Addendum CH 2 & 3 Derivatives (DONE)

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

69 Terms

Futures Contracts

Available on a wide range of assets

Exchange traded

Specifications need to be defined:

What can be delivered,

Where it can be delivered, &

When it can be delivered

Settled daily

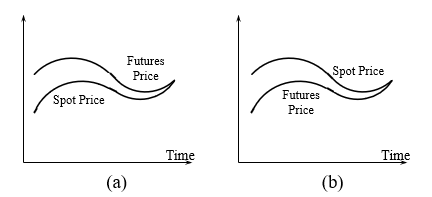

Convergence of Futures to Spot (Figure 2.1)

Margins

A margin is cash or marketable securities deposited by an investor with his or her broker

The balance in the margin account is adjusted to reflect daily settlement

Margins minimize the possibility of a loss through a default on a contract

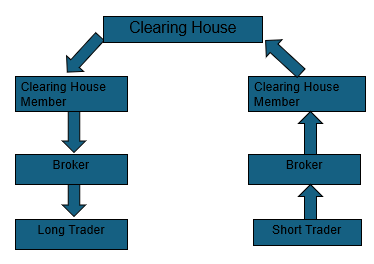

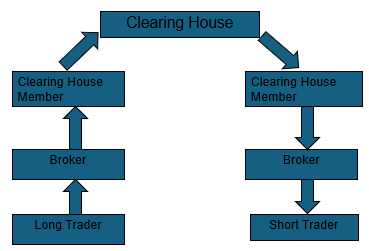

Margin Cash Flows

A retail trader has to bring the balance in the margin account up to the initial margin when it falls below the maintenance margin level

A member of the exchange clearing house only has an initial margin and is required to maintain the balance in its account at that level every day.

These daily margin cash flows are referred to as variation margin

A member of the exchange is also required to contribute to a default fund

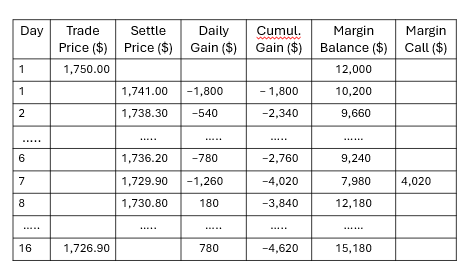

Example of a Futures Trade

A retail trader takes a long position in 2 December gold futures contracts on June 5

contract size is 100 oz.

futures price is US$1,750

initial margin requirement is US$6,000/contract (US$12,000 in total)

maintenance margin is US$4,500/contract (US$9,000 in total)

A Possible Outcome (Table 2.1)

Margin Cash Flows When Futures Price Increases

Margin Cash Flows When Futures Price Decreases

Some Terminology

Open interest: the total number of contracts outstanding

equal to number of long positions or number of short positions

Settlement price: the price just before the final bell each day

used for the daily settlement process

Volume of trading: the number of trades in one day

___________: the total number of contracts outstanding

equal to number of long positions or number of short positions

Open interest

___________: the price just before the final bell each day

used for the daily settlement process

Settlement price

______________: the number of trades in one day

Volume of trading

Key Points About Futures

They are settled daily

Closing out a futures position involves entering into an offsetting trade

Most contracts are closed out before maturity

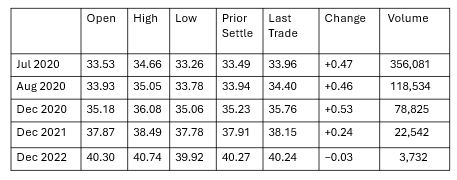

Crude Oil Trading on May 21, 2020 (Table 2.2)

Delivery

If a futures contract is not closed out before maturity, it is usually settled by delivering the assets underlying the contract. When there are alternatives about what is delivered, where it is delivered, and when it is delivered, the party with the short position chooses.

A few contracts (for example, those on stock indices and Eurodollars) are settled in cash

Questions

When a new trade is completed what are the possible effects on the open interest?

Can the volume of trading in a day be greater than the open interest?

Types of Orders

Orders entered to buy or sell commodity futures contracts are all entered to buy or sell a specific number of contracts in the stated contract month.

Investors can enter various types of orders to buy or sell futures. Some orders guarantee that the investor's order will be executed immediately.

Other types of orders may state a specific price or condition under which the investor wants their order to be executed.

All orders are considered day orders unless otherwise specified. All day orders will be canceled at the end of the trading day if they are not executed.

An investor may also specify that their order remain active until canceled. This type of order is known as good ‘til cancel or GTC.

Types of Orders

Limit

Stop-loss

Stop-limit

Market-if touched

Discretionary

Time of day

Open

Fill or kill

A market order will guarantee that the investor's order is executed as soon as the order is presented to the market. A market order to either buy or sell guarantees the execution, but not the price at which the order will be executed.

When a market order is presented for execution, the market for the contract may be very different from the market that was displayed when the order was entered. As a result, the investor does not know the exact price at which their order will be executed.

An investor may enter a market order to purchase crude oil such as:

Buy 3 June crude oil MKT

An investor who has entered the above order to purchase 3 June crude oil contracts at the market does not know what price he will pay for the contracts when the order reaches the market.

A _______________ will guarantee that the investor's order is executed as soon as the order is presented to the market. A market order to either buy or sell guarantees the execution, but not the price at which the order will be executed.

market order

A buy limit order sets the maximum price that the investor will pay for the futures contract. The order may never be executed at a price higher than the investor's limit price. While a buy limit order guarantees that the investor will not pay over a certain price, it does not guarantee an execution.

If the futures contract continues to trade higher away from the investor's limit price, the investor will not purchase the futures contract and may miss a chance to realize a profit from establishing a long position or may have to pay more for the contract when offsetting a short position.

An investor who wants to purchase corn may enter a limit order to purchase corn as follows:

Buy 2 December corn @1.40

The investor wants to purchase 2 December corn contracts at a maximum price of 1.40. If the market for December corn is above 1.40 when the order reaches the market, the order will only be executed if the futures contract trades down to the investor's limit price of 1.40, otherwise the order will not be executed.

A ______________ sets the maximum price that the investor will pay for the futures contract. The order may never be executed at a price higher than the investor's limit price. While a buy limit order guarantees that the investor will not pay over a certain price, it does not guarantee an execution.

buy limit order

A sell limit order sets the minimum price that the investor will accept for the futures contract. The order may never be executed at a price lower than the investor's limit price. While a sell limit order guarantees that the investor will not receive less than a certain price, it does not guarantee an execution.

If the futures contract continues to trade lower away from the investor's limit price, the investor will not sell the futures contract and may miss a chance to realize a profit from establishing a short position or may receive less for the contract when offsetting a long position.

An investor who wants to sell wheat may enter a limit order as follows:

Sell 5 September wheat 1.52

The investor wants to sell 5 September wheat contracts at a minimum price of 1.52. If the market for September wheat is below 1.52 when the order reaches the market, the order will only be executed if the futures contract trades up to the investor's limit price of 1.52, otherwise the order will not be executed.

A ______________ sets the minimum price that the investor will accept for the futures contract. The order may never be executed at a price lower than the investor's limit price. While a sell limit order guarantees that the investor will not receive less than a certain price, it does not guarantee an execution.

sell limit order

A stop order or stop loss order can be used by investors to limit or guard against a loss, or to protect a profit. A stop order will be placed away from the market in case the futures contract starts to move against the investor. A stop order is not a live order; it has to be elected.

A stop order is elected and becomes a live order when the futures contract trades at or through the stop price. The stop price is also known as the trigger price. Once the futures contract has traded at or through the stop price, the order becomes a market order to either buy or sell the futures contract depending on the type of order that was placed.

Stop orders for futures contracts may be elected without a trade taking place. A sell stop order may also be elected if the futures contract is offered at or through the stop price. A buy stop order may also be elected if the futures contract is bid at or through the stop price.

A __________________________ can be used by investors to limit or guard against a loss, or to protect a profit. A stop order will be placed away from the market in case the futures contract starts to move against the investor. A stop order is not a live order; it has to be elected.

stop order or stop loss order

A buy stop order is placed above the market and is used to protect against a loss or to protect a profit on a short sale of futures contracts. A buy stop order could also be used by a technical analyst to get long the futures contract after the futures contract breaks through resistance.

An investor has sold 10 June crude oil futures contracts at 81.25 to establish a short position. The June contract for crude oil has declined to 80.05. The investor is concerned that if the contract goes higher than 80.15 it may return to 81 very quickly.

To protect their profit, they enter an order to buy 10 June crude oil contracts at 80.20 stop. If crude trades at or through 80.20 the order will become a market order to buy 10 contracts, and the investor will cover their short and by offsetting their short position at the next available price.

The order in this case would be entered as follows: Buy 10 June crude oil @ 80.20 stop

A ______________ is placed above the market and is used to protect against a loss or to protect a profit on a short sale of futures contracts. A buy stop order could also be used by a technical analyst to get long the futures contract after the futures contract breaks through resistance.

buy stop order

A sell stop order is placed below the market and is used to protect against a loss or to protect a profit on the purchase of a futures contract. A sell stop order could also be used by a technical analyst to get short the futures contract after the futures contract breaks through support.

An investor has purchased 10 May silver futures contracts at 15.50. The contract has risen to 17.10. The investor is concerned that if May silver falls below 17 it may return to 16 very quickly. To protect their profit they enter an order to sell 10 May silver at 16.90 stop. If May silver trades at or through 16.90, the order will become a market order to sell 10 May futures contracts and the investor will sell the futures contracts and offset their long position at the next available price. The order in this case would be entered as follows: Sell 10 May silver at 16.90 stop

A ________________ is placed below the market and is used to protect against a loss or to protect a profit on the purchase of a futures contract. A sell stop order could also be used by a technical analyst to get short the futures contract after the futures contract breaks through support.

sell stop order

If in the same example the order to sell 10 May silver contracts at 16.90 stop was entered GTC, we could have a situation such as the following.

May silver closes at 17.40. The following morning the Federal Reserve Board announces that it plans to increase interest rates and to tighten the money supply, causing the U.S. dollar to rally sharply. As result, all the metals are indicated to open sharply lower. May silver opens at 16.45. The opening print of 16.45 elected the order and the futures contract would be sold on the opening or as close to the opening as practical.

An investor would enter a stop limit order for the same reasons they would enter a stop order. The only difference is that once the order has been elected the order becomes a limit order instead of a market order. The same risks that apply to traditional limit orders apply to stop limit orders.

If the futures contract continues to trade away from the investor's limit, they could give back all of their profits or suffer large losses. The investor in the above silver contracts could have entered the stop order as a stop limit order as follows: Sell 10 May silver at 16.90 stop 16.85 limit. GTC

In this case, the investor is saying that they want to sell the contracts if May silver trades down to 16.90, but in no case will they accept less than 16.85. In the situation where silver gapped down in price on the open after the Federal Reserve's announcement, the investor would have had their stop order elected on the opening print of 16.45.

However, their order would not be executed, and it would be a limit order to sell May silver at 16.85. If silver continues to trade lower, the market will be further away from the investor's limit order, and the investor could suffer large losses as a result.

Other Types of Orders

All or none (AON)

Immediate or cancel (IOC)

Fill or kill (FOK)

Not held (NH)

Disregard the tape (DRT)

Market on open/market on close (MOO/MOC) Limit or market on close

Market if touched

One order cancels the other

Cancels former order

Switch order

Scale order

Basis order

Exchange-for-physical order

Bunched order

Give-up order

___________________: May be entered as day orders or GTC. All-or-none orders, as the name implies, indicate that the investor wants to buy or sell all of the futures or none of them. AON orders are not displayed in the market because of the required special handling, and the investor will not accept a partial execution.

All-or-none orders

________________________: The investor wants to buy or sell as many futures contracts as they can immediately, and whatever contracts cannot be filled are canceled.

Immediate-or-cancel orders

_______________: The investor wants the entire order executed immediately and all contracts covered in the order must be bought or sold. If all contracts in the order cannot be executed, the entire order is canceled.

Fill-or-kill orders

_____________________________________: The investor gives discretion to the floor broker as to the time and price of execution. All retail not-held orders given to a representative are considered day orders unless the order is received in writing from the customer and entered GTC.

Not-held orders or disregard tape (NH/DRT)

Market on open: The investor wants their order executed on the opening of the market or as reasonably close to the opening as practical. The exchange sets an opening time range that is considered to be the open of the trading day.

All orders executed during this time will be considered to have been executed on the open. If the order is not executed during this time, it is canceled. Limit orders and partial executions are allowed for these orders. A market on open would be noted as follows: Buy 2 June crude market opening only

In this case the broker will buy 2 June crude contracts at whatever price is available during the opening range of the market.

A limit on open would be noted as follows: Buy 2 June crude at 81.20 opening only

In this case the broker will buy 2 June crude contracts only if a price of 81.20 or better is available during the opening range of the market. If the order cannot be executed it will be canceled at the expiration of the market-on-open period.

_________________: The investor wants their order executed on the opening of the market or as reasonably close to the opening as practical. The exchange sets an opening time range that is considered to be the open of the trading day.

Market on open

Market on close: The investor wants their order executed on the closing of the market or as reasonably close to the close as practical. The exchange sets a closing time range that is considered to be the close of the trading day.

All orders executed during this time will be considered to have been executed on the close. If the order is not executed during this time, it is canceled. Limit orders and partial executions are allowed for these orders. A market on close would be noted as follows: Sell 2 June crude market closing only

In this case the broker will sell 2 June crude contracts at whatever price is available during the closing range of the market.

A limit on close would be noted as follows: Sell 2 June crude at 81.50 closing only

In this case the broker will sell 2 June crude contracts only if a price of 81.50 or better is available during the closing range of the market. If the order cannot be executed it will be canceled at the expiration of the market on closing period.

______________: The investor wants their order executed on the closing of the market or as reasonably close to the close as practical. The exchange sets a closing time range that is considered to be the close of the trading day.

Market on close

Limit or market on close: With this type of order the investor wants their order executed during the trading session at their limit price or better. However, if the order has not been executed during the trading session the investor wants the order to turn into a market order to purchase or sell the contracts on the closing of the market or as reasonably close to the close as practical during the closing time range set by the exchange. A limit or market on close order would be entered as follows: Sell 10 May silver at 17.10 or market on close

In the above order the investor wants to sell the 10 May silver contracts at a price of 17.10 or better, but if they have not been sold at that price during the trading day the investor wants the 10 contracts sold at the market on the close of trading.

______________________: With this type of order the investor wants their order executed during the trading session at their limit price or better. However, if the order has not been executed during the trading session the investor wants the order to turn into a market order to purchase or sell the contracts on the closing of the market or as reasonably close to the close as practical during the closing time range set by the exchange. A limit or market on close order would be entered as follows: Sell 10 May silver at 17.10 or market on close

Limit or market on close

Regulation of Futures

In the US, the regulation of futures markets is primarily the responsibility of the Commodity Futures and Trading Commission (CFTC)

Regulators try to protect the public interest and prevent questionable trading practices

Accounting & Tax

Ideally hedging profits (losses) should be recognized at the same time as the losses (profits) on the item being hedged

Ideally profits and losses from speculation should be recognized on a mark-to-market basis

Roughly speaking, this is what the accounting and tax treatment of futures in the U.S. and many other countries attempt to achieve

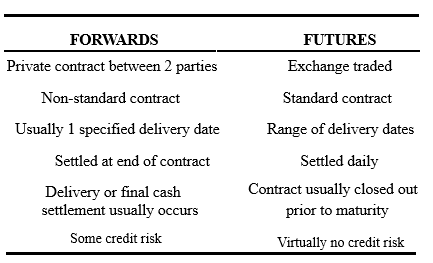

Forward Contracts vs Futures Contracts (Table 2.3)

Foreign Exchange Quotes

Futures exchange rates are quoted as the number of USD per unit of the foreign currency

Forward exchange rates are quoted in the same way as spot exchange rates. This means that GBP, EUR, AUD, and NZD are quoted as USD per unit of foreign currency. Other currencies (e.g., CAD and JPY) are quoted as units of the foreign currency per USD.

Long & Short Hedges

A long futures hedge is appropriate when you know you will purchase an asset in the future and want to lock in the price

A short futures hedge is appropriate when you know you will sell an asset in the future and want to lock in the price

Arguments in Favor of Hedging

Companies should focus on the main business they are in and take steps to minimize risks arising from interest rates, exchange rates, and other market variables

Arguments against Hedging

Shareholders are usually well diversified and can make their own hedging decisions

It may increase risk to hedge when competitors do not

Explaining a situation where there is a loss on the hedge and a gain on the underlying can be difficult

Basis Risk

Basis is usually defined as the spot price minus the futures price

Basis risk arises because of the uncertainty about the basis when the hedge is closed out

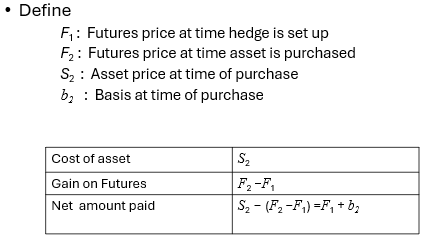

Long Hedge for Purchase of an Asset

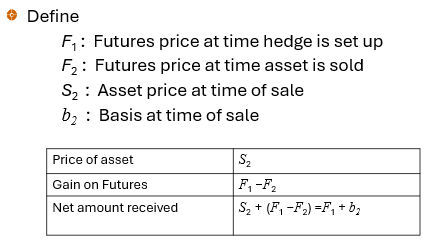

Short Hedge for Sale of an Asset

Choice of Contract

Choose a delivery month that is as close as possible to, but later than, the end of the life of the hedge

When there is no futures contract on the asset being hedged, choose the contract whose futures price is most highly correlated with the asset price. This is known as cross hedging.

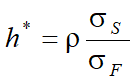

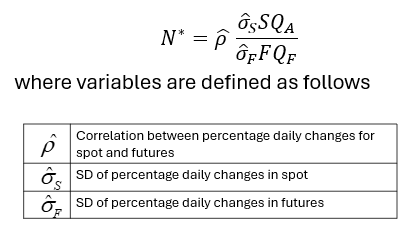

Optimal Hedge Ratio (equation 3.1)

Ignoring daily settlement of futures (or assuming forwards are used) , the proportion of the exposure that should optimally be hedged is

where

σS is the standard deviation of ΔS, the change in the spot price during the hedging period,

σF is the standard deviation of ΔF, the change in the futures price during the hedging period

ρ is the coefficient of correlation between ΔS and ΔF.

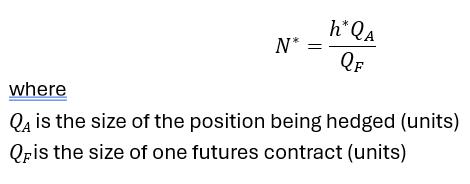

Optimal Number of Contracts (equation 3.2)

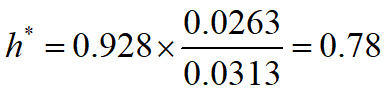

Example (Example 3.3)

Airline will purchase 2 million gallons of jet fuel in one month and hedges using heating oil futures

From historical data σF =0.0313, σS =0.0263, and ρ= 0.928

Example continued

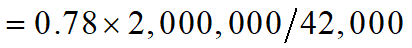

The size of one heating oil contract is 42,000 gallons

Optimal number of contracts is

which rounds to 37

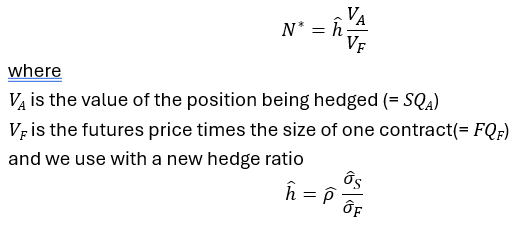

Optimal Number of Contracts When Contract Is Settled Daily

An Alternative Expression for N* when there is daily settlement (equation 3.3)

Daily Settlement

Day to day changes in N* are small and often ignored

Tailing the hedge involves dividing N* by one plus the amount of interest that will be earned over the remaining life of the hedge

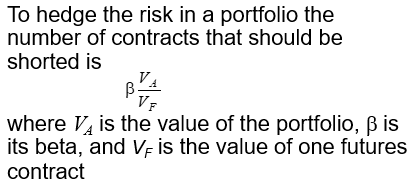

Hedging Using Index Futures

(equation 3.4)

Example

Index futures price is 1,000

Value of Portfolio is $5 million

Beta of portfolio is 1.5

What position in futures contracts on the index is necessary to hedge the portfolio?

Changing Beta

What position is necessary to reduce the beta of the portfolio to 0.75?

What position is necessary to increase the beta of the portfolio to 2.0?

Why Hedge Equity Returns

May want to be out of the market for a while. Hedging avoids the costs of selling and repurchasing the portfolio

Suppose stocks in your portfolio have an average beta of 1.0, but you feel they have been chosen well and will outperform the market in both good and bad times. Hedging ensures that the return you earn is the risk-free return plus the excess return of your portfolio over the market.

Stack and Roll

We can roll futures contracts forward to hedge future exposures

Initially we enter into futures contracts to hedge exposures up to a time horizon

Just before maturity we close them out an replace them with new contract reflect the new exposure

etc

Liquidity Issues (Business Snapshot 3.2)

In any hedging situation there is a danger that losses will be realized on the hedge while the gains on the underlying exposure are unrealized

This can create liquidity problems

Liquidity Issues (Business Snapshot 3.2)

(Example)

One example is Metallgesellschaft which sold long term fixed-price contracts on heating oil and gasoline and hedged using stack and roll

In 1993, the company lost 1.3 billion dollars suffering from flawed long hedge strategy in near term futures contracts that was meant to protect against forward sales commitments.

A fall in spot prices forced margin calls for the company and the contracts were closed at a loss. Subsequently, the spot price increased, and the company suffered even greater losses covering its customer commitments.