(Q)Chapter 8: Net Present Value and Other Investment Criteria (questions)

1/30

Earn XP

Description and Tags

Questions for practicing chapter 8

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

What is the payback period?

The period of time necessary to recoup the cost an investment

What length of payback periods are preferred?

Shorter

In reference to the payback period, under what conditions is the project considered desirable?

If the payback period is less than or equal to the firm’s maximum desired payback period.

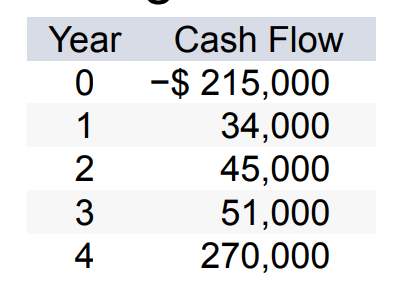

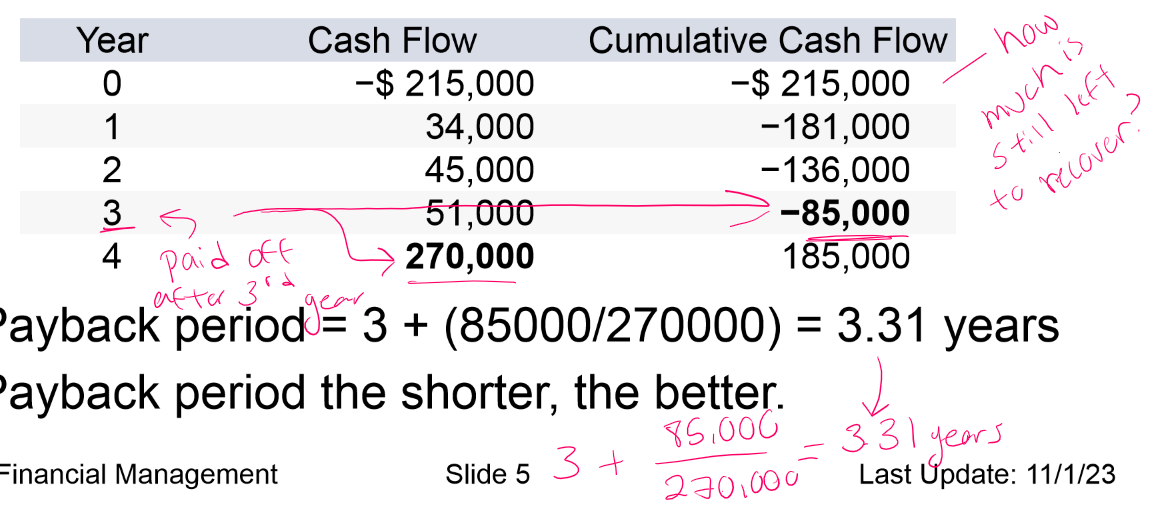

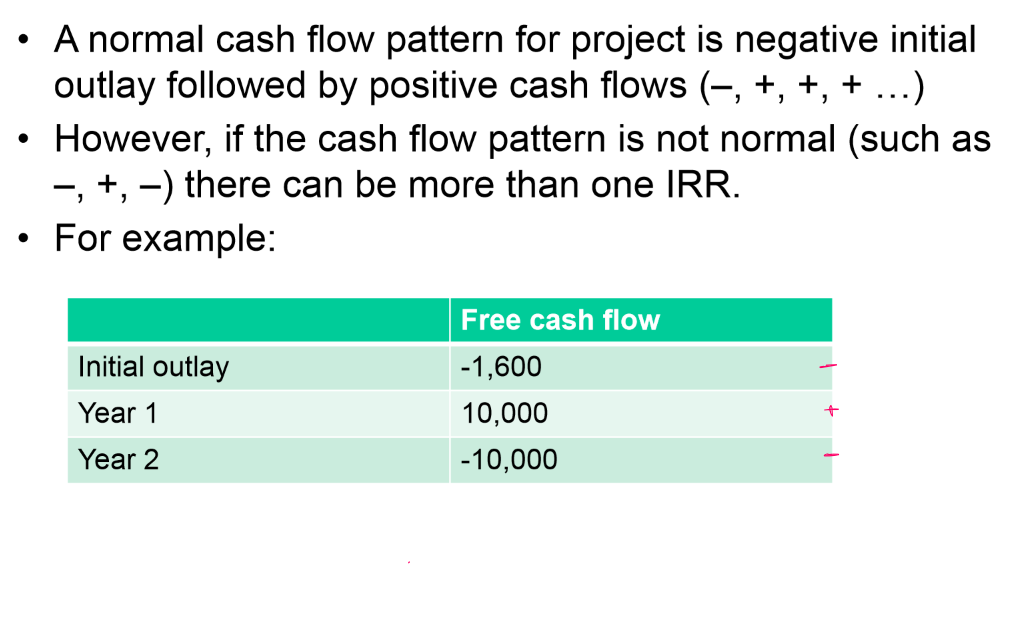

What is the payback period for the cash flows?

3.31 years

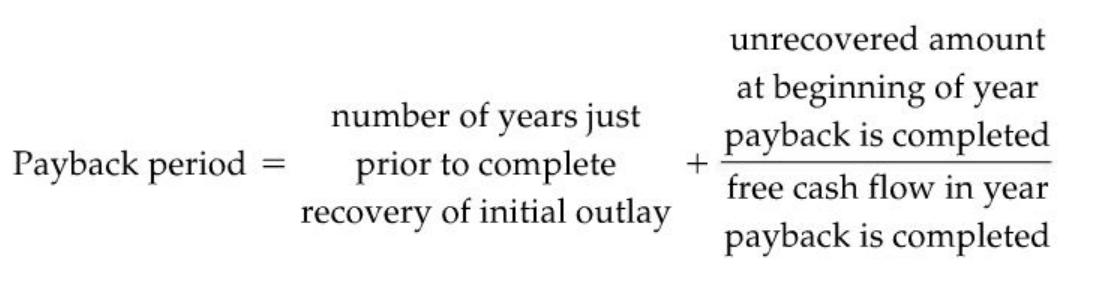

How do you calculate the payback period?

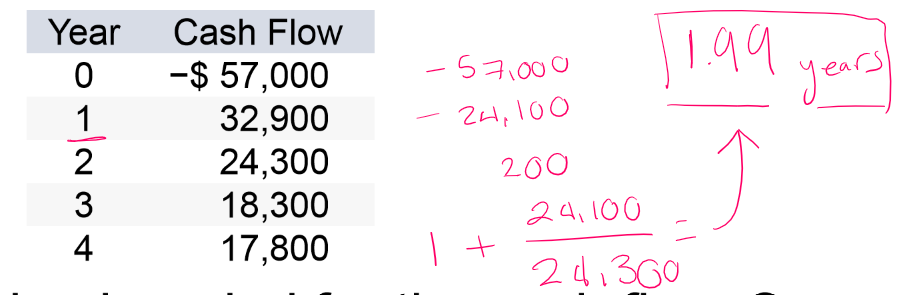

payback period = years + (unrecovered/free cash flow)

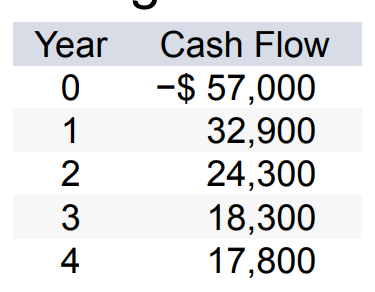

What is the payback period for the cash flows?

1.99 years

What are the benefits of payback periods?

Uses cash flows rather than accounting profits, easy to compute and understand, and useful for firms that have capital restraints

What are the drawbacks of payback periods?

Ignores time value of money and does not consider cash flows beyond the payback period

What is the solution to the payback periods lack of money time value?

Discounted Payback Periods

What is the Net Present Value?

It measures the net value of a project in today’s dollars.

What function (on financial calculator) do you use for net present values or profitability indexes?

The [CF] Function

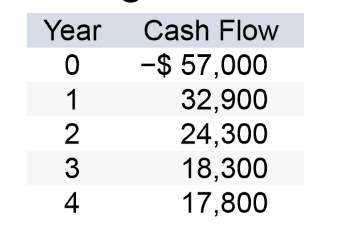

What happens if any of the future free cash flows are cash outflows?

The future free cash flows take a negative sign.

If NPV>0, should you accept or reject?

Accept

If NPV<0, should you accept or reject?

Reject

How do you calculate NPV?

[CF]

[CF0] = initial investment (negative)

[CF1] = year 1

[CF2] = year 2

[CF…]

[NPV]

[I] = required return on investments

[NPV] [CPT]

What is the profitability index?

It provides a relative measure of the absolute dollar desirability of a project

How do you calculate profitability index?

(Present Value of all the future annual free cash flows)/(initial cash outlay) or (NPV+year 0)/(year 0)

Is PI>1, do you accept or reject?

Accept

Is PI<1, do you accept or reject?

Reject

How do you calculate IRR on a financial calculator?

Input cash flows in [CF], hit [IRR], [CPT]

If IRR>Required Return Rate, should you accept?

Yes, accept

If IRR<Required Return Rate, should you return?

No, reject

Calculate the IRR and whether it should be accepted if the RR is 13%.

IRR = 26.71%, yes accept.

What’s the main issue with IRRs?

Inconsistent cash flows, you’d have multiple IRRs.

What are mutually exclusive projects?

Two investments in which the acceptance of one automatically excludes the acceptance of another

When ranking mutually exclusive projects, how should payback period be decided on?

The shorter period the better

When ranking mutually exclusive projects, how should NPV be decided on?

The larger the better

When ranking mutually exclusive projects, how should IRR be decided on?

The larger the better

When ranking mutually exclusive projects, how should PI be decided on?

The larger the better

What is the deciding factor in most cases regarding mutually exclusive projects?

NPV. NPV IS KING.

Which project should you choose?

Project A. NPV is larger. NPV IS KING.