government intervention and failure

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

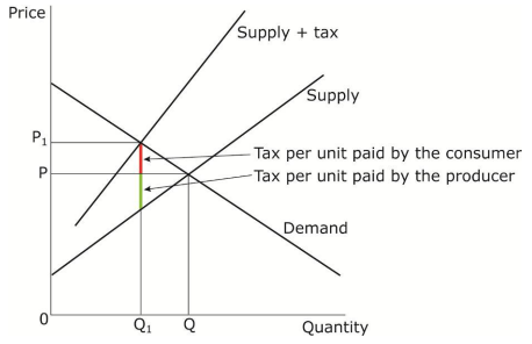

Indirect taxation (ad valorem)

An ad valorem tax is a percentage, such as VAT. With an ad valorem tax the supply curve becomes steeper – in the diagram below the supply curve has pivoted from supply to supply + tax. The buyer pays a proportion of the tax and the supplier the rest.

Indirect taxation (specific)

A specific tax is where the tax is a specific amount. The supply curve shifts left from supply to supply + tax. The buyer pays part of the tax because of the higher price and the supplier pays part because they now make less revenue.

indirect taxes advantages

• Corrects market failures e.g. negative externalities, information failures that lead to over-provision

• Deters consumption of goods that are bad for us, e.g. tobacco, sugar

• Source of revenue for government

• Helps tackle climate change

indirect taxes disadvantages

• Regressive

• Hard to determine best size of tax

• Compliance costs

• Possible tax avoidance/evasion

• Shadow market activity

• Government failure/unintended consequences

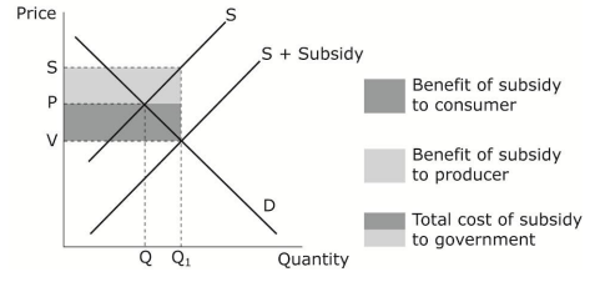

Subsidies

Subsidies increase supply, leading to a reduced price which encourages production/consumption of a good with positive externalities.

Subsidies advantages

• Corrects market failures e.g. positive externalities, information failures that lead to under-provision

• Encourages consumption of goods that are good for us, e.g. healthcare; fresh fruit

• Encourages firms to invest & innovate

• Helps protect producer incomes & jobs

• Supports those on lower incomes

• Can help tackle climate change

• Can help make exports more competitive

Subsidies disadvantages

• Cost to government (opportunity cost)

• Firms may become over-reliant on subsidy

• Firms have less incentive to be efficient and productive

• Firms may distribute extra profit to shareholders rather than re-invest

• May cause fraud/corruption

• Government failure/unintended consequences

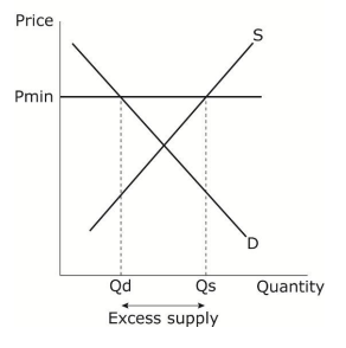

Minimum prices

Governments could introduce a minimum price, where goods cannot be sold at a price below this. A minimum price may be set by a government to discourage consumption of a particular good. Pmin is the minimum price and is set above the market price. Qd is the quantity demanded by consumers and Qs is the quantity supplied. Compared to the market equilibrium, firms have extended supply due to the higher prices but the consumers contracted demand. Qs-Qd gives an excess supply/surplus/glut.

Minimum prices advantages

• To support the incomes and jobs of producers and encourage investment and innovation

• To discourage consumption of goods that are bad for social welfare, have negative externalities or where consumers may lack all information

• To prevent consumers abusing any monopsony power they have at expense of suppliers

Minimum prices disadvantages

• Excess supply needs addressing

• For legal minimum price – suppliers cannot sell any excess, so they will cut supply, output and jobs

• For guaranteed minimum price – intervening to buy up the surplus can be expensive (opportunity cost); surplus will need storing, selling on, destroying etc.

• There may be better alternative policies the government could use if it believes the market price is too low e.g. indirect taxes, provision of information, regulations, government ban/restriction; direct grants to support producers

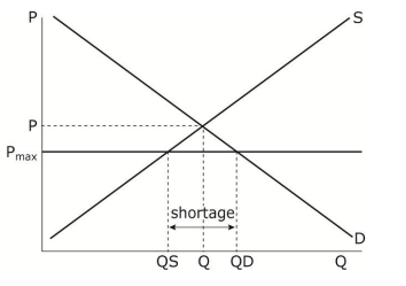

Maximum prices

Governments could introduce a maximum price, where goods cannot be sold at a price above this. A maximum price may be set by a government to encourage consumption of a particular good. Pmax is the maximum price and is set below the market price, P. Qd is the quantity demanded by consumers and Qs is the quantity supplied. Compared to the market equilibrium firms have contracted supply due to the lower prices but consumers have extended demand. Qd-Qs gives an excess demand/shortage. An example of this is Cyprus introducing a maximum price on milk.

Maximum prices advantages

• To make necessities more affordable, especially for those on low incomes (more equitable); reduces poverty/hardship

• To encourage consumption of goods that are good for social welfare, have positive externalities or where consumers may lack all information

• To prevent businesses profiteering at expense of consumers

Maximum prices disadvantages

• Excess demand needs addressing; alternative rationing methods may not work well

• Suppliers may leave the market if they cannot charge a price high enough to make profit (which would increase any shortage created by the maximum price)

• There may be better alternative policies the government could use if it believes the market price is too high e.g. subsidies, provision of information, redistribution from rich to poor, government provision

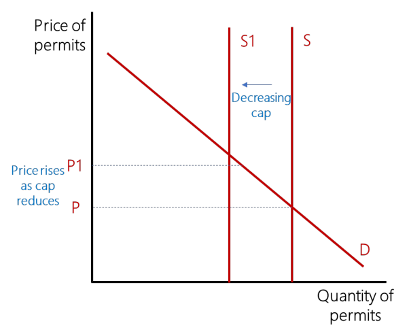

Trade pollution permits

Carbon emissions trading, also known as cap-and-trade, is a market-based system for reducing greenhouse gas emissions. Under a cap-and-trade system, the government sets a limit, or cap, on the total amount of emissions that can be produced in a given period. Companies are then issued permits, or allowances, to emit a certain amount of CO2. If a company emits less than its allotted amount, it can sell its surplus allowances to another company that has exceeded its limit. This incentivises firms to emit less because they can increase their revenue by selling permits and/or because if they pollute they will have to buy more permits adding to their costs.

Trade pollution permits advantages

• Revenue from permit auctions is raised and can be used to reduce external costs

• Incentivises firms to cut pollution

• Cheaper solution than regulation as less costly to administer and efficient firms cut emissions more

• Market-based as firms can decide whether to buy or sell permits

Trade pollution permits disadvantages

• Imperfect information and so it’s difficult to allocate the correct number of permits

• Costs of monitoring and administrating scheme

• Permits often allocated on past performance so those that were clean before receive fewer permits. Or if past levels were the basis for permit allocation then too many may be allocated as this would ignore significant growth and thus emissions since then eg ETS

• Unintended effects can occur such as higher energy prices which benefits nuclear power or others with low emissions

State provision of public goods

The government provides a good or service, using tax revenue to fund it. These goods are not provided by the private sector due to the free rider problem.

State provision of public goods advantages

• Equity – all people, whatever their income have access to public goods

• Efficiency – collective provision allows economies of scale

• Overcomes the free rider problem/missing market

• Public sector investment is higher

State provision of public goods disadvantages

• Government may lack the information needed to provide best amount of public goods

• Possible diseconomies of scale

• Government funding of private sector provision is often costly & wasteful

• Government corruption issues

Provision of information

The government provides information to consumers to correct any problem of information gaps.

Regulation

To tackle negative externalities, the government imposes rules regarding the production or consumption of goods or services. This is usually backed up legally by fines/prison sentences, etc.

Regulation advantages

• Regulations act as a spur for business innovation e.g. to cut the level of carbon emissions

• Regulations may be more effective if demand is unresponsive to price changes

• Regulations can be gradually toughened each year – this will help stimulate capital investment

• They are often straightforward to understand and for businesses to apply e.g. minimum purchase age for cigarettes, alcohol, lottery tickets etc.

• Regulations can often be imposed quickly – other policies, such as taxes and subsidies, may take a long time to be approved by government / parliament

Regulation disadvantages

• High cost of enforcement / administration

• Regulations can lead to unintended consequences / Government failure

• The cost of meeting regulations can discourage small businesses and also lead to less competition in markets

• Policies such as tax can lead to more tax revenue for the government, whereas regulation is usually just a cost

• Total bans are rarely justifiable by economic theory (i.e. the socially optimal level of output where MSC = MSB must be zero or below)

• Tight / strict regulation can lead to more illegal trade, increasing the time / cost of the police and lawenforcement agencies

Government failure

occurs when government intervention worsens the allocation of scarce resources and results in a greater net welfare loss.

Causes of government failure

1. Distortion of price signals

2. Unintended consequences

3. Excessive administrative costs

4. Information gaps

Distortion of price signals

Maximum prices lead to excess demand (shortage) e.g. rent controls cause more homelessness i.e. price is too low to incentivise suppliers. Minimum prices lead to excess supply (surpluses) e.g. butter mountains and milk lakes resulting from the minimum prices guaranteed to European farmers under the Common Agricultural Policy.

Unintended consequences

These are outcomes that were not foreseen and intended by the government action. There may be at least one and often many unintended consequences – some may be good, but it is the bad ones that are a cause for concern. Unintended consequences can deepen any existing market failure.

Excessive administrative costs

The costs of monitoring and enforcement may outweigh the benefits of the policy.

Information gaps

No government has the resources and information available to it to make fully informed, objective judgements. That is the nature of politics.