1.3: Market Failure (EDEXCEL A LEVEL ECONOMICS)

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

40 Terms

economic welfare

benefit to consumer-cost to producer

marginal private benefit

The benefit from an additional unit of a good or service that the consumer of that good or service receives.

marginal private cost

the cost of producing an additional unit of a good or service that is borne by the producer of that good or service

economic welfare is maximised at equilibrium

before equilibrium: MPB>MPC ( welfare is positive but up until equilibrium is reached there is still extra welfare to be attained)

after equilibrium : MPC>MPB ( welfare is negative so any increase in production subtracts from the optimum welfare at equilibrium )

market failure

failure to allocate scarce resources in the best or optimum way to maximise economic welfare

complete market failure

When a market fails to supply any of a good which is demanded, creating a missing market

partial market failure

When a market for a good exists but there is overproduction or underproduction of the good

externalities

under provision of public goods

information gaps

causes of market failure

externalities

when actions of a producer or consumer have an effect on the bystander, other than by the normal function of the price mechanism

negative externality

actions are harmful and reduce well-being, the bystander won't get compensation

positive externality

actions are beneficial and increase well-being, the bystander doesn't pay for the benefit

merit goods

goods which are under-provided by the private sector and have positive externalities

demerit goods

Goods that are considered to be undesirable for consumers and are over-provided by the market. ( negative externalities )

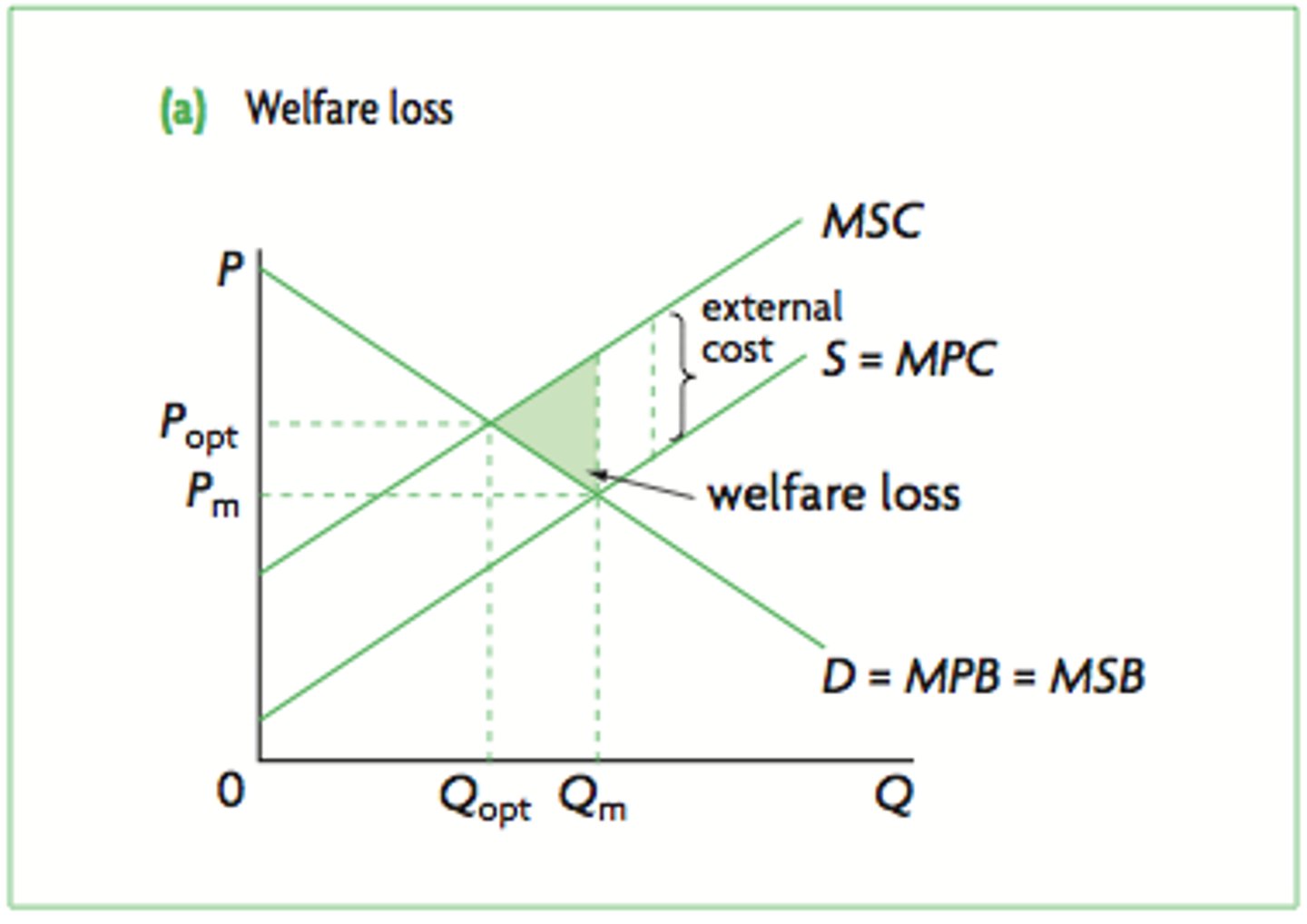

negative externalities in production

MPB=MSB benefit to society and consumer are equal

MPC

private costs

costs incurred by the individual

external costs

costs incurred by bystanders

social costs

private + external costs

welfare loss

reduction of economic welfare when external costs aren't taken into account, quantity is above socially optimal level

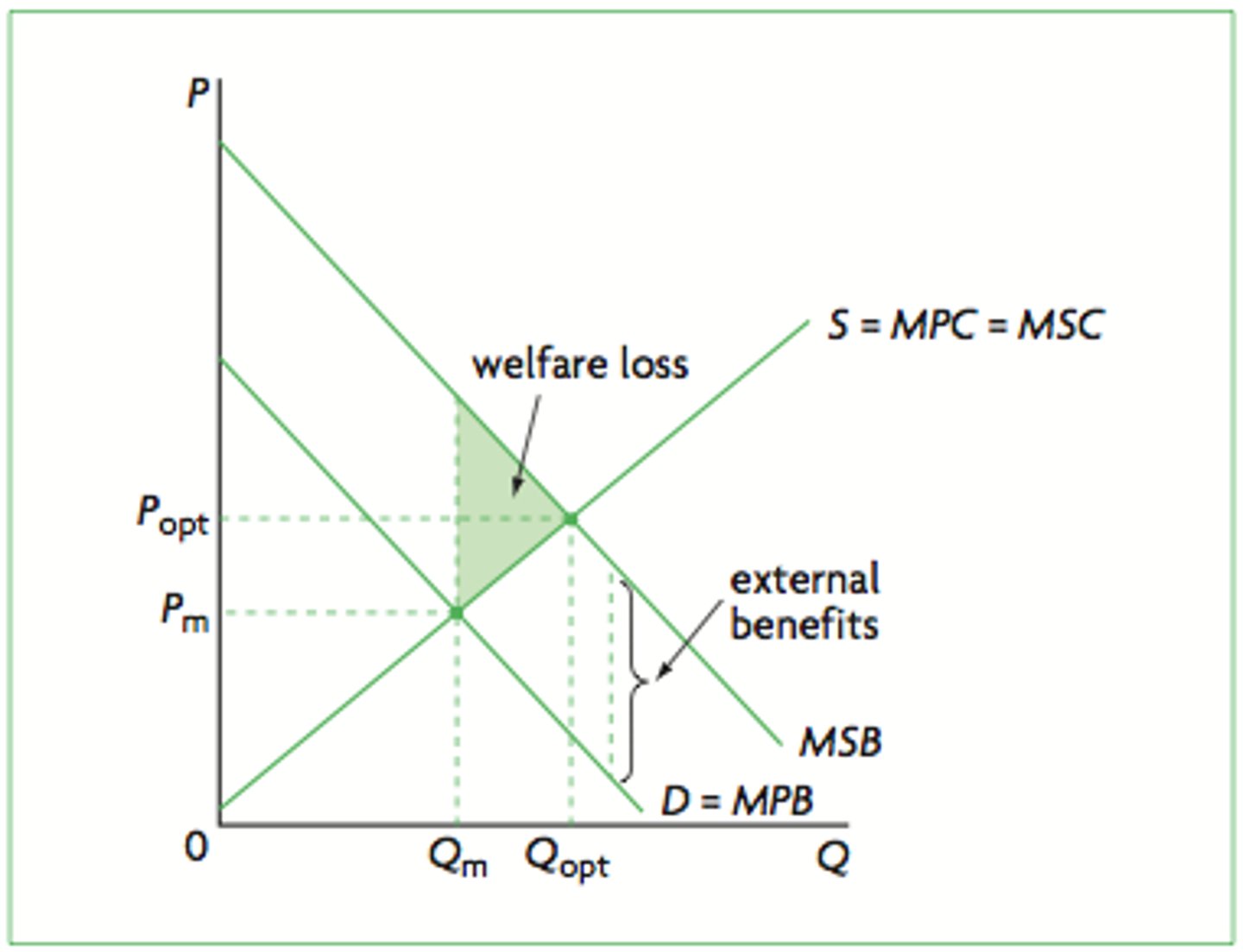

positive externalities in consumption

MPC=MSC no negative externalities, cost to individual and society is the same

MSC>MPB positive externalities, benefit to society is greater than to the individual if production is at MSC and MPB equilibrium then there will be underproduction and welfare loss, if it is at MSC and MSB equilibrium then production will rise to socially optimal levels

private benefits

benefit to the individual

external benefits

benefits that are received by those not immediately involved in economic transaction

social benefit

private + external benefit

internalising externalities

making the private supplier pay for the external costs

public goods

are goods that are non-rivalrous and non-excludable

non-rivalrous

A characteristic of some goods where the consumption of the good by one person does not reduce consumption by someone else; it is one of the two characteristics of public goods.

non-excludable

A characteristics of some goods where it is not possible to exclude someone from using a good, because it is not possible to charge a price. It is one of the characteristics of public goods.

private goods

goods that are both excludable and rival in consumption

semi-public goods

goods which are non-rivalrous but excludable

the free rider problem

people enjoy the benefits of the goods without paying because they are non-excludable, everybody waits for someone else to provide the good or service so they can use it for free, therefore no one ever does. Scarce resources are not used in the desired way because people's demand is never registered on the market-allocative inefficiency

information gaps

Where consumers, producers or the government have insufficient knowledge to make rational economic decisions. Can't assess the true cost or benefits, may over or under value goods and can't be sure if welfare is maximised, only with perfect information can there be allocative efficiency

symmetric information

Where consumers and producers have access to the same information about a good or service in a market. leads to perfect knowledge

asymmetric information

a situation in which one party to an economic transaction has less information than the other party, leads to imperfect knowledge

lemon laws

exist in many states and protect consumers from the consequences of buying a defective car, sellers know the truth about the car but buyers don't until purchase, therefore buyers are reluctant to pay the price for a good car meaning car dealers rarely got a fair price and the market collapsed

why there is asymmetric info between buyers and sellers

specialisation and technicality of financial products

perceived costs of obtaining info outweigh benefits

info may be limited to specific institutions

info may be expensive

leekage of info between departments and employees

regulatory capture

A situation in which bureaucrats favor the interests of the groups or corporations they are supposed to regulate at the expense of the general public.

moral hazard

taking risks to benefit yourself knowing the negative effects will be felt by other people, arises because of asymmetric information

externalities in the financial sector

bankers didn't account full external costs

imposed massive externalities on the economy

financial crisis: fall in GDP, income and unemployment

taxpayers had to suffer the costs

foreign exchange market rigging

bankers sold info about client activity on online forums

brag about 'free money and bonuses'- bank making money led to bankers making money

traders obtain private info about clients which could change currency value

traders then place orders and sales to profit from the change in currency

market rigging

price fixing

insider trading- buying and selling assets in possession of info not available to all

market bubbles

Occurs when prices are grossly overvalued due to speculation. fueled by poor lending decisions, once it peaks investors sell so the bubble bursts leading to a loss of confidence and aggregate demand