CBA 300 Exam 2 ch 6-10, Dr. Craig D. Macaulay, CSULB

1/128

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

129 Terms

International investment. Two ways.

Foreign Portfolio Investment (FPI). Foreign Direct Investment (FDI)

Foreign Portfolio Investment (FPI)

Holding securities of firms in other countries but without a controlling interest.

Foreign Direct Investment (FDI)

Investing equity stake of 10% or more in a foreign based enterprise.

Types of FDI

Horizontal FDI, Vertical FDI, Upstream Vertical FDI, Downstream Vertical FDI.

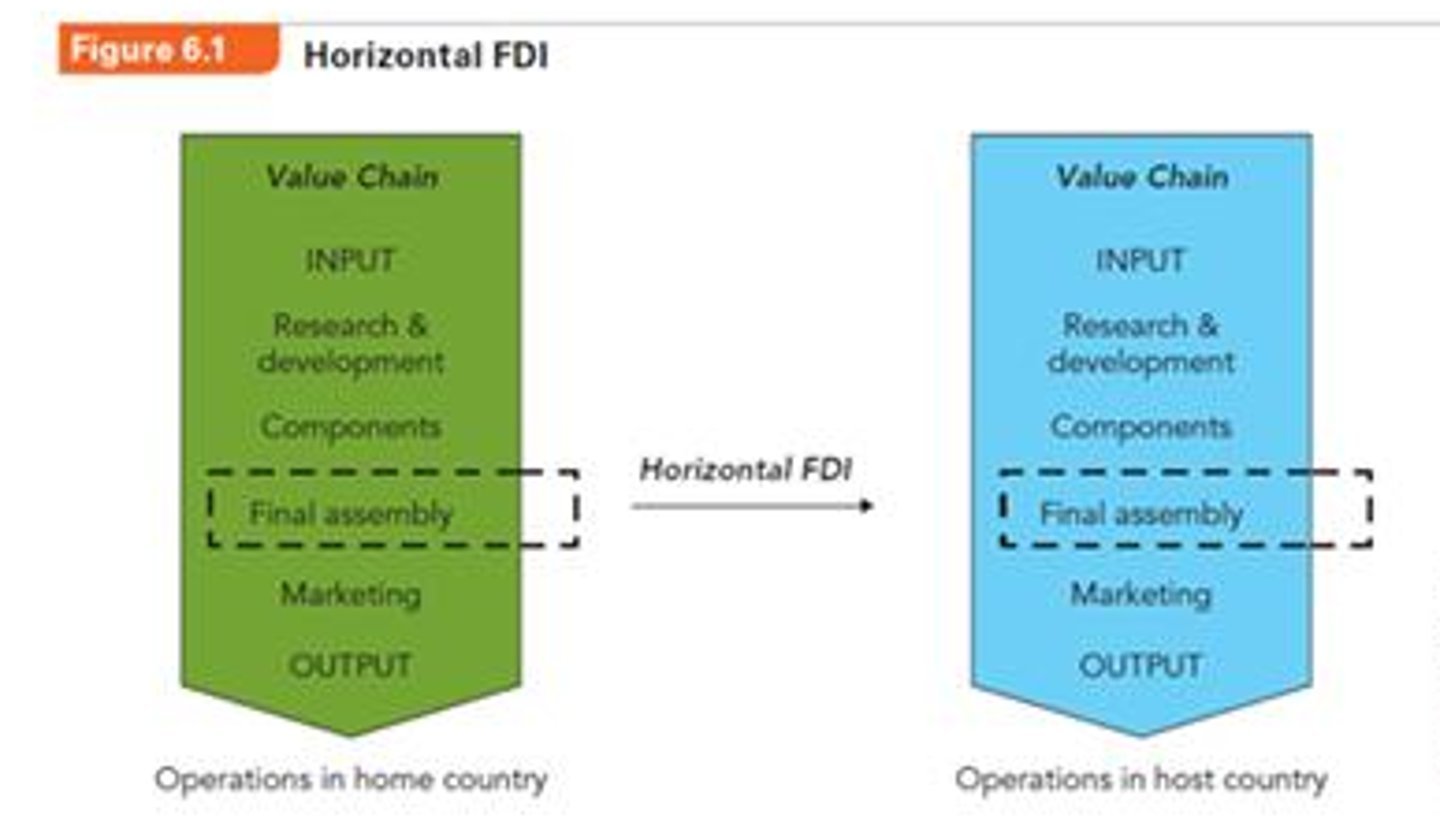

Horizontal FDI

Firms produce same products or offers the same services in a host country as at home.

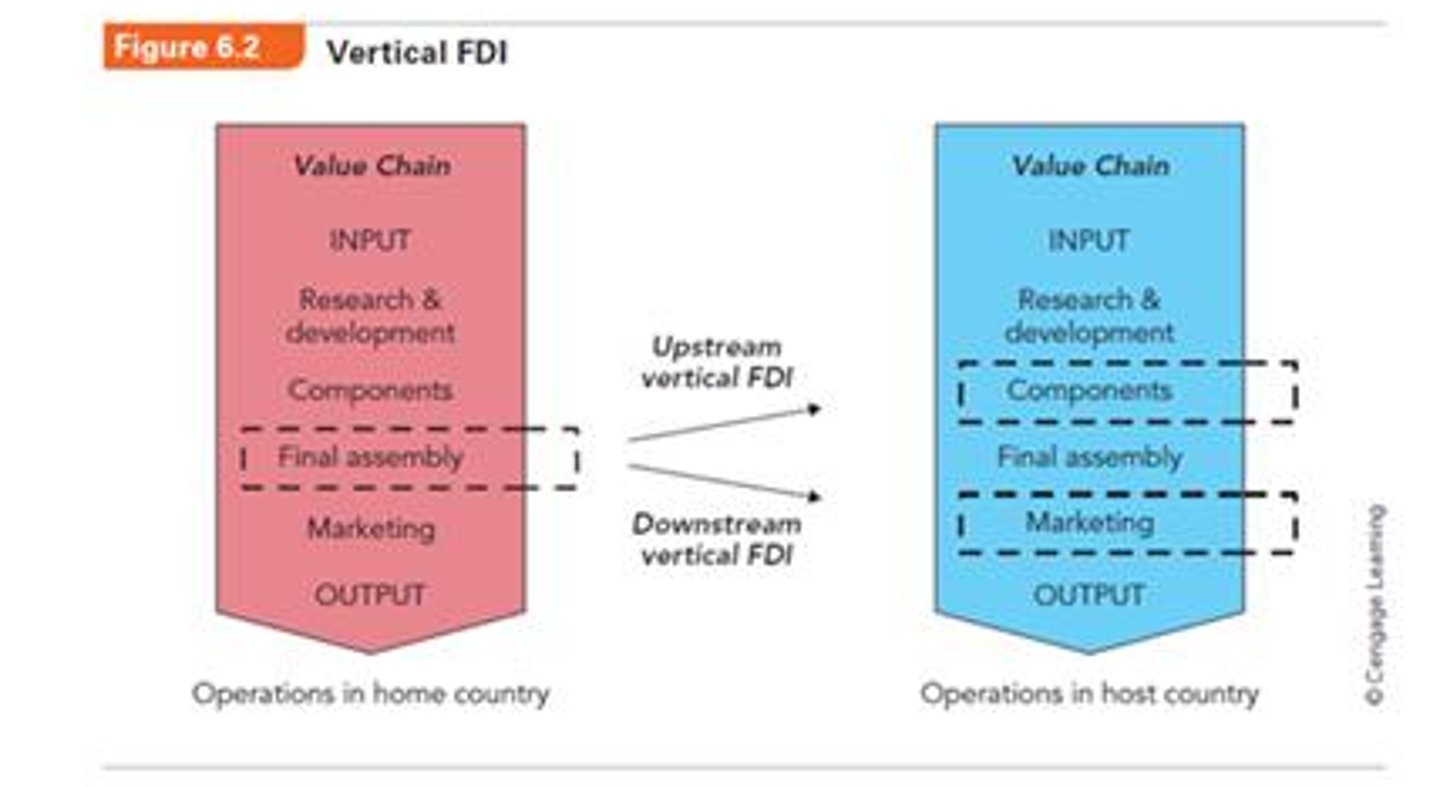

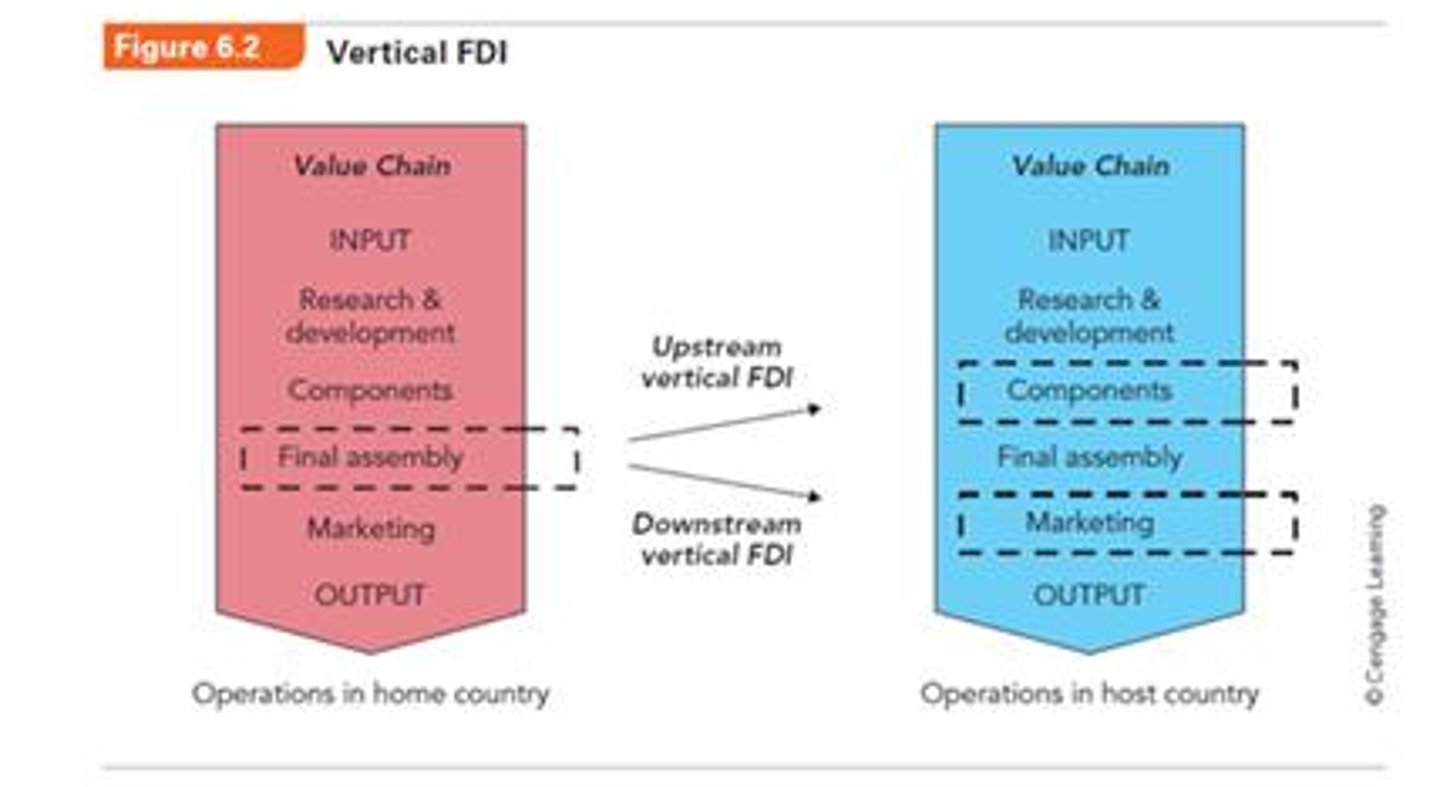

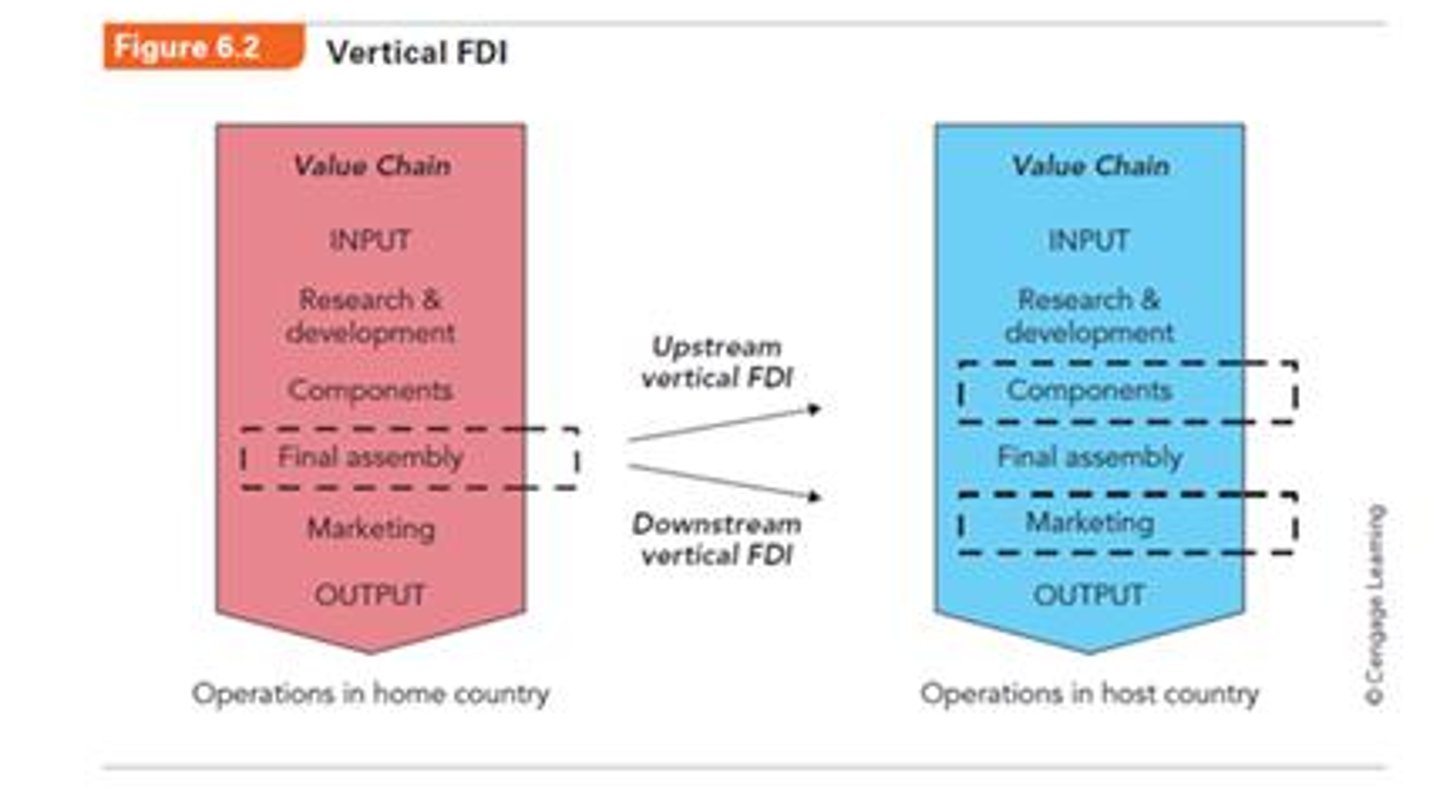

Vertical FDI

Firm moves upstream or downstream in a different value chain stages in a host country.

Upstream Vertical FDI

Firm engages in an upstream stage of the value chain

Downstream Vertical FDI

Firm engages in a downstream stage of the value chain

FDI Flow

Amount of FDI in a given period in a certain direction

FDI Inflow

FDI moving into a country in a year

FDI outflow

FDI moving out of a country in a year

FDI stock

Total accumulation of inbound FDI in a country or outbound FDI of a country across a given period of time (usually many years)

MNE

Firm that engages in FDI when doing business abroad.

Non-MNE

Firm that does business abroad by exporting and importing, licensing and franchising, outsourcing, or engaging in FPI

Reasons firms engage in FDI

- Ownership advantages

- Location advantages

- Internalization advantages

Benefits of Direct Ownership

- Combination of equity ownership rights and management control rights

- Ownership rights provide the management control rights

- FDI facilitates firm-specific resources and capabilities abroad to overcome foreign liabilities

Why firms prefer FDI to licensing

- FDI reduces dissemination risks

- FDI provides tight control over foreign operations

- FDI facilitates the transfer of tacit knowledge through "learning by doing"

Agglomeration

clustering of economic activities in certain locations

advantages of agglomeration

- Diffusion of knowledge from one firm to others among closely located firms

- Industry demand that creates a skilled labor force

- Industry demand that facilitates a pool of specialized suppliers and buyers in a region

Location Advantages

Obtained by a firm when operating in a location owing to its firm specific capabilities

Acquiring and Neutralizing Location Advantages

- Rivals hope to acquire or neutralize location advantages

- Mostly followed by oligopolistic industries

Advantages of Internalization

- Domestic transaction costs are cheaper than international transaction costs

- Combats market failure by replacing the external market with in-house links

Political views on FDI

Radical View.

Free Market View.

Pragmatic Nationalism.

Radical View

FDI is an instrument of imperialism and vehicle for foreign exploitation

(govt. nationalizes MNE assets or bans inbound MNE)

Free market view

When FDI is unrestricted by government intervention, it enables countries to tap into their absolute and comparative advantages (by specializing in the production of goods and services)

Pragmatic Nationalism

FDI is approved only when its benefits outweigh its costs

Foreign exchange rate

Price in one currency in terms of another

Appreciation

Increase in currency value

Depreciation

Loss in currency value

Determinants of foreign exchange rates

- Relative price differences and PPP

- Interest rates and money supply

- productivity and balance of payments

- Exchange rate policies

- Investor psychology

Supply and demand of foreign exchange

- Commodity's price is fundamentally determined by its supply and demand

- Strong demand will lead to price hikes

- Oversupply will result in price drops

Relative price difference

- purchasing power parity (PPP)

- determines equivalent amount of goods and services different currencies can purchase

- captures differences in cost of living between countries

- argues that exchange rates should move towards levels that would equalize the prices of an identical basket of goods in any two countries in the long run

Interest rates and money supply

- high-interest rates enhance exchange values

- exchange rate is influenced by:

- rate of inflation

- money supply

Productivity and balance of payments

Increase in productivity:

- improves a countries competitive position in international trade

- increases the value of home currency

- changes balances of trade

Affects Balance of Payments (BOP):

- currency account surplus leads to currency appreciation

Floating exchange rate policy

Willingness of a government to let demand and supply conditions determine exchange rates

-clean float

-dirty float

Clean float

pure market solution to determine exchange rates

Dirty float

uses selective government intervention to determine exchange rates

Fixed rate policy

Setting exchange rate of a currency relative to other currencies

Pegging

Setting exchange rate of a domestic currency in terms of another currency

- stabilizes import and export prices

- restrains domestic inflation when pegged to a country with relatively no inflation

Investor psychology

predicts short-run movements of exchange rates

Bandwagon effect

Effect of investors moving in the same direction at the same time, like a herd

capital flight

phenomenon in which a large number of individuals and companies exchange domestic currencies for a foreign currency

The gold standard (1870 - 1914)

Value of major currencies was maintained by fixing their prices in terms of gold

-Global peg system

-less volatile

-highly predictable and stable

The Bretton woods system (1944 - 1973)

All currencies were pegged at a fixed rate to the U.S. dollar

- reflected the higher U.S. productivity level

- rising productivity in the world and U.S. inflationary policies led to its demise

The post-Bretton woods system (1973 - present)

- System of flexible exchange rate regimes

- No official common denominator

- Characterized by the diversity of exchange rates

Drawbacks:

- Turbulence and uncertainty

International monetary fund (IMF)

International organization

- Established to promote international monetary cooperation, exchange stability, and orderly exchange arrangements

Core responsibility: lending

- collects fund from member countries

Strategic responses of financial companies

Primary strategic goal is to profit from the foreign exchange market

Foreign exchange market

The market where individuals, firms, governments, and banks buy and sell currencies of other countries

Functions:

- to service the needs of trade and investments

- to trade in its own commodity

Types of foreign exchange transactions

spot transaction, forward transaction, currency hedging, forward discount, forward premium, currency swap

Spot transaction

classic single shot exchange of one currency for another

Forward transaction

participants buy and sell currencies now for future delivery

Currency hedging

Protects traders and investors from exposure to the fluctuations of the spot rate

Forward discount

Forward rate of one currency relative to another currency is higher than the spot rate

Forward premium

Forward rate of one currency relative to another currency is lower than the spot rate

Currency swap

conversion of one currency into another at time one.

- Includes an agreement to report it to the original currency at a specified time two in the future

Spread

difference between offer rate and bid rate

Offer rate

Price at which a bank is willing to sell a currency

Bid rate

price at which bank is willing to buy a currency

Outcome of integrated nature of the foreign exchange market

- Razor thin spread

- Quick decisions on buying and selling

- Ever-increasing volume in order to make more profits

Strategic responses of nonfinancial companies

companies cope with currency risks by:

- Invoicing their own currency

- currency hedging

- strategic hedging

Strategic hedging

Spreading out activities across different currency zones to offset currency losses in one region through gains in other countries

Regional Economic Integration

efforts to reduce trade and investment barriers within one region

Global economic integration

efforts to reduce trade and investment barriers around the globe

General Agreement on Tariffs and Trade (GATT)

Multilateral agreement governing the international trade of goods

- became the world trade organization (WTO) in 1995

- economic integration in Europe led to the European Union EU

Benefits of global integration

Political:

- Promotes peace with trade as investment

- builds confidence in multilateral trading system

Economic:

- Disputes handled constructively

- Rules make life easier and discrimination impossible for participating countries

- Free trade and investment raise incomes and stimulate economic growth

GATT

General Agreement on Tariffs and Trade

- Reduced level of tariffs through multilateral negotiations

Areas of concern:

- Did not cover trade in services and intellectual property

- Loopholes in merchandise trade require reforming

- Global recessions led to governments to invoke nontariff barriers (NTBs)

World Trade Organization (WTO) (1955 - Present)

GATT's successor

Features:

- General agreement on trade in services (GATs)

- Trade related aspects of intellectual property rights(TRIPS)

-Trade dispute settlement mechanisms

- Trade policy reviews

The Doha round

Round of WTO negotiations to:

- reduce agricultural subsidies in developed countries

- slash tariffs

- free up trade in services

- strengthen intellectual property protection

Pros of regional economic integration

- promotes peace

- free trade and investment raise incomes and stimulate economic growth

- enables constructive handling of disputes

- consistent rules prevent discrimination

Cons of regional economic integration

- discrimination against firms outside of region

- loss of sovereignty

Types of regional economic integration

- political union

- economic union

- common market

- customs union

- free trade area

Political origin of the EU

- Countries integrated to end the cycle of hatred and violence

- Signed the European coal and steel community (ECSC) treaty in 1951

- Signed by Belgium, France, West Germany, Italy, Luxembourg, and the Netherlands

Treaty of Rome 1957

Launched the European Economic Community (EEC)

Maastricht Treaty 1993

Established a single Economic Union

Lisbon Treaty 2009

Amended the Maastricht treaty that served as a constitutional basis for the EU

European Union (EU)

Has 28 member countries, 500 million citizens, $18 trillion GDP

- Contributes about 26% of the worlds GDP

- Worlds largest economy

- Largest exporter and importer of goods and services

- Does not have internal trade barriers

- Built a single market in aviation

- EU and its predecessors gave more than 60 years of peace and prosperity

Euro

Currency used in 19 countries

Benefits of Adopting the Euro

1. Reduce currency conversion costs

2. Facilitate direct price comparison

3. Impose monetary discipline on governments

Costs of Adopting the Euro

1. Unable to implement independent monetary policy

2. Limit the flexibility in fiscal policy (in areas such as deficit spending)

Challenges faced by the EU

- Internal divisions

- Enlargement concerns

- Existential crisis

North American Free Trade Agreement (NAFTA)

FTA among Canada, Mexico, and the United States

Benefits of NAFTA

- Trilateral merchandise trade increased to $1.1 Trillion in 2016

- Increase in U.S. exports to Canada and Mexico

Costs of NAFTA

- Loss of jobs

- Many multinationals shifted work to china

Andean Community and Mercosur

- Customs unions formed in 1969 and 1991, respectively

- Not very effective as the majority of its members' trade is outside the region

Union of South American Nations (USAN)

- Formed in 2008 by integrating Andean community and Mercosur

- Modeled after EU

United States - Dominican Republic - Central American Free Trade Agreement (CAFTA)

- Formed in 2005

- Modeled after NAFTA

- Six CAFTA countries collectively represent the second largest U.S. export market in Latin America

- Central American Countries, Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua

Australia-New Zealand Closer Economic Relations Trade Agreement (ANZCERTA or CER)

- Removed tariffs and NTBs

- Allowed citizens of one country to freely work and live in the other country

Association of Southeast Asia Nations (ASEAN)

- Established ASEAN free trade market

- Main trade partners are outside the region

- Launched ASEAN - China free trade agreement (ACFTA) 2010

Asia - Pacific Economic Cooperation (APEC)

Includes ASEAN, CER, NAFTA, Japan, Chile, Peru, Russia

- contributes 46% of world trade

- contributes 54% of world GDP

Trans - Pacific partnership (TPP)

Multilateral free trade agreement being negotiated by 12 Asia Pacific Countries

Management methods for Global and regional economic integration

Focus on regional than global levels

- Most countries within a region share some cultural, economic, and geographical similarities

- Can lower the liability of foreignness when moving within the region

Small and medium-sized enterprise (SME)

Firms with:

- Fewer than 500 employees in the U.S.

- Fewer than 250 employees in the EU

Entreoreneurship

Identification and exploitation of previously unexplored opportunities

Entrepreneurs

Founders and owners of new businesses or managers of existing firms

International Entrepreneurship

Innovative, proactive, and risk-seeking behavior that crosses national borders

- Intended to create wealth in organizations

Institutions and entrepreneurship

Development of entrepreneurship within a country us based on its entrepreneur friendly institutional framework

Informal institutions

Individualistic and low uncertainty avoidance societies encourage entrepreneurship

Resources and entrepreneurship

Value (V), Rarity(R), Imitability(I), Organizational(O)

Characteristics of a growing entrepreneurial firm

growth, innovation, financing, internationalization

Born global firm

Start-up company that attempts to do business abroad from inception

- International transaction costs are high

Reasons:

- Numerous differences in formal institutions and informal institutions

- high potential opportunism