THEME 3

5.0(2)

5.0(2)

Card Sorting

1/66

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

67 Terms

1

New cards

formula for total revenue

price x quantity sold

2

New cards

what is marginal revenue

extra revenue a firm earns from the sale of one extra unit

3

New cards

what is average revenue

the average receipt per unit, calculated by total revenue divided by quantity sold

4

New cards

what is the AR curve

the firms demand curve as it is the price of the good

5

New cards

when is the AR curve horizontal

in markets where firms are price takers - perfectly elastic demand for the goods

6

New cards

when is the AR curve downward sloping

when firms are price setters

7

New cards

total cost

how much it costs to produce a given level of output

FC + VC = TC

FC + VC = TC

8

New cards

fixed costs

indirect costs that do not vary with output and firms always have to pay.

e.g rent

e.g rent

9

New cards

variable costs

direct costs that change with output e.g costs of raw materials increases as output increases

10

New cards

average total cost formula

TC/ quantity produced

ATC= AVC+AFC

ATC= AVC+AFC

11

New cards

average fixed costs formula

FC/quantity

12

New cards

average variable costs formula

VC/quantity

13

New cards

marginal cost

how much it costs to produce one extra unit of output

change in TC/ change in quantity

change in TC/ change in quantity

14

New cards

internal economies of scale

occur when a firm becomes larger

15

New cards

examples of internal economies of scale

Really Fun Mums Try Making Pies

Really Fun Mums Try Making Pies

risk bearing

financial

managerial

technoligcal/ production

marketing

purchasing

financial

managerial

technoligcal/ production

marketing

purchasing

16

New cards

marginal cost

cost of making the next one

17

New cards

marginal revenue

revenue from selling the next one

18

New cards

what does each example of internal EOS mean

risk bearing- 7/10 work

financial - negotiate low interest loans

marketing- promote the brand name

technological/ production - best machinery

managerial- best staff

purchasing - discount (buying in bulk)

financial - negotiate low interest loans

marketing- promote the brand name

technological/ production - best machinery

managerial- best staff

purchasing - discount (buying in bulk)

19

New cards

external economies of scale

occur within an industry when it gets larger

20

New cards

examples of external EOS

* better universities

* road infrastructure

* communication networks

* highly skilled population

\

* road infrastructure

* communication networks

* highly skilled population

\

21

New cards

diseconomies of scale

when average costs rise

22

New cards

examples of diseconomies of scale

* control - can’t monitor how productive workforce is

* coordination and communication reducing

* overused machinery

* no value workers/ poor staff morale

* coordination and communication reducing

* overused machinery

* no value workers/ poor staff morale

23

New cards

profit

difference between total revenue and total cost

24

New cards

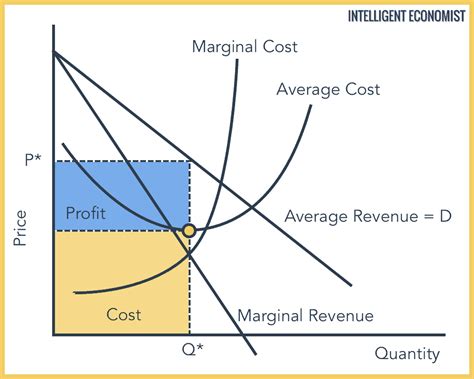

profit maximisation

occurs when marginal cost = marginal revenue

each extra unit produced gives no extra loss or revenue

each extra unit produced gives no extra loss or revenue

25

New cards

normal profit

The minimum profit required to keep factors of production in the long run

when TR-TC

when TR-TC

26

New cards

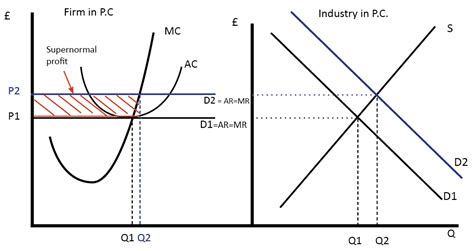

supernormal profit

the profit above normal profit

when TR > TC.

\

when TR > TC.

\

27

New cards

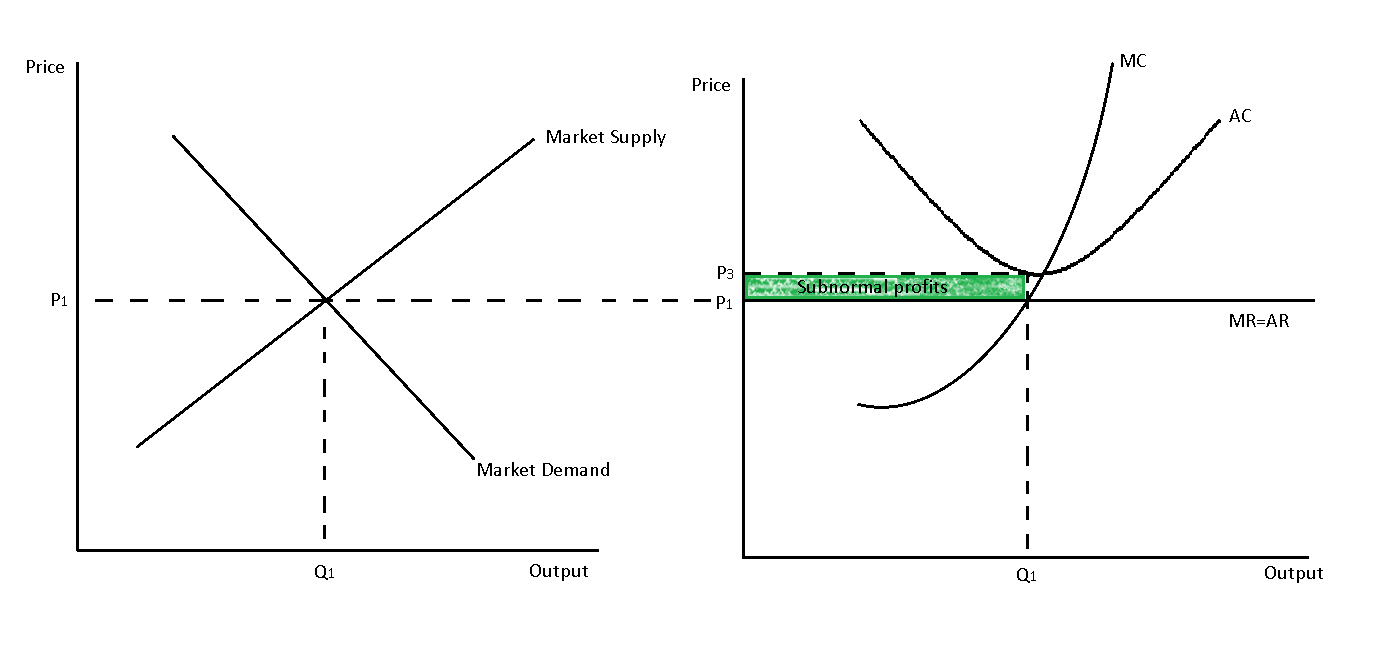

losses

a firm makes a loss when they fail to cover their total costs

28

New cards

market structures

identifies how a market is

29

New cards

concentration ratio

the percentage of market share taken up by the largest firms

30

New cards

sub-normal profit

profit which is less than normal

31

New cards

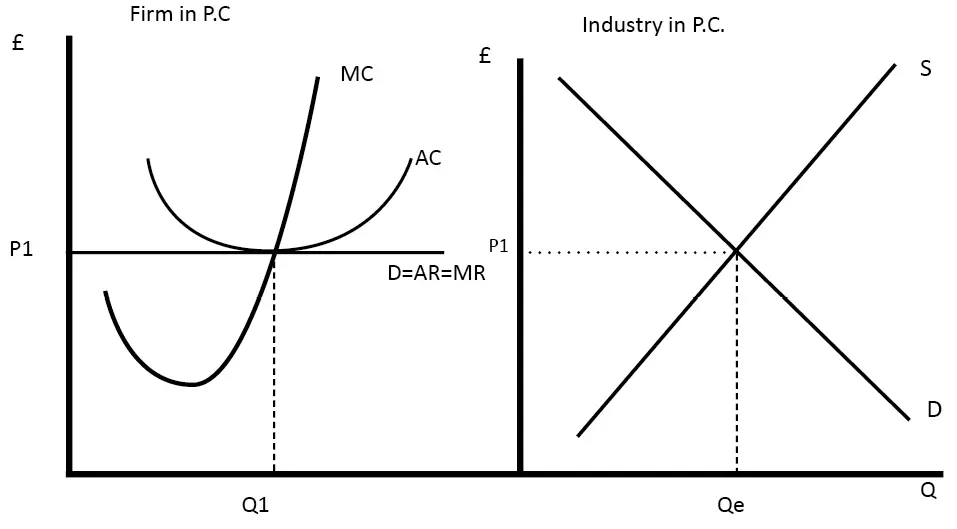

perfect competition

market structure where many firms offer a homogeneous product

32

New cards

###

33

New cards

features of perfect competition

* many firms

* freedom of entry and exit

* all firms produce an identical product

* all firms are price takers so demand curve is elastic

* perfect information

* freedom of entry and exit

* all firms produce an identical product

* all firms are price takers so demand curve is elastic

* perfect information

34

New cards

why do firms want to grow

* experience economies of scale

* more revenue

* larger profit

* more market share

* monopsony power

* build up assets and cash

* more revenue

* larger profit

* more market share

* monopsony power

* build up assets and cash

35

New cards

why do some firms stay small

* constraints on growth

* size of market

* access to finance

* owner regulation

* size of market

* access to finance

* owner regulation

36

New cards

what is the principal agent problem

separation of ownership and control in larger firms and this can cause issues as they have differing aims

37

New cards

what is the aim of a business owner

short run profit maximise

38

New cards

what are managers aims

maximise their own benefits

39

New cards

what are the two types of business growth

organic growth and integration

40

New cards

what is organic growth

firms grow by increasing output. e.g increased investment or longer working hours

41

New cards

what is vertical integration of firms

integration of firms in the same industry but at different stages in the production process

42

New cards

what is backwards integration

when the merger takes the firm back towards the supplier of a good

43

New cards

what is forward integration

when the firm is moving towards the eventual consumer of a good

44

New cards

what is horizontal intergration

where firms in the same industry at the same stage of production integrate.

45

New cards

what is profit maximisation

goal to make the most profit possible in the short run - can generate funds for investment and survive a slowdown

46

New cards

in order to profit maximise where do firms produce

where MC=MR

47

New cards

wha is revenue maximisation

producing the most of revenue - looks better for managers

48

New cards

what is sales maximisation

aim to maximise growth of company, gets the company well known and increases market share

49

New cards

short run

where at least one factor of production is fixed

50

New cards

long run

when all factors of production become variable

51

New cards

### **diminishing marginal productivity**

if a variable factor is increased when another factor is fixed, there will come a point when each extra unit of the variable factor will produce less extra output than the previous unit.

e.g costs fall initially as machinery is efficient but as production continues, efficiently falls as machinery is overused.

e.g costs fall initially as machinery is efficient but as production continues, efficiently falls as machinery is overused.

52

New cards

allocative efficiency

more concerned with the distribution and allocation of resources in society and achieved when resources and used to produce goods and services which consumers want.

occurs where price = marginal cost (MC)

occurs where price = marginal cost (MC)

53

New cards

productive efficiency

producing goods and services for the lowest cost so fewest resources are used to produce each product.

MC=AC

MC=AC

54

New cards

dynamic efficiency

achieved when resources are allocated efficiently over time - concerned with investment

55

New cards

what is perfect competition

when there is a high degree of competition - few industries fit this type of market structure e.g agriculture

56

New cards

long term perfect competition diagram

because there is freedom to entry this allows for more firms to enter, this causes supply to increase and therefore it will return to equilibrium over time

57

New cards

what shape is the demand curve for perfect competition and why

horizontal as they are price takers, this is also D=MR=AR

58

New cards

what shape is the demand curve for monopoly and why

There are 2 curves which are diagonally going downwards. One is the demand curve and the other is MR as they are price setters so they can reduce the MR for every extra unit.

59

New cards

short run profit minimisation for perfect competition (losses) diagram

operates where MC=MR

60

New cards

short run profit maximisation for perfect competition (supernormal profits)

operates where MC=MR

61

New cards

what is the outcome of perfect competition

* Firms are price-takers

* Firms will make normal profits which means consumers are getting the lowest place leading to greater equality in society (where AR=AC). If firms made supernormal profits – more firms would enter causing prices to fall

* Firms will make normal profits which means consumers are getting the lowest place leading to greater equality in society (where AR=AC). If firms made supernormal profits – more firms would enter causing prices to fall

62

New cards

X efficiency

Competition between firms will act as a spur to increase efficiency. In perfect competition, this is likely to occur.

63

New cards

what are the problems of perfect competition

* no dynamic efficiency as no supernormal profit is made in the LT so R and D is unlikely.

* no economies of scale

* with perfect knowledge there is no incentive to develop new tech as it’ll be shared with other firms

* products can get boring and not varied

* no economies of scale

* with perfect knowledge there is no incentive to develop new tech as it’ll be shared with other firms

* products can get boring and not varied

64

New cards

monopolistic competition

market structure which combines elements of monopoly and competitive markets

65

New cards

pure monopoly

where only one produces exists in the industry - rarely exists

66

New cards

characteristics of a pure monopoly

* lots of buyers, one seller

* total control over prices

* barriers to entry

* higher prices

* price setters

* poor quality/lower output

* homogenous products

* total control over prices

* barriers to entry

* higher prices

* price setters

* poor quality/lower output

* homogenous products

67

New cards

monopoly short and long run profit maximisation

as there is barriers to entry, it is the same for both short and long term.