2.1 - Raising finance (copy)

1/71

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

72 Terms

Why do businesses need finance?

- Start up a business

- Expand an existing business

- Increase working capital

- Day to day operations

- To buy stock

- To pay debts

What are internal sources of finance?

Funds generated from owner's capital, retained profit, or the sale of assets

What is owner's capital?

- The money provided by the owners in a business

- Shows the stake the owner has in the business

What are the advantages of owner's capital?

- No interest or repayments

- No need to share profits with new partners or through dividends to shareholders

- No loss of control of the business

What are the disadvantages of owner's capital?

- Owner risks savings

- Owner may not have enough savings

- Risk of bankruptcy

What is retained profit?

Acquired from profits on sales already made that a business re-invests into its operations

What are the advantages of retained profit?

-Can't make a loss because you re-investing your profit

- No interest so no debt

- Easy to obtain

What are the disadvantages of retained profit?

- Can be slow to accumulate

- Not available to new businesses

- Once it is used it is gone

What is sale of assets?

When a business sells something that it owns but no longer requires (e.g. machinery, land, buildings)

What are advantages of sale of assets?

- Can raise a lot of cash

- No interest

What are disadvantages of sale of assets?

- New business lack assets to sell

- It may be time consuming to find purchaser

What are the advantages of using internal finance?

- Often free

- Does not involve third parties who may want to influence business decisions

- Can usually be organised very quickly and without significant paperwork

- Businesses that may fail credit checks (necessary for a bank loan) can access internal finance sources more easily

What are the disadvantages of using internal finances?

- There is a significant opportunity cost involved in the use of internal finance

- May not be sufficient to meet the needs of the business

- Rarely as tax-efficient as many external methods

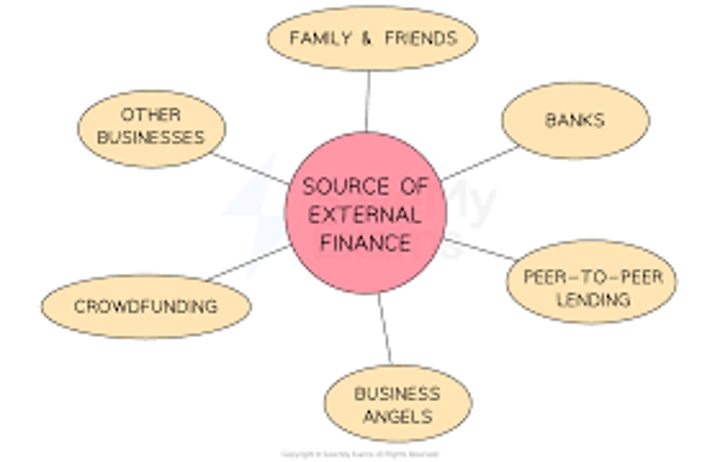

What are the external sources of finance available to a business?

What are the advantages of family and friends as a source of finance?

- Usually a very cheap source of funds

- May have 'no string attached' (e.g. a share of the business) and can be provided to the business on very flexible terms

- Owner can still keep control of the business and may be able to trust their business investors

What are the disadvantages of family and friends as a source of finance?

Relationships may be damaged if the finance is not repaid

What are the advantages of bank loans as a source of finance?

- May offer both short term finance (e.g. overdrafts) and long term finance (e.g. mortgages) if a business qualifies

- Banks are often keen to provide free advice and guidance to businesses that use their services

- Small sums may be borrowed from unsecured

What are the disadvantages of bank loans as a source of finance?

- A business plan is usually required to access bank finance

- Banks can be cautious about lending to new, untested businesses

- Interest is payable

- Businesses must be customers of the bank to access some loans

- For larger amounts, businesses may need to provide security to be granted a loan

What are the advantages of peer-to-peer funding as a source of finance?

- Loans can usually be made available to businesses very quickly

- Usually has 'no strings attached (e.g. a share of the business)

What are the disadvantages of peer-to-peer funding as a source of finance?

- Borrowers are charged a small fee to access finance in this way and have to pay interest in the same way as a bank loan

- The individuals who made the money available in the first place receive some of this interest as compensation

What are the advantages of business angels as a source of finance?

- Tend to be more willing to take a risk than banks

- Often offer advice and guidance to the businesses in which they invest

- Investment is usually for a determined period of time so owners regain shares in the future

What are the disadvantages of business angels as a source of finance?

- Finding the 'right' business angel (e.g. with appropriate experience, expertise or interest) can be challenging

- Networking is vital when entrepreneurs seek this kind of investment

- As business angels own a stake in the business they may be involved in decision-making and will receive a share of business profits

What are the advantages of crowdfunding as a source of finance?

- Creates an organic customer base and the platform provides a form of free marketing

- A good credit rating is not required so new businesses that lack a trading record can attract funding

What are the disadvantages of crowdfunding as a source of finance?

- Businesses need to provide a persuasive business plan to convince individuals to invest in their product as they will be competing with many other projects online

- The potential for negative publicity if the project is not successful in attracting enough crowdfunding capital

What are the advantages of finance from other businesses?

- May provide access to business processes and market knowledge alongside finance

- Can access large amounts of finance

What are the disadvantages of finance from other businesses?

- Profits need to be shared between businesses

- Decisions will usually need to be agreed by all of the businesses involved

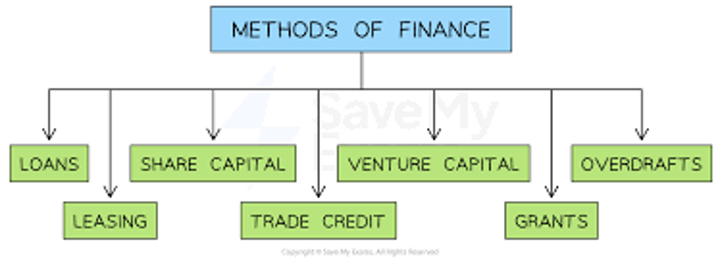

What are the different methods of finance available to businesses?

What are loans?

A sum of money is borrowed and repaid (with interest) over a determined period of time

What are bank loans?

Usually unsecured and are typically repaid over two to ten years

What are the benefits of bank loans?

- Interest rates are fixed for the term of the loan

- Repayments are made in equal instalments, helping budgeting

What are the drawbacks of bank loans?

- Interest rates depend on the businesses credit rating

- Non-current liabilities are increased in the balance sheet

What are mortgages?

- Long-term secured loans

- Typically used by a business to purchase buildings, land or large items of capital equipment

What are the benefits of mortgages?

Businesses can purchase expensive equipment or property without the need for large amounts of capital

What are the drawbacks of mortgages?

- Missed payments may lead to property being repossessed

- Repayments are variable, and linked to the current interest rate, making budgeting difficult

What are debentures?

- Long-term agreements between a business and a lender to repay a specified amount (with a fixed rate of of interest) by a certain date

- Debenture holders are creditors rather than owners of a business and do not hold voting rights

What are the benefits of debentures?

- Control over decision-making is retained within the business

- Interest is fixed, aiding budgeting

What are the drawbacks of debentures?

- Interest is often higher than for other types of loan

- Failure to repay debentures may deter investors in the future

What are overdrafts?

- An arrangement for business current account holders to spend more money than it has in their account

- A limit is agreed and interest is charged only when a business 'goes overdrawn'

What are the benefits of overdrafts?

A short-term source of finance that offers significant flexibility and aids cash flow

What are the drawbacks of overdrafts?

An overdraft may be 'called in' if the bank is concerned about a business's ability to repay what it owes

What is share capital?

- Finance raised from the sale of shares in a limited company

- Shareholders are the owners of shares and they are entitled to a share of the company's profit when dividends are declared

What are the benefits of share capital?

- Large amounts of capital can be raised, especially by public limited companies

- Interest is not payable on finance raised in this way

What are the drawbacks of share capital?

Shareholders usually have a vote at a company's Annual General Meeting where they can have a say in the composition of the Board of Directors

What is venture capital?

- Funds provided by specialist investors in small to medium-sized businesses that have significant potential for growth

What are the benefits of venture capital?

Businesses that may have been refused finance from other sources may be able to attract investment from less risk-averse venture capitalists

What are the drawbacks of venture capital?

Venture capitalists usually require a stake in the business in return for finance and often expect to exert some control over the business

What is leasing?

An asset such as a piece of machinery or a vehicle used by the business in return for regular payments

What are the benefits of leasing?

The business does not own the asset during the period of the lease and so is not responsible for maintenance or repair costs

What are the drawbacks of leasing?

Usually more expensive in the long run than buying an asset

What is trade credit?

An agreement is made with suppliers to buy raw materials, components and stock which are paid for at a later date, typically 30 to 90 days later

What are the benefits of trade credit?

Usually interest-free

What are the drawbacks of trade credit?

Discounts for early payment will not be available

What are grants?

Sums of money given by the government for businesses that meet specific criteria

What are the benefits of grants?

Do not need to be repaid

What are the drawbacks of grants?

The business must use the finance for its intended purpose

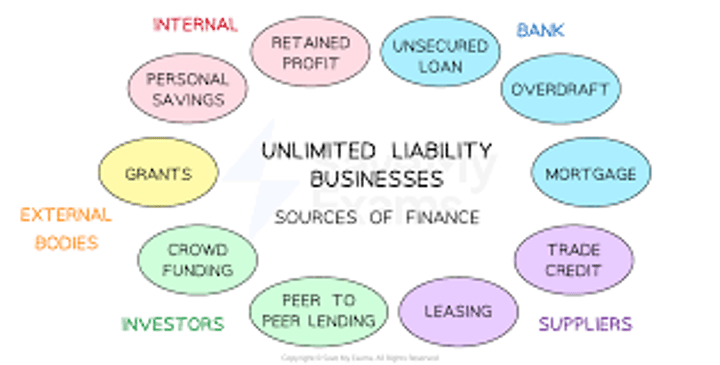

What is unlimited liability?

- Sole proprietors and partnership owners are fully responsible for all debts owed by the business

- Owners are also legally responsible for any unlawful acts committed by those connected to the business

What are the implications of unlimited liability?

- There is no legal distinction between owners with unlimited liability and the business

- As a result, these business owners may have to use their own personal assets to pay debts or legal fees

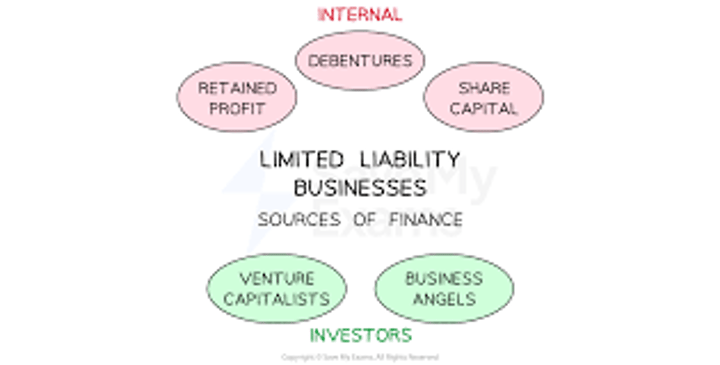

What is limited liability?

- Owners (shareholders) of private limited companies and public limited companies can only the original amount they invested in the business if it fails

- Shareholders are not responsible for business debts

- In most cases, the shareholders cannot be responsible for unlawful acts committed by those connected with the business

What are the implications of limited liability?

- Companies are incorporated and owners are considered a separate legal entity to the business

- This means that if a company fails, the owners would lost their investment (shares) but would not have to use their assets to meet additional debts or legal fees

What are the methods of finance suitable for limited liability businesses?

What are the methods of finance suitable for unlimited liability businesses?

What is a business plan?

A document produced by the owner at start-up, which provides forecasts of items such as sales, costs and cash flow

Why does a business write a business plan?

- To persuade lenders that a business will be able to pay back interest and loan capital on any finance taken out

- Attract potential investors

- To give the owners some direction

- To set targets and objectives that can be followed

- To identify early on any problems that the business might face

What's included on a business plan?

Cash flow forecast

What is a cash flow forecast?

- It is an estimate of future inflows & outflows of the business usually on a monthly basis

- Will help to show a bank that the interest rates can be afforded on any finance borrowed

- It shows the expected cash balance (NOT profit) at the end of each month

What are the advantages of cash flow forecasts?

- Can support an application for a loan and are an integral part of the business plan

- They can help identify where the business may experience cash shortfalls or cash surpluses so that plans can be made to manage these periods

- Aid planning and help a business avoid costly mistakes

What are the disadvantages of cash flow forecasts?

- Usually based on estimates and in reality inflows and outflows may differ significantly from the estimates

- Cash flow forecasts require appropriate skills, insight, research and time to prepare and update adequately

- External factors that can impact inflows and outflows may not be reflected in the cash flow forecast

Cash inflow examples

- Sales of products

- Sales of assets

- Interest on savings

- Borrowed money

Cash outflow examples

- Payments for stock/raw materials

- Payments for equipment

- Wages and bills

- Loan repayments

What is cash inflow?

Money coming into the business

What is cash outflow?

Money going out of the business

What is net cash flow?

Total inflow - Total outflow