Sample Exam

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

40 Terms

The primary purpose(s) of financial accounting is(are) to:

Both measure and communicate financial information to external parties.

Which business form has the advantage of limited liability?

Corporation

How many of the following transactions are financing activities?

Borrow $50,000 from the bank.

Purchase $12,000 in supplies.

Provide services to customers for $27,000.

Pay the utility bill of $750.

Purchase a delivery truck for $12,000.

Receive $25,000 from issuing common stock.

Two Borrow $50,000 from the bank and Receive $25,000 from issuing common stock.

Amounts owed to suppliers for supplies purchased on account are defined as a(n):

Liability

The costs of providing goods and services to customers are referred to as

Expenses

Given the information below, calculate net income in the current period.

Accounts Receivable $ 14,700

Rent Expense 7,500

Insurance Expense 3,100

Common Stock 24,000

Service Revenue 28,300

Supplies 4,300

Equipment 21,600

Income Tax Expense 4,200

$13,500.

Which of the following items is reported in the statement of stockholders' equity?

Dividends

Nina Corp. had the following net income (loss) for the first three years of operations, respectively: $7,100, ($1,600), and $3,600. If the Retained Earnings balance at the end of year three is $1,100, what was the total amount of dividends paid over these three years?

$8,000

Which of the following is not a balance sheet item?

Revenues

How many of the following transactions would affect operating cash flows reported in the statement of cash flows (all transaction involve cash)?

Repay $40,000 borrowed from the bank.

Pay $11,000 in salaries to employees.

Receive $25,000 from customers for services provided.

Pay $750 for advertising.

Purchase equipment for $15,000.

Receive $25,000 from the sale of land.

Three Pay $11,000 in salaries to employees., Receive $25,000 from customers for services provided., Pay $750 for advertising.

The body of rules and procedures that guide the measurement and communication of

financial accounting information in the United States is known as:

Generally Accepted Accounting Principles (GAAP).

Independent auditors express an opinion on the:

Extent to which financial statements are in compliance with GAAP.

The accounting equation is defined as:

Assets = Liabilities + Stockholders' Equity.

In what order are the following financial statements prepared: (1) balance sheet, (2) income

statement, and (3) statement of stockholders' equity?

1, 3, 2.

Which step in the process of measuring external transactions involves determining the effect on assets, liabilities, and stockholders' equity?

Analyze the impact of the transaction on the accounting equation.

When a company pays employees' salaries for the current period, how will the basic accounting equation be affected?

Stockholders' equity decreases

Which of the following would increase assets and increase liabilities?

Purchase office supplies on account

Purchasing supplies for cash has what effect on the accounting equation?

No net effect

Following are transactions of Gotebo Tanners, Inc., a new company, during the month of

January:

Issued 10,000 shares of common stock for $15,000 cash.

Purchased land for $12,000, signing a note payable for the full amount.

Purchased office equipment for $1,200 cash.

Received cash of $14,000 for services provided to customers during the month.

Purchased $300 of office supplies on account.

Paid employees $10,000 for their first month's salaries.

How many of these transactions decreased Gotebo's total assets?

One Paid employees $10,000 for their first month's salaries.

Assume that Sallisaw Sideboards, Inc. had a retained earnings balance of $10,000 on April 1, and that the company had the following transactions during April.

Issued common stock for cash, $5,000.

Provided services to customers on account, $2,000.

Provided services to customers in exchange for cash, $900.

Purchased equipment and paid cash, $4,300.

Paid April rent, $800.

Paid employees' salaries for April, $700.

What was Sallisaw's retained earnings balance at the end of April?

$11,400

Assets normally carry a ________ balance and are shown in the ________.

Debit; Balance sheet

Which of the following accounts would normally have a credit balance?

Accounts Payable, Service Revenue, Common Stock.

When viewing a company's accounting records, the terms "debit" and "credit" would typically be seen in which location?

Journal

Childers Service Company provides services to customers totaling $3,000, for which it billed the customers. How would the transaction be recorded?

Debit Accounts Receivable $3,000, credit Service Revenue $3,000.

A company received a bill for newspaper advertising services, $400. The bill will be paid in 10 days. How would the transaction be recorded today?

Debit Advertising Expense $400, credit Accounts Payable $400.

Posting is the process of

Transferring the debit and credit information from the journal to individual accounts in the

general ledger.

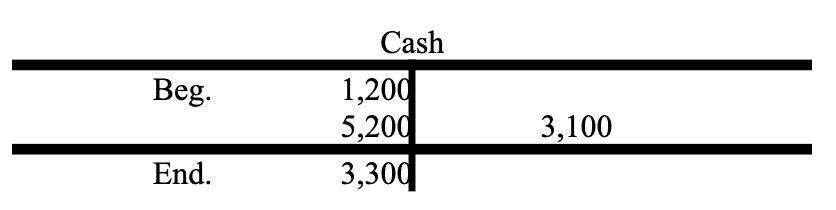

The $3,100 amount could represent which of the following?

Payment for salaries

The revenue recognition principle states that:

Revenue should be recognized in the period goods and services are provided

A company orders office supplies in June. Those supplies are received and paid for in July. The supplies are used in August. In which month should the company record supplies expense?

August

Which of the following is true about adjusting entries?

They are a necessary part of accrual-basis accounting.

Making rent payments in advance is an example of a(n):

Prepaid expense.

Adjusting entries:

Always involve at least one income statement account and one balance sheet account.

On May 1, 2021, Townsley borrowed $250,000 from Prime Bank by signing a three-year, 6% note payable. Interest is due each May 1. What adjusting entry, if any, should Townsley record on December 31, 2021?

Debit Interest Expense and credit Interest Payable for $10,000

On July 1, 2021, Charlie Co. paid $18,000 to Rent-An-Office for rent covering 18 months

from July 2021 through December 2022. What adjusting entry should Charlie Co. record on

December 31, 2021?

Debit Rent Expense and credit Prepaid Rent for $6,000.

A company receives a utility bill each month for services received. The company's policy is to pay the utility bill within 30 days of receipt. On December 31, 2021, the company receives a utility bill of $4,200 for the month of December and plans to pay the bill by January 30, 2022.

What adjusting entry, if any, will the company record on December 31, 2021?

Debit Utilities Expense and credit Utilities Payable for $4,200.

A company owes employee salaries of $16,000 at the end of the year. These salaries will be paid in the following year. What adjusting entry, if any, does the company need to record at the end of the year?

Debit Salaries Expense and credit Salaries Payable for $16,000

The adjusted trial balance should be prepared ________ the financial statements are prepared in order to prove the ________ of the debits and credits.

before; equality

A classified balance sheet ________.

Shows subtotals for current assets and current liabilities

The purpose of closing entries is to transfer:

Balances in temporary accounts to a permanent account.

Of the following six accounts, which ones have temporary balances:

(1) Service Revenue

(2) Dividends

(3) Salaries Expense

(4) Common Stock

(5) Retained Earnings

(6) Cash

(1), (2), and (3).