Topic 1.1 - What Is A Business (SL/HL)

5.0(2)

Card Sorting

1/48

Earn XP

Description and Tags

Last updated 8:10 AM on 5/8/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

1

New cards

Business

A decision-making organization that is involved in the process of using **inputs** to produce **goods** and/or provide **services**.

\

* Businesses can also provide goods and services to other businesses

\

* Businesses can also provide goods and services to other businesses

2

New cards

Inputs

The resources that a business uses in the production process

\

EXAMPLES:

\

* Labor

* Raw materials

\

EXAMPLES:

\

* Labor

* Raw materials

3

New cards

Outputs

The products generated using inputs

4

New cards

Product

Refers to both goods and services

5

New cards

Goods

Physical products

6

New cards

Services

Intangible products

7

New cards

Role of a business

The role of businesses is to combine human, physical, and financial resources to create goods and services in order to satisfy the **needs** and **wants** of people, organizations, and governments.

8

New cards

Needs

The basic necessities that a person must have to survive

9

New cards

Wants

People’s desires, i.e. the things they would like to have

10

New cards

Entrepreneur

* An individual who plans, organizes and manages a business, taking on financial risks in doing so.

* Entrepreneurs have the skills needed to oversee the whole production process, whilst having the ability and willingness to take potentially high risks

* They search for and exploit business opportunities by forecasting and/or responding to changes in the marketplace

* Entrepreneurs have the skills needed to oversee the whole production process, whilst having the ability and willingness to take potentially high risks

* They search for and exploit business opportunities by forecasting and/or responding to changes in the marketplace

11

New cards

Entrepreneurship

The collective knowledge, skills and experiences of entrepreneurs

12

New cards

Characteristics of successful entrepreneurs

* Creative

* Innovative

* Passionate

* Innovative

* Passionate

13

New cards

Purpose of business activity

The nature or purpose of a business is to generate **added value**. This occurs when there is a positive difference between the selling price of a product and the cost of producing the good or service.

14

New cards

Added value

Exists when products are appealing to customers, so they are willing to pay higher prices for such items

\

Added value =value of outputs (revenue received from the products sold) - the value of inputs (cost of production)

\

Added value =value of outputs (revenue received from the products sold) - the value of inputs (cost of production)

15

New cards

Customers

The people or organizations that purchase a product

16

New cards

Consumers

The people or organizations that actually use the product

17

New cards

Types of products

* Consumer goods

* Capital goods

* Services

* Capital goods

* Services

18

New cards

Consumer goods

Products sold to the general public, rather than to other businesses. They can be further split into;

\

* Consumer durables

* Consumer non-durables

\

* Consumer durables

* Consumer non-durables

19

New cards

Consumer Durables

Products that last a long time and can be used repeatedly

20

New cards

Consumer non-durables

Products that need to be consumed shortly after their purchase as they do not last or cannot be reused

21

New cards

Capital/producer goods

Physical products bought by businesses to produce other goods and/or services

22

New cards

Services

Intangible products provided by businesses, the service is not tangible, but the results are

23

New cards

Functional areas

For a business to operate effectively, tasks must be carried out by functional areas (departments). The nature of business requires these functional areas to work together in order to achieve the organization’s goal.

24

New cards

What are the functional areas

* Human resource management

* Finance & accounts

* Marketing

* Operations management

* Finance & accounts

* Marketing

* Operations management

25

New cards

Human resource management (HR)

Responsible for managing the personnel of the organization.

26

New cards

Roles of HR

* Human resource planning

* Organizational structures

* Management and leadership

* Motivation and demotivation

* Dealing with industrial/employee relations

* Organizational structures

* Management and leadership

* Motivation and demotivation

* Dealing with industrial/employee relations

27

New cards

Finance & accounts

In charge of;

* Managing the organization’s money

* Ensuring compliance with legal requirements (such as filing or corporate taxes)

* Informing those interested in the financial position of the business (such as shareholders and potential investors)

* The finance and accounts director must ensure that accurate recording and reporting of financial documentation takes place.

* Managing the organization’s money

* Ensuring compliance with legal requirements (such as filing or corporate taxes)

* Informing those interested in the financial position of the business (such as shareholders and potential investors)

* The finance and accounts director must ensure that accurate recording and reporting of financial documentation takes place.

28

New cards

Marketing

Responsible for;

* Identifying and satisfying the needs and wants of customers

* It is ultimately in charge of ensuring that the firm’s products sell.

* Identifying and satisfying the needs and wants of customers

* It is ultimately in charge of ensuring that the firm’s products sell.

29

New cards

Marketing activities

* Market research

* Promotion

* Branding

* Pricing

* Distribution

* Promotion

* Branding

* Pricing

* Distribution

30

New cards

Operations management

Responsible for the process of converting raw materials and components into finished goods, ready for sale and delivery to customers

\

* Operations is also applied to the process of providing services to customers

\

* Operations is also applied to the process of providing services to customers

31

New cards

Functional areas in large businesses

A large organization is able to allocate resources to each of the four functional areas, making their roles easily identifiable

32

New cards

Functional areas in small businesses

In a small business owned by just one person, each function would need to be carried out by the same person

33

New cards

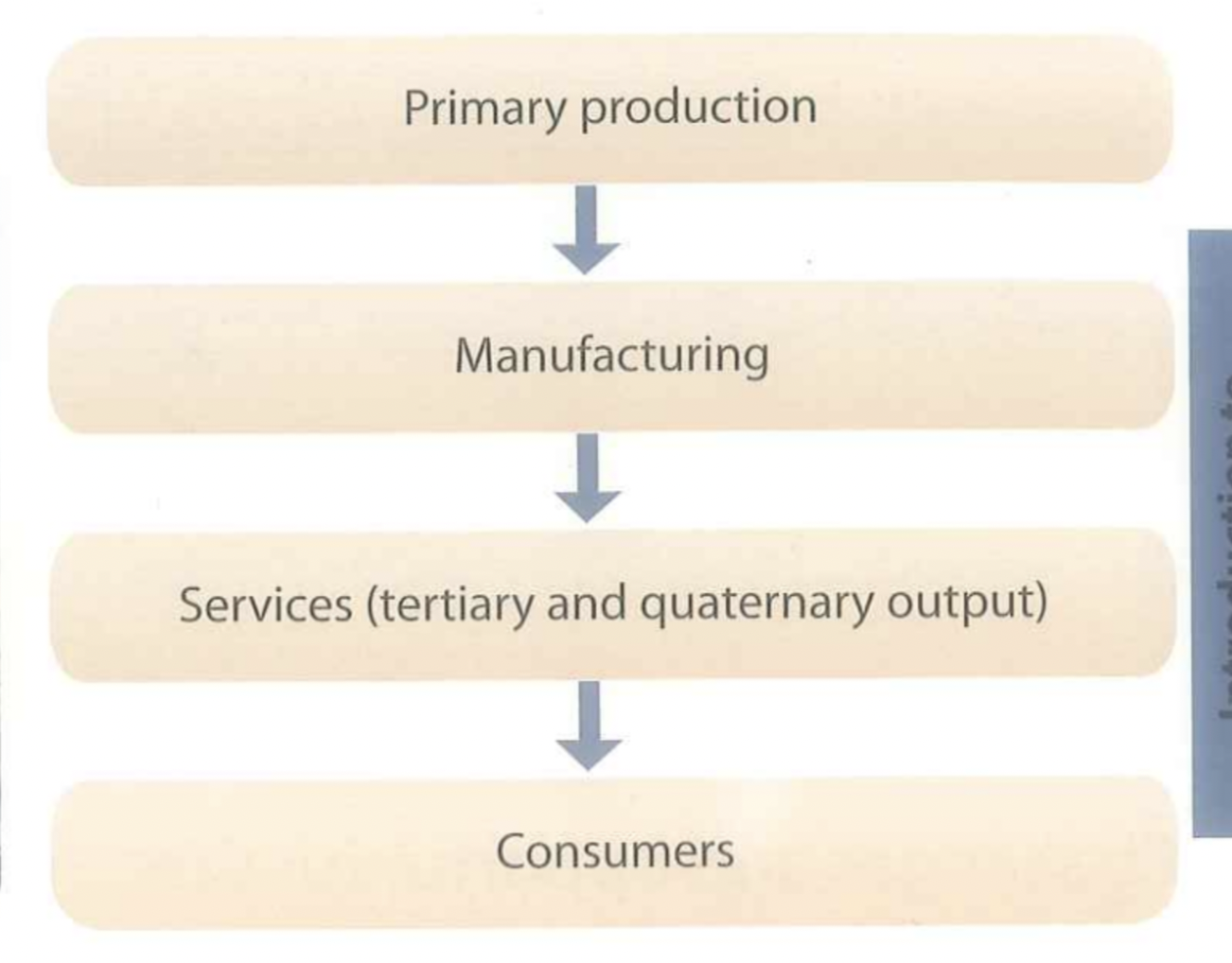

Business sectors

Businesses can be classified according to the stage of production (or chain of production) that they are engaged in

34

New cards

What are the business sectors

* Primary

* Secondary

* Tertiary

* Quaternary

* Secondary

* Tertiary

* Quaternary

35

New cards

Primary sector

Businesses operating in the primary sector are involved with the extraction, harvesting and conversion of natural resources

\

* Primary sector activities tend to account for a large percentage of output and employment in low income countries (LEDCs).

* Businesses operating in the primary sector in high income countries (MEDCs) use mechanization and automation, such as combine harvesters and automatic watering systems.

* As countries achieve sustained economic growth and development, there is less reliance on the primary sector in terms of employment and national output, partly because there is little value added in primary sector production

\

* Primary sector activities tend to account for a large percentage of output and employment in low income countries (LEDCs).

* Businesses operating in the primary sector in high income countries (MEDCs) use mechanization and automation, such as combine harvesters and automatic watering systems.

* As countries achieve sustained economic growth and development, there is less reliance on the primary sector in terms of employment and national output, partly because there is little value added in primary sector production

36

New cards

Secondary sector

Businesses that operate in the secondary sector are involved in the manufacturing or construction of products

\

* The output is then sold to customers, be they other businesses, governments, foreign buyers, or domestic customers

* Medium income countries (economically developing countries) tend to have a dominant secondary sector that accounts for a relatively large proportion of the country’s national output

* Economists argue that the secondary sector is a wealth-creating sector because manufactured goods can be exported worldwide to earn income for the country

* Value is added to the natural resources used during the production process

\

* The output is then sold to customers, be they other businesses, governments, foreign buyers, or domestic customers

* Medium income countries (economically developing countries) tend to have a dominant secondary sector that accounts for a relatively large proportion of the country’s national output

* Economists argue that the secondary sector is a wealth-creating sector because manufactured goods can be exported worldwide to earn income for the country

* Value is added to the natural resources used during the production process

37

New cards

Tertiary sector

Businesses in the tertiary sector specialize in providing services to the general population

\

* Physical goods can be transformed in the process of providing a service.

* In high income countries **(MEDCs)** such as Canada and Germany, the tertiary sector tends to be the most substantial sector in terms of both employment and as a percentage of gross domestic product

* The decline of the manufacturing/secondary sector in MEDCs also signifies their growing reliance on the tertiary sector

\

* Physical goods can be transformed in the process of providing a service.

* In high income countries **(MEDCs)** such as Canada and Germany, the tertiary sector tends to be the most substantial sector in terms of both employment and as a percentage of gross domestic product

* The decline of the manufacturing/secondary sector in MEDCs also signifies their growing reliance on the tertiary sector

38

New cards

Gross domestic product (GDP)

The value of the country’s output annually

39

New cards

Quaternary sector

A subcategory of the tertiary sector, businesses in the quaternary sector are involved in intellectual, knowledge-based activities that generate and share information

\

* The quaternary sector exists mainly in high income countries **(MEDCs)** as it requires a highly educated workforce.

* It is also the sector in which high-tech and e-commerce businesses invest for further growth and evolution

\

* The quaternary sector exists mainly in high income countries **(MEDCs)** as it requires a highly educated workforce.

* It is also the sector in which high-tech and e-commerce businesses invest for further growth and evolution

40

New cards

Chain of production

The four business sectors are linked through the chain of production, which tracks the stages of item’s production from the extraction or raw materials used to make the product all the way through being delivered to the customers.

41

New cards

Challenges of starting a new business

* __Lack of finance__ **→** all businesses need finance for the purchase of fixed assets. However start-up firms and most owners of new or small businesses do not have the credentials to secure sufficient funding without major challenges. Even if entrepreneurs are able to borrow some money, the funds may be insufficient or the relatively high interest charges might seriously affect the cash flow position of the business. Hence, new sole traders often have to remortgage their own homes to raise finance needed, thereby offering the lender more collateral in case they fail to repay the loan.

* __Unestablished customer base__ **→** a major challenge facing new businesses is attracting customers, i.e building a broad and loyal customer base. The problem is intensified when there are well established competitors already in the market. Customer loyalty is built over a long period of time, which may require marketing know-how and large amounts of money.

* __Cashflow problems__ **→** financing working capital is a major challenge for many business start-ups. A business may have a lot of stock, such as raw material, semi-finished outputs, or finished goods that it cannot easily turn into cash. Customers might demand a lengthy credit period (30-60 days) enabling them to buy now and pay later, so the business will not receive the cash payment until the credit period is over. However, during this time, the business still needs to pay for its on-going costs such a swages, rent, utility bills, taxes, and interest payments on bank loans.

* __Marketing problems__ **→** marketing challenges arise when businesses fail to meet customer needs, thereby resulting in poor sales and lack of profitability. Supplying the right products to the right customers at the right price is especially crucial for new businesses. However, small and new businesses might lack the expertise to do this. Quite often, the key to small business success is to identify a niche in the market and then fill it.

* __People management problems__ **→** business start-ups may lack experience in hiring the right staff with all the necessary skills. This can lead to poor levels of labor productivity and the need to retrain staff or to rehire people, all of which can be very expensive and time consuming. Moreover, new businesses might not know the ideal organizational structure or the most practical methods of staff motivation that best suits their organizational needs.

* __Production problems__ **→** it can be challenging for business start-ups to accurately forecast levels of demand so they are more likely to either over produce or under produce. Overproduction tends to lead to stockpiling, wastage, and increased costs. By contrast, underproduction leads to dissatisfied customers and a loss of potential sales.

* __Legalities__ **→** it is necessary for businesses to comply with all necessary legislation, including business registration procedures, insurance cover for staff and buildings, consumer protection laws and rules about intellectual property such as copyrights, patents, an trademarks. The paperwork and legal requirements of setting up a new business can be cumbersome, confusing, time consuming and expensive. Any oversight could result in the business having to pay compensation or financial penalties. This would obviously damage the already vulnerable cash flow position of business start-ups.

* __High production costs__ **→** new businesses are likely to have high set-up costs and running costs due to the large amount of money needed to purchase or pay for capital equipment, machinery, stocks, rent, advertising, insurance, and so forth. Smaller businesses will also be at a cost disadvantage as they cannot benefit from economies of scale. By contrast, economies of scale allow larger and more established businesses to benefit from lower average costs of production due to the size of operations, such as being able to get discounts from their suppliers for large bulk purchases or being able to borrow money at a lower interest rate because of their larger size and financial collateral.

* __Poor location__ **→** businesses face a dilemma in the location decision; busy areas offer the highest potential number of customers, but the premises in these area will also cost the most. Fixed costs, such as rent or mortgage payments account for a large percentage of total costs for many businesses. An aim for any new business is to reach. break-even as soon as possible, by keeping fixed costs down. This is one reason why many entrepreneurs set up small businesses that operate initially from their own homes (which also has a tax advantage). Ofcourse this is not suitable for businesses where location plays a key factor in business survival.

* __External influences__ **→** all businesses, irrespective of size or how long they have been in operation, are prone to exogenous socks that create a challenging trading environment, such as global financial crisis or the outbreak of a pandemic. However, larger and more established firms tend to be better resourced to handle these external influenced. Hence, new businesses face the added challenge of being more vulnerable to external shocks which also means the potential for business failure is great.

* __Unestablished customer base__ **→** a major challenge facing new businesses is attracting customers, i.e building a broad and loyal customer base. The problem is intensified when there are well established competitors already in the market. Customer loyalty is built over a long period of time, which may require marketing know-how and large amounts of money.

* __Cashflow problems__ **→** financing working capital is a major challenge for many business start-ups. A business may have a lot of stock, such as raw material, semi-finished outputs, or finished goods that it cannot easily turn into cash. Customers might demand a lengthy credit period (30-60 days) enabling them to buy now and pay later, so the business will not receive the cash payment until the credit period is over. However, during this time, the business still needs to pay for its on-going costs such a swages, rent, utility bills, taxes, and interest payments on bank loans.

* __Marketing problems__ **→** marketing challenges arise when businesses fail to meet customer needs, thereby resulting in poor sales and lack of profitability. Supplying the right products to the right customers at the right price is especially crucial for new businesses. However, small and new businesses might lack the expertise to do this. Quite often, the key to small business success is to identify a niche in the market and then fill it.

* __People management problems__ **→** business start-ups may lack experience in hiring the right staff with all the necessary skills. This can lead to poor levels of labor productivity and the need to retrain staff or to rehire people, all of which can be very expensive and time consuming. Moreover, new businesses might not know the ideal organizational structure or the most practical methods of staff motivation that best suits their organizational needs.

* __Production problems__ **→** it can be challenging for business start-ups to accurately forecast levels of demand so they are more likely to either over produce or under produce. Overproduction tends to lead to stockpiling, wastage, and increased costs. By contrast, underproduction leads to dissatisfied customers and a loss of potential sales.

* __Legalities__ **→** it is necessary for businesses to comply with all necessary legislation, including business registration procedures, insurance cover for staff and buildings, consumer protection laws and rules about intellectual property such as copyrights, patents, an trademarks. The paperwork and legal requirements of setting up a new business can be cumbersome, confusing, time consuming and expensive. Any oversight could result in the business having to pay compensation or financial penalties. This would obviously damage the already vulnerable cash flow position of business start-ups.

* __High production costs__ **→** new businesses are likely to have high set-up costs and running costs due to the large amount of money needed to purchase or pay for capital equipment, machinery, stocks, rent, advertising, insurance, and so forth. Smaller businesses will also be at a cost disadvantage as they cannot benefit from economies of scale. By contrast, economies of scale allow larger and more established businesses to benefit from lower average costs of production due to the size of operations, such as being able to get discounts from their suppliers for large bulk purchases or being able to borrow money at a lower interest rate because of their larger size and financial collateral.

* __Poor location__ **→** businesses face a dilemma in the location decision; busy areas offer the highest potential number of customers, but the premises in these area will also cost the most. Fixed costs, such as rent or mortgage payments account for a large percentage of total costs for many businesses. An aim for any new business is to reach. break-even as soon as possible, by keeping fixed costs down. This is one reason why many entrepreneurs set up small businesses that operate initially from their own homes (which also has a tax advantage). Ofcourse this is not suitable for businesses where location plays a key factor in business survival.

* __External influences__ **→** all businesses, irrespective of size or how long they have been in operation, are prone to exogenous socks that create a challenging trading environment, such as global financial crisis or the outbreak of a pandemic. However, larger and more established firms tend to be better resourced to handle these external influenced. Hence, new businesses face the added challenge of being more vulnerable to external shocks which also means the potential for business failure is great.

42

New cards

Collateral

Financial guarantee for securing external loan capital to finance investment expenditure for business growth

43

New cards

Working capital

The money available for the daily runnings of a business

44

New cards

Niche

Segment of a larger market that can be defined by its own unique needs, preferences, or identity that makes it different from the market at large

45

New cards

Opportunities of starting a new business (GET CASH)

* Growth → entrepreneurship tend to benefit personally when there is ana ppreciartion in the value of their businesses, especially as property and land tend to increase in value over time. This is called capital growth. it is quite common for the capital growht of a business to be worth more than the value of the owener’s salaries.

* Earnings → The potential returns from setting up your own business can easily outweigh the costs, even though the risks are hight. It is common that entrepreneurs earn far in excess of salaries from any other occupation that they might otherwise pursue.

* Transference & inheritance → in many societies, it is the cultural norm to pass on assets, including businesses, to the next generations. Many self-employed entrepreneurs view thier business as something that they are able to pass on (transferance) to their children (inheritence) to give them a sense of financial security that might not be possible if they chose to work for someone else.

* Challenge → some people might view setting up and running a business as a personal challenge. It is this challneg that dirves them to perform and what gives them particular satisfaction. Being successful in business boosts self-esteem.

* Autonomy → wokring for someone else means that employees have to follow the instructions and rules set by the organizationt hat they work for, such as conditions of employment, working hours, employment benefits and holiday entitlments. Conversely, being self employed means that there is autotnommy in how things are done within the organization. Essentially, this opportunity refers to the benefits of being your own boss.

* Security → there could be a greater sense of job security for someone who is their own boss. By contrast, employees can be dismissed, made redundant or even rpelcaed by technology. Although the risks are great, being self-employes also makes it potentially easier to accumulate personal wealth (financial security) to provide higher funds for retiremment.

* Hobbies → some people might want to purusr etheir passion or to turn their hobby and interests into a business opportunity. Succesful entrepreneurshave a passion for what they do and this is mde easier if the nature of the work is directly related to their personal interests.

* Earnings → The potential returns from setting up your own business can easily outweigh the costs, even though the risks are hight. It is common that entrepreneurs earn far in excess of salaries from any other occupation that they might otherwise pursue.

* Transference & inheritance → in many societies, it is the cultural norm to pass on assets, including businesses, to the next generations. Many self-employed entrepreneurs view thier business as something that they are able to pass on (transferance) to their children (inheritence) to give them a sense of financial security that might not be possible if they chose to work for someone else.

* Challenge → some people might view setting up and running a business as a personal challenge. It is this challneg that dirves them to perform and what gives them particular satisfaction. Being successful in business boosts self-esteem.

* Autonomy → wokring for someone else means that employees have to follow the instructions and rules set by the organizationt hat they work for, such as conditions of employment, working hours, employment benefits and holiday entitlments. Conversely, being self employed means that there is autotnommy in how things are done within the organization. Essentially, this opportunity refers to the benefits of being your own boss.

* Security → there could be a greater sense of job security for someone who is their own boss. By contrast, employees can be dismissed, made redundant or even rpelcaed by technology. Although the risks are great, being self-employes also makes it potentially easier to accumulate personal wealth (financial security) to provide higher funds for retiremment.

* Hobbies → some people might want to purusr etheir passion or to turn their hobby and interests into a business opportunity. Succesful entrepreneurshave a passion for what they do and this is mde easier if the nature of the work is directly related to their personal interests.

46

New cards

Capital growth

Capital growth is your property increasing in value over time.

47

New cards

Autonomy

Independence, freedom of choice and flexibility

48

New cards

Reasons for setting up a business

People set up their own businesses due to the opportunities to satisfy their personal desires, such as to fulfill a personal vision, to have the opportunity to achieve success, to be their own boss, or live a more extravagant lifestyle (if and when the business becomes successful). However, a significant number of new businesses fail to survive. There are three inter-related reasons or challenges behind this, a lack of cash in the business, poor cost control, substandard or weak management and leadership.

49

New cards

Reasons for start-up business failure

A significant number of new businesses fail to survive. There are three inter-related reasons or challenges behind this;

1. A lack of cash in the business

2. Poor cost control

3. Substandard or weak managament and leadership.

1. A lack of cash in the business

2. Poor cost control

3. Substandard or weak managament and leadership.