2.1.2 Government Policies

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

Fiscal policy

Manipulation of government spending and taxes in order to achieve macroeconomic objectives

Direct tax

A tax directly gained on income or profits, such as income tax or corporate tax, that is paid directly to the government.

Indirect tax

A tax that is imposed on goods and services, which can be passed on to the consumer, such as sales tax or value-added tax.

Why do governments impose taxes

Generate revenue for public services and infrastructure

Manage economic stability

Redistribute wealth to address social inequalities.

Three main areas of government spending

Capital expenditure

Current expenditure

Transfer payments

Capital expenditure

spending that impacts the long run growth of the economy (e.g. infrastructure, building hospitals etc)

Current expenditure

Day to day spending e.g. on wages for public sector staff, medicines for hospitals

Transfer payments

Government expenditures that provide financial assistance to individuals without requiring goods or services in return, such as unemployment benefits and social security.

Fiscal deficit

When government spending is higher than their tax revenue, causing a fiscal deficit or budget deficit - the accumulation of such being called ‘national debt’

Fiscal surplus

When tax revenues are greater than government spending

Fiscal debt impact

National debt gets bigger, meaning the government has to spend more of its revenue on paying off the debt.

Future generations may be burdened with the debt of ‘today’.

Fiscal surplus impact

Likely to be positive

If a government collects more revenue than it spends in a year, the surplus could be used in a number of ways. For example, it could be used to spend on the future provision of public services or used to lower taxes in the economy.

Most governments would use it to pay off some of the national debt. This would reduce future interest payments and strengthen the nation’s finances

Types of fiscal policies (2)

Expansionary fiscal policy

Contractionary fiscal policy

Expansionary fiscal policy

Increase in government spending or a decrease in tax in order to stimulate (speed up) the economy

Contractionary fiscal policy

Decrease in government spending or an increase in tax in order to slow down the economy

Expansionary fiscal policy effect

Increase in inflation

Increase in economic growth

The unemployment rate is likely to fall

Increase in demand for imports

Damage the environment

Contractionary fiscal policy effect

Decrease in inflation

Decrease in economic growth

The unemployment rate is likely to rise

Decrease in demand for imports

Monetary policy

The manipulation of interest rates and the money supply in order to achieve macroeconomic objectives.

Who controls the monetary policy

The central bank

Interest rates

Interest rates are the cost of borrowing and reward for saving

Types of monetary policies (2)

Expansionary monetary policy

Contractionary monetary policy

Expansionary monetary policy

A reduction in interest rates to boost aggregate (total) demand, therefore increasing inflation

Contractionary monetary policy

An increase in interest rates to reduce aggregate (total demand), therefore decreasing inflation.

Supply side policy

Long run policies that generally aim to increase productivity and total output.

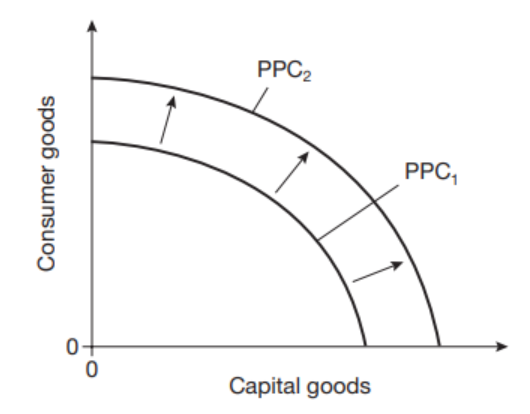

How do supply side policies affect the PPF

It will shift it out