AP Micro Unit 4

5.0(1)

5.0(1)

Card Sorting

1/40

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

41 Terms

1

New cards

Types of Barriers to Entry (Imperfectly Competitive Markets)

( 1 ) High fixed/start-up costs

→ (EX. there is only one electric company b/c they are the only ones that can make electricity at the lowest cost)

( 2 ) Geography or ownership of raw materials

( 3 ) Legal barriers

→ the government issues patents to protect inventors and forbids others from using their invention

→ (EX. there is only one electric company b/c they are the only ones that can make electricity at the lowest cost)

( 2 ) Geography or ownership of raw materials

( 3 ) Legal barriers

→ the government issues patents to protect inventors and forbids others from using their invention

2

New cards

Perfect vs. Imperfect Competition

→ perfectly competitive firms are price takers, so demand is constant and equal to MR

→ imperfectly competitive firms are price makers so they have downward sloping demand curves → MR is NOT equal to demand

→ imperfectly competitive firms are price makers so they have downward sloping demand curves → MR is NOT equal to demand

3

New cards

The Four Market Structures

( 1 ) Perfect Competition

( 2 ) Monopolistic Competition

( 3 ) Oligopoly

( 4 ) Monopoly

( 2 ) Monopolistic Competition

( 3 ) Oligopoly

( 4 ) Monopoly

4

New cards

Perfect Competition

→ control over price: none

→ number of firms: many

→ types of goods: identical

→ barriers to entry: low

→ ex. bottled water

→ number of firms: many

→ types of goods: identical

→ barriers to entry: low

→ ex. bottled water

5

New cards

Monopolistic Competition

→ control over price: limited

→ number of firms: many

→ types of goods: differenciated

→ barriers to entry: low

→ ex. restaurants

→ number of firms: many

→ types of goods: differenciated

→ barriers to entry: low

→ ex. restaurants

6

New cards

Oligopoly

→ control over price: varies depending on collusion

→ number of firms: few

→ types of goods: similar or differenciated

→ barriers to entry: high

→ ex. airlines

→ number of firms: few

→ types of goods: similar or differenciated

→ barriers to entry: high

→ ex. airlines

7

New cards

Monopoly

→ control over price: only limited by consumers’ willingness to pay

→ number of firms: one

→ types of goods: unique, rare

→ barriers to entry: very high/prohibited

→ ex. electric company

→ number of firms: one

→ types of goods: unique, rare

→ barriers to entry: very high/prohibited

→ ex. electric company

8

New cards

Characteristics of Monopoly

→ one large firm (the firm is the market)

→ unique product (no close substitutes)

→ high barriers--firms cannot enter the industry

→ monopolies are “price makers”

→ some advertising

→ unique product (no close substitutes)

→ high barriers--firms cannot enter the industry

→ monopolies are “price makers”

→ some advertising

9

New cards

Natural Monopoly

→ it is natural for only one firm to produce because they can produce at the lowest cost

→ one firm can produce the socially optimal quantity at the lowest cost due to economies of scale

→ one firm can produce the socially optimal quantity at the lowest cost due to economies of scale

10

New cards

Why are monopolies inefficient?

monopolies are inefficient because they…

( 1 ) charge a higher price

( 2 ) don’t produce enough → not allocatively efficient

( 3 ) produce at higher costs → not productively efficient

( 1 ) charge a higher price

( 2 ) don’t produce enough → not allocatively efficient

( 3 ) produce at higher costs → not productively efficient

11

New cards

Price Discrimination

the practice of selling the same products to different buyers at different prices

→ seeks to charge each consumer what they are willing to pay in an effort to increase profits

→ those with inelastic demand are charged more than those with elastic

→ seeks to charge each consumer what they are willing to pay in an effort to increase profits

→ those with inelastic demand are charged more than those with elastic

12

New cards

What conditions are required for a firm to price discriminate?

( 1 ) must have monopoly power

( 2 ) must be able to segregate the market

( 3 ) consumers must not be able to resell the product

( 2 ) must be able to segregate the market

( 3 ) consumers must not be able to resell the product

13

New cards

Price Discriminating Monopoly

results in several prices, more profit, no consumer surplus, and a higher socially optimal quantity--so no deadweight loss

14

New cards

Characteristics of Monopolistic Competition

→ relatively large number of sellers

→ differentiated products

→ some control over price

→ easy entry and exit (low barriers)

→ a lot of non-price competition (advertising)

→ differentiated products

→ some control over price

→ easy entry and exit (low barriers)

→ a lot of non-price competition (advertising)

15

New cards

“Monopoly” + “Competition”

→ Monopolistic Qualities: control over price of own good due to differentiated product, D > MR, plenty of advertising, not efficient

→ Perfect Competition Qualities: large number of smaller firms, relatively easy entry and exit, zero economic profit in long-run since firms can enter

→ Perfect Competition Qualities: large number of smaller firms, relatively easy entry and exit, zero economic profit in long-run since firms can enter

16

New cards

Differentiated Products

→ goods are NOT identical

→ firms seek to capture a piece of the market by making unique goods

→ since these products have substitutes, firms use NON-PRICE competition

→ examples of non-price competition: brand names and packaging, products attributes, service, location, advertising (two goals: ( 1 ) increase demand, ( 2 ) make demand more INELASTIC)

→ firms seek to capture a piece of the market by making unique goods

→ since these products have substitutes, firms use NON-PRICE competition

→ examples of non-price competition: brand names and packaging, products attributes, service, location, advertising (two goals: ( 1 ) increase demand, ( 2 ) make demand more INELASTIC)

17

New cards

Excess Capacity

→ given current resources, the firm can produce at the lowest costs (min ATC) but they decide not to

→ the gap between the min ATC output and the profit-maximizing output

→ not the amount underproduced

→ the gap between the min ATC output and the profit-maximizing output

→ not the amount underproduced

18

New cards

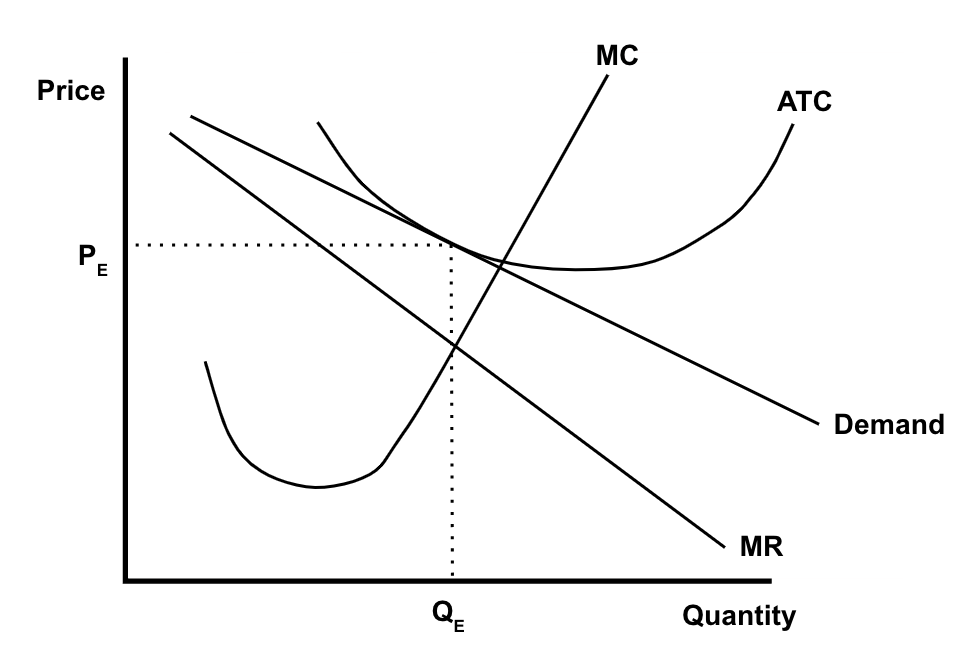

Monopolistic Competition Long-Run Equilibrium

→ not allocatively efficient because price does NOT equal MC

→ not productively efficient because not producing at min ATC

→ not productively efficient because not producing at min ATC

19

New cards

Characteristics of Oligopolies

→ few large producers (less than 10)

→ identical or differentiated products

→ high barriers to entry

→ control over price (price maker)

→ mutual interdependence → firms use strategic pricing

→ identical or differentiated products

→ high barriers to entry

→ control over price (price maker)

→ mutual interdependence → firms use strategic pricing

20

New cards

How do markets become oligopolies?

→ oligopolies occur when only a few firms start to control an industry

→ high barriers to entry keep other firms from entering

→ high barriers to entry keep other firms from entering

21

New cards

Types of Barriers to Entry (Oligopolies)

( 1 ) Economies of Scale

( 2 ) High start-up costs

( 3 ) Ownership of raw materials

( 2 ) High start-up costs

( 3 ) Ownership of raw materials

22

New cards

Game Theory

the study of how people behave in strategic situations

→ an understanding of game theory helps firms in an oligopoly maximize profit

→ an understanding of game theory helps firms in an oligopoly maximize profit

23

New cards

Why learn about game theory?

→ oligopolies are interdependent since they have to anticipate and react to the decision of competitors

→ in an oligopoly, pricing and output decisions must be strategic as to avoid economic losses

→ game theory helps determine the best strategy

→ in an oligopoly, pricing and output decisions must be strategic as to avoid economic losses

→ game theory helps determine the best strategy

24

New cards

Dominant Strategy

the dominant strategy is the best move to make regardless of what your opponent does

25

New cards

Nash Equilibrium

the optimal outcome that will occur when both firms make decisions simultaneously and have no incentive to change

26

New cards

Oligopolies & Game Theory

→ oligopolies must use strategic pricing (they have to worry about the other guy)

→ oligopolies have a tendency to collude to gain profit

→ collusion results in the incentive to cheat

→ firms make informed decisions based on their dominant strategy

→ oligopolies have a tendency to collude to gain profit

→ collusion results in the incentive to cheat

→ firms make informed decisions based on their dominant strategy

27

New cards

Collusion

the act of cooperating with rivals in order to “rig” a situation

28

New cards

3 Types of Oligopolies

( 1 ) Price Leadership

( 2 ) Colluding Oligopoly

( 3 ) Non-Colluding Oligopoly

( 2 ) Colluding Oligopoly

( 3 ) Non-Colluding Oligopoly

29

New cards

Price Leadership

→ collusion is ILLEGAL

→ firms CANNOT set prices

→ strategy used by firms to coordinate prices without outright collusion

→ firms CANNOT set prices

→ strategy used by firms to coordinate prices without outright collusion

30

New cards

General Process (Price Leadership)

( 1 ) “dominant firm” initiates a price change

( 2 ) other firms follow the leader

( 2 ) other firms follow the leader

31

New cards

Breakdowns in Price Leadership

→ temporary Price Wars may occur if other firms don’t follow price increases of dominant firm

→ each firm tries to undercut each other

→ each firm tries to undercut each other

32

New cards

Colluding Oligopoly

( 1 ) cartels set price and output at an agreed upon level

( 2 ) firms require identical or highly similar demand and costs

( 3 ) cartel must have a way to punish cheaters

( 4 ) together they act as a monopoly

( 2 ) firms require identical or highly similar demand and costs

( 3 ) cartel must have a way to punish cheaters

( 4 ) together they act as a monopoly

33

New cards

Cartel

a group of producers that create an arrangement to fix prices high

34

New cards

Non-Colluding Monopoly

if firms are NOT colluding they are likely to react to competitors pricing in two ways:

( 1 ) Match price → if one firm cuts its prices, then the other firms follow suit causing inelastic demand

( 2 ) Ignore change → if one firm raises prices, others maintain same price causing elastic demand

( 1 ) Match price → if one firm cuts its prices, then the other firms follow suit causing inelastic demand

( 2 ) Ignore change → if one firm raises prices, others maintain same price causing elastic demand

35

New cards

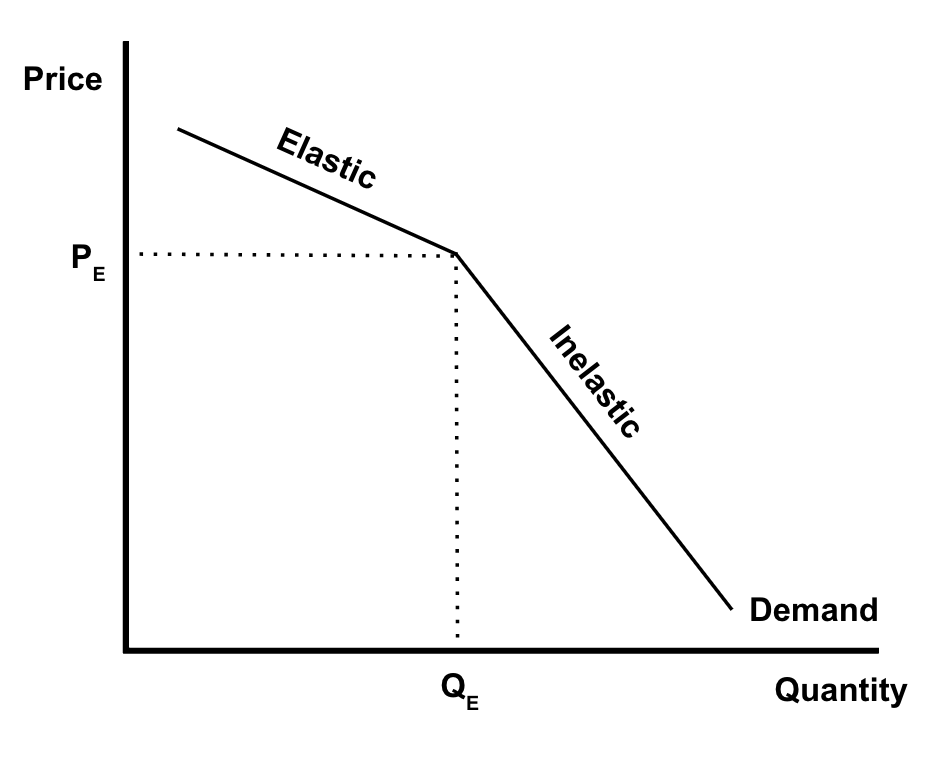

Kinked Demand Curve Model

shows how non-collusive firms are interdependent

36

New cards

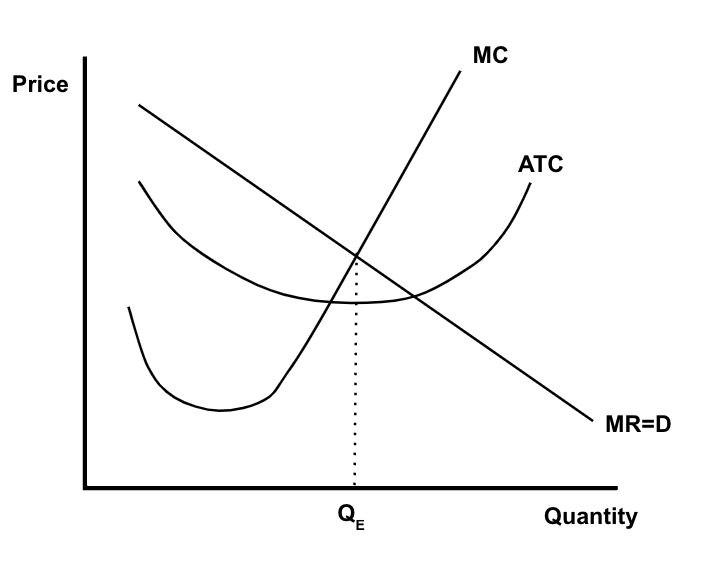

Price Discriminating Monopoly Graph

37

New cards

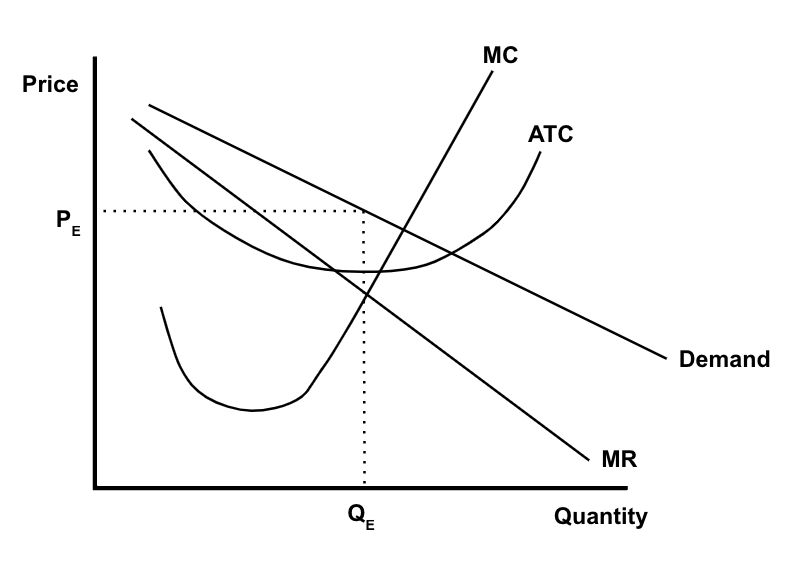

Non-Price Discriminating Monopoly Graph

38

New cards

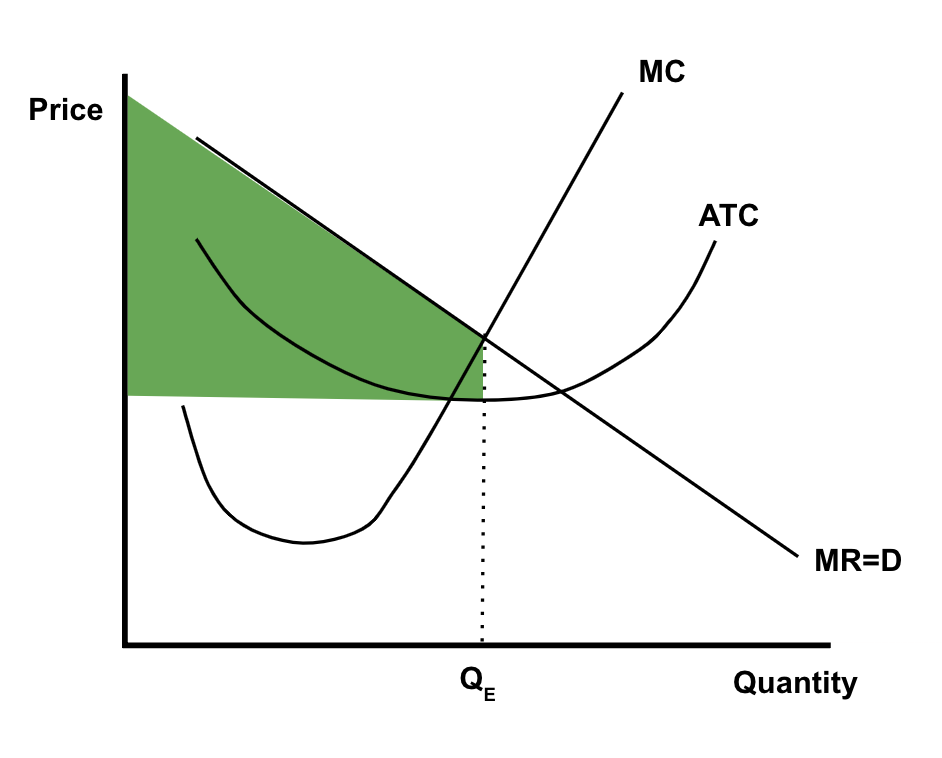

Price Discriminating Monopoly Graph (Profit)

39

New cards

Monopolistic Competition Graph Long-Run Equilibrium

40

New cards

Why does demand shift on the monopolistic competition graph?

when short-run profits are made…

→ new firms enter

→ new firms mean more close substitutes and less market shares for each existing firm

→ demand for each firm falls

when short-run losses are made…

→ firms exit

→ result is less substitutes and more market shares for remaining firms

→ demand for each firm rises

→ new firms enter

→ new firms mean more close substitutes and less market shares for each existing firm

→ demand for each firm falls

when short-run losses are made…

→ firms exit

→ result is less substitutes and more market shares for remaining firms

→ demand for each firm rises

41

New cards

Kinked Demand Curve Graph