Corporate Finance [Lectures] PART 3

1/57

Earn XP

Description and Tags

1-39 -> Lecture 10 | 40-58 -> Lecture 11

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

58 Terms

Sources of Short-Term Financing

bank sources and money market sources

BANK SOURCES

Banker's Acceptances;

Collateralised Loan;

Discounted Receivables; Factoring;

Overdraft Line;

Regular Line;

Revolving Credit Agreement; Uncommitted Line

NON-BANK SOURCES

Commercial Paper;

Nonbank Finance Companies

The major objectives of a short-term borrowing strategy include the following:

Ensuring that there is sufficient capacity to handle peak cash needs;

Maintaining sufficient sources of credit to be able to fund ongoing cash needs;

Ensuring that rates obtained are cost-effective;

Ensuring that rates obtained don't substantially exceed market averages.

ACTIVE BORROWING STRATEGIES

Borrowers are more in control and do not fall into the rollover trap;

Many of them are matching strategies (loans are scheduled to mature when large cash receipts are expected;

Usually involves reflecting on planning;

Usually involves reliable forecasting;

Usually requires seeking the best deal;

Usually more flexible

PASSIVE BORROWING STRATEGIES

An often reactive strategy in responding to immediate needs or "panic attacks";

A "take what you get" strategy;

Characterised by steady, often routine rollovers of borrowings for the same amount of funds each time;

Do not involve much comparison shipping;

May arise when borrowing is restricted (e.g. in a secured loan agreement);

Usually involve minimal activity with one source or type of borrowing;

Usually involve little planning

Other factors to be considered by borrowers as part of their short-term borrowing strategies involve

size and creditworthiness;

sufficient access;

flexibility of borrowing options

Size and creditworthiness

refers to the amount of money needed for borrowing and the borrower's ability to repay the loan based on their financial history, income, assets, and credit score

Sufficient access

indicates the ease and availability of obtaining funds when needed, including the accessibility of credit lines, loans, or other financial resources to meet short-term financial needs

Flexibility of borrowing options

refers to the variety and adaptability of borrowing methods and terms, including interest rates, repayment schedules, and collateral requirements, allowing borrowers to choose the most suitable option based on their specific circumstances and preferences

Blanket Lien

A lien that gives the right to seize, in the event of nonpayment, all types of assets serving as collateral owned by a debtor

Assignment of accounts receivables

the company remains responsible for the collection of the accounts

Factoring

the company is shifting the credit granting and collection process to the factor; the cost of this credit depends on the credit quality of the accounts and the cost of collection

Inventory as a source of cash flow through the use of the inventory as collateral - possible types of arrangement:

inventory blanket lien, trust reciept arrangement, warehouse receipt arrangement

INVENTORY BLANKET LIEN

in which the lender has a claim on some or all of the company's inventory, but the company can sell the inventory in the ordinary course of business

TRUST RECEIPT ARRANGEMENT

in which the lender requires the company to certify that the goods are segregated and held in trust, with proceeds of any sale remitted to the lender immediately

WAREHOUSE RECEIPT ARRANGEMENT

similar to the trust receipt arrangement, but there is a third party (i.e. a warehouse company) that supervises the inventory

Ways of computing the cost of borrowing

line of credit, banker’s acceptance, borrowing

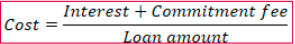

LINE OF CREDIT

that requires a commitment fee (a fee paid to the lender in return for the legal commitment to lend funds in the future)

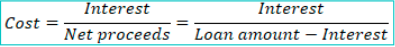

BANKER'S ACCEPTANCE

where the interest rate is stated as "all-inclusive", so the amount borrowed includes the interest

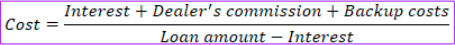

BORROWING

where there are dealer's fees and other fees, e.g. a backup fee and a commission and the borrowing is quoted as "all-inclusive", as in the case of commercial papers

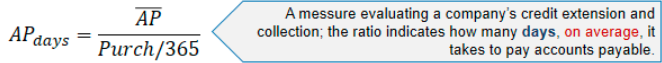

evaluating accounts payable management

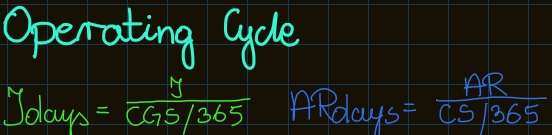

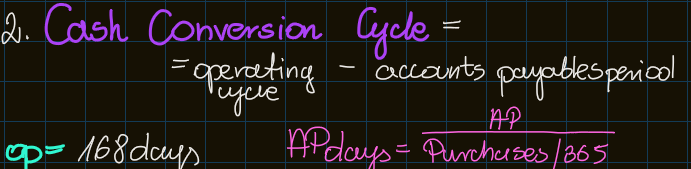

Operating Cycle

On average, [NUMBER OF DAYS] pass between the purchase of materials and the collection of sales recievables

Cash Conversion Cycle

It takes, on average [NUMBER OF DAYS] to collect sales receivables from incurring expenses for purchases

Strategies of working capital management

conservative, aggressive, moderate

Moderate Strategy

little short-term liabilities; big equity with long-term liabilities

Aggressive Strategy

equal parts of short-term liabilities and equity with long-term liabilities

Consrvative Strategy

little short-term liabilities; big equity with long-term liabilities; excess wrking capital

REGULAR CASH DIVIDENDS

Cash is distributed to shareholders on a regular schedule;

Frequency varies across markets;

Most companies strive to maintain or increase their dividends (consistent dividends over a long period = evidence of consistent profitability);

Increasing dividends = signal of company growth, management's confidence in the company's future often followed by a share price increase

Dividend Reinvestment Plan [DRP or DRIP]

a system that allows the shareholder to automatically reinvest their cash dividends (all or a portion) from a company in additional shares of the company

Advantages of DRP

For small shareholders: a cost-effective means to make additional investments (typically no transaction costs, new-issue often with discount 2-5% to the market price);

New-issued DRPs allow the company to raise equity capital without the flotation costs associated with secondary equity issuance using investment bankers;

They may encourage a diverse shareholder base by providing small shareholders an easy means to accumulate additional shares;

They may stimulate long-term investment in the company by encouraging shareholders to build loyalty to the company

Disadvantages of DRP

Discounts offered to DRP participants dilute the holdings of shareholders who do not participate in the DRP;

For a shareholder: cash dividends are fully taxed in the year received even when reinvested (shareholder is paying tax on cash not received);

For the shareholder: the extra recordkeeping involved in jurisdictions in which capital gains are taxed

Extra or special (irregular) dividends

A dividend paid by a company that does not pay dividends on a regular schedule, or a dividend that supplements regular cash dividends with an extra payment (due to special circumstances);

Special dividends are sometimes used as a means of distributing more earnings during strong earnings years

A dividend may be referred to as a liquidating dividend when a company

Goes out of business and the net assets (after all liabilities have been paid) are distributed to shareholders

Sells a proportion of its business for cash and the proceeds are distributed to shareholders;

Pays a dividend that exceeds its accumulated retained earnings

Advantages of Stock Dividends for Companies

More shares outstanding broaden the shareholder base

More shares outstanding increases the probability that more individual shareholders will own the stock

A lower stock price might attract more investors

STOCK DIVIDEND

A non-cash form of dividends,

With a stock dividend, the company distributed additional shares (2-10% of the shares outstanding) of its common stock to shareholders instead of cash;

It has no economic impact on the company

It does not affect assets or shareholder's equity

It does not affect either liquidity ratios or leverage ratios

CASH DIVIDEND

It affects a company's capital structure

Reduces assets and shareholder's equity

Reduces liquidity ratios

Increases leverage ratios

Stok Splits

A two-for-one stock split:

Each shareholder will be issued an additional share for each share currently owned;

Each shareholder will have twice as many shares after the split as before the split;

EPS will decline by half, leaving the P/E and equity market value unchanged;

Similar to stock dividends: no economic effect on the company and the shareholders' total cost basis

Assuming the same dividend payout ratio (dividends declared to net income) as before the split, dividend yield (DSP/P) will also be unchanged;

Neutral in their effect on shareholders' wealth

Most common stock splits: two-for-one, three-for-one

Unusual splits: five-for-four, seven-for-three

Reverse Stock Splits

Much less common than stock splits

Increases the share price and reduces the number of shares outstanding

Objective: to increase the stock price to a more marketable range

More common for companies in financial distress

Dividend Dates

declaration → ex-dividend → holder-of-record → payment

Declaration Date

Referred to as the "announcement date"

The date on which the board of directors of a company announces the next dividend payment

The statement includes the dividend's size, holder-of-record date, ex-dividend, and payment date

Ex-dividend Date

Referred to as the "ex-date"

Buyers aren't entitled to the next dividend payment on this date, the stock will usually drop in price by the amount of the expected dividend

It is determined by the security exchange on which the shares are listed

If a trader purchases a stock on this date or after, he will not receive the next dividend payment

In most markets, it takes place one or two business days before the holder-of-record date

The first date that a share trades without the dividend

Holder-of-record Dtae

Referred to as the owner-of-record date, shareholder-of-record date, record date, date of book closure

It determines which shareholders on the corporation's list are eligible to receive a dividend

The date that a shareholder listed in the corporation's record will be considered to have ownership of the shares to receive the upcoming dividend

Occurs typically two business days after the ex-date

Payment Date

Referred to as the "payable date"

It can occur on a weekend or holiday

The company states this date when the dividend declaration is made

The date on which the company transfers the dividend payment

If you buy the stock on Thursday, June 7 just as the market closes, -

you'll get the $1 dividend because the stock is trading cum dividend

If you wait and buy it just as the market opens on Friday, -

you won't get the $1 divided. (as it is a post ex-date)

Share Repurchase

It's a transaction in which a company buys back its shares (using corporate cash, unlike in the case of stock dividends or stock splits)

It's an alternative to cash dividends (TREASURY SHARES)

Companies’ reasons for share repurchases

to communicate, to support, flexibility, tax efficiency, absorbing increases, avoid paying an extra dividend

Share repurchase methods

buy in the open market → buy back a fixed number of shares at a fixed price → dutch auction → repurchase by direct negotiations

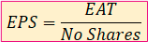

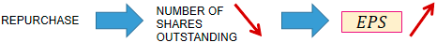

Changes in EPS

By assuming that the net income does not change we can say that, as we repurchase shares - we decrease the number of our shares outstanding, which means that EARNINGS PER SHARE increase

A share repurchase may decrease EPS when

E/P < Rd(1-t)

A share repurchase may increase EPS when

E/P > Rd(1-t)

A share repurchase may have no effect on EPS when

E/P = Rd(1-t)

When the market price per share is greater than its book value per share,

BVPS will decrease after repurchase

When the market price per share is lower than its book value per share,

BVPS will increase after repurchase

When we use cash dividend or share repurchase methods on the wealth per share of a shareholder, we can say that

there is no difference in shareholder’s wealth over the years regardless of whether a company uses its cash to repurchase shares or pay dividends, or hoards the cash

The PROS of paying dividends

Cash dividends can underscore good results and provide support to the stock price

Dividends absorb excess cash flows and may reduce agency costs that arise from conflicts between management and shareholders

Stock price usually increases with the announcement of a new or increased dividend

Dividends may attract institutional investors who prefer some return in the form of dividends. A mix of institutional and individual investors may allow a firm to raise capital at a lower cost because of the ability of the firm to reach a wider market

The CONS of paying dividends

Dividends can reduce internal sources of financing

Dividends may force the firm to forgo positive NPV projects or to rely on costly external equity financing

Once established, dividend cuts are hard to make without adversely affecting a firm's stock price

Dividends are taxed to recipients