2. Equity Value and Enterprise Value Overview

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

What is Equity Value?

How much is this company worth to equity investors?

Equity value is the same thing as market capitalization (share price * total number of shares?

What can it be compared to in terms of selling a house?

Equity value can be compared to the “sticker price of a house”

But what if they leave furniture, unfixed repairs, or unpaid bills?

What is Enterprise Value?

Enterprise value shows the value to all investors/the entire firm

Enterprise value = Equity Value + Net Debt (Debt, Debt-Like Items and Other Obligations – Cash, Cash-Like Items, and Anything That Saves Us Money)

What is Enterprise Value (Formula with everything)?

Enterprise Value = Equity Value + Debt + Convertible Bonds + Preferred Stock + Noncontrolling Interests + Unfunded Pension Obligations + Capital Leases + Restructuring / Environmental Liabilities – Cash & Cash-Equivalents - Short-Term/Long-Term/Equity Investments - Net Operating Losses (NOLs)

What are dilutive securities?

A security is “dilutive” if it can potentially create more shares.

Call options → Employees can pay the company money (the exercise price) and receive new shares in return.

What are in-the-money and out-of-the-money options?

If stock price = $10 and option exercise price = $5 → in-the-money (profitable to exercise).

If stock price = $10 and option exercise price = $15 → out-of-the-money (cannot be exercised yet).

Employees may wait to exercise if they

expect the share price to rise

or if they are restricted by vesting periods.

Why does dilution matter?

Diluted shares matter because they affect equity value and the true cost to acquire a company.

Potential for adding shares

What is the treasury stock method?

You assume that the new shares get created when options are exercised, and that the company then buys back some of those new shares with the funds it receives

Simple Example

Share price = $10

100 options with $5 exercise price

Options exercised → company receives $500

Company buys back $500 / $10 = 50 shares

Net dilution = 100 new shares – 50 repurchased = 50 additional shares

Which Securities Are Dilutive and what method should you use?

Options, warrants, convertible bonds, convertible preferred stock, Restricted stock units (RSUs), and performance shares

Options & Warrants

use TSM

Convertible bonds and preferred stock

treat as either debt or shares (convert fully, no TSM)

Restricted Stock Units (RSUs)

These are a straight addition – there are no exercise prices or conversion prices to worry about.

Performance Shares:

If the stock price is above a certain level, they count as additional shares; otherwise, they count as nothing.

Why Calculate Diluted Equity Value?

To understand the true cost to acquire a company.

What happens with dilutive securities in an acquisition?

in-the-money options usually get cashed out

convertibles get converted or bought out

buyer must pay for these

Therefore, diluted equity value is more realistic than basic equity value when determining Enterprise Value and estimating what the company truly costs to buy.

When do you subtract an item for EQ to EV?

Subtract when the item saves you money or could give you extra cash, now or later.

What are items you subtract?

Cash, short term investments, long term investments, equity investments (associate), and net operating losses (NOLs)

Why subtract cash?

This saves you cash right away because it’s yours once you buy the company; technically you should only subtract excess cash (i.e. the amount over the minimum they need to operate) but normally you subtract the entire amount.

Why subtract Short-Term, Long-Term, and Equity Investments?

You could sell these investments in the future and get extra cash, so sometimes they’re also subtracted – depending on how liquid they are.

Why subtract Net Operating Losses?

These could potentially save you cash as future tax deductions, so sometimes they are factored in

What are NOLs?

NOLs, or Net Operating Losses, are losses a company incurs when its tax-deductible expenses exceed its taxable income. They can be carried forward to offset future taxable income, which reduces cash taxes and increases future free cash flow. In valuation, NOLs matter because they create a tax shield, so you look at how long it takes to use them up and adjust projected taxes accordingly.

When Do You Add an Item for EQ to EV?

1) When it represents something that must be paid immediately upon acquiring the company (e.g. Debt)

2) When it’s something that must be repaid in the future, but wouldn’t come from the company’s normal cash flows (e.g. Unfunded Pension Obligations)

3) When you’re adding it back for comparability purposes (e.g. Noncontrolling Interests).

What are items you add to debt?

Debt and Preferred Stock (normally require immediate repayment in an acquisition scenario)

Unfunded pension obligations, capital leases, and restructuring/environmental liabilities (get added because they must be repaid in the future,but wouldn’t necessarily come from the company’s normal cash flows)

Noncontrolling Interests (you add back for

comparability purposes)

Why do you add Debt?

acquirer usually pays it off at closing.

Why do you add Preferred Stock?

It’s similar to Debt because of the required dividends, which act as interest expense; also, normally it must also be repaid upon acquisition.

Why do you add Unfunded Pension Obligations?

big for certain industries; buyer must cover unfunded portion.

What are unfunded pension liabilities?

Unfunded pension liabilities represent the gap between what a company has promised to pay employees in future pension benefits and the assets it has set aside to fund those payments. If the liabilities exceed the assets, the plan is underfunded.

Why add capital leases?

These are “Debt-like items” and sometimes you have to repay these leases in an acquisition; you add them because the funds from ordinary business operations are insufficient to repay these.

Why add Restructuring / Environmental Liabilities

future obligations the company owes that may require external funding.

Why add Noncontrolling interest?

Noncontrolling Interests (Minority Interests) → added so Enterprise Value reflects 100% of a consolidated subsidiary’s value.

What is Noncontrolling Interest?

You add these because when you own over 50% of another company, you consolidate 100% of its financial statements.

But Equity Value only reflects the percentage you own, not 100%.

To reflect 100% of the other company in Enterprise Value, you must add back the noncontrolling interest.

If you don’t add it, EV would only reflect 60%, 70%, or however much you own.

Example of NCI

Your revenue is $100.

You own 70% of another company that has $50 in revenue.

On your statements you show $150 in revenue because you consolidate 100% of the subsidiary.

But Equity Value only reflects the 70% you own.

Therefore, an EV/Revenue multiple would be wrong; you’d be comparing 100% of revenue to only 70% of value.

Adding noncontrolling interests fixes this by including the 30% you do not own in Enterprise Value so EV reflects 100% of value.

When do you use EQ?

If the denominator includes interest income and expense, you use Equity Value

When do you use EV?

If it does not include interest income and expense, you use Enterprise Value

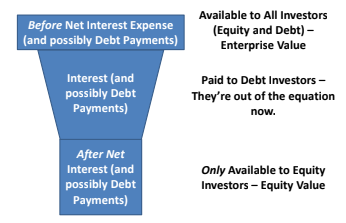

Graph that explains EQ and EV