Economics HL - Macroeconomic Policies

1/63

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

64 Terms

Macroeconomic Objectives

Economic Growth: Increase real GDP over time.

Low Stable Rate of Inflation: Maintain manageable and predictable price levels.

Low Unemployment: Minimize joblessness to utilize productive capacity.

Sustainable Level of Debt: Ensure public debt remains manageable long-term.

International Stability and Competitiveness: Balance trade, currency stability, and global competitiveness.

Equitable Society: Reduce inequality through policies like progressive taxation and welfare.

Fiscal Policies: Definition

Government use of taxation and spending to influence the economy (economic activity, employment, inflation)

Government Spending (G): Infrastructure, education, healthcare.

Taxation (T): Income tax, corporate tax, VAT.

Evaluation

Automatic stabilizers: Unemployment benefits (↑ in recession), progressive taxes.

Keynesian multiplier: initial injection of government spending into the economy leads to a larger increase in Aggregate Demand (AD) and Real GDP due to repeated rounds of spending

Government spending → GDP growth (if spare capacity).

Fiscal Policy: Pros

✅ Pros:

Quick impact (especially spending).

Direct job creation (e.g., infrastructure projects).

Can target inequality (progressive taxes, welfare).

Fiscal Policy: Cons

❌ Cons:

Crowding out effect (govt borrowing ↑ → private investment ↓).

Time lags (delays in implementation).

Risk of budget deficits if overused.

Fiscal Policies: Contractionary ←

typically implemented to:

reduce inflationary pressures

stabilize the economy

prevent excess economic growth from causing overheating (limit of capacity)

to get to:

full employment

low sustainable rate of inflation

Fiscal Policies: Expansionary →

government expenditure increases

reduction in taxes to stimulate economic growth

boost aggregate demand

encourage investment

reduce unemployment

used during periods of economic slowdown or recession

Fiscal Policy: Tax Types

Income Tax: Levied on personal income (wages, rent, dividends). Primary revenue source for governments.

Corporation Tax: Direct tax on business profits.

Capital Gains Tax: Applied to profits from investments (e.g., stocks, property).

Inheritance Tax: Tax on wealth transferred between individuals (e.g., bequests).

Windfall Tax: One-time levy on unexpected gains (e.g., lottery wins, corporate takeovers).

Fiscal Policy: Goals

Maintain low, stable inflation.

Achieve low unemployment (full employment).

Stabilize economic fluctuations (reduce business cycle volatility).

Promote equitable income distribution.

Ensure external balance (manage trade deficits/surpluses).

Balance the budget and manage public debt.

BUDGIE:

Business cycle fluctuations (stabilize)

Unemployment (full unemployment)

Distribution of Income (equitable distribution)

Growth

Inflation (low and stable)

External Balance (ensure, manage trade deficits/surpluses)

Monetary Policy: Definition

Central bank actions to control money supply & interest rates

Interest Rates:

↓ Rates → Cheaper loans → ↑ C + I → AD ↑.

↑ Rates → Costlier loans → ↓ C + I → AD ↓.

Quantitative Easing (QE): Buying bonds to inject money into the economy.

Reserve Requirements: Adjusting bank reserve ratios.

Monetary Policy: Pros

✅ Pros:

Quick implementation (no legislative delays).

Independent central banks reduce political bias.

Monetary Policy: Cons

❌ Cons:

Liquidity trap (interest rates near 0% → ineffective).

Time lags (takes ~18 months to fully affect economy).

Can worsen inequality (asset prices ↑ benefit the wealthy).

Monetary Policy: Goals

Primary Goal: Maintain price stability (control inflation).

Secondary Goals: Promote sustainable growth, reduce unemployment (dual mandate in some countries).

Key Proponents: Keynesian economists advocate using monetary policy to stimulate demand during recessions.

Monetary Policy: Tools

Interest Rates:

Base Rate/Discount Rate: Central bank sets benchmark rates; influences borrowing costs.

Lower rates → Cheaper loans → ↑ Consumption (C) & Investment (I) → ↑ AD.

Higher rates → Discourage spending → ↓ AD.

Open Market Operations (OMOs):

Buying/selling government bonds to adjust money supply.

Buy bonds → Inject liquidity → ↑ Money supply → ↓ Interest rates.

Sell bonds → Reduce liquidity → ↓ Money supply → ↑ Interest rates.

Reserve Requirements:

Mandate the % of deposits banks must hold (not lend).

Lower reserves → Banks lend more → ↑ Money supply.

Quantitative Easing (QE):

Central bank purchases long-term securities to inject liquidity during crises

Monetary Policy: Expansionary →

Goal: Stimulate AD during recessions (close deflationary gap).

Actions: ↓ Interest rates, ↑ Money supply via OMOs/QE.

Impact: AD shifts right → ↑ Real GDP, ↑ Employment.

AD1 → AD2 → Real GDP rises (Y1 → Y2), price level ↑ (P1 → P2).

Monetary Policy: Contractionary ←

Goal: Reduce AD during high inflation (close inflationary gap).

Actions: ↑ Interest rates, ↓ Money supply via bond sales.

Impact: AD shifts left → ↓ Inflation, ↓ Overheating.

AD1 → AD2 → Real GDP falls (Y3 → Y2), price level ↓ (P2 → P1)

Market-Based Supply-Side Policies: Definition

Policies to increase efficiency & LRAS by reducing government intervention.

Deregulation: Reducing business restrictions (e.g., Uber vs. taxis).

Privatization: Selling state-owned firms (e.g., British Rail).

Labor Market Reforms:

↓ Minimum wage → More hiring.

↓ Unemployment benefits → Incentivize work.

Tax Cuts: Corporate tax cuts to boost investment.

Market-Based Supply-Side Policies: Pros

✅ Pros:

↑ Competition → Lower prices, better quality.

Encourages innovation & entrepreneurship.

Market-Based Supply-Side Policies: Cons

❌ Cons:

↑ Inequality (e.g., lower wages, reduced worker rights).

Short-term unemployment (e.g., firms cut costs).

Interventionist Supply-Side Policies: Definition

Government-led policies to boost productivity & LRAS.

Education & Training: Upskilling workforce (e.g., Germany’s apprenticeships).

Infrastructure Investment: Roads, broadband (e.g., China’s Belt & Road).

Industrial Policy: Subsidies for R&D (e.g., US CHIPS Act for semiconductors).

Interventionist Supply-Side Policies: Pros

✅ Pros:

Corrects market failures (e.g., underinvestment in education).

Long-term growth ↑ (human capital & infrastructure).

Interventionist Supply-Side Policies: Cons

❌ Cons:

Expensive (higher taxes or borrowing).

Risk of government failure (misallocation of funds).

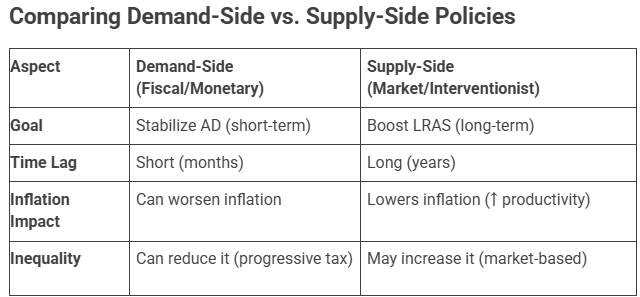

Demand-Side vs Supply-Side

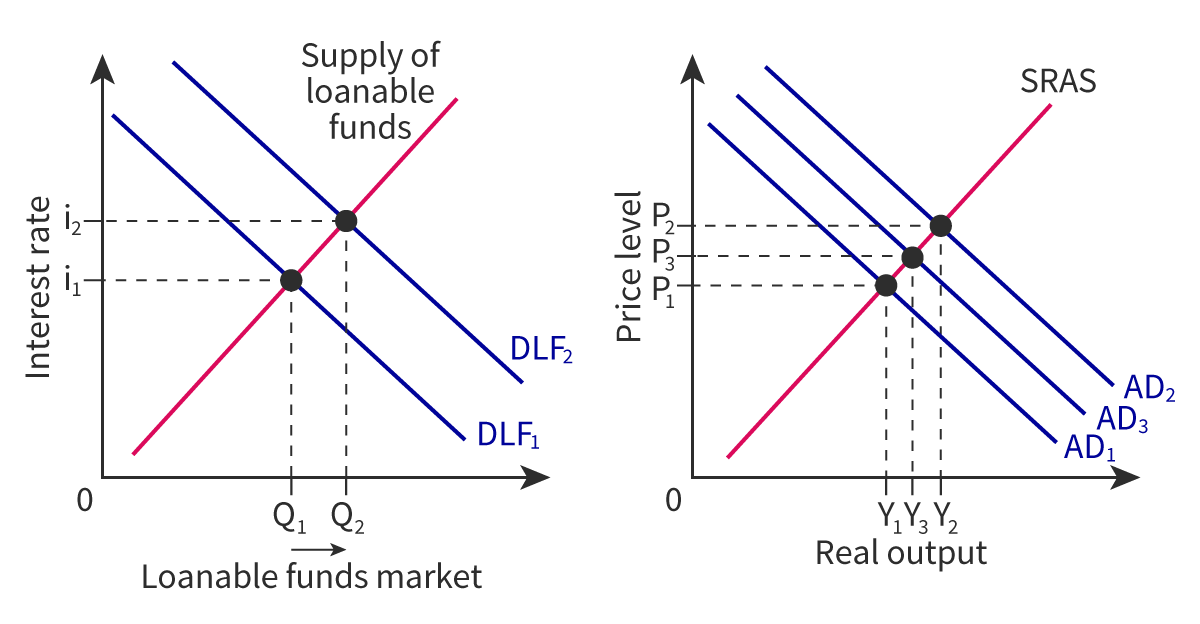

Crowding Out: Definition

Government crowds out the private sector (loanable funds and interest rates)

when government borrowing reduces the level of private investment in the economy

Occurs when the government attempts to stimulate the economy by increasing government expenditure on infrastructure

G↑ → GDP↑ but private investment↓

Crowding Out: Gov-Funded Expressway Example

Must run a budget deficit and finance its increased spending in some way

increase in government expenditure (G) on road building will shift out the aggregate demand curve from AD1 to AD2, increasing the price level from P1 to P2 and increasing real output from Y1 to Y2

Crowding Out: Domestically-Borrowed Expressway Example

Sell bonds and compete directly with the private sector in the loanable funds market

Loanable funds market = where potential investors are able to obtain money or funds for investment projects. Investors weigh up the cost of borrowing money (the interest rate) against the expected return on their investment. If the interest rate is low, and the expected return from the investment is high, then the potential investor is likely to borrow the funds.

Competition will drive the interest rate from i2 to i2

As interest rates rise, firms may find it too expensive to invest in projects → overall investment in the economy will fall

Decrease in investment (I) will shift AD2 to AD3, which is crowding out

Price level will fall from P2 to P3 and output will fall back from Y2 to Y3

Crowding out depends heavily on the interest rate change

Real Interest Rate = Nominal Rate - Inflation Rate

Real Interest Rate = Nominal Rate - Inflation Rate

Keynesian Multiplier Effect: Definition

how an initial injection of government spending into the economy leads to a larger increase in Aggregate Demand (AD) and Real GDP due to repeated rounds of spending

Marginal Propensity to Consume (MPC)

MPC = Δ Income / Δ Consumption

proportion of income spent on consumption

for ever dollar earned, percentage of dollar you spend

100% of Income

MPC + MPS + MPI + MPT = 1 (100% of income)

Marginal Propensity to (Consume + Save + Imports + Tax) = 1

Spending Multiplier

Spending Multiplier = 1 / (1 - MPC)

Example:

Initial injection = $100 million.

Leakages: 10% saved (MPS), 10% imports (MPI), 20% taxes (MPT) → Total leakages = 40%.

MPC = (1 - 0.4) = 60%

Multiplier = 1 / (1-0.6) = 2.5

Total AD Increase: 100 million × 2.5 = 250 million

Tax Multiplier

Tax Multiplier = MPC / MPS = MPC / (1 - MPC)

Q2CELL

Quantity and Quality of Capital, Enterprise, Land, Labor

Quality and Quantity of Labor

Higher population growth or immigration increases the workforce

Incentives: benefits, cutting income tax

Better education, training, and skill development improve labor productivity

Investment (spending money on capital goods: tech, R&D, new factories, machine upgrades

Increasing the quality and quantity of capital and improving the productive efficiency

Technological Advancements

Innovations in production methods boost efficiency and output.

Automation and AI reduce costs and increase productivity.

Long-Run Aggregate Supply (LRAS)

Vertical curve at full employment output.

Reflects the economy’s productive capacity, unaffected by price levels.

LRAS: Rightward Shift

Q2CELL = Quantity and Quality of Capital, Enterprise, Land, and Labor

Improved technology, education, infrastructure, resource discoveries, immigration, competition (deregulation)

LRAS: Leftward Shift

Huge decrease in labor productivity

Mass capital depreciation

War, conflict, natural disaster → destroys infrastructure → reduces quantity of capital

Death → reduces quantity of labor

Health crisis → affects productivity and quantity of labor

Hysteresis = long-term unemployment where workers become discouraged

When workers leave the economy → reduce the quantity of labor

Natural disasters, wars, capital depreciation, health crises, reduced labor productivity

Neo-Classical Model: Flexible Wages

Markets self-correct through flexible wages and prices. Temporary rigidities exist, but long-run equilibrium restores full employment without government intervention.

Keynesian Model: Sticky Wages

Wages do not adjust quickly, leading to prolonged unemployment.

fire > cut wages (demotivated, less productive)

Deflationary Gap ◀

AD < full employment output (LRAS), causing unemployment

Deflationary gaps result in unemployment and potential deflation (if prices are flexible)

Inflationary Gap ▶

AD > full employment output, causing rising prices

Inflationary gaps drive price increases (demand exceeds capacity)

Full Employment

Maximum sustainable output using all factors of production efficiently

Includes natural unemployment (e.g., workers transitioning jobs)

Indirect Taxes

Indirect tax is the tax levied on the consumption of goods and services (not directly levied on the income of a person)

Sales Tax (VAT): charge the manufacturing, sale, and consumption

Carbon Tax: imposed on firms producing excessive carbon emissions to discourage pollution

Nominal GDP: Calculation

value of final goods and services evaluated at current-year prices

Ex: NGDP2010 = Q2010 x P2010

Limitations:

Prices distorts data, only shows cases where the prices goes up

Unsure if the market is PRODUCING more

Real GDP: Calculation

use base year prices and current quantities to calculate

Ex: RGDP2011 = Q2011 x P2010

GDP Growth Rate: Calculation

Percent Change = %Δ

[(New Value - Old Value) / (Old Value)] x 100%

GDP Deflator: Calculation

[Nominal GDP / Real GDP] x 100%

Unitless, just a number

GDP Deflator = [(NGDP) / (RGDP)] x 100%

Inflation Rate: Calculation

Inflation Rate = [(GDPcurrent - GDPpast) / (GDPpast)] x 100%

Ex: [(GDP2011 - GDP2010) / (GDP2010)] x 100%

Aggregate Demand (AD): Rightward Expansion

Good:

↑ employment

GDP ↑

Incomes ↑

Standard of living ↑

Not-so-Good:

Inflationary gap ↑

Average price level ↑

Deficit spending → debt ↑ → interest ↑

Unsustainable, beyond potential

Fixed amount of FoPs, producing beyond full employment → more demand but for same amount of FoPs

Demand > Supply

Can temporarily increasing GDP

Prices going up

Equality vs Equity

Equality = same treatment/support for all.

Equity = fairness; ensuring everyone has opportunities to succeed.

Equality

Treated equally, assumed that everyone will benefit from the same supports

same treatment/support for all

Equity

Fairness, everyone should be given the same opportunities to succeed, empowerment

fairness; ensuring everyone has opportunities to succeed

Equity: Importance

Social stability: less turmoil, protests, polarization

Human potential: prevents wasted talent (poverty cycle)

Economic benefits: higher motivation, expanding markets, more competition

Social cohesion: less crime, violence, mistrust, and power imbalance

Well-being: better health indicators, improved quality of life

Inequality: Causes

Low-income households

Limited education/health access

Malnutrition, child labor

Entrapment in the poverty cycle

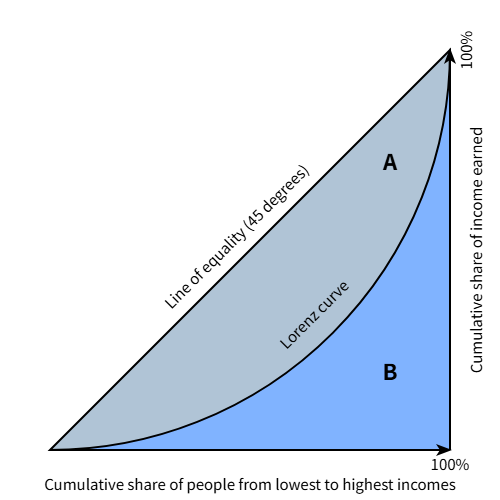

Lorenz Curve

Graph showing income distribution

Gini Index

Gini Index: ratio of area between Lorenz curve & line of equality to total area under equality line

Area above Lorenz curve and below equality over the total area below line of equality

Multidimensional Poverty Index (MDPI)

MDPI: indicator that considers health, education, and living standards

Distribution of Income Solution: Direct Support

Subsidized education (esp. lower quartiles)

Food assistance (stamps)

Unemployment benefits (automatic stabilizer)

Direct provision of services (healthcare, housing)

Progressive Tax

Higher-income → higher % taxed.

✅ Promotes equity, raises government revenue, more equal economy

❌ Tax evasion risk, work disincentive, politically unpopular

Limitations: only for income and wages, seperate from assets and stocks (capital gains: profits gained from the sale of capital assets)

Proportional (Flat) Tax

Same tax % for all income levels

One rate for every income level, will help redistribute wealth but it’s more equal than equitable

Fair tax, always a fixed percent

✅ Simple, predictable, “fair” rate

❌ Limited redistribution effect

Regressive Tax

uniform tax rate → heavier burden on low incomes (e.g., VAT value-added tax, cigarette tax)

Takes a larger percentage of income from lower-income earners than from high-income earners; makes inequality worse, higher income → lower average tax

✅ provide governments with a steady and reliable source of revenue, which is critical for maintaining public infrastructure, social programs, and economic stability

❌ Increases inequality, widens the wealth gap, making necessities more expensive for lower-income earners

Transfer Payments

Assistance given to different groups in the economy to improve standard of living and create a more equitable society

Child support, disability pay, government pensions, unemployment benefits, subsidies, tuition aid, food stamps, childcare.

Tax Deductions

donations, education/childcare, green energy savings, used with government subsidies; amounts that can be subtracted from tax payment

If the person puts sums of money towards work expenses, education and child care or products the government deems “positive” to society

Automatic Stabilizers (Fiscal Policy)

Fiscal mechanisms that adjust without new government action

Designed to offset fluctuations in a nation’s economic activity without any additional intervention by the government

Progressive income taxes

Corporate taxes

Unemployment benefits

Function: dampen booms & recessions (deficits in recessions, surpluses in booms).