accounting final exam lets fucking go

1/135

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

136 Terms

what is the purpose of budgeting

should be possible for management to maintain enough cash to pay creditors as well as have sufficient raw materials to meet production requirements

planning

setting company-wide objectives

budgeting

formal written statement of management plans for a specified time period, expressed in financial terms

what is budgeting good for

it deters waste and inefficiency and is a good basis for evaluating performance

primary benefits of budgeting

defines objectives

early warning system

coordination of activities

greater management awareness

motivates personnel

what are the essentials of budgeting

approval from all management personnels

research and analysis

sound organization structure

factors in choosing length of budget

type of budger

nature of organization

need for periodic approval

prevailing business conditions

budget commitee

consists of president, treasurer, chief accountant, and management personnel

budgeting characteristics

short term, annual profit objectives, very detailed

long-range planning characteristics

long term, long term goals and how to execute, less detailed

the master budget

set of interrelated budgets that constitues a plan of action for speciified time period

what are the two components of the master budget

operating budgets and financial budgets

operating budgets

individual budgets that result in budgeted income statementf

financial budget

cash resources needed to fund expected operations and planned capital expenditures

sales budget

derived from sales forecast—gives best estimate of sales reveneue by management totals

sales budget setup

quarter

expected sales

unit sell price

total sales

production budget setup

quarter

expected sales

add:desired end finished goods

total required units

less:beginning finished goods

required production units/units to be produced

how is desired end finished goods calculated

its a percentage of next quarters expected sales

how is beginning finished goods calculated

its a percentage of current periods expected sales

required production units=

expected sales+ desired end FG - beginning FG

direct materials budget setup

units to be produced

direct materials per unit produced

direct material units required for production

add: desired end direct materials

total materials required

less: beginning direct materials

direct materials units to be purchased

cost per pound ($)

cost of direct materials purchases

how is desired end direct materials calculated

percentage of next quarters units required for production

how is beginning direct materials calculated

percentage of current periods direct materials required

direct labor budget setup

units to be produced

Direct labor hours per unit (hours)

total required direct labor hours

direct labor cost per hour (wages)

total direct labor cost

manufacturing overhead budget setup

direct labor hours

variable costs

fixed costs

total manufacturing overhead

manufacturing overhead rate per direct labor hour

selling and administrative costs budget setup

budgeted sales in units (from sales budget)

variable expenses

x

y

z

fixed expenses

a

b

c

total s&a expenses

budgeted income statement

sales

COGS

gross profit

s&a expenses

income from operations

(less) interest expense

income before taxes

income tax expense

net income

cash budget

shows anticipated cash flows—most important budget

cash budget setup

beginning cash balance

add: cash receipts

total available cash

less: cash dispersments

excess/deficiency of available cash

financing

end cash balance

what is financing/borrowing in the cash budget

borrowing money to get back to desired/minimum cash balance

total unit cost

direct materials + direct labor + manufacturing overhead

cost of goods sold using unit cost

unit cost * units sold

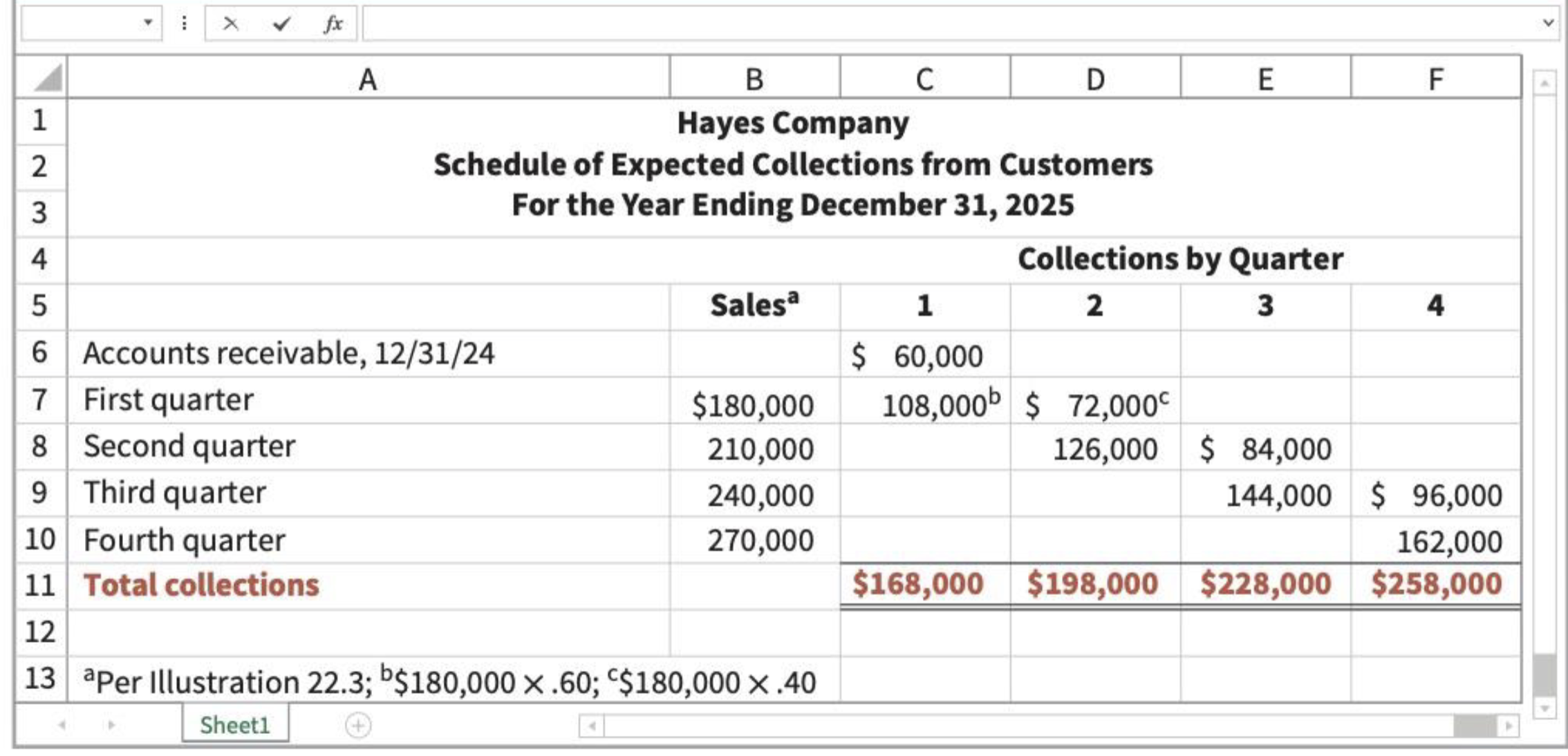

schedule of expected earnings

required merchandise purchases=

budgeted cogs (cogs*%) + desired end inventory - beginning merchandise inventory

service companies budget set up

___to be serviced

DL time per ___

total required DL hours

DL cost per hour

total DL cost

service problems if overstaffed:

Disproportionately high labor costs

Lower profits due to additional salaries

Staff turnover due to lack of challenging work

service problems if understaffed:

Lost revenues because existing and future client needs for services cannot be met

Loss of professional staff due to excessive work loads 41

what establishes goals for the companies sales and production personnel

operating budgets

what does participative budgeting do

doesnt allow unrealistic budgets to happen

budgets are created with the framework of a

sales forecast

budgetary control

use of budgets in controlling operations

what do budget reports do

compare actual results with planned objectives—without monitoring, planning objectives will lose value

what does a formalized reporting system do

identifies name of budget report, states frequency of report, specified purpose of report, and identifies recipients

static budget report

projection of budget data at a single level of activity before actual activity occurs

flexible budget report

series of static budgets at various levels of activity

steps to developing a flexible budget

indentify activity index

indetify varible costs, determine budgeted variable cost per unit

identify the fixed costs, determine budget for each

prepare budget for selected increments of activity when in relevant range

total budgeted costs=

fixed costs + variable costs(total var cost per unit * activity level)

responsibility accounting

identifying and reporting costs and relevant revenues on the basis of manager

as you move up in management,

there are more controllable costs

responsibility reporting system

preparation of report at every level of responsibility

order of rankings for responsibility reporting

cost center, profit center, investment center,

cost center

production/service departments—incurs costs and expenses but does not directly generate revenue

profit center

costs, expenses, and generate reveneue

investment center

costs, expenses, generate revenue—decisions over assets available for use

direct fixed costs

relate specifically to one center, controllable by profit center manager

indirect fixed costs

overall operating activity, benefit multiple centers—uncontrollable by profit manager

controllable margin

CM - controllable fixed costs

responsibility report setup

-—-————budget——-actual——U or F?

sales

var costs

-COGS

-sell&admin

CM

controllable fixed costs

-COGS

-sell&admin

controllable margin

what is the best basis to measure performance

ROI

ROI equation

controllable margin/average operating assets

how can you increase controllable margin

increase sales or decrease expenses

how can you improve ROI

decreasing average operating assets

what are standard costs

predetermined unit costs, used as a measure of performance

Materiality

Without

quantitative guidelines,

management would have to

investigate every budget

difference regardless of the

amount

Controllability of the Item -

Exception guidelines are

more restrictive for

controllable items than for

items the manager cannot

control

report D

department manager

report C

factory manager

report B

vice president looks at costs in his area

report A

president looks at production of VP

advantages of standard costs

facilitate management planning, promote greater economy by mamking employees “cost-conscious”, useful in setting prices, provides basis of evaluation for cost control, highlights variends in management by exception, simplifies cost of inventory

standard cost

unit amount

budget cost

total amount

manufacturing overhead in standard costing

budgeted OH cost / (activity index/normal capacity)

overhead varience

actual overhead - applied overhead

applied overhead

OH rate * std DL hours

variance report income statement

sales rev

cogs (at standard)

gross profit (at standard)

variances

gross profit (actual)

s&a expenses

net income

balanced scorecard

financial and non financial measures linked to measuring performance with strategic goals

4 perspectives of a balanced scorecard

financial, customer, internal, and learning & growth

if cash flow information isnt available, what do you do

adjust accrual numbers—add back depreciation expense

budgeting decision factors

availability of funds, relationship among proposed projects, company’s basic decision-making approach, risk associate with particular project

cash payback period

cost of capital investment / net annual cash flow

net annual cash flow is the same as

net cash from operating activities

when do you not accept a payback period

when period is over 60% of investments useful life

in uneven cash payment scenarios,

find cash flow needed for the fraction of the year, and divide by entire cash flow from year

what does cash payback ignore

time value of money and expected profitability

what are the two disscounted cash flow techniques

NPV and IRR

net present value method

disouncing net cash flows to present values and then comparing PV with capital outlay required

discount rate/required rate of return

minimum acceptable rate of return on investments—decided by management

when is the NPV method accepted

when NPV is 0 or positive

if cash flow is even over life time, use what table

PV of annuity (its a lump sum!!!)

if cash flow is uneven, use what table

PV of 1, multiply cash flow by decimal and get PV!

NPV then equals

PV - price of capital investment

cost of capital

rate it must pay to obtain funds from creditors and stockholders

choosing a discount rate/required rate of return/hurdle rate/cutoff rate

entails cost of capital and risk component

net annual cash flows

inflows - outflows - maintenence - other direct operating costs

profitability index

present value of net cash flows / initial investment

internal rate of return finds what

interest yield of a potential investment

how do you find IRR

financial calculator or trial and error

internal rate of return factor

captial investment / net annual cash flows

finding IRR with even cash flows