Trade and Tariffs

1/29

Earn XP

Description and Tags

Microeconomics Lecture 10

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

Absolute advantage

The ability to produce more of a good or service than a competitor using the same resources

Reminder* The opportunity cost of a good or service is…

what must be given up to acquire it

Comparative advantage

the ability to produce a good at a lower opportunity cost than competitors

True or False? No country can have a comparative advantage in the production of all goods

True

Autarky

a situation where a country does not trade with the world

Specialization

Each country allocates more resources toward producing what they are best at (and has the lowest opportunity cost)

Potential gain from specialization

There is now more of a good produced than when they operated under autarky

Countries/parties should specialize in the good they have ______ ______ in.

comparative advantage

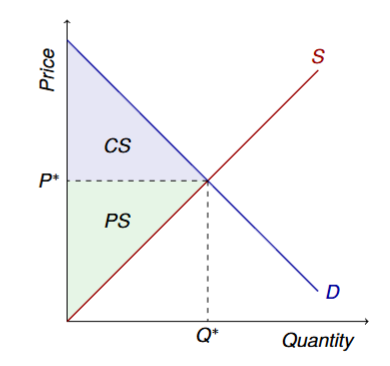

Visual of the market under autarky

Price and quantity would be determined by domestic supply and demand

What is the small country assumption for Pw?

World supply is perfectly elastic at Pw

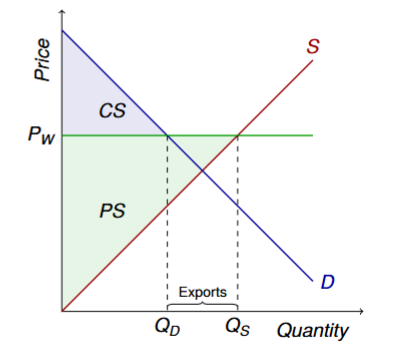

Visual of the market under free trade setting world price above the equilibrium price

Formula for exports

Qs - Qd

What happens to surplus under a market with exports

Higher price benefits domestic sellers (PS ↑)

Higher price hurts domestic buyers (CS ↓)

Total surplus rises

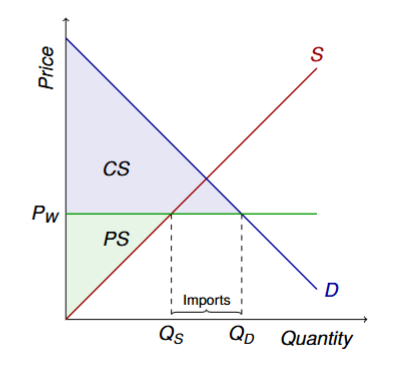

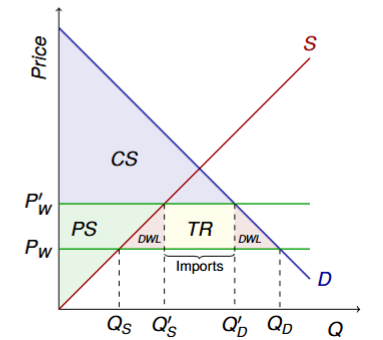

Visual of the market under free trade setting world price below the equilibrium price

Formula for imports

Qd - Qs

What happens to surplus under a market with imports

Lower price hurts domestic sellers (PS ↓)

Lower price benefits domestic buyers (CS ↑)

Total surplus rises

Trade produces _______ and _______

winners and losers

How can winners compensate losers?

Workers exit declining industries, join rising ones

Lump sum taxes on winners, lump sum transfers to losers

A Pareto improvement

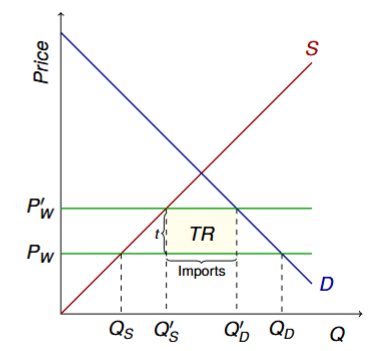

Tarrif

a tax on imported goods (and only on imported goods)

Why are taxes imposed?

To raise revenue

How do tarrifs affect the price of goods?

A tariff of $t increases the price of goods in the domestic market by t

New world price after tariffs formula

P′w = Pw + t

When tariffs are imposed, what happens to production and consumption

Production rises, consumption falls

When tariffs are imposed, what happens to imports

Imports fall

How much revenue does the government generate from tarrifs? (formula)

t × Qimport (Qimport = Q′d − Q′s)

Benefits of tariffs

Tariffs are easy to enforce

Popular in countries with low state capacity

What happens to surplus when tariffs are imposed?

CS ↓

PS ↑

TR ↑

TS ↓

red triangles are DWL

How can tariffs be harmful?

More than narrow protectionist tariffs (e.g., on steel)

They tax goods with no (or few) domestic producers

They tax inputs into production

They are regressive

They reduce long-run economic growth

What is the impact when large countries impose tariffs

Large countries imposing tariffs similar to a regular tax

World price falls from PW to PS

Burden of tariffs is now shared

What affects who bears the burden of the tariff?

Burden of tariffs depends on relative elasticity of demand/supply