ap macroeconomics review

1/224

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

225 Terms

4 key assumptions of PPC

1. only 2 goods can be produced

2. using all resources

3. fixed resources

4. fixed technology

policy economics

applied to fix problems or meet economic goals

Marginal Propensity to Save (MPS)

how much people save rather than consume when there is a change in income

- change in savings/change in disposable income

- 1 - MPC

Long Run Aggregate Supply

wages and resource prices will increase as price levels increase

Shifters of SRAS

1. Change in resource prices

- Inflationary expectations

2. Actions of the government

3. Change in Productivity

- Technology

US progressive income tax system

1. when gdp is down, the tax burden on consumers is low, promoting consumption and increasing AD

2. when GDP is up, more tax burden on consumers, discouraging consumption and decreasing AD

how to measure growth in GDP from year to year

Percent change in GDP = new year - old year / old year X 100

Investment

- Not stocks or bonds

- When businesses b uy capital like machines, resources, and. tools

Labor force participation rate

labor force ( unemployed + employed )/ civilian population rate

Price index

index number that shows how the weighted-average price of a "market basket" of goods changes over time

equation to calculate present value

$X/(1+ir)^N

money demand shifters

1. Changes in price level

2. Changes in income

3. Changes in technology

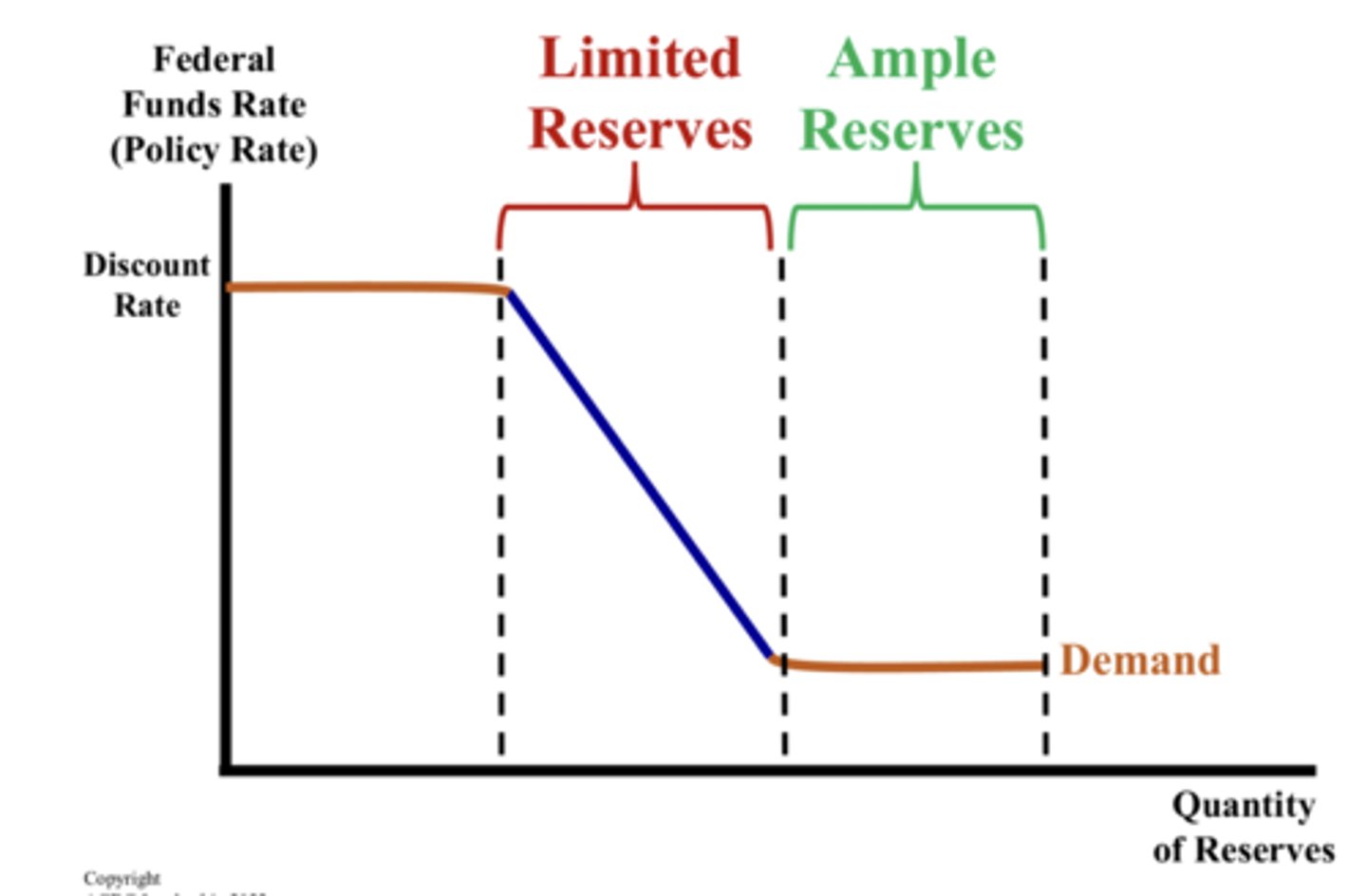

reserve market model graph

Supply Shifters in Loanable Funds Market

1. Changes in private savings behavior

2. Changes in public savings

3. Changes in foreign investment

4. Changes in expected profitability

monetary base

the sum of currency in circulation and bank reserves

Under the curve of the PPC

inefficient/unemployment

complements

two goods that are bought and used together (Ex. Hot dogs and hot dog buns)

supply

the different quantities of a good that sellers are willing and able to sell (produce) at different prices

surplus

Qs > Qd (too much of one good)

Spending multiplier

1/MPS or 1/1-MPC

Fiscal Policy

actions by congress to stabilize the economy

4 factors of production

land, labor, capital, entrepreneurship

welfare

government aid to the poor

Expenditures Approachj

add up all the spending on final goods and services produced in a given year

- GDP (y)= C + I + G + (X-M)

interest rate

the amount a lender charges borrowers for borrowing money; "price of a loan"

3 functions of money

1. medium of exchange

2. unit of account

3. store of value

demand deposits

money deposited in a commercial bank in a checking account

shifters of money supply

1. reserve requirement

2. discount rate

3. open market operations

administered rates

interest rates set by the Fed rather than determined in a market

- reserves at the fed have no risk

- banks have no incentive to lend money at an interest rate that is lower than what they can get from the fed

interest on reserves (IOR)

The interest rate that the Federal Reserve pays commercial banks to hold reserves.

monetary policy for ample reserves

- the fed would decrease the interest on reserves = demand for reserves in the ample reserves to decrease

- the fed would increase the interest on reserves = demand for ample reserves increases

national savings

public savings + private savings

budget deficit

when annual government spending without raising taxes to close a recessionary gap

Foreign Exchange Graph

shows the relationship between different countries exchange rates and quantities of currency

balance of payments

summary of a country's international trade;

CA and CFA must balance out CA + CFA = 0; Money that leaves a country ust coe back as either foreign purchases of g&s or foreign purchases of financial assets

subsidy

A government payment that supports a business or market; causes a good's supply to increase

National Rate of Unemployment (NRU)

Frictional + Structural unemployment; the amount of unemployment that exists when the economy is healthy and growing

the barter system

Goods and services are traded directly. There is no money exchanged.

production possibilities curve (PPC)

a model that shows alternative ways that an economy can use its scarce resources; graphically demonstrates scarcity, trade-offs, opportunity costs, and efficiency

the line of a PPC is

efficient

Above the curve of the PPC

impossible/unattainable due to scarce resources

constant oppurtunity cost

Resources are easily adaptable for producing either good

- Results are a straight PPC

law of increasing opportunity cost

As you produce more of any good, the opportunity cost (forgone production of another good) will increase.

- Result is a concave or a bowed out PPC

Why does opportunity cost increase?

Resources are not easily adaptable when producing both goods

3 shifters of the PPC

1. change in resource quantity or quality

2. change in technology

3. change in trade (allows more consumption)

demand

different quantities of goods

that consumers are willing and able to buy at

different prices.

law of demand

There is an INVERSE relationship between

price and quantity demanded.

why does the law of demand occur

1. substitution effect

2. income effect

3. law of diminishing marginal utility

substitution effect

if the price goes up for a product, consumers buy less of that product and more of another substitute product

income effect

if the price goes down for a product, the purchasing power increases for consumers, allowing them to purchase more

law of diminishing marginal utility

The more you buy of ANY GOOD the less satisfaction you get from each new unit consumed.

what to remember when graphing demand or supply

price does not shift the curve, it only moves along the curve

5 shifters of demand

1. Tastes and Preferences

2. Number of Consumers

3. Price of Related Goods

4. Income

5. Future Expectations

substitutes

goods used in place of one another (Ex. Coke and Pepsi)

law of supply

direct relationship between price and quantity supplied

- as price increases, the quantity producers make increases

- as price falls, the quantity producers makes falls

5 shifters of supply

1. Prices/Availability of Inputs (Resources)

2. Number of Sellers

3. Technology

4. Government Actions (Taxes, Subsidies)

5. Expectations of Future Profit

normal good

a good that consumers demand more of when their incomes increase (direct relationship; income falls demand falls)

- Ex. cars, luxury items, jewelry

inferior good

a good that consumers demand less of when their incomes increase (inverse relationship; income falls demand increases)

- Ex. Top ramen used clothes, used cars

shortage

Qd > Qs (shortage of a good)

double shift rule

If two curves shift at the same time, either price or quantity will be indeterminate

price ceiling

A legal maximum on the price at which a good can be sold (helps consumer)

price floor

A legal minimum on the price at which a good can be sold (helps producer)

per unit opportunity cost formula

Per unit opportunity cost = opportunity cost/units gained

absolute advantage

the producer that can produce the most output or requires the least amount of resources/input

comparative advantage

the producer with the lowest opportunity cost

export

to carry out of the country

import

to carry into the country

output questions

OOO - other goes over; inputs are the same for both countries (time, workers, other resources)

input questions

IOU - other goes under; outputs are the same for both countries (the product)

terms of trade

the agreed upon conditions that would benefit both countries

Economics

the science of scarcity; study of decision making of how we should use resources

scarcity

unlimited wants and limited resources

Microeconomics

study of small economic units (individual, market, firms)

macroeconomics

study of the large economy as a whole or economic aggregates

theoretical economics

uses scientific methods to make generalizations and abstractions to develop theories (guesses, supposed to happen)

positive statement

Based on facts. Avoids value judgements (what is).

normative statement

includes value judgements (what ought to be)

5 key economic assumptions

1. Society has unlimited wants and limited resources (scarcity).

2. Due to scarcity, choices must be made. Every choice has a cost (a trade-off).

3. Everyone's goal is to make choices that maximize their satisfaction. Everyone acts in their own "self-interest."

4. Everyone makes decisions by comparing the marginal costs and marginal benefits of every choice.

5. Real-life situations can be explained and analyzed through simplified models and graphs.

marginal analysis

making decisions based on increments (additional benefits or costs)

normative statement example

Pollution is the most serious economic problem

positive statement example

if average temperatures rise, the sales of sunscreen will rise

Aggregate Demand

the amount of goods and services in the economy that will be purchased at all possible price levels

AD: relationship between price level and RGDP

inverse relationship; increases pl inflation -> rgdp demanded falls

decreases pl -> rgdp demanded increases

shifters of AD

C, I, G, Xn

Marginal Propensity to Consume (MPC)

how much people consume rather than save when there is a change in income

- change in consumption/change in disposable income

total change in GDP

multiplier x initial change in spending

Tax multiplier

MPC/MPS ; always negative since an increase in taxes decreases GDP

Aggregate Supply

the amount of goods and services (real GDP) that firms will produce in an economy at different price levels

short-run aggregate supply curve

wages and resource prices will not increase as price levels increase

LRAS curve

price level increases but GDP doesnt as real output will always be the same when workers ask for higher wages if output is increased

Shifters of LRAS

1. Change in resource quantity or quality

2. Change in technology

inflationary gap

Output is high and unemployment is less than NRU; equillibrium is after LRAS

recessionary gap

Output is low and unemployment is more than NRU; equillibrium is before LRAS

stagflation

A period of falling output and rising prices; always happens when SRAS shifts left

demand-pull inflation

demand pulls up prices; customers want g&s -> prices go up (AD increase)

cost-push inflation

Higher production costs increase prices. A negative supply shock increases the costs of production and forces producers to increase prices. (SRAS decrease)

Long-Run Self-Adjustment

businesses and workers will adjust their price and wage expectations to bring the economy back into equilibrium

discretionary fiscal policy

Congress creates a new bill that is designed to change AD through government spending or taxation

- takes time for congress to act

Non-Discretionary Fiscal Policy

automatic stabilizers; permanent spending or taxation laws enacted to work counter cyclically to stabilize the economy

- when gdp goes down governmntt spending automatically increases and taxes automatically fall

contractionary fiscal policy (the brake)

Laws that reduce inflation, decrease GDP (Close a Inflationary Gap)

-Decrease Government Spending

-Tax Increases

-Combinations of the Two