Protectionism

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

protectionist policies

tariffs, quotas, subsidies and administrative barriers

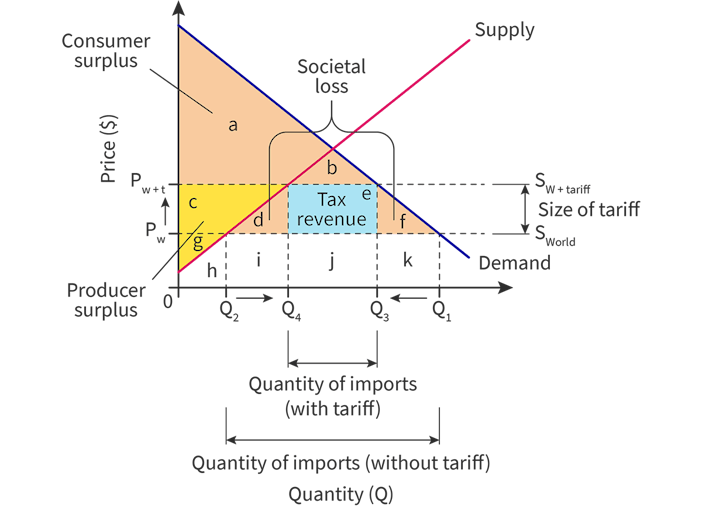

tariffs

a tax on a good or a service that is imported

they are most effective when demand is elastic and/or when a close substitute is produced within the domestic market

domestic producer revenue: before - g+h, after - c+d+g+h+i

foreign producer revenue: before - i+j+k, after - j

consumer surplus: before - a+b+c+d+e+f, after - a+b

government tax revenue: before - nil, after - e

domestic producer surplus: before - g, after - c+g

society misallocation: before - nil, after - d+f

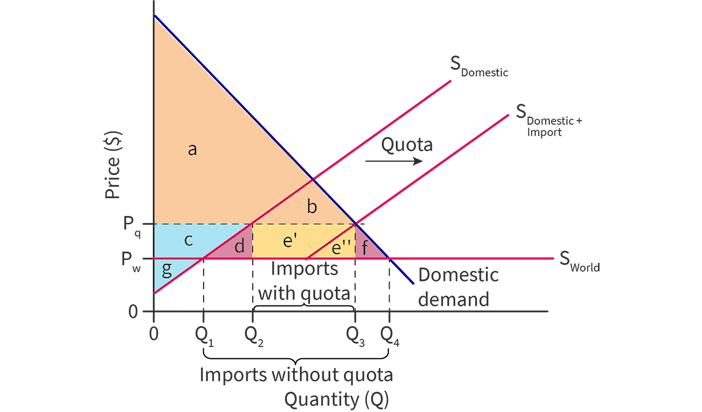

quota

a physical limit on the volume of a good or service that enters the country

domestic producer revenue: before - g+h, after: c+d+g+h+i

foreign producer revenue: before - i+j+k, after - j+e

consumer surplus: before - a+b+c+d+e+f, after - a+b

government revenue: before - nil, after - can charge for quota licenses

societal misallocation: before - nil, after - d+f

domestic producer surplus: before - g, after - c+g

administrative barriers

protection of domestic markets by governments from import of goods and services not deemed of adequate quality

bureaucratic barriers preventing foreign producers from exporting goods and services

types of administrative barriers

product standards

voluntary export restraints

buy national policies

product standards

includes laws or regulations to protect the quality, health or safety in the domestic market

voluntary export restraints

when an exporting country voluntarily agrees to reduce the volume of exports(occurs through negotiating a limit)

buy national policy

a campaign that encourages consumers to buy domestically produced goods instead of imported goods. Utilises patriotic feelings to encourage consumers to support the nation’s economy

For protectionism: protection of infant industries