POA updated

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

Revenue recognition theory

Revenue is only recognised when goods have been delivered or when services are provided

Define allowance for impairment of trade receivables

The estimated amount of debts likely to be uncollectible

State and explain the accounting theory that requires businesses to provide for allowance for impairment of trade receivables

Prudence theory, which ensures that trade receivables balance is not overstated and reflects the net amount that is collectable

Explain the purpose of source documents

Source document provides evidence to capture occurrence of a transaction

Accounting entity theory

The activities of a business are separate from the actions of the owner. All transactions are recorded from the point of view of the business

Accounting period theory

The life of a business is divided into regular time intervals

Accrual basis of accounting

Business activities that have occured, regardless of whether cash is paid or received, should be recorded in the relevant accounting period

Consistency theory

Once an accounting method is chosen, this method should be applied to all future accounting periods to enable meaningful comparison

Going concern theory

A business is assumed to have an indefinite economic life unless there is credible evidence that it may close down

Historical cost theory

Transactions should be recorded at their original cost

Matching theory

Expenses incurred must be matched against income earned in the same period to determine the profit for that period

Materiality theory

A transaction is considered material if it makes a difference to the decision-making process

Monetary theory

Only business transactions that can be measured in monetary terms are recorded

Objectivity theory

Accounting information recorded must b supported by reliable and verifiable evidence so that financial statements will be free from opinions and biases

Prudence theory

The accounting treatment chosen should be the one that least overstates assets and profits and least understates liabilities and losses

Revenue recognition theory

Revenue is earned when goods have been delivered or services have been provided

Accounting information of which goods to buy

Cost of inventory, storage cost

Non-accounting information of which goods to buy

Customer preference, types of storage for the product

Role of accountants

Accountants prepare and provide accounting information for decision-making, setting up an accounting information system and becoming stewards of businesses

Role of accounting

Information system that provides accounting information for stakeholders to make informed decisions

State the accounting cycle

Identify and record, adjust, report and close

Why do business give trade discount

To encourage customer to buy in bulk and increase customer loyalty

Why do businesses give cash discount

To encourage credit customers to pay early

Why is trial balance prepared

Facilitate the preparation of the financial statements and to ensure arithmetic accuracy in recording

Reasons for dishonoured check

Cheque has expired or payer’s bank account does not have enough money

What are internal controls for?

To safeguard assets of the business and comply with laws and regulations

What are some internal controls (update with all definitions)

Custody of cash, by securing cash and cheque in a locked storage Authorisation, by obtaining proper approval for all payments from authorised personnel

Define FIFO

Goods that are purchased first are assumed to be sold first

Prudence theory for impairment loss on inventory

According to the prudence theory, inventory is valued at the lower of cost and net realisable value to ensure that inventory is not overstated.

Define asset

Resources a business owns or controls that are expected to provide future benefits

Define liabilities

Obligations owed by a business to others that are expected to be settled in the future

Define equity

Claim by the owners on the net assets of a business

Define income

Amounts earned from the activities of a business

Define expenses

Costs incurred to earn income in the same accounting period

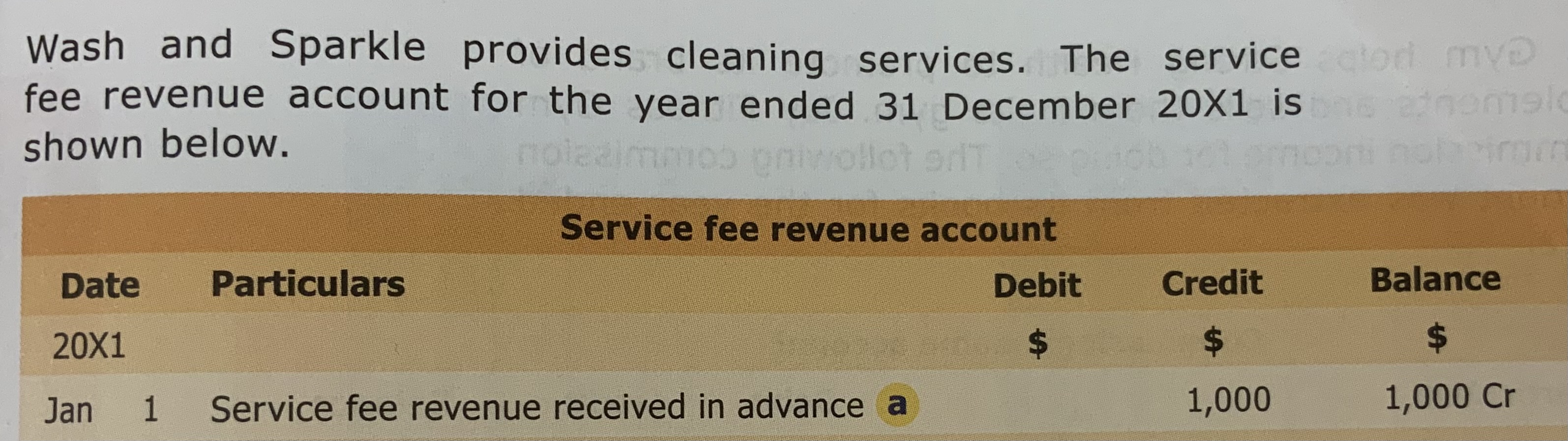

Interpret (a)

On Jan 1, $1000 worth of service fee revenue received in advance was adjusted, as it was collected last year, but the service is only being provided this year

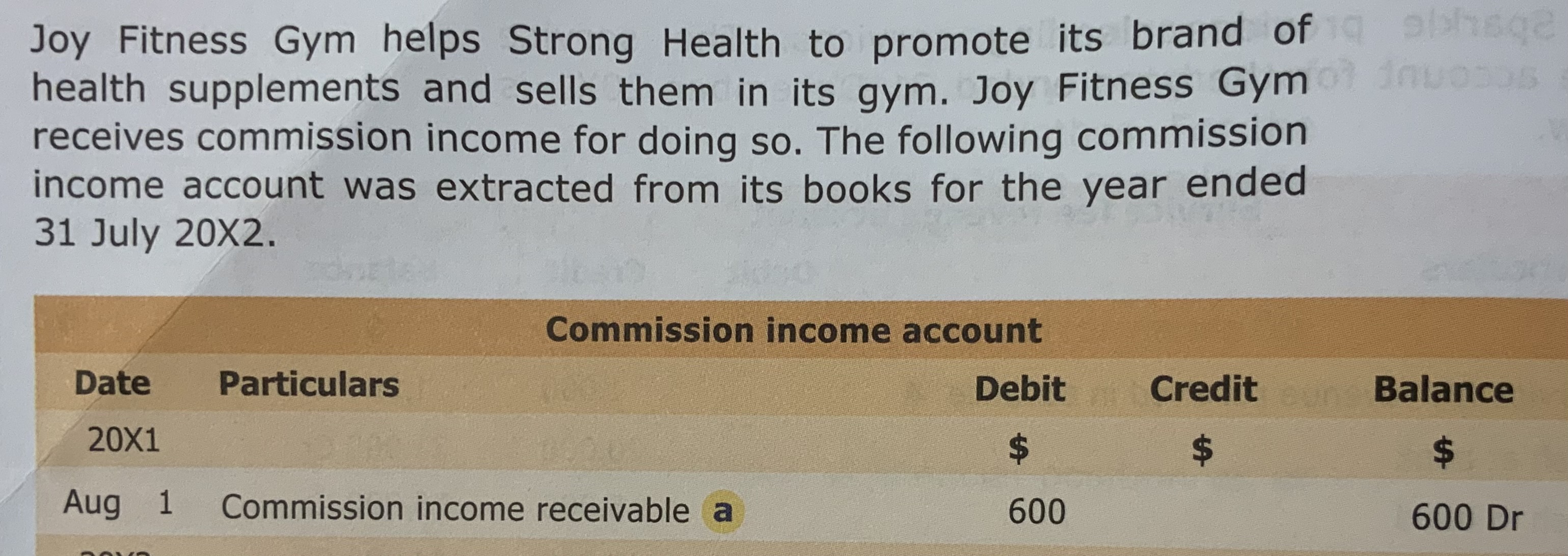

Interpret (a)

On Aug 1, the business adjusted $600 worth of commission income receivable to commission income, as payment will only be collected this year

State the effect on profit if prepaid rent expense was not adjusted for

DR Prepaid rent expense $6000

CR rent expense $6000

Profit would be understated by 6000

State the effect on Utilities expense, profit and current liability, if utilities expense was not adjusted

DR Utilities Expense 300

CR Utilities expense payable 300

Utilities expense is understated by $300

Profit for the year is overstated by $300

Current liability is understated by $300

Why is bank reconciliation done?

to check the cash at bank balance of the business against the bank's record as shown on the bank statement

Why is there internal control over cash

As cash is highly portable, it has a high chance of getting stolen

Why should business implement internal control

Reduce the possibility of theft to ensure that cash is well-protected

Define trade discount

Reduction to the list price

Define cash discount

Reduction to the invoice price

Why do business keep inventory

To prevent a stock-out situation, which often results in a loss of sales

Prudence theory in relation to value of inventory

Inventory is valued at the lower of cost and net realisable value to ensure inventory is not overstated

State the effects on profit, other expenses and assets if impairment loss on inventory is not adjusted

DR impairment loss on inventory $1650

CR inventory $1650

Profit is overstated by $1650

Asset is overstated by $1650

Other expenses is understated by $1650

Define net realisable value

It is the expected selling price that a business can get from selling inventory

Accrual basis of accounting for income

Service fee revenue/income received before services should not be recognized until the services are provided to the customer regardless of whether payment has been received or not

Accrual basis of accounting for expense

Expenses must be recorded in the period the services have been used, regardless of whether they have been paid for or not

Define cost of sales

cost incurred in buying the inventory that was sold

What can be considered when deciding to buy or rent NCA?

Cost of ownership vs renting, business current financial situation

What to consider when deciding which NCA to buy

Customer reviews, warranty, price of NCA

Define capital expenditure

Cost required to buy and bring the NCA to their intended use

Define revenue expenditure

Cost required to operate, mantain and repair the non-current asset in working condition

Everyday Gym recently bought bike mounts costing $200 to attach to all fitness bicycles which allows users to access their smartphones as they pedal. Everyday Gym reported a profit of $1 million in the previous year Should this be classified as capital expenditure or revenue expenditure? Use an accounting theory to explain your answer

The cost of the bike mounts is insignificant to decision-making when compared to the profit of the business. According to the materiality theory, such cost should be classified as revenue expenditure

Why would a business use straight line method to calculate depreciation?

The NCA may provide the same benefits throughout their estimated useful life

Why would a business use reducing balance method to calculate depreciation?

The NCA may provide more benefits in the earlier years than in its later years

List 3 causes of depreciation

Wear and tear, legal limits, usage

Explain the term ‘current portion of long-term borrowing’.

Current portion of long-term borrowing’ is the amount of loan that has to be repaid within one financial year from the statement of financial position date.

What is trading business

Business which buys goods from suppliers in order to resell goods to customers.

What is service business

Business which provides services to customers

Describe how business manage inventory

By keeping physical inventory in the warehouse and buying insurance to insure the inventory

Non accounting information of credit worthiness of customer

Customer reputation, economic outlook

Accounting information of credit worthiness of customer

Trade receivable balance, number of days trade receivable was overdue

Should a business halfway change their method of depreciation?

Unless there is a change of usage, a business should use the same method of depreciation and rate of depreciation every financial period to enable meaningful comparison of the net book value of non-current assets over time

Define depreciation

Allocation of cost of a non-current asset over its estimated useful life

Define accumulated depreciation

Total amount of depreciation expense to date

Define Liquidity

The ability of a business to convert current assets into cash to pay current liabilities

Define retained earnings

Accumulation of profits and losses that has not been distributed to shareholders yet since operation