IB Business Finance Formulae

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Labour turnover

# of staff leaving over a year

————————————————— x 100

average # of staff employed in a year

Variable costs

average variable cost x quantity

total cost

fixed cost + variable cost

Sales revenue

price x quantity sold

average revenue

Total revenue

——————

Quantity

Contribution (total and per unit)

Definition → money left over after variable costs have been subtracted from revenue. the money contributes towards fixed costs and profit

Contribution per unit = selling price - average variable cost

Total contribution = total revenue - total variable costs

Break-even point

Fixed costs

—————————-

Contribution per unit

Break-even price (how much you need to charge to break-even)

Total cost

—————

Output

Target profit (how many units of output need to be produced to generate a certain level of profit)

Fixed costs + target profit

Q = ————————————

Contribution per unit

Margin of safety

Current level of output — break-even output

Profit-loss account

Sales revenue — COGS = Gross profit

|

Gross profit — Expenses = Net profit before interest & tax

|

Net profit before interest & tax — Interest = Net profit before tax

|

Net profit before tax — Tax = Net profit after interest & tax

|

Net profit after interest & tax — Dividends = Retained profit

Balance sheet

Non-Current Assets:

- property/equipment

- accumulated depreciation (-)

Current Assets:

- cash

- debtors

- stock

Total Assets = Current Assets + Non-Current Assets

Current Liabilities:

- bank overdraft

- trade creditors

- short-term loans

Non-Current Liabilities:

- long-term loans

Total Liabilities = Current Liabilities + Non-Current Liabilities

Net Assets = Total Assets — Total Liabilities

Equity:

- share capital

- retained profit

Net Assets = Equity

Depreciation (straight line method)

original cost — residual value

—————————————

expected life (years)

Cash flow forecasts

Opening balance (previous month’s closing balance)

Cash Inflows:

- cash sales revenue

- other income

Total inflows =

Cash Outflows:

- stock

- labour costs

- other costs

Total outflows =

Net Cash Flow = Total inflows — Total outflows

Closing Balance = opening balance + net cash flow

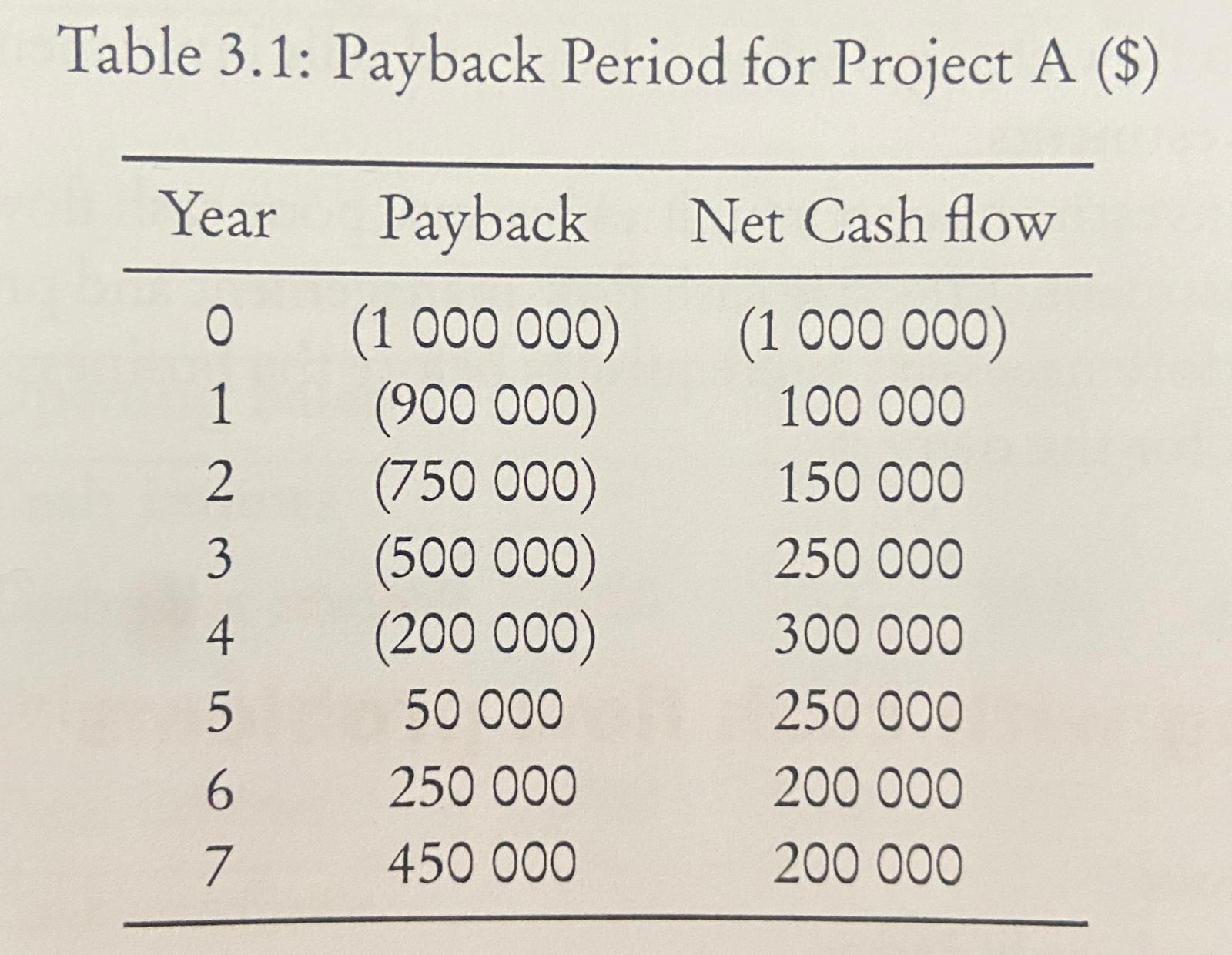

Payback period

Payback in last negative year

——————————————— x 12 = months

Net cash flow in first positive year

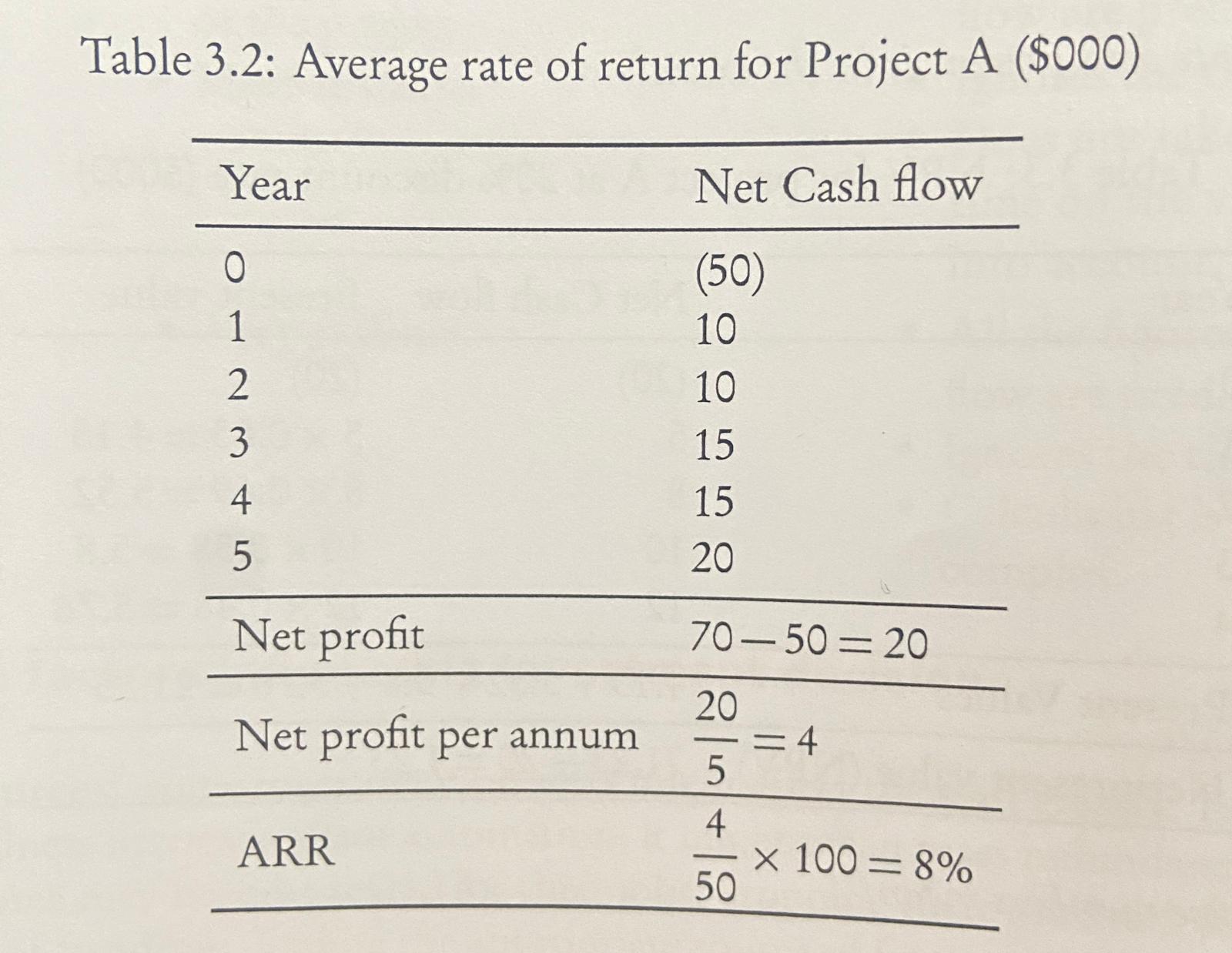

Average rate of return

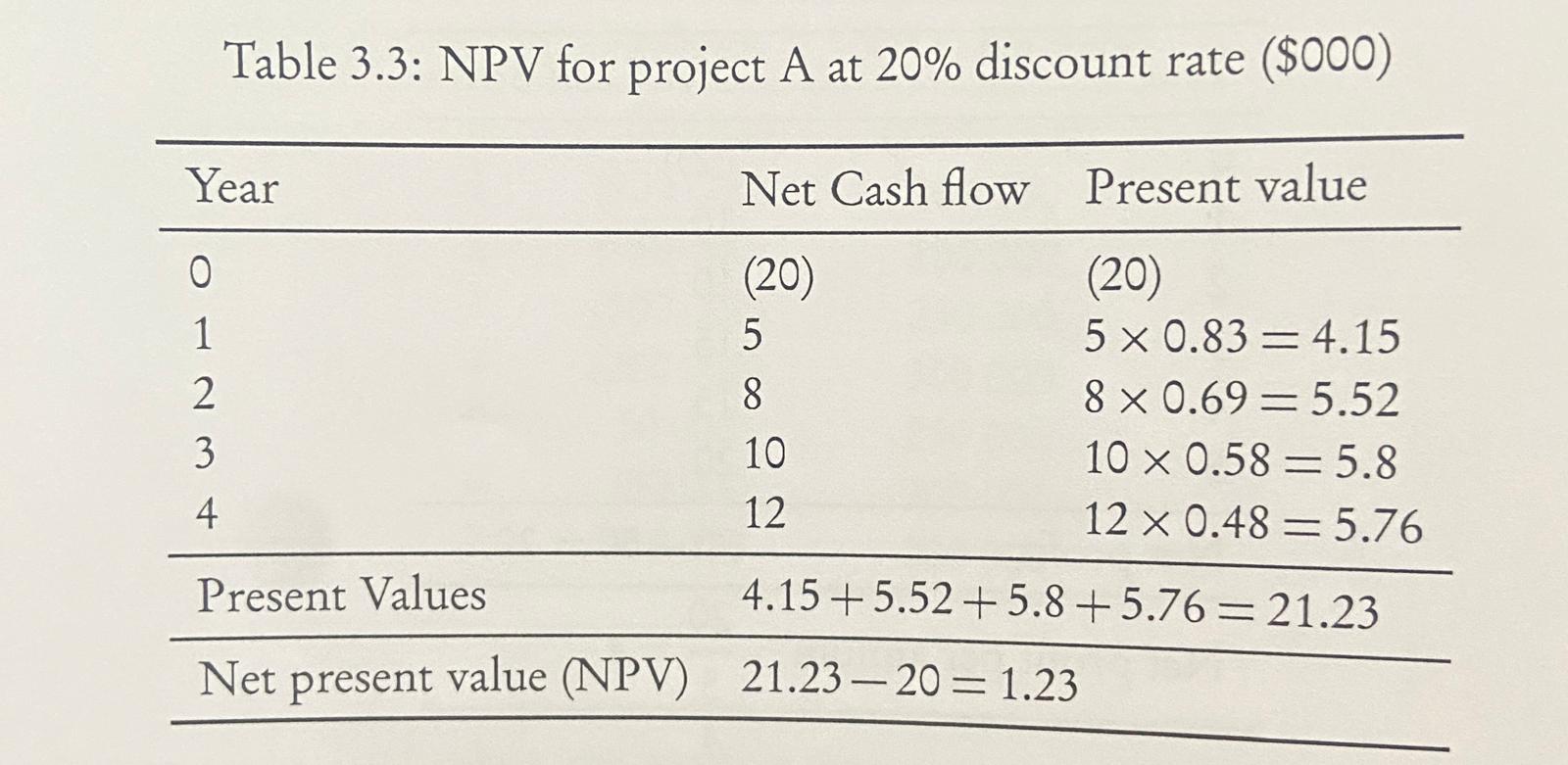

Net Present Value (discount)

Variance

actual outcome — budgeted outcome

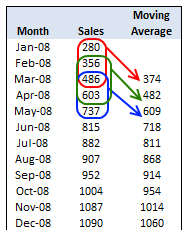

Time series analysis

attempts to predict sales levels by identifying the underlying trend from a sequence of actual sales figures recorded at regular intervals

3 point moving average = sales month 1, 2, 3

3

Variation = sales — 3-point moving average

Decision Tree: Expected value

Expected Value = ((FR x PS) + (FR x PF)) - cost

where,

FR = forecasted revenue

PS = probability of success

PF = probability of failure

cost = cost of the option

Labour productivity rate

total output

———————— x 100

number of workers

Cost to buy

price x quantity

cost to make

fixed costs + (average variable cost x quantity)