NIPA APA 3 - 2024 Practice Exam A

1/99

Earn XP

Description and Tags

Distributions and Loans

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

100 Terms

All of the following statements regarding termination distributions are true, EXCEPT:

A. The distribution timing depends on the provisions of the plan.

B. The distribution amount is based on the participant’s vested account balance.

C. All qualified plans allow for the distribution of plan benefits when a participant resigns or is discharged.

D. Special cash-out provisions may allow distributions to be made without the consent of the participant.

C. All qualified plans allow for the distribution of plan benefits when a participant resigns or is discharged.

All of the following statements regarding distribution rules are true, EXCEPT:

A. A plan’s distribution rules must be set forth in the plan document.

B. A plan’s distribution provisions must be disclosed to participants.

C. All forms of distributions allowed under a plan can be changed retroactively.

D. The time and form of distribution cannot be made at the discretion of the employer.

C. All forms of distributions allowed under a plan can be changed retroactively.

All of the following are considered distributable events, EXCEPT:

A. Severance from employment

B. Qualified domestic relations orders

C. Leave of absence

D. Death of the plan participant

C. Leave of absence

All of the following information is essential to the distribution process, EXCEPT:

A. The type of plan

B. The participant’s key employee status

C. The participant’s vesting years of service

D. Whether or not spousal consent is required

B. The participant’s key employee status

Optional forms of distribution include which of the following?

A. Annuities

B. Partial payments

C. Lump-sum payment

D. All of the above

D. All of the above

All of the following plans are covered by the survivor annuity requirements, EXCEPT:

A. Non-ERISA plans

B. Money purchase plan

C. Profit sharing plan that offers a life annuity D. 401(k) plan that holds benefits transferred from a defined benefit plan

A. Non-ERISA plans

Which of the following statements regarding the qualified preretirement survivor annuity (QPSA) requirements is TRUE?

A. The QPSA rules apply to death benefits in pension plans.

B. Beneficiaries of unmarried participants are paid in the form of a modified QPSA.

C. The QPSA rules do not apply to participants who have been married less than one year.

D. QPSA benefits are paid for the life of a surviving spouse of a participant who died after retirement benefit payments began.

A. The QPSA rules apply to death benefits in pension plans.

Which of the following statements regarding the qualified joint and survivor annuity (QJSA) requirements is TRUE?

A. Benefits are paid for the joint lives of the participant and the participant's spouse, with benefits ceasing upon the death of either the participant or spouse.

B. Unmarried participants are required to receive their benefits in the form of a 10- year certain annuity.

C. A defined benefit plan can elect to provide survivor benefits in the form of a either a QJSA or a qualified longevity annuity contract.

D. QJSA benefit payments may begin once the participant has satisfied the distribution requirements under the plan.

D. QJSA benefit payments may begin once the participant has satisfied the distribution requirements under the plan.

A participant incurs a one-year break in service when he/she does not complete more than:

A. 500 hours in a 6-month period

B. 500 hours in a 12-month period

C. 1,000 hours in a 6-month period

D. 1,000 hours in a 12-month period

B. 500 hours in a 12-month period

The accrued benefit of a participant in a defined contribution plan equals which of the following?

A. The vested portion of a participant's account balance

B. The contribution amounts made to the plan annually

C. The total of a participant's account balances

D. The future value of a projected benefit

C. The total of a participant's account balances

Steve is a terminated participant in a calendar-year profit sharing plan. The plan uses the elapsed time method to determine vesting years of service. Based on the following information, what is Steve’s vested percentage as of December 31, 2021

Steve’s date of hire = May 1, 2018

Steve’s date of termination = October 22, 2021

Plan’s vesting schedule = 6-year graded

A. 0%

B. 20%

C. 40%

D. 60%

C. 40%

Which of the following statements regarding missing participants in an on-going defined contribution plan is TRUE?

A. Automatic rollovers are available when the missing participant’s account value exceeds $7,000.

B. The plan cannot charge the fees for locating a missing participant to the missing participant’s account.

C. The participant’s designated beneficiary may be a good source for locating the missing participant.

D. Automatic enrollment will help minimize the occurrence of small balances and the likelihood of lost participants.

C. The participant’s designated beneficiary may be a good source for locating the missing participant.

All of the following statements regarding cash-out provisions are true, EXCEPT:

A. Cash-outs are mandatory plan provisions. B. Cash-outs are forced payments to terminated participants with vested balances below a certain threshold.

C. The cash-out threshold must be stated in the plan document.

D. A plan can provide that rollover balances are disregarded when determining who is subject to cash-outs.

A. Cash-outs are mandatory plan provisions.

Which two of the following statements regarding automatic rollovers are TRUE?

A. Plan benefits are paid as a direct rollover to an IRA.

B. Automatic rollovers apply to in-service distributions.

C. The SPD or SMM must describe the plan’s automatic rollover provision.

D. Participants with vested benefits greater than $1,000 but less than or equal to $7,000 are not able to elect a different form of distribution.

A. Plan benefits are paid as a direct rollover to an IRA.

C. The SPD or SMM must describe the plan’s automatic rollover provision.

All of the following statements regarding automatic rollovers are true, EXCEPT:

A. Automatic rollovers are an alternative form of involuntary cash-outs.

B. Automatic rollovers are not protected benefits and may be eliminated.

C. Automatic rollovers can be used as an option at the discretion of the employer.

D. A plan can avoid the automatic rollover requirements by eliminating cash-out distributions for amounts exceeding $1,000.

C. Automatic rollovers can be used as an option at the discretion of the employer.

All of the following statements regarding the DOL safe harbors for automatic rollovers are true, EXCEPT:

A. The IRA provider must be a bank, insurance company or other authorized provider.

B. The terms of the fiduciary’s agreement with the IRS provider must be enforceable by the participant.

C. The IRA investment product must be designed to preserve principal and provide a reasonable rate of return.

D. The plan sponsor is prohibited from selecting itself as the IRA provider to receive automatic rollovers from its own plan.

D. The plan sponsor is prohibited from selecting itself as the IRA provider to receive automatic rollovers from its own plan.

Which of the following statements regarding eligible rollover distributions is TRUE?

A. All distributions from a qualified plan can be rolled over.

B. Rollovers of eligible rollover distributions must be direct rollovers.

C. To be eligible for rollover, there must have been a separation of service.

D. Qualified plans are required to provide for rollovers out of the plan, but are not required to accept rollovers.

D. Qualified plans are required to provide for rollovers out of the plan, but are not required to accept rollovers.

Which of the following distributions is an eligible rollover distribution?

A. A deemed distribution of a plan loan

B. A distribution to a terminated participant

C. A hardship withdrawal of elective deferrals D. A corrective distribution of excess contributions

B. A distribution to a terminated participant

Which of the following statements regarding a direct rollover is TRUE?

A. An alternate payee cannot elect a direct rollover of QDRO benefits.

B. A non-spouse beneficiary may elect a direct rollover to an Inherited IRA.

C. Taxes are withheld and applied to the participant’s total tax liability for the year.

D. Plans that accept rollovers must accept rollovers that include designated Roth contributions.

B. A non-spouse beneficiary may elect a direct rollover to an Inherited IRA.

All of the following statements regarding direct rollover procedures are true, EXCEPT:

A. A plan must accept rollovers of amounts greater than $5,000.

B. A plan can make it impermissible for individuals to make rollovers to the plan inkind. C. A plan can make it impermissible for individuals to make rollovers to the plan that include an outstanding participant loan.

D. A plan can establish a minimum of $200 or more that can be directly rolled out of the plan.

A. A plan must accept rollovers of amounts greater than $5,000.

All of the following are permitted rollovers, EXCEPT:

A. A participant rolling over a required minimum distribution.

B. A surviving spouse rolling over the decedent's IRA to the spouse's IRA.

C. A profit sharing plan participant rolling over an eligible rollover distribution to an IRA.

D. A new employee who hasn't met the plan's eligibility requirements rolling over a distribution from a prior employer to the new employer's 401(k) plan.

A. A participant rolling over a required minimum distribution.

Which two of the following statements regarding the 60-day rollover rules are TRUE?

A. The entire amount distributed must be rolled over.

B. The 60-day period begins once all distributions for the year have been paid.

C. The 60-day rollover option is occasionally used to make up for a loan offset.

D. If a participant receives a distribution on March 10, a tax-free rollover can be made that same year on April 22.

C. The 60-day rollover option is occasionally used to make up for a loan offset.

D. If a participant receives a distribution on March 10, a tax-free rollover can be made that same year on April 22.

Madison terminated employment at age 45, and requests a full distribution of her $75,000 401(k) plan vested account balance. Madison elects a direct rollover of $50,000 to her new employer’s profit sharing plan. Assuming her account consists only of elective deferrals and matching contributions, how much of the distribution is included in taxable income?

A. $0

B. $25,000

C. $50,000

D. $75,000

B. $25,000

Sawyer terminated employment at age 35, and requests a distribution of his $50,000 401(k) plan vested account balance, which includes only elective deferrals and safe harbor nonelective contributions. Within a week of receiving his vested benefits, Sawyer decides to roll over to an IRA the net cash amount that was actually paid to him. What is the amount Sawyer will roll over?

A. $35,000

B. $40,000

C. $45,000

D. $50,000

B. $40,000

All of the following distributions are in-service distributions that may be made from a profit sharing plan if allowed by the plan, EXCEPT:

A. A distribution upon the attainment of age 55 B. A distribution upon attainment of 60 months of plan participation

C. A distribution upon attainment of age 59½ D. * A distribution under the 2-year aging rule on May 1, 2022 of contributions deposited on September 15, 2020 for the plan year ending December 31, 2019

All of the following distributions are in-service distributions that may be made from a 401(k) plan if allowed by the plan, EXCEPT:

A. A distribution of elective deferrals upon attainment of age 59½

B. A distribution of matching contributions due to financial hardship

C. A distribution of qualified nonelective contributions upon attainment of age 55

D. A distribution of safe harbor contributions at the plan’s normal retirement age of 62

C. A distribution of qualified nonelective contributions upon attainment of age 55

Which of the following in-service distributions may be made from a defined benefit pension plan, if permitted by the plan?

A. A distribution due to attainment of age 59½

B. A distribution once the participant becomes fully vested

C. A distribution upon completion of five years of participation.

D. A distribution before the plan's normal retirement age if the participant has attained at least age 50

A. A distribution due to attainment of age 59½

All of the following statements regarding hardship withdrawals are true, EXCEPT:

A. Hardship withdrawals are not taxable to the participant.

B. The distribution must be because of an immediate and heavy financial need.

C. The distribution amount must be needed in order to relieve the financial need.

D. Hardship withdrawal provisions are optional.

A. Hardship withdrawals are not taxable to the participant.

Which of the following qualifies as an immediate and heavy financial expense under the safe harbor hardship rules?

A. Funeral expenses of the participant’s sister B. Repair of the participant's car used to commute to work

C. Expenses for a participant's dependents to obtain medical care

D. Withdrawals to make a down payment on the participant’s second home

C. Expenses for a participant's dependents to obtain medical care

All of the following statements regarding whether a hardship withdrawal is necessary to satisfy a financial need are true, EXCEPT:

A. The participant must have first obtained all other available distributions.

B. The hardship distribution cannot include amounts necessary to pay expected income taxes or penalties.

C. If the need is for the payment of post-secondary tuition, the need can be based on expenses for the next 12 months.

D. The employee must represent that he or she has insufficient cash or liquid assets “reasonably available” to satisfy the need.

B. The hardship distribution cannot include amounts necessary to pay expected income taxes or penalties.

Derek is a participant in his employer’s 401(k) plan. He became a participant on January 1, 2020, and contributed elective deferrals of $10,000 in 2020 and $10,000 in 2021. In addition, his employer made safe harbor matching contributions of $5,000 each year on his behalf. As of December 31, 2021, his elective deferral account balance is $22,000, and his safe harbor account balance is $11,000. Hardship distributions of elective deferrals and earnings are allowed under the plan. Derek has never taken a hardship withdrawal from the plan, and he requests a hardship on January 1, 2022. What is the maximum amount Derek can withdraw?

A. $20,000

B. $22,000

C. $30,000

D. $33,000

B. $22,000

Which of the following statements regarding the taxation of hardship withdrawals is TRUE? A. They are eligible for rollover.

B. They are subject to mandatory 20% tax withholding.

C. They may be subject to the 10% additional tax on early distributions.

D. They are not taxable until the participant reaches their normal retirement age.

C. They may be subject to the 10% additional tax on early distributions.

In 2021, Jan has an excess deferral of $3,000. She is not eligible for catch-up contributions, nor has she made any designated Roth contributions. The plan administrator has determined that the earnings related to her excess are $150. To correct the excess, Jan receives a distribution of $3,150. Which of the following statements regarding the taxation of her corrective distribution is TRUE?

A. If the distribution is made on February 15, 2022, her 2021 taxable income is $0 and her 2022 taxable income is $3,150.

B. If the distribution is made on February 15, 2022, her 2021 taxable income is $150 and her 2022 taxable income is $3,000.

C. If the distribution is made on June 2, 2022, her 2021 taxable income is $3,000 and her 2022 taxable income is $3,150.

D. If the distribution is made on June 2, 2022, her 2021 taxable income is $3,000 and her 2022 taxable income is $150.

C. If the distribution is made on June 2, 2022, her 2021 taxable income is $3,000 and her 2022 taxable income is $3,150.

Sue has an excess contribution of $1,000 from her employer’s 401(k) plan for the plan year ending December 31, 2021. Earnings on the excess are $50. Which of the following statements regarding the correction of her excess contribution is TRUE?

A. A corrective distribution of $1,050 on June 1, 2022 is taxable to Sue in 2022.

B. Sue’s employer must pay a $100 excise tax if the excess is distributed on March 1, 2022. C. Sue can receive a distribution of $1,000 on February 11, 2022 to fully correct the excess contribution.

D. Sue’s corrective distribution may be paid before December 31, 2021 if the results are known before year-end.

A. A corrective distribution of $1,050 on June 1, 2022 is taxable to Sue in 2022.

Mark has an excess aggregate contribution of $1,500 from his employer’s 401(k) plan for the plan year ending October 31, 2021, consisting entirely of vested matching contributions. Earnings on the excess are $150. Mark receives a distribution of $1,650 on June 10, 2022. What year is his corrective distribution taxable?

A. 2020

B. 2021

C. 2022

D. 2023

C. 2022

Which of the following statements regarding the correction of excess annual additions is TRUE?

A. Elective deferrals may not be distributed to correct the excess.

B. A corrective distribution must include earnings.

C. A corrective distribution is taxed in the year the contribution was made to the plan.

D. Any related matching contributions must remain in the participant’s account and be used in subsequent years.

B. A corrective distribution must include earnings.

A 401(k) plan’s tax-qualified status is protected under all of the following corrective distributions, EXCEPT:

A. A tax year 2021 excess deferral distributed on April 1, 2022

B. A plan year ending April 30, 2022 excess annual addition distributed on June 20, 2022 C. A plan year ending September 30, 2021 excess contribution distributed on October 22, 2022

D. A plan year ending December 31, 2021 excess aggregate contribution distributed on March 24, 2022

C. A plan year ending September 30, 2021 excess contribution distributed on October 22, 2022

Which of the following statements regarding the tax and reporting rules of corrective distributions is TRUE?

A. They are reported on Form W-2.

B. They may be rolled over to an IRA.

C. De minimis excess amounts of less than $100 are not subject to taxation.

D. They are not subject to the 10% additional income tax on early distributions.

D. They are not subject to the 10% additional income tax on early distributions.

Which two of the following statements regarding allocable earnings are TRUE?

A. Earnings allocable to an excess annual addition are not included in a corrective distribution under $100.

B. Allocable earnings do not apply to excess contributions attributable to designated Roth contributions.

C. Earnings allocable to an excess deferral are the gains or losses for the tax year in which the excess deferral was made.

D. Excess aggregate contributions are not fully corrected unless the earnings allocable to the excess are also distributed.

C. Earnings allocable to an excess deferral are the gains or losses for the tax year in which the excess deferral was made.

D. Excess aggregate contributions are not fully corrected unless the earnings allocable to the excess are also distributed.

Adam, age 75, has a required minimum distribution of $5,000 in 2023. However, his distributions during the year only total $4,500. Which two statements regarding the excise tax on the failure to make required minimum distributions are TRUE?

A. Adam is subject to a $125 excise tax in 2023 unless the additional $500 is taken in the correction window.

B. Waivers of the excise tax are not available. C. The excise tax is paid with Adam's income tax return.

D. The excise tax applies also in 2024 unless Adam withdraws an extra $500 in 2024.

A. Adam is subject to a $125 excise tax in 2023 unless the additional $500 is taken in the correction window.

C. The excise tax is paid with Adam's income tax return.

Rob is a participant in his employer’s 401(k) plan and profit sharing plan. For 2022, his required minimum distribution is $2,000 from the 401(k) plan and $4,000 from the profit sharing plan. He receives a $6,000 distribution from the profit sharing plan, and no distribution from the 401(k) plan. What is the excise tax on the failure to make required minimum distributions in 2022?

A. $0

B. $500

C. $2,000

D. $3,000

B. $500

Christy is a participant in her employer’s profit sharing plan. Her birth date is March 28, 1950. The plan requires payments to begin under the more flexible required minimum distribution rules for non-owners. Christy is not an owner, and she elects to retire on February 28, 2024. By what date is she required to begin taking distributions from the plan?

A. April 1, 2021

B. April 1, 2023

C. April 1, 2024

D. April 1, 2025

D. April 1, 2025

Bob owns 50% of ABC Company. His date of birth is August 14, 1951. Assuming he won’t retire until June 2026, by what date is he required to begin taking distributions from the company’s 401(k) plan?

A. April 1, 2025

B. December 31, 2025

C. December 31, 2026

D. April 1, 2027

C. December 31, 2026

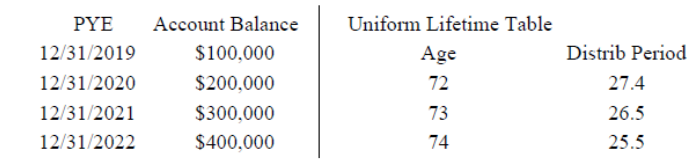

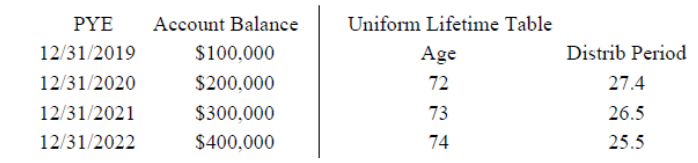

Joan owns 10% of a business that sponsors a calendar year money purchase plan. Her birth date is May 15, 1949, and her husband, her designated beneficiary, has a birth date of February 5, 1946. Using the following information, what is her required minimum distribution amount for the 2022 distribution year?

A. $10,948.91

B. $11,320.75

C. $11,764.71

D. $15,094.34

B. $11,320.75

Lucas is the 100% owner of a business that sponsors a calendar year 401(k) plan. His birth date is August 2, 1949, and his wife, his designated beneficiary, has a birth date of September 24, 1954. On January 12, 2022, Lucas received his first required minimum distribution. Using the information below, what is the 2022 required minimum distribution he must receive by December 31, 2022?

A. $0

B. $27,372.26

C. $28,301.89

D. $33,962.26

C. $28,301.89

Which of the following statements regarding the calculation of the required minimum distribution (RMD) amount is TRUE?

A. A participant's vested account balance is used to determine the amount of each annual distribution.

B. A defined contribution plan participant's annual RMD is calculated using the formula: Account Balance x Distribution Period.

C. Distributions made before the first distribution calendar year may be used to satisfy the RMD requirement for subsequent calendar years.

D. If a plan is valued annually each June, the RMD for 2022 is based on the participant's June 30, 2021 account balance, adjusted for contributions and distributions from July to December 2021.

D. If a plan is valued annually each June, the RMD for 2022 is based on the participant's June 30, 2021 account balance, adjusted for contributions and distributions from July to December 2021.

Gina is age 76 and receives required minimum distribution payments each year from her employer’s profit sharing plan. After receiving her 2021 required minimum distribution, Gina rolls over her remaining plan benefit to an existing IRA in 2021. Which of the following statements regarding the effect of the rollover on required minimum distribution (RMD) calculations is TRUE?

A. The IRA must revise the 2021 RMD.

B. The IRA must subtract the rollover amount when calculating the 2022 RMD.

C. The plan must revise the 2021 RMD.

D. The plan no longer takes into account the amount rolled over when calculating the 2022 RMD.

D. The plan no longer takes into account the amount rolled over when calculating the 2022 RMD.

Which of the following statements regarding designated beneficiaries for required minimum distribution purposes is TRUE?

A. The designated beneficiary may be an estate.

B. Designated beneficiaries may be added after the participant’s death.

C. Anyone receiving a portion of a participant’s benefit upon death is taken into account for RMD purposes.

D. A spouse beneficiary more than 10 years younger than the participant affects the life expectancy used.

D. A spouse beneficiary more than 10 years younger than the participant affects the life expectancy used.

Which of the following beneficiaries must be paid death benefits under the 10-year rule?

A. A disabled individual

B. The participant’s spouse

C. A chronically ill individual

D. The participant’s adult child

D. The participant’s adult child

All of the following statements regarding life insurance coverage in a qualified plan are true, EXCEPT:

A. The value of life insurance coverage is determined under the PS-58 rate table.

B. At the participant’s retirement, the policy can be distributed to the participant tax-free.

C. To make sure insured death benefits are incidental, no more than 50% of employer contributions can be used to buy whole life insurance.

D. The employer's plan document must contain provisions for life insurance if the plan provides for life insurance coverage for plan participants.

B. At the participant’s retirement, the policy can be distributed to the participant tax-free.

In the absence of a signed or valid beneficiary designation, which of the following is TRUE?

A. Plan provisions must outline what steps to follow whenever a plan participant dies without a written beneficiary designation form on file.

B. The proceeds will automatically be divided between any surviving children.

C. The Plan Administrator will dictate how the death benefit proceeds should be distributed. D. All plan provisions must be written that if there is not a signed or valid beneficiary on file, the distribution will be made to the participant's estate.

A. Plan provisions must outline what steps to follow whenever a plan participant dies without a written beneficiary designation form on file.

Which of the following statements regarding spousal beneficiaries is TRUE?

A. Same-sex couples are not treated as married under Federal law.

B. Spousal consent to waive survivor benefits may not be done electronically.

C. Spousal rights only apply after the participant has been married for one year.

D. A plan that is subject to the survivor annuity rules must provide a minimum 50% death benefit payable to the spouse.

D. A plan that is subject to the survivor annuity rules must provide a minimum 50% death benefit payable to the spouse.

All of the following statements regarding rollovers for non-spouse beneficiaries are true, EXCEPT:

A. The 60-day rollover rule applies to an inherited IRA.

B. A non-spouse beneficiary cannot roll over death benefits into another qualified plan.

C. A non-spouse beneficiary cannot roll over death benefits into an IRA that he/she may own.

D. A non-spouse beneficiary can elect to directly roll over only part of the death benefit to an inherited IRA.

A. The 60-day rollover rule applies to an inherited IRA.

All of the following are optional disability benefits, EXCEPT:

A. 100% vesting

B. Continued accruals

C. Waiver of allocation conditions

D. Waiver of the age and service eligibility requirements

D. Waiver of the age and service eligibility requirements

Which of the following is a qualified distribution from a designated Roth account under a 401(k) plan?

A. Joe becomes disabled and receives a distribution of his vested account balance in 2022 at age 50. Joe first made designated Roth contributions to the plan in 2019.

B. Helen turns age 59½ in 2022 and receives an in-service distribution of her vested account balance. Helen first made designated Roth contributions to the plan in 2018.

C. Faye terminates her employment and receives a distribution of her vested account balance in 2022 at age 50. Faye first made designated Roth contributions to the plan in 2017.

D. Brian dies in 2022 at age 56, and his beneficiary receives a distribution of his vested account balance. Brian first made designated Roth contributions to the plan in 2014.

D. Brian dies in 2022 at age 56, and his beneficiary receives a distribution of his vested account balance. Brian first made designated Roth contributions to the plan in 2014.

Beth receives a $40,000 nonqualified distribution from her designated Roth account under her employer's 401(k) plan, consisting of $35,000 in designated Roth contributions and $5,000 in investment earnings. Within 60 days, Beth rolls over $20,000 to her Roth IRA. What is the amount that is taxable to Beth in the year the nonqualified distribution is paid?

A. $0

B. $5,000

C. $20,000

D. $40,000

A. $0

Montana makes designated Roth contributions to her employer's 401(k) plan in 2020 and 2021. She terminates employment in 2021, and rolls her vested account balance directly to a designated Roth account under her new employer's 401(k) plan. Montana starts making designated Roth contributions to her new employer's plan in 2022. What year does the 5-taxable year period begin under her new employer's plan?

A. 2020

B. 2021

C. 2022

D. 2023

A. 2020

All of the following statements regarding in-plan Roth rollovers are true, EXCEPT:

A. In-plan Roth rollovers convert pre-tax money to Roth status.

B. In-plan Roth rollovers must be available in all 401(k) plans.

C. In-plan Roth rollovers are not subject to the 10% early distribution tax.

D. Amounts converted in an in-plan Roth rollover transaction are subject to taxation.

B. In-plan Roth rollovers must be available in all 401(k) plans.

Which of the following statements regarding missing participants in a terminated defined contribution plan is TRUE?

A. Public record databases may not be used to search for missing participants.

B. If the plan offers annuity options, benefits over $7,000 cannot be forced out.

C. Missing participants could cause substantial delays when distributing benefits in a terminating plan.

D. Assets for missing participants are disregarded when determining if all assets have been distributed from a terminated plan.

C. Missing participants could cause substantial delays when distributing benefits in a terminating plan.

All of the following statements regarding partial plan terminations are true, EXCEPT:

A. All affected participants are fully vested.

B. The presumption of a partial termination happens when the turnover rate is 20% or more.

C. Employees who voluntarily terminate are included in determining the turnover rate.

D. The period for determining if a partial plan termination has occurred is usually the plan year.

C. Employees who voluntarily terminate are included in determining the turnover rate.

All of the following statements regarding the general tax principles governing distributions from qualified retirement plans are true, EXCEPT:

A. Distributions are generally taxable as ordinary income.

B. Distributions are generally taxable in the year the distribution is made.

C. Taxation can be deferred for certain distributions through a rollover transaction.

D. Cash-out distributions under $1,000 are not subject to immediate taxation.

D. Cash-out distributions under $1,000 are not subject to immediate taxation.

Sylvia is a terminated participant in a qualified profit sharing plan. Her vested account balance is $120,000, consisting of a $20,000 loan and $100,000 in cash. Sylvia’s loan is offset, and she elects to have $40,000 of her total eligible rollover distribution rolled into an IRA. What is the required tax withholding amount?

A. $4,000

B. $12,000

C. $16,000

D. $18,000

C. $16,000

Martha, age 40, terminates employment with a vested account balance of $25,000 in her former employer’s 401(k) plan. She has only made elective deferrals to the plan. Martha elects to roll over $15,000 to an IRA and receive the remainder of her account as a cash distribution. What is the mandatory tax withholding amount?

A. $0

B. $2,000

C. $3,000

D. $5,000

B. $2,000

Troy, a 52-year-old participant, receives a $5,000 hardship withdrawal from his employer’s 401(k) plan. Which of the following statements regarding his tax withholding is TRUE?

A. $500 in taxes must be withheld.

B. $1,000 in taxes must be withheld.

C. Troy may elect not to have tax withholding apply.

D. Taxes are withheld as if the payment were wages.

C. Troy may elect not to have tax withholding apply.

Which two of the following statements regarding income tax withholding are TRUE? A. State tax withholding may apply to distributions.

B. Tax withholding will cover a participant’s tax liability.

C. Tax withholding is mandatory for all distributions from a qualified plan.

D. Total calendar year taxes on qualified plan distributions are reported on Form 945.

A. State tax withholding may apply to distributions.

D. Total calendar year taxes on qualified plan distributions are reported on Form 945.

Mary, age 45, terminates her employment and receives a distribution of her entire vested account balance of $75,000. The cash distribution consists of $40,000 of elective deferrals, $20,000 of employer matching contributions, and $5,000 of aftertax employee contributions. The remaining $10,000 represents earnings on the various contributions. What is the amount of the 10% additional tax on early distributions?

A. $0

B. $3,000

C. $7,000

D. $7,500

C. $7,000

Which two of the following distributions are exempt from the 10% additional tax on early distributions?

A. A distribution of death benefits to a 35-year-old beneficiary

B. A distribution made to an actively employed 56- year-old participant

C. A hardship distribution to pay medical expenses of $3,000 for a participant with $50,000 adjusted gross income

D. A distribution in 2022 to a participant who terminated in 2021 at age 56

A. A distribution of death benefits to a 35-year-old beneficiary

D. A distribution in 2022 to a participant who terminated in 2021 at age 56

All of the following distributions are subject to the 10% additional tax on early distributions, EXCEPT:

A. An involuntary cash out of $2,500 to a 50-year-old participant

B. A portion of a nonqualified distribution from a Roth 401(k) plan

C. A distribution to a 45-year-old participant upon his total and permanent disability

D. A hardship withdrawal to prevent eviction from a 48-year-old participant's home

C. A distribution to a 45-year-old participant upon his total and permanent disability

Which of the following statements regarding the cost recovery rules is TRUE?

A. The rules determine the taxable and nontaxable portions of an annuity distribution. B. The method used to calculate the return of cost basis is based on the type of annuity selected.

C. If a participant dies before recovering the full cost basis, the remaining cost becomes taxable.

D. If a participant's cost basis is less than $1,000, payments are nontaxable until the cost is fully recovered.

A. The rules determine the taxable and nontaxable portions of an annuity distribution.

All of the following give rise to an investment in the contract (cost basis), EXCEPT:

A. Designated Roth contributions

B. After-tax employee contributions

C. Matching contributions on catch-up contributions

D. Principal payments on plan loans that were previously treated as deemed distributions

C. Matching contributions on catch-up contributions

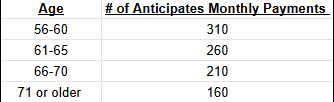

As of January 1, 2022, May, age 71, retires and begins receiving single life annuity payments from her former employer’s 401(k) plan. May had contributed $10,000 in after-tax employee contributions and $5,000 in elective deferrals to the plan. May will receive a monthly payment of $500. Using the following information from the statutory table, how much of May’s total annuity payments each year will be taxable?

A. $750.00

B. $4,875.00

C. $5,250.00

D. $5,428.56

C. $5,250.00

Heather is a participant in a qualified plan. An annuity is purchased for her with her vested account balance. Under its terms, the annuity will pay Heather $300 a month for life, beginning January 1, 2022 at age 75. Since Heather has made after-tax employee contributions to the plan, there is an investment in the contract of $9,000. Under the general rule, what is the tax-free portion of her monthly annuity, assuming her expected return multiple is 12.5?

A. $24

B. $60

C. $240

D. $720

B. $60

All of the following requirements must be met for a distribution to be considered a lump sum distribution, EXCEPT:

A. It is paid from an IRA.

B. It is the participant’s entire balance.

C. It is payable upon a triggering event.

D. It is paid within one tax year of the recipient.

A. It is paid from an IRA.

Which of the following is a triggering event for lump sum distribution purposes?

A. A participant attains age 59½

B. A self-employed person's separation from service

C. A deemed distribution of a defaulted loan

D. Hardship withdrawal due to the death of a participant's spouse

A. A participant attains age 59½

Which of the following statements regarding special tax treatment for lump sum distributions is TRUE?

A. A participant must file Form 945 in order to obtain special tax treatment.

B. Capital gains treatment might be available if an employee began participating in a plan after 2001.

C. The 10-year tax option might be available to a participant who was born before January 2, 1936.

D. A participant can roll over part of a lump sum distribution and apply special tax treatment to the remaining portion.

C. The 10-year tax option might be available to a participant who was born before January 2, 1936.

All of the following statements regarding the taxation of distributions that include employer securities are true, EXCEPT:

A. In a non-lump sum distribution, the distribution of employer securities attributable to employer contributions is taxed based on fair market value.

B. The special tax treatment for net unrealized appreciation continues to be available when the securities are rolled over to an IRA.

C. The special tax treatment for net unrealized appreciation is permitted if the securities are received as part of a lump sum distribution.

D. A participant may elect to include in income the amount of any net unrealized appreciation in employer securities distributed as part of a lump sum distribution.

B. The special tax treatment for net unrealized appreciation continues to be available when the securities are rolled over to an IRA.

A 38-year-old plan participant terminates employment and elects to roll over her $50,000 vested account balance to her IRA. There are no employee contributions in the plan. All of the following statements regarding the reporting of the distribution on Form 1099-R are true, EXCEPT:

A. The gross distribution is reported as $50,000.

B. The taxable amount is reported as $0.

C. The Federal income tax withheld is reported as $0.

D. The distribution code is 1 for an early distribution before age 59½.

D. The distribution code is 1 for an early distribution before age 59½.

All of the following statements regarding the IRS 402(f) tax notice are true, EXCEPT:

A. The notice must be provided 30-180 days before the distribution.

B. The notice is not required if vested benefits are less than $7,000.

C. The notice must explain the potential tax consequences of the distribution.

D. The notice must explain the special rules that apply to designated Roth contributions.

B. The notice is not required if vested benefits are less than $7,000.

All of the following statements regarding the IRS 402(f) tax notice are true, EXCEPT:

A. The model IRS notice must be used.

B. The notice must explain the rollover rules. C. The notice must be given to recipients of an eligible rollover distribution.

D. The notice must explain the mandatory tax withholding rules that may apply to cash distributions.

A. The model IRS notice must be used.

Which of the following statements regarding the waiver and consent requirements for qualified joint and survivor annuities (QJSA) and qualified preretirement survivor annuities (QPSA) is TRUE?

A. A participant's election to waive a QPSA must be irrevocable.

B. A newly hired 40-year-old participant cannot waive the QPSA since the notice period has expired.

C. A spouse's written consent to a participant's election to waive the QJSA must be witnessed by a plan representative or notary public.

D. Spousal consent is not required for the distribution of a 68-year-old participant's $100,000 vested benefit that is paid as a lump-sum rather than a QJSA.

C. A spouse's written consent to a participant's election to waive the QJSA must be witnessed by a plan representative or notary public.

All of the following statements regarding the qualified joint and survivor annuity (QJSA) notice are true, EXCEPT:

A. The notice must explain the effect of waiving the QJSA.

B. The notice must indicate the survivor annuity percentage.

C. The notice must be provided for any distribution from a defined benefit plan.

D. The notice must describe the optional forms of benefit available to the participant.

C. The notice must be provided for any distribution from a defined benefit plan.

All of the following statements regarding correcting overpayments under the Employee Plans Compliance Resolution System (EPCRS) are true, EXCEPT:

A. An overpayment due to a scrivener’s error is eligible for rollover.

B. Small overpayments of $100 or less are not required to be restored to the plan.

C. An overpayment is a payment to a participant that exceeds the amount due under the terms of the plan.

D. The correction generally requires the employer to make a reasonable attempt to recover the excess plus earnings from the person receiving the distribution.

A. An overpayment due to a scrivener’s error is eligible for rollover.

Under the Employee Plans Compliance Resolution System (EPCRS), which of the following statements regarding failure to obtain spousal consent is TRUE?

A. The error is exempt from the VCP submission fee.

B. The error cannot be corrected using the self-correction program.

C. The spousal benefit must be reduced to take into account distributions already paid to the participant.

D. The permitted correction method is to give the participant a choice between providing informed consent for the distribution actually made, or receiving a qualified joint and survivor annuity.

D. The permitted correction method is to give the participant a choice between providing informed consent for the distribution actually made, or receiving a qualified joint and survivor annuity.

Which two of the of the following participant loan terms satisfy the requirements under IRC §72(p)?

A. A loan with a 6-year term that is actually repaid in 4 years

B. An original loan with a 2-year term refinanced for an additional year

C. An extension of an original loan term by 5 years for a participant on a 6-month military leave

D. A loan with a 20-year term used to buy a condo that will be the participant's primary residence

B. An original loan with a 2-year term refinanced for an additional year

D. A loan with a 20-year term used to buy a condo that will be the participant's primary residence

Which of the following participant loan repayment schedules satisfies the requirements under IRC §72(p)?

A. Level monthly payments of principal and interest

B. Level quarterly payments of principal and interest paid annually by year-end

C. Level monthly interest payments with a balloon payment of principal at the end of the term

D. Level quarterly payments amortized over 10 years, but paid over a loan term of 5 years, with a lump sum payment at the end of the 5-year term

A. Level monthly payments of principal and interest

Renee takes a $40,000 participant loan on June 30, 2020 when her vested account balance is $100,000. The loan provides that payments will be made in level monthly installments over 5 years. Renee makes payments through January 31, 2022. No payment is made on February 28, 2022. The plan’s loan policy provides the maximum cure period under Treasury Regulations. What is the last day Renee can make the February 28, 2022 payment before the loan is defaulted and treated as a deemed distribution?

A. February 28, 2022

B. March 31, 2022

C. June 30, 2022

D. December 31, 2022

C. June 30, 2022

Steve has a vested account balance of $150,000 and receives a loan of $75,000. The loan is to be repaid in level monthly installments over a 5-year period. He has no other loans. How much is the deemed distribution?

A. $0

B. $25,000

C. $50,000

D. $75,000

B. $25,000

All of the following statements regarding a loan offset compared with a deemed distribution are true, EXCEPT:

A. Both only occur after the loan has been made.

B. Both may be subject to the 10% additional tax on early distributions.

C. A deemed distribution is not an eligible rollover distribution, while a loan offset may be eligible for rollover.

D. A loan offset is an actual distribution that reduces the participant's account balance, while a deemed distribution is only treated as distributed for tax purposes.

A. Both only occur after the loan has been made.

Dan is a terminated participant with a vested account balance of $50,000, including a $15,000 loan. His employer’s plan requires that a participant’s account balance is offset by an outstanding loan balance immediately following termination of employment. Which two statements regarding taxable income and tax withholding are TRUE?

A. If he elects a direct rollover of his non-loan balance to an IRA, $35,000 is rolled over and $15,000 is treated as taxable income. No tax withholding applies to the loan offset.

B. If he elects to have his account balance paid to him in a cash distribution, his taxable distribution is $50,000. He is paid $40,000 and $10,000 in taxes is withheld.

C. If he elects to roll over $20,000 to an IRA, his taxable income is $30,000. He is paid $24,000 and $6,000 in taxes is withheld.'

D. If he elects to defer payment of his account balance, the $15,000 loan is treated as a taxable distribution. However, no tax withholding applies to the loan offset.

A. If he elects a direct rollover of his non-loan balance to an IRA, $35,000 is rolled over and $15,000 is treated as taxable income. No tax withholding applies to the loan offset.

D. If he elects to defer payment of his account balance, the $15,000 loan is treated as a taxable distribution. However, no tax withholding applies to the loan offset.

All of the following statements regarding participant loans are true, EXCEPT:

A. Plans are not required to offer loans to terminated participants.

B. There are no statutory limits on the number of loans a participant can take.

C. Interest on participant loans secured by elective deferrals may be deducted.

D. To avoid being treated as a prohibited transaction, participant loans must bear a reasonable rate of interest.

C. Interest on participant loans secured by elective deferrals may be deducted.

All of the following statements regarding participant loans are true, EXCEPT:

A. A plan may require a $1,000 minimum participant loan.

B. A terminated participant may not continue making payments on an outstanding loan.

C. No more than 50% of the participant's vested accrued benefit may be used as security.

D. Loans may be refinanced or additional amounts borrowed without triggering a deemed distribution.

B. A terminated participant may not continue making payments on an outstanding loan.

Chip has an account balance of $80,000 and is 60% vested. His employer’s plan allows participant loans and Chip requests a loan of the maximum permissible amount under IRC 72(p). Assuming this is the first loan Chip has taken from the plan, what is the maximum amount he may take as a loan?

A. $24,000

B. $40,000

C. $48,000

D. $50,000

A. $24,000

All of the following statements regarding written agreement requirements for participant loans are true, EXCEPT:

A. The loan agreement may be an electronic version.

B. The agreement must include the payment schedule.

C. The loan agreement may be a written paper document.

D. The loan agreement doesn’t require spousal consent for the loan.

D. The loan agreement doesn’t require spousal consent for the loan.

Jason has a vested account balance of $200,000. His employer's plan allows participant loans, and Jason requests a loan of the maximum permissible amount. This is the first loan Jason has taken from the plan. What is the maximum loan he may take from the plan?

A. $50,000

B. $75,000

C. $100,000

D. $200,000

A. $50,000

Kristie has a vested account balance of $250,000. She currently has an outstanding loan balance of $25,000. The loan was originally for $35,000, which was the highest loan balance in the last 12 months. Assuming the plan allows participants to have two outstanding loans at a time, how much additional money can Kristie borrow from the plan without violating the amount limitation?

A. $15,000

B. $35,000

C. $50,000

D. $125,000

A. $15,000

All of the following statements regarding loan refinancing are true, EXCEPT:

A. Refinancing is treated as a replacement of the original loan.

B. A refinanced loan must be repaid by the end of the five-year period of the original loan.

C. The new payment must also cover the excess of the outstanding balance of the original loan.

D. IRS regulations issued under Code Section 72(p) essentially encourage the use of refinancing.

D. IRS regulations issued under Code Section 72(p) essentially encourage the use of refinancing.

Kay has a vested account balance of $70,000. She currently has an outstanding loan balance of $20,000. The loan was originally for $30,000, which was the highest loan balance in the last 12 months. Assuming the plan allows two outstanding participant loans, how much additional money can Kay borrow from the plan without violating the amount limitation?

A. $15,000

B. $30,000

C. $35,000

D. $40,000

A. $15,000

Which two statements regarding a qualified domestic relations order (QDRO) are TRUE?

A. All orders related to property settlements are not QDROs.

B. A QDRO cannot assign more than 50% of a participant's benefit to an alternate payee.

C. A QDRO can require benefits to be paid to an alternate payee in a form not permitted under the plan document.

D. An alternate payee under a QDRO can include a spouse, former spouse, child or other dependent of the participant.

A. All orders related to property settlements are not QDROs.

D. An alternate payee under a QDRO can include a spouse, former spouse, child or other dependent of the participant.

All of the following statements regarding disaster distributions are true, EXCEPT:

A. Plans may be retroactively amended to allow for these distributions.

B. The areas and timeframes that apply to these distributions are dictated by FEMA.

C. Tax law does not require the amount of the distributions to be limited to the loss.

D. Tax law requires documentation of the loss before the distribution can be made.

D. Tax law requires documentation of the loss before the distribution can be made.

All of the following statements regarding qualified reservist distributions are true, EXCEPT:

A. They are distributions of elective deferrals to a participant who was called to active duty.

B. The military service period must be indefinite or exceed 179 days.

C. They are not subject to a 6-month suspension on elective deferrals.

D. The distribution can be made at any time.

D. The distribution can be made at any time.