ACYAFAR2: Corporate Liquidation & IFRS 15

1/27

Earn XP

Description and Tags

Corporate Liquidation, IFRS 15, LTCC, Franchises, Consignment Sales

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

28 Terms

It refers to process of winding up the affairs of the corporation by settling its corporate debts and distributing the remainder to the stockholders.

a. Corporate liquidation

b. Corporate dissolution

c. Corporate rehabilitation

d. Corporate termination

a. Corporate liquidation

In reporting a company that is to be liquidation. Assets are shown at

a. Present value calculated using an appropriate effective rate

b. Net realizable value

c. Historical cost

d. Book value

b. Net realizable value

In a Statement of Affairs, how are liabilities classified?

a. Current and noncurrent

b. Secured and unsecured

c. Monetary and nonmonetary

d. Historic and futuristic

b. Secured and unsecured

If the valued of the pledged property is less than the obligation, what is the treatment of the liability?

a. Partially secured

b. Fully secured

c. Collateralized

d. Unsecured

a. Partially secured

The estimated deficiency to unsecured creditors without priority is computed as

a. Net free assets less total unsecured liabilities without priority

b. Net free assets divided by total unsecured liabilities without priority

c. Total assets at realizable values less total liabilities at expected net settlement amounts

d. A or C

d. A or C

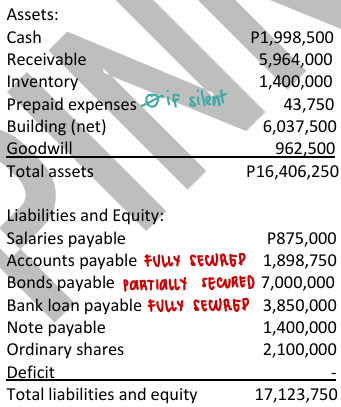

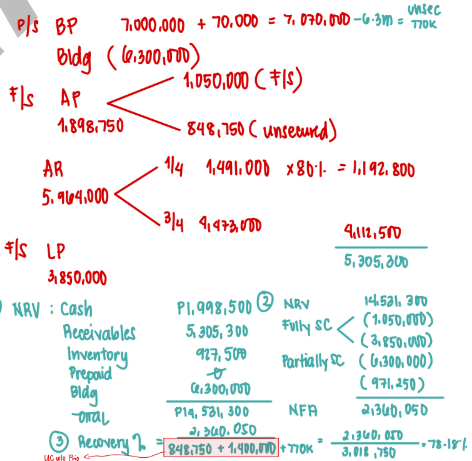

ABC Corporation is undergoing liquidation and has the following condensed Statement of Financial Position as of December 31, 2025:

• The bonds payable are secured by the building having a realizable value of P6,300,000.

• Of the accounts payable, P1,050,000 is secured by ¼ of the receivable which is estimated to be 80% collectible. The remainder in the book value of the receivables which has a realizable value of P4,112,500 is used to secure the bank loan payable.

• The inventory has a realizable value of P927,500.

• In addition to the recorded liabilities are accrued interest on bonds payable amounting to P70,000 and trustees expenses amounting to P43,750 and taxes P52,500.

Compute for the settlement to fully secured creditors, partially secured creditors and unsecured creditors without priority

Fully secured Partially secured Without priority

a. P4,900,000 P5,527,320 P2,360,070

b. P4,900,000 P6,901,990 P1,758,070

c. P5,042,800 P6,901,990 P2,360,070

d. P5,042,800 P5,527,320 P1,758,070

b. P4,900,000 P6,901,990 P1,758,070

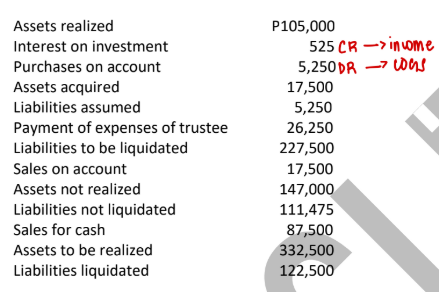

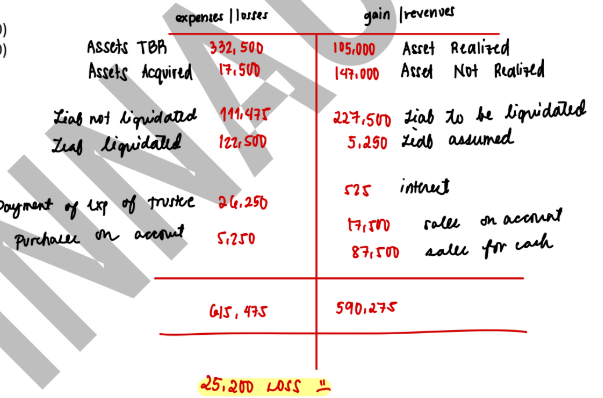

What is the net gain (loss) on realization and liquidation?

a. P61,250

b. (P61,250)

c. (P25,200)

d. P25,200

c. (P25,200)

Which of the following is not a step in recognizing revenue according to IFRS 15?

a. Identify the contract with a customer

b. Determine the transaction price

c. Identify the performance obligations in the contract

d. Recognize revenue before title of the asset is transfer to the customer

d. Recognize revenue before title of the asset is transfer to the customer

A performance obligation is satisfied over time if

a. The entity’s performance creates an asset which has an alternative use to the entity

b. The entity does not have an enforceable right to payment for the performance that has been completed to date

c. The entity’s performance creates an asset that the customer controls as it is created

d. The customer does not receive or consume the benefit provided by the entity’s performance until obligation is completely satisfied

c. The entity’s performance creates an asset that the customer controls as it is created

Under IFRS 15, in which of the following instances will the revenue from contracts with customers be recognized at a point in time instead of over time?

a. When the customer simultaneously receives and consumes all of the benefits provided by the entity as the entity performs

b. When the entity’s performance creates or enhances an asset that the customer controls as the asset is created

c. When the entity’s performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performance completed to date

d. When the entity has transferred physical possession and legal title to the asset to the customer

d. When the entity has transferred physical possession and legal title to the asset to the customer

It is a contract specifically negotiated for the construction of an asset or a combination of assets that are closely interrelated or interdependent in terms of their design, technology and function or their ultimate purpose or use.

a. Construction contract

b. Installment contract

c. Franchise contract

d. Consignment contract

a. Construction contract

The percentage of completion method that may be used to account for construction contracts can be justified on the basis that

a. The contractor will be continuously working and therefore earning revenue

b. In most long-term construction projects, payments are made periodically throughout the life of the contract allowing revenue to be recognized

c. It is unreasonable to expect a contractor record revenue only when the construction is completed

d. The contracting firm has a basis for measuring completion at particular interim dates

d. The contracting firm has a basis for measuring completion at particular interim dates

→ reliable estimate

One of the most popular input measures used to determine the progress toward completion in the percentage of completion method is

a. Revenue percentage method

b. Cost percentage basis

c. Progress completion basis

d. Cost to cost method

d. Cost to cost method

→ cost incurred (total cost)

IFRS 15 specifies the accounting treatment in the case that the outcome of a construction contract cannot be reliably assessed. The treatment specified is

a. Contract costs must be deferred and matched against revenue in the year in whey they are recognized where it is not probable that the costs will be recovered in the current period; and where it is probable that the costs will be recovered in the current period, revenue must be recognized only to the extent of the costs incurred

b. Construction cost must be recognized as a contra asset in the year in which they are incurred and set-off against the receivable recorded on the contract; and where the receivable is less than the accrued costs, the difference must be written off as an expense in the period

c. Contract costs must be recognized as an expense in the year in which they are incurred; and where it is probable that costs will be recovered, revenue must be recognized only to the extent of the costs incurred

d. Construction costs must be accrued and reported as a deferred asset to the extent that it is considered probable that the costs will be recovered; and revenue may be recognized only to the extent of the costs incurred

c. Contract costs must be recognized as an expense in the year in which they are incurred; and where it is probable that costs will be recovered, revenue must be recognized only to the extent of the costs incurred

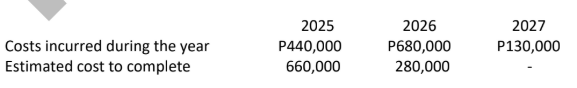

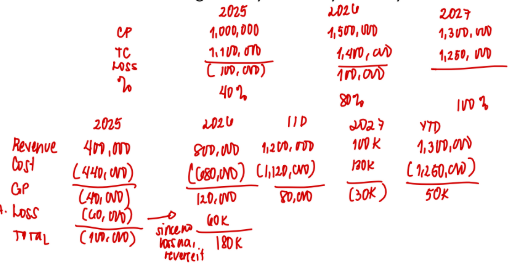

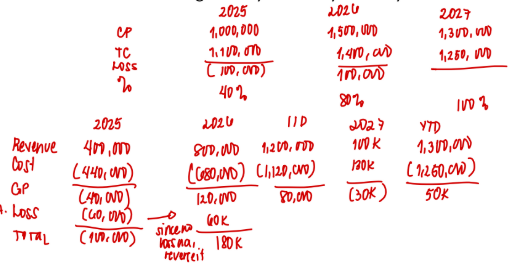

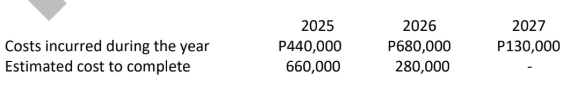

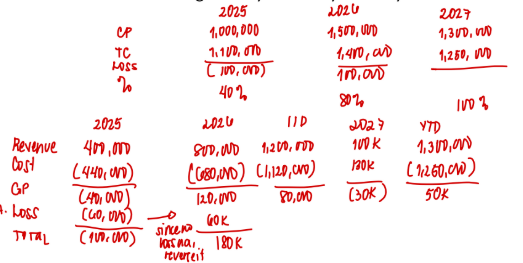

On January 1, 2025, an entity accepted a long-term construction project for an initial contract price of P1,000,000 to be completed on June 30, 2027. On January 1, 2026, the contract price was increased to P1,500,000 by reason of change in the design of the project. The project was completed on December 31, 2027 which resulted to a penalty amounting to P200,000. The outcome of the construction contract can be estimated reliably.

The entity provided the following data concerning the direct costs related to the said project:

What is the construction revenue to be recognized by the entity for the year ended December 31, 2025?

a. P340,000

b. P400,000

c. P440,000

d. P360,000

b. P400,000

On January 1, 2025, an entity accepted a long-term construction project for an initial contract price of P1,000,000 to be completed on June 30, 2027. On January 1, 2026, the contract price was increased to P1,500,000 by reason of change in the design of the project. The project was completed on December 31, 2027 which resulted to a penalty amounting to P200,000. The outcome of the construction contract can be estimated reliably.

The entity provided the following data concerning the direct costs related to the said project:

What is the realized gross profit (loss) to be recognized by the entity for the year ended December 31, 2026?

a. P200,000

b. P80,000

c. P180,000

d. (P20,000)

c. P180,000

On January 1, 2025, an entity accepted a long-term construction project for an initial contract price of P1,000,000 to be completed on June 30, 2027. On January 1, 2026, the contract price was increased to P1,500,000 by reason of change in the design of the project. The project was completed on December 31, 2027 which resulted to a penalty amounting to P200,000. The outcome of the construction contract can be estimated reliably.

The entity provided the following data concerning the direct costs related to the said project:

What is the realized gross profit (loss) to be recognized by the entity for the year ended December 31,2027?

a. P50,000

b. (P30,000)

c. P170,000

d. (P120,000)

b. (P30,000)

Under PFRS 15, how shall revenue from contracts with customers such as revenue from initial franchise fee be recognized by the franchisor?

a. Upon receipt of the initial franchise fee by the franchisor

b. Upon signing of the franchise agreement

c. When the franchisor satisfies the performance obligation under the franchise agreement

d. Applying the legality over the substance of the transaction

c. When the franchisor satisfies the performance obligation under the franchise agreement

Under PFRS 15, how may an entity satisfy a performance obligation in a contract with customers?

a. Satisfaction of performance obligation over time

b. Satisfaction of performance obligation at a point in time

c. Either A or B

d. Neither A not B

c. Either A or B

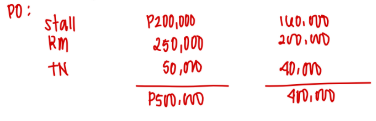

On January 1, 2025, an entity granted a franchise to a franchisee. The franchise agreement requires the franchisee to pay a nonrefundable upfront fee in the amount of P400,000 and an ongoing payment of royalties equivalent to 5% of the sales of the franchise. The franchisee paid the nonrefundable upfront fee on January 1, 2025.

In relation to the nonrefundable upfront fee, the franchise agreement requires the entity to render the following performance obligations:

• To construct the franchisee’s stall with stand-alone selling price of P200,000.

• To deliver 10,000 units of raw materials to the franchisee with stand-alone selling price of P250,000.

• To grant the franchisee the right to access the entity’s tradename for a period of 10 years starting January 1, 2025 with stand-alone selling price of P50,000.

On June 30, 2025, the entity completed the construction of the franchisee’s stall. As of December 31, 2025, the entity was able to deliver 3,000 units of raw materials to the franchisee. For the year ended December 31, 2025, the franchisee reported sales revenue amounting to P100,000.

The entity determines that the performance obligations are separate and distinct from one another.

What is the amount of nonrefundable upfront fee to be allocated to the construction of the franchisee’s stall?

a. P200,000

b. P160,000

c. P250,000

d. P120,000

b. P160,000

On January 1, 2025, an entity granted a franchise to a franchisee. The franchise agreement requires the franchisee to pay a nonrefundable upfront fee in the amount of P400,000 and an ongoing payment of royalties equivalent to 5% of the sales of the franchise. The franchisee paid the nonrefundable upfront fee on January 1, 2025.

In relation to the nonrefundable upfront fee, the franchise agreement requires the entity to render the following performance obligations:

• To construct the franchisee’s stall with stand-alone selling price of P200,000.

• To deliver 10,000 units of raw materials to the franchisee with stand-alone selling price of P250,000.

• To grant the franchisee the right to access the entity’s tradename for a period of 10 years starting January 1, 2025 with stand-alone selling price of P50,000.

On June 30, 2025, the entity completed the construction of the franchisee’s stall. As of December 31, 2025, the entity was able to deliver 3,000 units of raw materials to the franchisee. For the year ended December 31, 2025, the franchisee reported sales revenue amounting to P100,000.

The entity determines that the performance obligations are separate and distinct from one another.

What is the amount of revenue to be recognized in relation to the delivery of raw materials for the year ended December 31, 2025?

a. P75,000

b. P200,000

c. P60,000

d. P100,000

c. P60,000

On January 1, 2025, an entity granted a franchise to a franchisee. The franchise agreement requires the franchisee to pay a nonrefundable upfront fee in the amount of P400,000 and an ongoing payment of royalties equivalent to 5% of the sales of the franchise. The franchisee paid the nonrefundable upfront fee on January 1, 2025.

In relation to the nonrefundable upfront fee, the franchise agreement requires the entity to render the following performance obligations:

• To construct the franchisee’s stall with stand-alone selling price of P200,000.

• To deliver 10,000 units of raw materials to the franchisee with stand-alone selling price of P250,000.

• To grant the franchisee the right to access the entity’s tradename for a period of 10 years starting January 1, 2025 with stand-alone selling price of P50,000.

On June 30, 2025, the entity completed the construction of the franchisee’s stall. As of December 31, 2025, the entity was able to deliver 3,000 units of raw materials to the franchisee. For the year ended December 31, 2025, the franchisee reported sales revenue amounting to P100,000.

The entity determines that the performance obligations are separate and distinct from one another.

What is the amount of revenue to be recognized in relation to the use of entity’s tradename for the year ended December 31, 2025?

a. P5,000

b. P4,000

c. P50,000

d. P10,000

b. P4,000

On January 1, 2025, an entity granted a franchise to a franchisee. The franchise agreement requires the franchisee to pay a nonrefundable upfront fee in the amount of P400,000 and an ongoing payment of royalties equivalent to 5% of the sales of the franchise. The franchisee paid the nonrefundable upfront fee on January 1, 2025.

In relation to the nonrefundable upfront fee, the franchise agreement requires the entity to render the following performance obligations:

• To construct the franchisee’s stall with stand-alone selling price of P200,000.

• To deliver 10,000 units of raw materials to the franchisee with stand-alone selling price of P250,000.

• To grant the franchisee the right to access the entity’s tradename for a period of 10 years starting January 1, 2025 with stand-alone selling price of P50,000.

On June 30, 2025, the entity completed the construction of the franchisee’s stall. As of December 31, 2025, the entity was able to deliver 3,000 units of raw materials to the franchisee. For the year ended December 31, 2025, the franchisee reported sales revenue amounting to P100,000.

The entity determines that the performance obligations are separate and distinct from one another.

What is the total revenue to be recognized by the entity for the year ended December 31, 2025?

a. P229,000

b. P220,000

c. P285,000

d. P224,000

a. P229,000

Under PFRS 15, when shall a consignor recognize revenue from its consignment sales?

a. When the consignor satisfies its performance obligation under consignment contract

b. When the consignor enters into a consignment contract with a consignee

c. When the consignor receives cash remittance from the consignee

d. When it is probable that future economic benefits will flow to the consignor and the fair value of the revenue can be measured reliably

a. When the consignor satisfies its performance obligation under consignment contract

Under PFRS 15, how does a consignor satisfy its performance obligation under consignment contract?

a. Satisfaction over a period of time

b. Satisfaction at a specific point in time

c. Either A or B

d. Neither A nor B

c. Either A or B

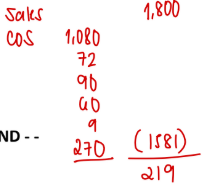

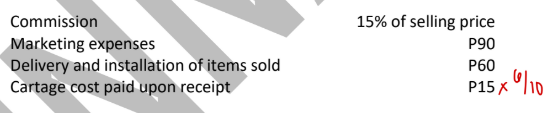

Company X consigned ten refrigerators to Company Y. These refrigerators had a cost of P180 each. Freight on the shipment was paid by Company X in the amount of P120.

Company Y submitted an account sales stating that it had sold six refrigerators and remitted the P1,365 balance due to Company X after the following deductions from the selling price of the refrigerators:

The consignee sold the 6 refrigerators for a total of

a. 1,080

b. 1,152

c. 1,530

d. 1,800

d. 1,800

Company X consigned ten refrigerators to Company Y. These refrigerators had a cost of P180 each. Freight on the shipment was paid by Company X in the amount of P120.

Company Y submitted an account sales stating that it had sold six refrigerators and remitted the P1,365 balance due to Company X after the following deductions from the selling price of the refrigerators:

The commission earned on the sale of the 6 refrigerators by Company Y was

a. 162

b. 180

c. 250

d. 270

d. 270

Company X consigned ten refrigerators to Company Y. These refrigerators had a cost of P180 each. Freight on the shipment was paid by Company X in the amount of P120.

Company Y submitted an account sales stating that it had sold six refrigerators and remitted the P1,365 balance due to Company X after the following deductions from the selling price of the refrigerators:

The consignor’s net profit from the sale of the consigned goods was

a. 219

b. 285

c. 600

d. 800

a. 219