Accounting Midterm 1

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

113 Terms

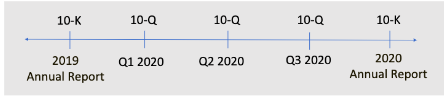

Reporting Process

Public companies are required to file certain reports with the Securities Exchange Commision (SEC)

10-K: audited annual financial statements and footnotes

10-Q: unaudited (but is reviewed) quarterly financial statements and footnotes

8-K: current events report–filed often for various types of events (restructuring, delisting from an exchange, change in fiscal period)

* some people may choose a different fiscal beginning and end than the calendar year. Retailers have a fiscal period go from 2/1 to 1/31

* They want people to have time to return their holiday shopping to capture the true economic value of their fiscal period

* Financial statements

* Footnotes (explain how the firm came up with the numbers reported in the financial statements)

* Managements’ discussion and analysis (talks about what their company does in their industry, their strategy and opinions, etc)

* Audit opinion

Financial Statements

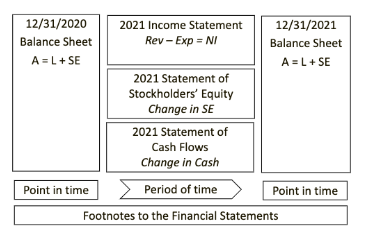

Balance Sheet

A snapshot of what the firms own and owes at a given point in time

“As of 12/31 2022, this is what we have”

Income Statement

A report of the economic performance of the firm over a time period (quarterly, annually, etc)

“For the year ended 12/31/22”

Statement of stockholders’ equity

A report of transactions with owners over a time period

“For the year ended 12/31/22”

Statement of cash flows

A report of sources and uses of cash over a time period

“For the year ended 12/31/22”

* assets= liabilities + stockholders’ equity

* This is accounting law

* If this equation doesn’t balance, check your work

* A resource owned by the entity

* A probable future benefit

* Ex: cash, property,

* A future obligation

* Ex: financing by creditors (ex: debt)

Stockholders’ Equity is:

A = L + SE

Owners' portion of assets after the liabilities have been paid

Financing from owners of the business (common stock) and reinvested earnings (known as retained earnings)

Aka owners’ equity, net worth, book value, net assets, etc.

Ex: stockholder’s equity could be what we own of a house minus what we owe to the bank

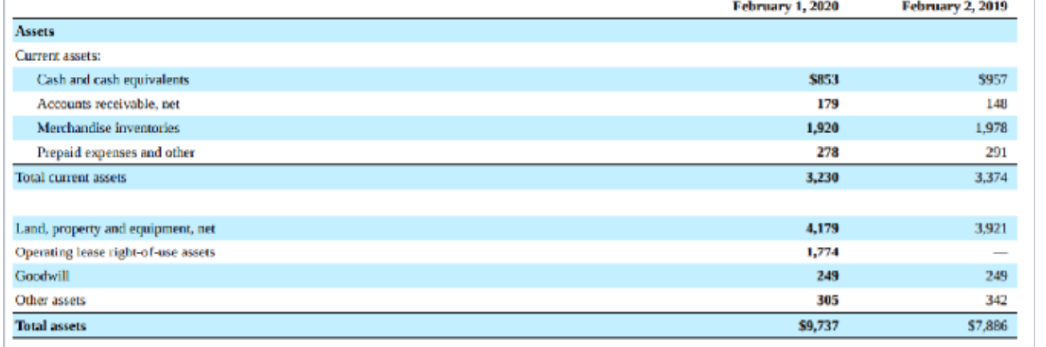

* Cash and cash equivalents: e.g. treasury bills (gov’t loan), certain short-term securities, that are “as good as cash”

* The gov is good at paying those back

* Land property and equipment, net: e.g. buildings owned, table displays, cash registers, etc

* Aka property, plant, equipment (PPE)

* Operating lease right of use assets:

* buildings that they rent

* Good will

* Intangible asset earned through acquisitions

* Merchandise inventory

* What the company sells.

* E.g. shirts, shoes, jewelry

* Accounts receivable, net

* E.g. a payment they expect to be coming from someone who owes you money – a venmo request

* Prepaid expenses and other

* E.g., rent

* Pay rent for 5 months out. It’s an asset because you have the rights to it and it’ll bring you benefit in the future (like housing)

what is prepaid rent classified as?

an asset

* Current assets;

* Converted to cash within one year

* Non current assets

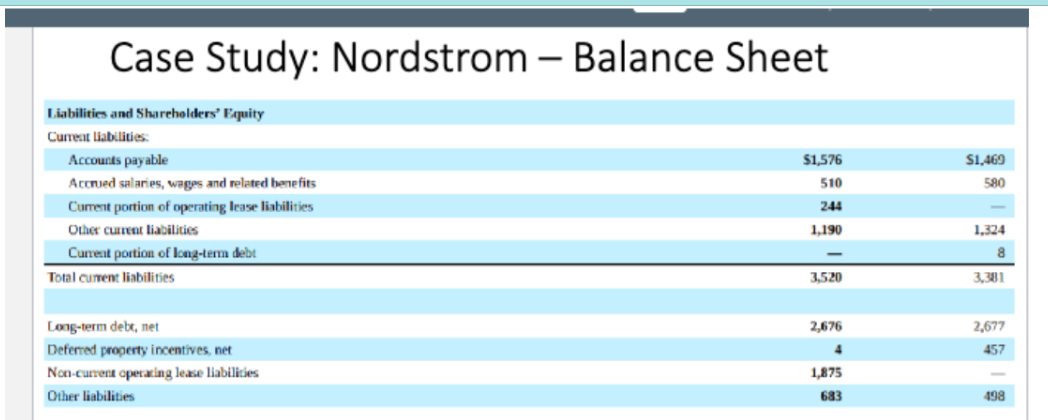

examples of liabilities

wages

accounts payable

debt

lease

* Accounts payable

* E.g., outstanding venom request that needs to be paid

* We have an IOU to pay

* Ex: paying our suppliers on a payment system

* Accrued salaries, wages and related benefits

* Eg: salaries that need to be paid

* Accrued means accumulated, come about over time

* So accrued salaries means accumulated salaries that need paid

* Long term debt is split into:

* Current portion of Long term debt

* Something we owe to the bank

* E.g. portion of the loan from the bank – due in 6 months

* Noncurrent portion of long term debt

* E.g. loan from the bank – due in 5 years

* Non current operating lease liabilities

* Talked about later

* Other current liabilities and other liabilities

* 2 main owner’s equity accounts

* 1. Common stock

* Aka contributed capital

* Contributions of cash or resources in exchange for an ownership stake in the firm (money from the investors)

* Increases when the company sells shares

* 2. Retained earnings

* Aka “earned capital”

* Accumulated net income/loss that hasn’t been returned to shareholders through dividends

* Earned over time

* Sitting in the bank

retained earnings

Aka “earned capital”

Accumulated net income/loss that hasn’t been returned to shareholders through dividends

Earned over time

Sitting in the bank

What is retained earnings known as if it’s negative

accumulated deficit

* Aka contributed capital

* Contributions of cash or resources in exchange for an ownership stake in the firm (money from the investors)

* Increases when the company sells shares

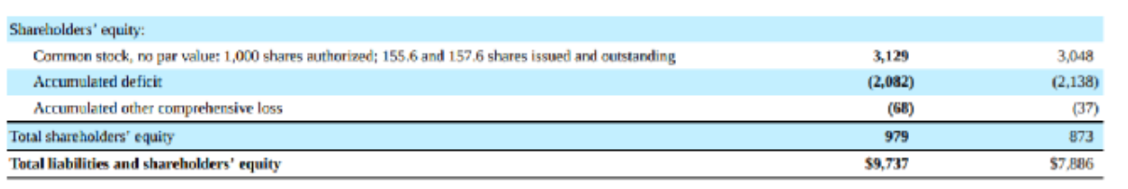

* Common stock: contributed capital

* Accumulated deficit=retained earnings

* Called deficit because it has a negative amount

* Retained earnings if positive

* Total liabilities and shareholders’ equity will equal total assets

* Because A = L + SE

revenues vs assets

revenues are paid to you by the customer for your product

assets are any other money or value earned from nonbusiness transactions

* 1. Checking Account

* Asset

* Something we own that brings us benefit in the future

* 2. Land the ice cream shop is built on

* Asset

* Something we own that brings us benefit in the future

* 3. Common stock

* Stockholders’ equity

* Contributed capital paid by investors for ownership in the company

* 4. Accounts payable owed to dairy provider

* Liability

* “payable”

* 5. Accounts receivable front target

* Asset

* IOU

* 6. Retained earnings

* Stockholders’ equity

* Earned capital that they’ve made over time, stored in the bank

* 7. Waffle cone inventory

* Asset

* Reports revenues and expenses to illustrate the profitability of the company over a period of a time (10-k is a year, 10 q is a quarter, etc)

* **Revenues minus expenses = net income**

* Revenues: amounts expected to be received from a customer for goods or services during the period

* Accrual accounting (when we earned them), distinction from cash accounting. When we acquired them but we didn’t use it or pay it in that same period

* RECORDING THINGS WHEN THEY HAPPEN, NOT WHEN CASH CHANGES HANDS

* Expenses: amounts used to earn revenues during the period

* Costs incurred to generate revenues

* Ex: wages, rent, utilities

* Accrual accounting (when we earned them), distinction from cash accounting. When we acquired them but we didn’t use it or pay it in that same period

* RECORDING THINGS WHEN THEY HAPPEN, NOT WHEN CASH CHANGES HANDS

* Net income: aka “bottom line,” or “profit” or “earnings”

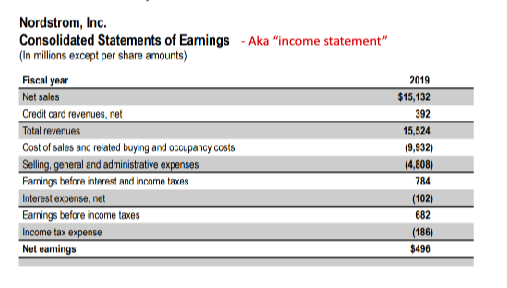

* Consolidated statements of earnings = income statement

* Net sales

* Of clothing, shoes, etc

* Credit card revenues, net

* From nordstrom credit cards

* Cost of sales (aka cost of goods sold) and related buying and occupancy costs selling, general and administrative expenses

* Costs incurred to generate revenues

* Cost of sales is inventory and products

* Selling, general and administrative expenses is non product related costs

* Interest expense, net

* Costs associated with debt financing

* Net earnings

* Net income, bottom line, earnings, profits

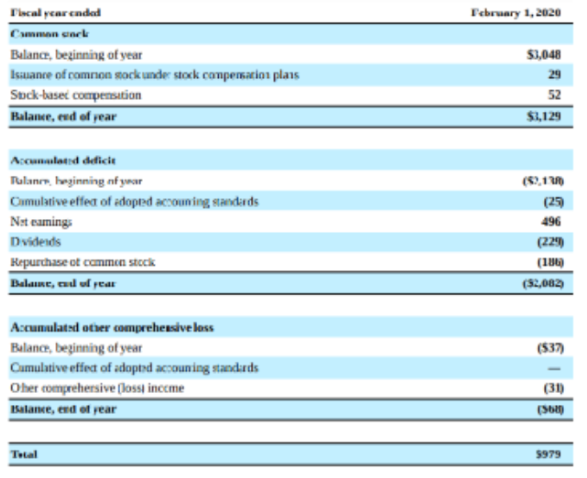

* Reports inflows of resources from investors to the business and outflows from the business to investors over a specified period of time

* Provides extra details on stockholders’ equity section of the balance sheet

* **(Beginning balance + contributed capital changes + earned capital changes (i.e. retained earnings)) = ending balance**

* **Beginning retained earnings + net income (-net loss) minus dividends = ending retained earnings**

* Retained earrings

* Aka “earned capital”

* **Accumulated net income/loss that has not been returned to shareholders through dividends**

* Issuance of common stock under stock compensation plans

* Issued as compensation

* Accumulated deficit

* Aka retained earnings if positive

* Cumulative effect of adopted accounting standards

* Tie to income statement

* Add net earnings, subtract dividends, repurchase of common stock affects net earnings

* Total equity should tie to the amount on balance sheet

* Reports sources of cash inflows and outflows over a period of time

* 3 categories

* Change in cash flow from operating activities

* E.g. selling product/service

* Day to day

* Change in cash flow from investing activities

* e.g. , equipment

* Make Expenditures to grow our business

* Ex: capital expenditures

* Investing activities related to long term assets

* Change in cash flow from financing activities

* E.g. loan, cash from investors

* Transactions with shareholders or people who lend money

* HOW WE FINANCE THE COMPANY

* Add the 3 changes together to arrive at the total change in cash

* **Ending cash should tie to balance sheet**

* current asset

* common stock

* equity

* accounts payable

* current liability

* inventory

* current asset

* accounts receivable

* current asset

* long term debt

* long term liability

* other assets

* current asset

* interest payable

* current liabiility

* retained earnings

* equity

* prepaid expense

* current asset

* net income

* income statement

Beginning balance retained earnings plus net income minus dividendeds equals ending retained earnings

beginning balance retained earnings = total equity minus common stock from 2020, which is 10,000-5000=5000

net income=revenue minus expenses=350,000-275,000=75,000

ending retained earnings=Assets minus liaibilites minus common stock (total equity minus common stock but we don’t have that)= 100,000-75,000-5,000=20,000

5000+75,000-DI=20,000

DI=60,000

how is a gift card recorded in financial statements?

as “stored value card” recorded as a liablity and current portion of deferred revenue

reason total revenues and total expenses would increase

customers are buying more so you have to buy more as a company, and you are earning more revenue with raised prices

* Baking equipment

* assets

* Retained earnings

* Equity

* Aka earned capital

* Note payable

* liability

* Accounts receivable from target

* asset

* Prepaid expense to smith brothers farms for milk used in the tres leches

* Asset

Difference between note payable and account payable?

Notes are long term, accounts payable are short term

Notes payable are to a creditor, while accounts payable go to a vendor or supplier

NOTES PAYABLE ARE FOR LOANS, ACCOUNTS PAYABLE ARE FOR INVENTORY

* Financing

* Obtaining funds for the business

* Can be debt or equity

* Investing

* Growing and setting up the business

* Operating

* Running the business

* Day to day

* In the U.S. the “Financial Accounting Standards Board” (FASB) writes the accounting rules known as the “Generally Accepted Accounting Principles” (GAAP).

* • There is a push to have an international set of accounting standards. Many countries, including the EU, use IFRS (International Financial Reporting Standards).

* How do we get to those ending balances on the financial statements?

* 1. Identify transactions

* Need to pay attention to what perspective we are thinking about. Normally we are thinking about a company’s perspective

* 2. Determine the effect on the accounting equation and all its parts (A = L +SE)

* 3. Determine whether to debit or credit impacted accounts

* Debits and credits are tools in recording the transactions

* 4. Record transaction in the journal

* 5. Post transaction to the ledger

* Summary of transactions

* 6. Prepare a trial balance

* Summary of accounts

* 7. Prepare financial statements

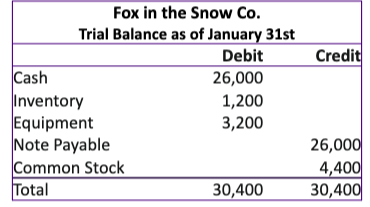

coffee shop example of recording transactions and it’s steps

Assets:

Inventory

Loans

Cash

Identify transactions

Jan 1. Owners contribute $4,400 cash to form the store, they receive 100 shares of common stock

Jan 1. Purchase pastry make equipment for $3200 and purchase inventory for $1200

Jan 1. Receive $26000 loan to start a business

2. Determine Effect on Accounting Equation

To preserve this, for every transaction:

Change in assets = change in liabilities plus change in equity

Entries on left = entries on the right

Every transaction has a dual effect: double entry bookkeeping

When determining the effect on the accounting equation, ask yourself:

Accounts: which accounts are affected? Create as many individual asset and liability accounts as needed

Direction: decrease or increase? More cash or less cash?

Amount: by how much?

Ex: determine the effect on accounting equation for: Lauren and Jeff contribute $4,400 to form Fox in the Snow. They each receive 100 shares of common stock (no par value)

Accounts: cash (A) and CS (E)

Direction: cash goes up, CS goes up

Amount: 4,400

4400 of cash = 4400 CS

Ex: determine the effect on accounting equation for: Purchase pastry making equipment for $3,200 cash and purchase inventory (chocolate, coffee beans, sugar, butter, and coconut) for $1,200 cash.

Accounts: cash (A), inventory (A), equipment (A)

Direction: cash goes down, inventory goes up, equipment goes up

Amount:

-4400 cash + 1200, +3200 = 0 + 0

Ex: determine the effect on accounting equation for: Receive $26,000 cash from the Buckeye Accelerator program to help start the business. For class, let’s assume this $26,000 is a loan

Accounts: cash (A), loan/note payable (L)

Direction: cash goes up, loan/note payable goes up

Amount

+26,000 = -26000 + 0

Step 3: Determine whether to debit or credit each account

Changes in assets = changes in liabilities + change in equity

Entries on left = entries on the right

Debits = credits

Debits are everything on the left, credits are everything on the right

Signal increases and decreases in the account

Increases are everything on the far outside of the t equation

So for assets, increase on the left, for liabilities and equity, increases on the right

Are these increases or decreases

Debit cash

Increase

Credit note payable

increase

Credit supplies

decrease

Debit retained earnings

decrease

Credit common stock

Increase

Step 4: Record Transactions in the Journal

Journal: chronological record of all transactions affecting a firm

Are formal means of recording transactions using debits or credits

Include date, reference number, accounts impacted, by how much, and how they’re debited or credited

Debits appear first

debits=dr.

creditors=cr.

Ex: Lauren and Jeff contribute $4,400 to Fox in the Snow. They each receive 100 shares of common stock (no par value)

Ex: Purchase pastry making equipment for $3,200 cash and purchase inventory for $1,200 cash

Date

Ref #

Accounts

Debit

Credit

1/1

1

Equipment (A+)

Inventory (A+)

Cash (A-)

\n

3200

\n

1200

\n \n \n \n

4,400

Received $26,000 cash from the Buckeye Accelerator program to help start the business. For class, let’s assume this $26,000 is a loan.

Date

Ref #

Accounts

Debit

Credit

1/1

1

Cash (A+)

Notes payable (L+)

26,000

\n

26,000

Step 5. Post transaction to the ledger

Summary of transactions

A ledger

A system that contains all the t accounts

The process of transferring the debits and credits from the journal to the ledger is called posting

What is a t account?

A visual representation of each account

Each type of asset, liability and equity has its own account

Debits on the left, credits on the right

Contains all the journal entries

Shows the running total in each account

Debit accounts have ending balance on the left, credit accounts have ending balance on the right

Ex:

SEE NOTEBOOK FOR EXAMPLE

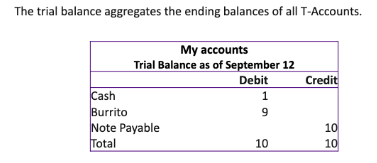

Prepare a trial balance

Summary of accounts

The trial balance aggregates the ending balance of all T-accounts. We will use the trial balance to create financial statements

how would you classify a loan

a notes payable or a loan payable

debits and credits

debits on the left (increase for assets, decrease for everything else)

credits on the right (decrease for assets, increase for everything else)

what is a journal

Journal: chronological record of all transactions affecting a firm

Are formal means of recording transactions using debits or credits

Include date, reference number, accounts impacted, by how much, and how they’re debited or credited

Debits appear first

debits=dr.

creditors=cr.

Ex: Lauren and Jeff contribute $4,400 to Fox in the Snow. They each receive 100 shares of common stock (no par value)

ledger

Summary of transactions

A ledger

A system that contains all the t accounts

The process of transferring the debits and credits from the journal to the ledger is called posting

What is a t account?

A visual representation of each account

Each type of asset, liability and equity has its own account

Debits on the left, credits on the right

Contains all the journal entries

Shows the running total in each account

Debit accounts have ending balance on the left, credit accounts have ending balance on the right

Ex:

Trial Balance

Summary of accounts

The trial balance aggregates the ending balance of all T-accounts. We will use the trial balance to create financial statements

* What’s wrong with this example?

* Nordstrom buys $1,000 of shirts from Nike to sell at Nordstrom’s downtown location. It will pay Nike next month. The beginning balance in its accounts payable account is $50. Nordstrom makes the following JE: Dr. Equipment 1,000, Cr. accounts payable 1,000

Financing with stock and par value and APIC

Each share of stock is legally required in certain states to have a minimum price listed on it, known as a par value. A Par value is completely unrelated to the actual market value of the stock

No par value: common stock account is credited for the amount of cash received from investors

Debit cash, credit common stock

Price per share times number of shares for both credit and debit

Par value: common stock is credited for the par value and any additional amount paid by the investor is credited to additional paid in capital (APIC)

Debit cash: price per share * number of shares

Credit common stock: par value * number of shares

Credit APIC: the difference

Ex:

DoorDash had its IPO (Initial Public Offering) in December, 2020. It issued 33 million shares at $102 per share. If the stock had no par value, the journal entry is:

Dr. Cash (A+) = 33 million * 102 =$3,366 million

Cr. Common stock (E+) = $3,366 million

DoorDash stock actually had a par value of $0.00001 per share, so the entry is

Dr. Cash (A+) = $3,336 million

Cr. Common Stock (E+) = 0.00001 * 33 million = $330

Cr. APIC (E+) = 3,336 million – 330 = $336,599,670

* As a stockholder, one benefit is that you could receive a portion of what the company earns in a form of cash dividends

* Beginning R/E + Net income – Dividends = Ending R/E

* Benefit you can receive as investors. You get paid cash from the companies, that’s a dividend

* Come out of retained earnings

* Dividends are paid out of retained earnings, the journal entry when dividend is declared is

* Dr. Retained earnings…(E-)....$

* Cr. Dividend payable…..(L+)

* When the dividend is paid

* Dr. dividend payable….(L-).... canceling out the credit on declaid day

* Cr. Cash….(A-).....

* When dividends are paid and declared are on different days

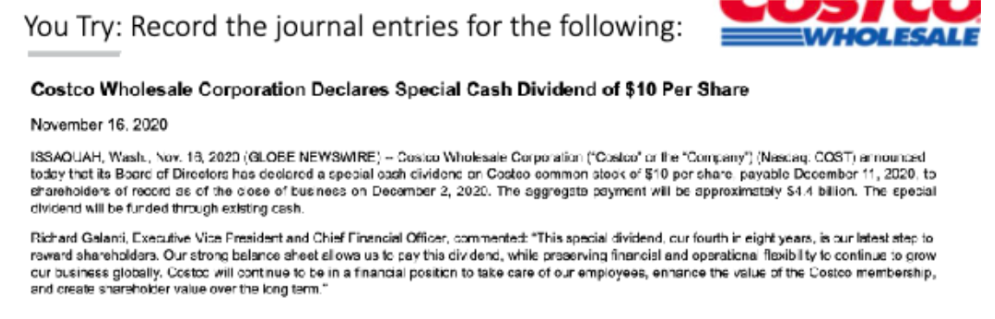

Dividends example

Declaration date of November 16, 2020

Dr Retained Earnings (E-): 4.4 B

Cr Dividend Payable (L+): 4.4 B

Payment day of december 11, 2020

Dr. Dividend Payable (L-): 4.4 B

Cr Cash (A-): 4.4 B

Recording Transaction example when you borrow $10 to buy a $9 burrito

1. You borrow $10 from a friend and buy a $9 burrito with it

2.

Assets= +10 cash +$9 burrito -$9 cash

Liability = Note Payable +10

3/4

Asset debit of $10 cash and $9 burrito and credit $9 cash

Liability credit of $10 NP

5

Create 3 tables

1. Cash (A)

1. Debit 10

Credit 9 2.

Ending balance: 1

2. Burrito (A)

Credit 9 2.

Ending balance: 9

3. N/P (L)

Credit 10 1.

Ending balance: 10

6.

7.

* Company issues 100 shares of common stock. The par value of the stock is $0.01 and the stock is issued at $17/share. Record the journal entry for this transaction

* Debit Cash: 17\*100 = 1700 (A+)

* Credit common stock (100\*0.01) = 1 (SE+)

* Credit Additional Paid in Capital 1700-1 = 1699 (SE+)

* If there’s no par value, just debit cash and credit common stock, no APIC

* Company declares a dividend for common stockholders of $0.50 per share on September 30 to be paid by November 1. There are 100 shares outstanding on the date of record

* Date of record: snapshot of who is a shareholder as of this date

* November 1: payment date

* September 30: declaration date

* Pay dividends out of retained earnings

* On September 30

* Debit retained earnings (E-) = $50

* Credit dividend payable (L+) = $50

* On November 1

* Debit dividend payable (L-) = $50

* Credit cash (A-) = $50

Entry for: “Austin wins a cash prize of 4,500. He decides to contribute the cash to create a company in exchange for 100 shares of common stock (par value of $1 per share)”

dr. cash (a+) 4500

cr. common stock (SE+) 100

cr additional paid in capital (SE+) 4400

Every income starts with nets sales (or revenues)

Then cost of sales (what they paid for inventory)

Then Gross Margin (of Gross Profit) = Revenues Cost of Goods Sold

Net sales minus cost of sales

Tells you about the company’s markup

Then is expenses

Then selling general and administrative expenses (cost of running business)

Depreciation amortization (has to do with fixed assets)

Operating income

Pretax earnings

Net earnings

Income statement accounts you see the most

Revenues

Expenses

gains/losses

revenues and expenses inside of the balance sheet equation

Assets = liabilities plus stockholder’s equity

Equity is made up of retained earnings (ending retained earnings = beginning retained earnings plus net income minus dividends) and contributed capital (common stock and APIC)

How all types of accounts fit into A = L + SE

Common stock and retained earnings debit when decreasing and credit when increasing

Revenues debit when they decrease and credit when they increase

Expenses DEBIT WHEN THEY INCREASE AND CREDIT WHEN THEY DECREASE

True or false: a transaction that impacts the income statements always impacts the equity section of the balance sheet too

True, net income falls under retained earnings which is under the equity section

Everything on the income statement comes down to net income

cost of goods sold

debiting stock holders equity because expenses increased due to crediting and getting rid of inventory

is an expense account representing the amount the business paid for inventory that it has sold.at it has sold.

if inventory is worth $200 and it gets sold

dr COGS 200

cr inventory 2000

Examples of revenue and expenses in the steps of recording transactions

Recording transactions steps

1. Identify transactions

1. On 2/28 they paid 2,000 to rent a storefront for the month of february

Debit rent expense (+exp, eq-) 2000

When expenses go up, net income goes down, retained earnings goes down, and stockholders equity goes down

Credit cash (a-) 2000

2. On 2/28 we prepaid rent for March and April for 4000

Debit Prepaid rent (a+) 4000

Credit cash (a-) 4000

3. On 2/10: sold pastry making tours for $50

When revenue goes up net income goes up retained earnings go up and stockholders equity goes up, so they all credit

Debit cash (a+) 50

Credit tour/service revenue (rev+,eq+) 50

4. Sold coffee and pastries costing 1200 to customers for 3500

+3500 cash (a+)

-1200 inventory (a-)

+3500 revenue (+re)

-1200 expenses (-re)

Sales side

Dr. cash (+A)

Cre. sales revenue (+REV, +NI, +SE)

Costs side

Dr. Cost of goods sold (+EXP, -NI, -SE)

Cr Inventory (-A)

Accrual vs cash based accounting

Accrual accounting doesn’t equal cash accounting

Cash accounting: records inflows and outflows of cash

Cash inflows = revenues

Cash outflows = expenses

So all the cash even before the expense is incurred?

Accrual Accounting: records transactions

When revenues are earned

When expenses are incurred

Not all of the total cash?

KEY DIFFERENCE IS TIMING

Cash accounting isn’t allow for public companies

Cruise Example

In 9/22 you book a $5000 cruise for 3/23

Can it be included in the company’s income statement for 2022?

Yes, under cash accounting it’s revenue

No, Under accrual accounting it’s not revenue until March 2023

Recording Revenue:

Revenue recognition principle

Revenue should be recognized when the performance obligation has been satisfied. A company satisfies its performance obligation by performing a service or delivering a good to a customer

Ex: for Nordstrom: selling the clothes

Ex for EA Games: when the person receives the game

Facebook: running ads

Revenue Recognition: 5 Step process

Apple inc. example: you order the iphone 14 with applecare for 12 months

1. Identify the contract between the company and the customer

Iphone 14 with 12 months warranty

2. Identify the performance obligations

To deliver the phone and provide the warranty

3. Determine the transaction price

1500

4. Allocate the transaction price to the performance obligation

Phone is 1300 and apple care is 200

5. Recognize revenue when each performance obligation is satisfied

Ex: In april, Delta sells 4 tickets for a flight to Hawaii from Columbus for the 4th of July. Delta’s year end is June. When is ticket revenue recognized under the cash method. What about the accrual method?

Cash = April

Accrual = July

Recording Expenses: Matching Principle

Under teh accrual method, expenses should be recognized in the same period as the revenues that they help to generate

Ex: when nordstrom sells clothes to a customer, revenue is earned and there are costs related to generating that revenue that need to be matched such as

Salaries and wages during that period

Cost of the clothes sold during that period

Utilities and rent on building during that period

Ex: In February, Buckeye donuts paid for February’s rent of 2,000 and March’s rent is 2500. How much rent expense will Buckeye donuts record in february

2000. Associated with the amount of revenues incurred in february

2500 won’t be recognized till march

Relevance vs. Faithful representation

Accrual accounting rules make financial statements more relevant but often sacrifice faithful representation

Relevance: information is more useful for understanding the firm and future performances

Faithful representation: the info more faithfully rerpesents the economics of the transactions; it is complete, neutral and erro free. This is harder to do with many assumptions and estimates

Relevance vs Faithful representation

Cash based accounting system

Objective and simple

Faithful representation – cash is what it is

Accruals based accounting system

More assumptions and complexity

More relevant to economics of the firm

But accruals allow for more discretion

Discretion + incentives = manipulation

Is accruals based accounting actually more useful than cash based accounting?

Revenues

are defined as increases in assets or settlements of liabilities from the major or central ongoing operations fo the business

Proceeds from goods sold or services rendered

Expenses

are defined as decreases in assets or increases in liabilities from ongoing operations incurred to generate revenues during the period

Expenditures (outflows) incurred to generate revenues

8/18: Dr Accts Receivable (a+): 2000

Cr. revenue (rev+, eq+): 2000

Dr. Cost of goods sold (exp+, eq-): 1000

Cr. Inventory (a-): 1000

9/25: Dr cash (a+): 2000

Cr accounts receivable (a-): 2000

4/30: Dr. insurance expense (exp+, eq-): 250

Dr. prepaid insurance (a+): 250 (has future benefit)

Cr cash (a-): 500

Assets: -250

Liabilities:

Equity: =net income = -250

Revenue: 0

Expenses: 250

net income: (0-250)=-250

true or false: the payment of dividends decreases cash and increases expenses?

False. Paid to shareholders while (financing) expenses are the costs of operating the business. Both reduce retained earnings though

Dividends and expenses both reduce retained earnings, but expenses relate to operating our core business whereas dividends are amounts returned to shareholders. Dividends do not appear on the income statement

Aren’t an expense because they are a part of equity

how to record: “a company’s freeze drier malfunctions. The owner hires a mechanic to repair the freeze drier, and is invoiced 350 for the service)

dr. operating expense (exp+, rev-) 350

cr. accounts payable (L+) 350

how to record: “company pays 3600 in advance for 2 year insurance policy”

dr. prepaid insurance (a+) 3600

cr. cash (a-) 3600

how to record: “company receives software bill of $40, which they pay in cash”

dr. operating exp (exp+, eq-) 40

cr. cash (a-) 40

how to record: “pays rent for this month and for next month totalling 1000”

dr. prepaid rent (a+) 500

dr. rent (exp+, eq-) 500

cr. cash (a-) 1000

how to record: “company receives 20,000 from backers, meaning his kickstarter goal is fully funded. Owner will deliver product evenly to customers over the next 10 months”

dr. cash (a+) 20000

cr. unearned revenue (L+) 20000

unearned revenue is like deferred revenue, like a gift card

Should’ve recorded:

(since wages were earned but not yet paid)

Dr. wage/salaries expense (exp+,eq-)

Cr. wages payable (L+)

Assets are the same. Liabilities are understated. Equity is overstated.

Adjusting Entries

TRYING TO GET THE STATEMENTS TO REFLECT THE TRUE ECONOMIC SITUATION

When cash is exchanged at a different time than the expense/revenue, the accrual method requires two journal entries

One for the cash exchanging hands and

One for the revenue or expense recognition

The goal

Make sure revenue is recorded when earned

Make sure expenses are recorded when incurred to generate revenue

Make sure assets and liabilities are reported at the amount that reflects the economic situation

Situations requiring adjusting entries

1. Prepaid expenses (aka deferred expenses)

Cash has been paid but expense hasn’t been incurred

2. Unearned revenues (deferred revenues)

Cash has been received from customers but revenue hasn’t been earned

3. Accrued expenses

Expense has been incurred but hasn’t been billed and paid for (salaries)

Ex: Salaries: the work has been done and cash is earned but you don’t get paid for 2 weeks

4. Accrued revenues:

revenue has been earned, but you haven’t billed and received payment from the customer yet

Ex: Fulfilled performance obligation but haven’t gotten the cash yet

Adjusting entries – tips

1. Cash is never part of the journal entry. Cash has either already been paid or will be paid in the future

2. All adjusting journal entries hit at least once balance sheet account (A, L, E) and one income statement account (Rev, Exp)

3. Ask yourself – how can I make this expense or revenue accurately represent what happened in this accounting period?

Deferred expenses – depreciation

Depreciation expense: allocation of the property’s cost over its estimated useful life to the company

Accumulated depreciation: sum of the asset’s depreciation taken to date. Accumulated depreciation is know as a contra account

Contra accounts

1. Always linked to a companion account

2. Always has a balance (debit or credit) opposite that of the companion account

Ex: equipment (A) and accumulated depreciation (XA)

Ex of adjusting entries: prepaid expenses

Feb 9: Dr. Prepaid rent (a+) 4000

Cr. Cash (a-) 4000

AJE: March 31: Dr. rent expense (exp+, eq-) 2000

Cr. Prepaid rent (a-) 2000

AJE: April 30: : Dr. rent expense (exp+, eq-) 2000

Cr. Prepaid rent (a-) 2000

Ex of adjusting entries: deferred expenses

Initially you dr. equipment and cr. cash

The machinery is depreciating

Debit depreciation expense (exp+, eq-)

Cr. Accumulated depreciation (xa+, a-)

Equipment net —> B/S. Value of equipment has decreased to 3,125

Ex of depreciation:

Journal entry on July 1

Dr. equipment (a+) 3500

Cr cash (a-) 3500

AJE Journal Entry on 31

Dr. Depreciation expense (exp+, eq-) (250*.5)

Cr Accumulated depreciation (XA+, A-) (250*.5)

Is it ok that total estimated depreciation over 12 years isn’t equal to the purchase price?

Yes. 250 a year times 12 years = 3000. In some cases you will depreciate the full amount and in some cases you won’t. Yes it may have a salvage value.

Ex:

Supplies. Not considered inventory because napkins are put with each product. Not every customer gets it with their goods

Ex: Adjusting Entry – Supplies

Unadjusted trial balance means: before adjusting journal entries. Before AJE

AJE

Dr. supplies expense (exp+, eq-) 50

Cr. supplies (a-) 50

Deferred Expenses and fraud

Because there is some discretion involved, fraud it possible

What they were doing: spreading cost out over years to inflate income

Dr capitalized asset (a+)

Cr cash (a-) 1 million

—------- dr. dep exp (exp+, eq-) 100k

Cr. a/d (XA+, A-) 100k

What they should’ve been doing

Dr. expense (exp+,eq-) 1 million

Cr cash (a-) 1 million

Ex: Adjusting entries – deferred revenue

3/10: dr. cash (a+) 200

Cr. unearned revenue (L+) 200

AJE: Later in march 3/31: dr. unearned revenue (L-) 50

Cr. service revenue (rev+, eq+) 50

Adjusting entries

Ex: Adjusting entries – accrued expenses

AJE 3/31: dr. salaries expense (exp+, eq-) 400

Cr. salaries payable (L+) 400

Later: dr. salaries payable (L-) 400

Cr. cash (a-) 400

types of accounts payable

Dividends (paying shareholders), accounts (for things like equipment), and salaries payable (paying workers), notes payable (getting cash from someone)

Ex: Adjusting entries – accrued expenses

1/1/Y1: dr cash (a+) 26000

Cr. notes payable (L+) 26000

1/31Y1, 2/28/Y1, 11/30/Y2)

Dr. interest expense (exp+, eq-) 65

Cr. interest payable (L+) 65

12/31/Y2: 26000(*.3)=780/yr, 65 dollars a month

Dr. interest expense (exp+, eq-) 65

Dr. notes payable 26,000

Dr. interest payable 1495 (23 months of interest) (will be 27560 at the end)

Cr. cash (a-)

Ex: Adjusting Entries – accrued revenue

1/1/Y1: dr. notes receivable (a+) 26,000

Cr. cash (a-) 26,000

AJE: 1/31/Y1, 2/28/YR1…11/30/Y2

Dr. interest receivable (a+) 65

Cr. interest revenue (rev+ eq+) 65

12/31/Y2

Dr. cash (a+) 27560

Cr interest revenue (rev+, eq+) 65

Cr. notes receivable (a-) 26000

Cr. interest receivable (a-) 1495(23 months)

Closing the temporary accounts

Balance sheet accounts are permanent

They are cumulative and their balances carry from one period to the next. The ending balance in one period becomes the beginning balance in teh next period

Income statement accounts are temporary

Transfer the balance in each account to retained earnings and establish zero balance to start off the next accounting period

Closing entries close all temporary (income statement) accounts into retained earnings via a journal entry.

• Moves net income into Retained Earnings

• Zeros-out the Income Statement accounts to begin again next period

Ex:

Literally just put the same amount in for the opposite side of each account. Debit revenue and credit expenses.

Dr. sales revenue 10,000

Dr. service revenue 50

Cr COGS 3200

Cr wage expense 400

Cr rent expense 2000

Cr interest expense 65000

Cr depreciation expense 25

Our debits will not equal our credits, so put the remaining amount in retained earnings

Cr retained earnings 4360, also the same as our net income for the period

Retained earnings becomes 4535

Ex:

Dr. revenue 10,000

Cr cogs 5000

Cr rent exp 500

Cr wage exp 1000

Cr RE 3500

What is equipment and land classified as?

long term asset

Dragon Company pays dividends of $500 in Year 1. The dividends were declared in Year 0. How does the accounting equation change because of the journal entry for the payment in Year 1?

Assets decrease by 500, Liabilities decrease by 500.

originally under accounts payable when they are declared, that’s why liaiblities decrease, you get rid of the accounts payable

Indicate whether each transaction would increase (I), decrease (D), or have no effect (NE) on the total assets of the company.

Borrowed money from the bank on a Notes Payable | I |

Purchased inventory on credit | I |

Purchased inventory with cash | NE |

Paid off an accounts payable to a supplier | D |

Collected cash on accounts receivable | NE |

Issued capital stock in exchange for cash contributed by owners | I |

Loaned money to an employee in exchange for a note | NE |

Declared dividends | NE |