Pitch Deck

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

9 Terms

Opening Slide

Imagine bringing the quality of Oxbridge tutoring to students not just in the UK, but all over the world.

We’re building the future of education by combining high-quality Oxbridge tutors with our AI trained specifically on GCSE content

Tutoring works — but it's expensive, unequal, and hard to scale. Our mission is to make elite learning accessible to every student, not just the privileged few.

Our hybrid model improves learning outcomes and reduces human cost, and on average, helps students improve by 2–3 grades.

Between us, we’ve tutored for nearly twenty years and know how powerful great teaching can be. Now we’re using technology to deliver it at scale.

We’re revenue-positive, with 150 active students and over 500 handpicked tutors from Oxford and Cambridge. We’ve raised £1.5 million to build this, and I’m going to tell you what we did with that money — and we’re just getting started.

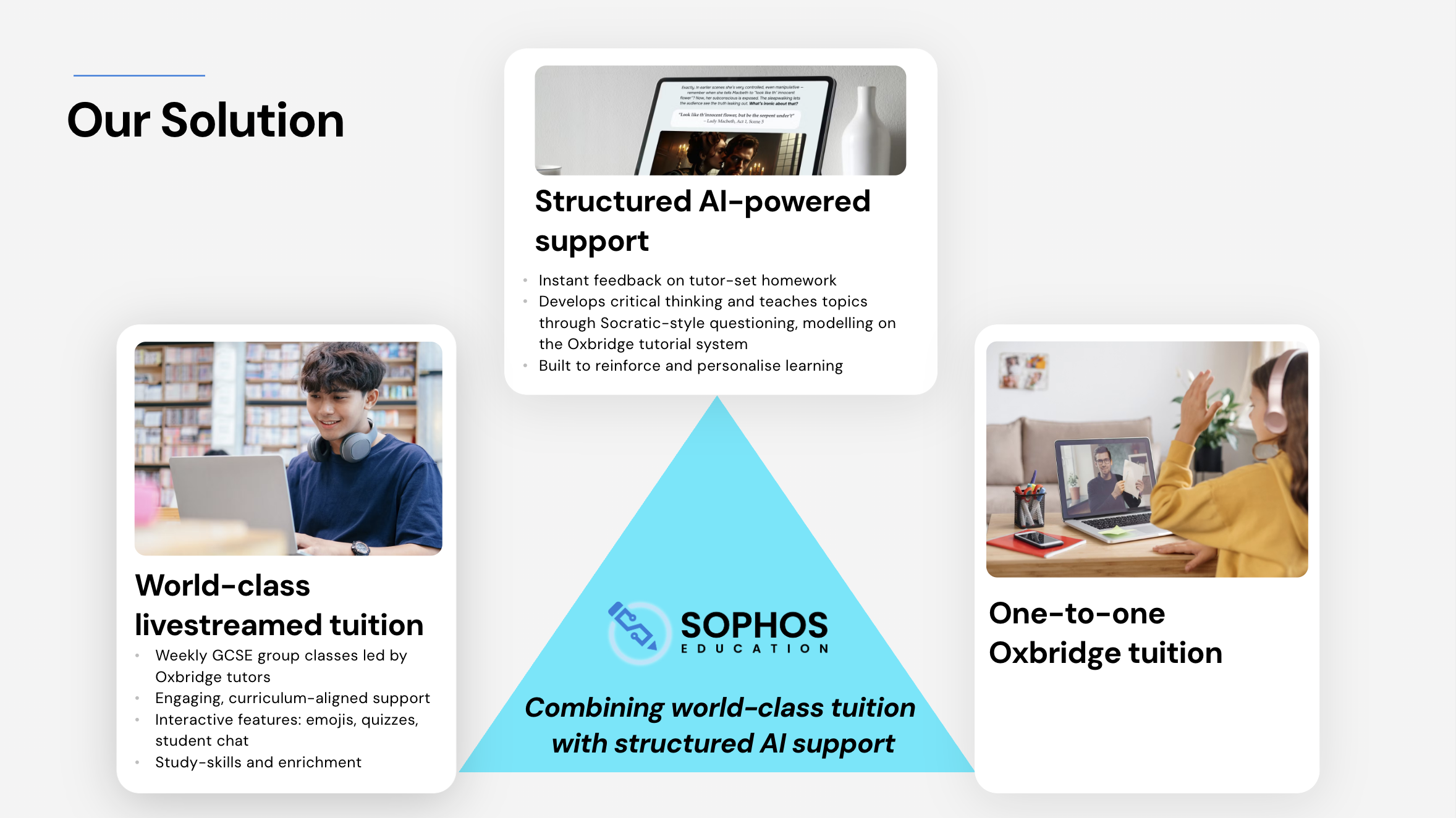

Our Solution

And we’re already doing it: We are going to deliver a profitable business in that arena, because we’ve already built a platform that brings the two together and it’s already working.

To date we have raised our first pre-seed round of 1.5M, which has allowed us to develop our AI technology, inclusive of

Plus build a live tutoring platform that had 3,500 tutor applications from Cambridge and Oxford, which we handpicked the best 500 using our bespoke and rigorous interview process.

We are now revenue positive, reaching 20k per month at a 38% growth rate with a 89.9% retention rate, our students are increasing by an average of 2 grades.

We’ve also built a brand of highest quality and a high touch personalised experience - one that is obsessed with the customer experience. We know all our students and parents by name, and we’re now sitting down with each student personally to truly understand what the modern student requires,

Our deep understanding of student needs also led us to create an entirely new lesson type not yet addressed in the private tutoring market: exam and revision skills. We realised students weren’t being taught how to revise, and many simply didn’t know where to begin. So we built structured lessons to close that gap, which became sellable as stand-alone lessons at a premium price. Not to mention building a Director of Studies package to suit the highest price point.

Today, we’re looking to raise £3M to launch a more accessible and scalable version of our product — a new shape that we believe the market is ready for. We will come back to the raise and use of proceeds later.

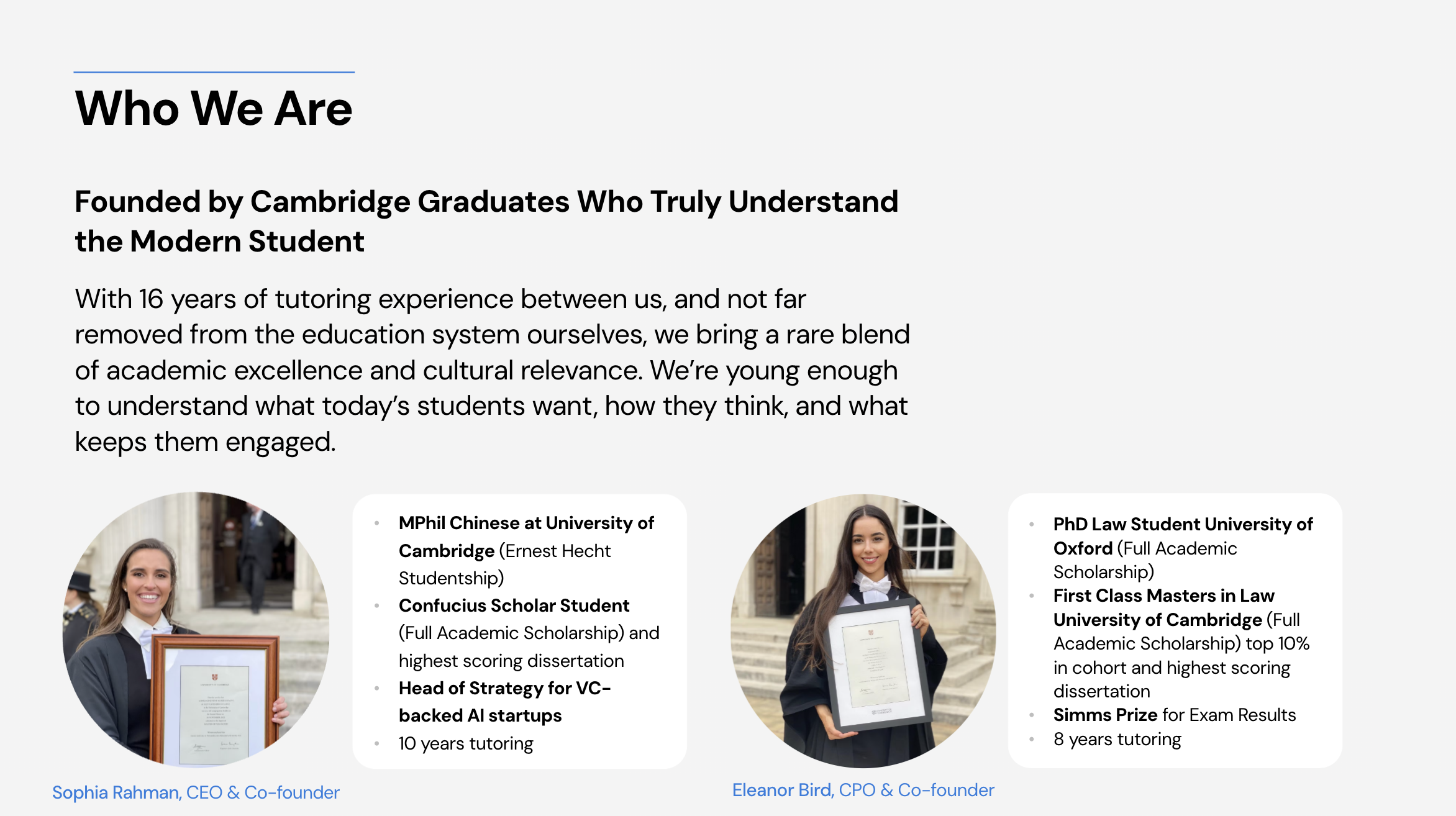

Who We Are

So, who are we and why are we the right team to build this?

What’s unique about our founding team is that we span all three sides of the ecosystem.

We’re young enough to relate to students and to meet them on their level, which is why we can create something they actually would want to use.

We’ve walked in tutors’ shoes, we know the struggles and pain points of being a tutor. Which is why 3,500 of the UK’s top academic tutors applied to work with us, without a formal recruitment push.

And we’ve earned deep trust from parents, many of whom see us as more than a platform, but a real support system for them and their children.

Then looking at our team:

Tech Team

Our AI + Tech Team is currently outsourced with plans to bring key roles in-house next year

Fractional CFO/Advisor

AJ Rahman Is our strategic advisor and fractional CFO his background is X, he is supporting our finance strategy until the point where we’d need a full-time CFO

Board

We’re in the process of formalising our board as we raise this next round. Sophia and I will act as Directors, AJ our Chairman and Ron our lead investor in the last round and has X years of experience growing an Energy and Oil company will act as X

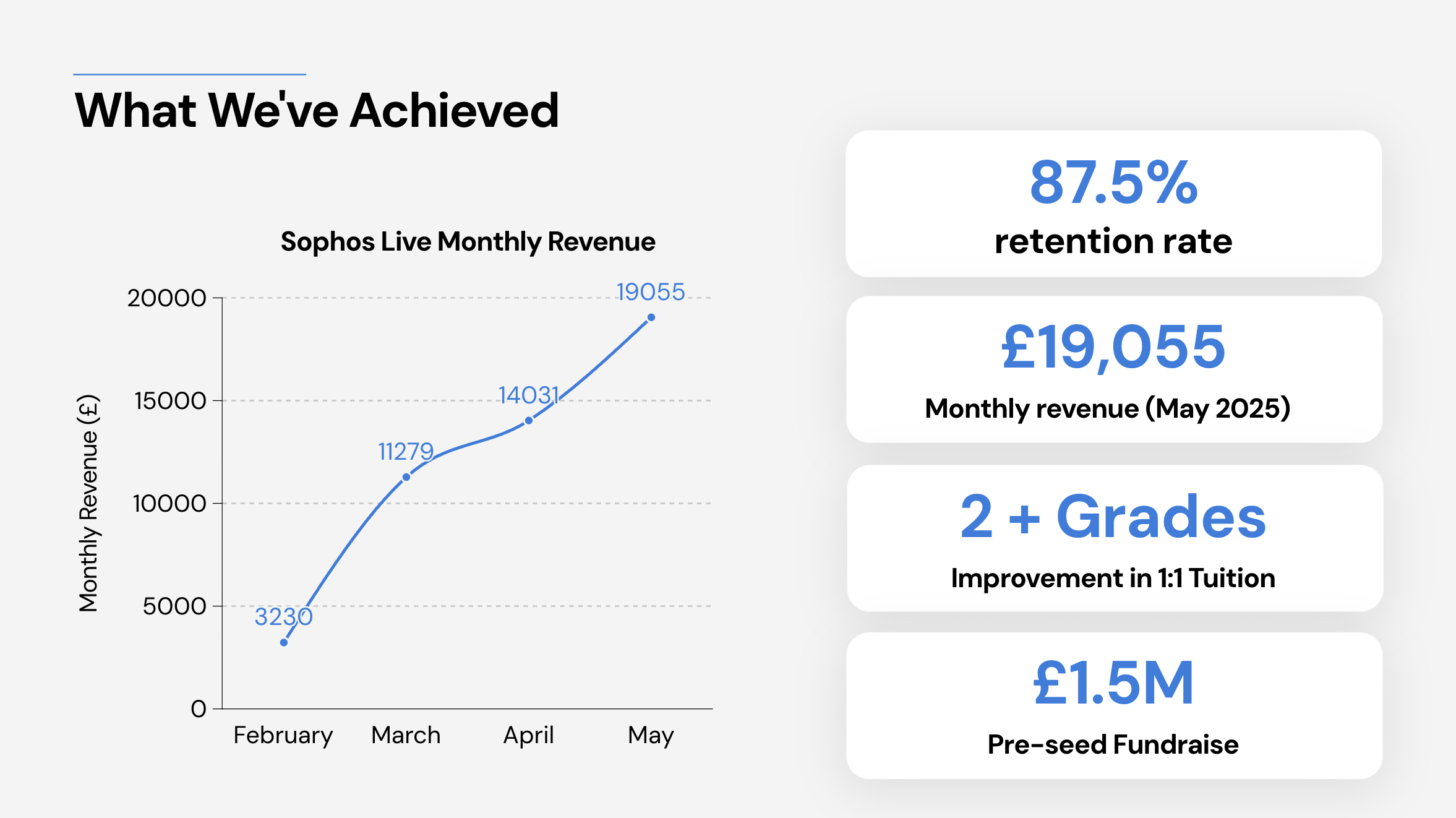

What We Have Achieved

Consistent, high-growth revenue: We've scaled monthly revenue from £3.2k in February to over £19k in May—a 6x increase in just four months.

Strong retention: 87.5% of students continue month-over-month, demonstrating real product-market fit and satisfaction.

Clear academic impact: Students using our 1:1 tuition improve by over 2 grades on average, a key value proposition for parents and learners.

Efficient funnel: Much of this growth is organic or referral-driven—indicating trust, word-of-mouth, and high satisfaction.

Ready to scale: This traction was achieved pre-platform. With the dedicated product launch, we expect conversion, retention, and margin to improve further.

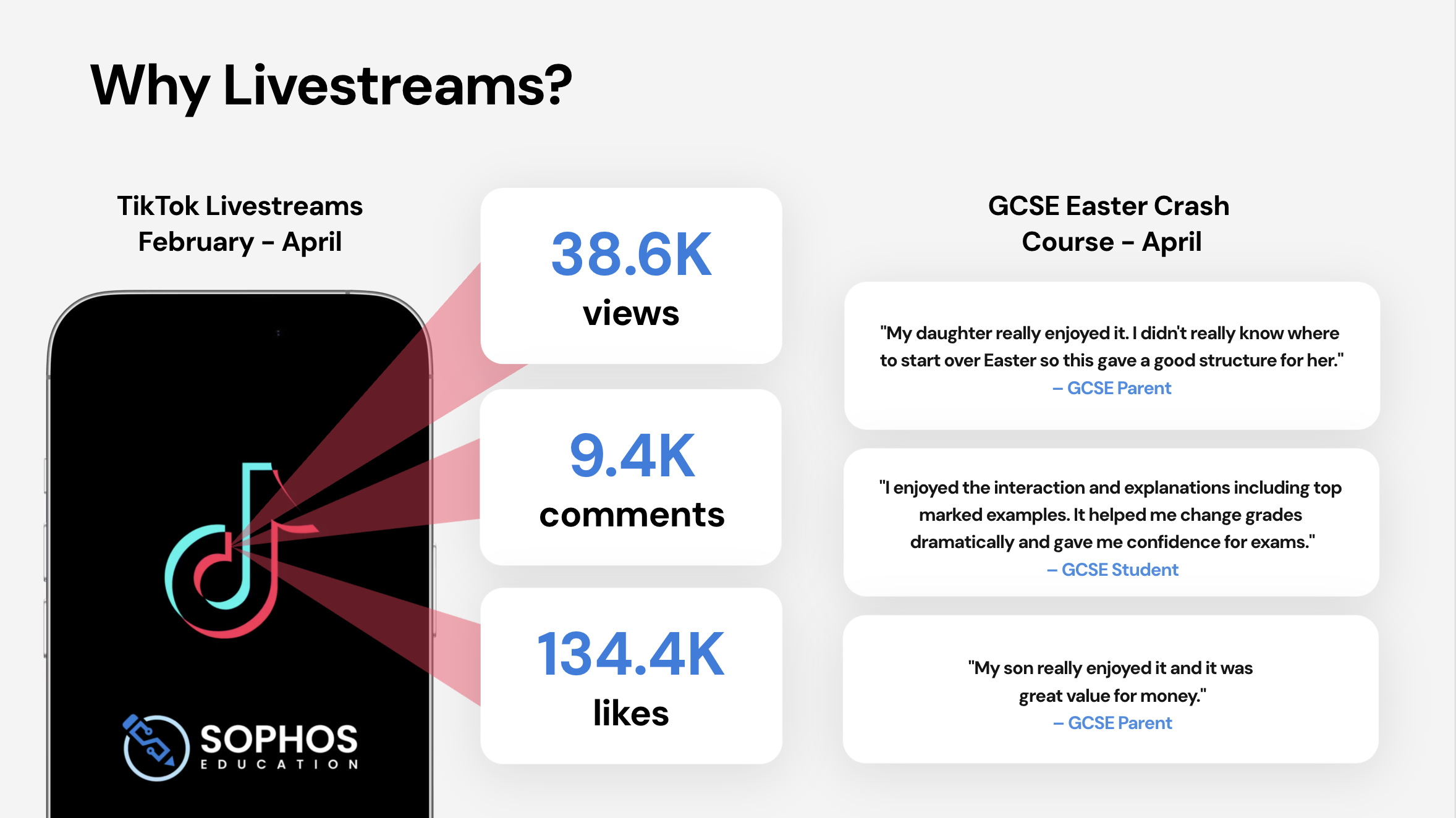

Why Livestreams?

Here’s a snapshot of why livestreams have become such a powerful part of our education strategy.

On the left, you can see the traction we’ve had on TikTok between February and April — nearly 39,000 views, over 9,000 comments, and 134,000 likes. These numbers reflect not just reach, but engagement. Students aren’t just watching — they’re interacting, asking questions, and sharing.

And this isn’t just vanity metrics. On the right, we’ve pulled out real testimonials from parents and students after our GCSE Easter Crash Course.

So the message here is clear: livestreams work. They provide structure, interactivity, and accessibility — all of which are critical for helping students succeed.

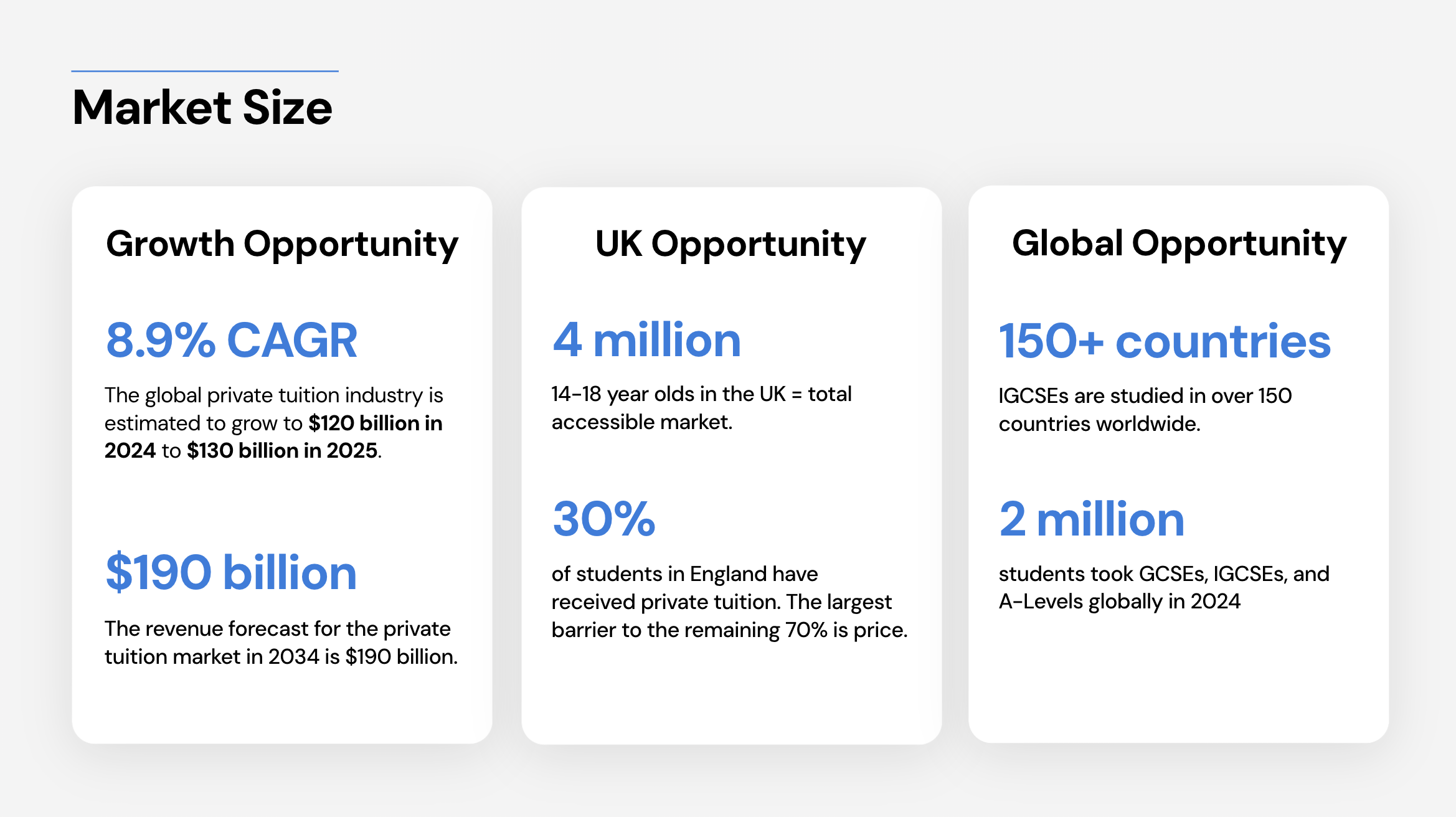

Market Size

Let’s talk about the market.

The global private tuition industry is growing fast at a 8.9% CAGR and is expected to hit $130 billion by next year, rising to $190 billion by 2034.

In the UK alone, there are 4 million students aged 14–18. That’s our core addressable market.

Right now, 30% of those students have received private tuition, and the biggest reason the other 70% haven’t? Price. That’s exactly the problem we’re solving. We’ve already tested this with two crash courses priced at just £10, and nearly 1 in 2 parents who signed up weren’t paying for private tuition before. That’s proof that price is the barrier, and we’re converting a whole new market segment. When collecting feedback regarding the price point, the common consensus was appreciation for the low price point.

And the opportunity goes beyond the UK. IGCSEs are taught in over 150 countries, and 2 million students sat GCSEs, IGCSEs, or A-Levels globally in 2024.

This is a massive, fast-growing global market.

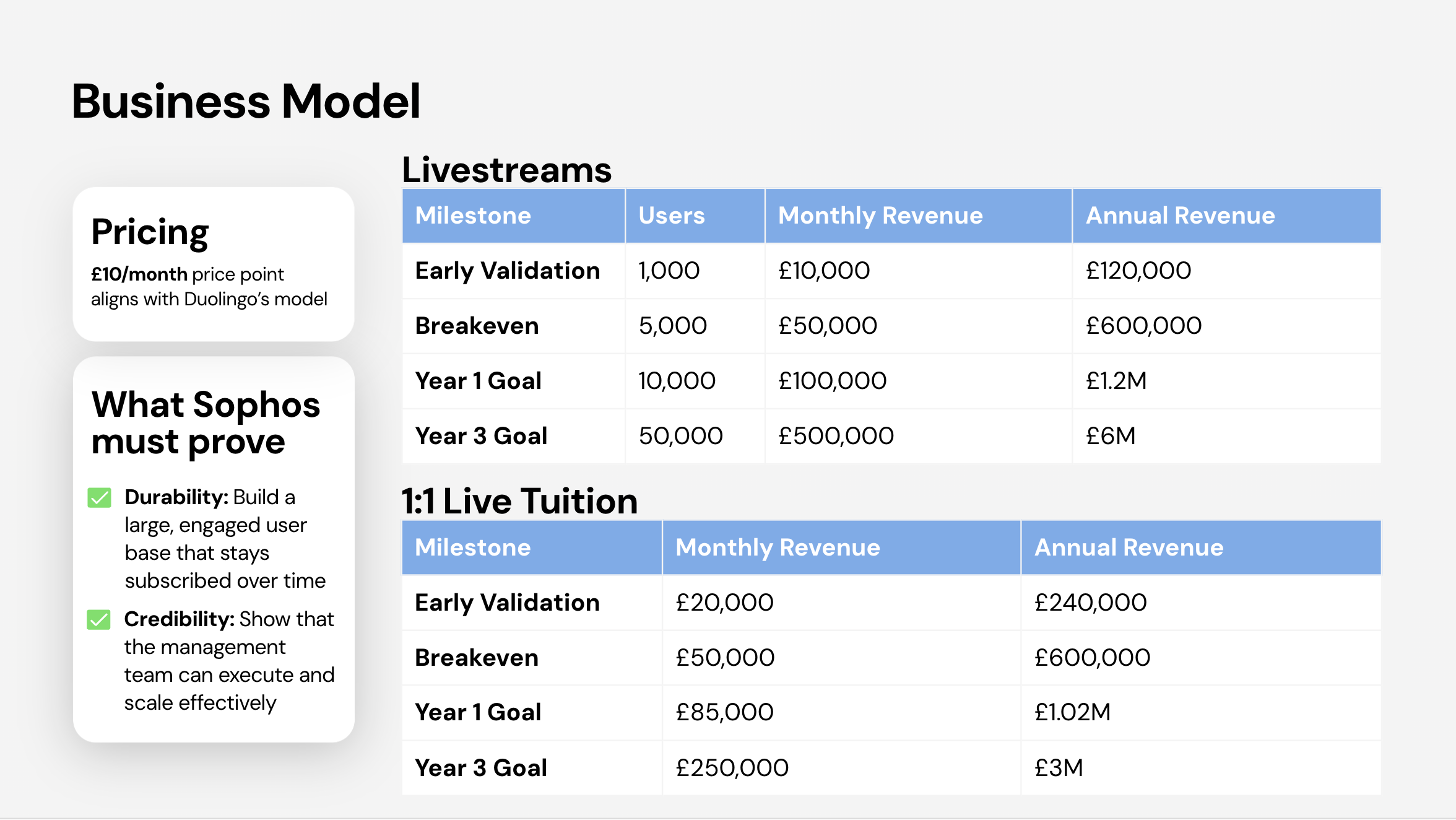

Business Model

Livestreams:

We operate on a £10/month subscription model, inspired by Duolingo’s low-friction price point.

Our first major milestone is getting 1,000 paying users, proving willingness to pay for crash courses.

Our breakeven point is 5,000 subscribers — a realistic target given the strong retention and exam season demand.

By Year 3, we aim for 50,000 subscribers, generating £6M ARR — built on scale, retention, and exam-season acquisition.

1:1 Live Tuition:

A high-margin offering with £60/hr pricing — our current May revenue of £19k/month already validates demand.

We’ve defined £50k/month as our breakeven for this vertical.

Based on our current growth rate, we forecast £85k/month within 12 months, and £250k/month by Year 3 — translating to a £3M ARR business line.

What Sophos must prove:

Durability: Our ability to keep users paying over time — driven by outcomes and engagement.

Credibility: That this team can scale efficiently, hitting both user and revenue milestones with disciplined execution.

Our Long-Term Strategy

Stage 1: We started in 2023 by building the technology, developing our AI systems specifically on GCSE content and testing our delivery model. We have over 3,500 AI-powered video lessons, a sophisticated marking bot that breaks down assessment objectives on the GCSE syllabus, a private tuition company that is revenue positive and allows us to know our users and what they need, and also have already tested our livestreams. That first £1.5M raise enabled us to get real traction: 150 active students, strong retention, and tangible learning gains.

Stage 2 Where we’re at now: With this £3M raise we’re building a scalable, fee-paying customer base. The goal here is to prove the business model works at scale. We're delivering high-quality tutoring at just £10/month, which is real affordability at volume. And it’s already converting students who weren’t in tutoring before.

Stage 3: As we scale, we’re not just acquiring customers, we’re building a rich, high-impact dataset on how students learn best, inclusive of:

Where students struggle

What explanations they respond well to

How top tutors teach

Which styles unlock progress fastest

Freemium model

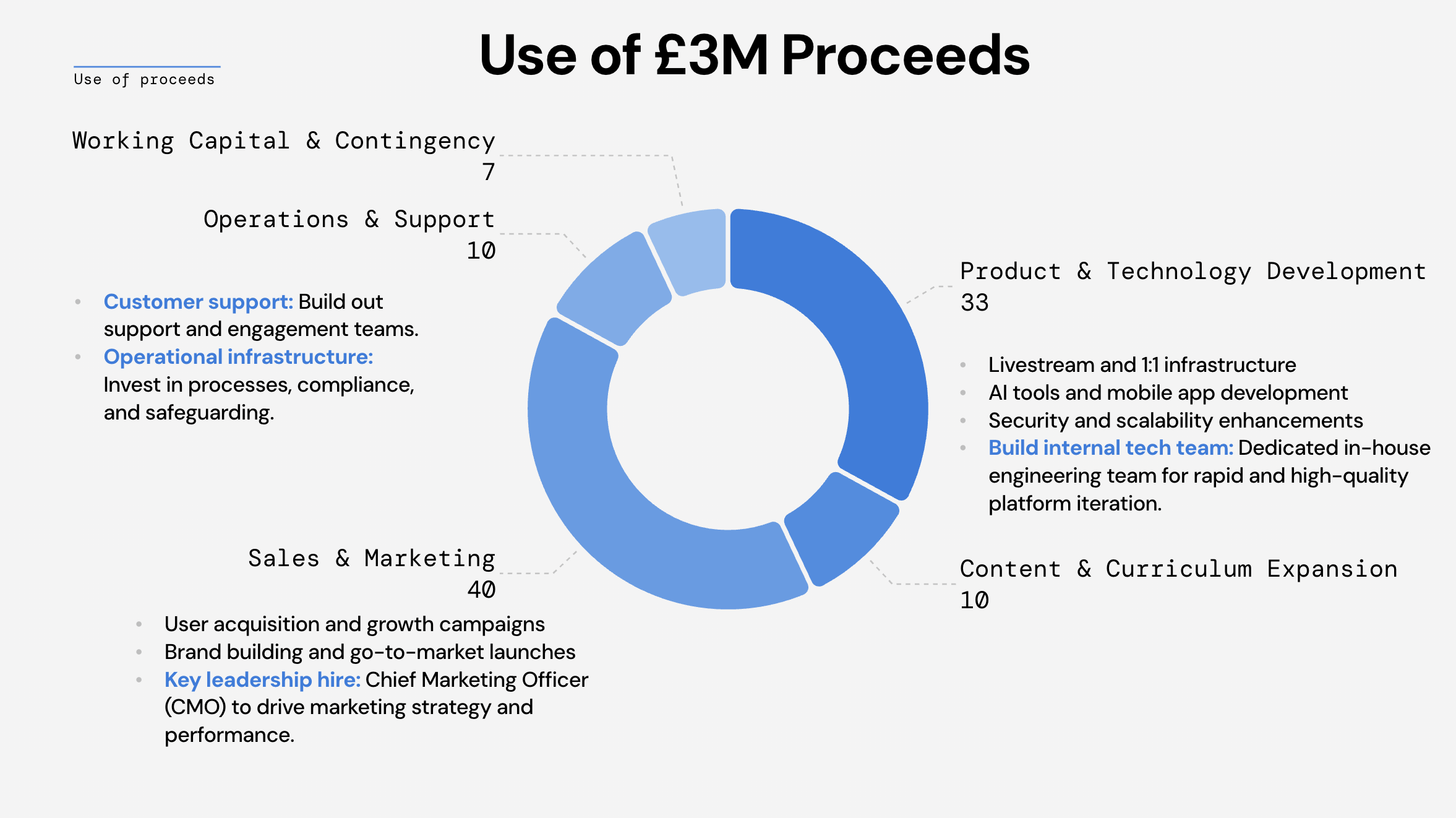

Use of Proceeds

We’re raising £3 million at a £31.5M pre-money valuation

40% will go towards Sales and Marketing this is where we unlock our next stage of customer acquisition. We’ll drive growth campaigns, accelerate our brand presence, and make a key leadership hire: a Chief Marketing Officer who can take our go-to-market strategy to the next level.

33% will go into Product and Technology Development. That means improving our livestream and 1:1 infrastructure, accelerating mobile app development, and building AI tools to increase automation and impact — all while ensuring security and scalability. Most importantly, we’ll build an internal tech team so we can iterate faster and with higher quality.

10% is allocated to Content and Curriculum Expansion, so we can keep growing our GCSE subject offering and maintain the standard of quality that’s become our signature.

Another 10% goes to Operations and Support. That’s customer support, safeguarding, compliance — everything needed to deliver a high-touch experience at scale.

And finally, 7% is reserved for Working Capital and Contingency.

This is a disciplined raise to get us to the next stage, where we’ll have the data, customer base and traction to be in a powerful position for a potential next fundraise and beyond.