CPAR - B97

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

70 Terms

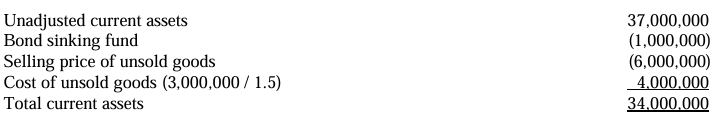

An entity reported the following on December 31, 2025:

Cash (including bond sinking fund of P1,000,000) 10,000,000

Accounts receivable 15,000,000

Notes receivable (net of discounted note of P500,000) 4,000,000

Inventory 8,000,000

Total current assets 37,000,000

An analysis disclosed that accounts receivable comprised of the following:

Trade accounts receivable 10,000,000

Allowance for sales discount (500,000)

Allowance for doubtful accounts (500,000)

Selling price of entity’s unsold goods sent to Company H on

consignment at 150% of cost and excluded from entity’s ending inventory 6,000,000

Accounts receivable 15,000,000

Statement I: An entity shall present assets as current or noncurrent in the statement of financial position, unless presentation based on liquidity provides information that is more reliable and relevant.

Statement II: Total current assets should be reported at P34,000,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

A. All statements are true.

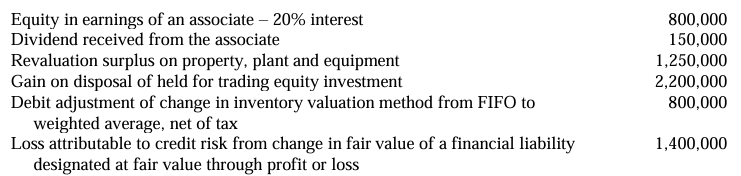

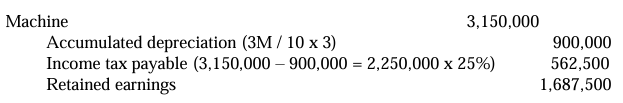

An entity reported net income of P8,500,000 for the current year. The auditor raised questions about the following amounts that had been included in net income:

Which of the following statements is true?

A. Comprehensive income is the change in equity during a period resulting from transactions including changes resulting from transactions with owners in their capacity as owners.

B. Other comprehensive income may be classified as those subsequently reclassified to profit or loss only.

C. Reporting comprehensive income is to show an entity’s overall financial position.

D. The correct net income of the entity is P9,300,000.

D. The correct net income of the entity is P9,300,000.

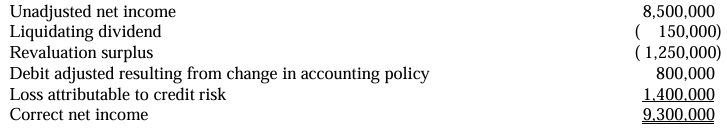

On January 1, 2025, an entity discovered that it had incorrectly expensed a P3,150,000 machine purchased on January 1, 2022. The entity estimated the machine’s useful life to be 10 years and the residual value at P150,000. The entity used the straight-line method of depreciation and is subject to a 25% income tax rate.

What amount should be reported as a prior period error in the December 31, 2025 financial statements?

A. 3,150,000

B. 2,250,000

C. 1,687,500

D. 0

C. 1,687,500

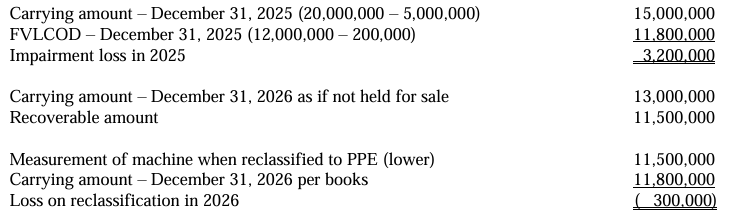

On December 31, 2025, an entity had a machine costing P20,000,000 and accumulated depreciation of P5,000,000. On such date, the entity classified the machine as held for sale and had a fair value of P12,000,000 and disposal cost of P200,000. On December 31, 2026, the entity believed that the criteria for classification as held for sale can no longer be met. Accordingly, the entity decided not to sell the machine but to continue to use it. On December 31, 2026, the fair value less cost of disposal and value in use were P10,000,000 and P11,500,000 respectively. If the asset was never classified as held for sale, the carrying amount on December 31, 2026 would have been P13,000,000. Which of the following statements is false?

A. The impairment loss in 2025 is P3,200,000.

B. The recoverable amount on December 31, 2026 is P11,500,000.

C. On December 31, 2026, the machine should be reported at P13,000,000.

D. On December 31, 2026, loss on reclassification is P300,000.

C. On December 31, 2026, the machine should be reported at P13,000,000.

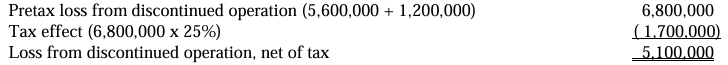

On December 31, 2025, an entity is committed to a plan to discontinue the operations of Automobile Division. The entity estimated that the division’s operating loss for 2026 would be P2,000,000. The fair value of the facilities was P1,200,000 less than carrying amount on December 31, 2025. The division’s operating loss for 2025 was P5,600,000 and the division was sold for P1,600,000 less than carrying amount in 2026. The income tax rate is 25%.

Statement I: IFRS allows the retroactive classification as a discontinued operation when the discontinued criteria are met after the end of the reporting period.

Statement II: The results of discontinued operation are presented as a single amount, net of tax, in the income statement below continuing operation but before profit or loss.

Statement III: The loss from discontinued operation in 2025 is P5,100,000.

A. All statements are true.

B. Only statements II and III are true.

C. Only statement II is true.

D. Only statements I and II are true.

B. Only statements II and III are true.

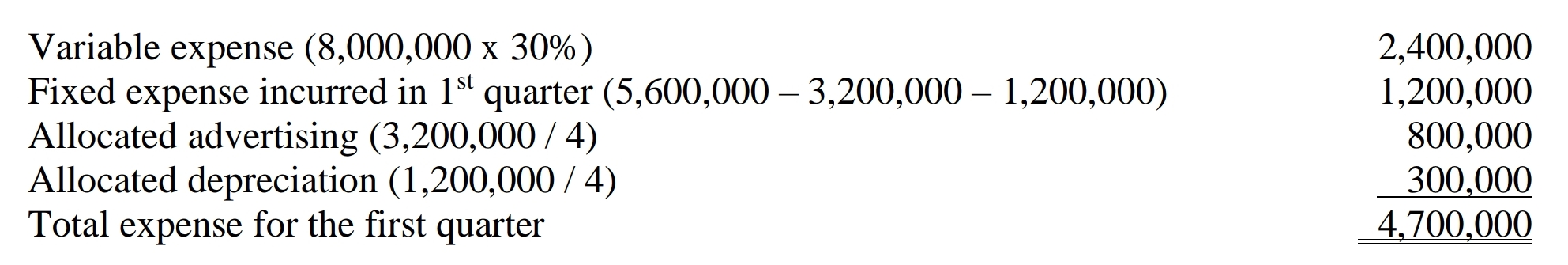

An entity is preparing interim financial statements for the first quarter ending March 31. Expenses in the first quarter totaled P8,000,000 of which 30% was variable. The fixed expenses included television advertising expense of P3,200,000 representing air time to be incurred evenly during the current year and depreciation expense of P1,200,000 for the year, for an equipment that was available for use on January 1. What total amount of expense should the entity report for the quarter ending March 31?

A. 8,000,000

B. 3,600,000

C. 4,700,000

D. 7,100,000

C. 4,700,000

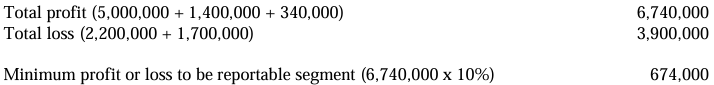

An entity reported the following profit (loss) for each of its operating segments for the current year:

Statement I: For segment reporting purposes, revenue, profit or loss, asset, and cash flow test must be applied if a component is a reportable segment.

Statement II: The minimum segment profit or loss to be considered a reportable segment is P284,000.

A. All statements are true

B. All statements are false

C. Only statement I is true

D. Only statement II is true

B. All statements are false

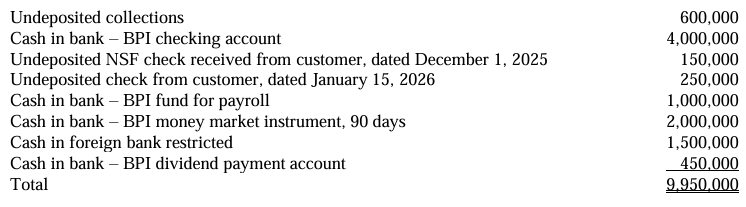

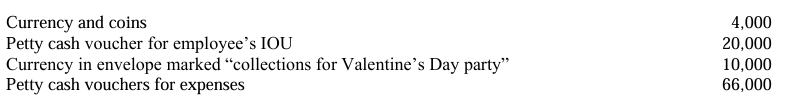

On December 31, 2025, an entity reported cash of P9,950,000 which comprised the following:

Undeposited collections 600,000

Cash in bank – BPI checking account 4,000,000

Undeposited NSF check received from customer, dated December 1, 2025 150,000

Undeposited check from customer, dated January 15, 2026 250,000

Cash in bank – BPI fund for payroll 1,000,000

Cash in bank – BPI money market instrument, 90 days 2,000,000

Cash in foreign bank restricted 1,500,000

Cash in bank – BPI dividend payment account 450,000

Total 9,950,000

Which of the following statements is false?

A. The line item “Cash and Cash Equivalents” is presented as part of current assets.

B. The entity shall P250,000 as a receivable.

C. The entity shall recognize cash and cash equivalents amounting to P8,050,000.

D. Equity investments cannot be qualified as cash equivalents.

B. The entity shall P250,000 as a receivable.

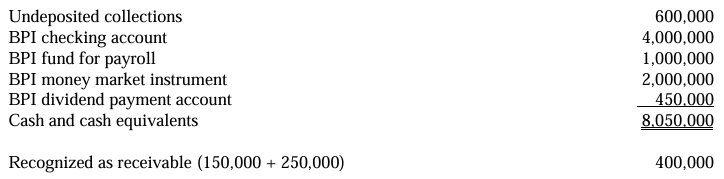

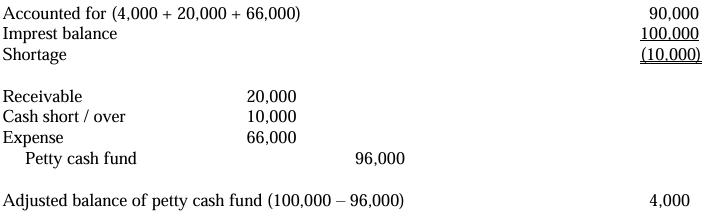

An entity is accounting for its petty cash fund using the imprest system. On November 1, 2025, the entity established a petty cash fund of P100,000. On December 31, 2025, the fund consisted of the following items:

The petty cash fund was not replenished on December 31, 2025.

Statement I: Under the imprest system, the petty cash account is debited upon replenishment.

Statement II: The entry to adjust the petty cash fund will include a debit to Cash Short / over of P10,000.

Statement III: The entity shall report petty cash fund at P100,000 on December 31, 2025.

A. All statements are true.

B. Only statement II is true.

C. Only statements II and III are true.

D. All statements are false.

B. Only statement II is true.

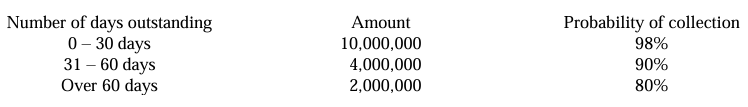

An entity used the allowance method of accounting for doubtful accounts. The following summary was prepared from an aging of accounts receivable outstanding on December 31, 2025:

Net credit sales for the year 2025 were P80,000,000 and the allowance for doubtful accounts before adjustment on December 31, 2025 had a debit balance of P40,000. The entity based the estimate of doubtful accounts on the aging of accounts receivable.

Statement I: The aging of accounts receivable method in estimating doubtful accounts focuses on the income statement.

Statement II: Any allowance for doubtful accounts is deducted from accounts receivable to compute the net realizable value.

Statement III: The entity shall report doubtful accounts expense of P1,040,000 for the year 2025.

A. All statements are true.

B. All statements are false.

C. Only statement II is true.

D. Only statements II and III are true

D. Only statements II and III are true

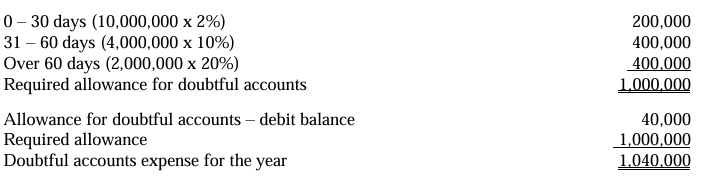

An entity records sales return during the year as a credit to accounts receivable. However, at year-end, the entity estimates the probable sales return and records the same by means of an allowance account. Also, the entity uses the gross method of recording cash discounts. The following transactions occurred during the year:

What is the net realizable value of accounts receivable to be reported by the entity at year-end?

A. 2,760,000

B. 2,800,000

C. 3,000,000

D. 2,820,000

A. 2,760,000

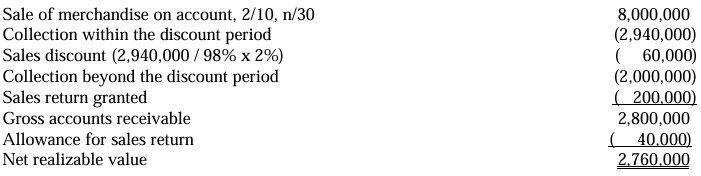

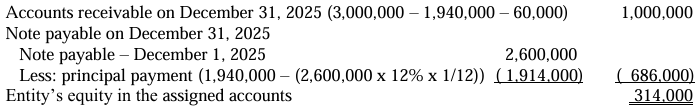

On December 1, 2025, an entity assigned P3,000,000 of accounts receivable to a bank on a non-notification basis in consideration for a loan. The bank advanced P2,600,000 less a service charge of P50,000. The entity signed a promissory note bearing interest at 12%. On December 31, 2025, the entity collected assigned accounts of P2,000,000 less sales discount of P60,000. Also on December 31, 2025, the entity remitted the collection to the bank in payment first of interest and the balance to the principal amount of the note.

Statement I: Assignment of accounts receivable is accounted for as an absolute sale of asset.

Statement II: On December 31, 2025, the entity shall report accounts receivable at P1,000,000.

Statement III: On December 31, 2025, the entity’s equity in the assigned accounts is P686,000.

A. All statements are true.

B. Only statements II and III are true.

C. Only statement II is true.

D. All statements are false.

C. Only statement II is true.

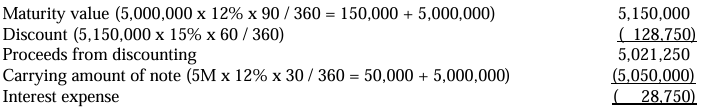

On August 31, 2025, an entity discounted with recourse a note at the bank at discount rate of 15%. The discounting transaction is accounted for as a secured borrowing. The note was received from the customer on August 1, 2025, is for 90 days, has a face amount of P5,000,000, and carries an interest rate of 12%. The customer paid the note to the bank on October 30, 2025, the date of maturity. What is the following statements is false?

A. Discounting of notes receivable with recourse can be accounted for as a conditional sale with disclosure of a contingent liability or secured borrowing.

B. If secured borrowing, an entity shall record a separate liability for notes receivable discounted.

C. At the date of discounting, the entity shall recognize proceeds from discounting at P5,050,000.

D. At the date of discounting, the entity shall recognize interest expense at P28,750

C. At the date of discounting, the entity shall recognize proceeds from discounting at P5,050,000.

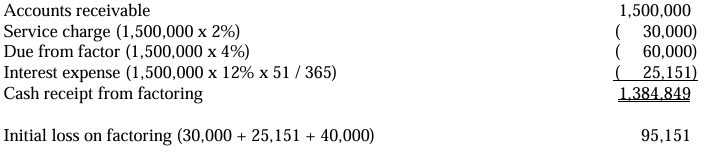

An entity factored P1,500,000 of accounts receivable at year-end. Control was surrendered. The factor accepted the accounts receivable subject to recourse for nonpayment. The fair value of the recourse obligation is P40,000. The factor assessed a fee of 2% and retained a holdback equal to 4% of the accounts receivable.

In addition, the factor charged 12% interest computed on a weighted-average time to maturity of 51 days. The accounts receivable was fully collected by the factor at year-end.

Statement I: Factoring of accounts receivable is accounted for as a sale of asset.

Statement II: The entity shall recognize cash receipt from factoring at P1,384,849

Statement III: The entity shall recognize an initial loss on factoring at P95,151

A. All statements are true

B. All statements are false

C. Statements II and III are true.

D. Only statement II is true.

A. All statements are true

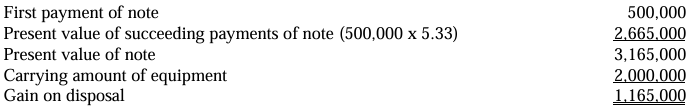

On December 31, 2025, an entity sold used equipment with a carrying amount of P2,000,000 in exchange for a noninterest bearing note of P5,000,000 requiring ten annual payments of P500,000. The first payment was made of December 31, 2025. The market interest for similar note was 12%. The present value of an ordinary annuity of 1 at 12% is 5.65 for ten periods and 5.33 for nine periods. What amount of gain or loss on disposal of equipment should the entity report on December 31, 2025?

A. Loss of P3,000,000

B. Loss of P2,500,000

C. Gain of P2,825,000

D. Gain of P1,165,000

D. Gain of P1,165,000

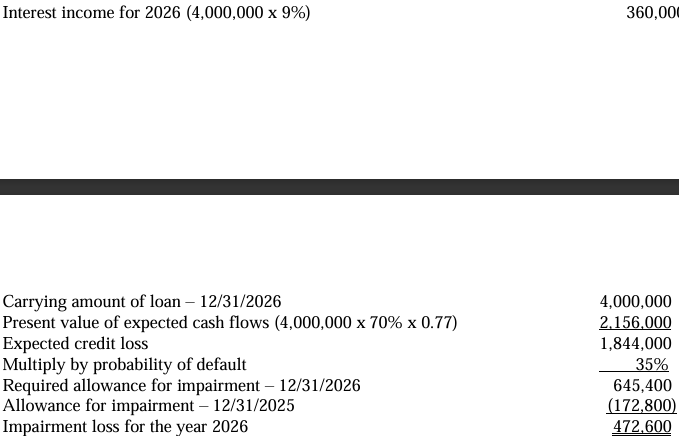

On January 1, 2025, a bank loaned P4,000,000 to one of its customers. The loan is due on December 31, 2029, has an interest rate of 9% and interest is payable annually every December 31. On December 31, 2025, the entity had recognized a 12-month expected credit loss of P172,800. On December 31, 2026, the entity assessed that there was a significant increase in credit risk of the loan but no objective evidence of impairment. On such date, the entity concluded that there is a 35% probability of default over the remaining term of the loan and it is expected that only 70% of the loan will be collected. Interest for the years 2025 and 2026 were collected. The present value of 1 at 9% for 3 periods is 0.77.

Statement I: Interest income for the year 2026 is P194,040.

Statement II: The impairment loss for the year 2026 is P472,600.

A. All statements are true.

B. Only statement II is true.

C. Only statement I is true.

D. All statements are false.

B. Only statement II is true.

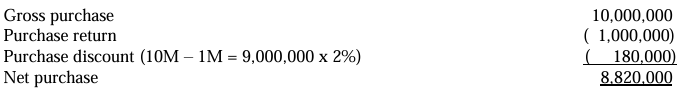

An entity recorded purchases at gross amount. On December 1, 2025, the entity purchased merchandise on account for P10,000,000 with terms 2/10, n/30. On December 5, 2025, the entity returned P1,000,000 and received credit on account. On December 11, 2025, the entire account was paid. What amount of net purchases should be included as part of cost of goods available for sale?

A. 10,000,000

B. 8,820,000

C. 9,000,000

D. 9,800,000

B. 8,820,000

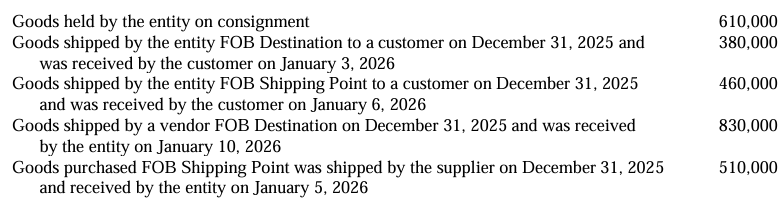

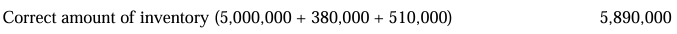

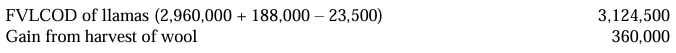

An entity conducted a physical count on December 31, 2025, which revealed inventory with a cost of P5,000,000. The following items were excluded from the physical count:

Statement I: Merchandise sold in transit FOB Shipping Point is owned by the vendor.

Statement II: Merchandise purchased in transit FOB Destination is owned by the buyer or customer.

Statement III: On December 31, 2025, the entity shall recognize inventory at P5,890,000.

A. All statements are true.

B. All statements are false.

C. Only statement III is true.

D. Statements I and III are true.

C. Only statement III is true.

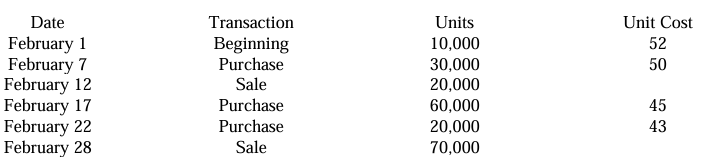

The entity provided the following information relating to inventory for the month of February:

The entity uses FIFO cost flow. What is the entity’s inventory cost on February 28?

A. 1,371,000

B. 1,400,000

C. 1,310,000

D. 1,395,000

C. 1,310,000

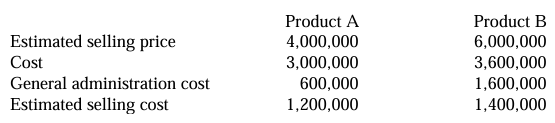

An entity provided the following information pertaining to its ending inventory:

The entity uses the allowance method of recognizing inventory writedown. The allowance for inventory writedown at the beginning of the year is P450,000. Which of the following statements is true?

A. An entity shall apply the LCNRV measurement to inventory on a total basis.

B. Net realizable value equals estimated selling price of inventory.

C. The entity shall report inventory amounting to P6,600,000 at year end

D. The entity shall record a gain on reversal of writedown of P250,000 for the current year

D. The entity shall record a gain on reversal of writedown of P250,000 for the current year

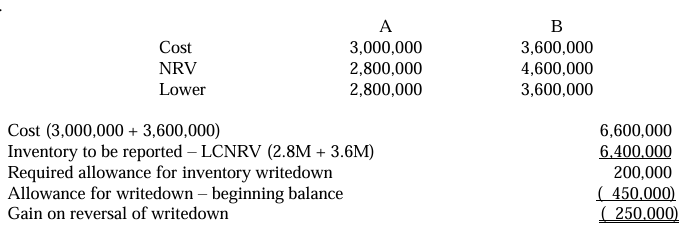

An entity’s accounting records indicated the following for 2025:

A fire destroyed the entity’s warehouse and all inventory on hand were burned. However, the entity confirmed it had goods out on consignment costing P500,000 with a consignee. The gross profit on sales remained constant at 30% in recent years. What is the amount of fire loss?

A. 3,150,000

B. 3,650,000

C. 4,105,000

D. 3,605,000

A. 3,150,000

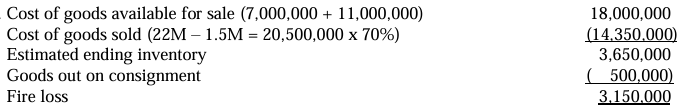

An entity purchased 1,000 llamas on January 1, 2025. These llamas will be sheared semiannually, and their wool sold to specialty clothing manufacturers. The llamas were purchased for P2,960,000. During 2025, the increase in fair value due to growth and price changes of the llamas was P188,000, the wool harvested but not yet sold is valued at P360,000, and the decrease in fair value of the llamas due to harvest is P23,500.

Statement I: On December 31, 2025, the llamas should be reported at P3,124,500.

Statement II: In 2025, the gain attributable to the agricultural produce should be reported at P336,500.

A. All statements are true. C. Only statement II is true.

B. All statements are false. D. Only statement I is true.

D. Only statement I is true.

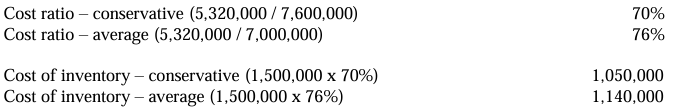

An entity used retail method on inventory valuation. The entity provided the following information for the

year 2025:

Statement I: If the entity uses the conservative approach, the cost of inventory is P1,050,000.

Statement II: If the entity uses the average approach, the cost of inventory is P1,500,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

C. Only statement I is true.

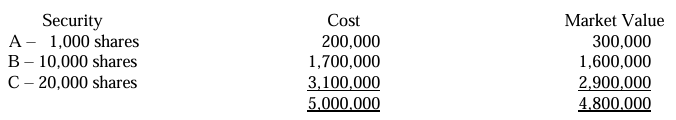

During 2025, An entity acquired trading securities with the following data on December 31, 2025:

The entity sold 10,000 shares of Security B on January 15, 2026 for P180 per share. Which of the following statements is false?

A. Equity investments held for trading are measured at fair value through profit or loss.

B. Any transaction costs on acquiring trading equity investments shall be recognized as an expense.

C. The gain on disposal in 2026 is P100,000.

D. The unrealized loss from the change in fair value in 2025 is P200,000.

C. The gain on disposal in 2026 is P100,000.

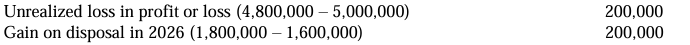

On January 1, 2025, an entity acquired bonds with face amount of P8,000,000 for P8,412,000. The business model in managing the financial asset is to collect contractual cash flows that are solely payments of principal and interest, and to sell the bonds in the open market. The bonds mature on December 31, 2027 and pay 10% interest annually on December 31 each year with 8% effective yield. The bonds are quoted at 95 on December 31, 2025 and 90 on December 31, 2026.

Statement I: The unrealized loss in other comprehensive income for the 2025 is P684,960.

Statement II: The unrealized loss in other comprehensive income for the year 2026 is P947,756.

Statement III: The bond investment should be reported at P7,200,000 on December 31, 2026.

A. All statements are true.

B. Only statements I and III are true.

C. Only statement III is true.

D. Only statements I and II are true.

B. Only statements I and III are true.

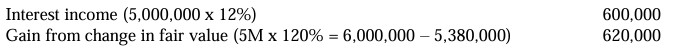

On January 1, 2025, an entity purchased 12% bonds with a face amount of P5,000,000 for P5,380,000. The bonds provide an effective yield of 10%. The bonds are dated January 1, 2025, mature on January 1, 2030 and pay interest annually every December 31 of each year. The bonds are quoted at 120 and at 115 on December 31, 2025 and December 31, 2026 respectively. The entity has elected the fair value option for this investment.

What is the interest income and gain from change in fair value, respectively, in 2025?

A. 600,000 and 620,000

B. 538,000 and 620,000

C. 600,000 and 1,000,000

D. 538,000 and 1,000,000

A. 600,000 and 620,000

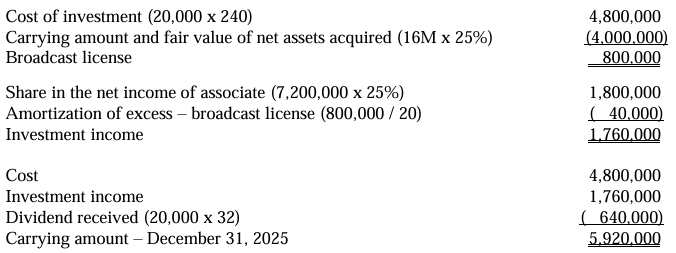

An entity acquired 20,000 shares of Hero Company on January 1, 2025 at P240 per share. Hero Company had 80,000 shares outstanding with a carrying amount of P16,000,000. The difference between the carrying amount and fair value of Hero Company on January 1, 2025 is attributable to a broadcast license which is an intangible asset. Hero recorded earnings of P7,200,000 for 2025 and paid per-share dividend of P32 in 2025. The entity has a 20-year straight-line amortization policy for the broadcast license.

Statement I: Under the equity method, distributions received from an associate reduce the carrying amount of investment.

Statement II: The investment income under the equity method for 2025 is P1,800,000.

Statement III: The carrying amount of the investment in associate on December 31, 2025 is P5,920,000.

A. All statements are true.

B. All statements are false.

C. Only statements II and III are true.

D. Only statements I and III are true.

D. Only statements I and III are true.

On January 1, 2025, an entity acquired 20% of the ordinary shares of another entity for P6,000,000. On such date, all identifiable assets and liabilities were recorded at fair value and the acquisition resulted in goodwill on the purchase of P300,000. The investee reported net income of P3,000,000 and P4,000,000 for the years ended December 31, 2025 and December 31, 2026 respectively. No dividends were paid. In December 2025, the investee sold inventory to the entity for P900,000. The cost was P600,000. This inventory remained unsold by the entity on December 31, 2025. However, it was sold by the entity in 2026. What amount of investment income under the equity method shall the entity recognize in 2026?

A. 800,000

B. 860,000

C. 540,000

D. 980,000

B. 860,000

On January 1, 2025, an entity acquired land for P3,000,000, held as a future plant site. On June 30, 2026, the entity decided to lease out the land under an operating lease and not use it as a plant site anymore. The fair value of the land on June 30, 2026 is P4,600,000. The entity’s policy is to carry all investment properties at fair value.

Statement I: The entity shall reclassify the land to investment property on June 30, 2026.

Statement II: The entity shall recognize revaluation surplus of P1,600,000 on June 30, 2026.

A. All statements are true

B. All statements are false

C. Only statement I is true.

D. Only statement II is true.

A. All statements are true

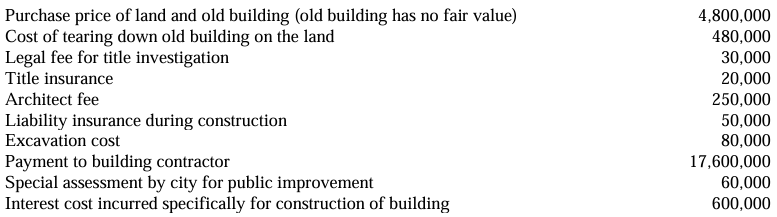

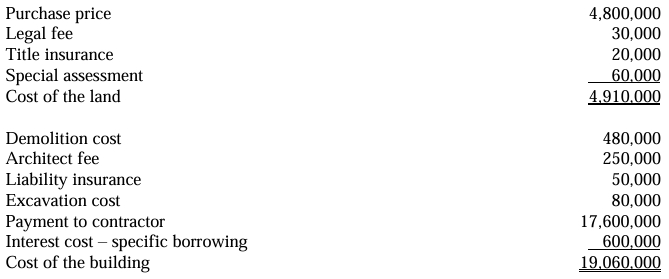

An entity incurred the following costs in acquiring land as a factory site:

Statement I: The cost of the land is P4,910,000.

Statement II: The cost of the building is P19,060,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

A. All statements are true.

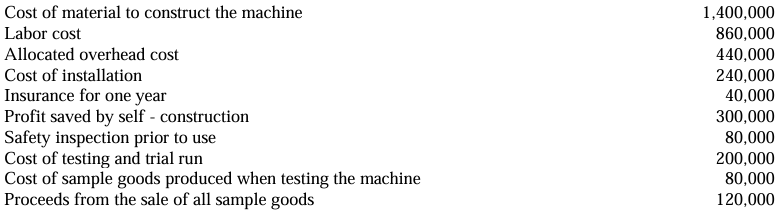

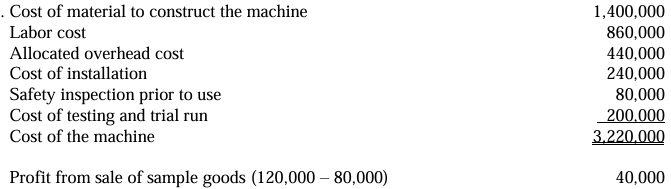

An entity constructs a machine for producing goods to be sold in the ordinary course of business. The following costs were incurred:

Statement I: The cost of the machine is P3,180,000.

Statement II: The profit from the sale of sample goods is P40,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

D. Only statement II is true.

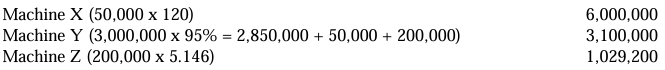

An entity acquired the following machines during 2025:

Machine X in exchange for 50,000 ordinary shares with a P100 par value and market price of P120 per share.

Machine Y at an invoice price of P3,000,000 subject to a 5% cash discount which was not taken. Freight and insurance during shipment were P50,000 and installation cost amounted to P200,000

Machine Z in exchange for a noninterest bearing note requiring eight payments of P200,000. The note was dated January 1, 2025 and the first payment was made on December 31, 2025. The prevailing market interest rate is 11%. The PV of an ordinary annuity of 1 at 11% for 8 periods is 5.146 and the PV of an annuity of 1 in advance at 11% for 8 periods is 5.712.

Which of the following statements is false?

A. An item of property, plant and equipment should initially be recorded at cost.

B. The cost of Machine X is P6,000,000.

C. The cost of Machine Y is P3,100,000.

D. The cost of Machine Z is P1,142,400.

D. The cost of Machine Z is P1,142,400.

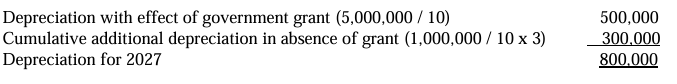

An entity received a government grant of P1,000,000 related to a building that it acquired in January 2025. The entity’s policy is to treat the grant as a deduction from the cost of the building. The entity acquired the building from an industrialist identified by the government. If the entity did not purchase the building, which was in the slums of the city, it would have been repossessed by the government agency. Peach acquired the building for P6,000,000 with a useful life of 10 years and no residual value. On January 1, 2027, the entire amount of the grant became repayable by reason of noncompliance with conditions attached to the grant.

Which of the following statements is true?

A. Repayment of government is a change in accounting policy.

B. The depreciation for the year 2025 is P600,000.

C. The depreciation for the year 2027 is P800,000.

D. A government grant is recognized only when there is no assurance that the entity will comply with any conditions attached to the grant and the grant will be received.

C. The depreciation for the year 2027 is P800,000.

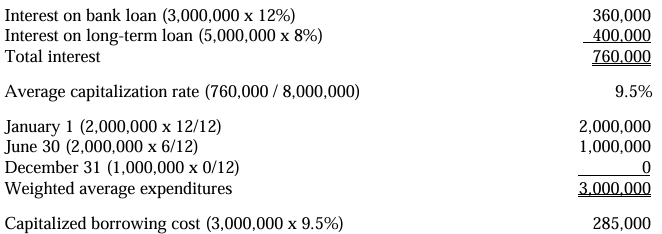

An entity had the following borrowings during 2025. The borrowings were made for general purposes but some of the proceeds were used to finance the construction of a new building: 12% bank loan P3,000,000 and 8% long-term loan P5,000,000. Construction began on January 1, 2025 and was completed on December 31, 2025. Expenditures on the building were P2,000,000, P2,000,000 and P1,000,000 on January 1, June 30 and December 31 respectively. What amount of borrowing cost should the entity capitalize in 2025?

A. 760,000

B. 285,000

C. 475,000

D. 300,000

B. 285,000

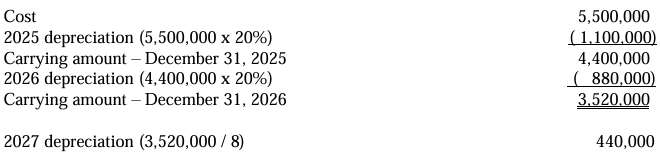

On January 1, 2025, an entity acquired a machine for P5,500,000. The machine was depreciated using the double declining balance method based on a useful life of 10 years and no residual value. On January 1, 2027, the entity changed to the straight-line method of depreciation. The entity can justify the change.

Statement I: A change in depreciation method is a change in accounting estimate.

Statement II: The depreciation for 2025 is P1,100,000.

Statement III: The depreciation for 2027 is P440,000.

A. All statements are true.

B. All statements are false

C. Only statements I and II are true.

D. Only statements I and III are true.

A. All statements are true.

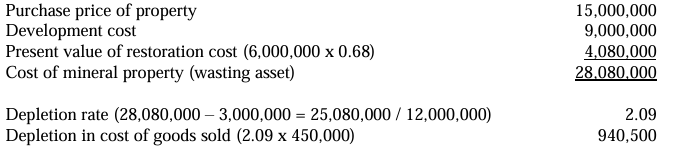

An entity operates a copper mine in Mindanao. The entity paid P15,000,000 in 2025 for the mining site and spent an additional P9,000,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the entity is required to restore the land to its original condition after which the land can be sold for P3,000,000. The cash outflow possibility for the restoration cost is P6,000,000. The credit adjusted risk-free rate of interest is 10%. The present value of 1 at 10% for 4 periods is 0.68. The entity expects to extract 12,000,000 tons of copper from the mine. Actual production was 500,000 tons in 2025 and 450,000 tons were sold in 2025.

Statement I: The cost of the wasting asset is P30,000,000.

Statement II: The amount of depletion included in cost of goods sold is P940,500.

A. All statements are true.

B. Only statement II is true.

C. All statements are false.

D. Only statement I is true.

B. Only statement II is true.

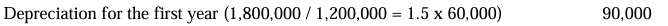

An entity has purchased a tract of mineral land for P4,500,000. It is estimated that this tract will yield 1,200,000 tons of ore with sufficient mineral content to make mining and processing profitable. It is further determined that 60,000 tons each will be mined the first and last year and 120,000 tons every year in between. It is determined that all the ore will be removed after 11 years. The land will have a residual value of P150,000. The company builds necessary structures and sheds on the site at a cost of P1,800,000. It is estimated that these structures can serve 15 years. The entity does not intend to use the buildings after all resources have been extracted. What amount depreciation of structures should the entity recognize for the first year?

A. 120,000

B. 110,000

C. 90,000

D. 82,500

C. 90,000

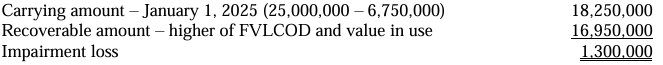

An entity purchased four convenience store buildings on January 1, 2019 for a total cost of P25,000,000. The buildings have been depreciated using the straight-line method with a 20-year useful life and 10% residual value. On January 1, 2025, the entity tested the buildings for impairment because impairment indicators existed. On this date, the fair value less cost of disposal of the four buildings totaled P15,000,000 and the value in use is P16,950,000. Which of the following statements is false?

A. An asset is impaired if its carrying amount exceeds its recoverable amount.

B. Recoverable amount is the higher between fair value less cost of disposal and value in use.

C. The impairment loss in 2025 is P1,300,000.

D. The recoverable amount is P15,000,000.

D. The recoverable amount is P15,000,000.

An entity reported intersegment sales of P15,000,000. The minimum amount of sales to be considered a major customer was determined to be P3,000,000. What amount of segment revenue should the entity report?

A. 45,000,000

B. 18,000,000

C. 30,000,000

D. 15,000,000

A. 45,000,000

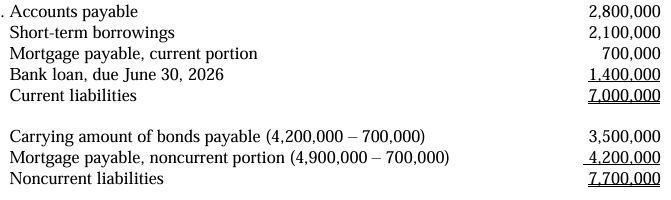

An entity reported the following liability balances on December 31, 2025:

Accounts payable 2,800,000

Short-term borrowings 2,100,000

Bonds payable due 2027 4,200,000

Discount on bonds payable 700,000

Mortgage payable, current portion P700,000 4,900,000

Bank loan, due June 30, 2026 1,400,000

The P1,400,000 bank loan was refinanced with a 4-year loan on January 15, 2026. The financial statements were issued on March 31, 2026.

Statement I: On December 31, 2025, the entity shall report current liabilities at P7,000,000.

Statement II: On December 31, 2025, the entity shall report noncurrent liabilities at P7,700,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

A. All statements are true.

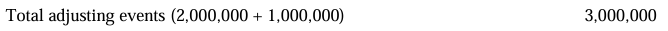

An entity is completing the preparation of the financial statements for 2025. The financial statements are authorized for issue on March 31, 2026. On March 5, 2026, a dividend of P6,000,000 was declared and a contractual profit share payment of P2,000,000 was made based on the net income for 2025. On February 1, 2026, a customer went into liquidation having owed the entity P1,000,000. No allowance had been made against this account. On March 20, 2026, a manufacturing plant was destroyed by fire resulting in a financial loss of P5,000,000.

Statement I: If an entity declares dividends after the reporting period, the entity shall recognize those dividends as a liability at the end of the reporting period.

Statement II: The total amount of adjusting events that the entity shall recognize amounts to P3,000,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

D. Only statement II is true.

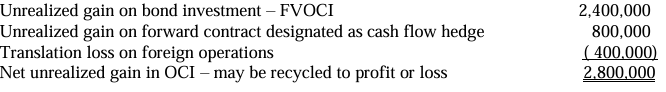

An entity reported the following items of other comprehensive income for the year 2025:

Unrealized gain on bond investment - FVPL 1,600,000

Unrealized loss on equity investment - FVOCI 2,000,000

Unrealized gain on bond investment - FVOCI 2,400,000

Unrealized gain on forward contract designated as cash flow hedge 800,000

Translation loss on foreign operations 400,000

Net remeasurement gain on defined benefit plan 1,200,000

Loss on credit risk of a financial liability at FVPL under the fair value option 600,000

Revaluation surplus 5,000,000

What net amount in OCI that may be reclassified to profit or loss should the entity report for the year 2025?

A. 2,800,000

B. 4,400,000

C. 2,200,000

D. 4,000,000

A. 2,800,000

On January 1, 2025, an entity had a division that met the criteria for discontinuance of a business component. For the period January 1 through October 31, 2025, the component had revenue of P1,000,000 and expenses of P1,600,000. The assets of the component were sold on October 31, 2025 at a loss of P200,000. The income tax rate is 25%. What amount of loss from discontinued operation should the entity report for 2025?

A. 800,000

B. 600,000

C. 400,000

D. 300,000

B. 600,000

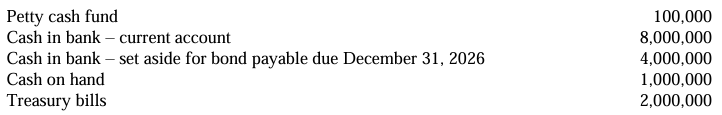

An entity had the following account balances on December 31, 2025.

The petty cash fund included unreplenished December 2025 petty cash expense vouchers P10,000 and employee IOU P10,000. The cash on hand included a P200,000 customer check dated January 15, 2026. In exchange for a guaranteed line of credit, the entity has agreed to maintain a minimum balance of P400,000 in the unrestricted current bank account. What total amount should the entity report as cash and cash equivalents on December 31, 2025?

A. 12,880,000

B. 14,880,000

C. 15,080,000

D. 10,880,000

B. 14,880,000

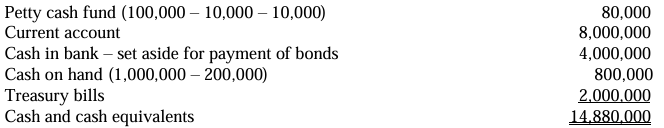

An entity reported the following information before adjustments on December 31, 2025:

Accounts receivable 1,500,000

Allowance for doubtful accounts 100,000

Sales 5,000,000

Sales returns and allowances 250,000

Accounts written off 75,000

Collection of accounts previously written off 15,000

75% of all sales are on credit and an average of 4% of gross credit sales may prove uncollectible. What amount of allowance for doubtful accounts should the entity report on December 31, 2025?

A. 150,000

B. 182,500

C. 142,500

D. 190,000

D. 190,000

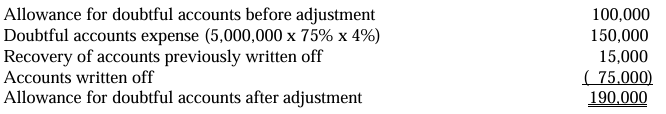

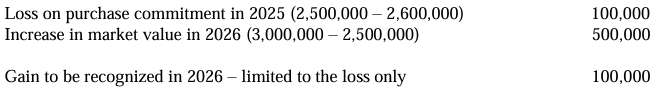

On October 1, 2025, an entity entered a 6-month, P2,600,000 purchase commitment for a supply of a special product to be acquired on March 31, 2026. On December 31, 2025, the market value of this material had fallen to P2,500,000. On March 31, 2026, the market value of the purchase commitment is P3,000,000.

Statement I: In 2025, the entity shall record a loss on purchase commitment of P100,000.

Statement II: In 2026, the entity shall record a gain on purchase commitment of P500,000.

A. All statements are true.

B. All statements are false.

C. Only statement I is true.

D. Only statement II is true.

C. Only statement I is true.

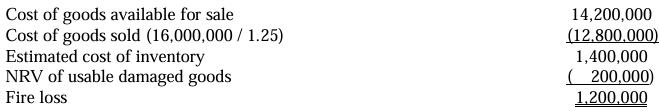

At year-end, an entity reported that a fire caused severe damage to the entire inventory. The entity had a gross profit of 25% on cost. A physical inventory disclosed usable damaged goods which can be sold for P200,000.

The entity provided the following data for the current year:

What amount should the entity report as fire loss?

A. 1,400,000

B. 2,200,000

C. 1,200,000

D. 2,000,000

C. 1,200,000

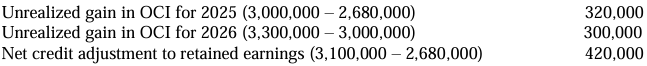

On January 1, 2025, an entity purchased nontrading equity securities for P2,500,000. The investment was irrevocably designated to be measured at FVOCI. The entity also paid P180,000 in the form of transaction costs. The securities had fair values of P3,000,000 on December 31, 2025 and P3,300,000 on December 31, 2026. The entity sold the equity investment for P3,100,000 on February 14, 2027. Which of the following statements is false?

A. Nontrading equity investments may be irrevocably elected to be measured at fair value through OCI.

B. The entity shall recognize unrealized gain – OCI in 2025 amounting to P500,000.

C. The entity shall recognize unrealized gain – OCI in 2026 amounting to P300,000.

D. The net credit adjustment to retained earnings because of disposal in 2027 is P420,000.

B. The entity shall recognize unrealized gain – OCI in 2025 amounting to P500,000.

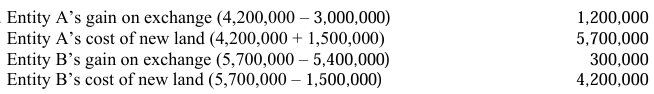

Entity A owned a tract of land that it purchased for P3,000,000. The land is held as a future plant side and had a fair value of P4,200,000 on the date of exchange. Entity B Company also owned a tract of land held as a future plant date. Entity B paid P5,400,000 for the land upon purchase and the land had a fair value of P5,700,000 on the date of exchange. On date of exchange, Entity A exchanged its land and paid P1,500,000 cash for the land owned by Entity B. The configuration of cash flows from land acquired is expected to be significantly different from the configuration of cash flows of the land exchanged. Which of the following statements is false?

A. Entity A shall recognize a gain on exchange of P1,200,000.

B. Entity A’s cost of the newly acquired land is P4,200,000.

C. Entity B shall recognize a gain on exchange of P300,000.

D. Entity B’s cost of the newly acquired land is P4,200,000.

B. Entity A’s cost of the newly acquired land is P4,200,000.

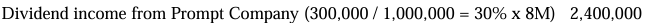

An entity held 30,000 shares of Kole Company’s 100,000 outstanding shares and 60,000 shares of Quora Company’s 400,000 outstanding shares. During the year, the entity received P300,000 cash dividend from Kole and 5% share dividend from Quora. The closing price of a Quora share is P150. The entity also owned 300,000 preference shares of Prompt Company’s 1,000,000 P50 par 10% cumulative, nonparticipating preference shares and 200,000 ordinary shares representing 5% interest. During the current year, Prompt Company declared and paid preference dividends of P8,000,000. Prompt did not declare nor pay dividends during the prior 2 years. What amount of dividend income should the entity recognize for the current year?

A. 2,400,000

B. 3,150,000

C. 2,700,000

D. 2,850,000

A. 2,400,000

Based on the Revised Conceptual Framework, the enhancing qualitative characteristics

A. Comparability and understandability

B. Verifiability and timeliness

C. Comparability, understandability and verifiability

D. Comparability, understandability, verifiability and timeliness

D. Comparability, understandability, verifiability and timeliness

The accounting record where a transaction is initially recorded is

A. Ledger

B. Account

C. Trial balance

D. Journal

D. Journal

If a reporting entity comprises both parent and its subsidiaries, the financial statements are referred to as

A. Consolidated financial statements

B. Unconsolidated financial statements

C. Combined financial statements

D. Separate financial statements

A. Consolidated financial statements

Which of the following should be classified as current asset?

A. Bond sinking fund

B. Property, plant, and equipment

C. Noncurrent asset held for sale

D. Equity investments at fair value through other comprehensive income

C. Noncurrent asset held for sale

Which of the following is not a related party?

A. A shareholder owing 25% of the outstanding ordinary shares of an entity

B. An entity providing banking facilities

C. An associate

D. Key management personnel

B. An entity providing banking facilities

The following items of other comprehensive income may be recycled to retained earnings, except

A. Unrealized loss on equity investments at fair value through other comprehensive income

B. Gain from change in fair value attributable to credit risk of financial liability designated at fair value through profit or loss

C. Revaluation surplus

D. Gain as a result of translating financial statements of a foreign operation

D. Gain as a result of translating financial statements of a foreign operation

All of the following may be classified as cash and cash equivalent, except

A. Money market instrument

B. Checking account

C. Held for trading equity investments

D. Savings deposit

C. Held for trading equity investments

For interim financial reporting, gain on disposal of asset occurring in the third quarter shall be

A. Recognized ratably over the last three quarters

B. Recognized ratably over all four quarters with the first quarter being restated

C. Recognized in the third quarter

D. Only be disclosed in the notes in the third quarter

C. Recognized in the third quarter

In a period of declining prices, which inventory cost flow method would result in the highest cost of goods sold?

A. Moving average method

B. Specific identification method

C. FIFO

D. Weighted average method

C. FIFO

Which of the following is an application of the principle of systematic and rational allocation?

A. Depreciation of equipment

B. Research and development cost

C. Officers’ salaries

D. Sales commission

A. Depreciation of equipment

Which is included within the financial statements?

A. A statement of retained earnings

B. Accounting policies

C. An auditor’s report

D. Board of directors’ report

B. Accounting policies

When the cost of goods sold method is used to record inventory at net realizable value

A. There is a direct reduction in the estimated selling price that results in a loss.

B. A loss is recorded directly by crediting inventory.

C. Only the portion of the loss attributable to inventory sold during the period is recorded.

D. The net realizable value for ending inventory is substituted for cost and the loss is buried in cost of goods sold.

D. The net realizable value for ending inventory is substituted for cost and the loss is buried in cost of goods sold.

An entity purchased land and a hotel with the plan to tear down the hotel and build a new hotel. The allocated cost of the old hotel should be

A. Depreciated over the remaining life of the old hotel

B. Written off as loss in the year the hotel is torn down

C. Capitalized as part of the cost of the land

D. Capitalized as part of the cost of the new hotel

B. Written off as loss in the year the hotel is torn down

Trading bond investments are reported at

A. Amortized cost

B. Face amount

C. Fair value

D. Maturity

C. Fair value

When bonds are purchased at a premium, the effective interest rate is

A. Higher than the stated interest rate

B. Lower than the stated interest rate

C. Equal to the stated interest rate

D. Cannot be determined

B. Lower than the stated interest rate

Which of the following expenditures would never qualify as an exploration and evaluation asset?

A. Costs for acquisition of rights to explore

B. Costs for exploratory drilling

C. Costs related to the development of mineral resources

D. Costs for activities to evaluate the technical feasibility of extracting a resource

C. Costs related to the development of mineral resources

What financial assets are assessed for impairment?

A. Equity investments at FVPL

B. Equity investments at FVOCI

C. Debt investments at FVPL

D. Debt investments at amortized cost and debt investments at FVOCI

D. Debt investments at amortized cost and debt investments at FVOCI

If an associate has outstanding cumulative preference shares, the investor computes share of profit or loss of the investee

A. After adjusting for preference dividends which were actually paid during the year

B. Without regard for preference dividends

C. After adjusting for the preference dividends only when declared

D. After adjusting for the preference dividends, whether or not the dividends have been declared

D. After adjusting for the preference dividends, whether or not the dividends have been declared

When the entity uses the cost model, transfer between investment property, property plant and equipment and inventory shall be accounted for at

A. Fair value

B. Carrying amount

C. Original cost

D. An amount determined by management

B. Carrying amount

Which condition must exist in order for an impairment loss to be recognized?

A. Carrying amount is less than fair value

B. Carrying amount is not recoverable

C. Carrying amount is less than value in use

D. Carrying amount is recoverable

B. Carrying amount is not recoverable