4.2.3.3 inflation and deflation

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

70 Terms

inflation definition

The natural tendency for the average price level within the economy to rise over time.

hyperinflation

a phase of extremely rapid inflation nearly always the result of mass money printing by the gov with money as an asset ending up as worthless. It is also associated with economies where there has been a collapse in real output/supply.

deflation

is a sustained period when the general price level for goods and services is falling.This means that a weighted basket of goods and services is becoming less expenisive over time. The annual rate of inflation is negative

disinflation

is a fall in the rate of inflation but not sufficient to bring about price deflation.During a period of disinflation,consumer prices are still rising but at a slower rate.

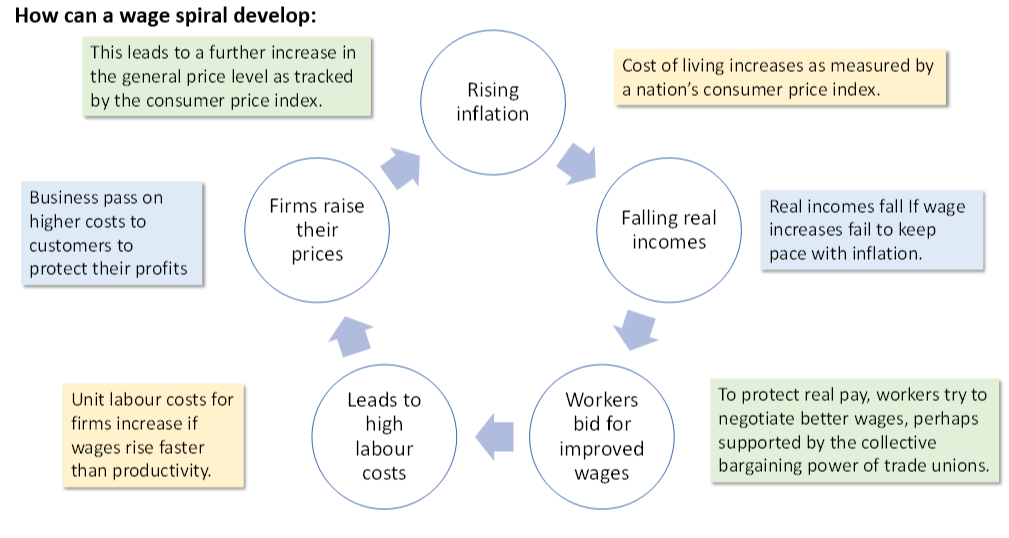

inflation expectations

describes what people and businesses expect to happen to consunmer prices in the future (usually one year ahead).Once a high rate of inflation becomes established it can be difficult to remove.If people expect higher prices,this can feed through to higher wage claims and rising costs.This is known as a wage price spiral.

stagflation

- refers to the unfortunate and costly combination of stagnant (slow) economic growth,rising unemployment and high and rising inflation.

Main causes of inflation

Money & credit boom

Higher wage costs

Increased energy bills

Falling exchange rate

Higher indirect taxes

Economic boom

higher indirect tax graph (for inflation)

draw it

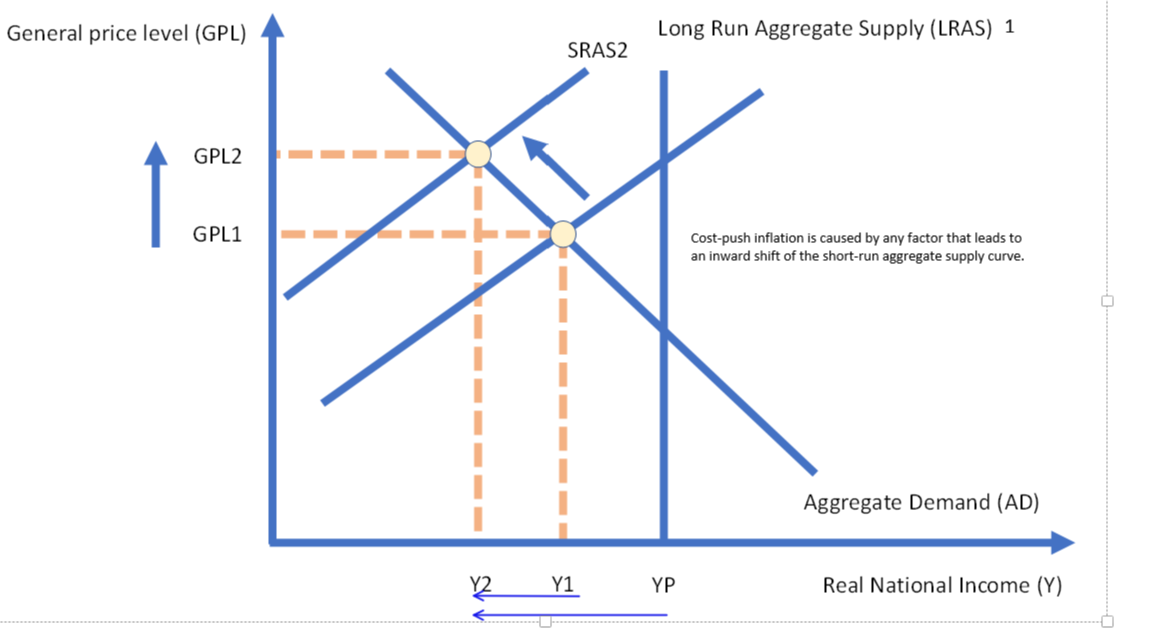

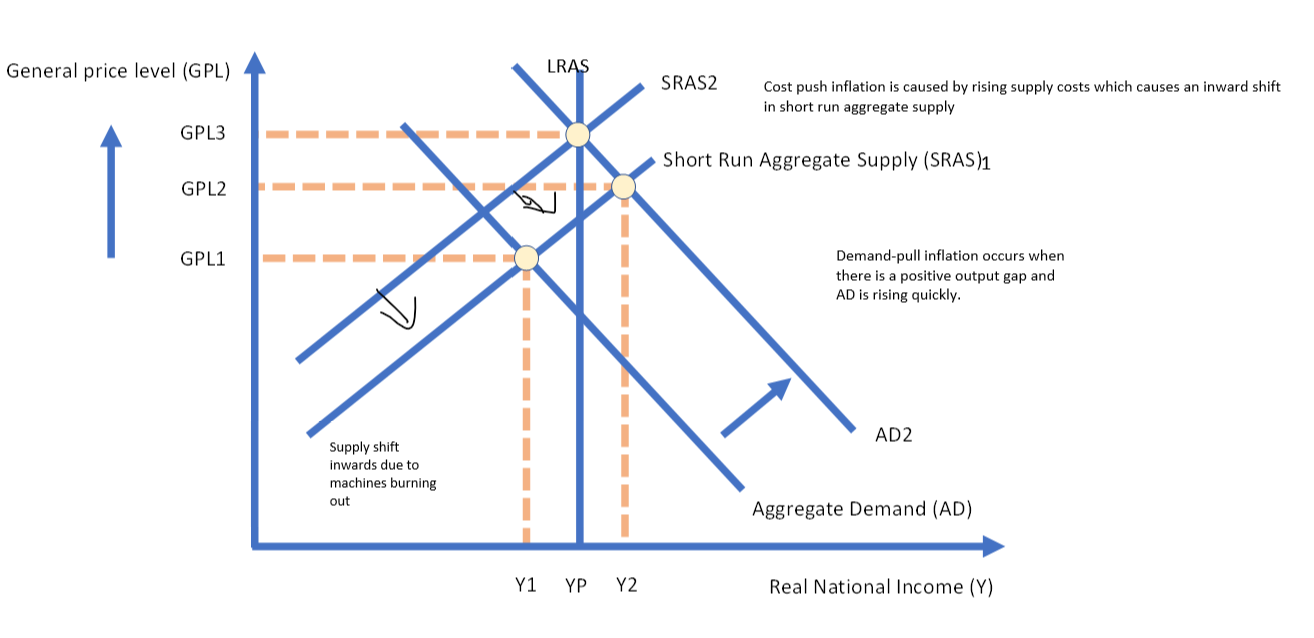

Cost push inflation

When inflation is caused by an increase in the costs of production. For example, an increase in wages or the cost of raw materials.

Cost push inflation examples

Rising labour costs perhaps due to an increased minimum wage

Higher global prices for components and raw materials including imported energy (oil and gas) and foodstuffs

A depreciation in the external value of the exchange rate which then causes a rise in import prices – many imports are priced in US $s

An increase in indirect taxes such as higher VAT or environmental taxes such as a carbon tax

Inflation from cost-plus factors can be

difficult to control, since the central bank has little control over the factors that cause it

cost-plus inflation is caused by any factor…

that leads to an inward shift of the short-run aggregate supply curve.

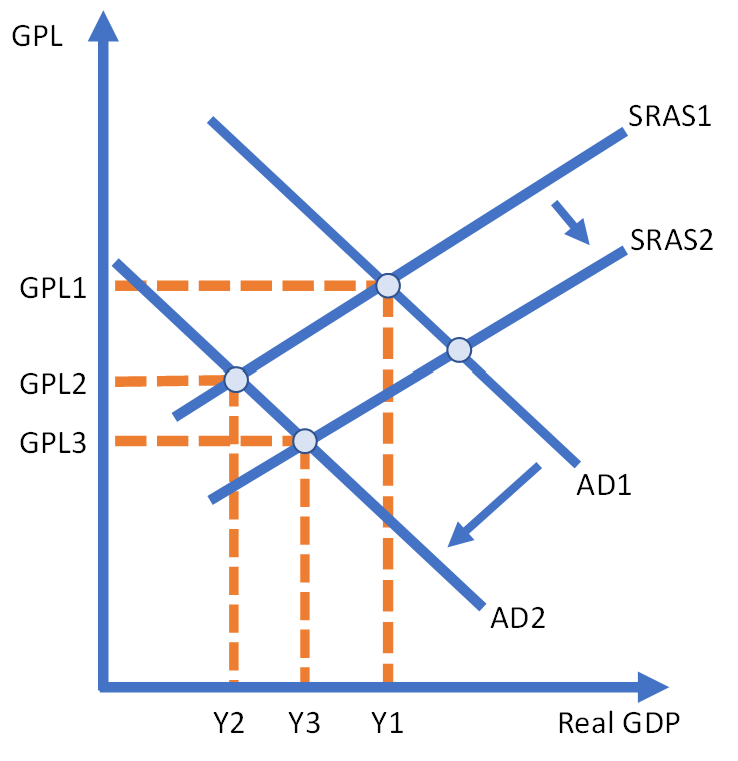

Cost push inflation graph

draw it

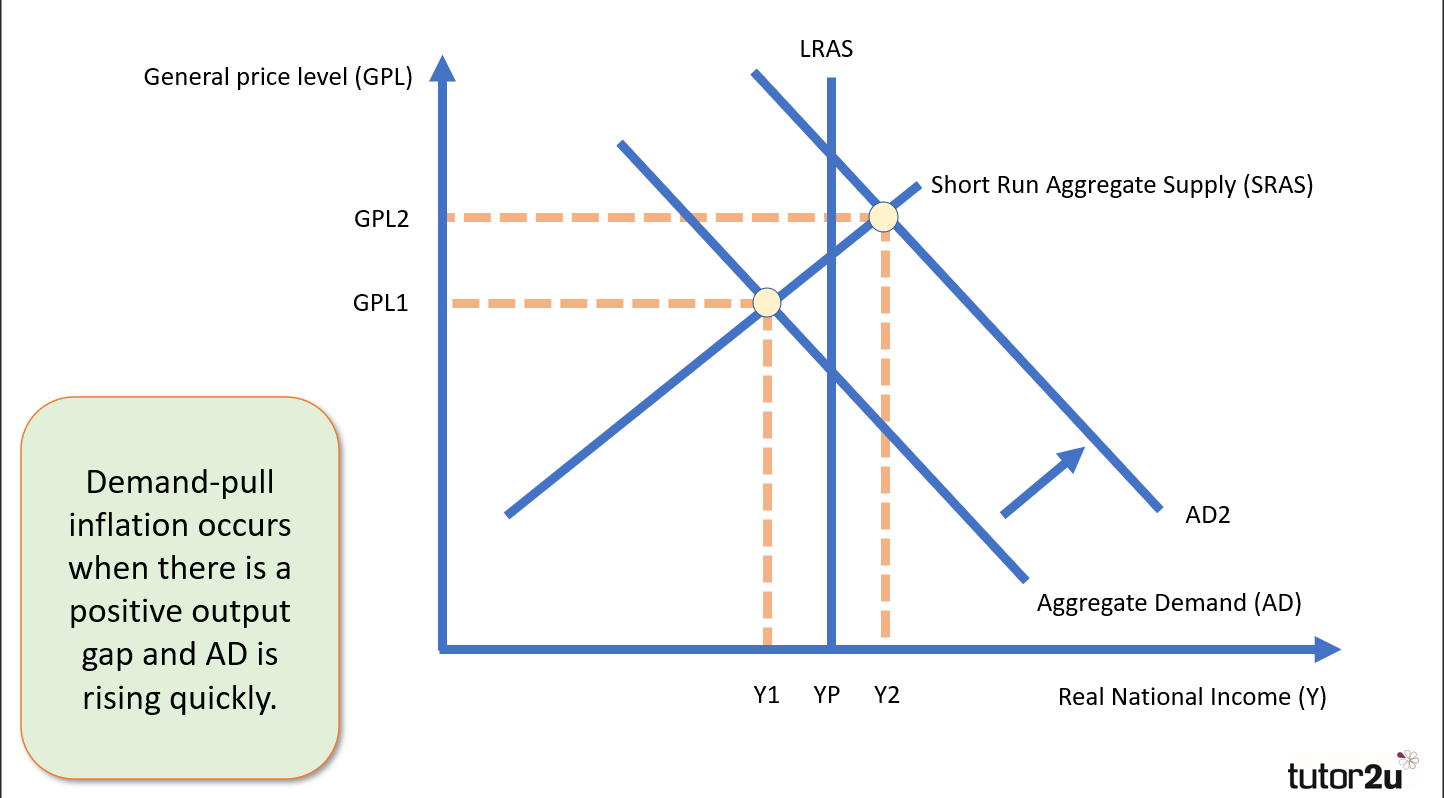

demand pull inflation

When inflation is caused by an increase in demand for goods and services within an economy (this often occurs during a recovery or boom stages of the economic cycle).

demand pull inflation :explaination

Demand-pull inflation happens when the economy is growing too quickly, and aggregate demand for goods and services outstrips supply.

When this happens, prices for everything start to rise, because consumers are willing to pay more to get the things they want.

This can be caused by several things, including economic growth, low interest rates, and an increase in the money supply.

If the government engages in excessive fiscal stimulus, like cutting taxes or increasing spending, it can boost demand and lead to inflation.

This kind of inflation is often seen as a sign that the economy is "overheating" and that corrective measures need to be taken

demand-pull inflation diagram

draw it

demand pull and cost push inflation diagram

draw it

deflationary policies are policies to …… and do not necessary result in ……

deflationary policies are policies to reduce aggregate demand and do not necessarily result in deflation.

difference between disnflation and deflation

deflation exists when the price level is falling whereas disinflation is when the rate of inflation is falling.

Monitarism (Milton Freeman)

Monetarism suggests that the amount of money in an economy plays a crucial role in determining the overall price level, or inflation.

If the central bank increases the money supply too rapidly, it can lead to inflation because there is "too much money chasing too few goods.”

Monetarists are often critical of using fiscal policy (government spending and taxation) to manage the economy. They argue that fiscal policies can be unpredictable and lead to economic instability.

Monetarists also believe in the concept of long-run neutrality of money. This means that in the long term, changes in the money supply do not affect real variables like employment and output but primarily impact nominal variables like prices.

Montarism linked with inflation explaination

As the money supply grows, individuals and businesses have more to spend. If the supply of goods and services in the economy does not increase at the same rate (or if it decreases), the demand for these goods and services can exceed their supply.

When demand exceeds supply, sellers can increase their prices to capture more of the available money.

Expectations of future inflation can further exacerbate the problem. If people anticipate that prices will continue to rise, they may make purchases sooner rather than later, which can fuel additional demand and price increases.

Rising prices can lead to demands for higher wages as workers seek to maintain their real purchasing power.

Inflation-too much money chasing too few goods

Fisher’s equation of exchange

Fisher's equation of exchange, also known as the quantity theory of money, was proposed by economist Irving Fisher in the early 20th century.

The equation is MV = PQ

M is the money supply

V is the velocity of money

P is the price level

Q is the quantity of goods and services produced.

In other words, the equation says that the money supply times the velocity of money equals the price level times the quantity of goods and services produced

How does the growth of money supply (the Quantity Theory of money)

The growth of the money supply can be a cause of inflation when it outpaces the growth of real economic output (goods and services produced).

The quantity theory of money

states that the price level in an economy is directly related to the money supply and the velocity of money (how quickly money circulates in the economy) relative to the quantity of goods and services produced

The quantity theory of money explained

The quantity theory of money, as laid out in Fisher's equation, essentially says that the amount of money in an economy times how often that money is spent determines the overall price level in the economy.

So, the more money there is in an economy, the more likely prices will rise.

This is because if there's more money in the system, people can spend more, and this can lead to increased demand for goods and services.

As demand increases, the prices for those goods and services rise as well.

Causes of surges in UK inflation 22/23

Pandemic-related supply shortages: As the world economy recovered from the pandemic, demand for these supplies and materials increased, but the supply couldn't keep up. This led to higher prices for raw materials and products, which pushed up inflation.

Conflict in Ukraine: The conflict has caused a spike in energy prices, as Russia is a major exporter of natural gas and other fuels. Higher energy prices have pushed up the cost of production for many businesses.

Labour shortages: These have been a big problem in the UK, especially in sectors, like healthcare and logistics. A lack of workers has made it difficult for businesses to operate, and it's pushed up wages for those workers who are availab

Reasons for acceleration in the UK economy:

Rising cost of energy including a surge in European wholesale gas prices

Increasing cost of food – linked to energy price rises, weak currency + rising wage costs

Profit-push inflation from suppliers – firms taking advantage of supply-chain shortages

Greedflation:

Greedflation/price gouging

Greedflation is also known as price gouging

Price gouging refers to the practice of charging excessive or unreasonable prices for goods or services in response to a situation of increased demand or limited supply, such as during a natural disaster, pandemic, or other emergency.

In such situations, demand for certain goods or services may increase dramatically, and the supply may be constrained, leading to scarcity and higher prices.

Price gouging occurs when sellers take advantage of this situation by charging prices that are much higher than what would be considered reasonable under normal market conditions.

Shrinkflation

Shrinkflation refers to the practice of companies reducing the size or quantity of a product, while keeping the price the same or even raising it.

This allows companies to keep prices stable or even increase them, without consumers noticing as much.

It's a form of "hidden inflation" that can be difficult to detect.

Companies may shrink the size of products, reduce the amount of product in a container, or even reduce the quality of the product.

Consequences of high rate of inflation

The main reason economists view inflation as damaging is because it erodes the value of money.

This can cause problems for consumers, who find that their money doesn't go as far as it used to.

It also affects businesses, because it can lead to uncertainty and instability. For example, businesses may have a harder time planning for the future and making long-term investments when inflation is high.

When inflation is high, the central bank will often raise interest rates in an attempt to curb inflation

interest rates take ….. months to take into effect in an economy

18-24

interest rates definition

The cost of money which are set via the base rate by the Monetary Policy Committee of the Bank of England. Also the reward for saving.

fiscal policy

The use of government spending and taxation in order to influences the level of demand within the Economy.

importance of relative inflation rate(inflation on international trade)

A country's relative inflation rate matters because it can affect its competitiveness in international trade.

If one country has high inflation, while another country has low inflation, that can lead to an imbalance in trade. (protectionism)

The country with high inflation will see its exports decline, while the country with low inflation will see its exports increase.

This can lead to imbalances in the balance of trade, and it can also cause problems for the country with high inflation, since it will become less competitive in the global marketplace.

In extreme cases, this can lead to problems like capital flight and debt crises.

High inflation and yields on government bonds

• When a government issues new bonds, it has to offer a certain interest rate, known as the "yield“(means interest), to attract investors.

• If inflation is high, the government will have to offer a higher yield on its bonds to entice investors to lend it money.

• This is because investors will want to be compensated for the risk of inflation eroding the value of their investment. In other words, they'll want to earn enough interest to offset the effects of inflation.

• High inflation leads to higher interest rates on government bonds.

• When governments must pay higher interest rates on their bonds, they ultimately increase taxes to pay off the interest

High inflation and risk of capital flight

When a country experiences high inflation, investors may start to worry about the stability of the economy.

They may fear that the high inflation will lead to a decline in the value of the country's currency.

To protect their assets, these investors may decide to move their money out of the country, in a process known as "capital flight". (when everything leaves the country)

They might do this by selling their assets in the country, like stocks or real estate, and then moving the proceeds to a different country, like one with a more stable currency.

Economic costs of high inflation (A03-)

Inequality: Inflation has a regressive effect on lower-income families in developed & developing countries – most of their wealth is held in cash

Falling real incomes – if wage rises lag price increases each year

Negative real interest rates: If the interest rate on savings is lower than inflation

Cost of borrowing: High inflation may also lead to higher interest rates for businesses and consumers with debts (perhaps via rising mortgage rates)

International competitiveness: A high relative rate of inflation can reduce competitiveness which will lower demand for the country’s exports

Business uncertainty: High and volatile inflation is not good for confidence because businesses cannot be sure of what costs will be – this might hold back investment

Gainers of high inflation (A03+)

|

|

|

losers of high inflation(A03-)

• Retired people relying on on fixed incomes / pensions

• Lenders if real interest rates on loans are negative

• Savers if real returns on their savings deposits are negative

• Workers in low-paid jobs with little or no bargaining power – perhaps those with no union representation

cost of high inflation to the gov (A03-)

1. Pressure on the government to raise the value of state welfare benefits including the state pension or out of work benefits to help control poverty

2. High inflation can cause real GDP growth to slowdown – this can lead to lower tax revenues & the government then having to borrow more money

3. High inflation can lead to increased market interest rates making government borrowing more expensive when they issue new bonds

4. High relative inflation can lead to a worsening of international competitiveness causing a fall in exports which can then threaten jobs and GDP growth

Benefits of high inflation to the gov (A03+)

Higher inflation can lead to fiscal drag – this happens when people’s wages / incomes are rising in nominal terms which causes them to pay more in direct and indirect taxation

High inflation can cause a reduction in the real value of the government’s existing / outstanding debt

The real interest rate on borrowing money might be negative if the nominal yield (on a government bond) is less than the rate of inflation

Moderate positive inflation helps businesses to make higher profits – this generates more tax revenues for the government via corporation tax and increased VAT payments

Economic problems associated with high inflation

Cuts in real wages / real incomes: This can be a problem for people on fixed incomes or jobs with low trade union membership as well as for savers. Real interest rates often negative when inflation rises.

Redistribution of income and wealth: People who hold cash or fixed-income assets lose out, while people who have assets that rise in value with inflation can benefit. Relative poverty increases.

Uncertainty and impact on investment: High & volatile inflation make it difficult for businesses to plan. Commercial banks will raise interest rates on loans making it more expensive to borrow.

why high relative inflstion is costly

Can lead to a loss of price competitiveness for exporters – causing a slowdown or fall in export demand leading to weaker AD + negative effects for the trade balance, employment and capital investment.

High relative inflation can cause exchange rate volatility – perhaps leading to a currency depreciation which then increases import prices and lowers real living standards. Also makes it more expensive for the government to borrow.

Why inflation can have regressive effects

Spending patterns: Low-income households spend a larger proportion of income on food, housing, and transportation each of which has a low PED. They are more vulnerable to the effects of fast-rising prices as we have seen in 2021-2023

Real wage cuts - high inflation can lead to job losses and real wage stagnation. This can make it more difficult for low-income households to make ends meet. Their limited savings are hit by high inflation, and they are exposed to higher interest rates on unsecured credit.

Wage-price spiral

A wage price spiral is a situation where workers bid for higher wages because they have seen their real income eroded by fast-rising prices.

This can lead to a further burst of cost-push inflation in an economy.

How can a wage spiral develop

A wage-price spiral is more likely when an increase in the actual cost of living leads to

A wage-price spiral is more likely when an increase in the actual cost of living leads to people raising their own expectations of inflation. Expectations of the future can drive behaviour today. The Central Bank is concerned to keep inflation expectations under control to help meet their inflation target.

Policies to help control demand-pull inflation

Increases in interest rates and a tightening of the supply of credit (interest rates are going up)

Contractionary fiscal policy – higher taxes and cuts in state spending

Policies to help control cost-push inflation

1. Supply-side policies to increase productivity

2. Labour market reforms to increase labour supply

Eg. Nationalise transport allowing trains to be more efficient and workers can get into London easliy (my example not tutor2u)

Supply side policies to help control inflation (normally long run but can be short run)

Expansion of the worker-visa programme to encourage more skilled workers into the UK from the EU and beyond

Policies to encourage increased house-building to address chronic shortages and rent inflation

Investment in human capital to improve labour productivity and lower unit labour costs

Investment tax allowances to drive investment in and scale of renewable energy and gas storage

Infrastructure investment to help lower business costs in the long run (improved transport networks, telecoms)

3 reasons why high interest rates (ceterus parabus) will lead to disinflation in the uk economy

Appreciation of the exchange rate via an inflow of hot money – makes imports cheaper (direct impact on CPI)

Slower growth of aggregate demand helps eliminate a positive output gap – less demand-pull inflation

Wage inflation - Reduced consumer borrowing and spending may cause the labour market to soften – fall in job vacancies / perhaps leading to weaker wage growth

How higher interest rates control demand-pull inflation

Increase in interest rates is a contractionary of monetary policy

Should, in theory, lead to slower growth of aggregate demand

Helps to control demand-pull inflation by closing the output gap

Can also lead to a stronger exchange rate (less imports,less exports: less mony lesaving the country,leading to stronger exchange)

This leads to a drop in the prices (costs) of imports

How higher direct taxes control inflation

•Increase in direct tax is a deflationary fiscal policy

•Higher taxes cause a drop in household disposable income

•Consumers see a drop in their spending power

•This feeds through to weaker aggregate demand

•Which in turn, causes a fall in demand-pull inflationary pressure

Paragrpah structure:

How higher interest rates control inflation

Higher interest rates | Impact on AD & exchange rate | UK base rates have risen to 5.25% | Risks causing a recession |

Paragraph structure:

How lower indirect taxes reduce inflation:

Lower indirect taxes | Reduces supply costs for business | VAT currently 20% - fall to 15% | Will suppliers pass on the cut in tax? |

Paragraph structure:

How Subsidizng energy bill reduce inflation

Subsidizing energy bills | Designed to offset high global prices | Energy price guarantee of £2.5K | Short-term and very expensive |

Paragraph structure:

How an increase in energy bills reduces inflation

Increase in direct taxes | Cuts real disposable income | Tax allowance frozen until 2028 | Real disposable incomes are hit |

Reasons why inflation is so hard to control

Global Economic Factors: Fluctuations in global commodity prices, exchange rates, and international trade can affect the cost of imports and, consequently, domestic prices.

Supply-Side Shocks: Supply-side factors, such as natural disasters, geopolitical conflicts, or supply chain disruptions, can lead to sudden and unexpected increases in production costs.

Built-In Inflation: In countries with a history of high inflation, there may be built-in inflationary expectations. Workers may demand higher wages to keep up with expected price increases, and businesses may increase prices in anticipation of rising costs. This wage-price spiral can be self-reinforcing and challenging to break.

Monetary Policy Lag: The impact of higher interest rates, may not be felt immediately. There can be a lag between the time a policy change is implemented and when it affects the economy. Household spending may be resistant to changes in interest rates.

Demand side causes of deflation

Demand side causes of deflation:

• Deep fall in AD causing a recession

• Large negative output gap – high level of spare supply capacity

Supply side causes of deflation

Supply side causes of deflation:

Improved labour productivity

Technological advances

Significant fall in money wages

Strong (rising) exchange rate causing import prices to fall

Deflation diagram

draw

Economic cost of deflation (A03-)

Falling wages – businesses need to cut their costs to maintain profits – they may decide to reduce jobs

Real value of debt goes up – makes it harder to repay that debt (including mortgages & government bonds)

Consumers might hold back their spending – expecting price falls – lower C leads to fall in AD

Investment may slump (fall in C) & diversion overseas

Real interest rate on debt / savings will rise

Example: Nominal interest on loan = 2%

Inflation = -2%, real interest rate = 2% - (-) 2% = +4%

Economic opportunities of deflation A03+

Fall in general prices - might increase real incomes of poorer families (perhaps due to strong currency)

Rise in demand for “value products” – business must offer value for money (shrinkflation)

Asset prices falling can improve housing affordability – important for first time buyers

Asset price deflation

When the valuations of assets such as bonds, housing and equities fall over a sustained period. This often happens at the end of a financial bubble.

Economic impact of deflation (point)

Real interest rates rise

Real level of debt rises

Pressure for lower wages

Declining business profits

Rise in cyclical unemployment

Improved price competitiveness

Overview of the impact of price deflation (explain)

Overview of the impact:(therefore...,which means that....);

Holding back on spending: Consumers may postpone demand if they expect prices to fall

Debts increase: Real value of debt rises with deflation - can be a drag on consumer confidence

Real cost of borrowing increases: Real interest rates will rise if nominal rates of interest do not fall in line with prices.

Lower profit margins: Lower prices can mean reduced revenues & profits for businesses - this can then lead to higher unemployment as firms seek to reduce costs by shedding labour. Also can negotiate reduced wages

Confidence and saving: Falling asset prices such as price deflation in the housing market hits personal sector wealth and confidence

Income distribution: Deflation leads to a redistribution of income from debtors to creditors – but debtors may default on loans

Deflation can make exporters more competitive eventually – but this often comes at a cost such as. higher unemployment and weaker economic growth in the short term

Economic policies to avoid price deflation

ECONOMIC POLICIES TO AVOID PRICE DEFLATION:

Low interest rates and quantitative easing

In some countries, policy interest rates have become negative (Switzerland)

Expanding the supply of credit in banking system

QE used by many central banks including BoE and European Central Bank

Fiscal stimulus measures

Higher government spending (capital infrastructure projects) (multiplier effect)

A rise in government borrowing to inject demand into the circular flow

Lower direct taxes to increase disposable income and spending

Other measures to stimulate aggregate demand

Attempts to lower the value of the exchange rate (perhaps via central bank intervention to sell their own currency in the FO REX market)

Higher taxes on savings to encourage consumption of goods and services

How changes in world commodity prices affect domestic inflation.

Globalization has increased the interconnectedness of economies, and when commodity prices increase from a strong dollar, this typically results in domestic deflation. While commodity prices are not 100% indicative of inflation, they can be a good starting point when attempting to hedge against inflation.

world commodity prices definiton

the average prices at which they enter into foreign trade among the countries of the world

Commodities are raw materials used to manufacture consumer products. They are inputs in the production of other goods and services, rather than finished goods sold to consumers.

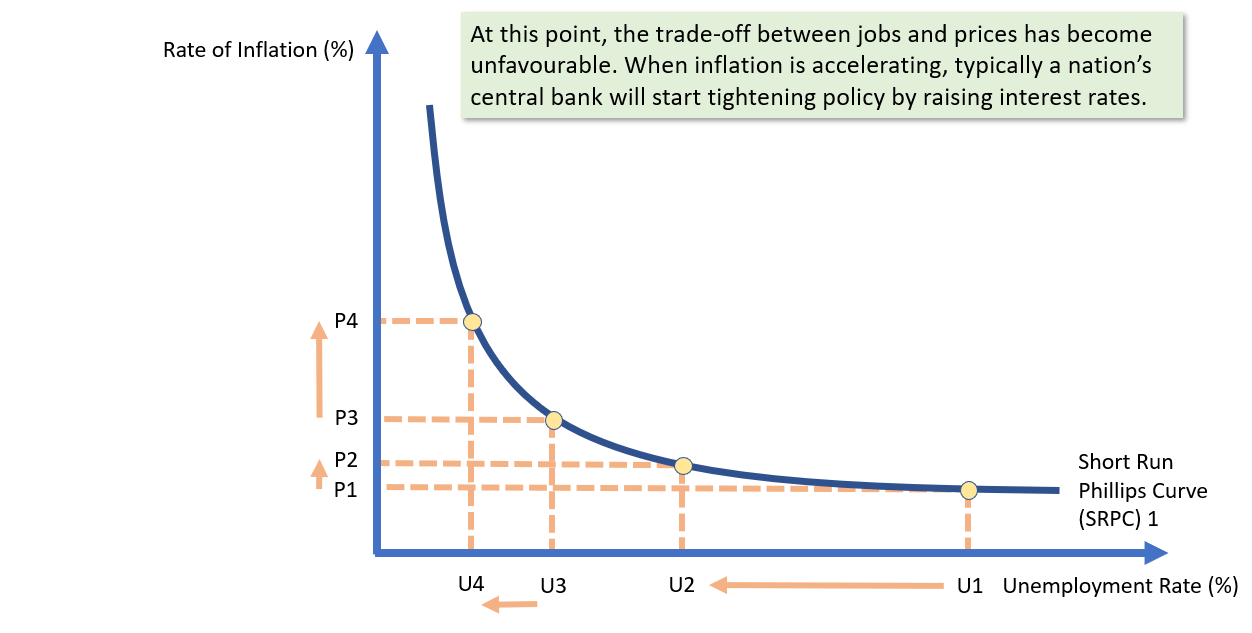

Phillips curve

draw it

With high unemployment, inflationary pressures tend to be weak

There is a negative output gap

High unemployment tilts the balance of wage negotiating power in the labour market towards employers

Real spending power is depressed leading to reduced AD

When unemployment is low, there is upward pressure on wages and prices as firms compete for workers. As a result, the rate of inflation might increase.

Falling unemployment and strong economic growth (productivity) can lead to shortages of components and other inputs leading to a rise in cost-push inflation

quantitavive easing

. It is a form of expansionary monetary policy and has been used as a technique to stimulate aggregate demand at a time when nominal interest rates have fallen to historically low levels.