1.2: How Markets Work (EDEXCEL A LEVEL ECONOMICS)

1/87

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

88 Terms

rational decision making

describes choices that are logical and consistent and maximize value (consumers want to maximize utility and producers want to maximize profit)

Utility

Ability or capacity of a good or service to be useful and give satisfaction to someone.

Demand

the quantity of a good or service that consumers are willing and able to buy at any given price in a given time period

Law of Demand

quantity demanded varies inversely with price

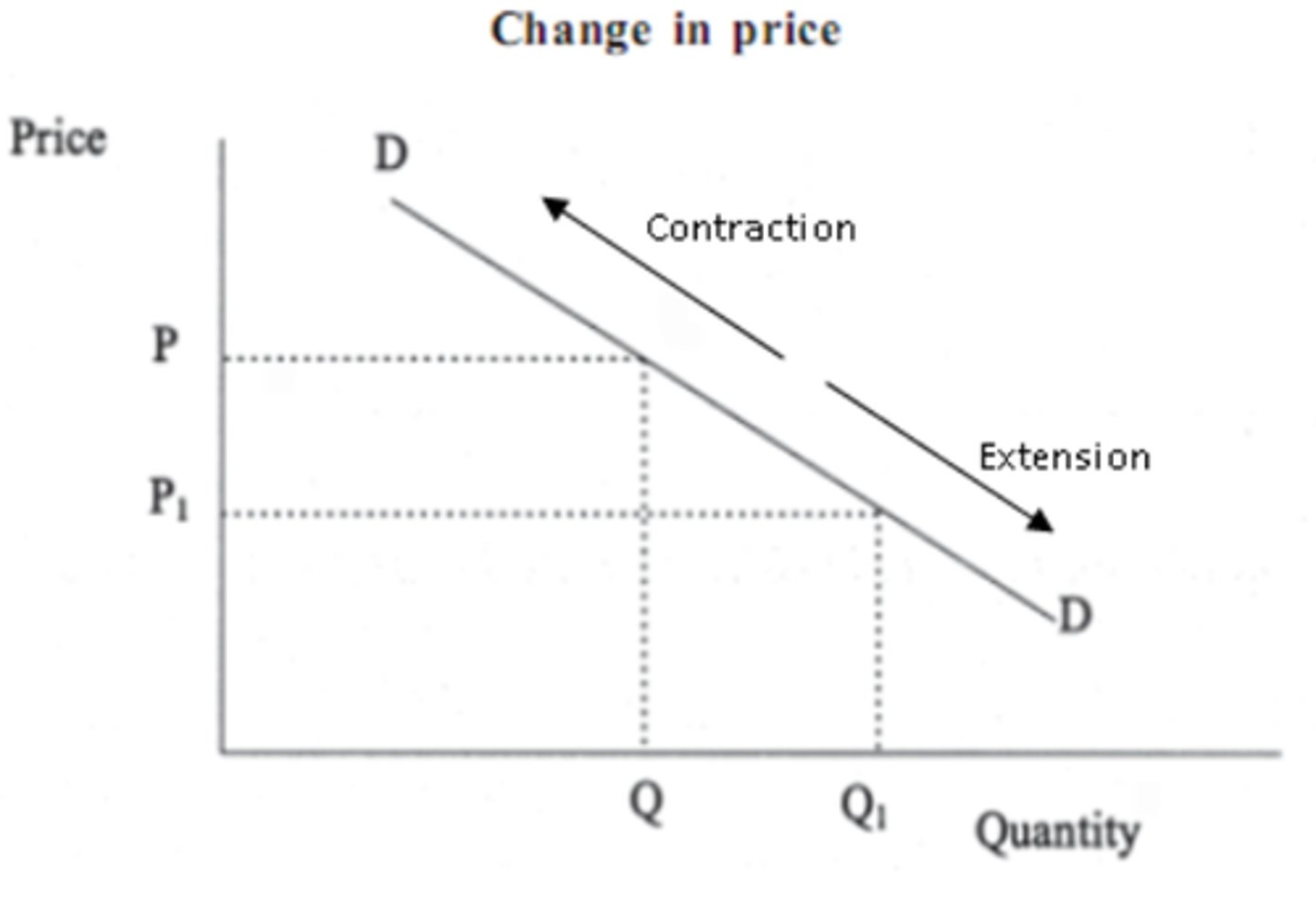

extension of demand

the increase in quantity demanded due to a fall in price

contraction of demand

the fall in the quantity demanded due to a rise in price

the income effect

the change in consumption that results when a price increase causes real income to decline

consumers can buy less with a given budget

the substitution effect

the change in the quantity demanded of a good that results from a change in price, making the good more or less expensive relative to other goods that are substitutes ( depends on closeness of substitutes )

Shifting the Demand Curve

things that determine buyers' demand for a good, other than the good's price (non-price determinants) (shift right=increase; shift left=decrease)

Conditions of demand

changes in income

fashion/tastes/preferences

advertising and branding

population size/demographic change

external shocks

seasonality

market expectations

price of complements

price of substitutes

Marginal utility

the extra usefulness or satisfaction a person gets from acquiring or using one more unit of a product, customers are willing to pay a price less than or equal to their marginal utility

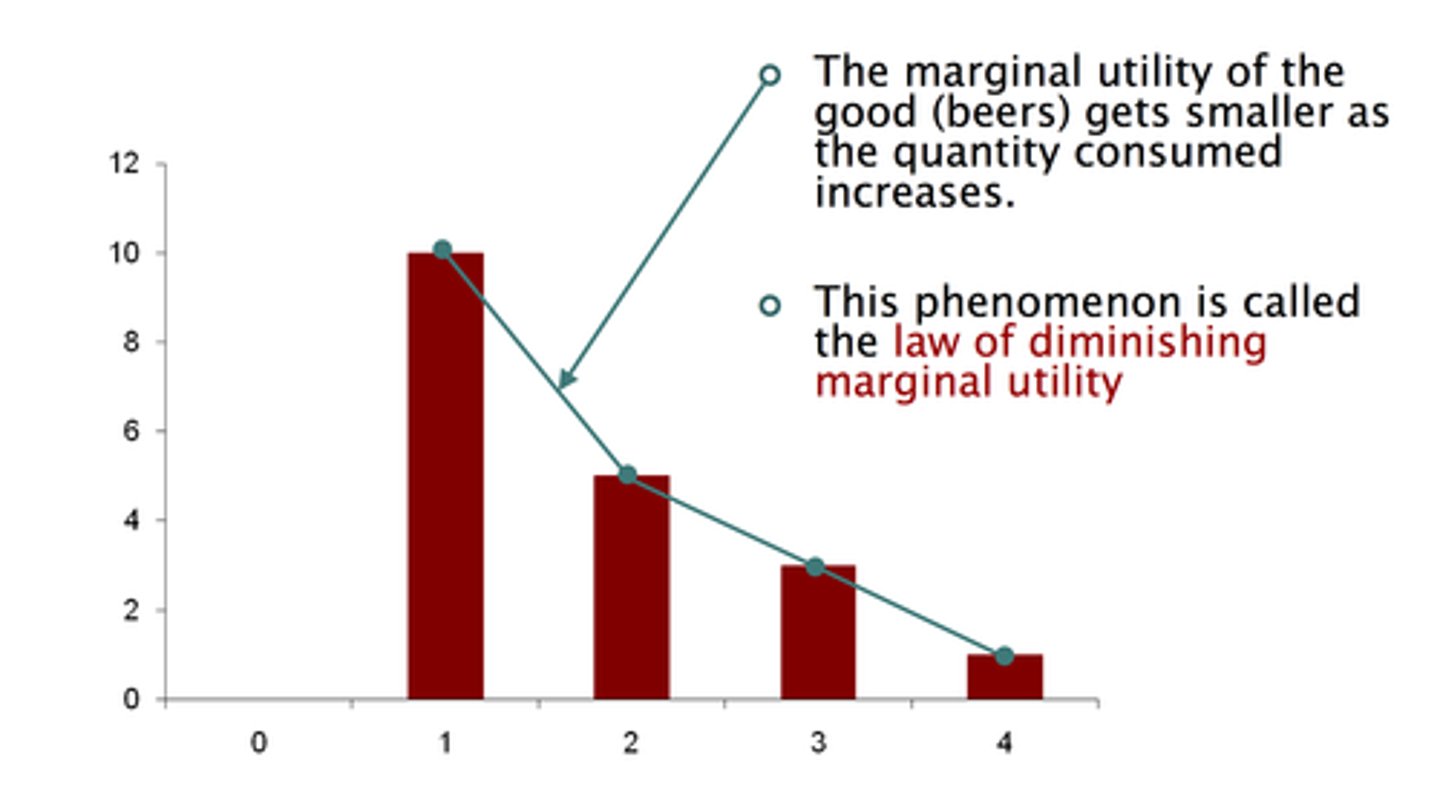

Diminishing marginal utility

the principle that our additional satisfaction, or our marginal utility, tends to go down as more and more units are consumed, the additional satisfaction obtained from the consumption of the next unit will go down as we consume more units

Derived demand

demand for a good when it is required in the making of another

veblen goods

are goods that have snob value and are bought to display wealth rather than utility. Their demand curve slopes upwards from left to right, as the higher the price the greater the quantity demanded, reverse economic logic, more expensive they are the more effectively they claim their status

Supply

quantity that producers are willing and able to sell at any given price in a given time period

law of supply

supply has a direct relationship with price because the higher the price the more opportunity for profit

extension of supply

When there is an increase in supply because the market price has risen.

contraction of supply

When the amount offered for sale is reduced because the price level has fallen.

shifting the supply curve

non-price determinants shift the supply curve (shift right=increase; shift left=decrease)

conditions of supply

cost of production

external shock

new technology

indirect taxes (increases cost of production)

subsidies

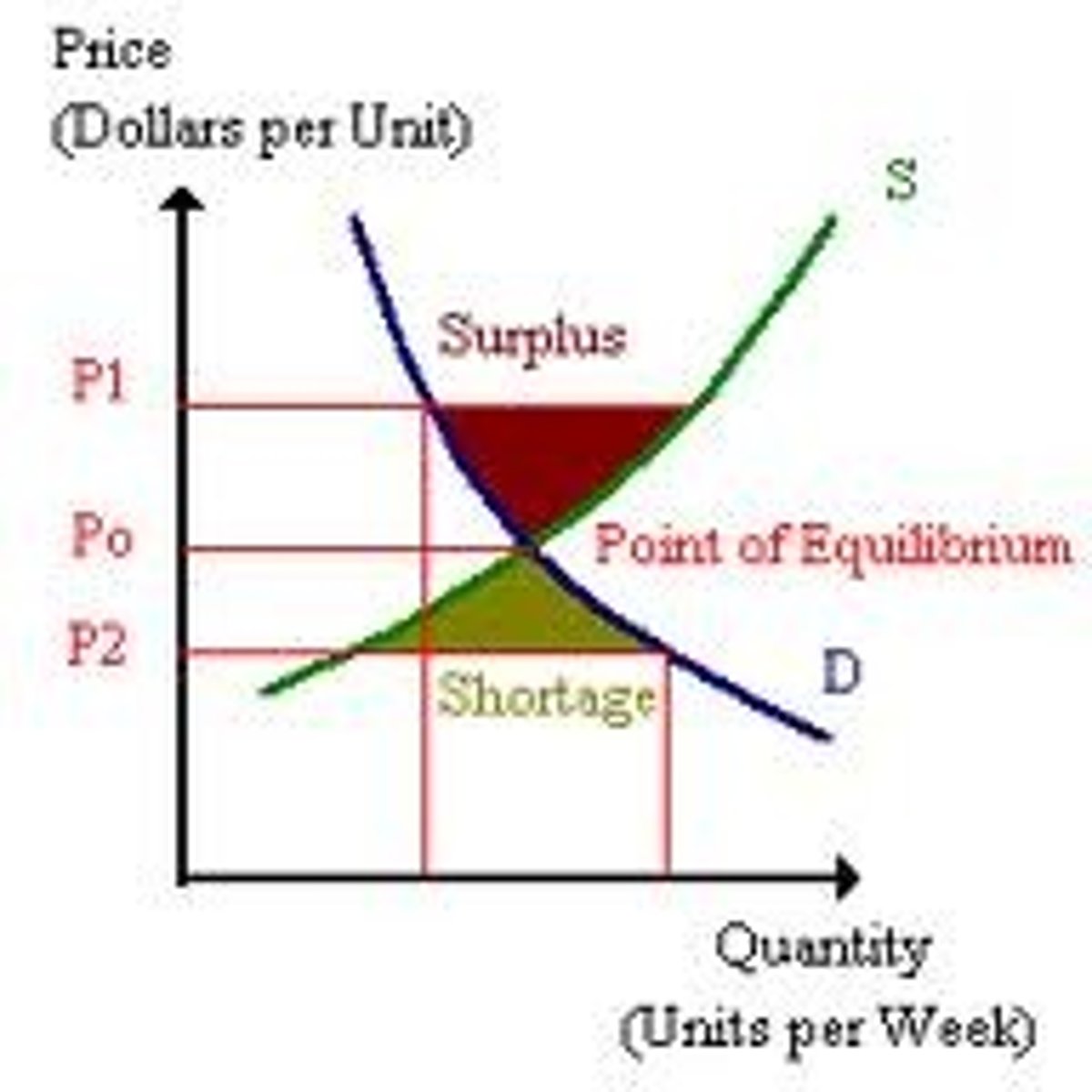

equlibrium price

The quantity consumers are willing and able to buy is exactly equal to the quantity firms are willing and able to sell. here there is no excess supply causing surplus and no excess demand causing shortage

When market price is above equilibrium price

producers supply more and consumers demand less so there is a surplus, market price will fall. there will be a contraction of supply and extension of demand until equilibrium price and quantity is reached

when market price is below equilibrium price

consumers demand more and producers supply less so there is a shortage, which causes the market price to rise. there is an extension of supply and contraction of demand until equilibrium price is reached

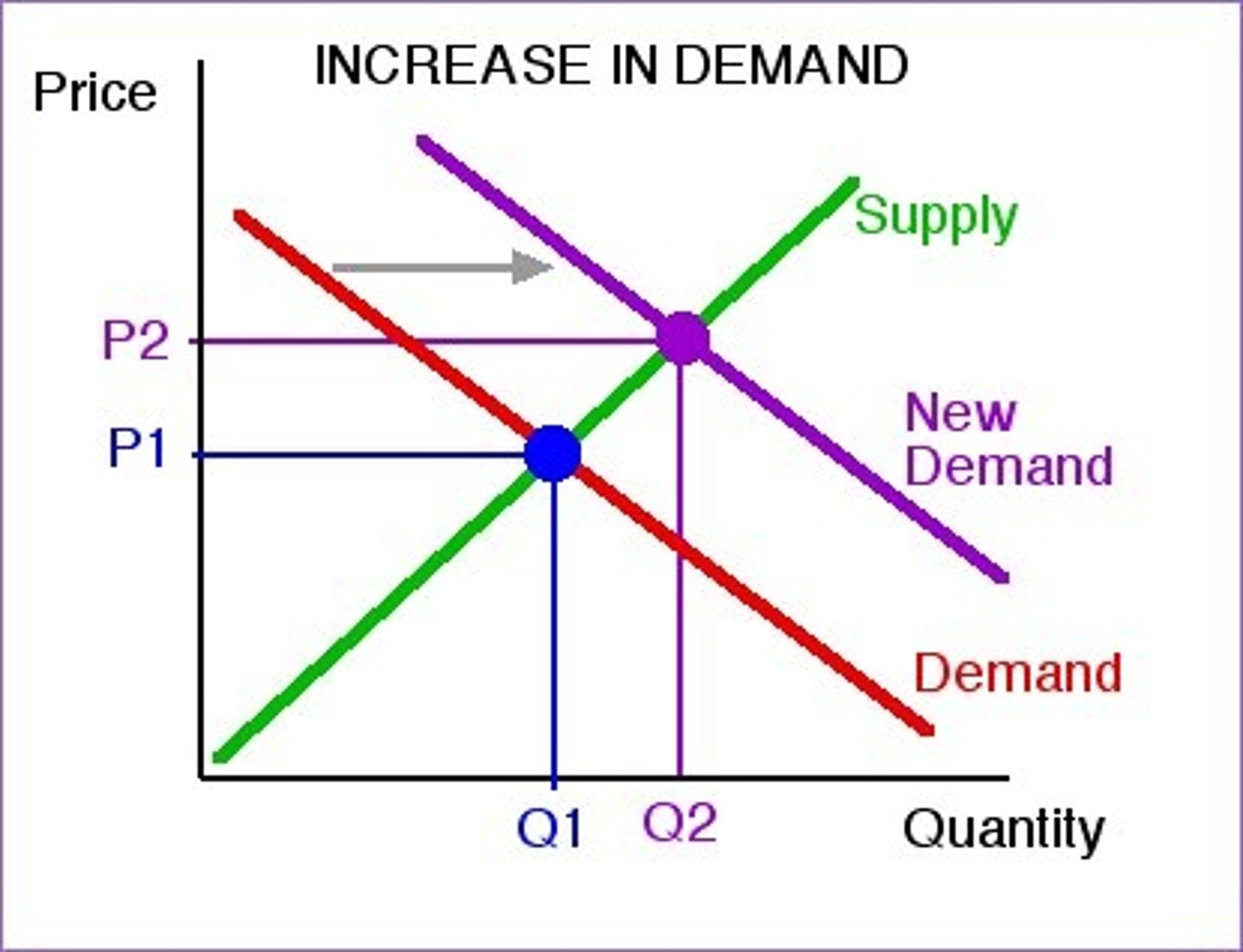

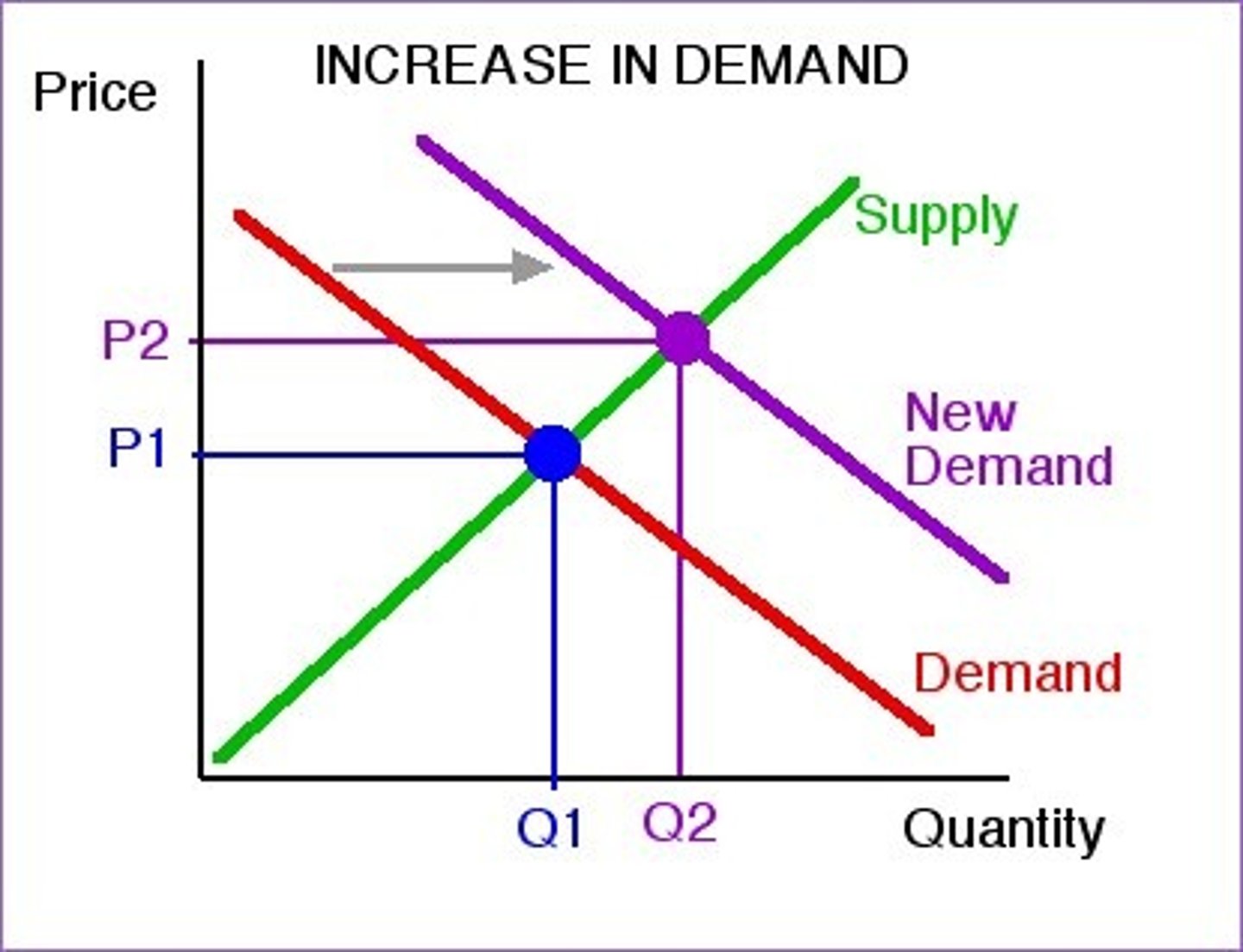

increase in demand

a rightward shift in the demand curve representing a willingness on the part of buyers to demand more of a good or service at any price. equilibrium price will increase and so will equilibrium quantity

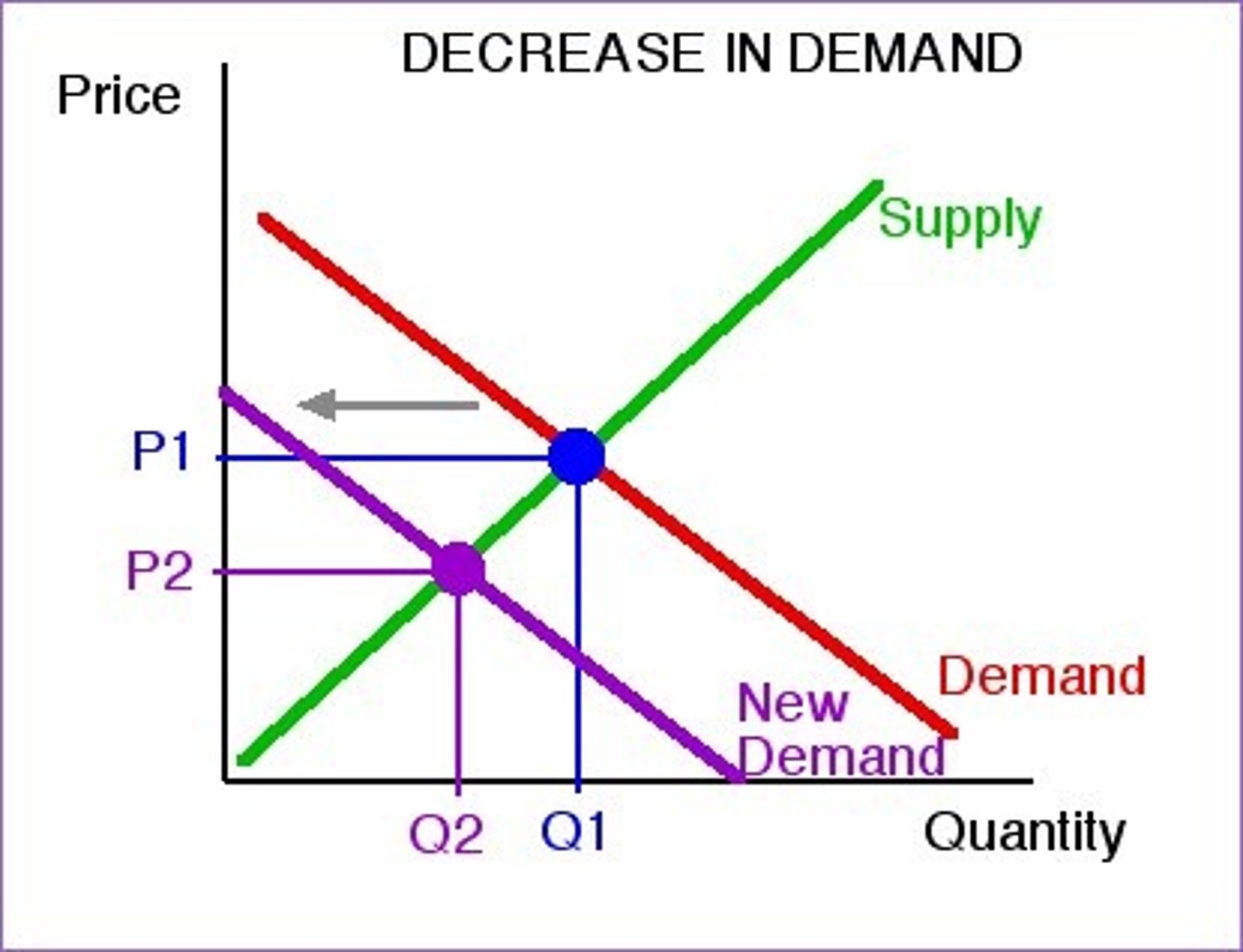

decrease in demand

a leftward shift in the demand curve representing a decrease in the willingness of buyers to demand an item at any price. equilibrium price will fall as will equilibrium quantity

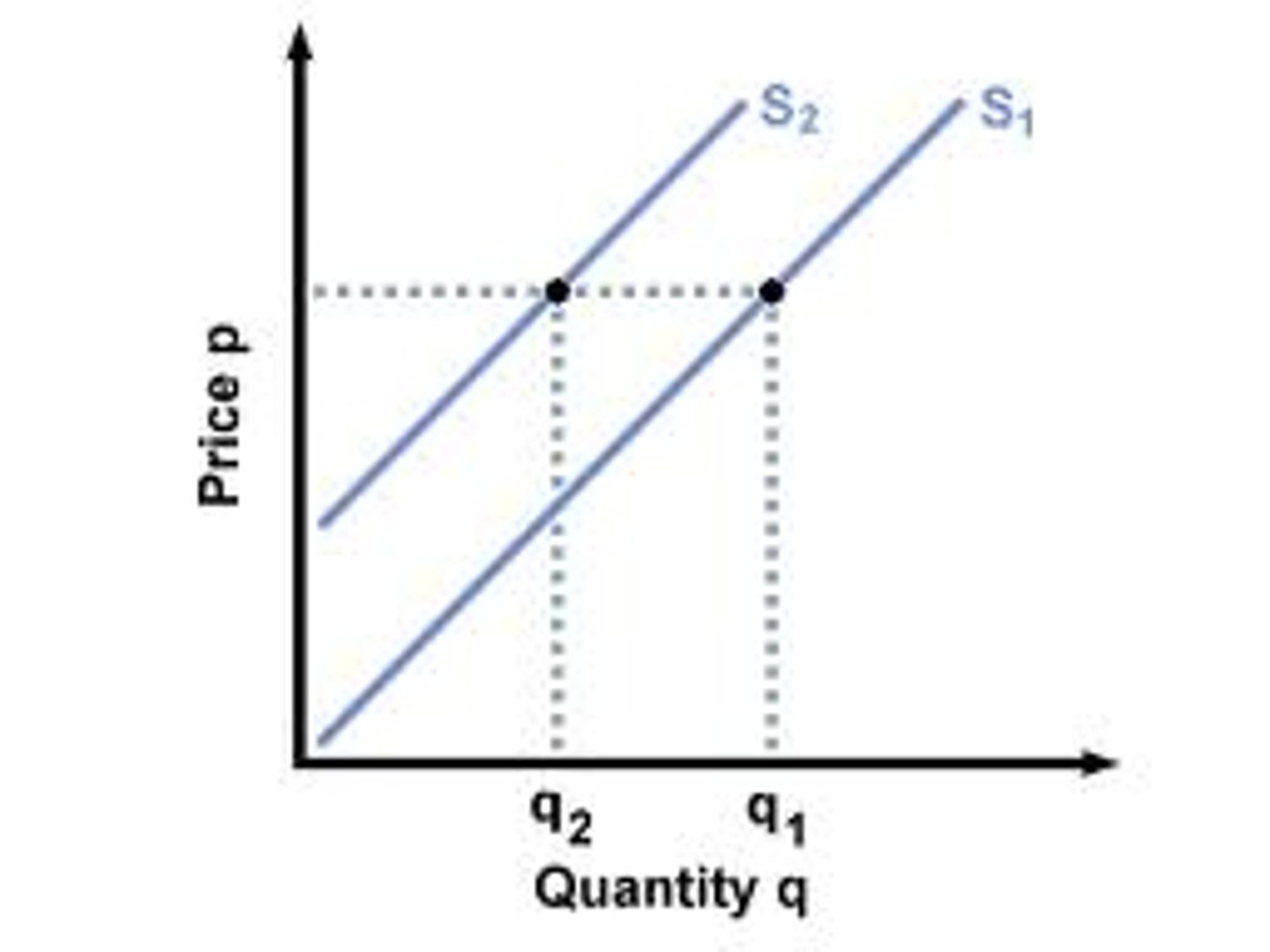

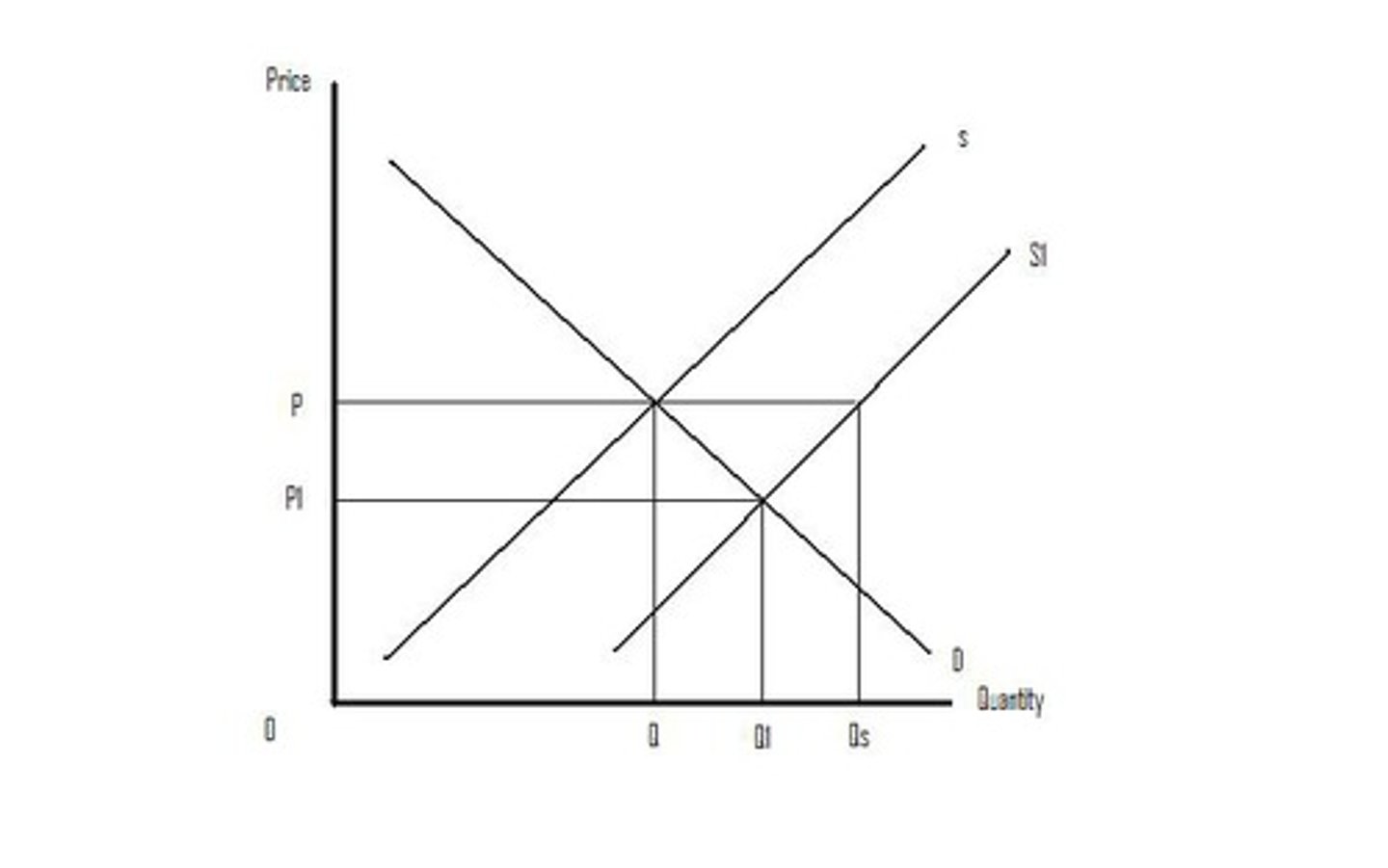

increase in supply

a rightward shift in the supply curve indicating a willingness of business firms to produce more of an item at any given price. equilibrium price will fall and equilibrium quantity will rise

decrease in supply

a leftward shift of the supply curve indicating a decrease in the quantity suppliers are willing to produce at any price. equilibrium price will rise and equilibrium quantity will fall

the price mechanism

forces of supply and demand determine the price of commodities, therefore influencing how scare resources are allocated to their highest value use

rationing

A system of allocating scarce goods and services using criteria other than price, when demand is greater than supply prices rise and the good is rationed so that only those who can afford to pay the higher prices get it

incentivising

when price rises it creates an incentive for firms to produce more to meet demand, if it falls it creates an incentive to leave the market

signalling

long term impact, changes in curves signals for producers and consumers to enter or leave the market

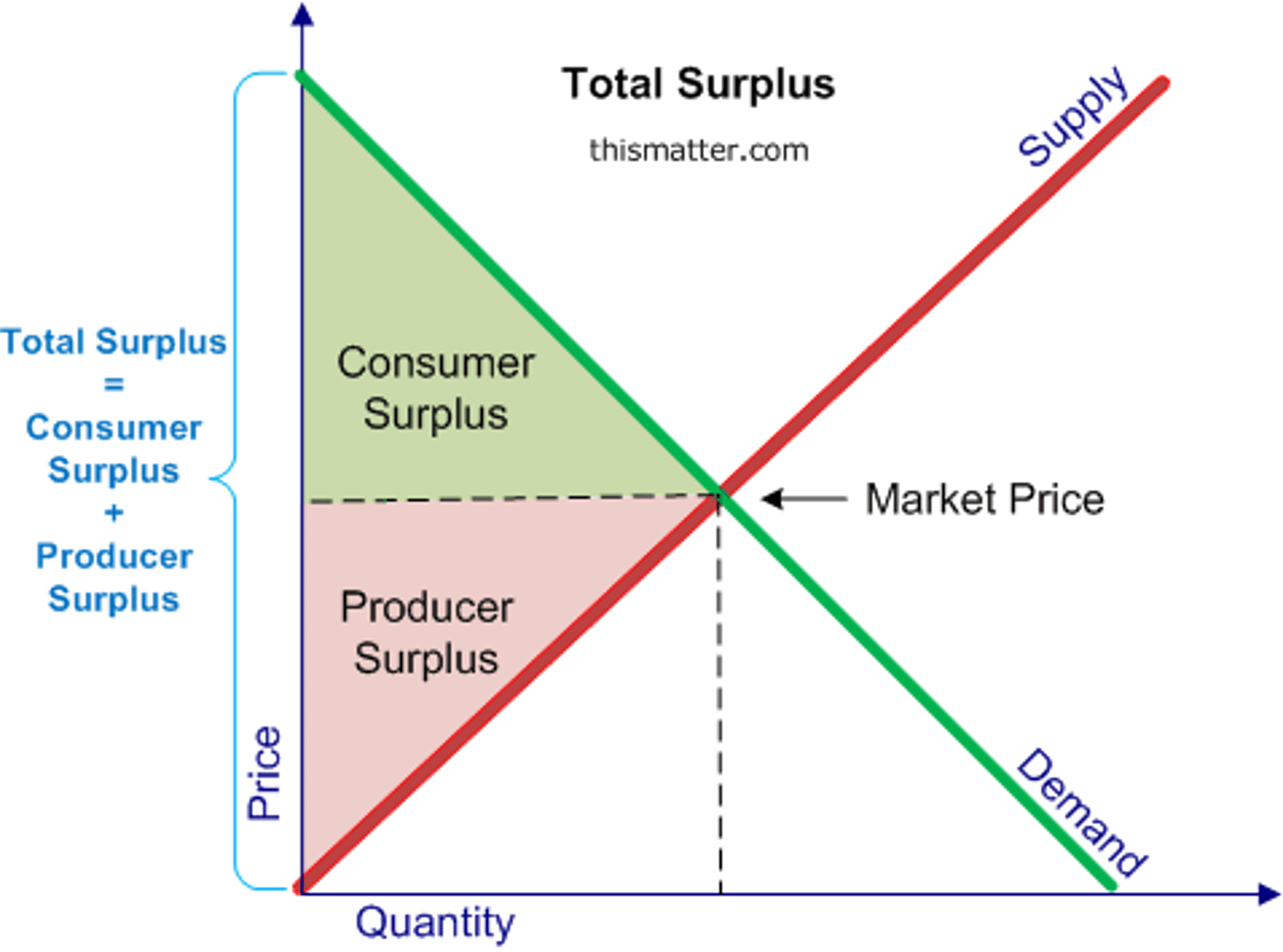

consumer surplus

The difference between the maximum amount a person is willing to pay for a good and its current market price.

producer surplus

the difference between the lowest price a firm would be willing to accept for a good or service and the price it actually receives

elasticity

a measure of responsiveness to a change in another variable

PED

the responsiveness of the quantity demanded to a change in price

price elastic demand

% change in QD> % change in P

price inelastic demand

%change in QD< % change in P

unit elastic demand

% change in QD=% change in P

PED determinants

ease of substitution

luxury or necessity

frequency of purchase

proportion of income

elasticity is effected by...

time period

width of market definition

elastic demand curve

Elasticity is greater than 1, quantity moves proportionately more than the price

inelastic demand curve

Elasticity is less than 1, quantity moves proportionately less than the price

PED

% change in QD/% change in P

values of PED

elastic= -1 to -infinity

inelastic= 0 to -1

it is always negative to show that the relationship between price and quantity demanded in inverse

PED: effect on total revenue

ELASTIC: price rises= total revenue falls

price falls= total revenue rises

INELASTIC: price rises= total revenue rises

price falls= total revenue falls

UNIT ELASTIC: price rises= no change

price falls= no change

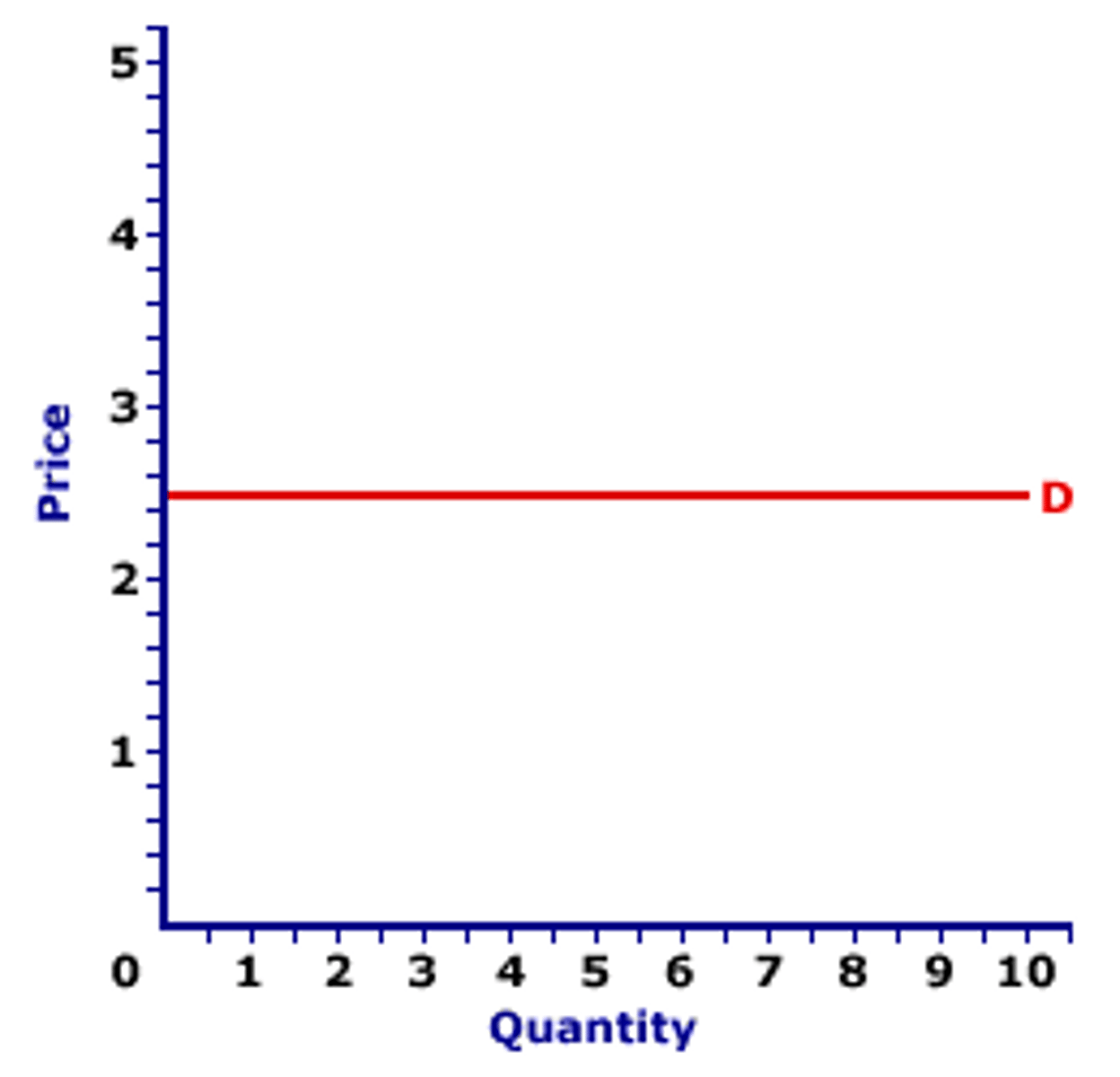

perfectly elastic demand curve

a horizontal line reflecting a situation in which any price increase reduces quantity demanded to zero; the elasticity has an absolute value of infinity

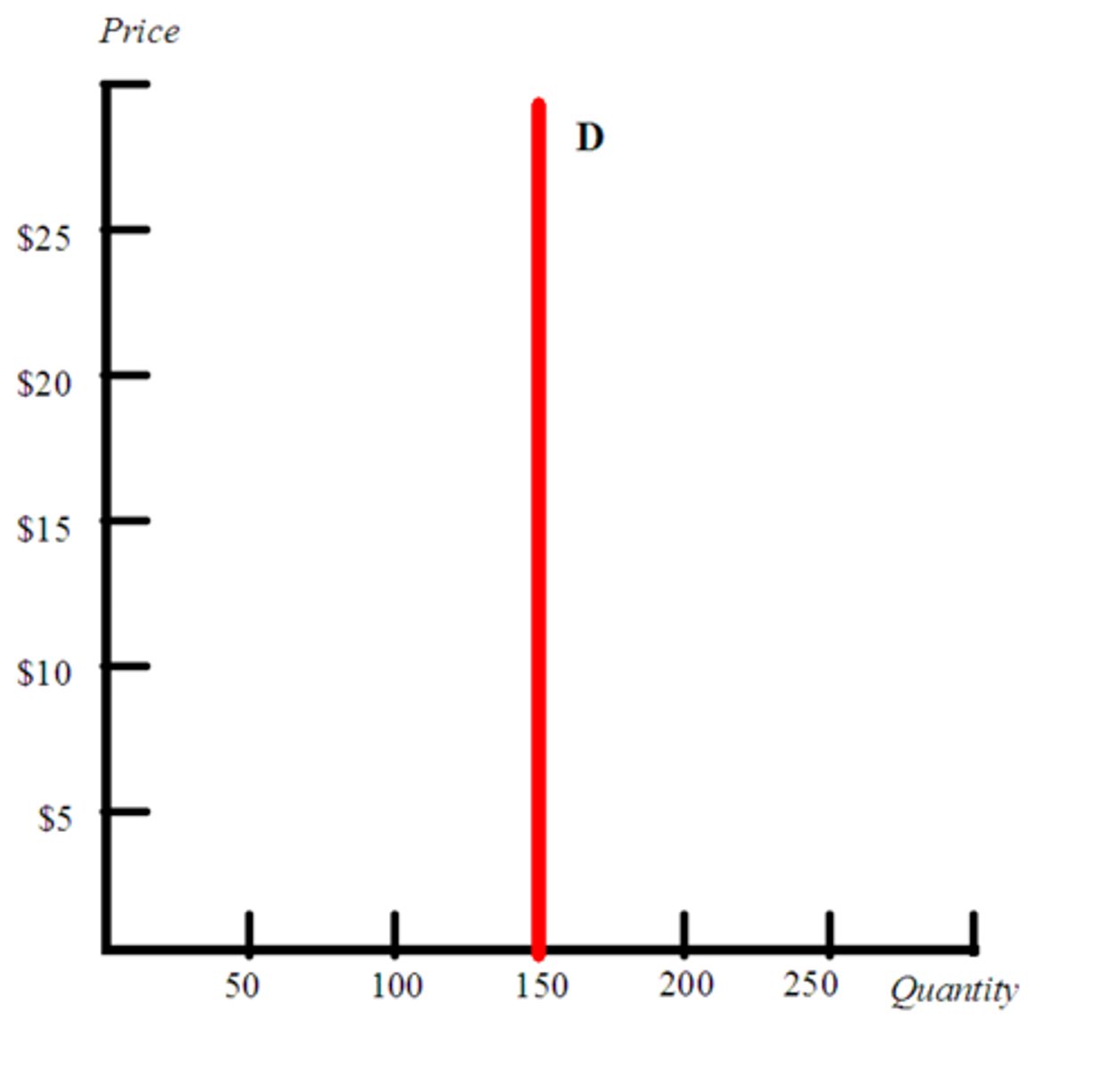

perfectly inelastic demand curve

a vertical line reflecting a situation in which any price change has no effect on the quantity demanded; the elasticity value equals zero

income elasticity of demand

measures responsiveness of quantity demanded to a change in income

YED

% change in QD/ % change in Y

YED normal goods

positive: rise in income causes a rise in quantity demanded

if it is a necessity it will likely be less than one

if it is a luxury it will likely be more than one

YED inferior goods

negative: a rise in income causes a fall in quantity demanded

YED values

NORMAL GOODS:

elastic= >1

inelastic= <1

INFERIOR GOODS:

elastic= -1 to - infinity

inelastic= 0 to -1

Cross elasticity of demand

measures responsiveness of quantity demanded of good A to a price change of good B

XED

% change QD A / % change P B

XED values

XED > 0 when they are substitutes

XED < 0 when they are complements

XED = 0 when they are unrelated

the more closely related they are the higher the numerical value

why XED is important for businesses

firms need to know how their demand will alter to a change in price of competitors

Price elasticity of supply

measures responsiveness of quantity supplied to a change in price

PES

% change in QS / % change in P

PES values

always positive to reflect direct relationship between price and quantity supplied

PES > 1 = relatively elastic

PES < 1 = relatively inelastic

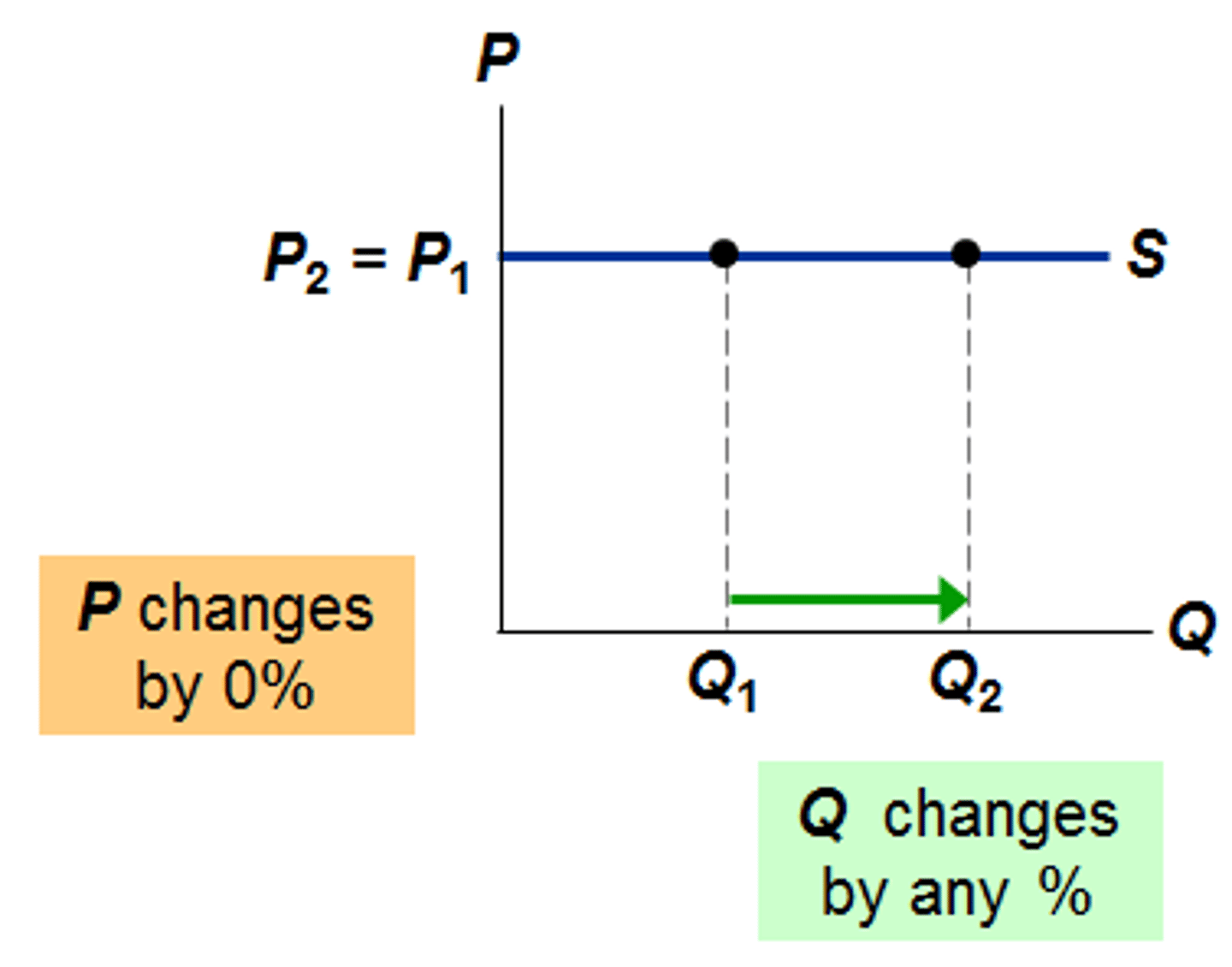

Perfectly elastic PES

supplies any amount at the same price, at a constant cost per unit, no production limits

PES = infinity

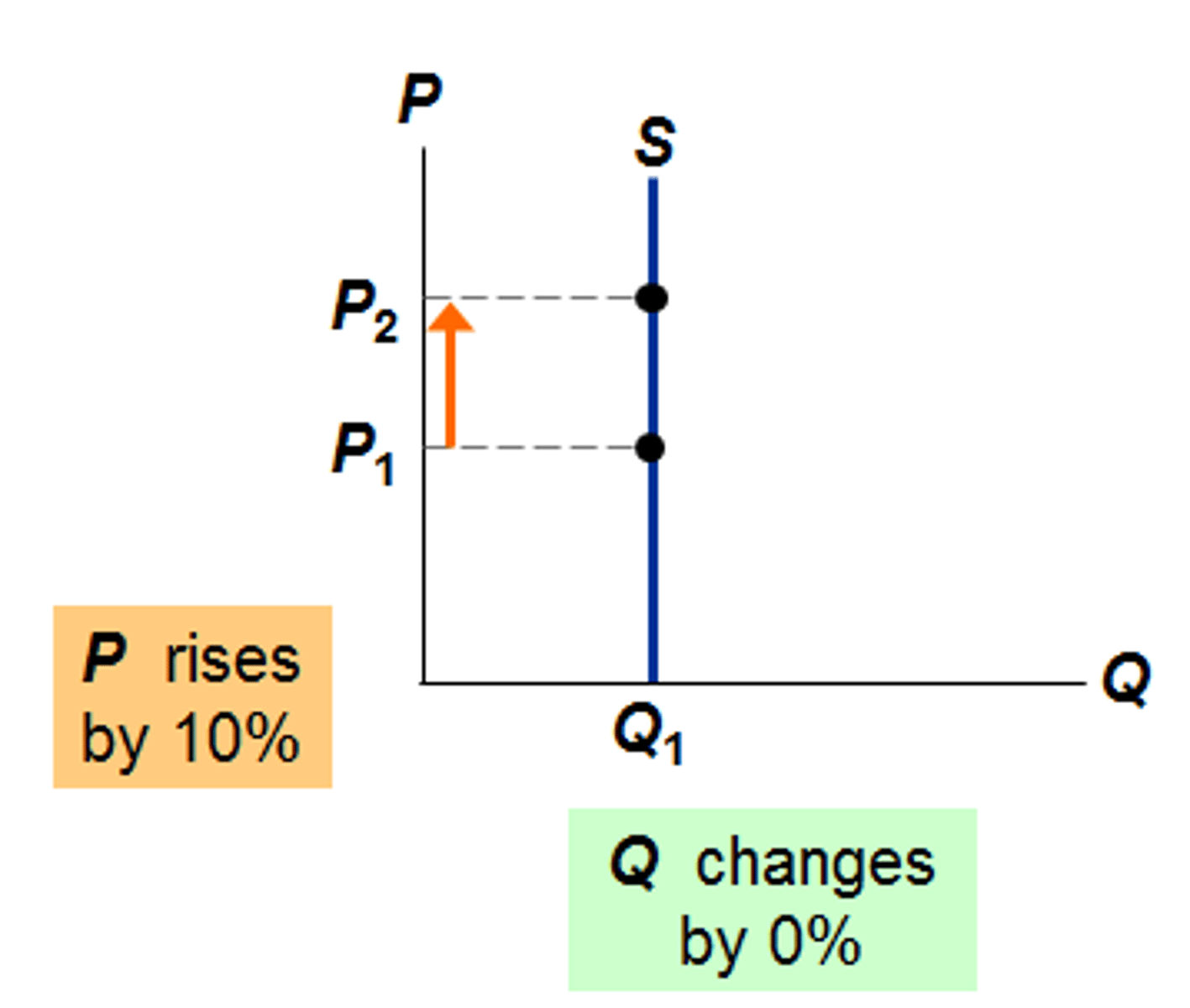

Perfectly inelastic PES

no matter the change in price, supply won't change

PES = 0

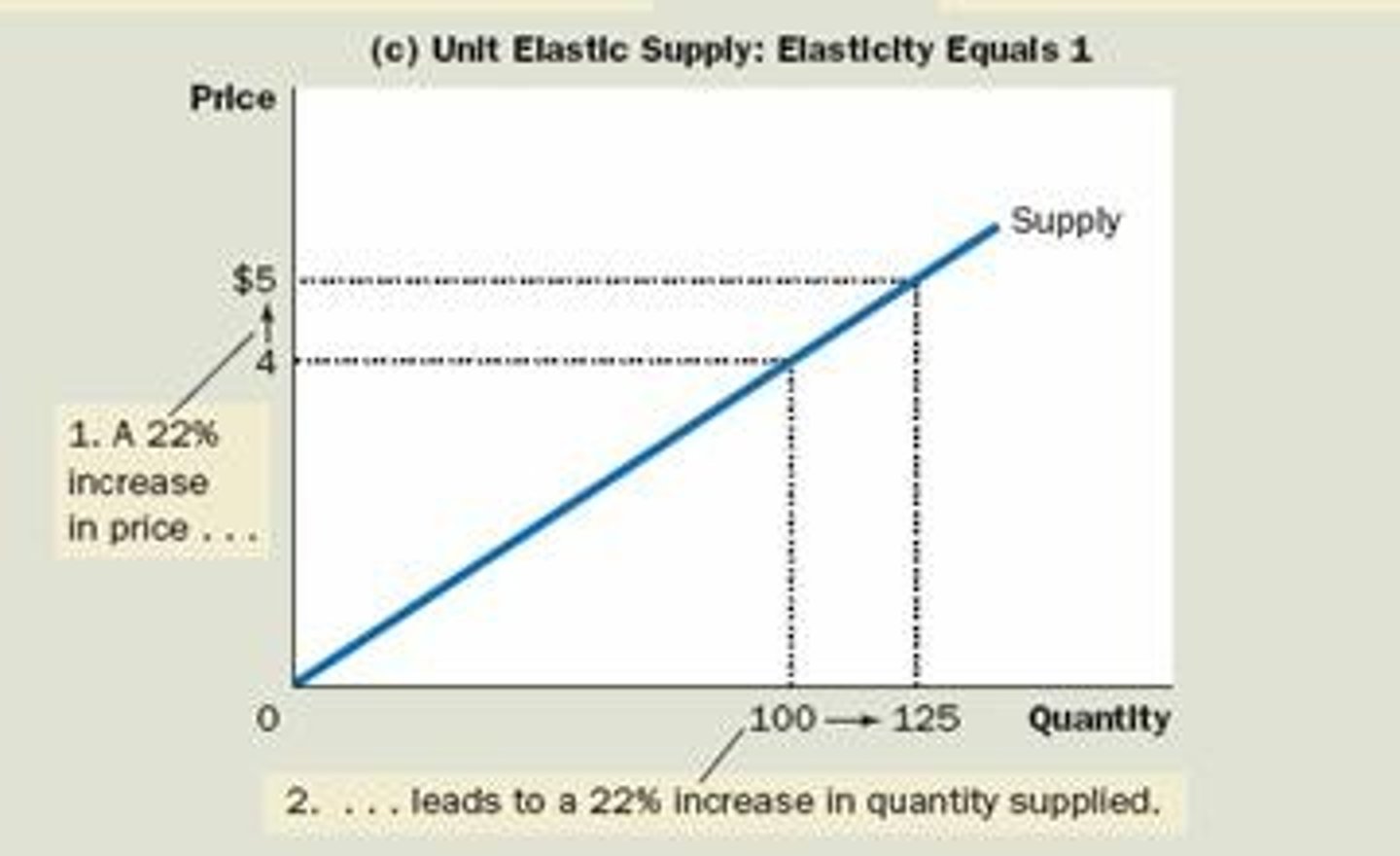

Unit elastic PES

% change QS = % change P

length of production period

availability of spare capacity

ease of expanding capacity

access to raw materials

ease of accumulating stock

number of firms/ ease of entering

time

Determinants of PES

Short run vs Long run

Short run- difficult to adjust production as some factors of production are fixed so supply is inelastic

Long run- all factors are adjustable so firms can change supply in response to price change - more elastic

an involuntary fee levied on individuals and corporations by the government

tax

tax is charged on...

income

wealth

spending

levied directly on an individual organisation, payed on income or profit ( income tax, national insurance)

Direct tax

charged on values of goods, services or properties. Charged when consuming goods or using services, responsibility of consumer ( VAT, council tax )

Indirect tax

doesn't depend on value of good but is a fixed amount on each unit

Indirect tax: specific tax

based on retail price of a good or service ( VAT )

Indirect tax: ad valorem

proportion of tax liability rises as an individual or entity's income rises

Progressive tax

those with lower incomes pay a higher amount of it in tax compared to higher earners, percentage of tax as a percentage of income decreases

Regressive tax

charges same rate to tax payers regardless of income, a set percentage of their income

Proportional tax

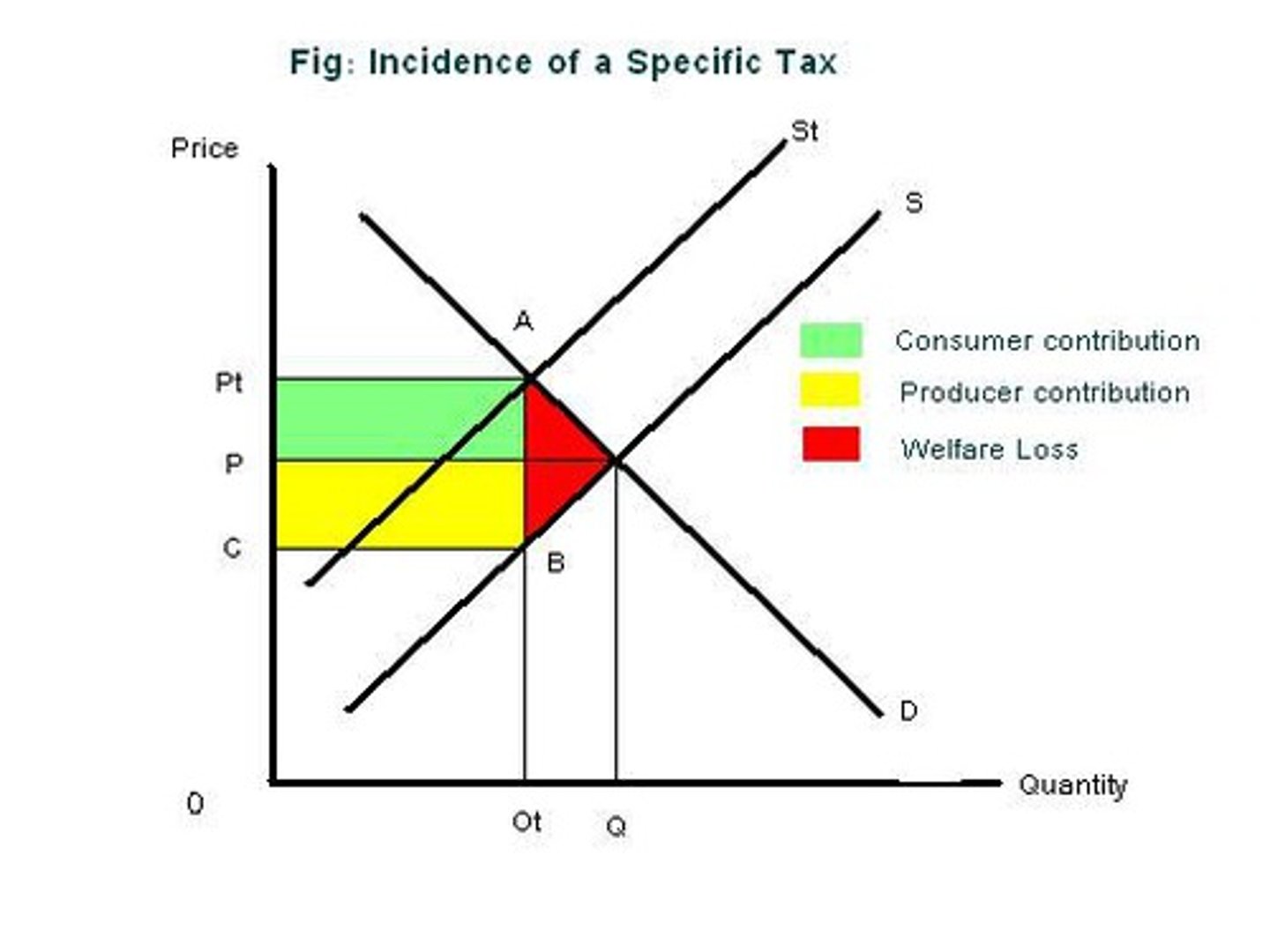

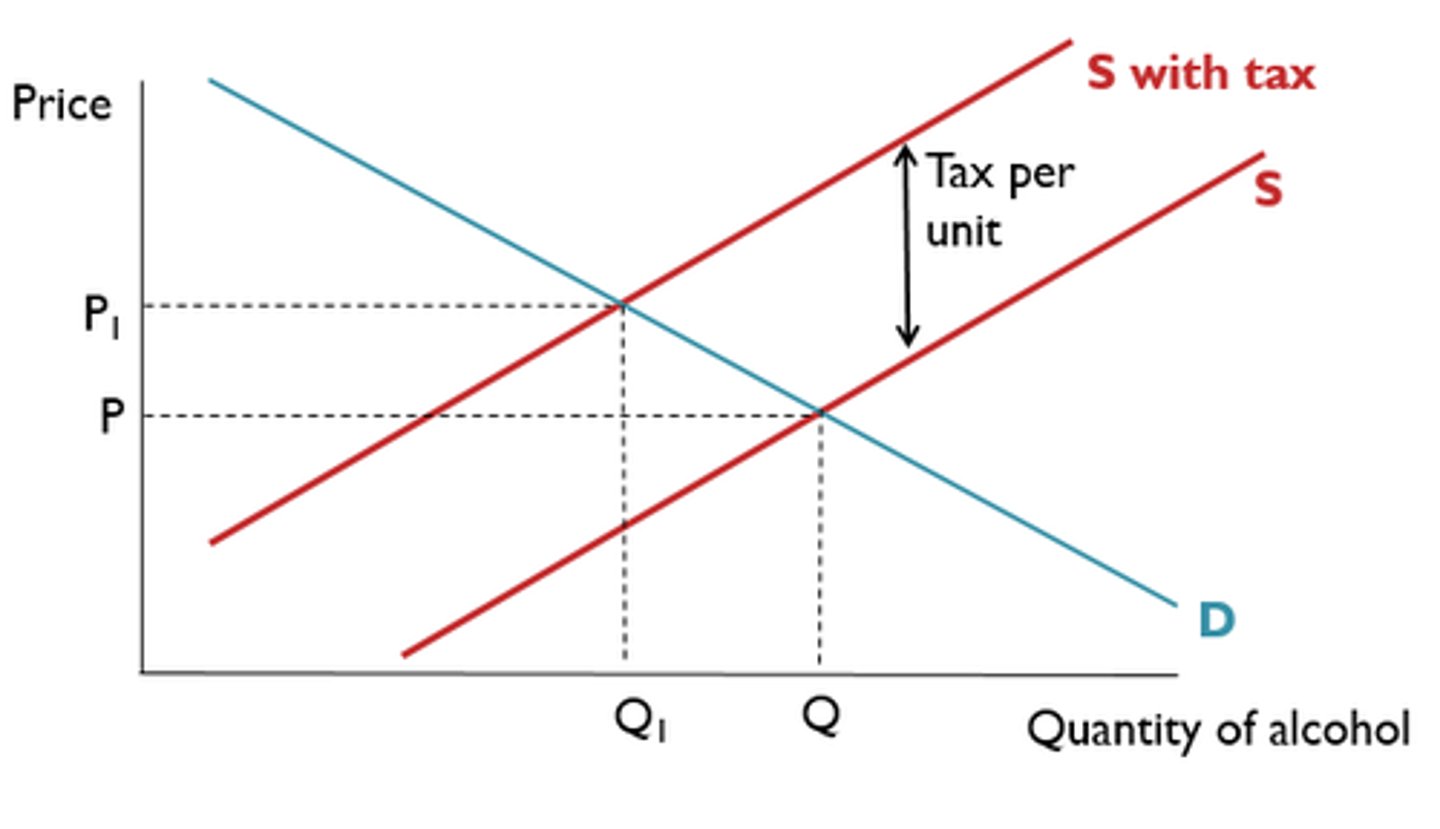

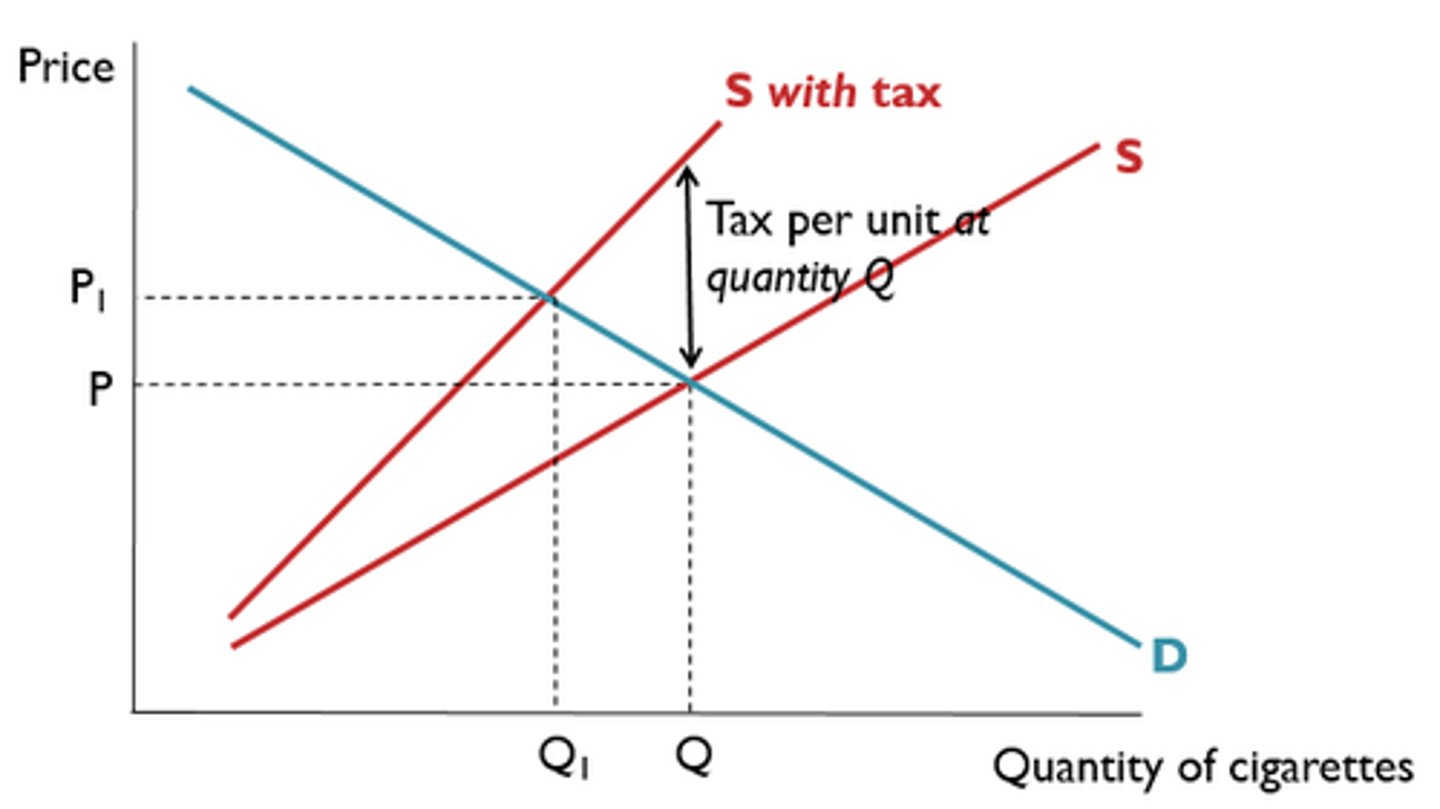

tax burden allocated to buyer an seller when an indirect tax is introduced, shifts supply curve left as price of production is higher so profitability is lower

incidence of tax

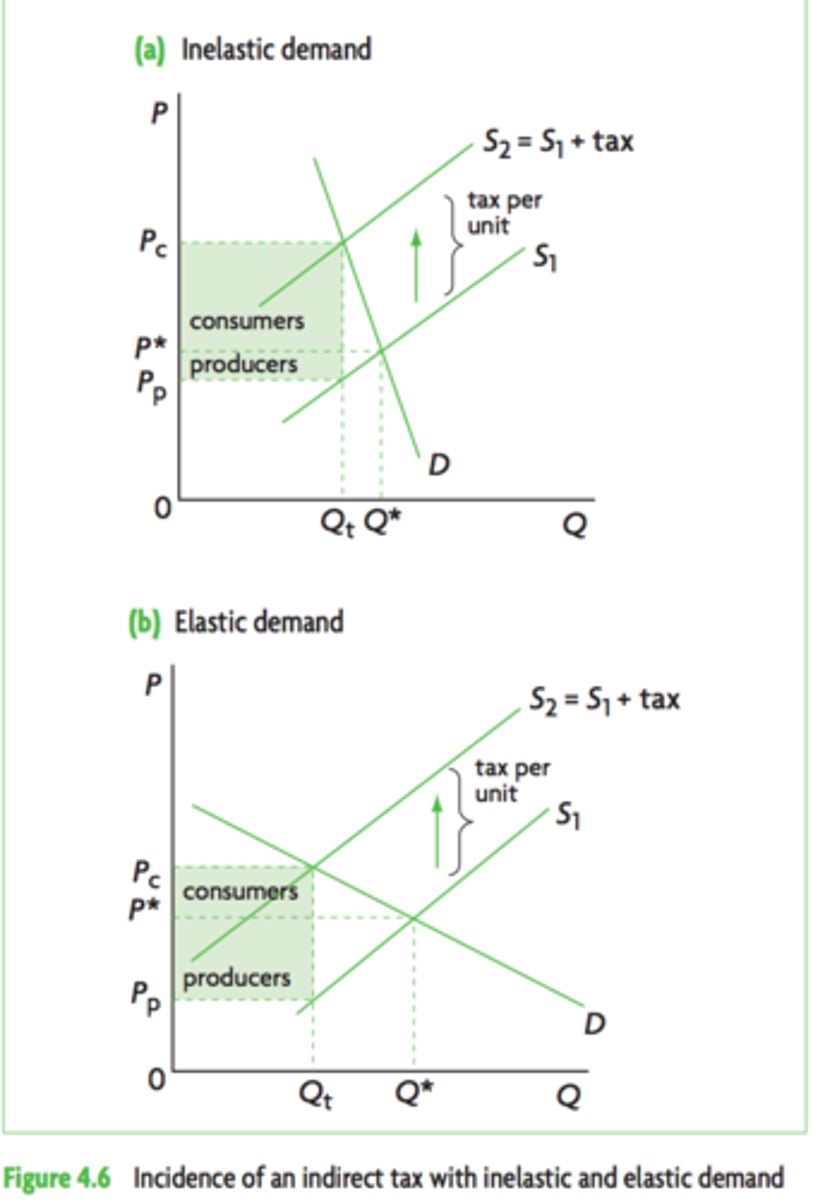

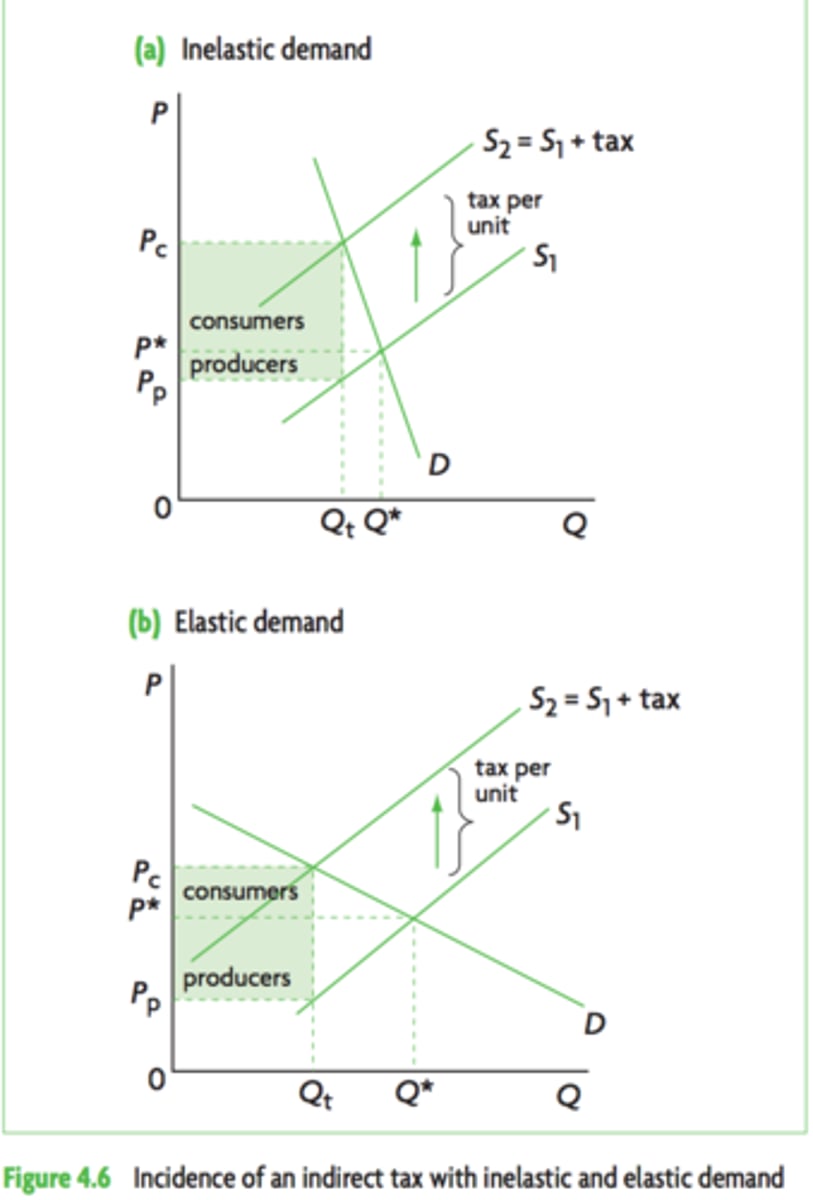

incidence of tax: elastic demand

producers have a greater incidence of taxation, if prices increase too much customers will leave

incidence of tax: inelastic demand

consumers have a greater incidence of taxation, if price increases customers still won't leave

decrease in surplus

may need to substitute

if demand is inelastic they will have less money for other goods

impact of tax on consumers

decrease in surplus

change in profits

change in revenues ( Depends on PED )

impact of tax on producers

increase in tax revenues ( amount of tax x equilibrium quantity) and savings on public services

chance to redistribute funds

impact of tax on the government

potential loss of employment

switch to producing other products

substitute industries may benefit

impact of tax on industry

specific tax graph

causes a parallel shift left because the price increase on each unit is the same

ad valorem tax graph

non-parallel shift left because the price increase gets bigger the more units

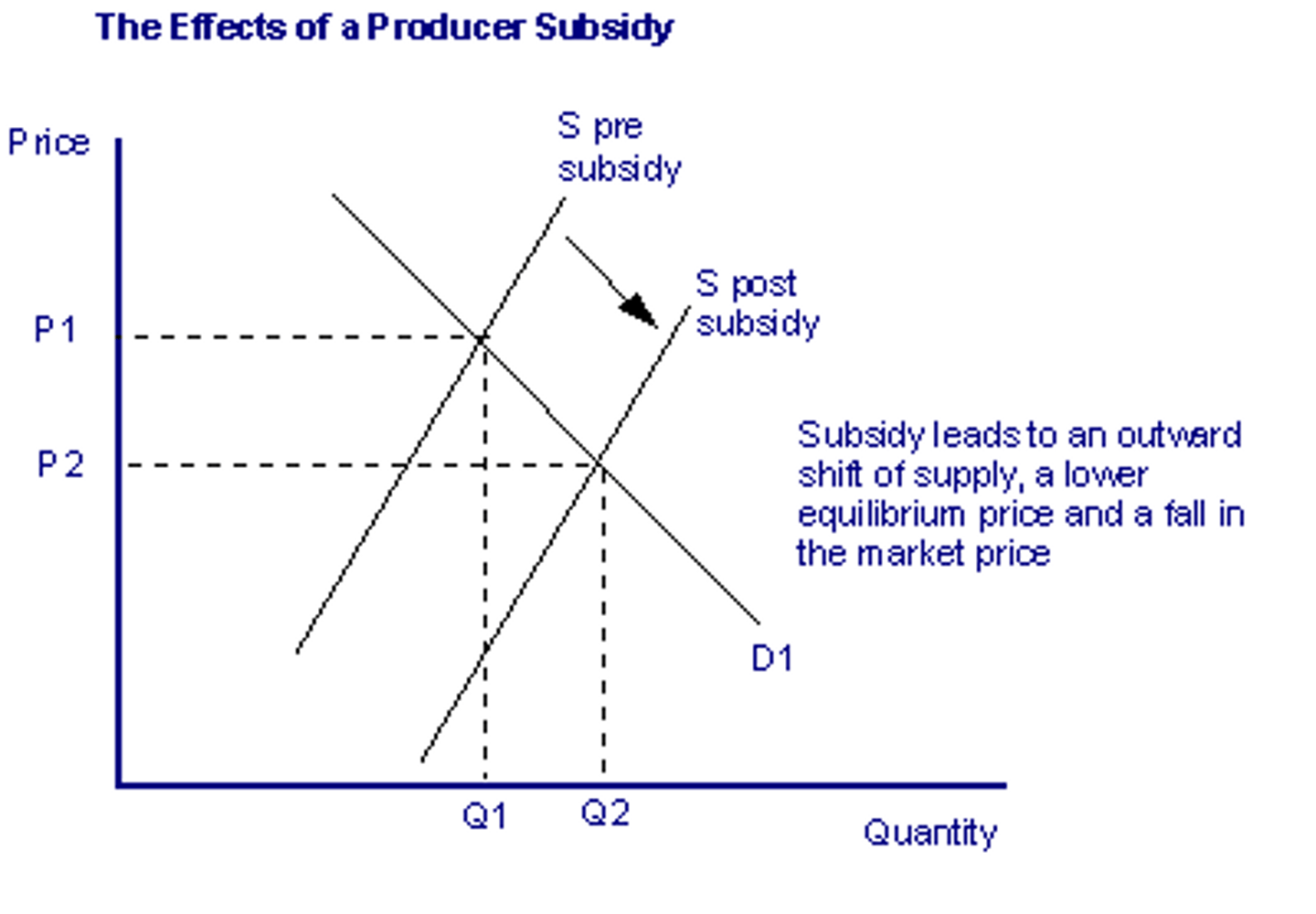

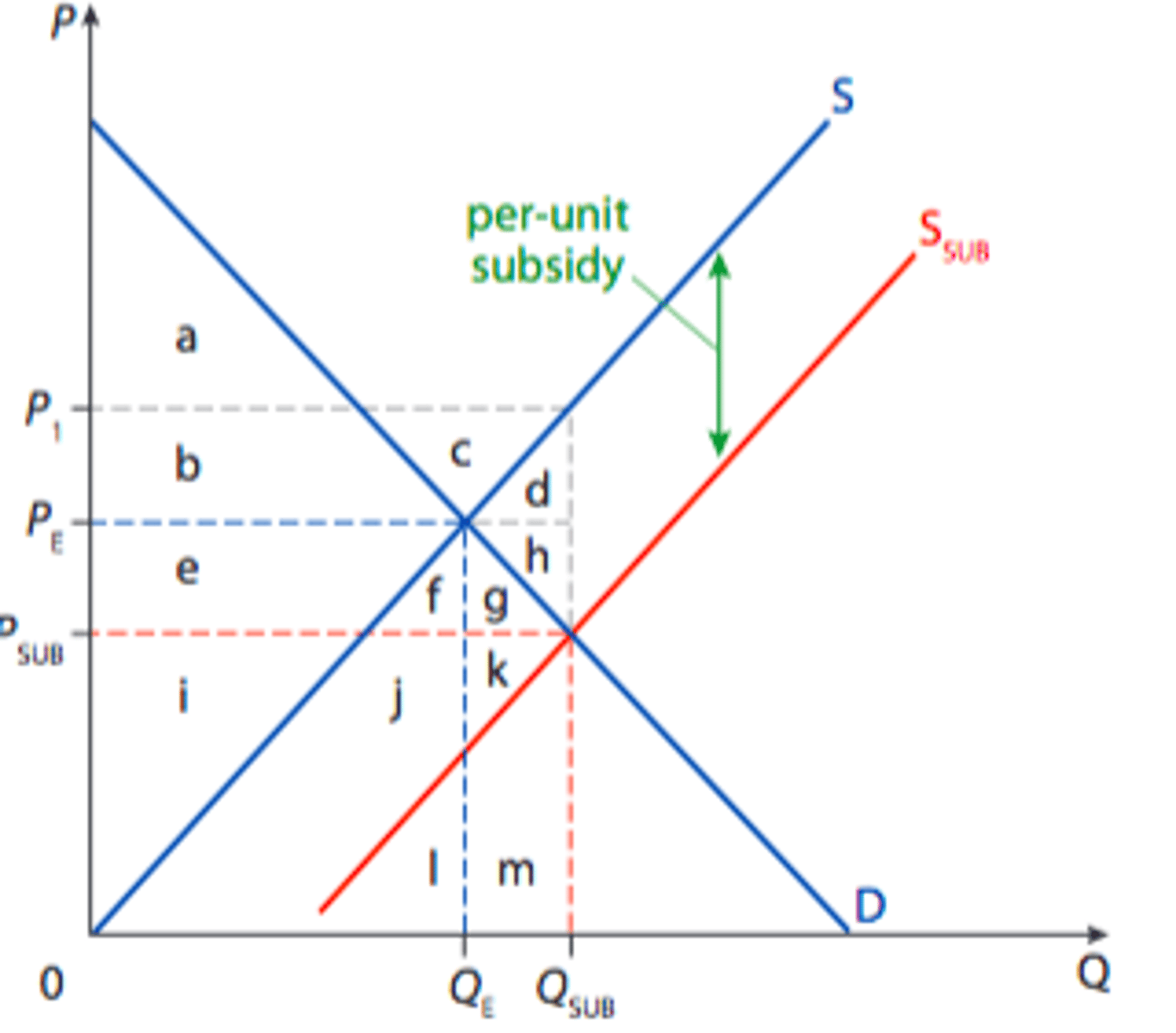

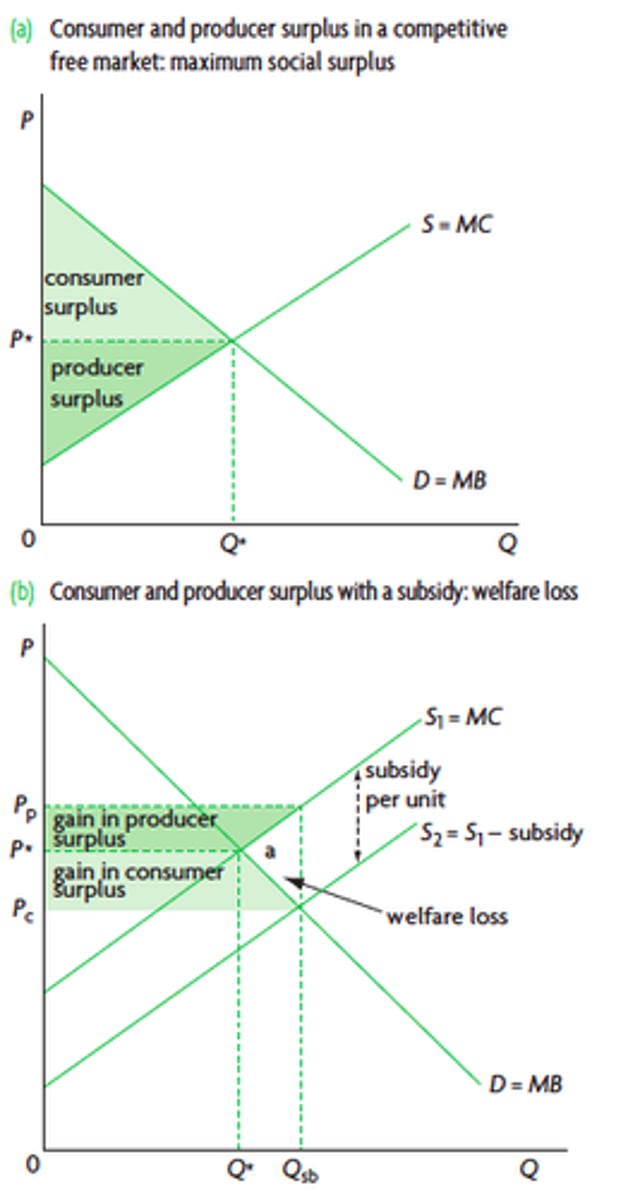

a non-refundable payment to a producer intended to lower the market price and encourage provision

reduces cost of production

leads to increased supply

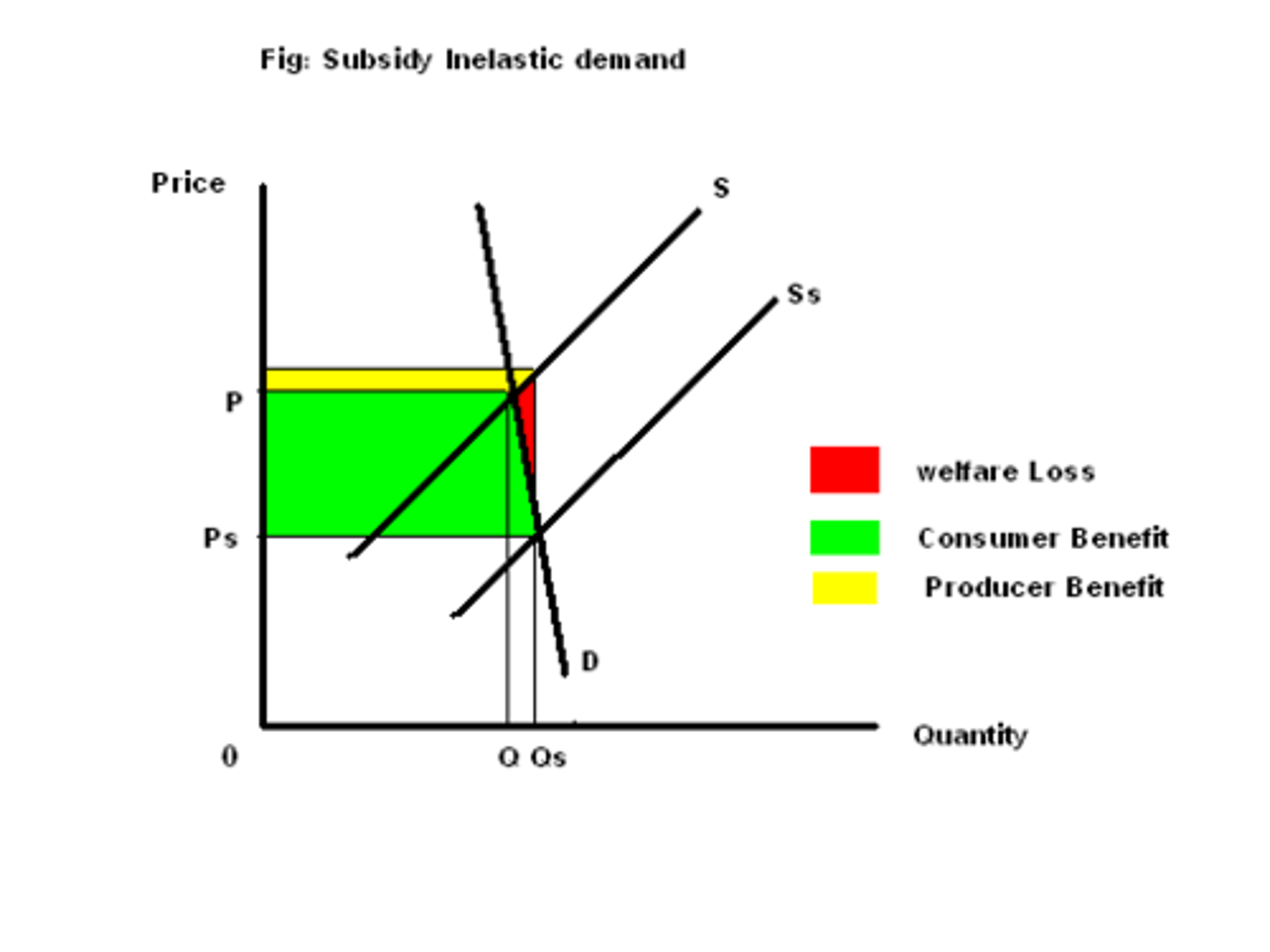

subsidy

Subsidy graph

shifts right because producers increase supply as reduced production costs increase profitability

incidence of subsidation

subsidies: surplus

both consumer and producer surplus increase meaning so does economic welfare

subsidies: elastic demand

producer gets most of the benefit from the subsidy

subsidies: inelastic demand

consumer gets most of the benefit from the subsidy