PTT 6/3 12/02 Australias international trade

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

Tariff definition

a tariff is a tax on imported goods, designed to increase the price of imports to allow domestic producers to compete with imports

Subsidy definition

a payment to domestic producers who compete against imports and instead of making imports more expensive (tariff) , they aid the domestic producer and lowers their cost allowing them to compete

Quota definition

a set restriction on the amount of imports for a particular good that can enter a country, a quota can be a set number or even zero, for example a country can set a quota of zero for dairy imports into the country

WHy is there a DWL on a tarriff

the loss to consumers outweighs the gain to producers and tax revenue

name consumer and producer before and after also dwl

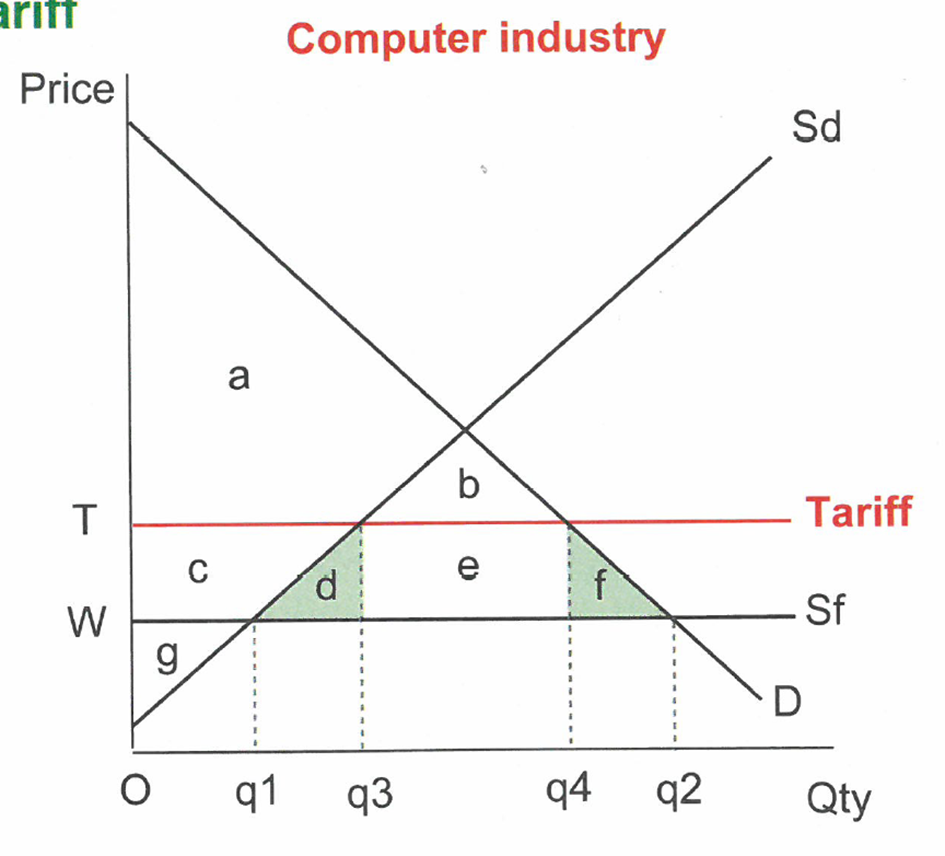

before cs=abcdef ps=g after cs=ab ps=cg tariff=e DWL=d + f

How to calc imports after and before

Q

Trade

P + Q’s, price change , quantity change - producers and consumers, import change

market efficiency

letters, consumer and producer surplus, tax revenue, total surplus (always say the before and after), producer surplus increases for G to CG bc the price they receive increases from Pw to PT and they sell more Q1 to Q3

Macroeconomy

economic growth, unemployment, price level/inflation increase, national income decrease leads to consumption decrease (decrease in GDP) leads to living standards decrease, the industry the tariff is based on wins