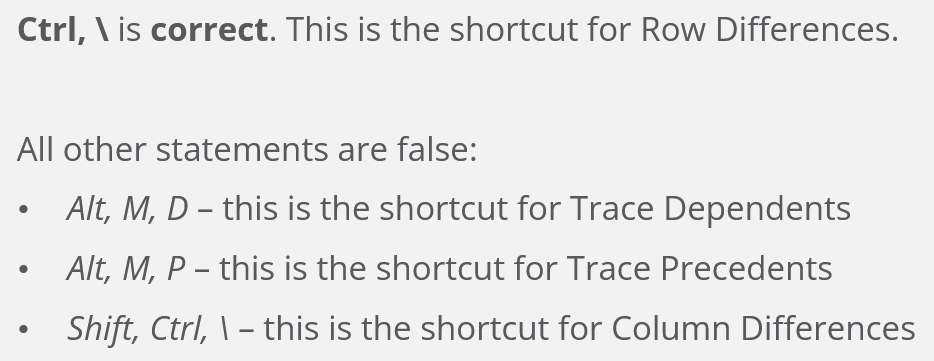

Moving cash flows forward or backward is usually referred to as the time value of money

for some reason CFI prefers time quantity of money as the quantity of money is changing over time

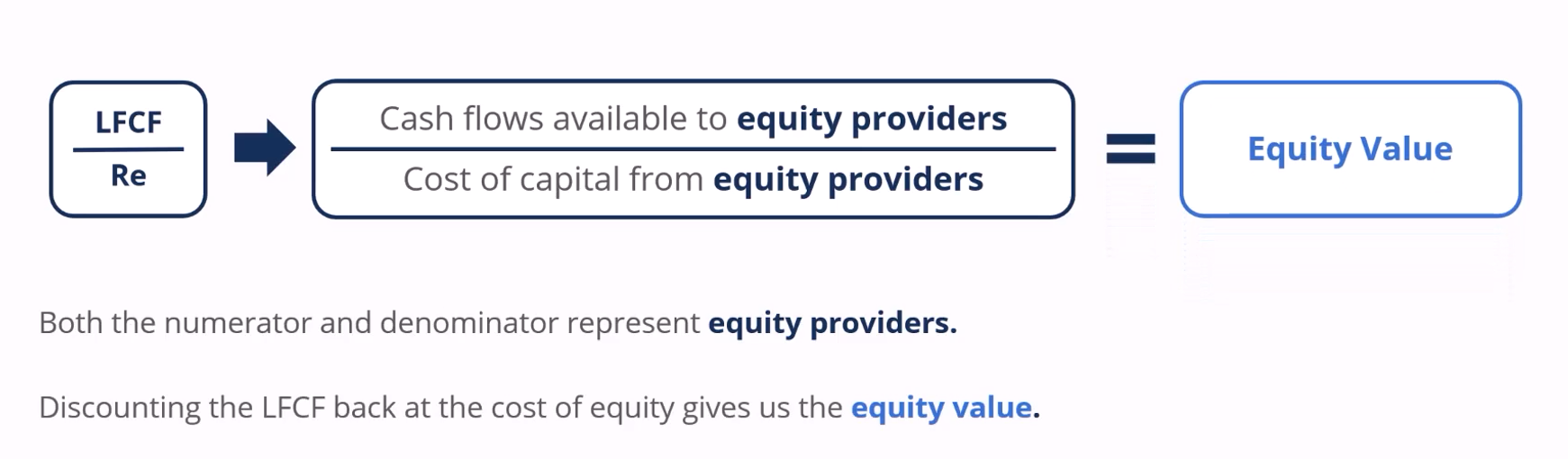

Choosing Cash Flows and Discount Rates

Using the wrong cash flows and incorrect discount rates is a common mistake

As a general rule:

Consistency is needed between the numerator and denominator

Both the numerator and denominator should represent all capital providers

Discounting all UFCF back at the WACC gives the EV.

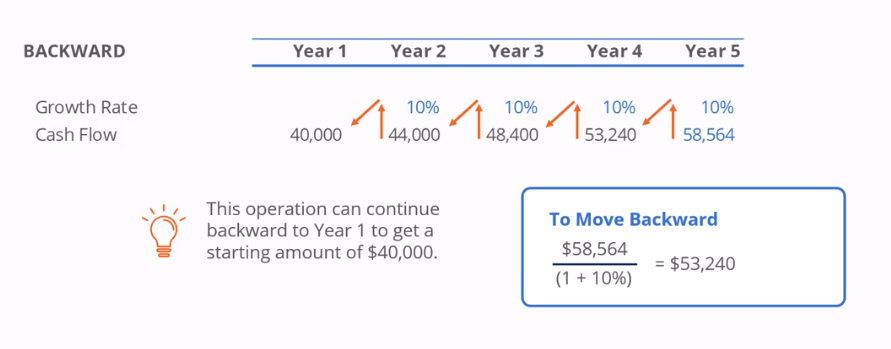

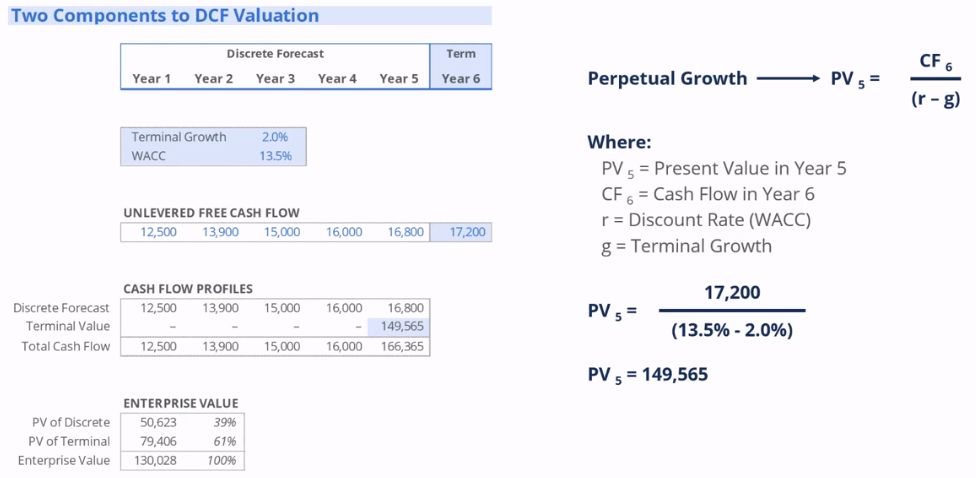

Forecasting Period

Often assume that the business is a ongoing concern when doing a valuation analysis (aka operating continuously)

This is done by separating cash flows into two parts

Discrete Forecasts

Shows the first few years when the company grows faster than the economy

Growth fore the company slows in later years as competitors enter the market

Eventually the company is mature and grows in line with the economy (point where TV occurs)

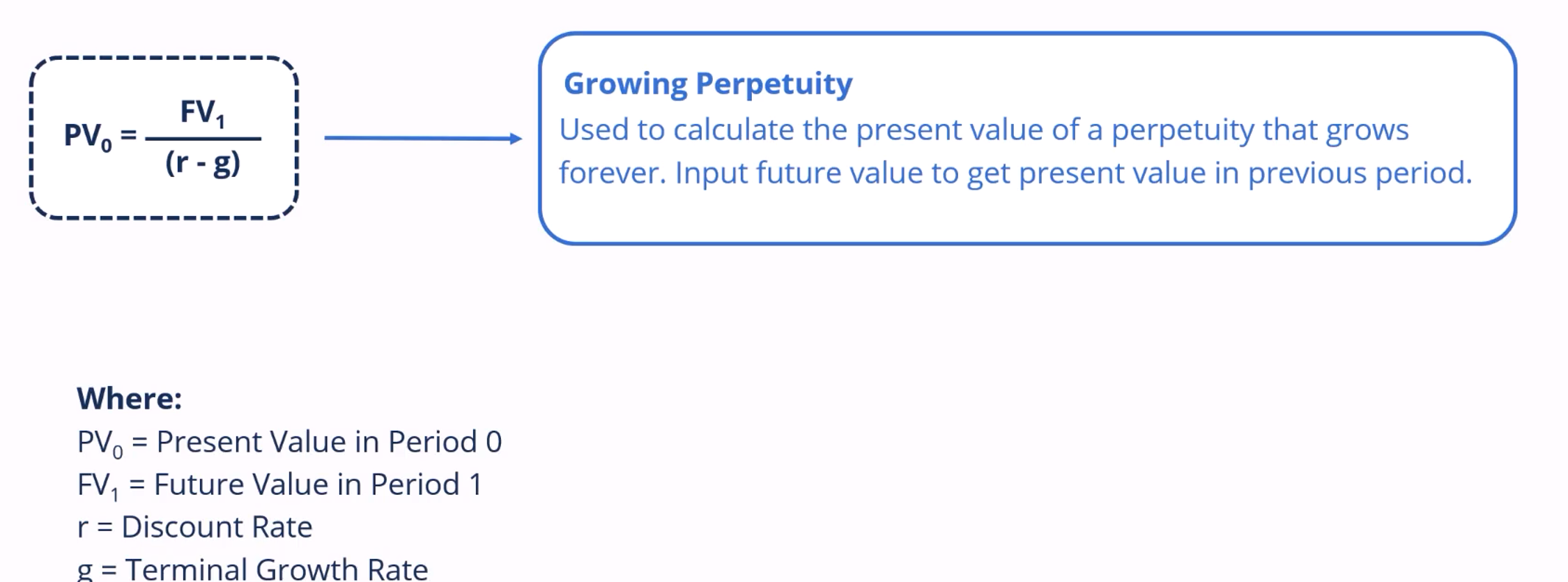

Terminal Value

covers the steady state period which continues indefinitely

not practical to forecast the cash flows forever in the model, therefore a growing perpetuity formula is used to value the perpetual cash flows

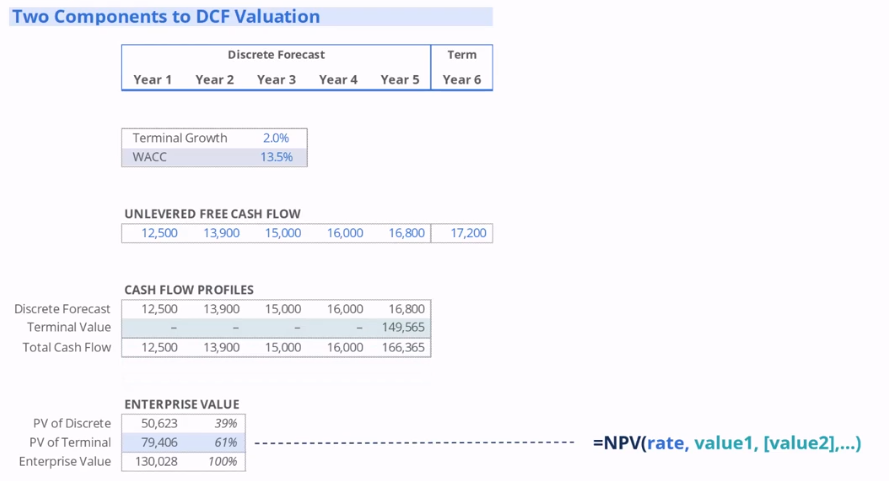

Discrete Forecast

Note that in this example the NPV function gives the present value at the end of year 0, however we don’t have any control over the timing of cash flows or the valuation date

in this example, the function is taking the cash flows over the 5 year period and discounting it leading to a PV of over $50000

Terminal Value

assumes that the UFCF of 17200 is going to grow forever at a rate of 2% (Terminal Growth Rate)

note that running the PV of a terminal UFCF will give a present value one year prior (aka last year of discrete forecast)

Enterprise Value

Represents our view of the company’s value

Calculated by:

PV of Discrete Forecast + PV of Terminal Value

Equity Value

value that equity holders are entitled to

Calculated by:

Enterprise Value - Net Debt

Equity value for a singular shareholder can be calculated by:

Equity Value / Shares Outstanding

This represents our view of equity value per share and can be compared against the market price

Net Debt

Net debt reflects cash being used to pay off debt

Calculated by:

Total Debt - Cash

Enterprise Value – Equity Value (may not be a general rule)

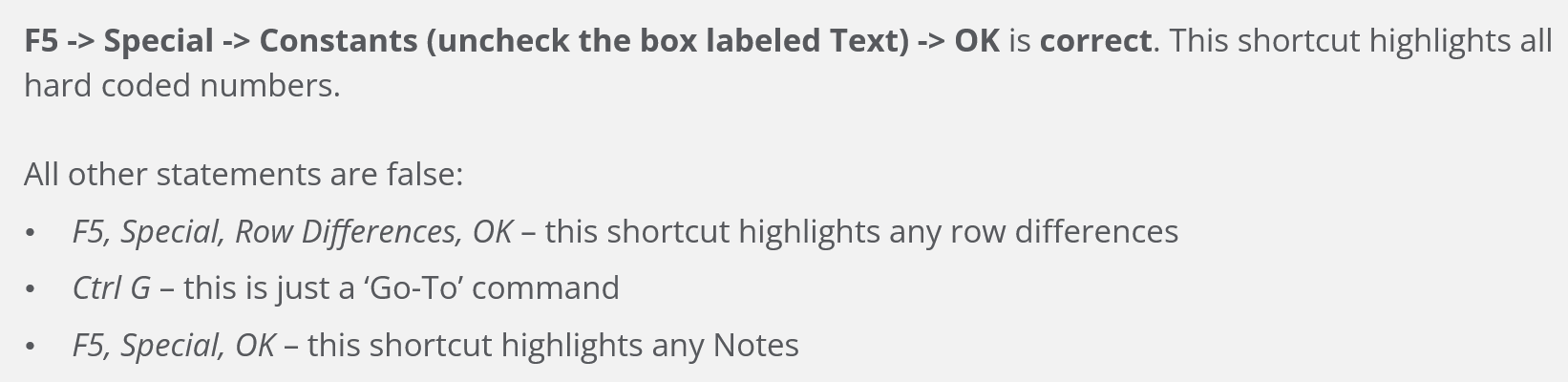

Cell Colours Shortcut

Alt + H + H

Can be used with multiple cells

Remove cell colour: Alt + H + H + N (No Fill)

Group Tabs / Sheets Shortcut

Careful with this shortcut as any actions taken in one tab / sheet will be replicated on all the sheets that are grouped

Ctrl + Shift + Page Up / Page Down

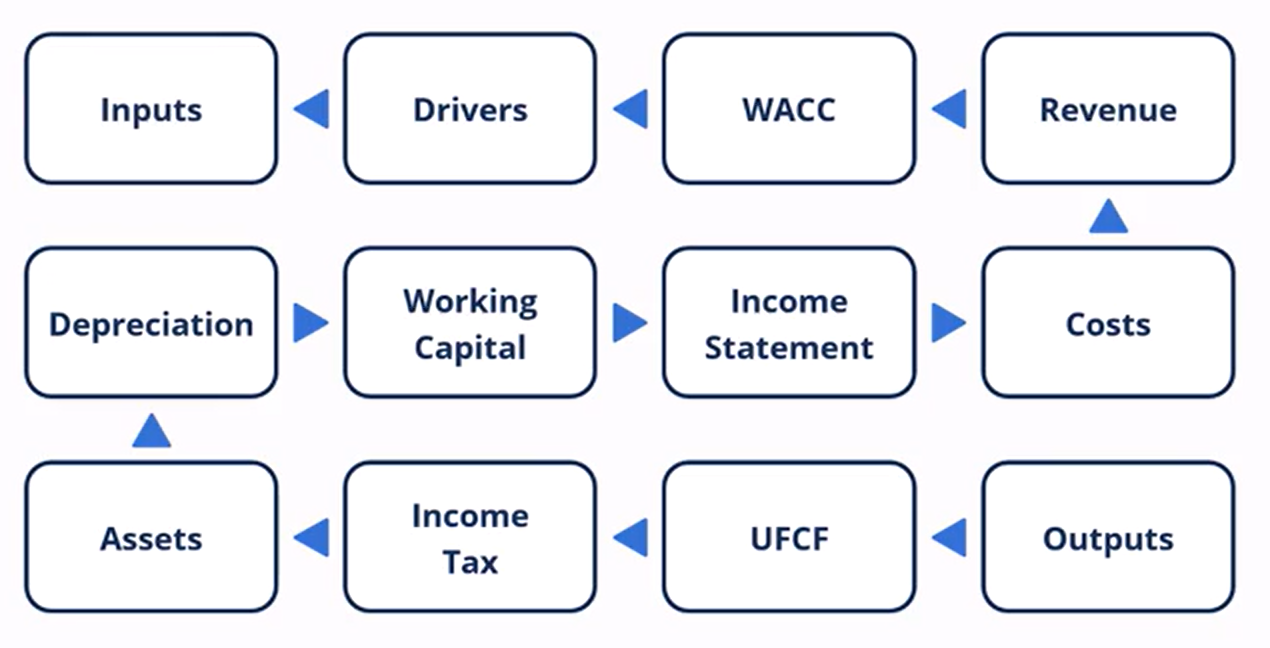

Model Flow for DCF

First is the UFCF Schedule which draws from EBITDA, Current Taxes, Capital Expenditure and Cash from Working Capital variables

Remember that Taxes, Capex and Cash from WC will be negative.

UFCF will allow the calculation of the DCF schedule, split into the discrete forecast and terminal values

Next is sensitivity analysis which allows for plotting enterprise value, varying it across different terminal growth rates and values for WACC, where we are then able to find equity value per share and the premium / discount

DCF Schedule

After finding the UFCF, repeat the values for the discrete forecast

The terminal value however uses the last cash flow divided by WACC - terminal growth rate

After finding the discrete forecast and terminal value respectively, use the NPV functions to find the Enterprise Value

Enterprise Value subtracting net debt can then be used to calculate Equity Value

Equity Value per share can be calculated by dividing shares outstanding with Equity Value

Equity Value per share can then be compared against current price to determine the premium/discount of the current share price relative to EVPS

Setting forecast dates

Forecast dates can be odne using the Edate function in excel

=Edate(Start Date, No of Months)

Start date is typically given by the first forecast date

Sensitivity Schedule Inputs

Typically pull them from the DCF assumptions and includes:

terminal growth rate, WACC, Enterprise Value, Net Debt, Shares Outstanding, Current Price

Typically placed on the very top of the schedule as they are meant to be informative for viewers

Sensitivity Table

Start with the first table typically the EV table and drive the other tables using the first table

Each table shows the Enterprise value, Equity Vlaue, EVPS, Premium/Discount to current price under different circumstances (WACC and terminal growth rate)

Above the WACC and terminal growth rate we should also put the enterprise value in the top left corner (only for the first table)

This is done by selecting the entire table (inc WACC and terminal growth rate): Alt + A + W + T

The row input cell must refer to the terminal growth rate

The column input cell must refer to the WACC in the DCF

Ensure that workbook calculation is set to automatic

Another Quick Check is the WACC and terminal growth rate we calculated being hard coded

Typically, we also repeat the terminal growth rate and the WACC across all the sensitivity tables

Font Colour Keyboard Shortcut

Select cell with data

Alt + H + FC

Calculating Equity Value Table

Essentially once we have derived all the enterprise value variables in the top table, it is possible to find all the equity value variables

This is done by the same formula: Enterprise Value - Net Debt = Equity Value

Ensure the Net Debt is locked using the F4 Function

Calculating Equity Value Per Share table

Following the correct calculation of the equity value the equity value per share can be derived simply by:

Equity Value / Shares Outstanding

Ensure that shares outstanding variable is locked

Calculating premium/discount to current price table

Following the calculation of the equity value per share the premium / discount can simply be derived by

Equity Value Per Share / Current Price - 1

Ensure that current price variable is locked

Data Table Important takeaways

Ensure that calculation options are always running on automatic by default

if there are a number of data tables running inside one model, it may be necessary to select the calculation option running on automatic except for data tables

This will mean that the F9 key will need to be refreshed to update

The Y and X axis cannot move under any circumstances

This can be somewhat mitigated by hardcoding the WACC and Terminal Growth Value manually to centre the table

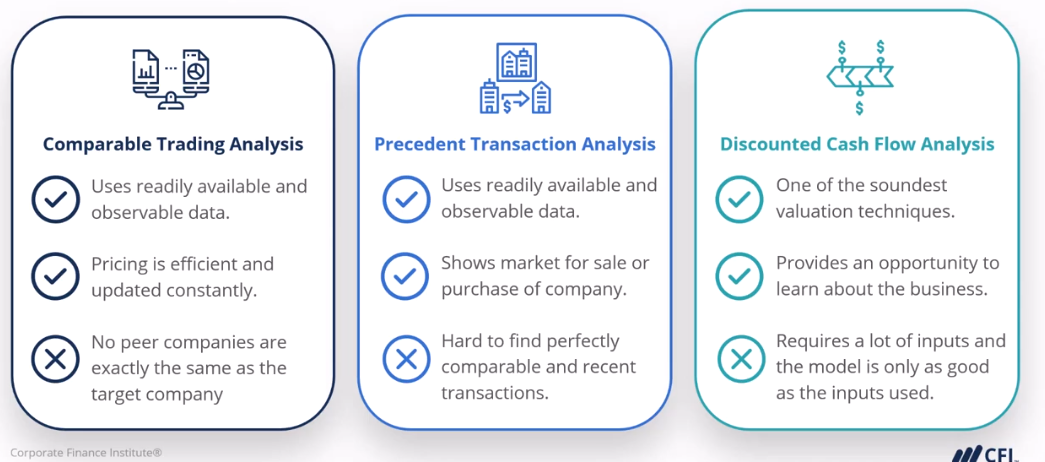

Valuation Techniques

Three most common analysis techniques

Comparable Trading Analysis

looks at the valuation for similar peer companies that are publicly traded

relative valuation technique, as the target company is valued relative to where its peers are trading in public markets

Precedent Transaction Analysis

looks at the acquisition prices for similar peer companies in recent transactions

relative valuation technique as the target company is valued to where its peers have been acquired in past transactions

DCF Analysis

builds a model of the company to get the present value of all the company’s future free cash flows

absolute valuation technique, aka the intrinsic valuation technique, the value of peers is not considered in this process

Various Views of Value

Comparable Trading Analysis

Market participants move the stock prices for peer companies so this technique shows their view

Precedent Transaction Analysis

Previous buyers set acquisition prices, so this technique shows their collective view

DCF Analysis

One builds the DCF model, select the inputs, therefore outputting “your view”

Advantages and Disadvantages of the techniques

Importance of model design

Upfront model design is critically important as:

will result in a better financial model in the end

will save large amounts of time on the model build

Why model businesses

Modelling provides a deeper understanding of a business as modelling essentially forces you to understand all aspects of the business

Start by understanding how it generates revenue or its cost structure in terms of variable and fixed costs, furthermore we also need to understand tax regulations and the company’s obligations (current or deferred)

Model Design

Start by thinking about inputs needed for the model

Once gathered think about the calculations needed to lead us to the outputs

In a linear flow we are going from the inputs, calculations all the way to the outputs

The role of financial models

Decision Making

Financial decisions can be very complex, therefore models are important tools to assist with decision making

Communication

Financial models must be easy for other to understand, dashboards are necessary so that figures can be clearly and easily communicated

Preferred Model Design

Using a DCF as the prime example, we are trying to make an informed decision about the valuation of a company

The preferred method is to design using the opposite order, designing backward ensures all schedules support the outputs

This also ensures the right level of detail through the financial model

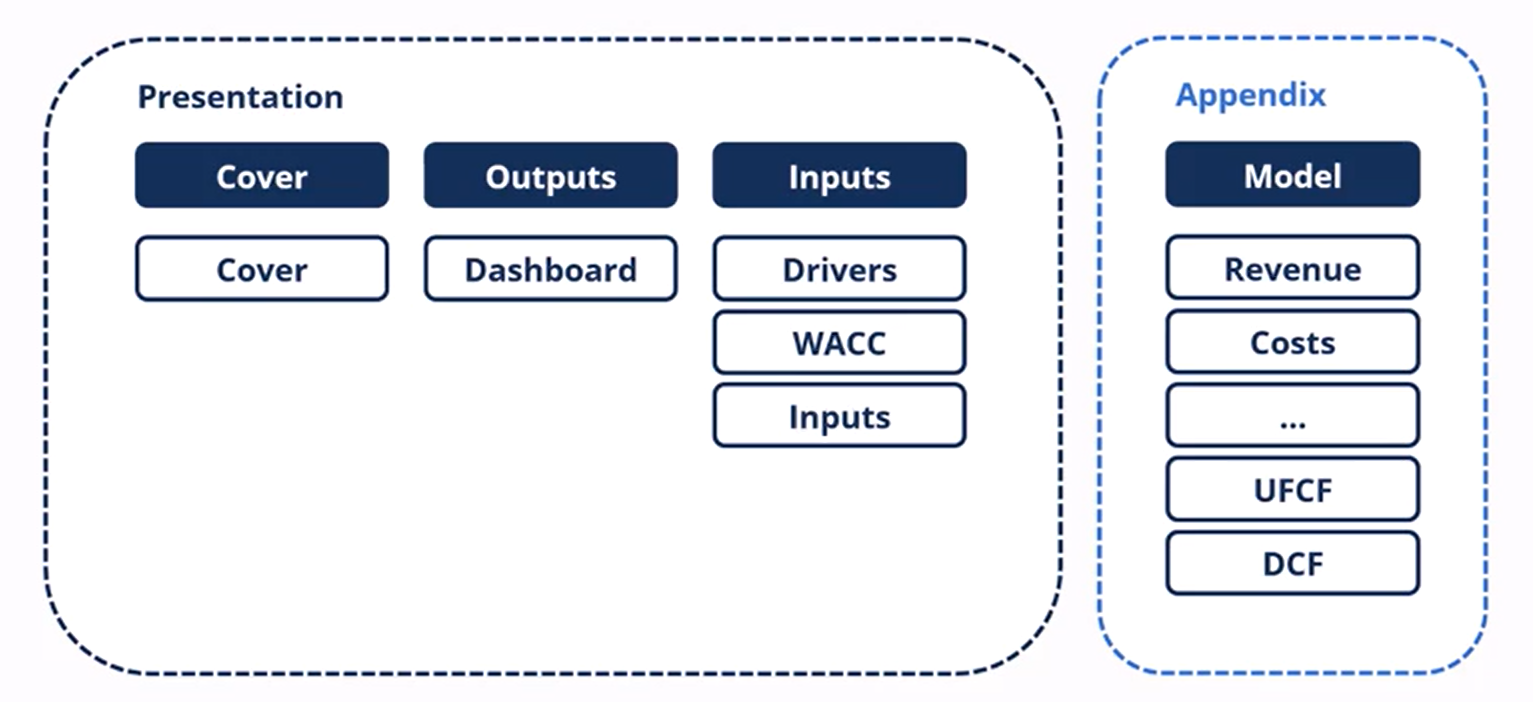

Preferred model layout (communications perspective)

Cover:

Typically consists of the business name, date, legal disclaimers and possibly model alerts

Sets the stage for the model and lets the readers know that the model has been formatted to be an effective financial presentation

Dashboard

shows all the outputs and summarises the results from the inputs

Inputs

consists of the drivers, WACC and inputs that are the engine of the model

Appendix

large number of schedules that are driving all the calculations and formulas inside the model

this is gonna show everything in detail and how we’ve come to a decision

Building Blocks and how to employ them

Should always think of models in a modular fashion made up of building blocks

This reduces the difficulty and also enhances learning potential as one can simply practice one particular building block to get really proficient

How to save building blocks

Those engaged in modelling typically have portfolios of schedules that facilitate model construction

These are often referred to as building blocks, they might include schedules for claculating revenue, costs or taxes

this allows to approach financial modelling in a modular fashion made up of a collection of schedules

Once the schedule has been built and properly reviewed for integrity, they can be saved in a single excel file or multiple excel file with singular schedules for easy usage.

Understanding Drivers

Model drivers are the most important inputs in the financial model, therefore we need to test how the model reacts when the drivers move

evaluating the importance of the model inputs

isolate the drivers so that we can test how the model reacts to them

need to separate model drivers from other less important inputs

model drivers are volatile and have a significant impact on model outputs

identifying the drivers requires detailed knowledge of the business

Testing model drivers

using an example, sales volume and sales price can be volatile and may have large impacts on the business

therefore the first step is identifying the model drivers through conversations with the business owners and understanding the business

the next logical step is to consider a minimum and maximum value for the drivers (best and worst case)

this can be used to find and estimate a base case

only the model drivers need to be tested with switches this way as errors can create large deviations

Choose Function

Used to switch between wors, base and best case scenarios for an input driver (sales volume growth for example)

Formula:

=Choose(Index Number/Switch, Value 1, Value 2, Value 3)

Values are the best, base and worst case

Index Function

Formula:

=Index(Array,Row_Num)

Array will be the cases

Row numbers will be the driver switch cell

Combo Box

Developer tab needed, which can be done through excel options

Alt + F + T

Customise ribbon → Developer tab check

Once developer tab is available as an option, select the insert function and combo box

Once a combo box has been created, select format

Input range should be the best, base and worst case variables

Cell link should be the driver switch cell

Errors will occur as the program will put a 0 by default

Macabacus library function

Bring up library manager for macabacus → create a personal or corporate shared library → group schedules according to type (operational, financial)

this would allow an easy way to access lots of schedules quickly across the whole organisation

Macabacus Uploading to library

Select the entire schedule → Macabacus ribbon → settings → library manager → tables → new groups / within a group → publish

Macabacus inserting tables into sheets

Typically start by clicking library → tables → library should pop up with library of schedules → simply double click to insert the model into the sheet

Isolating the schedule for uploads

can be done using the flatten option on macabacus

the function will replace all worksheets referencing other workbooks or worksheets with values

Macabacus show all precedents

Ctrl + Alt + [ to initiate

Ctrl = Alt + \ to clear

Macabacus format colour

Using format and colour under the macabacus tab, select format → colour → font colours → autocolour sheet

this will automatically make all formulas black and all inputs blue

Operational Schedules

used to model the operational movements of a business

typically positioned on the top of the model tab in a DCF worksheet

Current Taxes

“current” is an accounting term meaning in the current period, also often thought of as cash taxes

these are the amounts that are paid to the government as tax payments

these represent the physical cash outflows from the company

important for DCF as they can be used to calculate UFCF values

Deferred taxes

Are essentially “non-cash” taxes, amount that the company will have to pay at some point in the future

Most jurisdictions will offer these deferred taxes in the form of accelerated depreciation (done by adding accounting depreciation and subtracting tax depreciation to lead to a lower payable balance)

Some jurisdictions also offer companies the ability to carry a tax loss forward into the future (credits that can be used to minimise the tax company pays)

Total Taxes

Simply the current taxes + deferred taxes

Income statements often only show one line for the total taxes, however it is important to note that many companies will have current and deferred taxes

this can be identified in the cash flow statement particularly cash from operations where deferred taxes will be added back to net income

Levered Tax Schedule

Starts with EBT

Shows taxes that are payable when the company has debt in it’s capital structure

Needed to calculate tax lines in the income statements

Unlevered Tax Schedule

Starts with EBIT

Shows taxes that are payable excluding debt in the company’s capital structure

Needed to calculate the tax shield

Tax Shield Calculation

the tax shield is essentially the tax savings for the company when it uses debt to finance part of it’s operations resulting in an overall lower taxable income for the company hence the “shield”

EBITDA Method for calculating UFCF

more common in capital market groups

shorter and uses EBITDA which is a common measure of profitability

method is also shorter as it starts with an unlevered term and ends with an unlevered term

Net Income Method for calculating UFCF

method is longer as it starts with a levered term and ends with an unlevered term

the unlevering is done by adding the interest and subtracting the tax shield

the tax shield being the difference between the amount of cash taxes saved by having debt in the capital structure

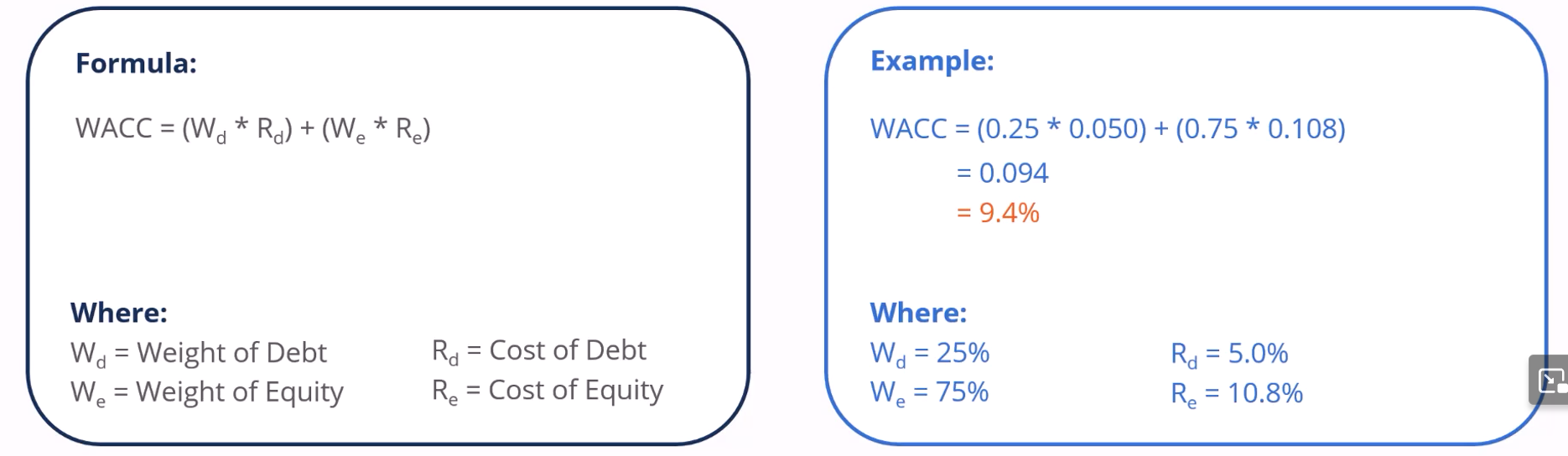

WACC Formula

Discount rate that is used to discount the UFCF

WACC must represent the cost of capital from all capital providers (debt and equity)

Typically debt has a lower weight than equity

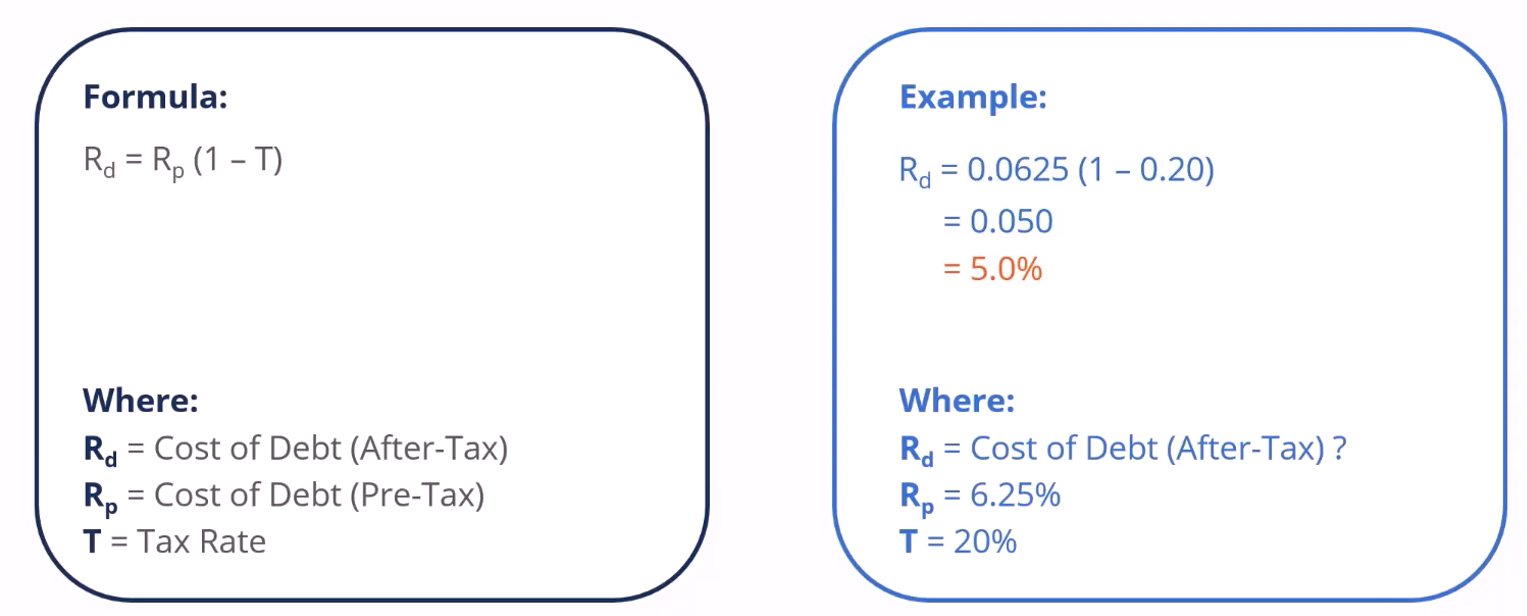

Cost of Debt Formula

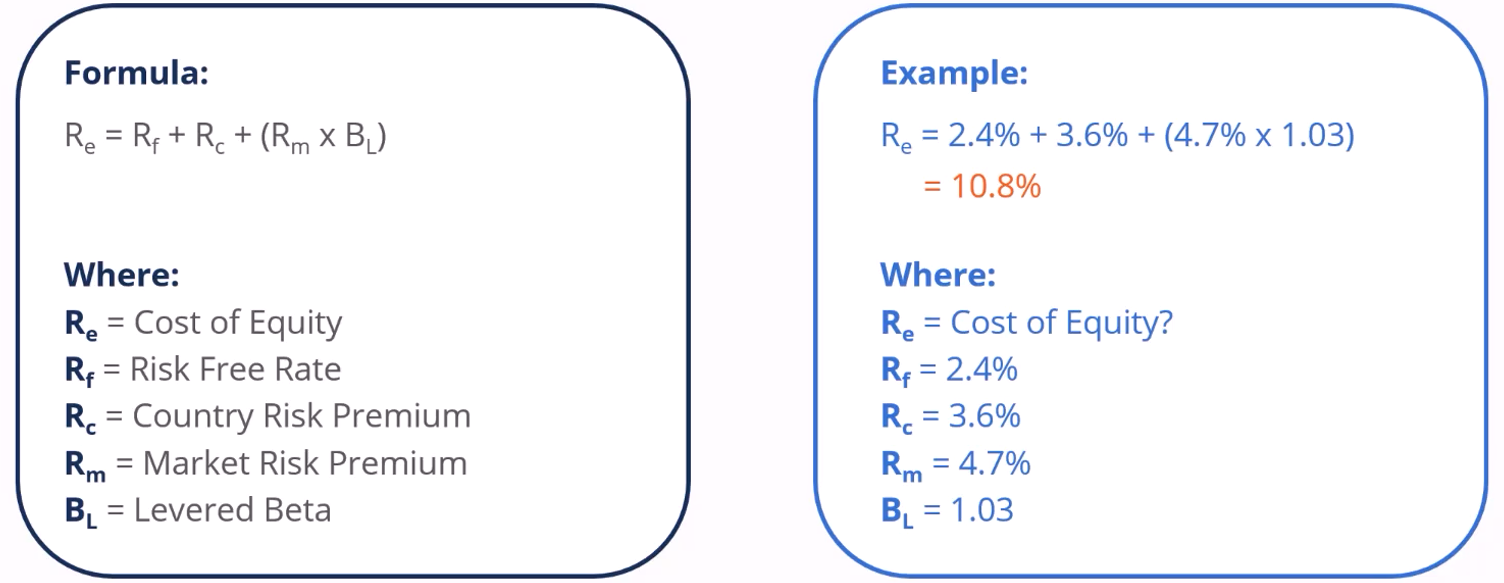

Cost of Equity Formula

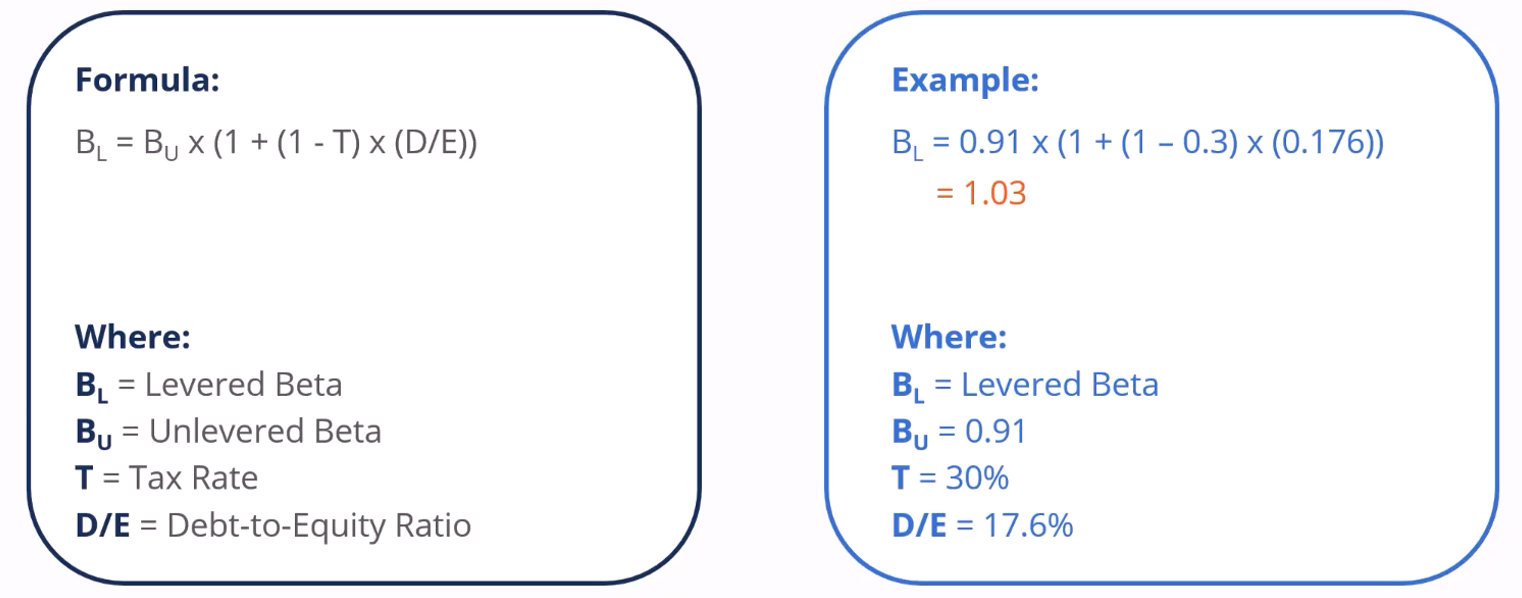

Levered Beta Formula

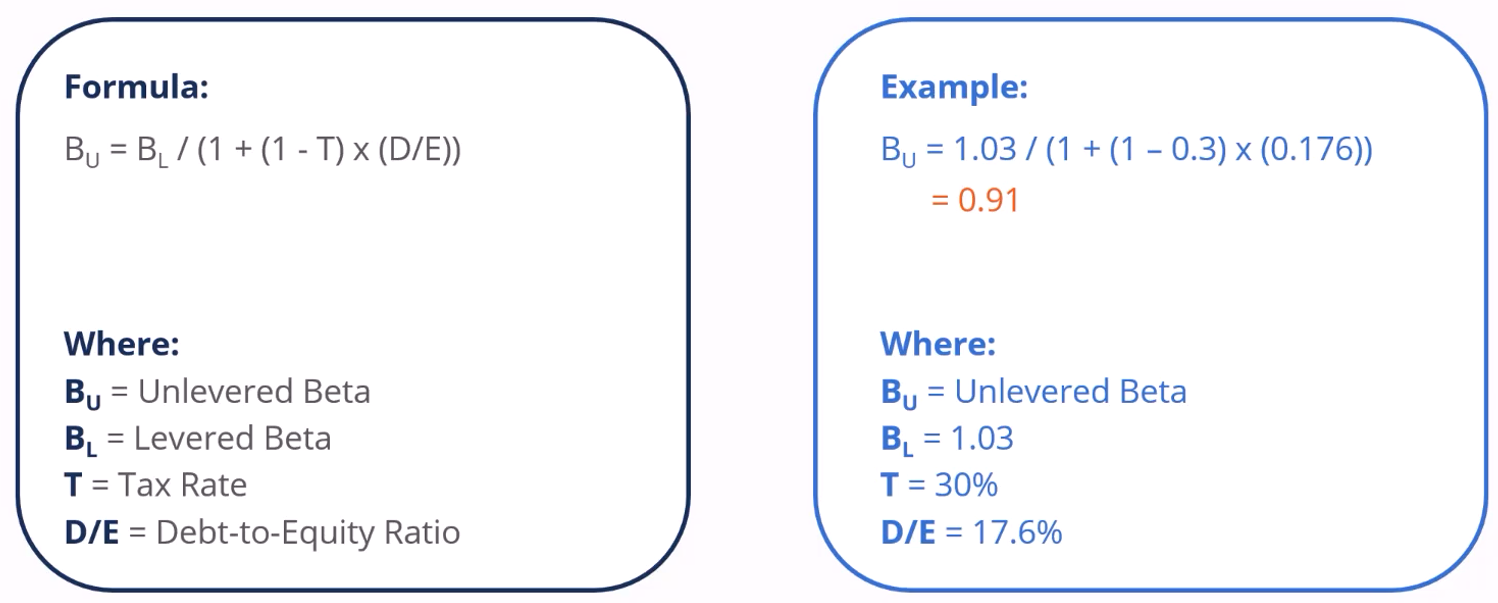

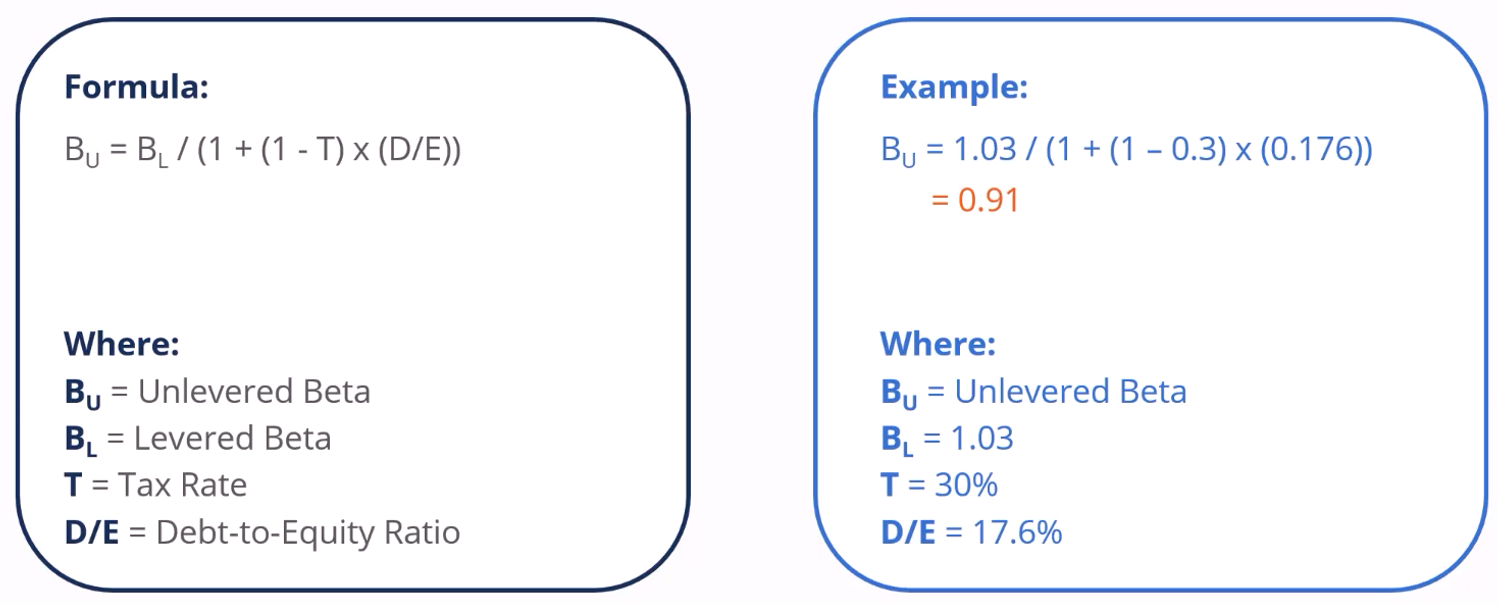

Unlevered Beta Formula

Equity Risk Premium

Can be calculated by Levered Beta * Market Risk Premium

After Tax Cost of Debt

Can be calculated by Pre Tax Cost of Debt * (1 - Tax Rate)

Model Alert for WACC and terminal growth

Essentially used for ensuring that the terminal growth rate is not equal or supercedes the WACC, as otherwise the equation (GGM) would not work

Can be constructed by an if function:

IF(Terminal Growth Rate > WACC), 1, 0

Can be further improved with custom format cells (Ctrl +1)

[=0],"No"_);[=1],"Yes"

Can also be improved with conditional formatting (Alt + H + L + N)

Select the cell and condition this case being “1”

Format by Colour

Select Colour

Components to forecasting well for DCFs

It is critical that DCFs are able to forecast forever, this is done in 2 components

Discrete Forecast

This forecast is till the steady state where the company’s growth will outpace the economy’s growth

Terminal Forecast

This forecast is theoretically till forever and is where the company’s growth will be identical to the growth rate of the economy as the business matures

Important to be accurate with the terminal value as it repeats and grows forever and will carry a heavy weight in the valuation of the company

Key Timings for DCFs

Understanding and determining the timing of cash flow and the valuation date

Valuation dates can be set at any period within the first period (typically at the end or the beginning of the period when doing valuation work)

However for cash flows, it may be useful to understand the underlying business, a business that generates most of its revenue in Q4 will have timings at the center of the 4th Quarter

Businesses with no seasonality meanwhile would generate its cash flows evenly resulting in a timing in the middle of the year shown below

Dates to consider

Fiscal Year End

date of the fiscal year end for the company

date can be easily found in the financial statements

common to see the same month and day every year

Cash Flow Timing

date in which the cash flow is expected to occur

this could be closer to the fiscal year end if Q4 is seasonally strong

Between two fiscal year dates if there is no seasonality

Valuation Date

Date in which all cash flows are discounted into

Date is set by the model building team

Present Value of the business will be as of this date

Present Value / time quantity of money formula

Growing Perpetuity Formula

Edate Function

Useful for filling out discrete forecast and terminal forecast tables with fiscal year end and cash flow timing data

Formula

=EDATE(Starting Date Cell, Months usually 12)

Unadjusted Cash Flow

The discrete forecast is simply the UFCF copied and pasted

The terminal value can be found by using the growth perpetuity method

Terminal UFCF / (WACC - Terminal Growth)

Partial Period Adjustment

Companies may oftentimes have a fiscal year end date that is different hence the need to do partial adjustments

This is because from the valuation date we are only looking into the future hence we are ignoring the data prior to the valuation date

Can be calculated using the YEARFRAC formula

YEARFRAC(Fiscal Year End, Valuation Date)

Discounting using YEARFRAC

YEARFRAC can also be used with discounting

This is done by inputting the formula

Previous Cell + YearFrac(Cash Flow Timing, Valuation Date)

Using the TQM formula we are then able to find the discrete forecast and terminal value

XNPV Function

Formula is as follows:

XNPV(WACC, Undiscounted Cash Flows including valuation date and all dates including valuation dates)

it is important to have the first cash flow as 0, it will correspond to the valuation date

The manual and XNPV calculations of Enterprise Value may differ due to the treatment of leap years by the function and the manual method

Finding Percentages of Discrete and Terminal

This may be necessary to calculate and it is done by simply adding the discounted discrete forecasts for the PV of discrete

PV of terminal is calculated by taking the discounted terminal value

EV is obviously the sum of both these values and we can then find the contributions of both the TV and Discrete

Terminal tends to be higher as it stretches to infinity

Terminal Value using multiple method

Multiply EBITDA of the final term with the multiple for the terminal value

However there might be some cases where FYE doesnt align with the final cash flow timing, in this case we might have to find terminal adjustment

This terminal adjustment is calculated by the yearfrac function between FYE and the final cash flow timing

Afterwards the terminal value would be adjusted with the formula:

(EBITDA x Multiple) / (1+WACC)^Terminal Adjustment

This in turn will discount the terminal value by the correct amount of time

Model Dashboards

Model drivers are critical inputs that must be shown

A toggle is often provided to change these drivers as well

A DCF dashboard would need to have a toggle to show the range of enterprise and equity values

A range of valuations are normal as different views and valuations may differ for the WACC and growth rate of the company

These can be done using data tables

Data Tables to find Enterprise Value

First the top left will typically have an area to input the enterprise value into the table

It is important to ensure that the enterprise value matches the method used such as perpetuity/multiple

After this select the entire table and create a data table using the shortcut

Alt + A + W + T / Alt + D + T

Row Input Cell: Terminal Growth Rate (select the cell with the TGR),

Column Input Cell: WACC (select the cell with WACC)

Ensure workbook calculation is set to automatic

Master Switch Linking between outputs and inputs

Typically done by going to input side switch and linking it to the output side switch

Change the input side combo box to the output side cell

Create a combo box for the output side and select the range as usual being the best, base and worst case while the cell link would be set for the switch

1 Dimensional Data Tables

This is used to calculate the best, base and worst case for enterprise value

Select EV and the numbers 1,2,3 signifying the cases

Column being the EV

Row input cell being the numbers

This would allow easily calculation for equity value and equity value per share

Checks and Balances