Inflation and Deflation (Causes)

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Deflation

Sustained decrease in average price levels.

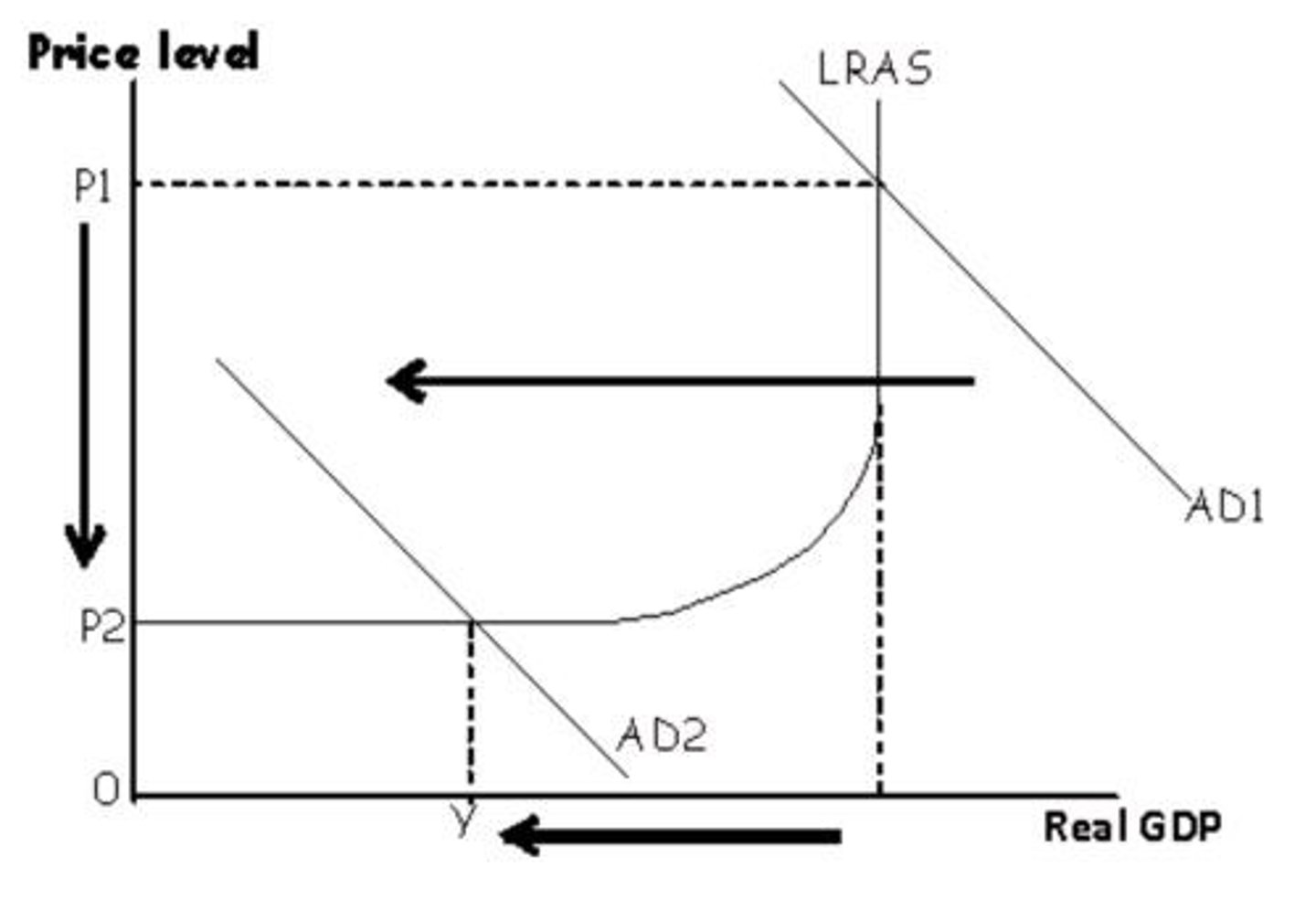

Demand-side deflation

Fall in aggregate demand shifts AD curve left.

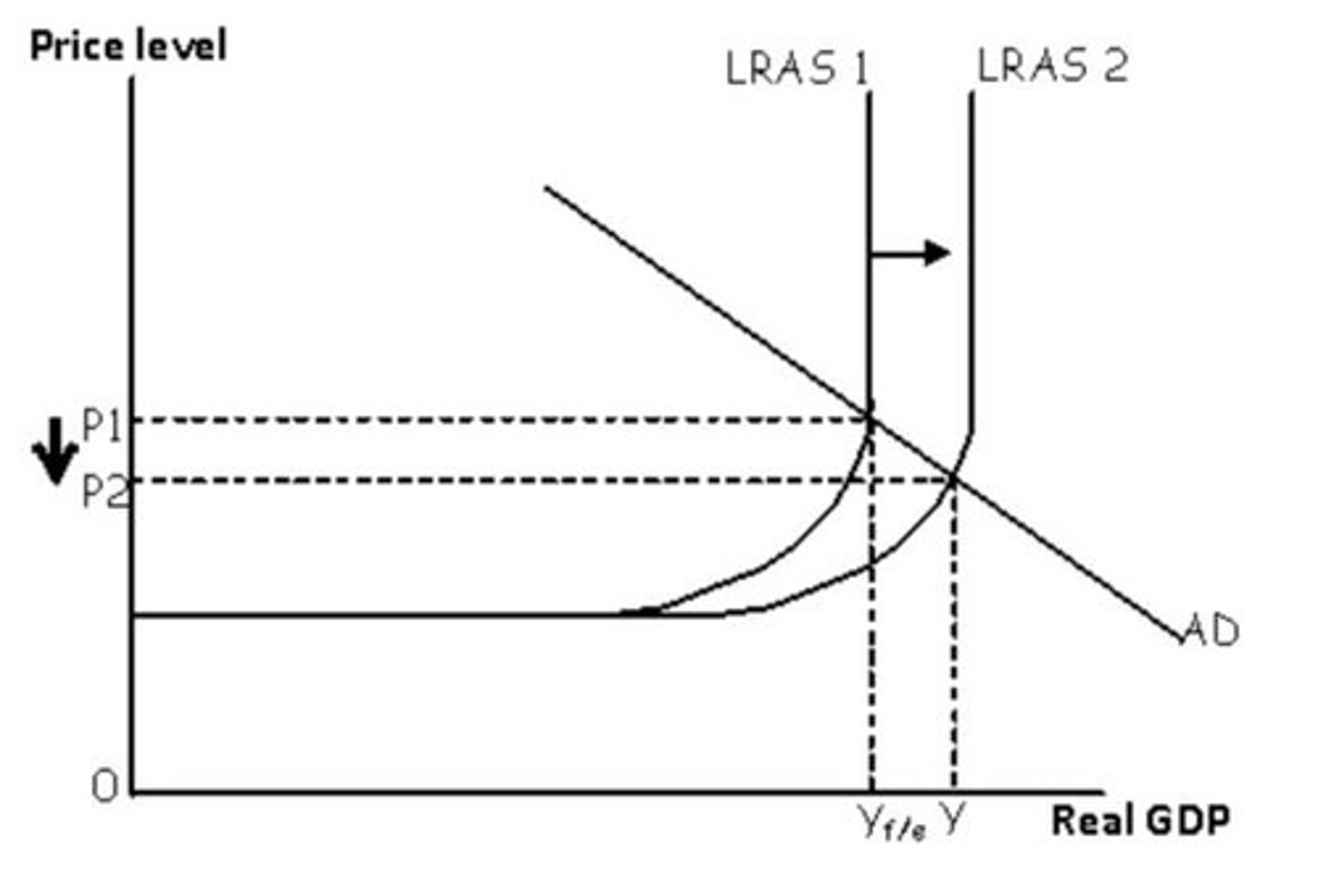

Supply-side deflation

Increase in economic capacity shifts LRAS curve right.

Bad deflation

Negative effects from falling aggregate demand.

Good deflation

Positive effects from increased economic capacity.

Disinflation

Decrease in the rate of inflation.

Sticky wages

Resistance to nominal wage cuts by workers.

Real balance effect

Price level fall increases consumption.

Deflationary pressures

Economic conditions leading to potential deflation.

Real value of debt

Debt's worth increases during deflation.

Increased real interest rates

Real rates rise when nominal rates are zero.

Real wage unemployment

Unemployment caused by rising real wages.

Deflationary spiral

Cycle where deflation causes further deflation.

Aggregate demand (AD)

Total demand for goods/services in economy.

Long-run aggregate supply (LRAS)

Total output an economy can produce sustainably.

Short-run aggregate supply (SRAS)

Total output firms produce in the short term.

Consumer spending

Expenditure by households on goods/services.

Economic growth

Increase in a country's output over time.

Nominal wage cuts

Reduction in workers' money wages.

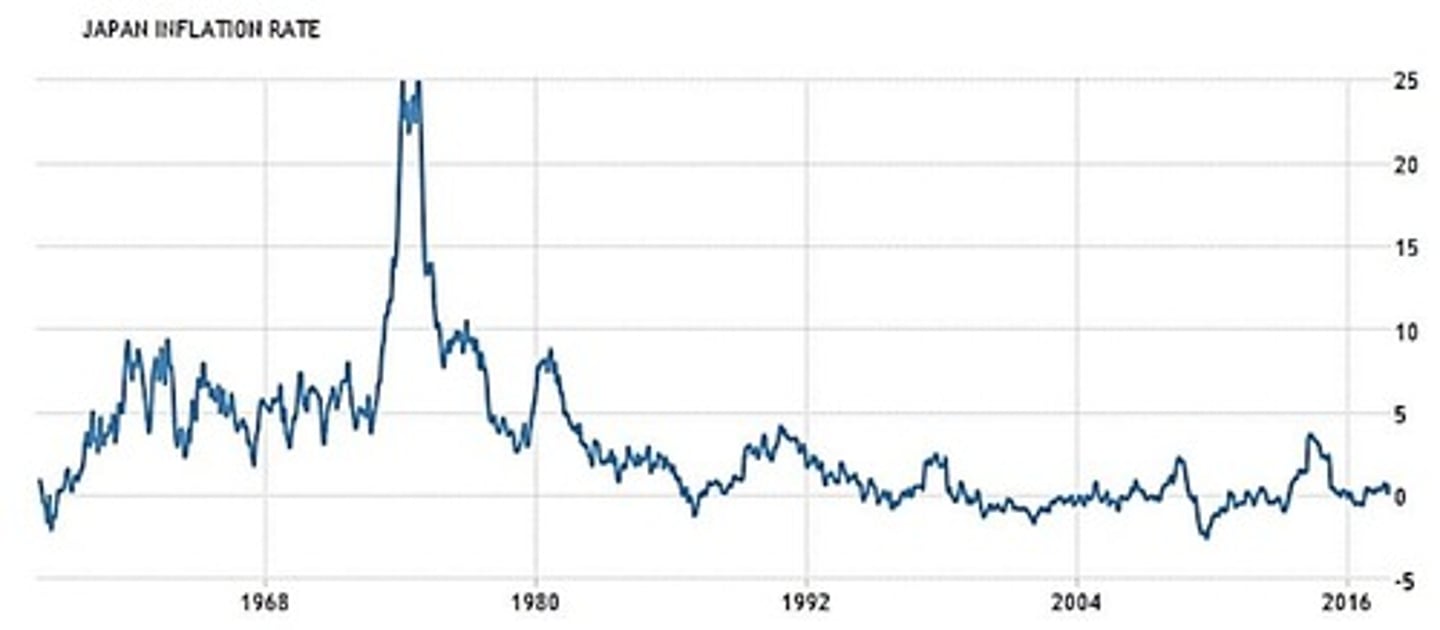

Japan's deflationary experience

Prolonged deflation in Japan during the 90s.

Price level

Average of current prices across the entire spectrum.

Luxury goods

Non-essential items consumers delay purchasing.

Cost reductions

Decreases in production costs leading to lower prices.

Deflationary expectations

Belief prices will fall in the future.

Deflationary Spiral

A cycle where falling prices lead to reduced spending.

Deflationary Expectations

Belief that prices will decline in the future.

Real Interest Rate

Nominal interest rate adjusted for inflation.

Aggregate Demand

Total demand for goods and services in an economy.

Real Value of Debt

Increased purchasing power of debt during deflation.

Supply Side Deflation

Deflation resulting from increased production efficiency.

Long-Run Aggregate Supply (LRAS)

Represents potential output in the economy over time.

International Competitiveness

Ability of a country to sell goods abroad.

Reflationary Policies

Government measures to counteract deflation.

Expansionary Fiscal Policy

Increased government spending and reduced taxes.

Quantitative Easing (QE)

Central Bank buys bonds to increase money supply.

Liquidity Trap

Monetary policy ineffective at low interest rates.

Helicopter Drop

Direct money distribution to consumers to stimulate spending.

Announcement Effects

Market reactions to public policy statements.

Devaluation

Reduction of currency value to boost exports.

Purchasing Power

Value of money in terms of goods and services.

Consumer Spending

Expenditures by households on goods and services.

Positive Multiplier Effect

Increased spending leads to further economic growth.

Deferred Spending

Postponement of purchases due to expected price drops.

Real Incomes

Income adjusted for inflation, reflecting true purchasing power.

Economic Agents

Individuals or entities making economic decisions.

PED of Exports

Price elasticity of demand for exported goods.

Competitive Devaluation

Countries lowering currency value to enhance trade.

Short Periods of Deflation

Temporary deflation that may not harm the economy.

Costs of Deflation

Negative impacts such as increased debt burden.