Comm 294 - Lecture Clickers

1/47

Earn XP

Description and Tags

BEFORE MIDTERM

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

Issuing a quarterly earnings report to investors

a) financial accounting

b) managerial accounting

Financial Accounting

Calculating a breakeven point (where a company's total revenue equals its total costs)

a) financial accounting

b) managerial accounting

Managerial Accounting

Determining the cost of producing a product

a) financial accounting

b) managerial accounting

Managerial accounting

Preparing a report for the Securities and Exchange Commission

(SEC)

a) financial accounting

b) managerial accounting

Financial Accounting

Preparing a sales budget

a) financial accounting

b) managerial accounting

Managerial Accounting

Preparing a Statement of Cash Flows in accordance with generally accepted accounting principles (GAAP)

a) financial accounting

b) managerial accounting

Financial Accounting

Choosing among competing capital projects using net present value analysis

a) financial accounting

b) managerial accounting

Managerial Accounting

Property taxes on factory building |

a) product cost

b) period cost

product cost

Boxes used for packing detergent (Company

makes detergent)

a) product cost

b) period cost

product cost

Sales commissions

a) product cost

b) period cost

period cost

Factory Supervisor’s Salary

a) product cost

b) period cost

product cost

Depreciation on headquarters' furniture

a) product cost

b) period cost

period cost

Wages to workers for assembling computers

a) product cost

b) period cost

product cost

Lubricants for factory machines

a) product cost

b) period cost

product cost

Shipping costs on sold goods

a) product cost

b) period cost

period cost

Thread used in garment factory

a) product cost

b) period cost

product cost

Yarn used in the production of sweaters

a) product cost

b) period cost

product cost

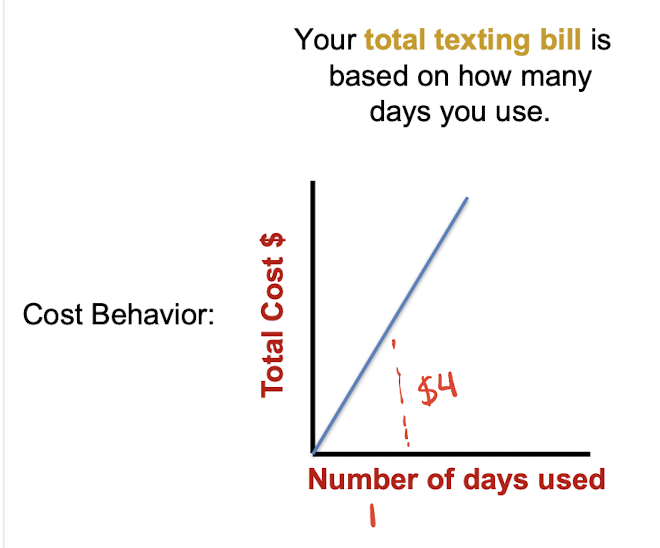

TRUE or FALSE: The line for a pure variable cost would begin at the origin of the cost-volume graph.

TRUE

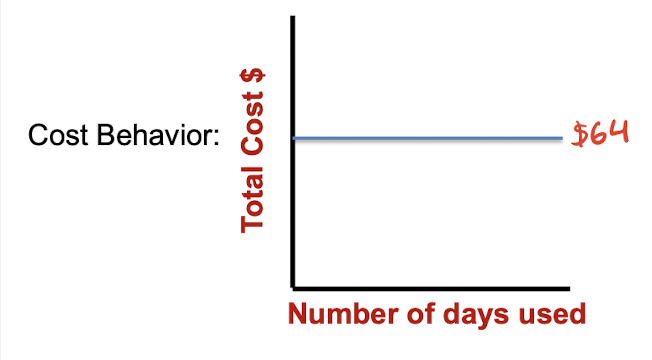

TRUE or FALSE: The line for a pure fixed cost would begin at the origin of the cost-volume graph.

FALSE

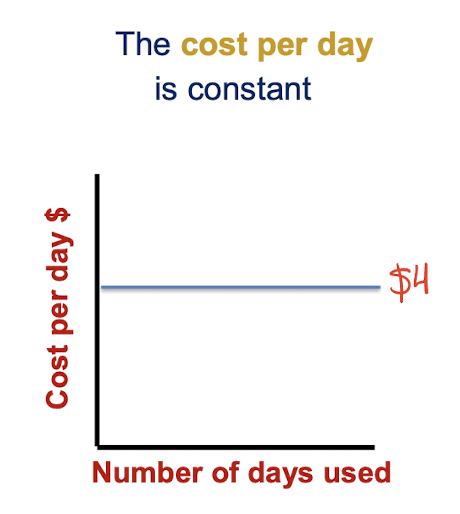

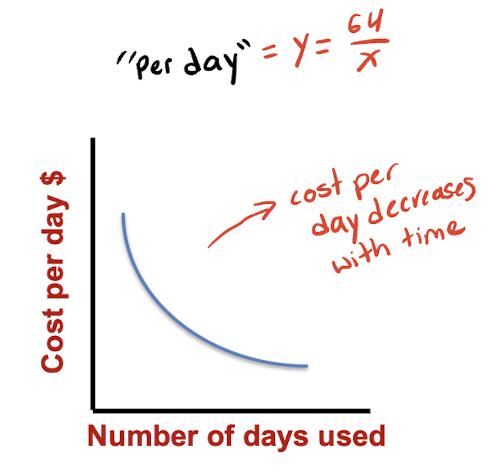

TRUE or FALSE: The line for variable cost per unit has positive slope.

FALSE

TRUE or FALSE: The line for fixed cost per unit is flat.

FALSE

Which of the following would be considered an indirect cost of an iPad? (choose all that apply)

a. Assembly labor

b. iPad case

c. Factory manager salary

d. Health insurance for factory workers

e. Touch-screen

c. Factory manager salary

(overall function not end product)

d. Health insurance for factory workers

(manufacturing - not direct relation to final product)

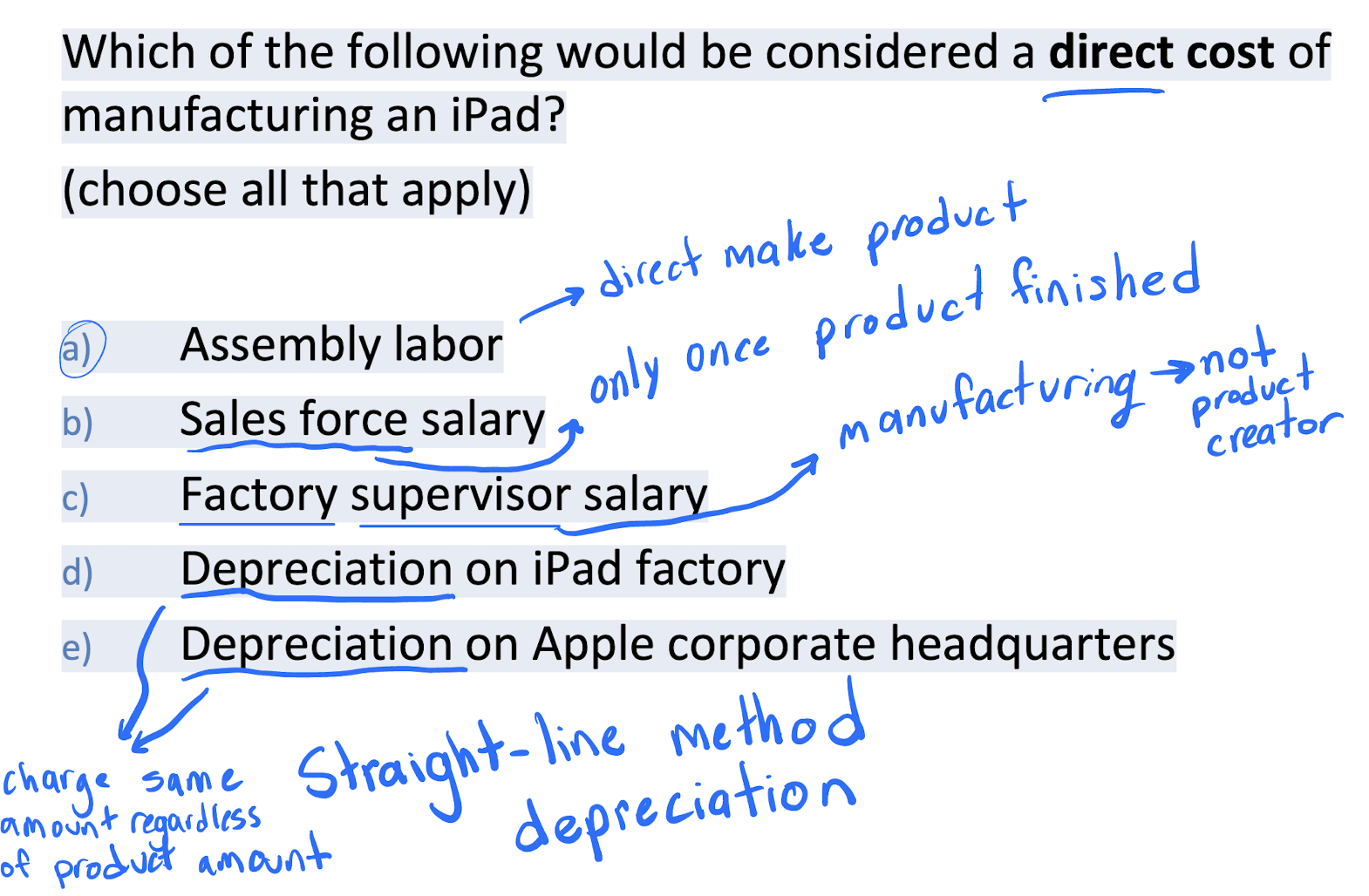

Which of the following would be considered a direct cost of

manufacturing an iPad? (choose all that apply)

a) Assembly labor

b) Sales force salary

c) Factory supervisor salary

d) Depreciation on iPad factory

e) Depreciation on Apple corporate headquarters

a) Assembly labor

You got accepted into University of Toronto and UBC. If you go to Toronto, your parent will need to pay $2,000 for your rent each month. Your parents own a condo at UBC that you can use for free. All other costs are similar. Based on this analysis, you chose UBC to save costs. What cost is being overlooked in your analysis?

a) Sunk cost

b) Differential cost

c) Opportunity cost

d) None of the above

c) Opportunity cost

(can rent to others for more - other option)

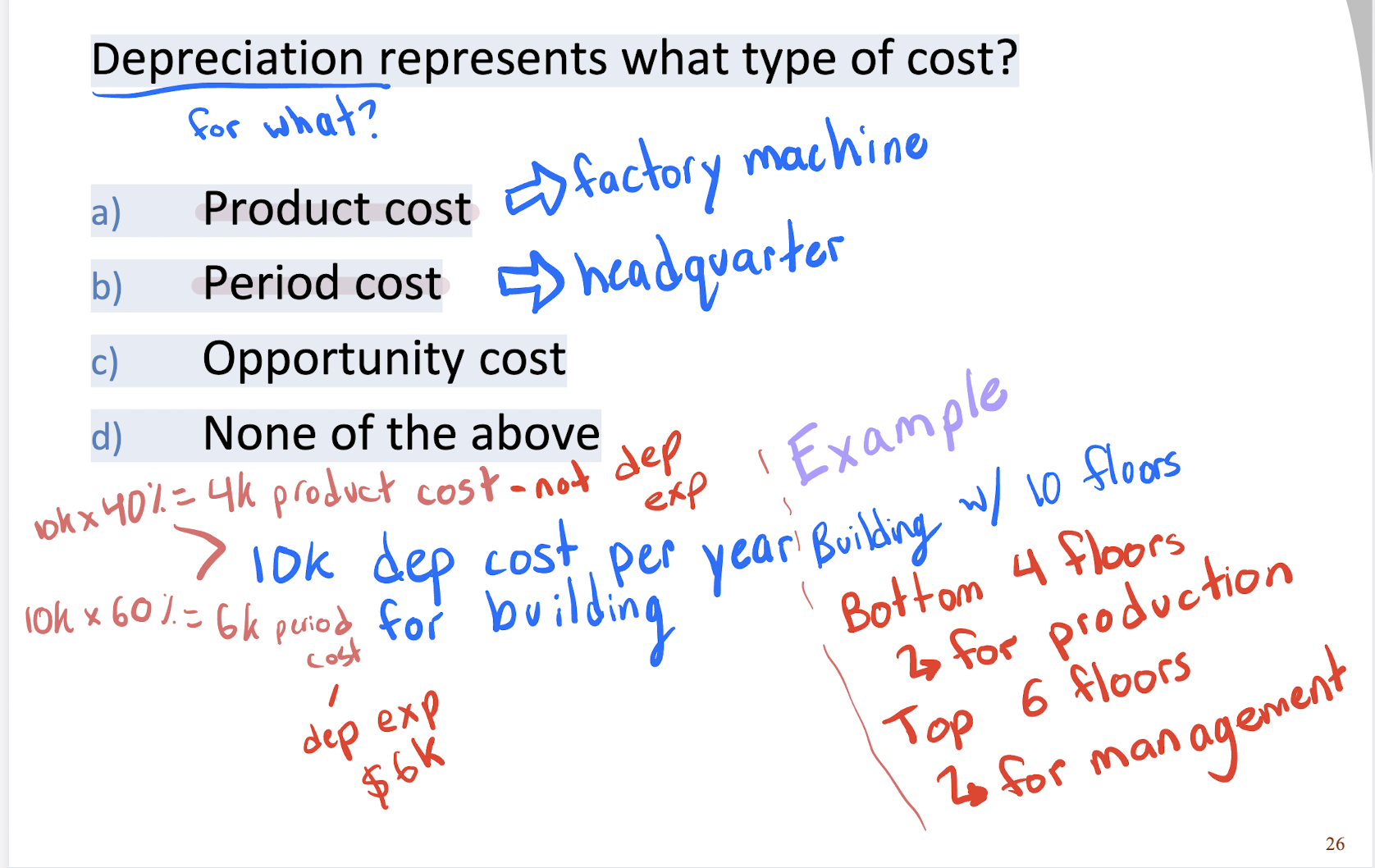

Depreciation represents what type of cost?

a) Product cost

b) Period cost

c) Opportunity cost

d) None of the above

a) Product cost

(factory machine)

b) Period cost

(headquarters)

Depreciation for what??

The cost of shipping products to customers is which type of costs?

a) Product cost

b) Period cost

c) Opportunity cost

d) Sunk cost

e) None of the above

b) Period cost

(happens after product production)

A power failure occurs during one of several

production jobs, the idle time that results from it

should be classified as:

A. Direct labor cost

B. Manufacturing overhead

B. Manufacturing overhead

A specific job required idle time caused by waiting for material as a result of a specification change by the customer:

A. Direct labor cost

B. Manufacturing overhead

A. Direct labor cost

Property taxes on factory building

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

C.) MOH

Boxes used for packaging detergents (company makes detergent)

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

A.) DM

Sales Commissions

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

D.) Selling

Factory Suprivisor’s Salary

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

C.) MOH

Depreciation on Headquarters Furniture

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

E.) Admin

Wages to workers for assembling computers

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

B.) DL

Lubricants for factory machines

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

C.) MOH

Shipping costs on sold goods

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

D.) Selling

Thread used in a garment factory

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

C.) MOH

Yarn used in the production of sweaters

A.) DM

B.) DL

C.) MOH

D.) Selling

E.) Admin

A.) DM

A power failure occurs during one of several

production jobs, the idle time that results from it

should be classified as:

A. Direct labor cost

B. Manufacturing overhead

B. Manufacturing overhead

A specific job required idle time caused by waiting for material as a result of a specification change by the customer:

A. Direct labor cost

B. Manufacturing overhead

A. Direct labor cost

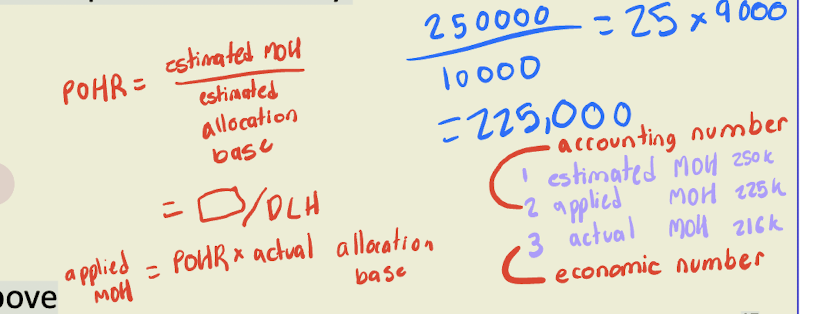

Assume you own a manufacturing company that budgets an estimated $250,000 in overhead for the upcoming year and 10,000 direct labor hours. Also assume your manufacturing overhead application base is direct labor hours. Actual overhead during the year amounts to $216,000 and the employees work 9,000 actual direct labor hours. Compute the amount of overhead that is applied to work-in-process inventory.

a. $ 250,000

b. $ 216,000

c. $ 225,000

d. $ 194,400

e. None of above

c. $ 225,000

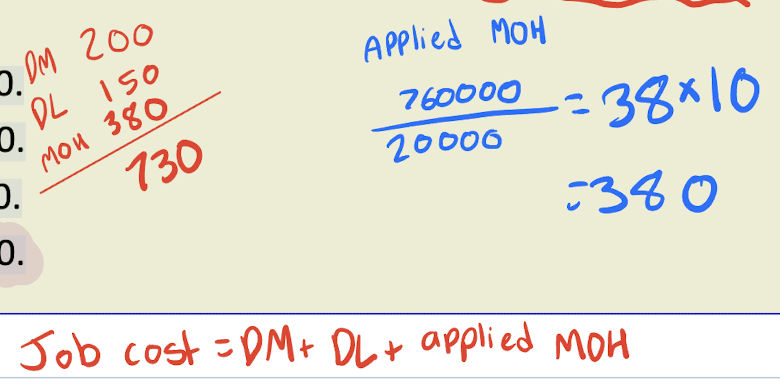

Job WR53 at NW Fab, Inc. required $200 of direct materials and 10 direct labour hours at $15 per hour. Estimated total overhead for the year was $760,000 and estimated direct labour hours were 20,000 (allocation base). What would be recorded as the cost of job WR53?

a. $200.

b. $350.

c. $380.

d. $730.

d. $730.

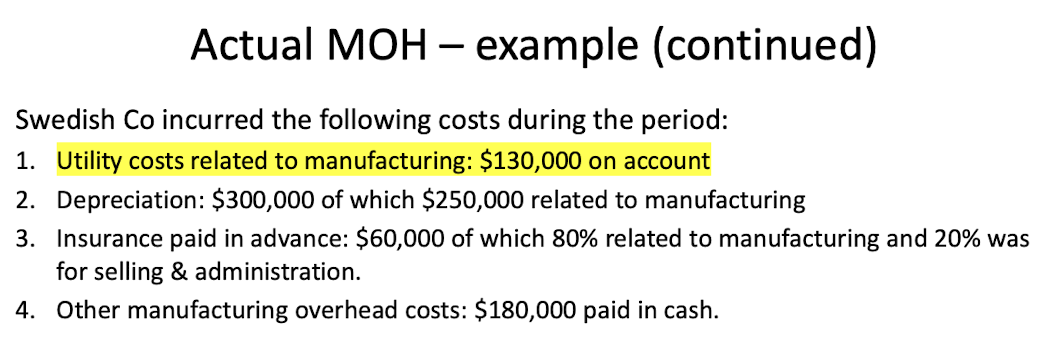

Choose one of the following:

(a). Dr. Utility Expense $130K

Cr. Accounts Payable $130K

(b). Dr. Manufacturing Overhead $130K

Cr. Accounts Payable $130K

(c). None of the above

(b). Dr. Manufacturing Overhead $130K

Cr. Accounts Payable $130K

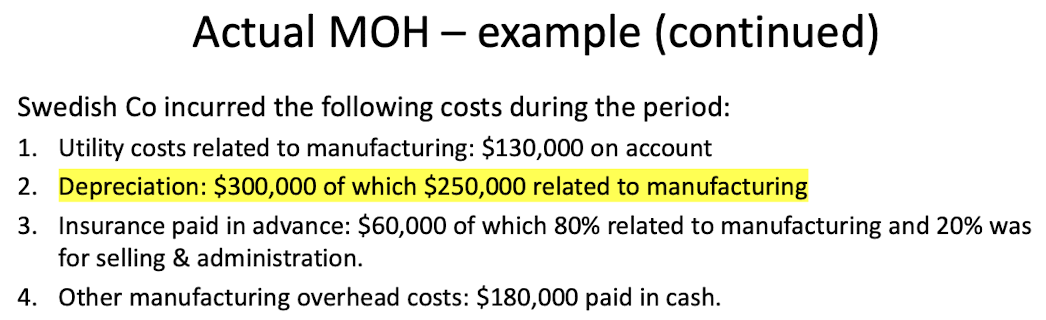

Choose one of the following:

(a). dr. Depreciation Expense $300K

cr. Accounts Payable $300K

(b). dr. Manufacturing Overhead $250 K

dr. Depreciation Expense $50K

cr. Accumulated Depreciation $300k

(c). None of the above

(b). dr. Manufacturing Overhead $250 K

dr. Depreciation Expense $50K

cr. Accumulated Depreciation $300k

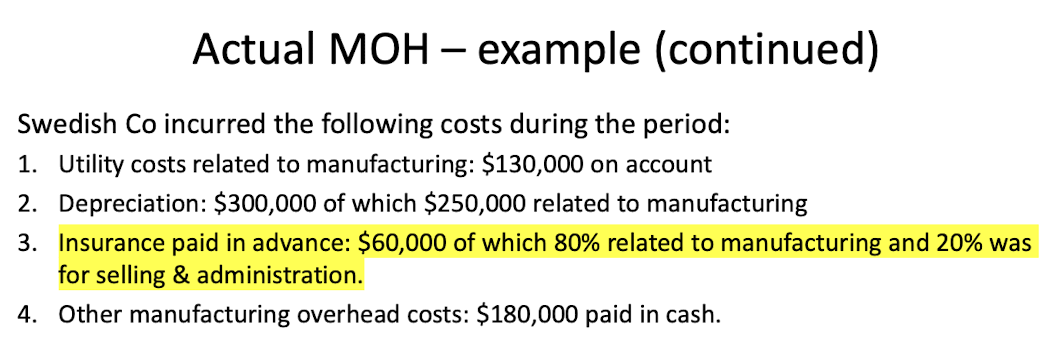

Choose one of the following:

(a). dr. Insurance Expense $60K

cr. Accounts Payable $60K

(b). dr. Manufacturing Overhead $48K

dr. Insurance Expense $12K

cr. Prepaid Insurance $60K

(c). None of the above

(b). dr. Manufacturing Overhead $48K

dr. Insurance Expense $12K

cr. Prepaid Insurance $60K

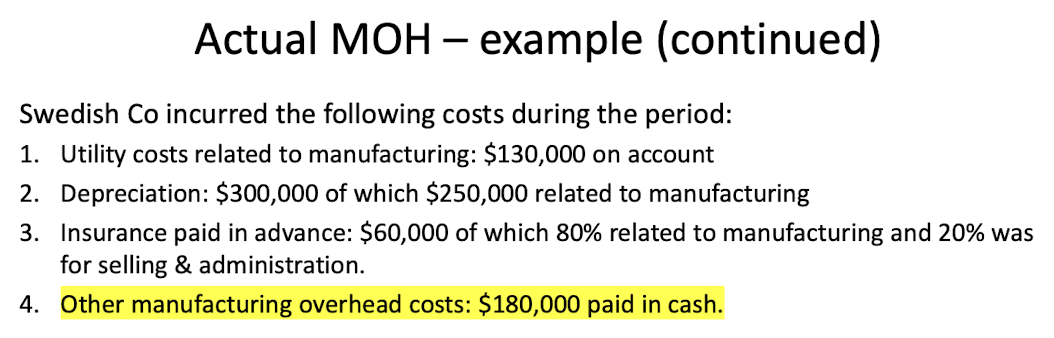

Choose one of the following:

(a). dr. Manufacturing Overhead $180K

cr. Cash $180K

(b). dr. Product Cost $180K

cr. Cash $180K

(c). Both (a) and (b) are correct

(a). dr. Manufacturing Overhead $180K

cr. Cash $180K

Applied MOH - example EXPECTED TO KNOW EASILY

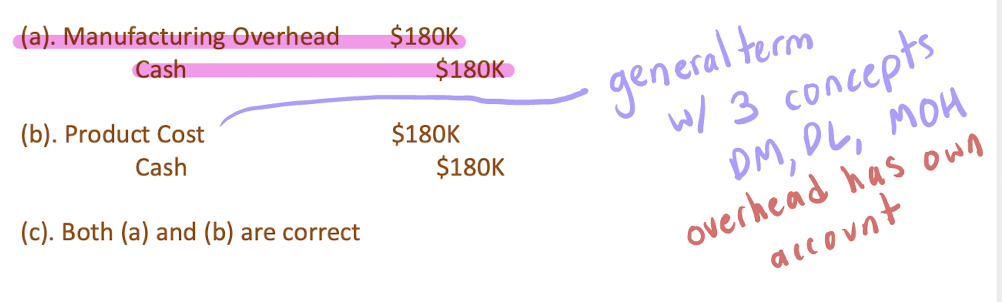

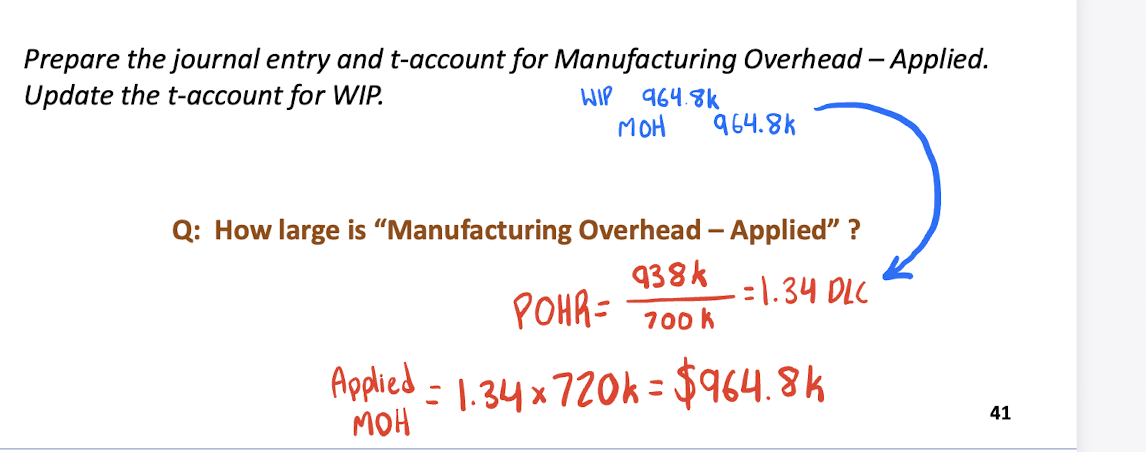

Swedish Co calculates a predetermined overhead rate using direct labour cost as its allocation base. Swedish Co estimated that it would incur $938,000 in total manufacturing overhead costs and $700,000 in direct labour costs. The Company incurred Direct labour cost of $720,000 during the period:

Calculate the pre-determined overhead rate (POHR).

Prepare the journal entry and t-account for Manufacturing Overhead - Applied.

Update the t-account for WIP.

Q: How large is "Manufacturing Overhead - Applied" ?

$968.4K

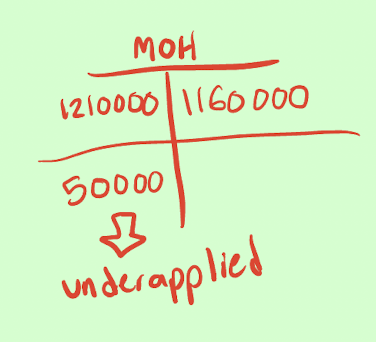

Tiger, Inc. had actual manufacturing overhead costs of $1,210,000 and a predetermined overhead rate of $4.00 per machine hour. Tiger, Inc. worked 290,000 machine hours during the period. Tiger's manufacturing overhead is

a.) $50,000 overapplied

b.) $50,000 underapplied

c.) $60,000 overapplied

d.) $60,000 underapplied

b.) $50,000 underapplied