Theme 6 II A: Firms and Decisions

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

23 Terms

Compare price and non-price strategies

Price strategies | Non-price strategies |

|

|

Explain how the 3 cognitive biases are used by firms generally

Sunk cost fallacy: encouraging customers to continue spending after an initial investment

Loss aversion: businesses frame offers to make people fear missing out, pushing quicker purchases

Saliency bias: highlight flashy features or discounts, drawing attention away from better options

Draw our graphs for increased revenue and reduced costs

Increased revenue | Reduced costs |

|

|

Define price discrimination and 3rd-degree discrimination

Price discrimination PD (Def.): Same product is sold at different prices to different buyers for reasons not associated with differences in production costs (SAME cost of production)

3rd-degree PD (Def.): Consumers segmented into distinct groups are being charged different prices for the same product for reasons not arising from cost difference

Describe 3rd-degree price discrimination + examples

Firms charge a higher price for consumers with a price inelastic demand and a lower price for other consumers with a price elastic demand assuming cost of production is constant

Eg. Public transportation rates – Lower bus and MRT fares for students and senior citizens (they have lower income -> greater proportion of income spent -> PED > 1) VS working adults

Eg. Airline tickets – Lower airfares for those who buy in advance (likely leisure travellers) VS last minute buyers (likely business or urgent travellers)

Eg. $9 for weekday movie ticket VS $13 for weekend movie ticket = NOT price discrimination = not same product (screened on different days) + due to cost difference (higher labour costs on weekend)

Describe conditions for 3rd-degree price discrimination

Price setter -> this strategy is for imperfectly competitive firms

Ability to differentiate markets and PED value must differ in each market

Separate customers into separate and identifiable groups, each with different PED

Markets must be kept separate

No possibility of resale or ‘seepage’ between markets

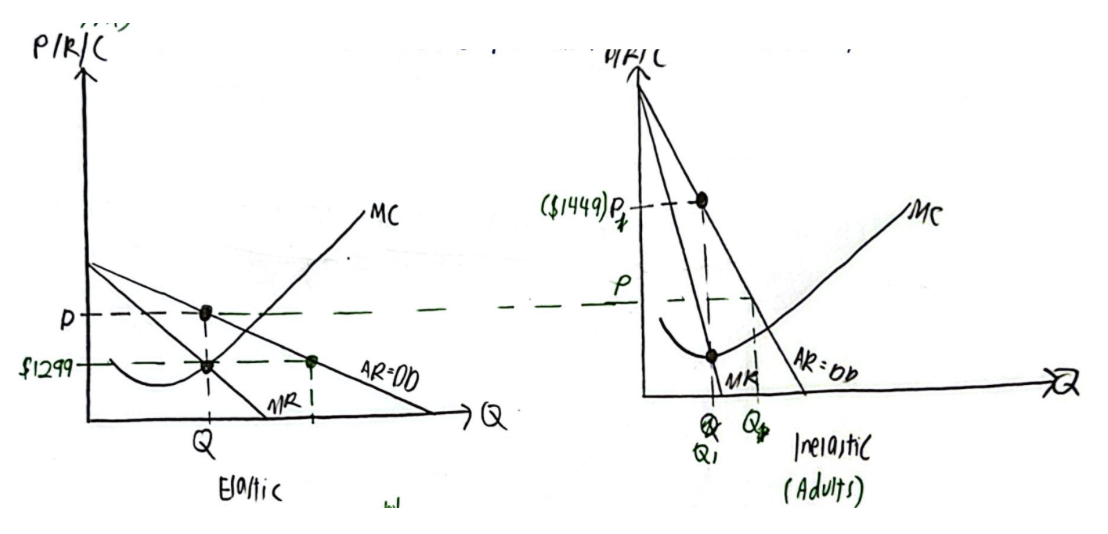

Explain how 3rd-degree price discrimination increases TR

*Q-Q’ is equidistant to Q1-Q

If you draw AC, AC curves MUST be the same!

Assuming a firm sells its output in 2 markets…, [describe 2 markets and their PEDs]

If apple charges the same price, TR = P x Q + P x Q

Since the PED differs between the two markets, the firm can charge different prices in the two markets to earn more revenue for the same output produced

[Describe charge what price individually market + how it increase revenue]

With total cost faced by the firm being the same (because there is no change in the overall quantity produced, where QA+QB = Q+Q’), price discrimination allows the firm to earn more profits as TR increased

Explain how 3rd-degree price discrimination increases TR graph

Impact of 3rd-degree price discrimination on consumers

Consumers with a price inelastic demand are negatively impacted as they get charged a higher price, consume less and lose consumer surplus

Consumers with a price elastic demand benefit as they get charged a lower price, consume more and gain consumer surplus

Impact of 3rd-degree price discrimination on government (efficiency VS equity)

Efficiency | Equity |

|

|

State limitation of 3rd-degree price discrimination

Difficult to segment market according to PED

Due to imperfect information, firms may segment market wrongly

For income groups: If firm charge higher price for low-income adults with PED > 1, it will lead to a more than proportionate fall in Qd -> fall in TR instead of rise in TR -> strategy ineffective in increasing profits

Others (use different PED factor): Even if the consumer has a low level of income, the demand for the sugar sweetened sodas may still be price inelastic (due to the addictive nature of the good)

For countries (developing VS less developed): Degree of necessity will be different between countries. In a developing country like Nepal with large geography and harsh terrain, cars take a large proportion of income but have a high degree of necessity -> PED hard to determine

Evaluation: In SR, difficult for firms to identify overall PED value but easier to identify in LR after firm collect more data on effects of its pricing strategies

Evaluation: Depends on pre-existing profits

Smaller problem if firm has ability to hire more data analysts to analyse sales patterns and effects of pricing strategy

Define price competition

(Def.): Firm sells its good/service at a lower price than a similar good/service sold by other firms (in the same market/industry)

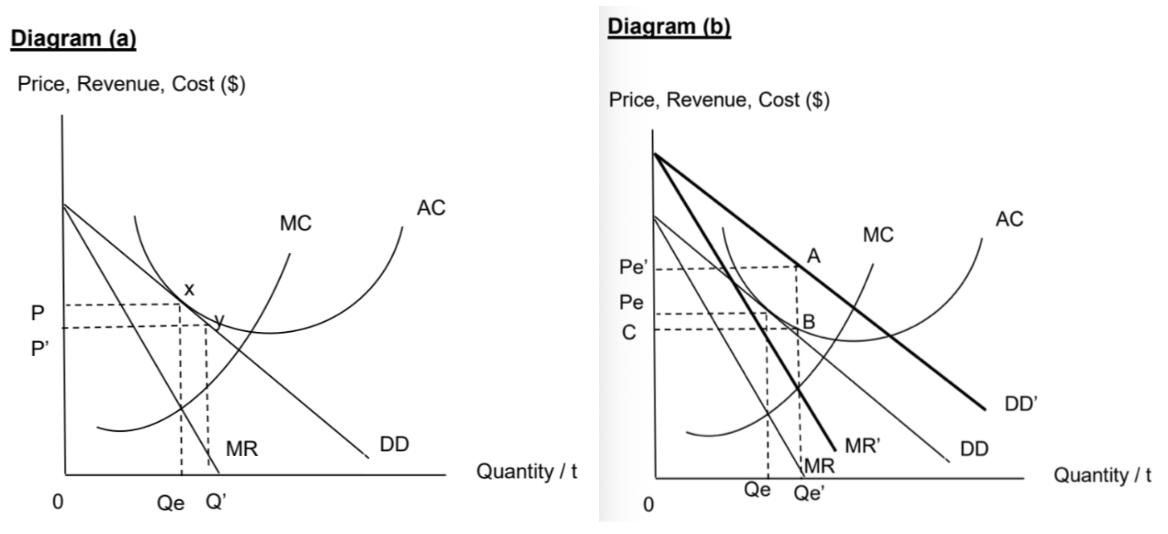

Explain how price competition can increase TR by increasing demand

Assume that a firm is initially earning only normal profits

When demand is price elastic (due to availability of close substitutes) where a fall in price leads to a more than proportionate rise in Qd, the firm could cut its price to increase TR

In diagram (a), the cut in price from P to P’ causes TR to rise from area 0PexQe to area 0P’yQ’ because the rise in TR from increase in Qd exceeds the fall in TR from fall in P

Cut in P will also win customers

Entice consumers to try its good/service with the hope that consumers come to see the benefits of the product after trying it

If taste and preference change in favour of your product -> their MPB rises -> consumers’ demand rises in the next period to DD’ in diagram (b)

Firm switches back to the normal practice of charging the price that enables it to sell its profit-maximising output and earn more profits

In diagram (b) (next time period), the firm produces Qe’ units (where MR’=MC) and charge price Pe’ -> total profits rise to area Pe’ABC

Explain how price competition can increase TR by increasing demand (graph)

Explain how firms use behaviourial economics in price competition

Firms tap into loss aversion by offering the price discount only for a limited period to increase the likelihood of swaying the decision of potential customers to buy the good/service

This triggers an emotional response where the consumer is driven to act impulsively by going ahead to buy, to avoid the negative emotions associated with a loss

Explain how price competition can increase TR by increasing demand of complements

A firm might perceive the demand for its good/service (printer) to be price inelastic, such that a cut in price leads to a less than proportionate rise in Qd

Rise in revenue from the rise in quantity sold does not exceed the fall in revenue from the price cut leading to an overall fall in revenue from the sale of printers

While this causes it to move away from its profit-maximising output level for printers, the rise in Qd for printers leads to increases in demand for its complement where the cross- price elasticity of demand is negative (printer ink), such that its profits from the sale of the complement rises

Leads to overall rise in profits if the rise in profits from printer ink exceeds the fall in profits from printers

State limitation of price competition

Unintentionally trigger a price war

Occurs in an oligopoly where there is rival consciousness among the firms in the market / industry and a price cut by one firm may cause other firms to follow suit -> Qd rise less than proportionate -> fall in TR

Oligopolists prefer to engage in non-price competition

Describe impact of price competition on other firms, consumers, government objectives

Other firms |

|

Consumers |

|

Government objectives |

|

Define marketing and advertising

Marketing: (Def.): Efforts taken by the firm to promote its product

Advertising: (Def.): an activity of making a product known to the public to persuade them to purchase it

Explain whether PC, MC, Oligo, Mono will carry out advertising

PC: no advertising due to perfect information and homogeneous products

MC: with more limited financial resources (since they only earn normal profits in the long run), engage in less costly types of advertising like flyers or small-scale social media publicity

Oligopolies: have the financial resources (since they may earn sustained supernormal profits in the long run) to compete by creation of brand loyalty through extensive advertising in the mass media

Monopoly: will engage in advertising if demand can still increase and become less price elastic + market is contestable (potential threat of new entrants, need to strengthen brand loyalty and create artificial BOE) -> depends on nature of the product

Explain how advertising can be persuasive

Firm aims to subjectively influence consumers about the quality or desirability of its product

Relies heavily on aesthetic and emotional appeal and celebrity endorsement

This may distort choices as consumers are swayed to buy _ instead of basing their decisions on actual MU (tangible quality of products)

Consumers may end up paying a price higher than their ‘true’ MU, which they only realise after consuming the product

Explain how advertising can be informative

Relies more heavily on information of the product

Firm aims to inform consumers about the prices of its products, tangible characteristics of its products, or the locations and conditions of sale

Describe evaluation for price discrimination

Eval: Condition not met (Eg. Given that air travel is now common and affordable for those in more affluent countries, resale could be possible if those from more affluent countries travel to less-affluent countries to buy the same drug that is priced more cheaply there -> If this were not controlled, price discrimination might not be effective)