Booklet 7 micro - Theory of the Firm

1/47

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

Characteristics of perfect competition

Infinite number of buyers and sellers

→ Each firm is small enough that no single firm/consumer has ‘market power’.

→ Each firm is a price taker as all small firms have to comply to the current ‘market price’.

Consumers and producers have perfect information

→ Every consumer decision is well-informed regarding how much every firm in the market charges for a product, as well as details about said products.

→ No firm has any ‘secret’ low-cost prod. methods, and every firm knows the prices charged by every other firm.

Products are homogenous

No barriers to entry and exit

Firms are profit Maximisers (will produce where MR=MC)

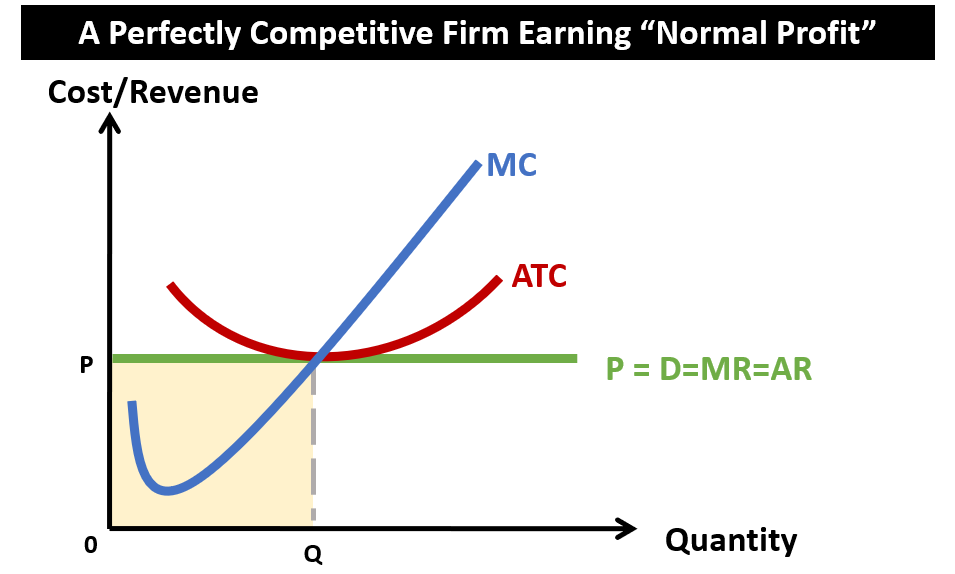

What efficiencies do perfectly competitive markets have?

Allocative efficiency → when a goods price is equal to what consumers want to pay for it. In a p.c market, the price mechanism works perfectly to ensure producers supply exactly what cons demand (P = MC)

Productive efficiency → pc. markets profit maximise where mr=mc, and so will have productive efficiency as the mc curve will always pass through the lowest point of the AC curve.

X-efficiency → measures how successfully firms keep costs down, p.c markets produce at lowest average costs.

What might stop a perfectly competitive market from being allocatively efficient?

Externalities.

Allocative efficiency is where P = MSC, but p.c. markets will in the L-R produce where P = MPC. So if there are negative externalities, there will be allocative inefficiency.

What might stop a perfectly competitive market from being productively efficient?

Economies of scale (but this is highly unlikely in a p.c market due to the infinite number of small firms.

What efficiency do perfectly competitive markets NOT have?

Dynamic efficiency → involves improving efficiency in the L-R through research + development, and investment in new tech or training. BUT, there is little incentive for firms in a p.c market to take these risks as they only make normal profits in the L-R.

Why can’t L-R supernormal profits be made by a perfectly competitive market?

Short term supernormal profits will incentivise new firms to enter the market, which is done easily due to no barriers to entry (these firms are aware of the supernormal profits due to perf. information). These new entrants will shift out the industry’s supply curve, driving down prices until all supernormal profits are exhausted, and there is a return to normal profits (see diagram).

Why won’t firms make losses in the L-R in a perfectly competitive market?

If firms are making a loss in the L-R, they will simply leave the industry as there are no barriers to exit.

(They may still choose to make a loss in the S-R to cover fixed costs if AR > AVC)

Drawbacks of perfect competition?

Unrealistic model → real-life markets will usually lie somewhere on a spectrum between perfect competition and a pure monopoly.

What are barriers to entry?

Any potential difficulty or expenses a firm may face if it wants to enter a market.

High barriers to entry will allow firms to make supernormal profits for longer, without being competed away.

Structural barriers to entry?

First mover advantage → Can produce at lower costs due to being an established firm, and probably have good management/location/distribution networks/ established brand, low overheads (e.g. Google). BUT this may be a temporary adv. (e.g. Zoom).

Economies of scale → If existing firms have econ. of scale, new entrants will struggle to compete on price due to greater avg. costs.

Vertical integration → Where a firm controls all stages of production, raw materials, and retail. This gives firms more control over the market (e.g. Apple, Tesco)

Control of Technology → A firm may have the technology needed to operate in a market (e.g. Microsoft, Google)

Strategic barriers to entry?

Brand proliferation → Where a firm makes a number of different brands/variants, making it more difficult for firms to enter and gain market share (e.g. Kellogg's, Coca-Cola)

Brand loyalty → re-enforced by advertising. Reluctance of consumers to try new/unknown brands, unless they’re very cheap.

Predatory pricing → Setting a price below cost with the aim of driving out comp. and raising prices later.

Limit pricing → Setting prices low to discourage new entrants, allowing the firm to make normal profits.

Legal barriers to entry?

Licenses → Where a firm needs a license to produce (e.g. pubs, pharmacists, food outlets, dentists, taxi firms)

Patents → Provides a right under law to produce and market a good for a specified time period (lasts 20yrs).

Public franchises → Govt. award franchises for operating some services, meaning other firms cannot enter to compete until the franchise is up for renewal (e.g. train lines, BBC, national lottery used to be Camelot)

Characteristics of monopolistic competition

Some product differentiation.

→ So seller has some price making power, making the demand curve slope downwards.

→ The smaller the product differences, the more price elastic.

Either no or very low barriers to entry

→ If high supernormal profits, new entrants can join the industry fairly easily.

Many producers and consumers.

Why can’t L-R supernormal profits be made in monopolistically competitive markets?

Similar to perfect comp, when there’s supernormal profits, the low barriers to entry will allow firms to enter the industry with ease, causing the established firm’s demand curve to shift to the left until only normal profit can be earned (where P = AR = MC) (see diagram)

What efficiencies do monopolistically competitive markets NOT have?

Productive efficiency → Not producing at the lowest point of the AC curve

Allocative efficiency → Price in a m.c market is greater than MC

Dynamic efficiency (usually) → Depends on how long a firm is able to make supernormal profits before the demand curve is pushed left. More likely, there won’t be enough money to invest due to them only making normal profits in the L-R.

STILL more efficient than a monopoly

Why do prices in monopolistic competition tend to be higher than in perfect competition?

Firms in a m.c market need to spend money on differentiating their product (e.g. advertising) to create brand loyalty.

What is a monopoly?

A pure monopoly is a market with only one firm in it (100% market share), although in the UK a firm is legally considered a monopoly if it has 25%+ of the market share. They are price-makers.

Why might monopoly power come along?

Barriers to entry - preventing new comp. from entering and competing away large profits.

Ads and product differentiation - A firm may become a price-maker if consumers think its products are more desirable than others.

Few competitors in the market - If a market is dominated by few firms, they’re likely to have some price-making power, and find it easier to differentiate.

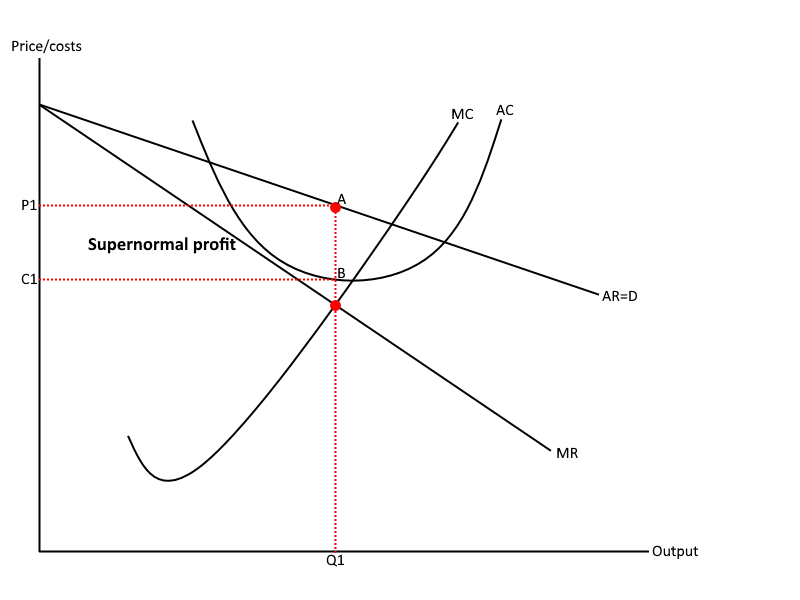

For how long can monopolies make supernormal profits?

Supernormal profits can be made in the long run. Firms will profit maximise where MR = MC, but as monopoly markets have total barriers to entry, no new firms enter to compete away the supernormal profits

What efficiencies do monopolies markets NOT have?

Productive efficiency → Monopolies don’t operate at the lowest point of the AC curve.

Allocative efficiency → The price monopolies charge is greater than MC. Producers are being ‘over-rewarded’ for the products they’re providing.

Drawbacks of monopolies?

Supply is restricted to be less than the equilibrium, and so some of the consumer surplus that would have existed is transferred to the producer.

There is no need for a monopoly to innovate or respond to consumer preferences to be profitable (so may choose not to be dynamically efficient).

No need to increase efficiency, so x-efficiency may be high.

Restricted consumer choice due to a lack of alternative products.

Monopsonist power may be used to exploit consumers.

May exploit price-making power.

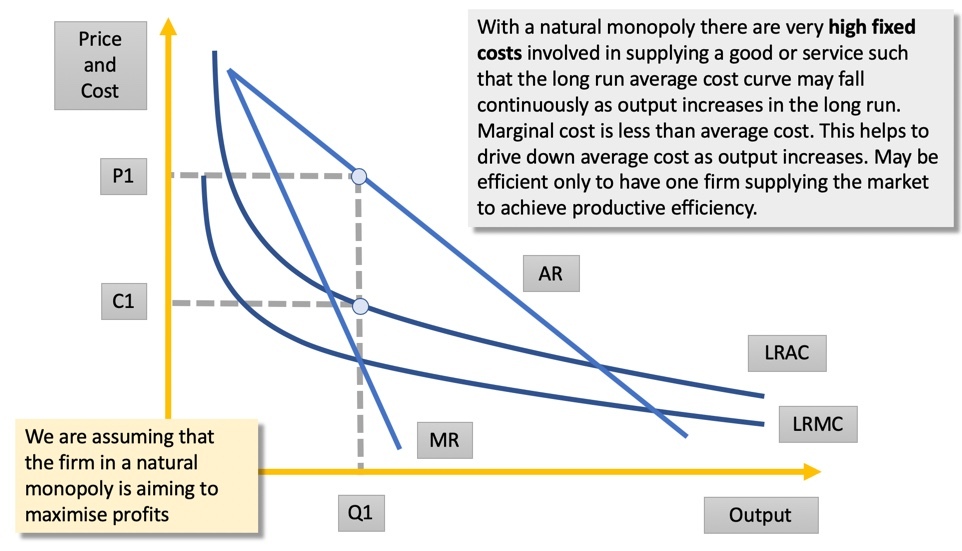

What are natural monopolies?

Industries where there are high fixed costs and/or large economies of scale. In this type of industry, one large business can supply the entire market at a lower price than two or more smaller ones. It is further explained in the diagram. e.g. London Underground.

Benefits of monopolies?

May exploit economies of scale to keep avg. costs (and maybe prices) low.

Long-term supernormal profits may be used to invest in developing and improving products for the future (dynamic efficiency).

More financially secure so can provide stable employment for workers.

Monopsony?

When a single buyer dominates a market.

They can act as a price-maker, and drive prices down. Supermarkets are accused of unfairly using their market power to force suppliers to sell their products at a price that means those suppliers make a loss (exploit suppliers… but in the interest of consumers? lower prices passed on)

Monopsonies who buy labour in a market can exploit its power and keep wages down.

e.g. Amazon in the book market, food retailers like Tesco, Sainsbury

Possible govt. policies for industries that resemble a natural monopoly…

Nationalisation (unlikely) e.g. Network Rail in 2001.

Price controls e.g. energy price cap.

Fines for anti-competitive behaviour e.g. Microsoft fined €1.68 in 2008 for pre-installing its browser, Internet Explorer, on computers that ran Windows.

Introducing competition to the industry

Price discrimination?

When a seller charges different prices to different consumers for the exact same good/service.

It attempts to turn consumer surplus into additional revenue.

e.g. Window cleaners may charge more in nicer neighbourhoods, Train tickets at rush hour cost more

Conditions for a firm to make use of price discrimination?

→ Must have some price-making power (e.g. monopolies, oligopolies).

→ Must be able to distinguish separate groups of consumers who have different PED.

→ Must be able to prevent seepage (prevent customers who have bought a product at a low price re-selling it themselves at a higher price to those who could have been charged more)

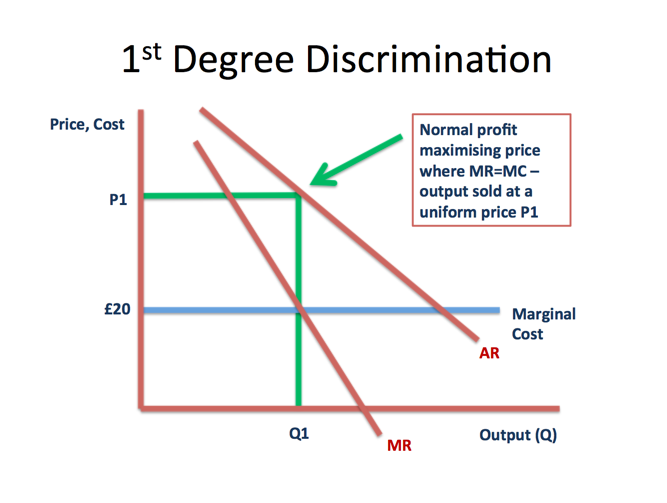

First degree price discrimination?

Perfect price discrimination (optimal pricing).

Each consumer is charged the max that they’re willing to pay, which if done successfully would turn all consumer surplus into extra revenue.

Unlikely due to costs of gathering required info, and difficulty in preventing seepage.

Second degree price discrimination?

Whereby businesses sell off packages or blocks of a product deemed to be surplus capacity at lower prices. Price usually falls as quantity increases, and some of the consumer surplus is turned into revenue

e.g. hotel industry

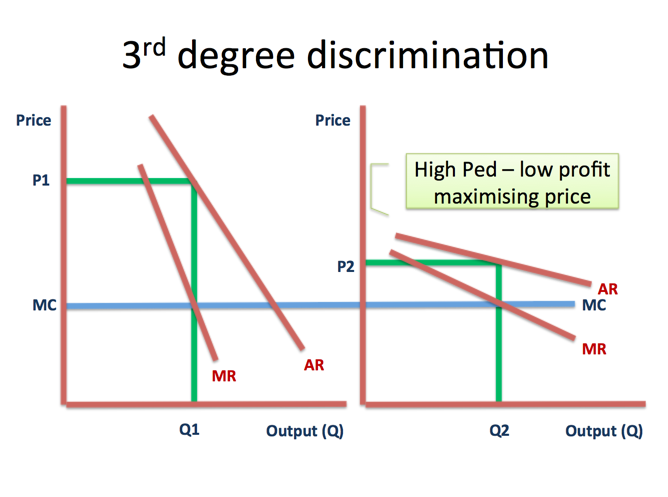

Third degree price discrimination?

When a firm charges different prices for the same product to different segments of the market.

Could be based on:

→ Age / families e.g. senior tickets, students

→ Time - Seasons, days of the week etc. (e.g. telephone company charging more in the evening)

→Events e.g. concerts, sports

It is highly dependant on the elasticities of demand for the identified groups of consumers (see diagram)

To maximise profits at MR = MC, sellers will charge a higher price to the group with a more inelastic PED, and a lower price to the group with a more elastic PED (e.g. commuters vs tourists)

Advantages of price discrimination

Firm

→ Increased revenue (possibly profit)

→Improved capacity utilisation (spreading demand out)

Consumer

→ Benefits those who pay the lower price

→ Firms extra revenue may be used to improve products or to invest in more efficient prod methods, leading to lower prices.

Disadvantages of price discrimination

Firm

→ Too many different prices may confuse customers… may disincentives consumption.

→Need to control seepage.

→ Not allocatively efficient (where P = MC)

Consumer

→ Some consumers paying a higher price (but oftentimes are those on higher incomes).

→ Loss of consumer surplus as has been converted to revenue

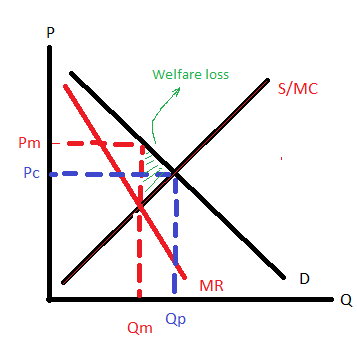

Compare price + output for perfect competition and a monopoly in a market (not firm so S + D)… draw it.

A monopoly will have higher prices, lower output, and a reduced consumer surplus.

Monopolies will have economies of scale.

Perfect competition profit maximises ALWAYS, monopolies usually do but not always.

Oligopoly?

A market structure whereby there are a few dominant firms, and lots of very small producers.

This domination is calculated by the concentration ratio.

Usually has a five-firm concentration ratio of more than 60%

Characteristics of an oligopoly?

→ Dominated by a few firms.

→ High barriers to entry (new entrants can’t easily compete away supernormal profits).

→ Offer differentiated products, so has product branding.

→ Firms are interdependent - firms must take into account the likely reactions of their rivals to any changes in price, output, or any other forms of non-price comp.

→ Non price competition e.g. Innovation, free upgrades, branding, quality of service, loyalty schemes, sales promotions (e.g. McDonalds monopoly).

Competitive Oligopoly

Firms don’t cooperate but compete, often non-price comp.

Competitive behaviour is more likely when:

→ One firm has lower costs than others.

→ There’s a relatively larger no. of big firms in the market (harder to know what everyone else is doing)

→ The firms produce very similar products.

→ Barriers to entry are relatively low.

Collusive oligopoly

When various firms co-operate with each other, especially over prices.

Formal collusion → Involves an agreement between firms, who become a price-fixing cartel (deemed illegal by UK and EU competition law)

→ Overt/explicit price fixing in an attempt to control supply and fix price close to the level expected from a monopoly.

Tacit collusion → Happens without any agreement, as firms understand that it’s in their best interest not to compete, so long as others do the same.

→ Price leadership where prices and price changes established by a dominant firm are usually accepted by others firms who adopt and follow e.g. petrol retailers

Collusive behaviour is more likely when:

→ Firms have similar costs.

→ There are relatively few firms in the market (easier check what others are changing) e.g. oil

→’Brand loyalty’ where customers are less likely to buy elsewhere, even if prices are lower.

→Relatively high barriers to entry.

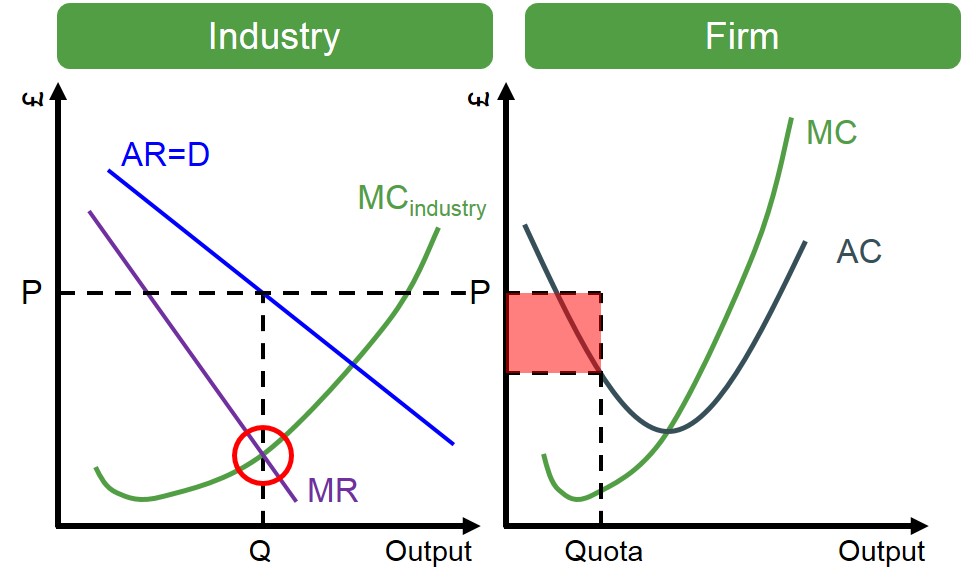

How can collusive oligopolies bring about similar results as a monopoly?

Generally lead to higher prices and restricted output, as well as productive and allocative inefficiency.

Collusive oligopolies often have the resources to invest and gain dynamic efficiency, but often lack an incentive to do so, so can lead to market failure.

Firms may agree to restrict output to maintain high prices through output quotas, which results in supernormal profits.

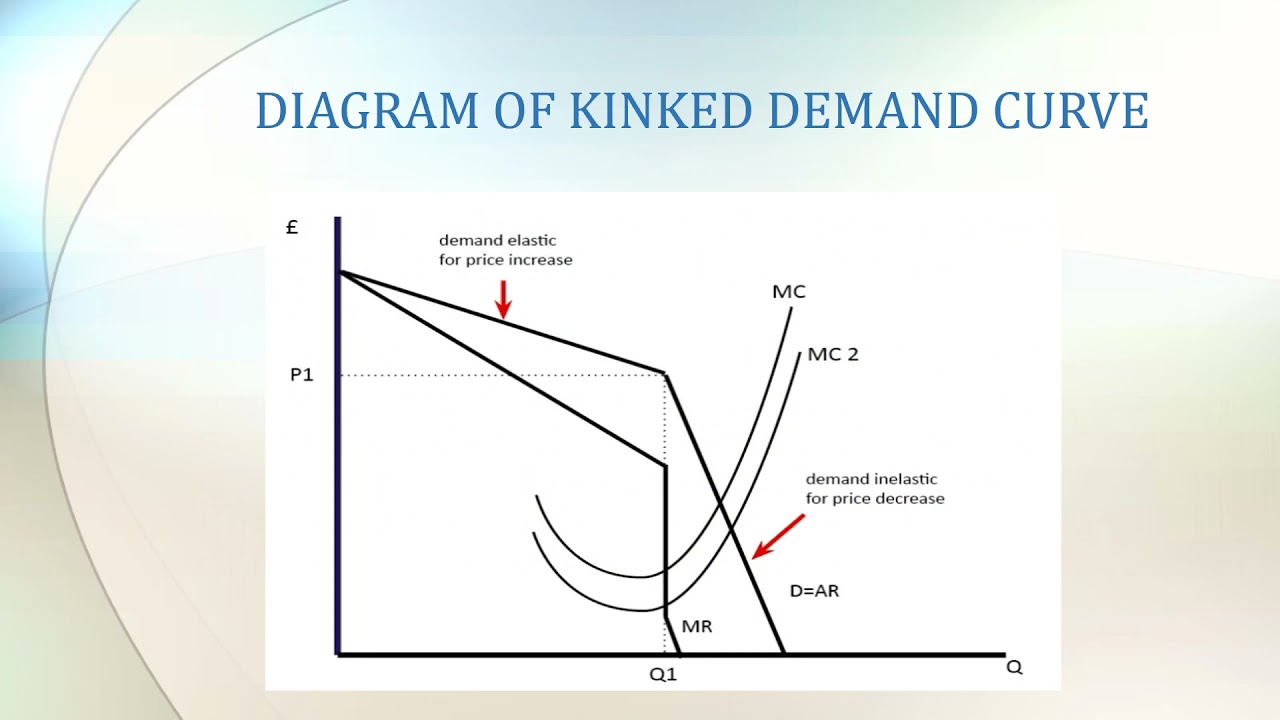

What diagram could be used to demonstrate the interdependence of oligopolies?

The Kinked Demand Curve demonstrates why prices are quite stable in oligopolistic markets, incentivising non-price competition) even those that are competitive.

The curve model has 2 assumptions:

If a firm raises its prices, then the other firms will NOT raise theirs, so will see quite a large drop in demand (when price is increased, demand is elastic)

If a firm lowers its prices, then other firms will also lower theirs, and so will not gain any market share (when price is decreased, demand is inelastic)

This may encourage firms to collude.

Issues with the kinked demand curve?

Doesn’t explain how we get to that point.

Not applicable to behaviour in every oligopoly e.g. phone companies can raise their prices and consumers will continue to pay because the price is not the dominant factor.

What authority regulates markets on behalf of the gov. in the UK?

Competition and Markets Authority (CMA) investigates anti-competitive practices.

What does the CMA consider anti-competitive practices?

→ Predatory pricing

→ Collusion

→ Bid-rigging

→ Full line forcing (e.g. often in pubs where if you want to stock 1 of a brewers goods, you must stock them all.)

→ Refusal to supply

How does the CMA regulate anti-comp practices?

→ Price controls.

→ Reducing/eliminating barriers to entry through deregulation.

→ Monopoly break-up / prevent mergers

→ Taxation / windfall tax / fines

→ Changing ownership (nationalisation / privatisation)

Contestability?

How open a market is to new competitors.

In a contestable market there are low barriers to entry/exit, and supernormal profits can potentially be made by new firms (in s-r). Perfectly contestable markets are costless.

The threat of increased competition incentivises existing firms to set prices at a level that won’t generate vast supernormal profit

What can make a market have low-contestability?

High barriers to entry:

Patents on key products or production methods.

Advertising by existing firms that has already created strong brand loyalty.

Limit pricing (i.e. predatory pricing) tactics would discourage new entrants who fear a ‘price war’, especially if the existing firm has low costs due to its time in the market.

Trade restrictions (e.g. tariffs or quotas)

Vertically integrated existing firms - limits access to supplies of raw materials or distribution networks for new firms.

Sunk costs are high (things that have been committed or spent by a business that can’t be recovered) - cost of failure is high

What issue for existing firms may low barriers to entry/exit result in?

‘Hit-and-run’ tactics whereby firms enter when there are supernormal profits, competing them away, and then leaving the market. This is why in the L-R, firms will make normal profits and move towards productive and allocative efficiency.

Technological impact on market structures?

Invention and innovation can lead to:

→ Improvements in capital equipment (e.g. factories, roads), leading to improvements in the quality of goods/services.

→ Barriers to entry being increased or reduced.

→ a level of monopoly power for the first firm that innovates or uses new invention.

→ Improvements in labour productivity and efficiency.

→ Larger economies of scale

→ CREATIVE DESTRUCTION

Creative destruction?

Where the development of new inventions/innovations lead to the destruction of existing markets and the creation of new ones e.g. VHS to DVD