Math Finance Formulas and Uses

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

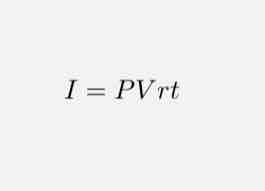

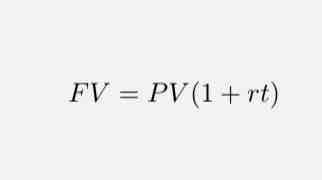

simple interest formula

ex: Initial investment of $1000, an interest rate of 5% per year, money is invested for 3 years.

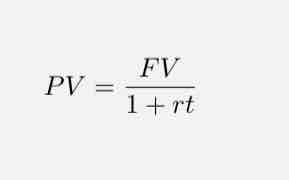

present value of a sum of money that will be received in the futures

ex: you want $3000 in 3 years, the interest rate is 5% per year.

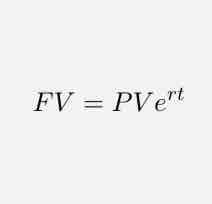

future value using continuous compounding

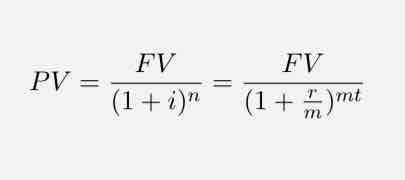

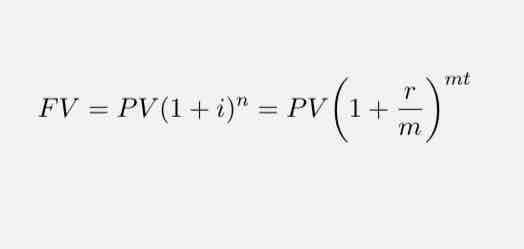

present value with compound interest (second equation used when it’s compounded more than yearly)

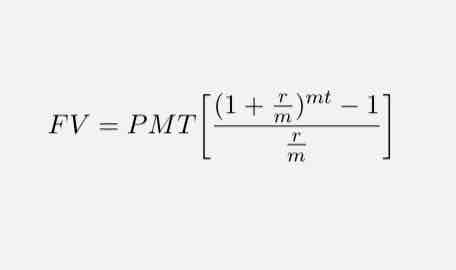

futurw value of annuity formula

future value of a series of regular payments with compound interest

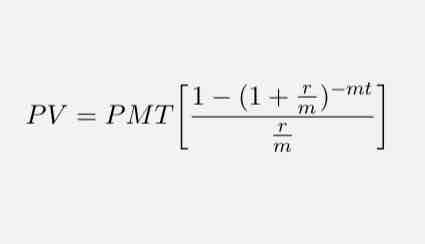

present value of annuity formula for regular payments with compound interest

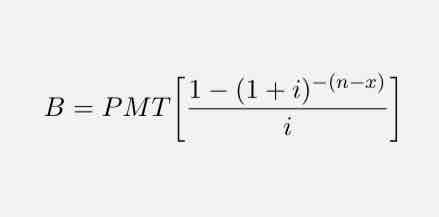

present value of a remaining series of payments after some payments have already been made

usually used when you want to find out how much is still owed on a loan/investment

simple interest formula

calculates the future value of an investment/loan

formula for future value with compound interest (second one used when it’s compounded more than once a year)

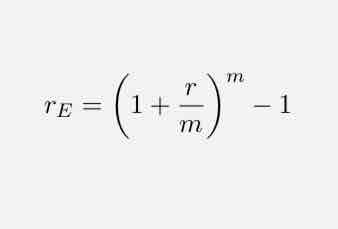

effective interest rate (APY) used to compare

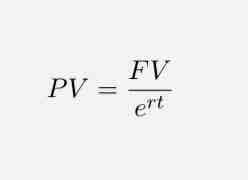

present value of continuous compounding

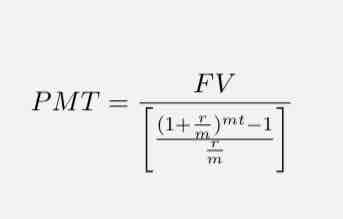

periodic payment required to accumulate a future value with compound interest that is applied more than once a year

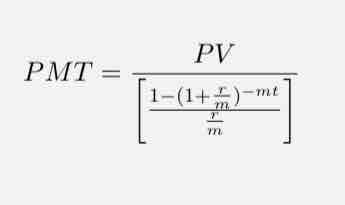

periodic payment required to repay a PV and the interest is compounded periodically (more than once a year)