chapter 7: external economies of scale and the international location of production

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

the models of comparative advantage thus far assumed constant returns to scale:

when inputs to an industry increase at a certain rate, output increases at the same rate

if inputs were doubled, output would double as well

increasing returns to scale or economies of scale:

means that when inputs to an industry increase at a certain rate, output increases at a faster rate

a larger scale is more efficient: the cost per unit of output falls as a firm or industry increases output

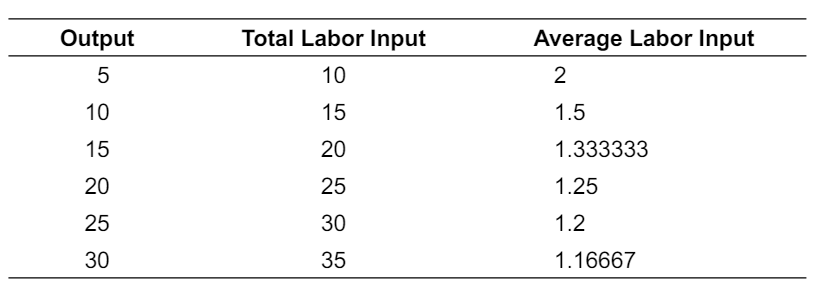

the presence of economies of scale may be seen from the fact that

doubling the input of labor more than doubles the industry’s output

the average amount of labor used to produce each widget is less when the industry produces more

relationship of input to output for a hypothetical industry (table)

mutually beneficial trade can arise as a result of

economies of scale

international trade permits each country to produce a limited range of goods without

sacrificing variety in consumption

a country can take advantage of economies of scale to produce more efficiently than if it tried to produce everything for itself due to

trade

external economies of scale

occur when cost per unit of output depends on the size of the industry

internal economies of scale

occur when cost per unit of output depends on the size of the firm

both internal and external economies of scale are

important causes of international trade

external economies implications for the structure of industries

will typically consist of many small firms and be perfectly competitive

internal economies implications for the structure of industries

when large firms have a cost advantage over small firms, causing the industry to become imperfectly competitive

modern examples of industries that seem to be powerful external economies

in the United States

semi-conductor industry in Silicon Valley

investment banking in New York

entertainment industry in Hollywood

in developing countries such as China, external economies are pervasive in manufacturing

one town in China produces most of the world’s underwear, another nearly all cigarette lighters

external economies played a key role in India’s emergence as a major exporter of information service

indian information services companies are still clustered in Bangalore

external economies may exist for a few reasons

specialized equipment or services

labor pooling

knowledge spillovers

for a variety of reasons, concentrating production of an industry’s in one or a few locations can reduce

the industry’s cost, even if the individual firms in the industry remain small

specialized equipment or services

may be needed for the industry, but are only supplied by other firms if the industry is large and concentrated

labor pooling

a large concentrated industry may attract a pool of workers, reducing employee search and hiring costs for each firm

knowledge spillovers

workers from different firms may more easily share ideas that benefit each firm when a large and concentrated industry exists

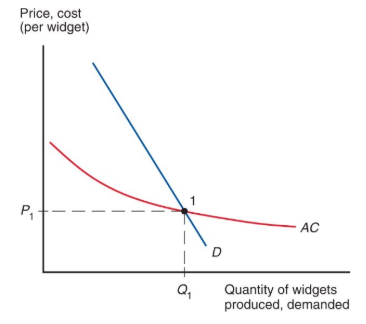

forward-falling curve

the larger industry’s output, the lower the price at which firms are willing to sell

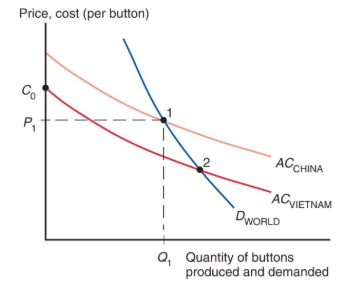

external economies (graph)

AC can be interpreted as a forward-falling supply curve. as in ordinary supply-and-demand analysis, market equilibrium is at point 1, where the supply curve intersects the demand curve, D. the equilibrium level of output is Q1, the equilibrium price P1

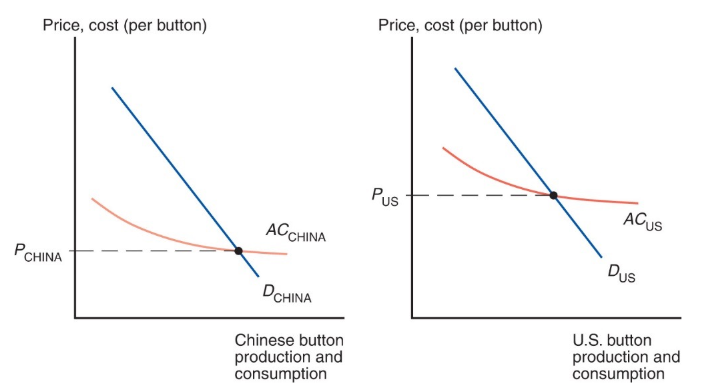

prior to international trade, equilibrium prices and output for each country would be

at the point where the domestic supply curve intersect the domestic demand curve

external economies before trade (graph)

in the absence of trade, the price of buttons in China, PCHINA, is lower than the price of buttons in the United States, PUS

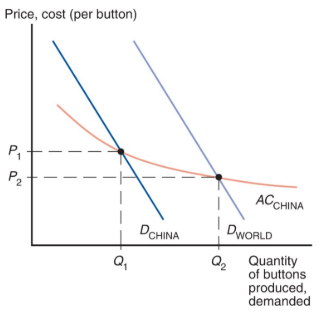

trade leads o prices that are lower than

the prices in either country before trade

in the standard trade model relative prices converge as a result of

trade

with external economies, by contrast, the effect of trade is to reduce

prices everywhere

trade prices (graph)

when trade is opened, China ends up producing buttons for the world market, which consists both of its own domestic market and of the U.S. market. output rises from Q1 to Q2, leading to a fall in the price of buttons from P1 to P2, which is lower than the price of buttons in either country before trade

what might cause one country to have an initial advantage from having a lower price

one possibility is comparative advantage due to underlying differences in technology and resources

if external economies, however, the pattern of trade could be due to

historical accidents

no guarantee that the right country will produce a good that is

subject to external economies

the importance of established advantage (graph)

the average cost curve for Vietnam, ACVIETNAM, lies below the average cost curve for China, ACCHINA. thus Vietnam could potentially supply the world market more cheaply than China. if the Chinese industry gets established firs, however, it may be able to sell buttons at the price P1, which is below the cost C0 that an individual Vietnamese firm would face it began production on its own. So, a pattern of specialization established by historical accident may persist even when new producers could potentially have lower costs

trade based on external economies has an ambiguous effect on

national welfare

there will be gains to the world economy by

concentrating production of industries with external economies

it’s possible that a country is worse off with trade that it would have been without trade:

a country may be better off if it produces everything for its domestic market rather than pay for imports

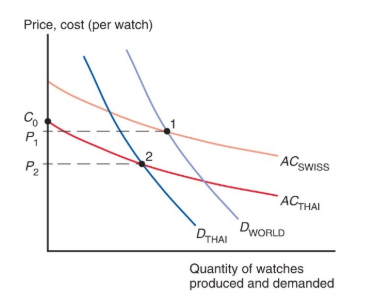

external economics and losses from trade (graph)

when there are external economies, trade can potentially leave a country worse off than it would be in the absence of trade. in this example, Thailand imports watches from Switzerland, which is able to supply the world market (DWORLD) at a price (P1) low enough to block entry to Thai producers, who must initially produce the watches at cost C0. yet if Thailand were to block all trade in watches, it would be able o supply its domestic market (DTHAI) at the lower price, P2

external economies may also depend on the amount of

cumulative output over time

dynamic increasing returns to scale exist if

average costs fall as cumulative output over time rises

dynamic increasing returns to scale imply dynamic external economies of scale

dynamic increasing returns to scale could arise if the cost of production depends

on the accumulation of knowledge and experience, which depend on the production process over time

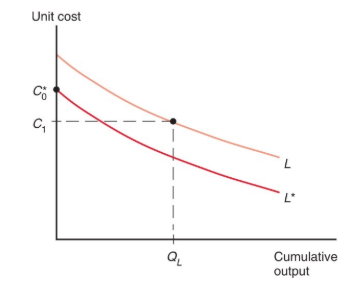

learning curve

a graphical representation of dynamic returns to scale

the learning crve

the learning curve shows that unit cost is lower the greater the cumulative output of a country’s industry to date. a country that has extensive experience in an industry (L) may have a lower unit cost than a country with little or no experience, even if that second country’s learning curve (L*) is lower - for example, because of lower wages

infant industry argument

temporary protection of industries enables them to gain experience

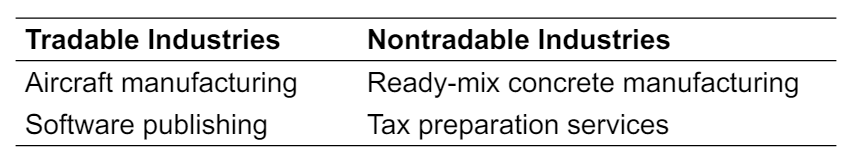

interregional trade

trade taking place among different regions and different states within the frontiers of a country

some non-tradeable goods must usually be

supplied locally

if external economies exist, the pattern of trade may be due to historical accidents:

regions that start as large producers in certain industries tend to remain large producers even if another region could potentially produce more cheaply

some examples of tradable and non-tradable industries (table)

economic geography

refers to the study of international trade, interregional trade and the organization of economic activity in metropolitan and rural areas

economic geography studies how humans transact with each other across space

communication changes such as the internet, email, text mail, video conferencing, mobile phones (as well as modern transpiration) are changing how humans transact with each other across space