Diluted Earnings Per Share – Comprehensive Study Notes

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

10 Terms

Handy Hanson Inc. (HHI), a publicly traded company, has a December 31 year end. Select information for the calculation of diluted EPS for the current year is as follows:

Basic EPS is $4.90, with 100,000 shares outstanding throughout the year.

HHI had $3,100,000 in 10% convertible bonds. Each $1,000 bond was issued at par and is convertible into 15 common shares.

HHI had $900,000, 5% cumulative preferred shares.

No dividends were declared or paid in the year.

HHI’s tax rate is 30%.

What is HHI’s diluted EPS for the current year?

Basic EPS is $4.90 and the incremental EPS on the convertible bonds is $4.67 (calculated below). As such, the convertible bonds are dilutive and need to be considered in calculating diluted EPS.

Convertible bonds income effect: $3,100,000 × 10% interest × (1 – 0.3) = $217,000.

Convertible bonds share effect: $3,100,000 / $1,000 × 15 shares = 46,500.

Increment EPS of convertible bonds = $217,000 / 46,500 = $4.67.

Income | Shares | Basic EPS | Provisional EPS | Diluted EPS | |

|---|---|---|---|---|---|

Basic EPS | $490,000 | 100,000 | $4.90 | ||

Convertible bonds | 217,000 | 46,500 | |||

Provisional EPS | $707,000 | 146,500 | $4.83 | $4.83 |

(Choice B) Incorrect. This is the incremental EPS for the convertible bonds only. It must be incorporated into the diluted EPS calculation. Incorrect calculation: [$3,100,000 × 10% interest × (1 – 0.3)] / ($3,100,000 / $1,000 × 15 shares) = $4.67.

(Choice C) Incorrect. This is the basic EPS rather than the diluted EPS.

(Choice D) Incorrect. This is the average of basic EPS and incremental EPS of the convertible bonds. Incorrect calculation: ($4.67 + $4.90) / 2 = $4.79.

Jennifer is the controller for Swatchi Co., a public company, and is calculating the company’s diluted EPS for the year. Jennifer has gathered the following information:

Swatchi has a total of 100,000 common shares outstanding.

On January 1, Swatchi issued 2,000 debentures for $1,000 each that are convertible into a total of 10,000 common shares. The debentures mature in five years, have a coupon rate of 4%, and were issued at par.

The debentures are outstanding at year end.

Swatchi’s tax rate is 30% and its year end is December 31.

What is the incremental EPS of the convertible debentures?

Income impact: (2,000 × $1,000) × 4.0% × (1 – 0.30) = $56,000

Share impact: 10,000

Incremental EPS: $56,000 / 10,000 = $5.60

A company is preparing its calculation of diluted EPS for the year ended December 31, Year 2. On August 1, Year 1, the company issued 30,000 $4 cumulative preferred shares. Each preferred share is convertible into eight common shares. Preferred share dividends of $120,000 were declared before year end but not paid until February 1, Year 3. The company’s tax rate is 25% and it reports under IFRS.

What is the incremental EPS for the preferred shares?

When the preferred shares are converted, the income effect will be equal to 30,000 × $4 = $120,000. The share effect is equal to 30,000 × 8 = 240,000. Incremental EPS is calculated as: $120,000 / 240,000 = $0.50.

On December 31, Year 2, Gillis Inc., an entity subject to IFRS, had 325,000 common shares issued and outstanding. During Year 1, Gillis issued 60,000 options. Each option can be exercised in the future for the purchase of one common share at a price of $35. The average market price of the shares during Year 2 was $48 per share.

How many shares should be used in calculating the diluted EPS as at December 31, Year 2?

The share effect of the options can be calculated as follows: 60,000 number of options issued × ($48 market price – $35 exercise price) / $48 market price = 16,250 shares.

Dwight is calculating the diluted EPS for Fun Paper Co., a Canadian company that reports under IFRS. Which of the following must be disclosed regarding Fun Paper’s EPS?

Weighted average number of shares used in calculating basic and fully diluted EPS

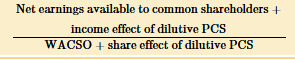

Which of the following is the formula for diluted EPS?

Diluted EPS = (Net income - Preferred dividends) / (Weighted average shares outstanding + Dilutive shares)

Saanich Yogurt Ltd. (SYL) is a publicly traded Canadian company with a year end of December 31. Markus, SYL’s controller, is determining the company’s diluted EPS and has been provided with the following information:

Income before income taxes | $6,000,000 |

Income taxes | $1,800,000 |

Shares outstanding, beginning of year | 1,500,000 |

Shares issued, April 1 | 1,000,000 |

SYL issued $10,000,000 in convertible bonds on October 1 at par, bearing interest at 6%. The bonds are convertible to 1,000,000 common shares. Assume a tax rate of 30%.

Which of the following is the dilutive effect of the convertible bonds for SYL?

Increase the numberrator by $105000 and icnrease the denominator by $250000

The numerator is increased by the pro-rated interest on the bonds less tax: ($10,000,000 × 6% × 0.25) × (1 – 0.30). The denominator increases by the weighted average of the dilutive potential common shares (October to December): (1,000,000 × 0.25).

For the current year ended December 31, Stratus Inc. (SI) had a net income attributable to common shareholders of $25,000. The weighted average number of common shares outstanding and issued at year end was 15,000. Additional information for this year end was as follows:

Basic EPS for the year was $1.67.

SI had $525,000 in 8% convertible bonds issued at par. Each $500 bond is convertible into 20 common shares.

SI had 1,000, $150, 3% cumulative preferred shares outstanding during the year. Each preferred share is convertible into four common shares.

SI had stock options that granted the employees the right to buy 5,000 common shares for $123 per share.

The average market price for the year was $115.

SI is subject to a tax rate of 20%.

SI’s controller is calculating EPS for the current year ended December 31. Which of the following correctly orders each of the above potential common share items from most dilutive to least dilutive? SI reports under IFRS.

This option properly identifies the convertible bond and convertible preferred shares as dilutive because their incremental EPS is less than the basic EPS of $1.67. Also, the convertible preferred shares at $1.13 are more dilutive than the convertible bonds at $1.60. The stock options are anti-dilutive because the average market price is less than exercise price.

Incremental EPS for convertible preferred shares: [(1,000 shares × $150) × 3%] / 4,000 shares = $1.13.

Incremental EPS for convertible bonds = [($525,000 × 8%) × (1 – 20%)] / [($525,000 / $500) × 20 shares)] = $1.60

Huguette is calculating EPS for her employer, Lace Pharmaceuticals Inc. (LPI), a public company. At year end there were 500,000 employee stock options outstanding with an exercise price of $15. The average share price during the year was $20.

What is the share effect of the employee stock options that Huguette must consider when calculating incremental EPS for the options?

$125000.00

The stock options are in the money; therefore, the number of shares to be issued using the treasury stock method is: 500,000 number of shares issued × ($20 market price – $15 exercise price) / $20 market price = 125,000

John, the CFO of Salmon Manufacturing Ltd. (SML), is preparing the company’s financial statements for the year ended December 31, Year 2. As part of this process, John is calculating diluted EPS. John notes that SML has 10,000, $100 cumulative preferred Class A shares that are each entitled to dividends of $2 per year. At the option of the holder, each $100 preferred share can be converted into one common share at any time after January 1, Year 4.

Dividends were declared and paid on the cumulative preferred shares for Year 1 in arrears, and for Year 2.

SML has a corporate tax rate of 30% and reports under IFRS.

What is incremental EPS for the Class A preferred shares?

$2,00

The incremental EPS is calculated as: (10,000 × $2.00) / (10,000 × 1) = $2.00. The shareholders’ entitlement to dividends is used to determine the income effect as the preferred shares are cumulative in nature. Only the current-year entitlement of the cumulative dividend is used in calculating diluted EPS regardless of the total amount declared or paid