Ch. 17 - Audit reports

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

58 Terms

Types of audit opinion

Unqualified: “without exception” / everything is good

No material misstatements

Qualified: “with exception” / mostly good except

There is a non-pervasive material misstatement

Adverse: BAD

There is 1+ pervasive material misstatements

Disclaimer of opinion

There are 1+ pervasive scope limitations

Scope limitation

when the auditor is unable to gather sufficient appropriate evidence on which to base their opinion.

it’s not saying good/bad, it’s just that the auditor has no opinion on this area

The Qualified opinion can be given when (2)

there is a non-pervasive material misstatement, or

there’s a non-pervasive scope limitation

Additional/Explanatory Paragraphs

When the auditor adds additional language to the audit report

some cases required, some optional.

different names for PCAOB/AICPA

Required situations (2)

Going concern issues

GAAP consistency issues

“Explanatory language” per the PCAOB

“Emphasis-of-Matter paragraph” per AICPA

PCAOB term for required situations

Explanatory language

AICPA term for required situations

Emphasis-of-matter paragraph

Optional situations (5)

Change in accounting estimate

Uncertainties

Important Subsequent Events

Major catastrophies

Division of responsibilities

PCAOB: “emphasis of matter” paragraph

AICPA: “emphasis of matter” paragraph

PCAOB term for optional situations

Emphasis of matter paragrpah

AICPA term for optional situations

Emphasis of matter paragraph

Which situations reference stuff that’s included in the financial statements?

Both required and optional situations

“Other items NOT in the financial statements” situations

references stuff NOT included in the financials

AICPA: “Other matter paragraph”

Not directly addressed by PCAOB standards

AICPA term for “Other items NOT in financials”

Other matter paragraph

In all (3) these situations, there are…

No GAAP violations/misstatements and the core Audit Opinion is still clean/unqualified/unmodified

there is nothing wrong with the financials, the auditor is just adding more info for readers

R1) Going concern Issues

Arise when there is significant doubt about a company’s ability to continue operating for the foreseeable future.

If there are serious financial or operational problems that might force a business to shut down, sell off assets, or restructure, then its "going concern assumption" is in question.

Being a “Going concern” is a GOOD thing

Because it means the business is expected to continue operating normally—earning revenues, paying bills, and meeting obligations—for at least the next 12 months.

GAAP requires that companies evaluate on an annual basis whether any conditions exist that…

raise Substantial doubt about the company’s ability to operate as a Going Concern “for a reasonable period of time” (1 year)

What could cause a company to bankrupt within a year?

cashflow issues

recurring losses

critical lawsuit fines

government regulation that may close the business

Auditing Standards require the auditor to make the same Going Concern assessment about their clients

That is, whether any conditions arise that raise “substantial doubt” about the company’s ability to continue as a going concern within the next year.

Depending on the circumstances & the client’s plan to “fix” the GC issue…

the auditor may be required to add Explanatory language (PCAOB) / Emphasis of matter paragraph (AICPA) to the audit report

Going concern issue extra paragraph is optional when

The auditor has substantial doubt → the client has a satisfactory plan to address the issues (like raising new capital)…

THEN, the extra paragraph is optional

GC extra paragraph is required when

The auditor has substantial doubt → the client does NOT have a satisfactory plan to address the issues

In this case, the extra paragraph is required

Clients dislike having the extra GC paragraph added

Bc they believe it creates a “self-fulfilling prophecy” where investors/lenders are scared away & they actually do go bankrupt

Auditors also don’t like adding the GC extra paragraph

Because:

it puts them in an odd spot with their client

they aren’t trained to make these kinds of assessments

they aren’t actually very good at it

very high Type 1 and Type 2 errors

Conflicting incentives

If you do add the extra GC pg → client gets angry at you

If you don’t & client does end up going bankrupt → you get blamed and sued bc you “shoul’ve seen it coming”

If bankruptcy is imminent…

the client must switch to a Liquidation Basis of Accounting and write-down ALL assets to their “fire-sale” values.

R2) GAAP consistency issues

Clients must use the same accounting method from year to year in areas like:

inventory costing (LIFO vs FIFO)

Depreciation methods

How to calculate A4DA

But in some circumstances, GAAP may allow a change if:

the new method is GAAP & “preferable”

the effect of the change is disclosed

If there is a justified change in Accounting Method,

the auditor is required to add Explanatory language (PCAOB) to te audit report

Optional Emphasis of matter paragraphs (5)

change in acct. estimate: changing the useful life of an asset

uncertainties: lawsuits

important SEs

Major catastrophies

Division of responsibility

It is VERY important that in all of the (5) optional situations…

the client has followed GAAP!

All the changes / disclosures / JEs are done properly

“Other matter” paragraphs (OMP)

it discusses items NOT included in the financials

Because there no misstatements with Other Matter Paragraphs, we can assume the item did NOT have to be included in the financials.

OMP examples

issues with conducting the audit

elaboration of the auditor’s responsibilities

remote (no disclosure) but catastrophic contingencies

Incentives & Frequency of OMPs

OMPs are rarely used in reality

Incentives are skewed towards the auditor saying as little as possible in the audit report, because if they say more than what’s needed:

client gets angry bc u’re “sharing their business”

possible ethical violations from sharing client confidential info

concerns about how “anything u say can be used against u” by lawyers/regulators

So, if you’re not “required” to say it, auditors typically just shut up

Because auditors have a unique information advantage,

the investors and regulators want auditors to say more about the comapanies they audit

led to CAM/KAM creation

Critical Audit Matter (CAM)

A little paragraph @ end of report describing something on the audit that was hard to deal with, that readers of financials might want toknow about

it does NOT mean that anything was wrong, and it does NOT change the audit opinion.

also called “Key audit matter” (KAM) by AICPA

2 motivations for CAM/KAMs

the audit process is EXTREMELY opaque & there wasn’t enough discretionary use of EOMPs

Part of a broader trend to get more info out of the auditor

What qualified as a CAM?

Parts of the audit that:

material

required communications to the Audit committee

challenging, subjective or complex

If it hits all 3, then u gotta write/add the CAM portion to the report

What do you have to describe in the CAM?

name/description of the CAM

what accounts are affected by the CAM

Why it is a CAM

How the auditor responded to the CAM

common CAM examples (3)

revenue recognition (for long-term contracts)

goodwill

Taxes (lots of estimates in the UTB = uncertain tax benefits)

business combinations

CAM hopes vs reality

The PCAOB/AICPA had the hopes that:

CAMs would not be boiler plate

they would offer a window into what is actually going on during the audit

In reality, neither is happening.

Miscellaneous issues with Reports

Group financial statements

comparative statements

audit firm tenure disclosures

form AP partner disclosures

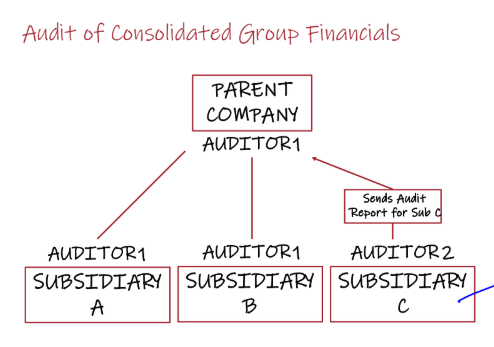

1) Group financial statements

Sometimes a parent and a subsidiary have different auditors.

The Parent auditor needs to decide if they are going to “take legal responsibility” for the sub auditor.

If so, the parent auditor doesn’t mention the sub auditor in the audit report.

If not, the parent auditor needs to name the sub auditor and what % of assets they were responsible for.

Parent auditors may take responsibility for the sub-auditor because:

They are part of the same network.

The parent auditor hired the sub auditor

The sub is immaterial.

Audit Opinions of Parent/Sub Do NOT have to match!

🙂

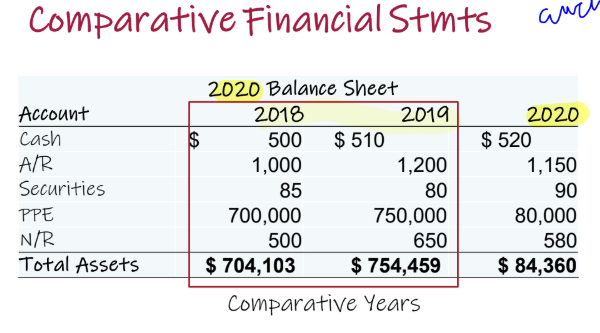

2) Comparative financial statements

The audit report & opinion covers all years presented, even prior years presented for comparative purposes

This does NOT mean we re-audit every year presented! Instead, we do what’s called “Update” on our prior audit opinions

Update

a fancy way of saying that we did NOT find anything during the current year audit that would make us change our opinion about the old financial statements

If the prior years were audited by a different auditor…

we have to ask the prior auditor to reissue their old audit opinion

Reissuing the audit opinion

means allowing the new/current auditor to republish the Audit Report from prior years with the current year financial statements.

Reissuing is not cost-less for the old auditor.

Before they Reissue, they must:

Read the new financial statements.

Compare old financial statement data to the comparative columns.

Get a new Management Representation Letter stating nothing has happened that would/should change the old data.

If the previous auditor does not Reissue the report…

the current auditor’s Audit Report should indicate that the comparative columns were audited by someone else

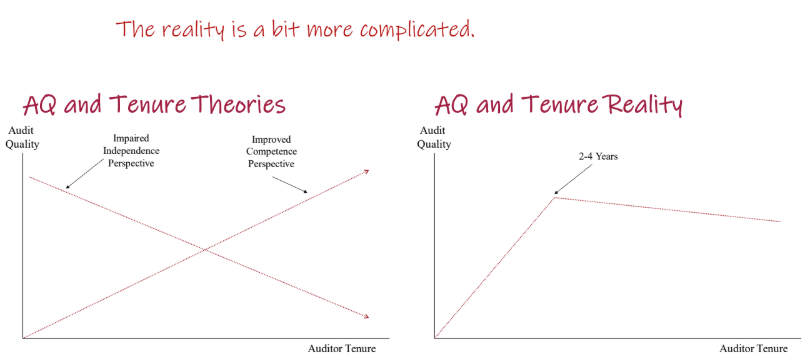

3) Audit firm tenure disclosures

Regulators vs industry concerns about audit quality vs tenure

the disclosure requirements in the Audit Report allow investors to see / take into account the tenure of the audit partner, however they interpret it.

Regulators care about tenure because of 2 reasons:

Fresh Look Perspective – It’s good to change auditors every now and then to get a “fresh look”. This will make the audit/financials better.

Impaired Independence Perspective – If the firm/partner stay with the same client for a long time, they will become

friendly/soft/predictable and the quality of the audit will suffer.

The industry actually maintains that auditor tenure makes the quality

of audits better!

Increases Competence Perspective: Auditing is difficult with a

large client-specific learning curve.

As auditors learn more about clients, their ability to do a quality audit goes up.

Since SOX…

audit Partners have to rotate off clients after 5 years, and stay off for another 5 years.

Starting in 2016, audit firms have to

disclose in the audit report how long the firm has had the client.

4) Form AP partner disclosures

Since 2016, the identity of the specific Audit Partner has been disclosed on Form AP, which is filed with the PCAOB at the same time as the Audit Report.

Prior to 2016, there was no way for the investing public to see the

identity of the audit partner.

Audit partners “sign” the Audit Report, but they only signed their firm’s name.

Regulators pushed in 2014-2015 to have the audit partner sign their own name on the Audit Report instead, revealing their personal identity.

regulators thought “revealing” the Audit partner idendity would increase the quality of the audit because:

Personally “signing off” on the audit would have a psychological effect on audit partners, causing them to take more responsibility for the audit.

Publicly signing the audit report would do a better job of putting the auditor’s personal reputation at stake, incentivizing them to do better audits.

Audit Partners were concerned that revealing their personal identity would increase their legal exposure and lead to personal harassment.

there’s very little evidence to support either claim lol, nobody cares