Practice Management Flashcards

1/174

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

175 Terms

What are Levels of a Corporation

stakeholders

directors

officers

AIA B101 requires which insurances and for what

General Liability - Covers physical office space

Professional Liability - Covers erros and omissions

Workers Compensation Insurance - Covers employee injuries or illnesses- medical care and lost wages

Automobile liability- covers company vehicles and personal cars used for business purposes

Employee liability- Covers employers if they get sued for causing a workplace injury - settlements, court costs, legal fees

Standard of care

expected quality of service for architect by area. the standard of care often decides whether architect is at fault when architect made an error/omission

format types for specifications

MasterFormat: classifies by material: concrete, metals, etc. (older format, more commonly used)

Uniformat: classifies by system: substructure, shell interiors, etc. (newer format, better for BIM)

Employment Practice Liability Insurance

Intellectual Property Insurance

Employment Practice Liability Insurance- insurance to protect from wrongful termination

Intellectual Property Insurance- insurance to cover claims based on copyright/intellectual property infringement

The owner is responsible for…

Pre-existing site conditions (geological, hazardous materials, surveying)

Paying Contractor

Paying Owner’s consultants

Change Orders

With or Without cause hiring and firing of Architect

Aggregate Limit, Premium, Deductible, Claim

Aggregate Limit- Total Coverage Amount

Premium- Monthly/yearly bill

Deductible- Maximum paid by you, prior to coverage kicking in and paying

Claim- You think you experienced a covered event and demand payment from the insurance company

Tail Insurance

Covers the architect’s projects after architect’s retirement

The insurance is liability insurance for the projects the architect has already done prior to retirement which are still within the relevant statutes of limitation/repose- so that should there be a problem resulting in a lawsuit, the retired architect is still covered. Tail insurance is much cheaper than the insurance carried by a professional, practicing architect, because the risks are more defined and limited for the insurer- since the architect has retired, no new projects will be being built, and all of the other projects that need to be covered by the tail insurance are known

What is the process to file an ethical complaint against an architect?

1- File the complaint through AIA National (National Ethics Council) within a year of the alleged violation (can be longer if there’s good cause for delay)

2- Advisory board and chair will be chosen

3- Pre-hearing, hearing, start, claim, defense, end, judgement*

*Confidential, no counter-claims, cant’t fine or enforce behavior, but can admonish/suspend

Who are the most common ethics complainants?

Other architects

Homeowners

Does the architect have a fiduciary duty to the client: a legal obligation to act in the owner’s best financial interest?

No, architects do not serve as an owner’s fiduciary.

Fiduciary duty: The obligation a professional has to act in the best interests of their client

Generally, the term is used for professions who protect the financial interest of the people they represent. Certified financial planners (CFPs) can’t recommend a particular investment if they do so because the CFP gets a higher commission from the brokerage if that particular investment is purchased; lawyers or accountants can’t advise their client to move forward with a deal because the lawyer or accountant owns the property to be sold; and a corporate director can’t steer the company to sign a worse deal because the person on the other side of that deal is her brother-in-law. (Of course, if the brother-in-law really has the best corporate travel agency and charges the company the lowest fees, it is probably not a breach of fiduciary duty.)

If you, as a fiduciary, breach your duty, you are liable in court, though as you would imagine, proving a breach is difficult in practice. The concept of fiduciary was set up because professions like attorneys, accountants and physicians are granted a monopoly to practice their craft, and hold power or knowledge asymmetries over their clients. While architects are granted a monopoly to practice by the state and do hold knowledge asymmetries, they are not fiduciaries.

Clients often assume a professional is bound by fiduciary duty, when in fact she is not. For instance, a stockbroker is not a fiduciary. She can legally steer you to a particular stock only because she gets the largest commission for selling that stock–even if purchasing that stock is not in your financial best interest.

Fiduciary duty is the highest standard of care level that can be imposed under law, and thus it far exceeds the “standard of care” threshold for architects’ performance established in the AIA contracts. Owner-generated contracts sometimes sneak in a clause binding the architect to fiduciary duty, but because your professional liability insurance almost certainly won’t cover that level of expectation, you will need to strike that fiduciary clause out of the contract. If the owner generates her own non-standard contract, you might even want to go out of your way to include a clause that establishes that the architect is not held to a fiduciary standard.

Why isn’t an architect held to a fiduciary standard? Perhaps because we protect the health, safety, and welfare of the public. Have a story where doing financially right by the owner conflicted with doing right by the public? Share it with me at michael@amberbook.com and perhaps I’ll add it to the bottom of this flash card (anonymized). Or maybe architects aren’t held to the higher standard because the AIA, with an obligation to protect the architects, is the entity writing the industry-standard contracts.

Retainer

Retainer: Regular services for a fixed fee, more efficient than hourly over the long term… like if a university is regularly updating rooms as small projects (adding A/V equipment, accessibility ramps, upgrading outdated bathrooms) the university might hire an architect on retainer. The architect then can bill the university for the work completed, without having to create a new contract for each door that is replaced.

Are architects agents of the owner?

The agent creates a legally binding relationship between third party and principal, for instance, in a CM as Agent project, the principal is the client and the contractor is the third party.

Architects are Not agents of the owner (unless the owner would like them to be and a formal agreement is drawn up). That means, the architect, can’t while walking the site, claim to speak for the owner when talking to the contractor!

Who contracts directly under the architect and who contracts under the owner?

Architects: MEP, Lighting Consultant, Civil Engineer (utilities, land contouring, and all things related to the improvement to the land with new building), Landscape Architect/Engineer, Cost Estimator, Code Consultant

Owner: Zoning, Traffic, Site, Geotechnical (underground), Surveyor, Civil Engineer (for duties related to permitting, and documenting the existing condition of the site)

The contractor is responsible for…

“Perfection” in construction

Nothing outside the contract

Paying and coordinating sub-contractors

Providing owner with operation manuals

Some design of specific systems (delegated design) for things like curtain wall details, concrete formwork, and steel fabricator shop drawings

The Architect is responsible for…

The project being on time and on budget

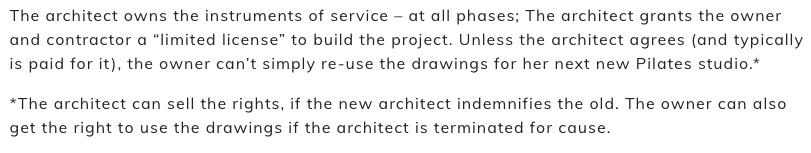

The instruments of service

The standard of care and protecting the health, safety, and wellness of the public

Coordination and administration of project team and processes

Enforcement of contract term (as able)

Adherence to applicable codes

NOT means and methods of construction, existing site conditions, safety on the job site, anything outside the contract (additional services)

Fair Labor Standards Act

Davis Bacon Act

Fair Labor Standards Act- Regulates minimum wage, overtime pay, and child labor

Davis Bacon Act- Contractors working on federal construction must pay workers no less than the locally prevailing wages

General Liability Insurance

Covers the physical property of the firm, usually has a limit to total claims

*Landlords can require

Professional Liability Insurance

Covers the cost of mistakes made by the architect, as well as disciplinary, regulatory, and administrative expenses

*Also called “errors and omissions” insurance

Mechanic’s Lien

Mechanic's lien: A claim placed against owner's property due to unpaid debts. Used when the contractor fails to pay sub-contractors but can also be used when the owner does not pay the Architect. The land and building can be sold to settle the debts if the owner can't pay cash.

If the owner owes money to the contractor, or the owner owes money to the architect, and the owner can't or won't pay her debts, a court can order the property to be sold to raise to cash to pay the debts. But the property can also be used to make unpaid subcontractors whole. If the contractor owes money to subcontractors, and the contractor skips town, the subs can go after the owner. If the owner can't pay, a "lien" is put on the project and a court can force the owner to sell to square up with the subs. This is one of the reasons that the owner confirms that the contractor pays their subcontractors throughout the process... the owner doesn't want to be on the hook later for the contractor's unpaid bills.

OSHA

Occupational Safety and Health Administration (OSHA): enforces workplace safety regulations for things like construction falls, exposure to dangerous construction solvents, potentially dangerous power tools, and requirements for neón safety vests, glasses, & hardhats on site.

OSHA considers office workplaces, like architects' offices, to be low-hazard but requires reporting of workplace deaths or multiple simultaneous workplace hospitalizations, even in offices.

Common Types of small business Taxes

Federal and state income tax

Self-employment tax

Personal property tax

Post occupancy evaluation

Post occupancy evaluation- Surveys used to see how well a building is performing, usually administered at least a year after occupancy

*Very important! Employees are the major expense for any business, so knowing how design affects their performance is key,

Contractual liability insurance

Contractual liability insurance: Covers you when something goes wrong and you, by virtue of a contract you signed, are held responsible for it. Contractual liability coverage typically is included in your general liability insurance (the one that covers your business for nonprofessional incidents, like a slip-and-fall or dog bite at the office).

Architects sign many kinds of contracts in the course of day-to-day business: leases, purchase orders, agreements to engage an accountant, etc. (professional liability protection from errors and omissions claims falls in a separate category of insurance). Contractual liability insurance covers you when one of those signed contracts puts the burden of a problem on the architect.

For example, Lauren, an employee of your firm, tours a quarry with a client to select stone for an office building courtyard. In order to tour the quarry, Lauren signed a common release form, the type you sign all the time, indemnifying the quarry should something go wrong. Something did go wrong on the tour and Lauren was injured. Because she signed the release form holding the quarry harmless, your firm, rather than the quarry, is held responsible. And because you have contractual liability insurance as part of your general liability insurance policy, you're covered for Lauren's injury. (You're probably covered... with insurance, it's always hard to say for sure without knowing the specifics of the incident and the contract.. and even knowing that, the lawyers may need to hash it out because of a difference of interpretation.)

Subrogation

Subrogation: Process of the insurance company assuming agency for an insured party in order to sue another party.

For example, an electrical subcontractor error triggers a fire. The contractor's insurance company. Amber Insurance, pays the contractor promptly for the damage, which is the type of prompt service the contractor has been paying for over the years in its monthly premiums.

In the policy, the contractor has given permission ahead of time for Amber Insurance to pursue reimbursement from the electrical subcontractor (or the sub's insurance policy). Amber Insurance can then "stand in his shoes" and chase down reimbursement as his agent, as if he (the contractor) were suing. He also gives up his right to sue the subcontractor afterward to collect MORE damages. The catastrophe happened, the insurance company already paid the contractor to make him whole, and now the insurance company alone retains the right to make themselves whole by filing a claim against the party at fault.

*BUT the AIA A201 requires a WAIVER of subrogation by all the relevant parties-owner, contractor, subcontractors, architect. consultants-meaning by contract, the insurance companies in construction must still pay the insured. but may not go after the others in the group to recover what the insurance company paid out. This is an important protection for the contractor. and one of the relatively few concessions he's entitled to in the standard AlA suite of agreements.

I'll offer an example: A building under construction collapses in a hurricane. Maybe the contractor didn't properly secure the half-built structure. If the owner's insurance paid the owner $750,000 right after the collapse, the owner's insurance may NOT attempt to recover that money from the contractor (or the contractor's insurance), " because everyone has WAIVED subrogation. The owner's insurance may then not "stand in the shoes?

of the owner to make

themselves whole... they're out the $750.000 with no one to recover it from.

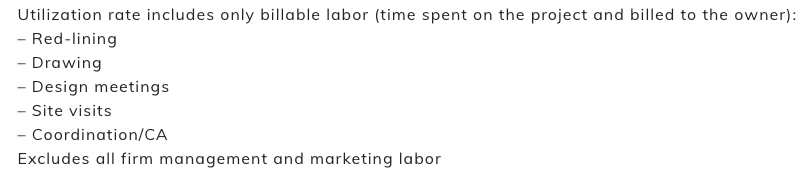

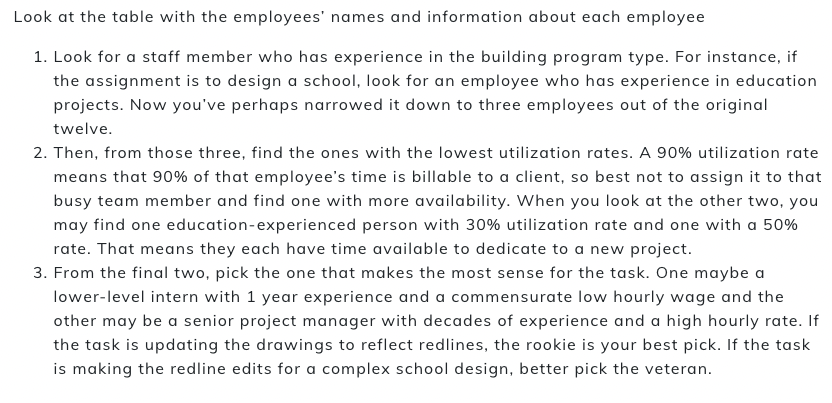

Utilization Rate

Revenue Factor

Utilization Rate (also known as the billable or chargeable rate) =Direct Salary Expense/Base

If an employee, Amber, earns $100,000 per year, and 70% of her hours are charged to the client, we say that she has a utilization rate of 70% (which is a healthy, but realistically healthy, rate).

Revenue Factor= Utilization Rate x Direct Salary Expense Ratio

If your firm charges the client $3 for each dollar it pays Amber for her time, then we have charged the client $210,000 for Amber's time. We say our firm's Direct Salary Expense Ratio is 3.0.

By multiplying Amber's utilization rate (70%) by the firm's Direct Salary Expense ratio (3.0) we get a revenue factor of 2.1. That means that for our $100,000 investment in Amber's salary, we earned the firm $210,000 in revenue.

This is your yield on total payroll, which measures productivity, profitability, and efficiency. Think about it: if we halve Amber's utilization rate to 35%, we've reduced our revenue by half.

Likewise, if we halve our firm's Direct Salary Expense Ratio to 1.5, we have also cut revenue by half.

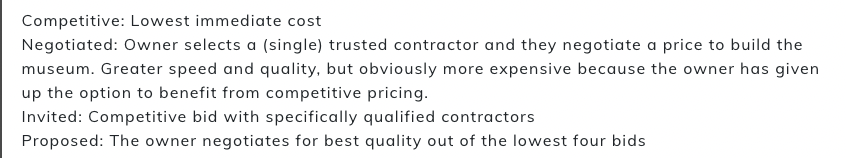

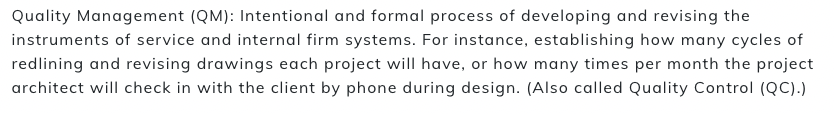

How do you decide how much to charge a client?

Value pricing- Base on quality

Effort Pricing- Based on time spent (this is the ARE’s assumption in the exams)

% Cost Pricing- Based on percentage of total construction cost

Fixed Fee Pricing- Fixed cost to client typically derived based on triangulating estimates of the other three models

Risky Contract Language

Warranty

Guaruntee

Indemnify/Indemnification

“Highest” standard of care

As required/as necessary

Hold harmless

*Anything that passes liability to the Architect

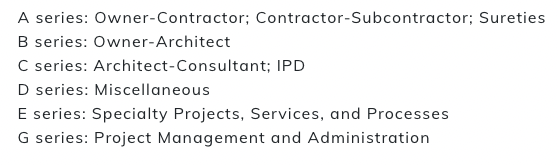

AIA Documents A701; C401; A305; G701; G702; G704

A701- Instructions to Bidders

C401- Architect-Consultant Agreement

A305- Contractor’s Qualification Statement

G701- Change Order

G702- Application and Certificate of Payment

G704- Certificate of Substantial Completion

While it is worth becoming familiar with these concepts like change orders, paying the contractor, bidding, and declaring substantial completion are highly prescribed and very important in this exam, I don’t think its worth your time memorizing the numbers of these AIA documents

1- Net Profit

2- Net Billing

3- Profit Earnings Ratio

4- Prospect/Suspect

Net Profit: Profit before tax and distributions to firm owners, but after paying wages and bills

Net Billing: Billing that only covers fees for architect's labor

Profit-To-Earnings Ratio= Net Profit / Net Operating Revenue (defines the health of the business). If our firm brings in $100,000 (after paying our consultants, but before we pay our salaries or rent), and our expenses (salaries and rent) are $80,000, then our profit is the $20,000 left over. We divide the 20k in profit by the 100k in net operating revenue to derive a profit earnings ratio of 0.20. That means that for every dollar we take in, 20 cents is available to our firm owners and investors as profit.

Prospect and Suspect: Potential projects with a >51% (prospect) or <%50 (suspect) chance of income generation

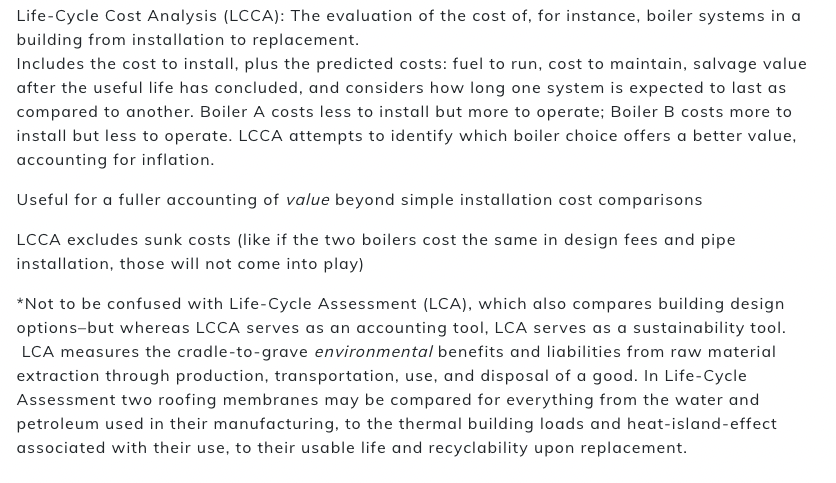

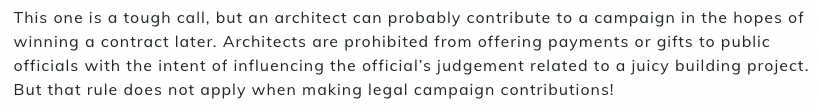

What types of damages can be pursued in litigation? Which are called for in AIA B101? Consequential vs liquidated vs direct damages

Consequential damages – Estimated cost of lost owner profit due to project delays (planned potential profit had my lemonade stand been open in time for the summer rush). The contracts prohibit all parties from recovering consequential damages.

Liquidated damages – Per-day penalty for a delayed construction project completion, agreed upon at the beginning. The A101 Owner-Contractor Agreement allows for liquidated damages (which in construction are almost always related to per-day-late penalties); The B101 Owner-Architect Agreement, section 11.10.2.2, states that the owner cannot deduct or withhold any amount of money from the architect’s compensation as a penalty or liquidated damages without the architect’s agreement or a binding dispute resolution process. Additionally, the owner cannot withhold any amount of money from the architect’s compensation to cover the cost of changes made to the work by contractors, unless the architect has agreed to it or has been found liable for those costs in a binding dispute resolution proceeding.

Some more context: in Wolf Saar’s Consequential damages: What they are and how architects can mitigate them, Saar states “liquidated damages are rare in professional services contracts and not part of the AIA owner-architect documents.” What he is saying is not that architects are immune from clients making claims that their work or decisions resulted in costly delays to the construction process, but instead that we do not include those in our contracts so that we do not open the door for every client to nitpick our process in order to take money off of their payment to us.

Direct damages – Actual cost of fixing unacceptable work (maximum allowed is = the Architect’s fee). The owner may pursue a claim for the cost of repairing the leaky foundation from either the contractor or the architect (or both).

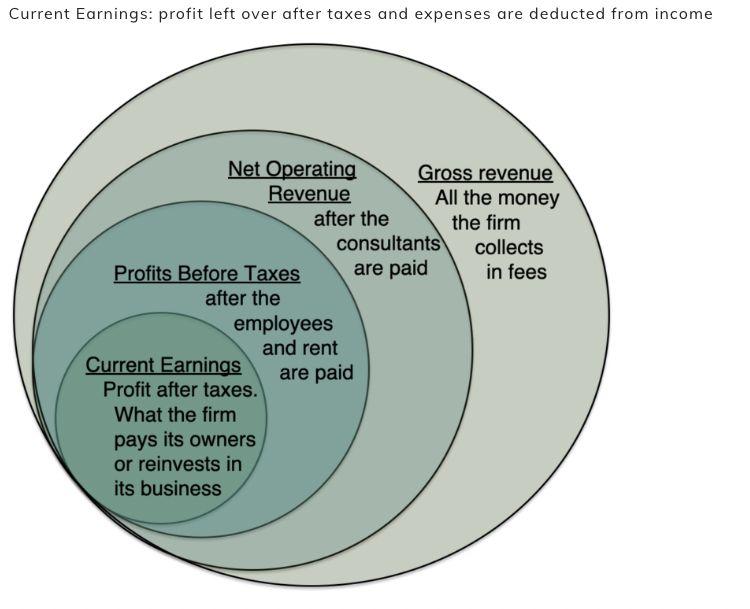

Current earnings

Base vs Direct vs Indirect Salary

With more employees, your firm is subject to additional regulatory hurdles to protect workers.

1–15 employees: FLSA, I-9, HIPAA, ERISA, Equal Pay Act, OSHA, Worker’s Compensation, Minimum Wage

16–50: add COBRA*, ADEA, ADA, Civil Rights* (7+20+)

50+: add FMLA, Obamacare, EEO Reporting, Affirmative Action

FLSA = Fair Labor Standards Act. Minimum wage, overtime pay, child labor laws.

I-9 = Employment eligibility verification. Are your employees legally permitted to work in the US?

HIPAA = Health Insurance Portability and Accountability Act. Protects privacy of employee health information. You can’t tell one employee that another employee is suffering from gout.

ERISA = Employee Retirement Income Security Act. Sets minimum standards for retirement and health plans. For instance, the person who manages the retirement plan must act as a fiduciary (puts the best interest of the plan above their own self-interest).

Equal Pay Act = Prohibits wage discrimination by gender

OSHA = Occupational Safety and Health Administration. Protects employees from workplace injury

Workers compensation = Gives those injured at work wage replacement and medical treatment

COBRA = You lost your job that came with health insurance? You divorced your spouse or your spouse died and you were covered on her health insurance plan? COBRA allows you to temporarily pay out-of-pocket to stay with your old health insurance until you can find a new plan.

ADEA = Age Discrimination in Employment Act. Prohibits age discrimination against those 40 and older. You may discriminate against someone for being too young! Why? Young people don’t vote so congress doesn’t pass laws to protect them.

Civil rights = Civil Rights Act. Protects workers against discrimination on the basis of race, color, religion, gender, and national origin. As of 2020, this also includes sexual orientation. Most people don’t know that you can fire someone legally for any other reason not included above: if you don’t like the color of an employee’s shoelaces, you may be able to legally fire them for that. And the first amendment protects citizens from government punishment based on free speech, but not from employment action. So you can fire someone for saying something offensive or stupid (unless you work for the government). I have found that smart people I work with still go to friends instead of legal experts when it comes to labor law... and I’ve found them to be wrong almost every time I checked with the university lawyer for clarity. Obviously, consult a labor lawyer first.

FMLA = Family Medical Leave Act. Allows employees to take unpaid, job-protected leave for family and medical reasons (birth, adoption, military deployment).

Obamacare = Affordable Care Act (ACA). Large employers must offer affordable health care insurance as an option to those working 30+ hours per week.

EEO Reporting = Equal Employment Opportunity. Employer reports hires by race and gender. For 100+ employees, race/ethnicity must be reported by job category.

Affirmative Action = Employers must recruit and advance qualified minorities, women, veterans, and people with disabilities.

Design-Bid-Build: Unless told otherwise, assume that the ARE is asking you based on this "vanilla" option.

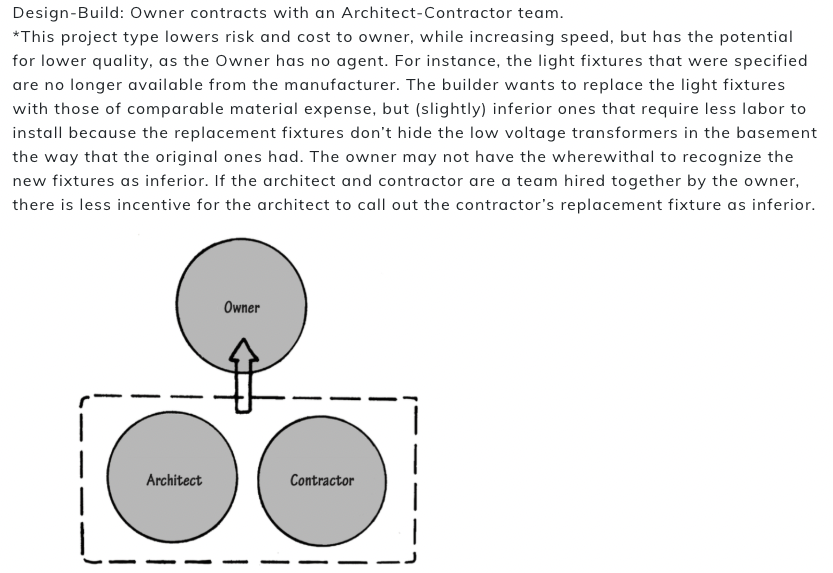

Design-Build: A single contract between the owner and a design-build firm employing architects and contractors (or joint-venture entity owned by architect and contractor)

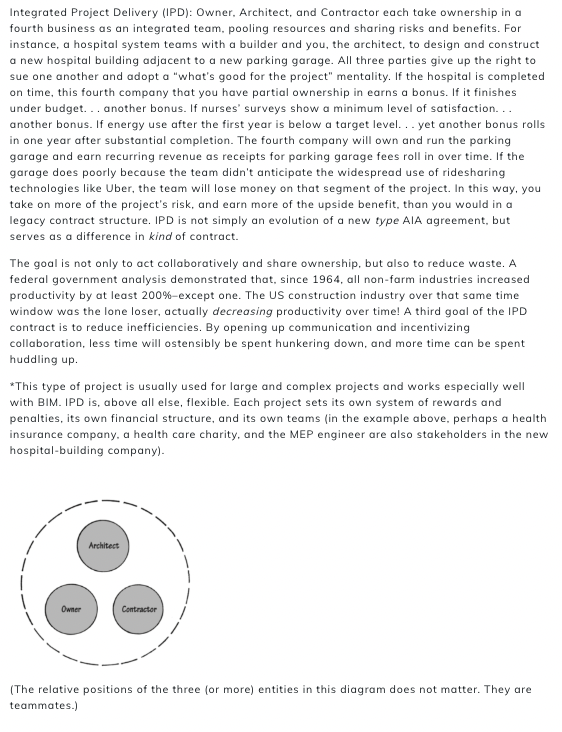

IPD: Integrated project delivery. Catch-all category for one-off teamwork-focused contracts where owner, contractor, and architect share the financial risks and rewards of a completed building.

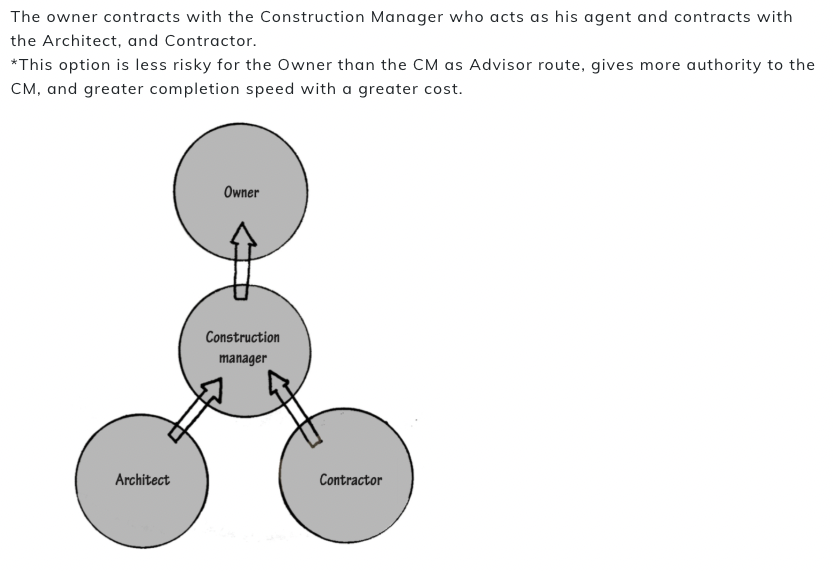

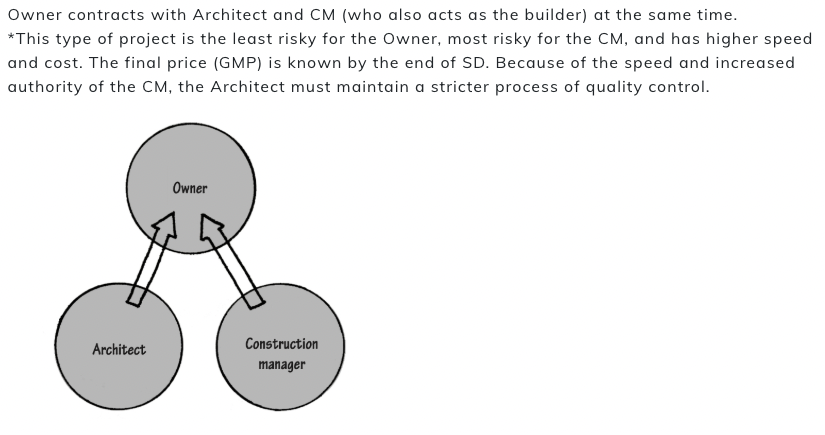

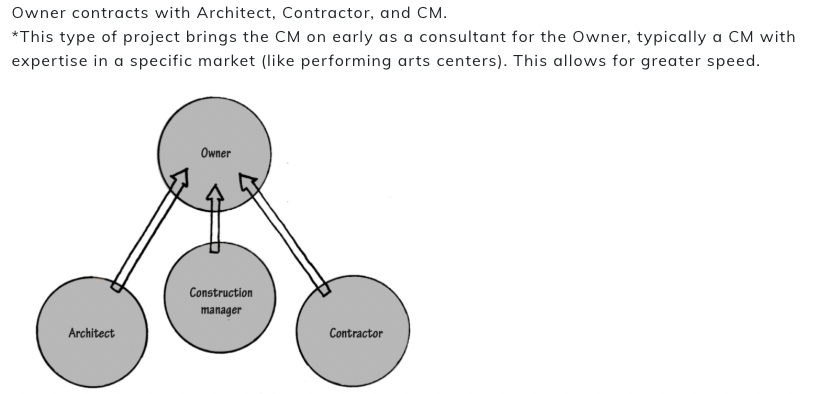

Construction Manager: A powerful entity, hired by the owner and answering directly to her, who may serve as a consultant in an advisory role, a legal representative of the owner who hires the architect and contractor, or a one-stop shop for both advising the owner and then constructing the building.

It may seem like the project delivery options are both prescribed and limited in choices… because they kind of are prescribed and limited… If that feels strange to you, read on (but you have my permission to move onto the next card if the selection of contracts available feels “normal” to you)

By constricting the legal formats available to a small number of options, the AIA contracts can legally protect everyone with a relatively small number of owner-architect-builder agreements, updated regularly to account for new developments in the field (BIM, LEED) as they arise. If every possible legal structure were on the table for every project, basic contract templates could not possibly cover all the options and expensive lawyers would reinvent the wheel for each project, negotiating over little details, while the parties schemed to unscrupulously take advantage of unforeseen loopholes in the fine print.

With a limited number of contracts, when disputes arise, there is established case law tied to that particular contract and a process of revising the next iteration of that contract template to address the most common disputes so that they won’t need to be settled in the courts going forward. Who gets to decide when there is a new project delivery method available? Generally, the owners who through their collective market power.

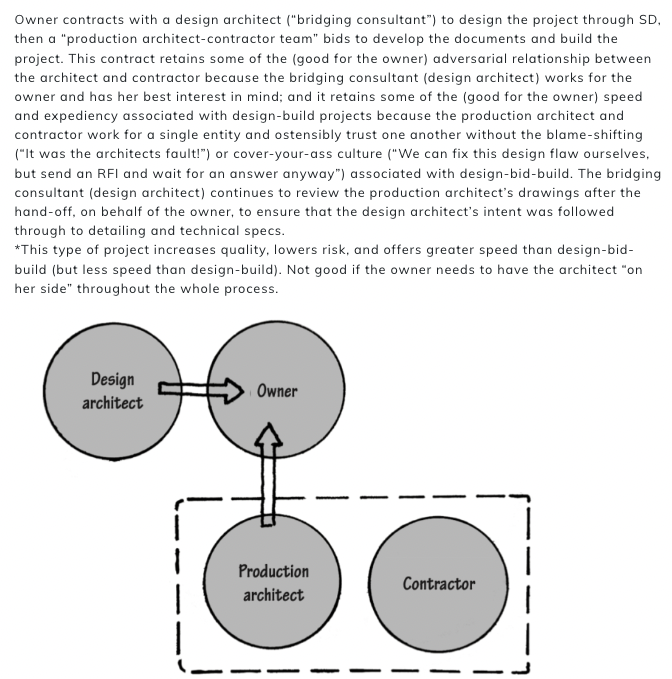

If you were making an upright-walking species from scratch, you would design it with two spines instead of one, and those spines would be more the shape of a capital H. But because we evolved from beasts that walked on four legs, we were stuck with the single spine that worked well for them. Now many of us suffer from back pain because of that start-from-what-were-used-to mindset. When you or your firm are working with the AIA contracts, whether a decision is as much a reaction to what was available before than what would be absolutely ideal. IPD was created to hold a position as the default for the time, but construction took too long to complete, and the adversarial parties so the design-build option took its position. And then the large insurance carriers were taking too much risk with too little information, so construction-manager-at-risk agreements were invented. Then some owners and architects wanted to separate themselves from risk for more profit upside so the AIA invented owner advisors, each with their own contract template and responsibility. Finally, BIM allowed all the parties to make better decisions before construction began, so a new generation of entrepreneurial project managers were born. Instead of being a developer as selling out, and some grew tired of the adversarial system, so the existing contracts focused more on what each owner, contractor, and architect would get paid, but left out the separate discussion of what happens if one party shows up with inertia, content to use the contract type that worked out well last time.