Core 1

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

113 Terms

A combined approach is used when

when the auditor assesses the control risk below a maximum and does not intend to rely on internal controls with respect to a particular assertion

When determining progress on a LT construction contract using input method, % complete formula is

costs incurred to date / estimated total cost

A change in contract/transaction price should be

adjusted to the performance obligations on the same basis as at contract inception, do not reallocate or update transaction price

Under IFRS, goodwill is not considered to be an identifiable asset and therefore it cannot

generate cash flows independently of other assets, it cannot be tested for impairment unless it is assigned to a cash generating unit

Recoverable amount is higher of

fair value less costs to sell or value in use

Material right formula

Two types of fraud are

fraudulent financial reporting and misappropriation of assets

What should the auditor do to discharge the firms responsibility relating to fraud?

determine audit responses to address RMM

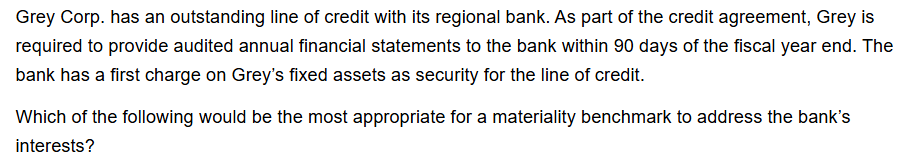

Normalized profit before tax as a materiality benchmark

entity has shown positive net income over the long term

Gross profit as a materiality benchmark

entity where there are fluctuations in profit after tax

Total revenue or expenses as a materiality benchmark

Not-for-profit or entity that has minimal or variable profits

Total assets as a materiality benchmark

property management company with value derived from asset valuations

Total equity as a materiality benchmark

entity whose operating results are so poor that liquidity or solvency are a real concern

Under ASPE, an asset is impaired if

Net recoverable amount < Carrying Value

Under ASPE, impairment loss is calculated is

fair value less carrying value

Cash generating unit

the smallest group of assets that generate cash inflows independent of the cash inflows of other assets/groups of assets. Example: an aircraft is a collection of assets that when assembled creates cash - the airplane seat alone would not generate cash without all the assets that make up the plane.

The recoverable amount under ASPE is

undiscounted net cash flows

The recoverable amount under IFRS

the higher of:

-fair value less disposal costs

-discounted net cash flows

A combined approach uses

tests of controls and and substantive procedures

Echo is auditing ESL and has begun its audit work on the allowance for doubtful accounts. What is a substantive procedure Echo might perform for estimates and related disclosures?

evaluate whether assumptions used by management in developing the estimates are reasonable

The auditor will determine a lower materiality for the purposes of assessing the RMM and determining the nature, timing, and extent of further audit procedures. This is referred to as

performance materiality

performance materiality will always be ______ than materiality for the financial statements in order to

lower; reduce to an appropriately low level the probability that the aggregate amount of uncorrected or undetected misstatements in the financial statements exceeds materiality for the financial statements as a whole

sales less gross profit

COGS

performance materiality is

60-75% of materiality (lower the %, higher the risk)

specific materiality

a materiality threshold set if factors indicate the existence of one or more particular classes of transaction, account balances, or disclosures for which misstatements of lesser amounts than materiality for the financial statements as a whole could reasonably be expected to influence users

FOB shipping

revenue recognized when shipped

Significant influence ownership %

20-50%

Control ownership %

50% or more

Passive investment %

20% or less

FV in bond calculation

what is owed/to be paid at end of bond

PV in bond calculation

proceeds, what is actually received

Interest expense bond

market rate * carrying amount

normalized net income - they are interested in profitability

a financial statement audit would reduce

agency risk

a financial statement audit would increase

agency costs

then auditor notices a company has no bank reconciliations prepared for a new bank account during the year. There is a risk that

cash has been removed from the account and not recorded properly, which leads to existence risk. It also affects the accuracy/valuation/allocation assertion as the balance may not reflect the correct amount.

when the auditor is determining the mix of substantive analytical procedures and tests of details to use on an account balance,

the auditor will consider the RMM to determine the mix of substantive analytical procedures and tests of details - depends on professional judgement as well as any evidence collected from tests of controls

Limited liability

protects auditors when there is negligence, default, breach of duty, breach of trust occurring during the audit for which the auditor is responsible

Redundant assets

assets that are not required by the business to generate operating cash flows, such as marketable securities, excess cash (above the amount normally required to operate the business), vacant land, etc.

Redundant liabilities

liabilities not associated with operations of the business, i.e. mortgage on vacant land or provisions related to redundant assets

Costs incurred during the year, LT construction contract

Dr Contract assets

Cr Cash or A/P

Billing to the client, LT construction contract

Dr A/R

Cr Progress billings

Progress billings

is a contra asset to contract asset

Revenue and expense entry at each period end, LT construction contracts

Dr Cost of sales

Dr Contract assets

Cr Revenue

At completion of contract, LT construction contract

Dr Progress billings

Cr Contract asset

Valuation - liquidation approach

when going-concern is a concern

Adjusted net asset valuation approach used when

either the company does not maintain active operation, or the company does have active operations but no excess earnings

Replacement cost valuation approach

replaces asset carrying value with current cost to replace the asset - is rarely used as it lacks economic validity

Capitalized cash flow valuation approach used when

the entity is going concern with active operations, the historical results of the entity reflect anticipated future operating results with constant annual future growth rates, or the entity does not prepare reliable financial projections

When a material right extends beyond the intial contract period, such as a right to a discounted monthly fee after a certain amount of time, the revenue recognition period

is extended

What is a procedure an auditor would perform to gain an understanding of internal control activities in the sales and A/R cycle?

observe the junior accounting clerk prepare a list of all cheques received in the mail before passing the cheque’s to the A/R clerk

FMV

the highest price available in an open and unrestricted market between informed and prudent parties, acting at arm’s length, and under no compulsion to act, expressed in terms of money or money’s worth

Replacement cost approach for valuation is commonly used for

insurance purposes, for individual assets

The discounted cash flow valuation approach is used when

if past cash flows are not representative of potential future cash flows, i.e. if the business is in the startup stage

A market based valuation approach is used when

the company is going concern and information required to determine a multiple is publicly available and reasonably comparable

Allocation of transaction price to performance obligations is calculated as

(standalone price/sum of standalone prices)*actual transaction price

When a firm providing assurance services is considering providing non-audit services, how can threats to independence be reduced?

establish a formal process to inform the audit engagement partner when the firm is considering providing non-audit services to an audit client

Conditions required to establish duty of care (1)

economic loss arising would have to be reasonably forseeable

Conditions required to establish duty of care (2)

Close direct relationship between defendant (auditor) and claimant. At the time the audit is prepared, the auditor would reasonably know the audited financial statements would be shown to a third party and the purposes for which the third party intended to place reliance on statements

Conditions required to establish duty of care (3)

Imposition of duty of care is fair, reasonable, and just in the circumstances

Customers can purchase tickets for movie showings up to a month in advance, tickets can be cancelled anytime before the screening and be fully refunded. An auditor, when collecting evidence on the revenue cycle, would be concerned about

occurrence, the risk revenue is being recognized before earned

The auditor should consider _________ in relation to the entity’s risk assessment process. This will allow the auditor to begin to evaluate the entity’s overall risk assessment process.

whether the entity has a process to identify business risks relevant to the entity’s financial reporting

Positive balance

terminal loss

Negative balance

recapture

add back to net income

recapture

deduct from net income

terminal loss

disposals during the year

lower of cost and proceeds

Prior to November 20th 2018, for CCA classes subject to half year rule

half year rule applies

Prior to November 20th 2018, for CCA classes not subject to half year rule

no half year rule

November 20th 2018-December 31st 2027

no half year rule applies

November 20th 2018-December 31st 2023, CCA calculated at

1.5x normal rate

January 1st 2024-December 31st 2027, classes not subject to half year rule, CCA calculated at

1.25x normal rate

After January 1st 2028

half year rule applies for applicable classes, and CCA calculated at normal rate

Classes not normally subject to half year rule

12, 14, 15, 23, 24, 27, 34, 52

Passenger vehicles costing _____ or more must be placed in class 10.1

$37,000

Class 10.1 can only claim _____ in disposition year

half of CCA

______does not apply to class 10.1

recapture

accelerated investment incentive does not apply when

disposals are greater than additions

Capital losses on disposal of depreciable property are

prohibited

A corporation can deduct charitable donations up to

75% of net income

A corporation can carry forward

any unused donations for up to five years

Operating cost benefit when 50% or more is for work, lower of

50% of standby charge and per km benefit or $0.33 per km (per km benefit)

Operating cost benefit when 50% or more for personal use

$0.33 per km (per km benefit)

When an employer provides an employee with an automobile and pays the operating costs, the taxable benefit is

standby charge + operating cost benefit - reimbursements by employee

When the employee owns the vehicle, the taxable benefit is:

operating cost - reimbursements by employee

Standby charge reduction when

Employee is required to use automobile for employment duties

Used primarily (50% or more) for employment purposes

Personal use km is 20,004km or less (or 1667km per month available)

Standby reduction calculaton

(Personal use km) /(1667 * D) where D = total days in period automobile is available/30

Effective January 1, 2022, the CRA has updated its administrative policy with respect to gift cards provided to employees as a gift (for a special occasion such as a birth of a child, wedding, etc.) or an award for an employment-related accomplishment (such as outstanding service or suggestion). Considered non-cash gift if:

Gift card with pre-loaded funs

Can only be used at single retailer/group of retailers

Cannot be converted to cash

Log is kept by employer that contains specific details

Length of service award not taxable if:

Given for at least 5 years of service

Non-cash up to a value of $500

Arms length employee

Compensation expense - equity settled

(fair value at grant date % expected to vest proportion of vesting period completed) - current contributed surplus value

Compensation expense - equity settled

Dr compensation expense

Cr Contributed surplus - share options or SARs

Compensation expense - cash settled

(fair value % expected to vest * proportion of vesting period completed) - current SAR liability

Compensation expense - cash settled

Dr compensation expense

Cr SARs liability

If equity settled share options or SARs exercised

Dr Cash

Dr Cr Contributed surplus - share options or SARs

Cr Common shares

If cash settled SARs exercised

Dr SARs liability

Cr Cash

If equity settled share options or SARs expired

Dr Contributed surplus - share options or SARs

Cr Cr Contributed surplus - share options or SARs - expired options or SARs

If cash settled SARs expired

Dr SARs liability

Cr Compensation expense

Individual tax return/filing due date when taxpayer or spouse carried on a business

June 15th

Corporation balance due date

two months after YE, 3 months for some CCPCs