Book 7 II D - Effect of AD shocks

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

Describe US multiplier size + compare with SG

For US: Larger multiplier size -> US has a rich resource endowment leading to a low MPM + higher MPC due to western consumerism culture

The same initial rise in AD will lead to less income flowing back to domestic firms -> less income generation for subsequent parties in the economy in Singapore than the US -> smaller cumulative increase in real GDP for Singapore compared to US

MPS is affected by:

MPS (savings) affected by:

Country’s attitude towards thrift |

|

Social security system |

|

Government policy |

|

Distribution of income |

|

MPT and MPM affected by:

MPT (tax) affected by: Country’s tax system

Higher personal income tax rate -> higher MPT -> small k

MPM (import) affected by: Country’s factor endowment

SG lack of raw natural resources -> import most goods -> high MPM -> smaller k as there are higher leakages

Elaborate on extent on AD shift (size of k, spare capacity, time lag, structural stuff)

Leakages (Size of k) |

|

Lack of spare capacity |

|

Structural rigidities |

|

Time lag |

|

Describe impact of a fall in AD when the economy is below full employment + why GPL doesnt fall

If the economy is initially in equilibrium at below full-employment level of output (there is spare capacity in the economy), Y0, when AD falls from AD0 to AD1 (due to fall in autonomous C, I, G or X), general price level does not fall

Equilibrium is restored by adjustment in output level from Y0 to Y1

This is due to downward inflexibility of factor prices

In particular, wage rates may be fixed by contracts in the short run, so when AD falls, firms are not able to respond by lowering prices to sell off the unsold goods, since their unit costs cannot be changed in the short run -> firms have to lower output and retrench workers

Real GDP falls by a multiple of the initial fall in AD via the downward multiplier process

Describe impact of a rise in AD when the economy is near or at full employment: (To show inflation)

AD initially intersects AS at E0 where the economy is nearing the full employment level of output

An AD shock causes AD to rise from AD0 to AD1, actual GDP rises to Yf

This rise in AD will create shortages and cause an unplanned fall in inventories of stored unsold goods -> Firms would respond by increasing production and raising employment FOP

However, as the economy is nearing full employment, firms will be forced to use resources that are less and less suitable for their production

Thus, increasingly larger amounts of labour and other inputs are required per additional unit of output produced -> unit cost of production to increase (movement along intermediate range of AS curve)

Firms will only produce extra output if it can be sold at higher prices

Equilibrium is restored partly by the increase in the GPL from P0 to P1 and partly by the increase in the country’s output level from Y0 to Yf

Describe GDP and GPL effect when economy near Yf and at Yf

When an economy is nearing Yf

An increase in AD results in minimal rise in real GDP and rise in GPL

Once the economy is already at full employment level of output, Yf

Any further increases in AD from AD1 to AD2 will not cause real GDP to rise as all factors of production have been fully utilised

Instead, equilibrium is restored by adjustment in the general price level, resulting in demand-pull inflation as GPL rises along the vertical segment of AS from P1 to P2

Describe 2-sector closed economy

2-sector closed economy (no gov) |

|

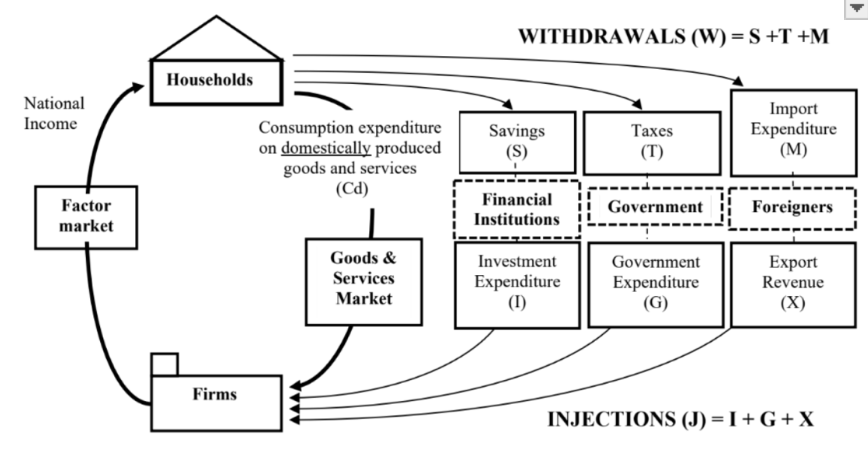

Draw CFOI

Define W

(Def.): are household’s income that is NOT passed on to domestic firms through spending on goods and services produced by these domestic firms

W = savings (S) + taxes (T) + import expenditure (M)

Define J

(Def.): Income receipts by domestic firms that do not arise through households’ spending

J = investment expenditure (I) + government expenditure (G) + export revenue (X)