3.3

1/54

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

55 Terms

Investments -

Strategic decisions with long term consequences

Techniques for investment definition

Allows the business to assess the forecast of financial returns and make comparisons between investments. Accounting rate of return, payback and Net present value.

For these techniques you need

initial capital cost

yearly cash inflows

cash outflows

Lifespan of investment

Payback

The amount of time is takes for a project to return its initial investment outlay

Payback equation

Amount required /Net cash flow un a year of payback x 12

Pros and cons of payback

Pros- Focusses on cash, emphasises speed of return, Important in dynamic markets

Cons- Ignores cash flow which arises from payback, lead to short terminist, Ignores qualitative factors. JUST A FORECAST

Accounting rate of return

Measures the overall profitability of an investment as a % of the intial cost

Steps for ARR

Add up the total forecasted return and - the investment cost

Divide the figure by the expected life of investment

Calculate the % of the initial capital cost

Pros and Cons of ARR

Pros- Looks at profitability, considers returns from the whole life of the project

Cons- Treats profits arriving late the same as treating them if they were early, Cashflows could be bias, Reduce reliability if data is incorrect.

NPV- Net Present Value

What money in the future is worth now

Steps of NPV

List out NCF for product life

Select discount factors

Discounts x cashflow

add up all values

Pros and cons of NPV

Pros- Takes into account of time and value of money, looks at all cashflows involved through the whole project, decision making, takes opportunity cost into account

Cons- Complicated for users, difficult to select most appropriate discount rate, Difficult to compare.

Decision trees

A mathematical model used to help make decisions. Helps decide if net gain is worth while. looking at probabilities

Probability

The chance of an outcome occurring

expected outcome-

The anticipated value of an investment (multiplying each outcome with the likelihood of it happening).

Pros and cons of Probability trees-

Pros- Forces managers to decide all options, more useful then investment appraisal, helps business see worst and best case scenarios

Cons- Only good if data is accurate, Bias, Does not focus on qualitative data.

Business growth measured through-

revenue

volume

profit

value

market share

Companies may want to grow because-

achieve economies of scale

increase market power

increased market share

increased profitability

Economies of scale

Unit costs fall as output increases

Internal economies of scale

Business/ individual enjoys Unit costs lowers

External economies of scale

Falling unit costs are enjoyed by all businesses

Three types of internal economies of scale

Technical- new technology

Purchasing- bulk buying

Managerial- Specialist staff e.g. accountant to lower unit costs

Three types of external economies of scale

Expertise- Country or area being known for a particular industry

Cooperation- Good communication means greater effectiveness

Supports services- when services specialise in particular industry

Market power over customers and suppliers

Customers- Higher prices and brand loyalty

Suppliers- Stronger negotiation power and securing raw materials.

How can a business achieve profitability

Lower costs, charge higher prices, increased productivity

Reasons for diseconomies of scale

Wider span of control, Longer chain of command, create risk of distortion and too much technology

Over trading

When a business grows too fast without sufficient resources to fund the expansion. Businesses may use their cash up too quickly and as a result go insolvement. -too much capital, trade credit.

Three negatives of growth

Alienation, Co-ordination and control, Internal communication

Organic growth-

Occurs when a business expands through size- eg new stores, control, expansion and time consuming

External inorganic growth

Growth occurs when expanding in size by either merging or taking over another business. This is high risk

Methods of growing organically

New products

New markets

new routes to markets

franchising

diversification

Pros and cons of organic growth

Pros- Less risky, greater consistently, less loss of control, less brand dilution

Cons- Lack of shared expertise, missed opportunities and lack of competitiveness

Merger-

Two or more businesses agree to become integrated to form one business under joint ownership

Takeover-

One business gains control over one business and becomes the owner if they buy 51% of shares.

Horizontal merger

Two businesses at the same stage of integration and selling the same product

Vertical merger- 2 types

Forwards- Vertical joins with business at the next stage of the production process. Manufacturing to retailer

Backwards- Joins with a business at an earlier stage in the process e.g. manufacturers with suppliers

Conglomerate merger

Two unrelated businesses integrate

Joint venture

Businesses and arrangements which two or more parties agree to. Can be a new product of any other business activity

Reasons for external growth

Synergy

Secure suppliers

Secure outlets

distribution

foothold in the market

benefits from expertise

intellectual property

brand recognition

achieve corporate objectives

External growth-

When a business expands through mergers and takeovers rather than their operations.

Financial risks and rewards of takeovers

Risks- Costs of integrating operations, research is costly, impact on share value, very risky

Rewards- greater revenues, economies of scale, market share and profits

Why might a business grow too fast?

Over trading-, cultural clashes, taking on debt, uncertainty, strain on resources, diseconomies of scale.

Why do some businesses want to remain small?

owners preference

operate in a niche market

offer personal services

tradition

less administration procedures

Methods of business survival

Product differentiation

Offer unique products , tailor made, good reputation

Flexibility to respond to customer needs

closer relationship, greater control, less formal structure

Customer service

More personal, long term relationships, local

E- Commerce

Low start up costs, niche market and global markets

why are sales forecasts useful

prudcing a cashflow forecast, planning resources, stocking

Steps of Time series analysis

Step 1- work out moving averages

Step 2- Plot them on a graph and draw a line of best fit

Step 3- Extrapolate the line of best fit to forecast future sales.

Pros and cons of time series analysis

Pros- Good for a stabilised future

Cons- Sales are influenced internally- PESTLE

Variation

Actual data- trend data

Average cyclical variation equation

Total of all cyclical variation for a quarter/ Number of results for this quarter

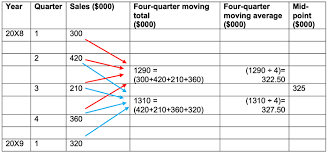

Steps of Four point moving averages

Add up all the periods for the total

add two totals together

then divide them by 8

repeat for all figures

Critical path analyses

Technique used to identify the order in which all activities need to be competed when planning a complex project.

The critical path

The set of activities that will lengthen the duration of the project if they are delayed

EST

LFT

Node Number

Est- earliest starting time TOP OF NODE

Lft- Latest starting times BOTTOM OF NODE

Node number- What node is numbered- 1,2,3,4

Calculating the float

LFT - Duration - EST

Pros and cons of critical path analysis

Pros- speeds up the time of projects, helps gain first mover advantage from the speed, improves working capital and improves efficiency

Cons- Reliability depends on accuracy of data used, estimates are vulnerable, managers must ensure that the estimates are actually achieved- could have issues with motivation.