Economics Macroeconomics

1/159

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

160 Terms

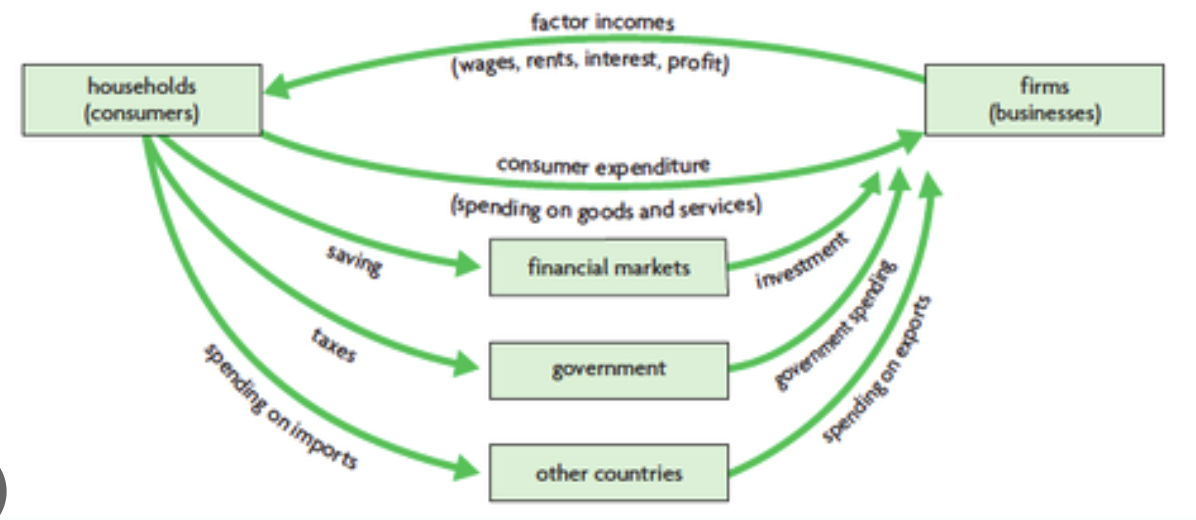

circular flow of income model

GDP equation

C + I + G + (X - M)

GNI equation

GDP + (income from abroad - income sent abroad)

GDP deflator equation

nominal GDP / real GDP x 100

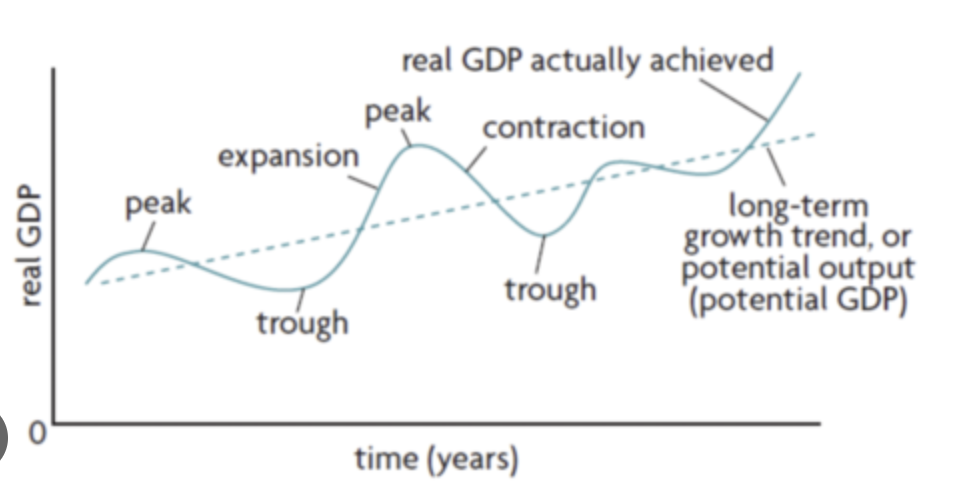

business cycle diagram

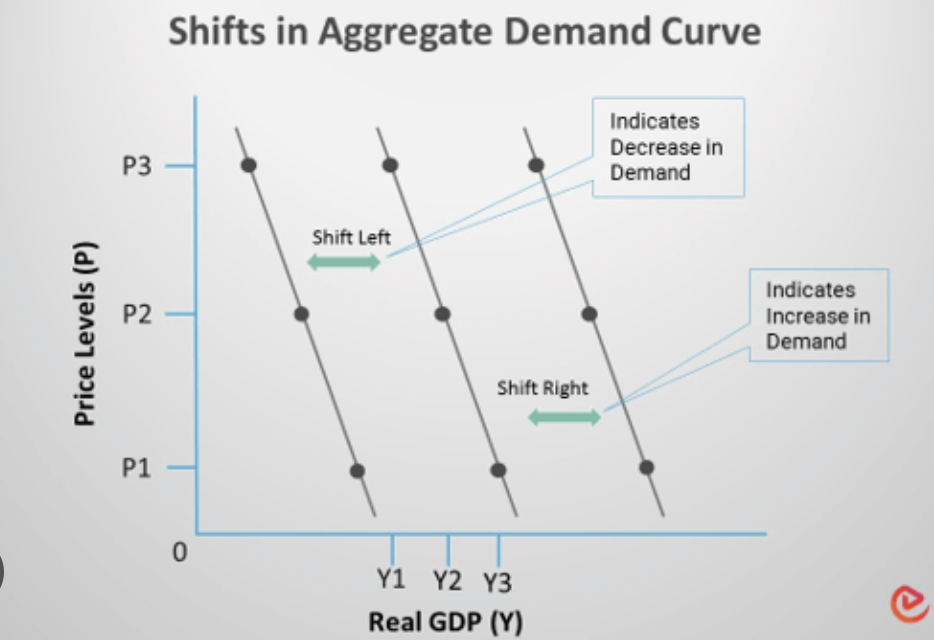

aggregate demand (AD) diagram

changes in consumer confidence

high consumer optimism = shift right

low consumer optimism = shift left

increase in interest rates = shift left

decrease in interest rates = shift right

increase in consumer wealth = shift right

decrease in consumer wealth = shift left

increase in personal income taxes = shift left

decrease in personal income taxes = shift right

high level of debt = shift left

low level of debt = shift right

high optimism = shift right

low optimism = shift left

increase in interest rates = shift left

decrease in interest rates = shift right

increase in business taxes = shift left

decrease in business taxes = shift right

high level of debt = shift left

low level of debt = shift right

increase in government spending = shift right

decrease in government spending = shift left

increase economic growth = shift right

decrease economic growth = shift left

country A's national income increases = country B shifts right

country A’s national income decreases = country B shifts right

country A's exchange rates appreciate = country A shifts left

country A’s exchange rates depreciate = country A shifts right

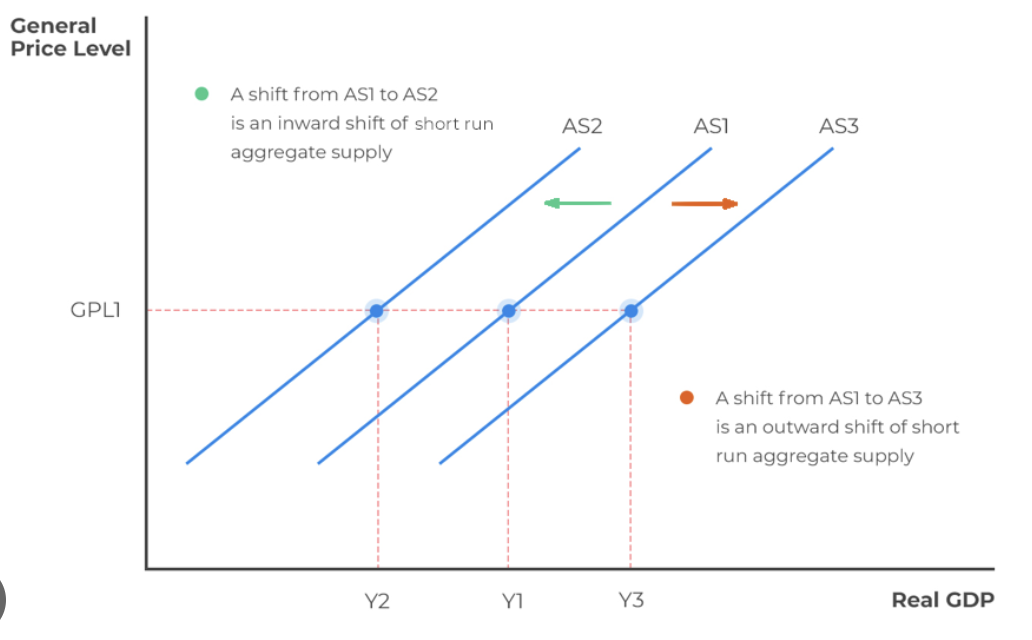

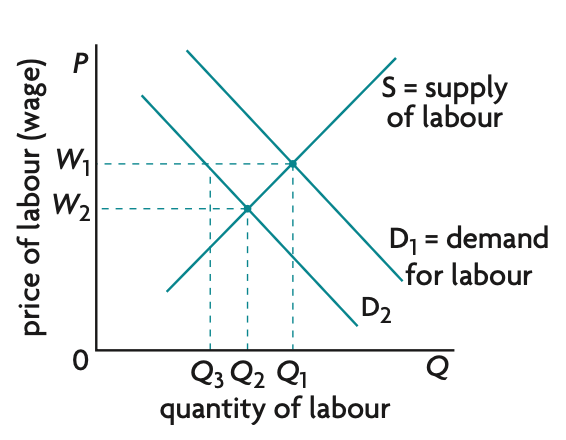

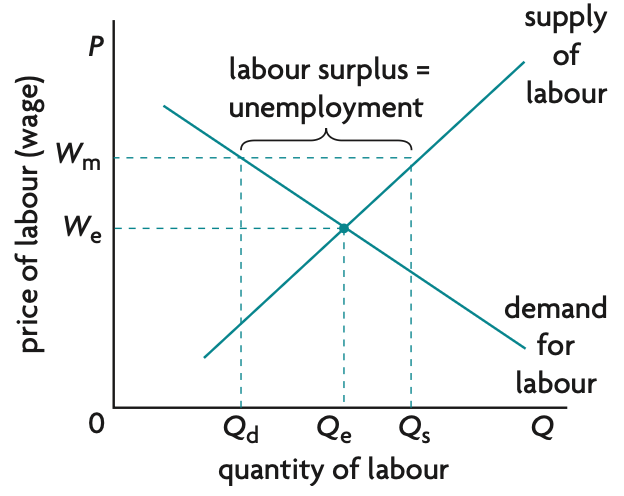

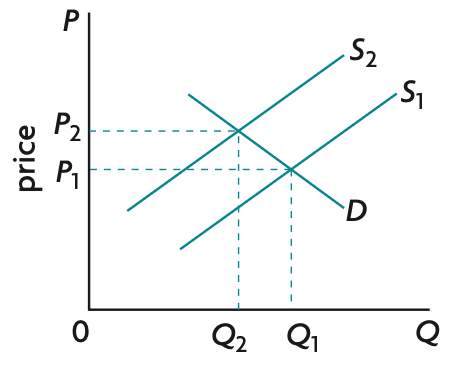

aggregate supply (SRAS) diagram

increase in wages = shift left

decrease in wages = shift right

increase in resource costs = shift left

decrease in resource costs = shift right

increase in business taxes = shift left

decrease in business taxes = shift right

increase in subsidies = shift right

decrease in subsidies = shift left

positive supply shock = shift right

negative supply shock = shift left

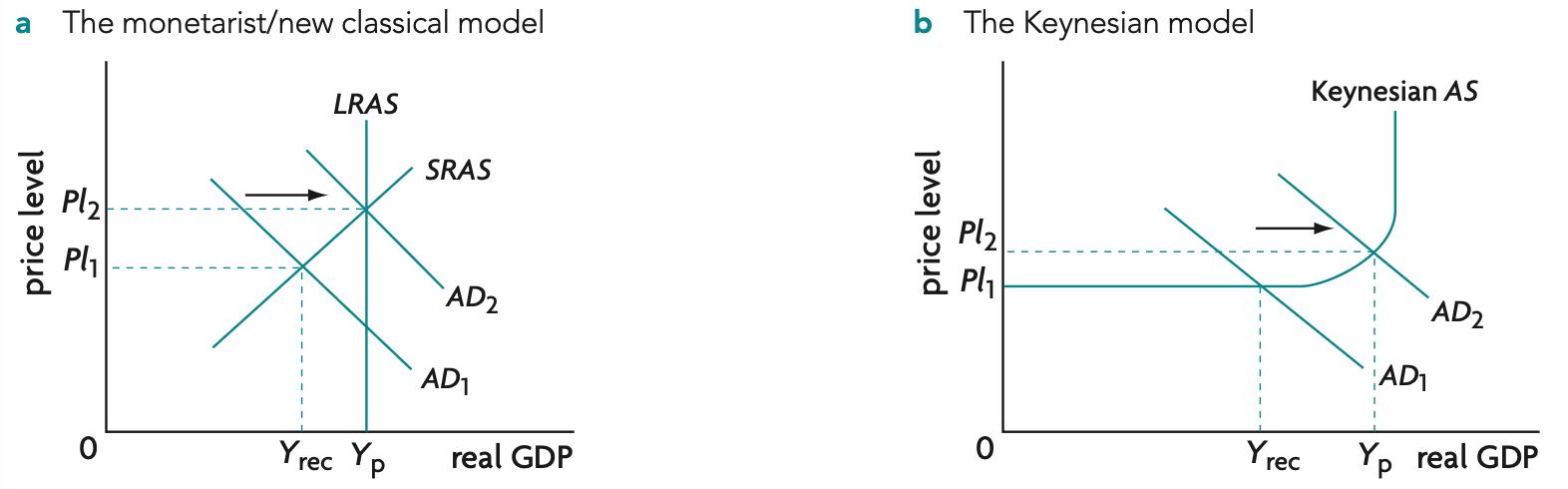

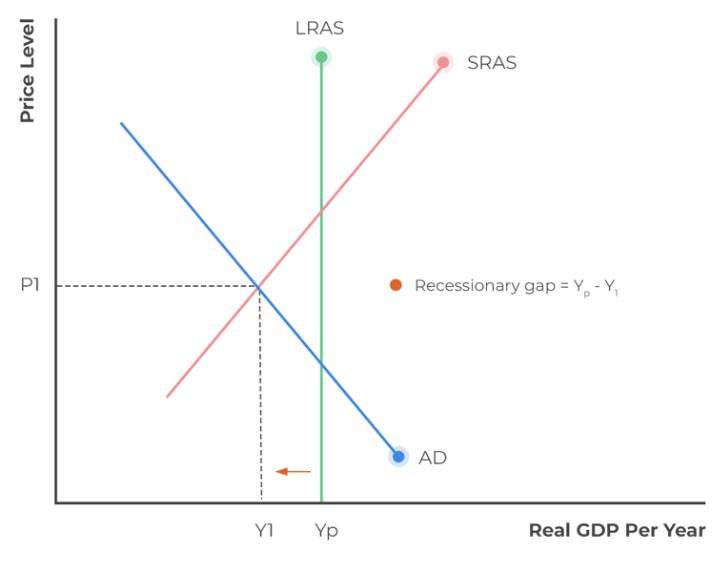

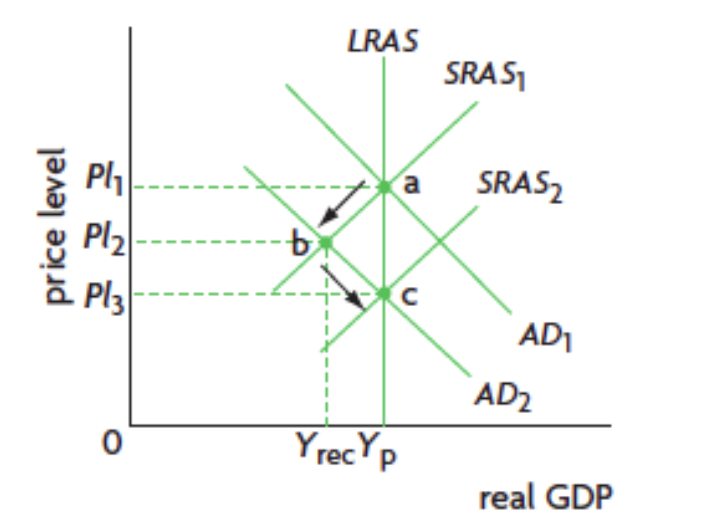

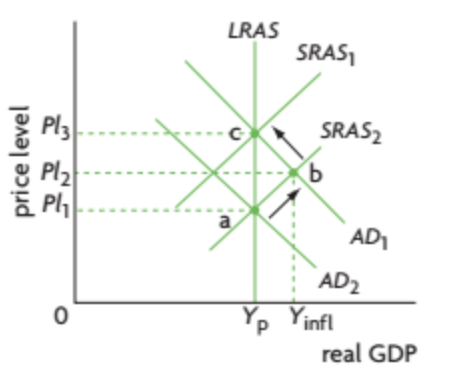

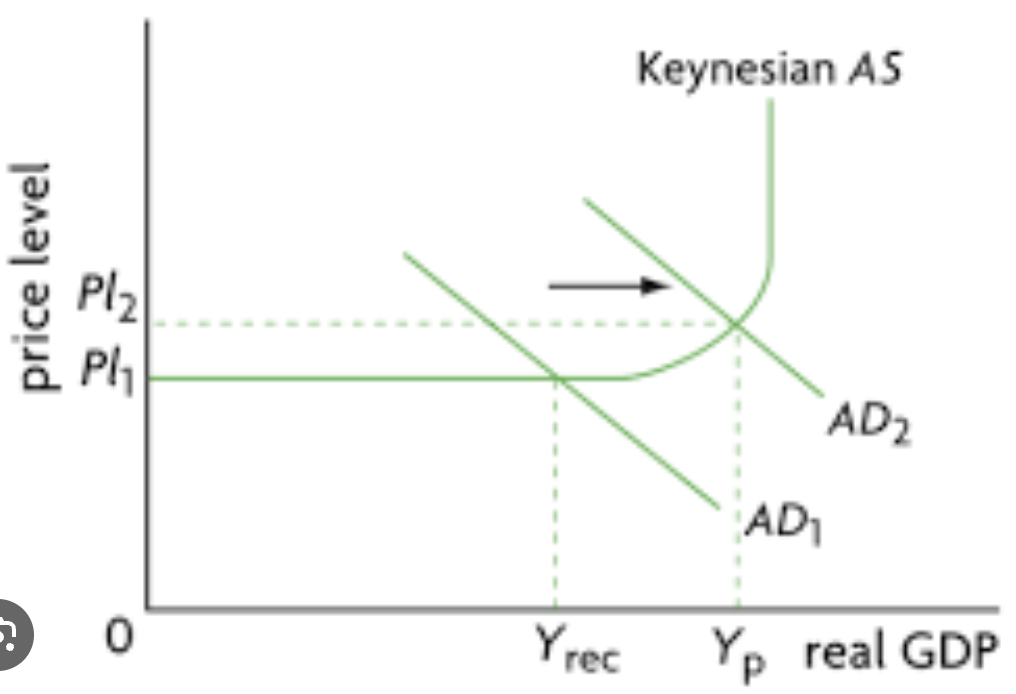

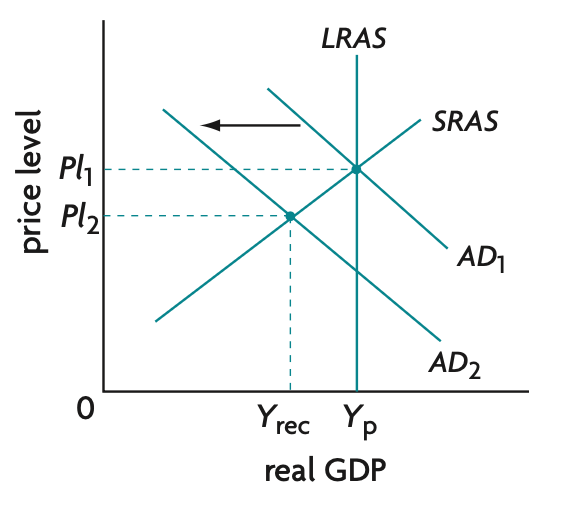

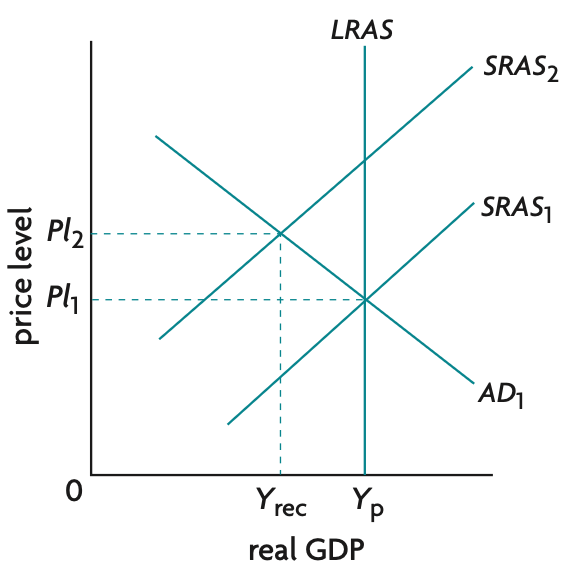

creating and eliminating a deflationary gap diagram

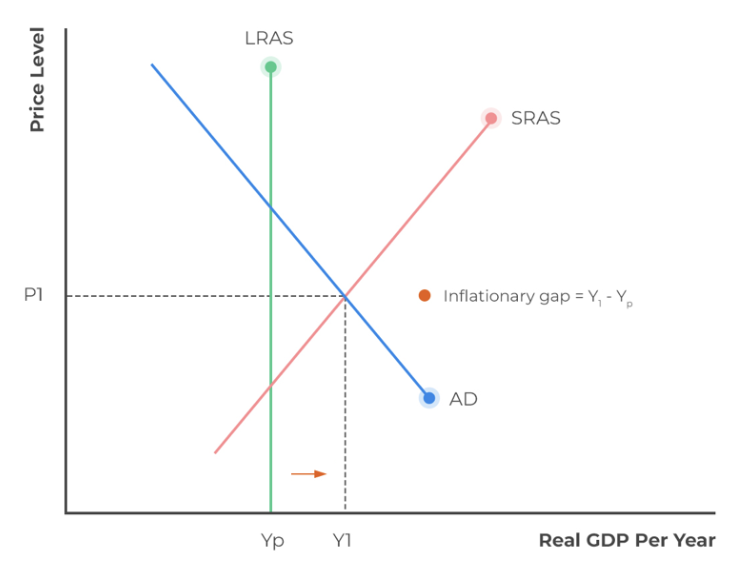

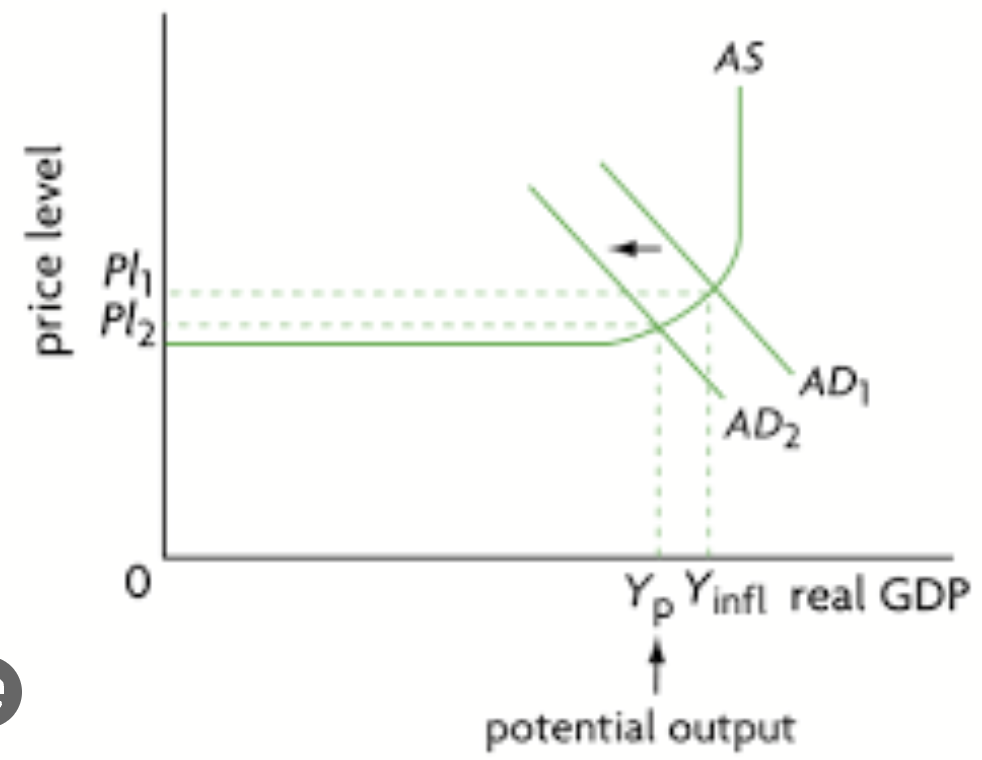

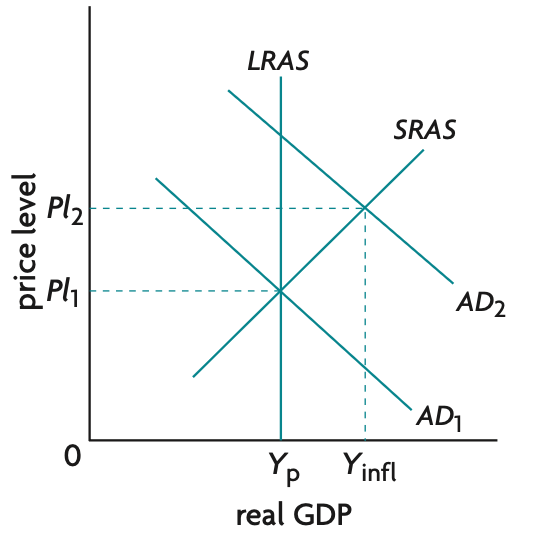

creating and eliminating an inflationary gap diagram

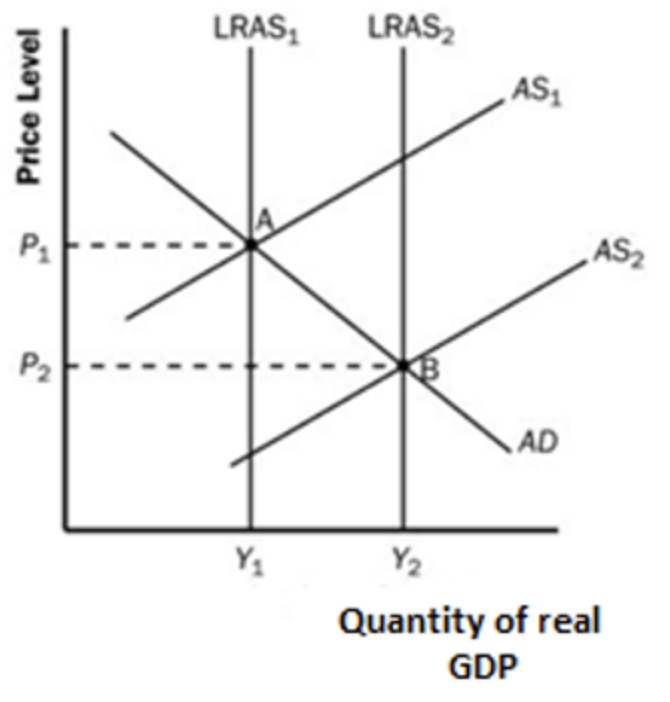

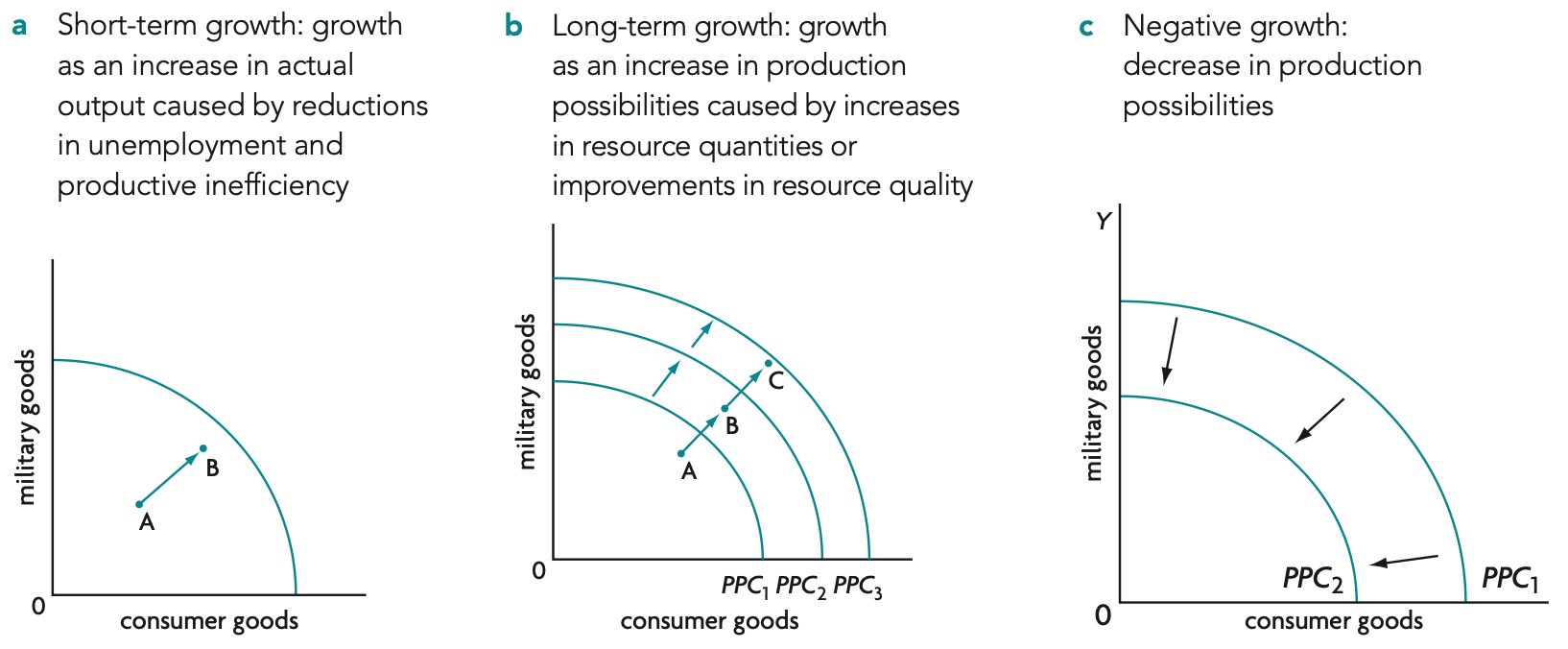

- increase in quantity of factors of production

- improvement in quality of factors of production

- improvement in technology

- increase in efficiency

- better institutions

- reductions in natural rate of unemployment

number of employed / labour force x 100

number of underemployed / labour force x 100

- loss of real GDP

- loss of income for unemployed workers

- loss of tax revenue for the government

- costs to the government of unemployed benefits

- costs to the government of dealing with social problems resulting from unemployment

- more unequal distribution of income

- unemployed people may have difficulties find work in the future

value of basket in specific year / value of same basket in base year x 100 (1dp)

(final value of CPI - initial value of CPI) / initial value of CPI x 100

positive = inflation, negative = deflation

different rates of inflation for different income earners

different rates of inflation depending on regional or cultural factors

changes in consumption patterns due to consumer substitutions when relative price changes

changes in consumption patterns due to increasing use of discount stores and sales

changes in consumption patterns due to introduction of new products

changes in product quality

international comparisons

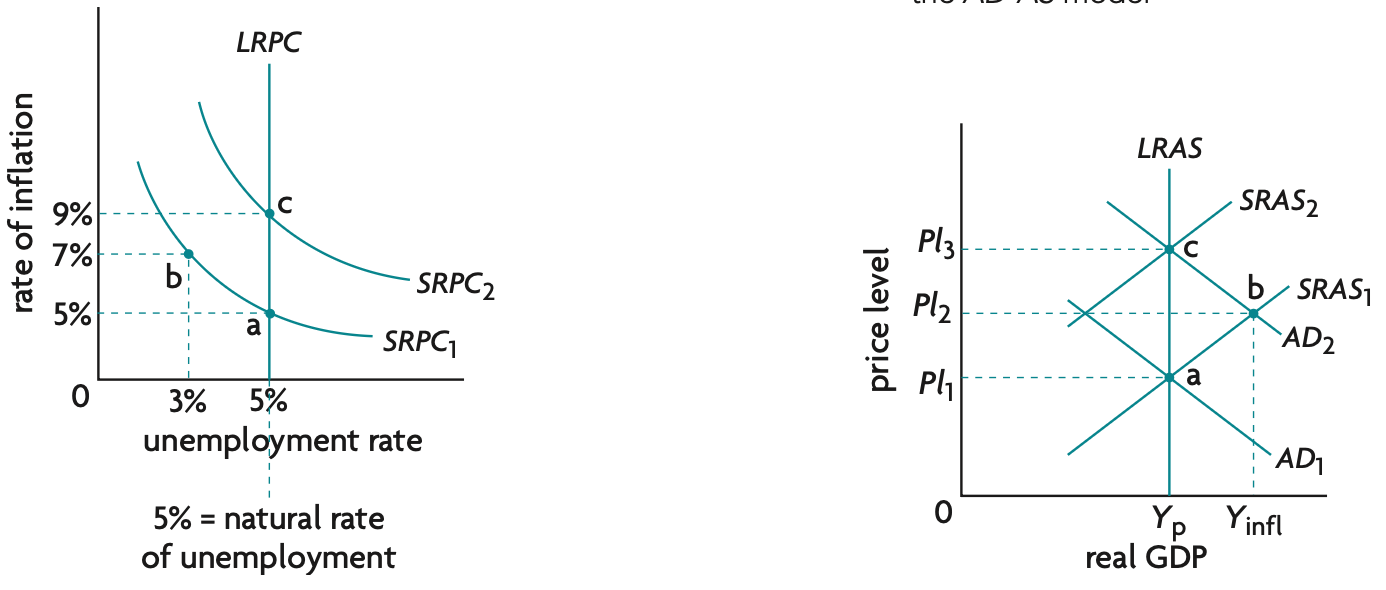

phillips curve diagram (SRPC)

LRPC diagram

production possibilities curve (PPC) diagrams

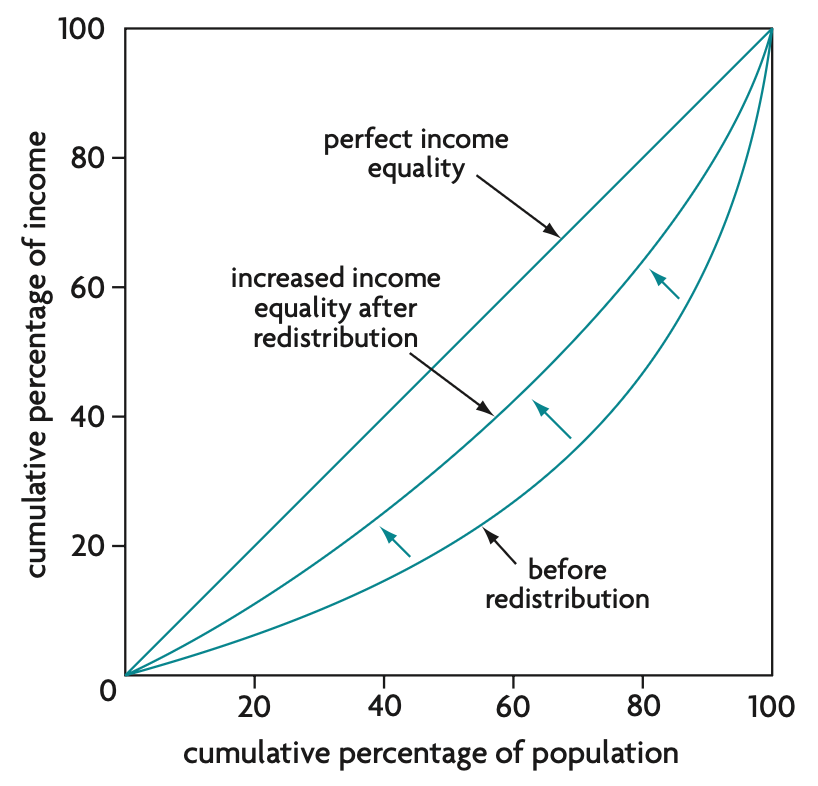

area between diagonal and lorenz curve / entire area under diagonal x 100

Income equality based on Gini coefficient

closer to 0 = greater income equality

closer to 1 = greater income inequality

perfect income equality = 0

1. introduction with definitions and argument

2. diagrams

3. explanation

4. real-world examples

5. evaluation using CLASPP (conclusions, long-term vs short-term, assumptions, stakeholders, priorities, pros and cons)

marginal tax rate equation

total marginal tax / average tax rate x 10