Exam 3: Government and Business Douglass Davis Fall 2025

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

46 Terms

Briefly summarize the alleged behavior, the firm’s defense and the outcome of the Kodak (1997) case

Allegation: Tied repair parts to maintenance, blocking ISOs.

Defense: Argued no market power as customers could switch.

Outcome: Supreme Court allowed case, Kodak guilty and fined $72M, ordered to sell parts fairly for 10 years.

Briefly summarize the alleged behavior, the firm’s defense and the outcome of the Microsoft (2001) case

Allegation: Microsoft used its Windows monopoly to stifle competition by bundling Internet Explorer.

Defense: Argued IE was essential to Windows and separating them would harm functionality.

Outcome: Ordered to split but overturned on appeal. Faced restrictions to prevent anti-competitive practices.

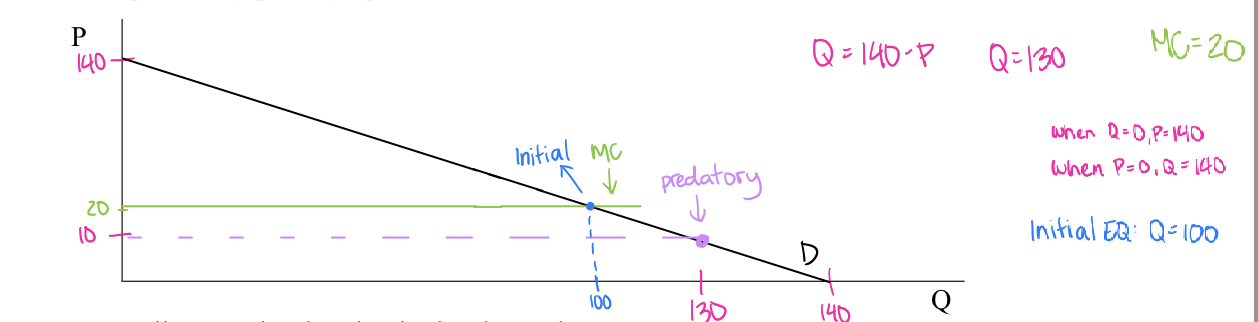

Assume that a two firm constant cost market is performing competitively. Unit costs c=20 and the demand curve is Q=140-P. Suppose that initially the big firm produces 100 units and the small firm produces the remainder. From this situation, suppose that the big firm chooses to predate by posting a price of 10. ILLUSTRATE

Assuming that the incumbent stays in the market, how many units must the big firm produce to service with a price c=$10?

Part 2: Q = 140-P —> 140-10 = 130

How to find how much loss a leader will incur to drive the small firm from the market

(P-MC)Q

Why may your graph understate the costs of a predatory strategy to the predator?

Doesn’t fully account for the opportunity cost of the target’s assets that are waiting in the wings for a new rival to acquire

Identify the 3 part test for predatory pricing identified by the Supreme Court in the Brook Group (1993)

1) Define the market and assess if the predator could have monopoly power without the target

2) Determine whether the defendants prices were below cost

3) Identify the likelihood that the defendant could raise prices high and long enough to recoup losses

Why is market definition important?

It determines competition, market power, and market structure

What should economists look for when defining markets?

They assess demand and supply substitutability, using cross-price elasticities and geographic scope

How do U.S antitrust authorities define antitrust markets?

“SSIP” (Small, Significant Increase in Price) - smallest collection of producers in a product / geographic space, that could hypothetically profitably raise prices by a small, but significant and non transitory amount

How to calculate CR4 in an industry

sum of the 4 largest market share percentages

How to calculate HHI in an industry

sum of all squared market shares

What is the advantage of using HHI to measure industrial concentration?

HHI is more precise than CR4 because it includes all firms and weighs larger ones more heavily, making it more sensitive to changes (better for antitrust analysis)

Suppose that the 4 digit NAICS code for cement manufacturing has an HHI of 446. Do you think this measure understates or overstates the state of concentration in in cement markets. Why?

Likely understates because NAICS groups many firms under one category, ignoring the geographic scope of competition

Suppose that the 4 digit NAICS code for automobiles has an HHI of 4250. Do you think this measure understates or overstates the state of concentration in in cement markets. Why?

The NAISC HHI fails to reflect automobiles because the market is international

Suppose the industry consists of 2 firms, one who has a capacity of 50 units and the other with a capacity of 30 units. Suppose further that the market would take up to 90 units at a price of $20. Given demand and these Given demand and these output levels, is it possible for a 3rd firm to enter? Explain why or why not.

No because the market demand is not large enough to support another firm at the MES without driving prices below cost

What are the 3 different types of mergers? Explain each

Horizontal: A consolidation among competitors in an industry

Vertical: A firm at one stage of the production / sales process acquires another at a different stage

Conglomerate: Mergers between unrelated firms

Identify each of the 4 merger “waves” and each of their main drivers

1890’s-1905: Merger to monopoly - driven by the passage of the Sherman Act which prohibited collusion, but did not clarify what constituted monopolization

1920’s: Merger to oligopoly - driven by weak enforcement of the Clayton Act

1960’s-70’s: Conglomerate wave (inefficient) - driven by the passage of the Celler-Kefauver Act, which closed loopholes in the Clayton Act

1980’s and on: Giant horizontal consolidations - driven by a rise in hostile takeovers, deregulation, and globalization

What is the primary market power concern that each type of merger may rise?

Horizontal: Reduces competition, enabling price increases

Vertical: Raises entry barriers or limits competitors’ access to resources

Conglomerate: Reduces potential competition, possibly leading to higher prices

Each type of merger may also create efficiencies. Give examples of the most likely sort of efficiency arising from each merger type below.

Horizontal: Economies of scale (increased output lowers costs)

Vertical: Reduction in transaction costs and technological complementaries

Complementaries: synergies in production or distribution

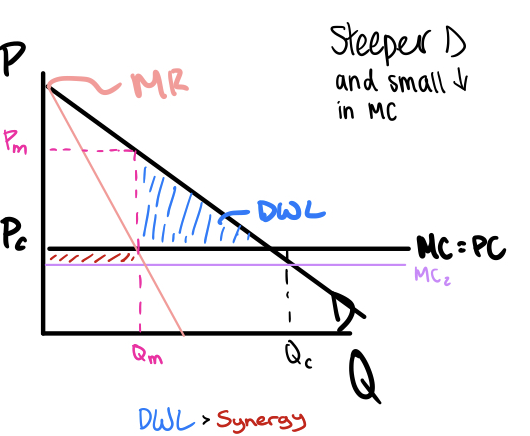

Illustrate what a “bad merger” looks like

LOOK

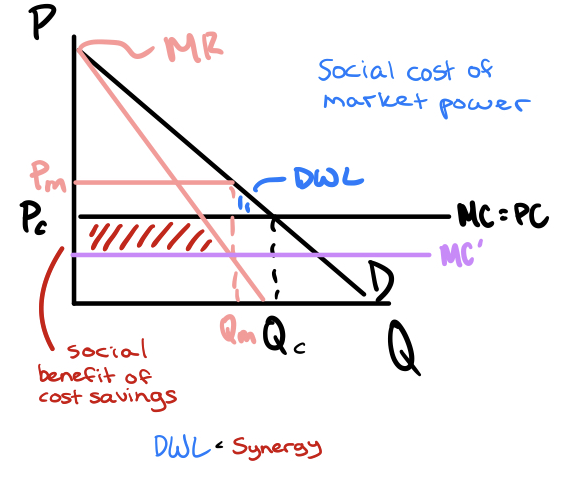

Illustrate what a “good merger” looks like

LOOK

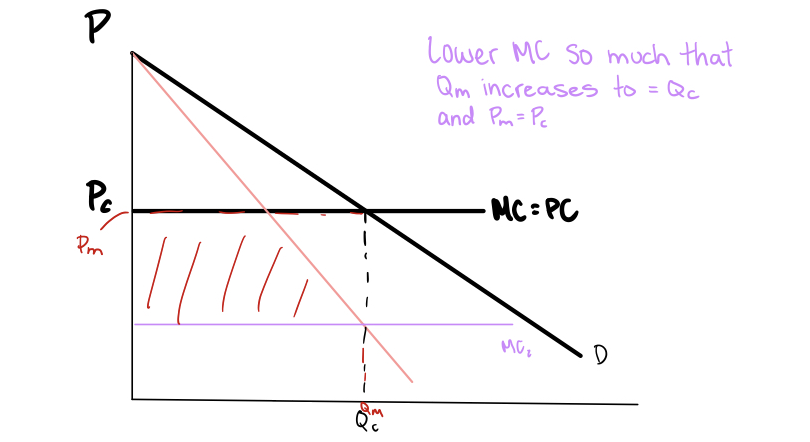

Illustrate a merger that creates both market power and cost savings that would be permissible under this alternative standard. Explain why your illustrated merger is permissible.

Explanation: The efficiency is large enough that it doesn’t result in a price increase post merger

Explain the precedent and consequence set by the Supreme Court in Thatcher Manufacturing (1926)

Precedent: The Clayton Act did not apply if a firm acquired a competitor’s assets before government action, creating a loophole

Consequence: Firms could bypass antitrust enforcement by acquiring assets instead of stock

Explain the precedent and consequence set by Brown Shoe (1962)

Precedent: Established the incipiency precedent, blocking horizontal mergers to prevent future concentration

Consequence: Strengthened antitrust enforcement by deterring mergers that could lead to oligopolies

What prompted a change in horizontal merger enforcement standards?

The Celler-Kefauver Act closed the Thatcher loophole by banning anticompetitive mergers through asset and stock acquisition, strengthening Brown Shoe enforcement.

What was the General Dynamics (1974) precedent?

Market share alone doesn’t prove anticompetitive effects. Future competitiveness matters.

What was the Waste Management (1974) precedent?

High market share doesn’t imply a monopoly if entry barriers are low

As illustrated by the proposed Staples/Office Depot consolidation (2001) even verifiable efficiencies, are not always sufficient for a merger to go unchallenged. Explain what else must be true.

It must not significantly reduce competition in a well-defined market.

A proposed acquisition of T-Mobile by AT&T was blocked by the FCC and the DOJ in 2011. Yet in 2020, T-Mobile was allowed to consolidate with Sprint. What was the rationale for blocking the first consolidation, but allowing the second?

The 2011 proposition was blocked to avoid reducing competitors, while the 2020 merger was allowed to strengthen competition with AT&T and Verizon because Sprint was weak. Dish entered to maintain balance.

Why was the Hart Scott Rodino Act important for efficient merger enforcement?

Required notice for big mergers so DOJ/FTC could review early and avoid costly issues later. Improved efficiency.

How big must the consolidating parties be in order to incur a notification of intention to consolidate?

One firm must have $100 million in sales/assets ; other is $10 million.

Once the merging parties file, how long does the Government have to challenge the merger?

30 days to review and change if needed.

1982 Horizontal Merger Guidelines – Policy Changes

Market Definition

Defined and measured using SSIP test.

1982 Horizontal Merger Guidelines – Policy Changes

Concentration Measures

Now measured with HHI

1982 Horizontal Merger Guidelines – Policy Changes

Federal Merger Enforcement Posture

The government wouldn't challenge mergers with post merger of below 1000 HHI. If its between 1000 and 1800 with <100 change in HHI, unlikely to be challenged.

In 1992 the Guidelines underwent a fundamental revision with the intention of offering two reasons for concern regarding market power exercise, cooperative effects and unilateral effects.

Describe each source of concern

Cooperative Effects: Firms may easily coordinate pricing post-merger.

Unilateral Effects: Merged firm raises prices by removing a rival.

Why did the addition of a unilateral effects theory change the Government’s approach to investigating mergers?

Coordination wasn’t required for harm. Focus shifted to closeness and firm power.

At the same time, the adoption of a unilateral effects theory prompted the Government to clarify the role of admissible efficiencies in 1997.

Why was clarification necessary?

Unilateral effects shifted focus to efficiency claims. The government needed clear standards to assess claims.

Same context as previous question.

What three elements must an admissible efficiency possess?

Merger Specific: can’t be achieved otherwise

Verifiable: backed by evidence

Cognizable: must benefit consumers

The Guidelines changed again in 2010. It painted a clearer picture of how the FTC/DOJ uses efficiencies in evaluating efficiencies.

How did the standard change? Why was the change made?

Change: Focused more on competitive effects, less on market shares.

Reason: Reflected modern economics and aimed for more real-world impact approach.

The 2023 revision of the Merger Guidelines took a more aggressive approach to enforcement. What are two specific changes that show this stricter posture?

Lower HHI threshold – makes it easier for the government to flag anti-competitive mergers.

30% market share rule – mergers giving a firm >30% share are likely blocked.

What is the most standard sort of case in which a vertical merger raises antitrust concerns?

What pre-condition must exist for such a case to make sense?

Case Type: Raising rival’s costs / entry deterrence

Precondition: Existence of market power and vertical merger creates barriers that limit competition or access

Give an example of a case where the Supreme Ordered divestiture of a vertical merger.

Identify a more recent case example, that illustrates a more development of the standard

Case: Dupont / GM (1957)

More Recent Case: U.S vs. Valero (2001)

Change in Standard: Gov must show more than a small share of potential excluded customers would be affected

What is the most standard sort of case in which conglomerate merger raises antitrust concerns?

What two pre-conditions must exist for such a case to make sense?

Case Type: Elimination of potential competition

Preconditions:

a) Target market is concentrated and hard to enter

b) Acquiring firm is one of few likely future competitors that could’ve entered on its own

Identify a case where Supreme Court blocked a conglomerate merger.

Give another more recent Appeals Court case that shows an evolution of the standard.

Supreme Court Case: FTC vs Proctor & Gamble (1967)

More Recent Case: Staples — Office Depot (1997)

How has that standard changed?

Focus on price effects, competition, and consumer harm over theoretical potential entry.