Government and Fiscal Policy

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

50 Terms

Government Purchases (G):

government expenditures on currently produced goods and services and capital goods. (Government Investment are around 1/6 of G in the US

Transfer Payments (TR):

Payments made to individuals for which the government does not receive current goods or services in exchange (Social Security, military and civil service pensions, unemployment insurance, Medicare

Net Interest Payment

Interest Paid to the holders of government bonds less

the interest received by the government

The Government revenues come from _____

TAXES.

Personal Taxes:

Tax increases: Biggest jump during World War II, Clinton in deficit-reconstruction effort

Tax cuts: Kennedy Johnson 1964, Reagan 1981, Bush early 2000s

Contributions for Social Insurance

usually are levied as fixed percentage of a worker’s salary

up to a ceiling (increases both in the contribution rate and in the ceiling)

Taxes on production and imports

Sales taxes declined in WWII and then stable

Corporate taxes (on profits)

High during WWII and Korean war

Fiscal Policy is the use of

government spending G and taxes T

The objective of Fiscal Policy is to

stabilize the economy

Governments can have:

Output targets, Price Targets, Unemployment Targets

Stabilizing the economy means

moving the economy towards targets

Fiscal policy would be the

manipulation of G and T to move the economy towards

Y*. (Assumes government knows where Y* is - we will discuss other drawbacks to fiscal policy later in the course).

Government Budget Deficits

the actual budget deficit in the current period

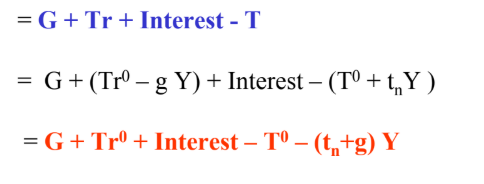

Deficit =

outlays - tax revenues = G (Government Purchases) + Tr(Transfer Payments) Interest - T (Transfer)

Primary Government Budget Deficits

excludes net interests from gov outlays

Primary Deficit =

(outlays – interest) – tax revenues = G (Government Purchases) + Tr (Transfer Payments) - T (Transfer)

Transfer Revenues =

T^0 + TnY

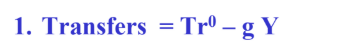

Transfers =

= Tr^0 - gY

When Y ______, Taxes ______(more earnings in economy)

increases, increases

When Y______, Transfers _____

increases, fall (less people on welfare)

Actual Government Deficits

T^0 =

Tr^0 = Interest = 0

Automatic stabilizers:

fiscal policies that work without government action to stabilize economic cycles.

Side Effect of automatic stabilizers is

government budget deficits tend to increase in recessions!

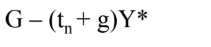

Structural Budget Deficits

G - (Tn + g)Y*

Cyclical Deficits:

Actual Deficits - Structural Deficits

Deficits are countercyclical!

(They rise when Y(income) falls and fall

when Y(income) rises)

What dampens the effects of consumption over the business cycle

Welfare Payments, Unemployment Insurance, and Tax System

T does what when times are good

it goes up

G/Tr does what when times are bad

goes down (welfare payments)

Given Automatic Stabilizers (and potentially proactive governmental fiscal

policies), cyclical deficits

seem to be an inherent part of our economy.

Government Debt (B)

the total value of government bonds outstanding

at any particular time.

government deficit is a

flow variable

government debt is a

stock variable

A given year deficit = new borrowing that the government must do

= change in the debt that year

Should Governments Try to Prevent Deficits.

it may be bad to have policies requiring governments to eliminate all deficits,

but there may be some benefits from eliminating structural deficits.

Consumption G

Governments can provide services that may be inefficiently provided in private sector

(i.e., police protection, parks, post office, etc).

Investment G: Physical Capital

Governments can provide investment that is used as an input into other production

(i.e., highway and transportation infrastructure, bridges, enforce property rights).

Investment G: Training and Education

Governments can train the work force

(i e student loan programs public education state colleges etc) (i.e., student loan programs, public education, state colleges, etc).

Infrastructure G

is government purchases of capital goods whose benefits arrive after the year of purchase.

Education G

includes public schools and public grants to students at private schools.

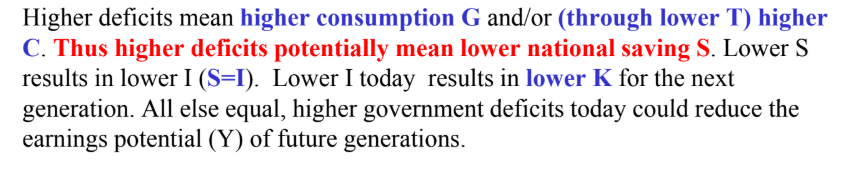

Argument that Public Debt will be a burden for Future generations

Argument that Public Debt will not be a burden for Future generations

Ricardian Equivalence:

Theory that states that consumers behavior is equivalent

regardless if the government finances G through increased taxes or through

increased debt.

Martin Feldstein claims

that the tax rebate was a flop!

Christian Broda and Johnatan Parker claim

that the tax rebate was successful!

US Social Security is largely pay-as-you-go system

most of the payroll taxes

that workers and employers pay go directly to retirees and other beneficiaries

Average tax rate

total amount of taxes paid by a person divided by the

person’s before-tax income

Marginal tax rate

fraction of an additional dollar of income that must be paid in taxes