Econ207 finals

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

risk aversion

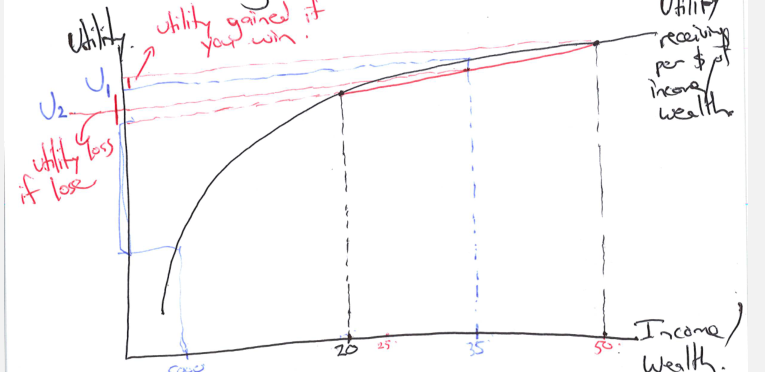

tendency to refuse fair gamble because a loss will decrease utility more than a gain increases utility.

fair gamble

a gamble where the expected value is zero, an equal chance of winning and losing.

expected value formula

p1 × x1 + p2 × x2

expected value

average outcome for a game

how to find the utility given from a gamble

find the expected payout, the average payout of the gamble, and calculate the utility from there

finding the utility on a graph

straight line between the two possibilities, where it cuts the expected value is the utility

Asymetric information

one party has an information advantage, they know things the other doesn’t

Adverse selection

underinformed party enters a deal that favors the informed party, without the knowledge of the underinformed party

Moral hazard

one of the parties changes behaviour as a result of entering a contract

a person speeding because they have their car insured is an example of what?

example of moral hazard

an insurance company entering into a contract with someone who is likely to die soon is

an example of adverse selection

a company not having info about the skill level of an employee is

an example of asymetric info.

flexiblity

prevents a decision from being tied to a single choice, as it can be adjusted based on the future

fair insurance

premium of the insurance is the same as the expected loss

what price is a person Willing to pay up to for insurance

until its equal to the utility of the expected income without insurance

searching cost

the cost to find information or a deal to make a transaction

transaction costs

costs incurred when a party sells something, such as searching, admin or advertising

pooling equilibrium

signals from a group are all similar, so they are all treated the same. the effort of employees is hard to tell, so they are all paid the same

seperating equilbrium

members of a group have different signals so they are treated differently. employees send signals of effort, and those who work harder are payed more.

why do firms exist

to reduce transaction and searching costs, improving effciency and allowing for more transactions to take place

what happens if transaction costs are too high

the transaction doesn’t get done and is avoided instead

naive signal

signal that costs the same to everyone

weak signal

inaccurate signal, different cost to different types

signals

conveys accurate information, different costs for different types

4 ways to reduce risk

insurance, diversifcation, information, flexibility

transaction costs

costs of a business deal, both finacial and non financial

General equilbrium

prices and quantites for multiple markets are decided at once

parital equilbrium

equilbrium for a single market is found and the other prices are taken as given

abatements

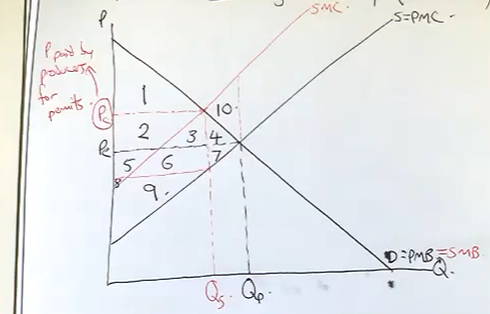

reductions to harmful externalities, and the incentives for doing so

command and control

using laws and standards to effect economic activity, over using market activity.

input tax

taxes on the harmful inputs used in making a good, creates incentive to decrease the harmful inputs

cap and trade

caps amounts of outputs at the socially beneficial quantity, and trades the permits for making outputs using harmful inputs.

pareto equilbrium

a point where no one actor can be made better off, without diminishing the outcome of another.

second welfare theorem

any particular parteo optimal outcome can be achieved by a lump sum redistrobution, and letting the market take over

first welfare theorem

market tends towards a pareto optimal outcome when it has perfect information, price taking behaviour, no externalities and non satiation

lump sum redistrobution

single payment to an effected party, eg benefits or settlements to iwi

how does the second welfare theorem suggest that inequalities should be addressed?

lump sum redistrobution to move the society to a pareto equilbrium that is more equal

framing effect

changing the choices of an actor, by reframing the same choice in 2 different ways

what does behavioral economics indicate about decision making

people will make ineffcient choices because biases, self control issues

what is discounting, behavioural economics

a bias that places greater value on things avalible now, rather than in the future

what are some examples of nudging

setting the preferred, rational option as the default, or adding a useless, inferior option to make another look better

how can classical models account for a persons concern for others

adding the utility of others into their utility curve.

what are the defining characteristics of public goods

non-excludable, non-rival

non-excludble

people can’t be stopped from using the good

non-rival

one person consuming the good doesn’t stop others from consuming the good, more than one person can benefit

for a public good, what does the p represent in a demand curve

represents the willingness to pay, given the benefit. they cant be made to pay because its non-excludble.

solving for p on a demand curve for a public good gives what?

the marginal benefit at the given quantity

how to find the marginal social benefit in the public good scenario

add the demand curves for all of the consumers, giving the total benefit

when finding the optimal quantity for public goods, what do you do when exceeding one of the consumers marginal benefit

ignore them and find the marginal benefit for the other consumer

when the permits for a cap and trade have to be paid for, what line do consumers produce along?

along the SMC curve, because its an extra cost above their private costs.

how does diversifcation decrease risk

reduces probablity of the largest possible losses by spreading risk over more options

why is the utility over income function curved

to show the diminishing marginal utility of income, as extra income from a dollar decreases as wealth increases

diffrerence between signalling and screening devices

signalling shows others what your qualities are, a screening device is applied to others to figure out what their qualities are.

what view did the māori have over land ownership

no one person held rights to the land, it was used for the benefit of the group.

what type of utility to income do you have if you are risk averse

diminsihing utility to income, less utility per dollar of income as income increases

fair premium

insurance premium is the same as expected loss * probablity of the loss or the amount you lose from inital wealth to expected wealth

What concept did Māori use instead of land ownership

Guardianship of the land and resource, being tanagata whenua, or people of the land

Māori worldview was based on connection to what?

based on connection to the land

what view did the Europeans have on land

people can have rights and ownership over the land, stemming from background of royalty owning everything.

was their ownership of land in the māori worldview

no, people had relationships and guardianship over the land

why may a government give away a cap and trade permit rather than charging

political reasons.

difference between input and output taxes on a graph

input shifts the supply line, showing higher costs, output doenst change supply line but limits where the supply is

how does a businesses climate and consumption graph differ to a persons

steeper to give more consumption and less enviromental quality, because the companies benefit from the greater consumption.

what is needed for the first welfare theorem to hold

Perfect information, price taking behaviour, non sasitanon and no externalities.

how did asymetric info effect the Māori land sales

Māori did not have information on the transaction costs

if someone is risk neutral, what are they only interested in

the expected value of the gamble

prospect theory

people are more sensitive to a decline in wealth than they are to increases, would rather gamble to avoid a loss, over guaranteed loss