ECO 239 Managerial Economics Midterm

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

61 Terms

Accounting profits

The total amount of money taken in from sales minus the dollar cost of producing goods or services.

Economic profits

the difference between the total revenue and the total opportunity cost of producing the firm’s goods or services.

Opportunity cost

the loss of potential gain from other alternatives when one alternative is chosen

sum of explicit costs and implicit costs

Explicit cost

Accounting cost

Implicit cost

Best alternative

Consumer-Producer Rivalry

Consumers attempt to locate low prices, while producers attempt to charge high prices.

Consumer-Consumer Rivalry

Scarcity of goods reduces the negotiating power of consumers as they compete for the right to those goods.

Producer-Producer Rivalry

Scarcity of consumers causes producers to compete with one another for the right to service customers.

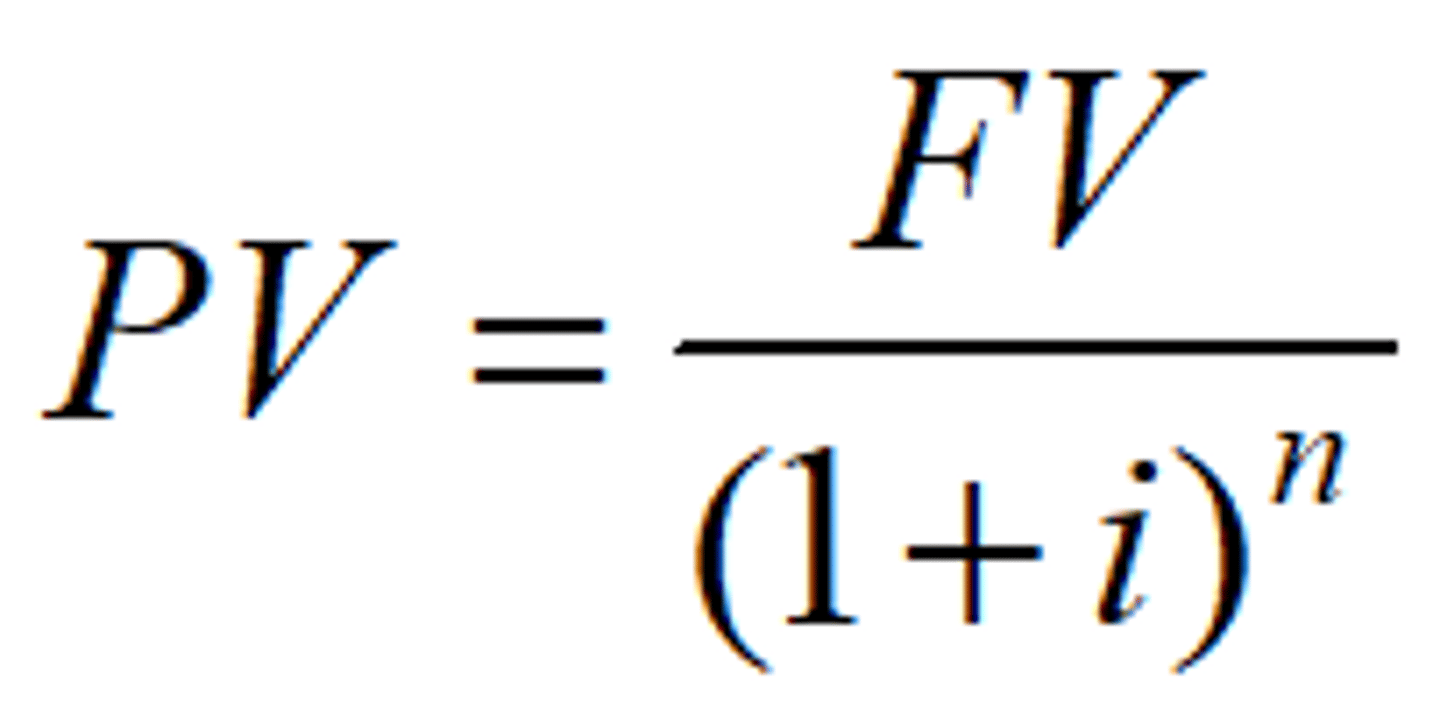

Present value

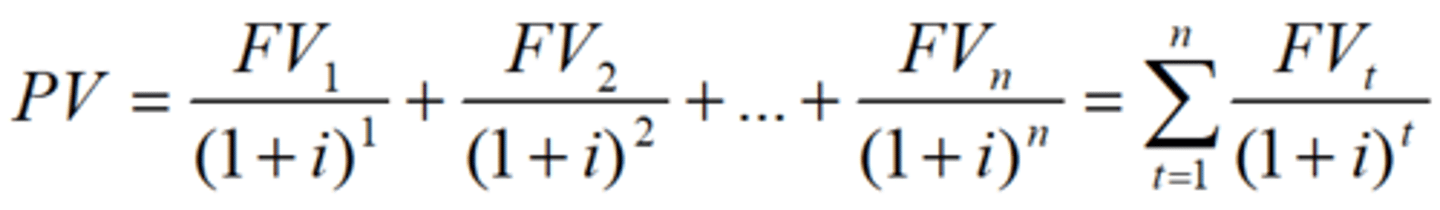

Present value of a stream

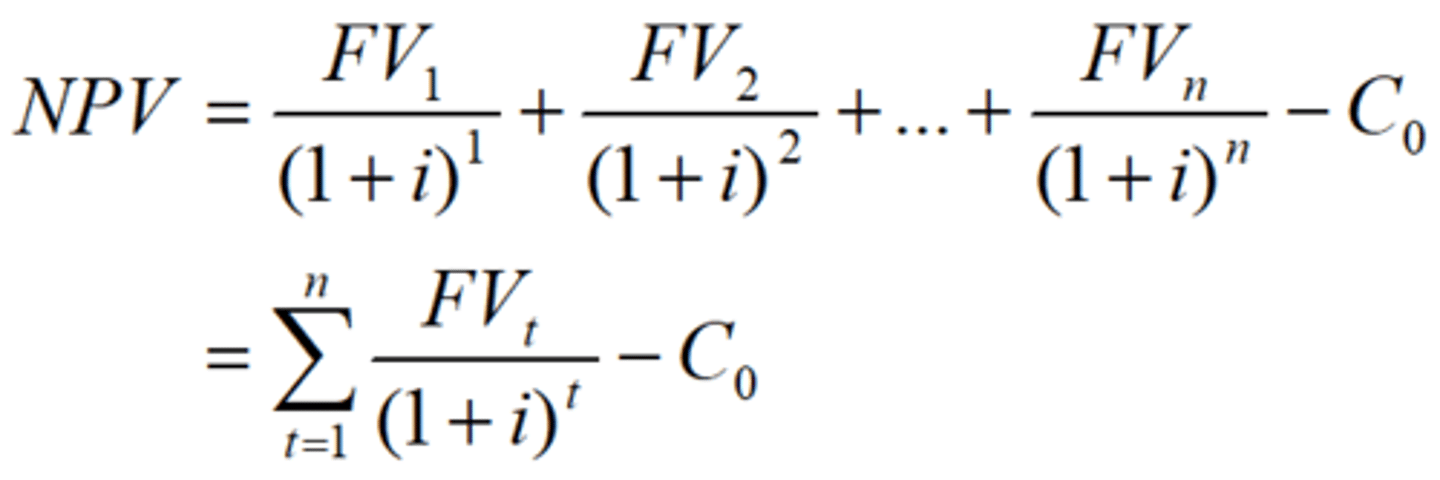

Net present value

If NPV is greater than or equal to zero, the manager should carry out the project.

If NPV is less than zero, the manager should NOT carry out the project.

Managerial Control Variables

Output, Price, Product Quality, Advertising, R&D

Basic Managerial Question

How to choose the level of control variables to maximize profits?

Marginal Analysis

Marginal benefit (MB): The change in total benefits arising from a change in the managerial control variable.

Marginal cost (MC): The change in total costs arising from a change in the managerial control variable.

Net benefit is maximized when marginal benefit equals marginal cost.

Chapter 2

Law of Demand

Price and quantity demanded are inversely related, holding other factors constant

Normal goods

Increase (decrease) in income leads to an increase (decrease) in demand.

Inferior goods

Increase (decrease) in income leads to an decrease (increase) in demand

Complement

Increase in the price of one good leads to a decrease in the demand of other good

Substitutes

Increase in the price of one good leads to an increase in the demand for the other good

Demand Shifters

- Income

- Price of related goods

- Advertisements

- Population

- Consumer expectation

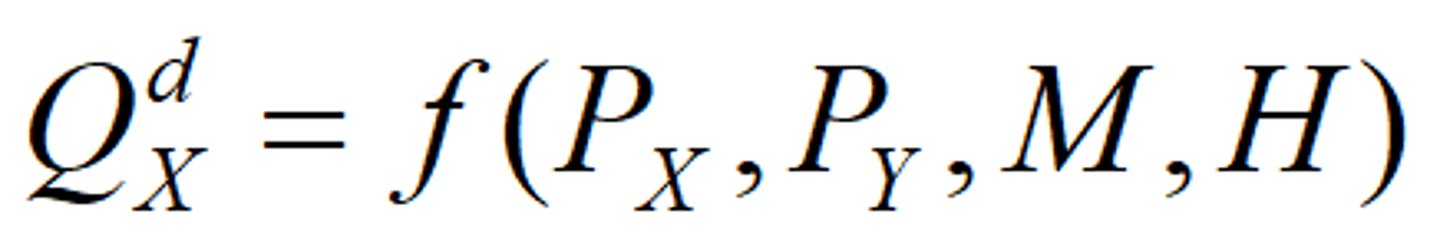

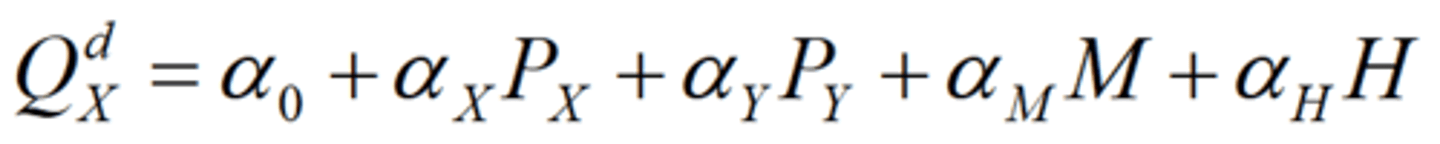

Demand function general form

The linear demand function

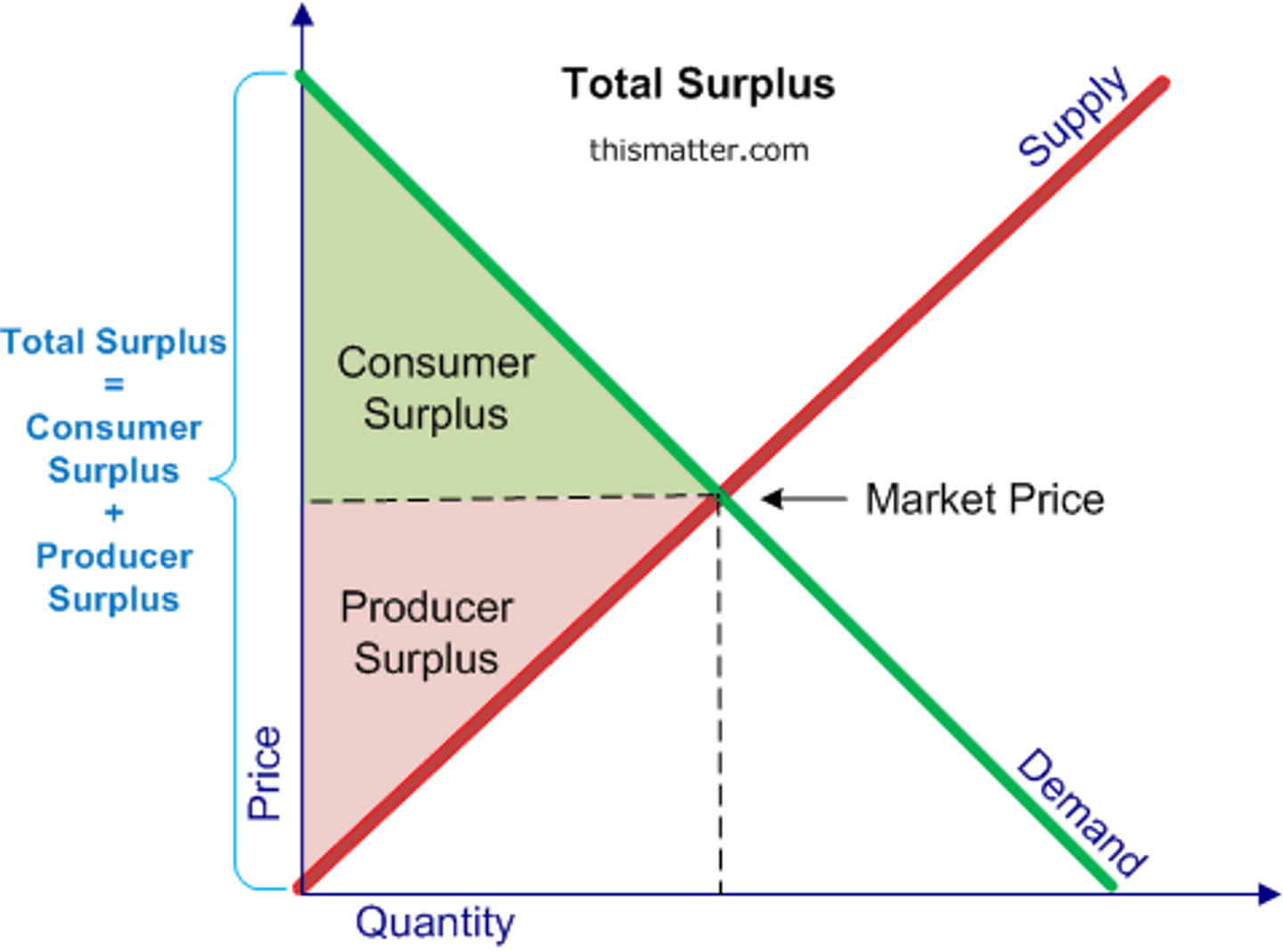

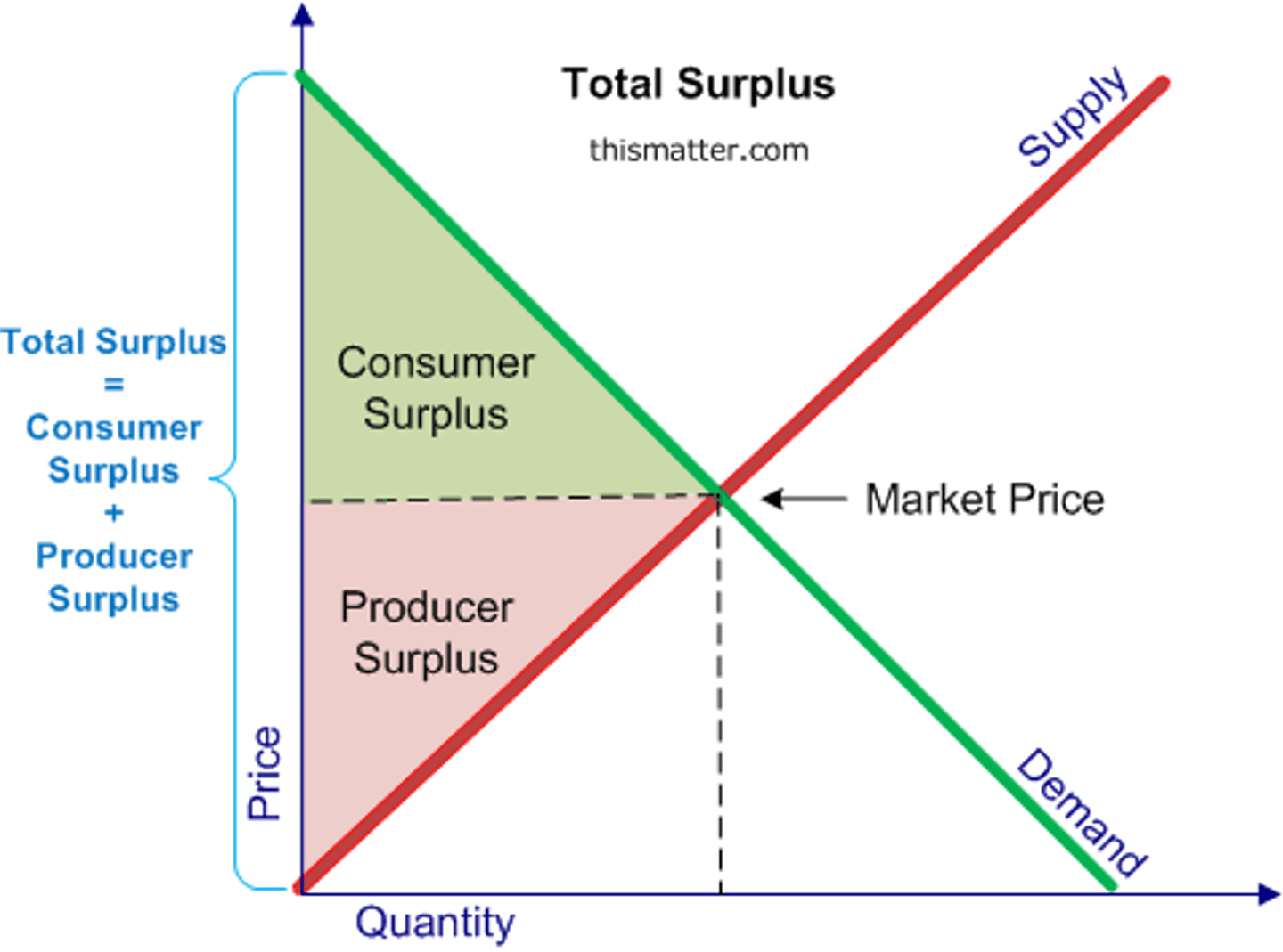

Consumer Surplus

The value consumers get from a good but do not have to pay for

Law of Supply

As the price of a good rises (falls) and other things remain constant, the quantity supplied of the good rises (falls)

Determinants of Supply

- Input prices

- Technology or government regulations

- Number of firms

- Substitutes in production

- Taxes

- Producer expectations

Producer Surplus

The amount producers receive in excess of the amount necessary to induce them to produce the good

Market Equilibrium

demand = supply

Price Floor

The minimum legal price that can be charged

Ex. minimum wage, farming goods

Surplus

Price Ceiling

The maximum legal price that can be charged

Ex. Rent

Shortage

Chapter 3

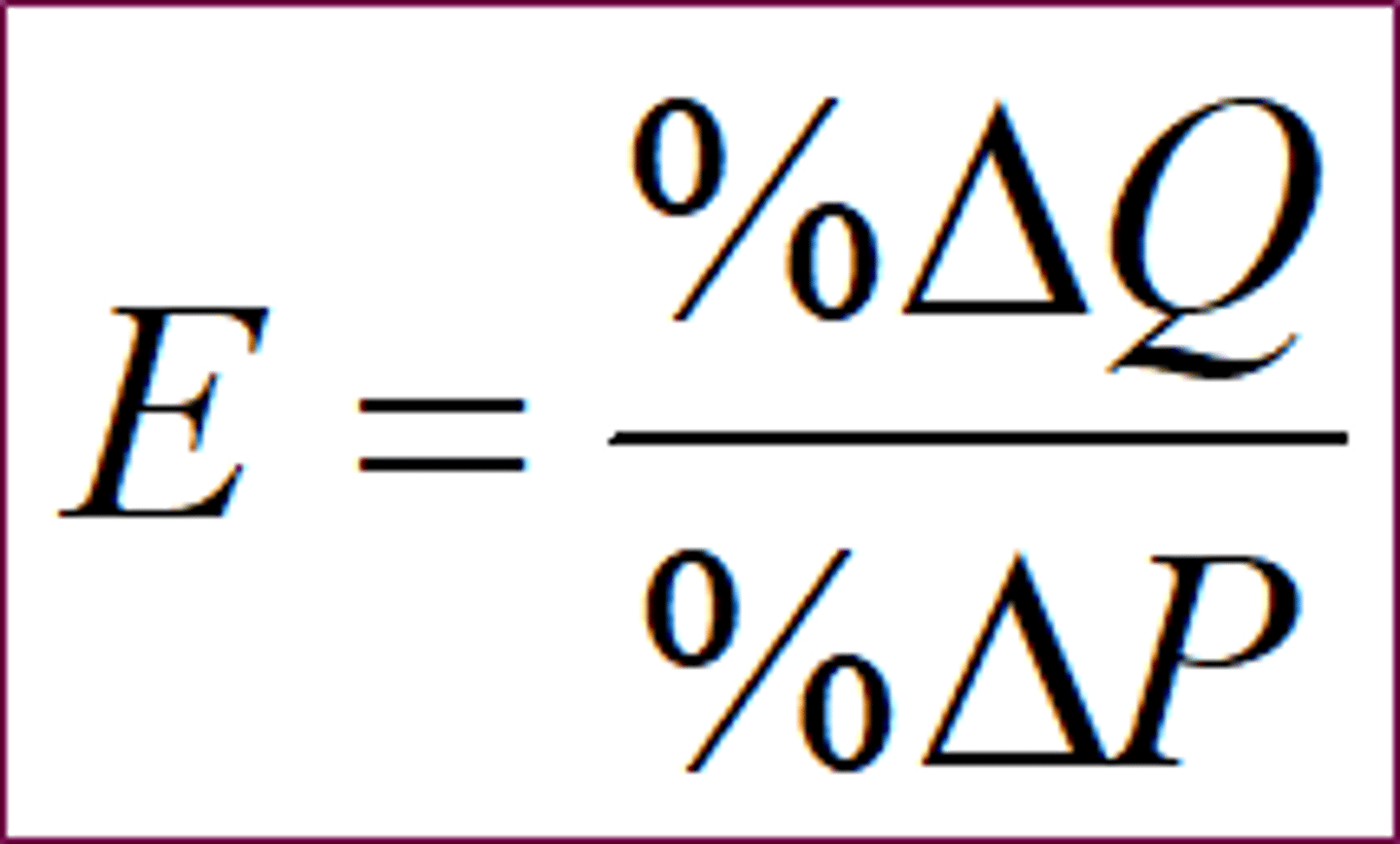

Elasticity

- is a measure of how much buyers and sellers respond to changes in market conditions

- allows us to analyze supply and demand with greater precision

Price Elasticity of Demand

- the percentage change in quantity demanded given a percent change in the price

- It is a measure of how much the quantity demanded of a good responds to a change in the price of that good

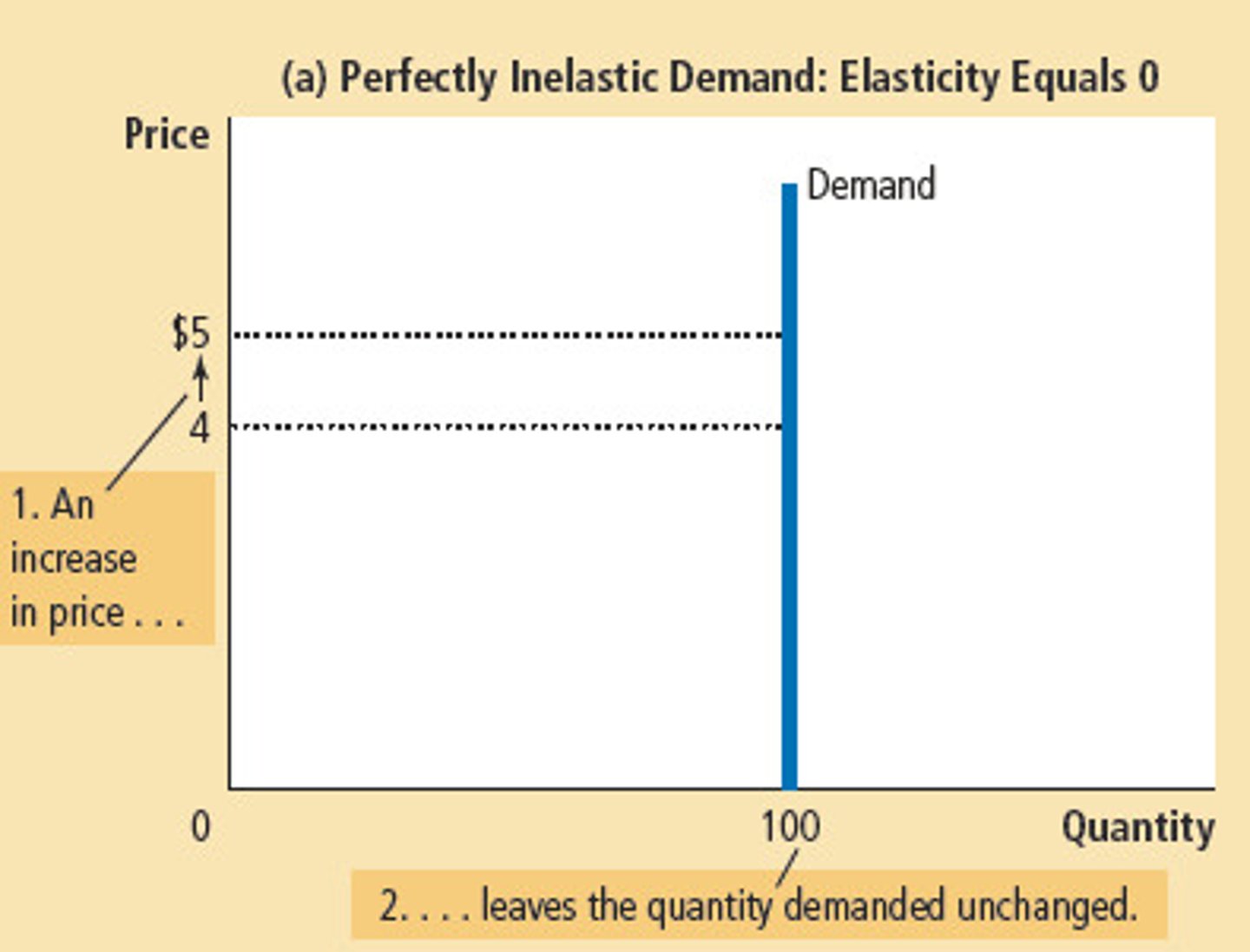

Perfectly Inelastic Demand

Elasticity equals 0

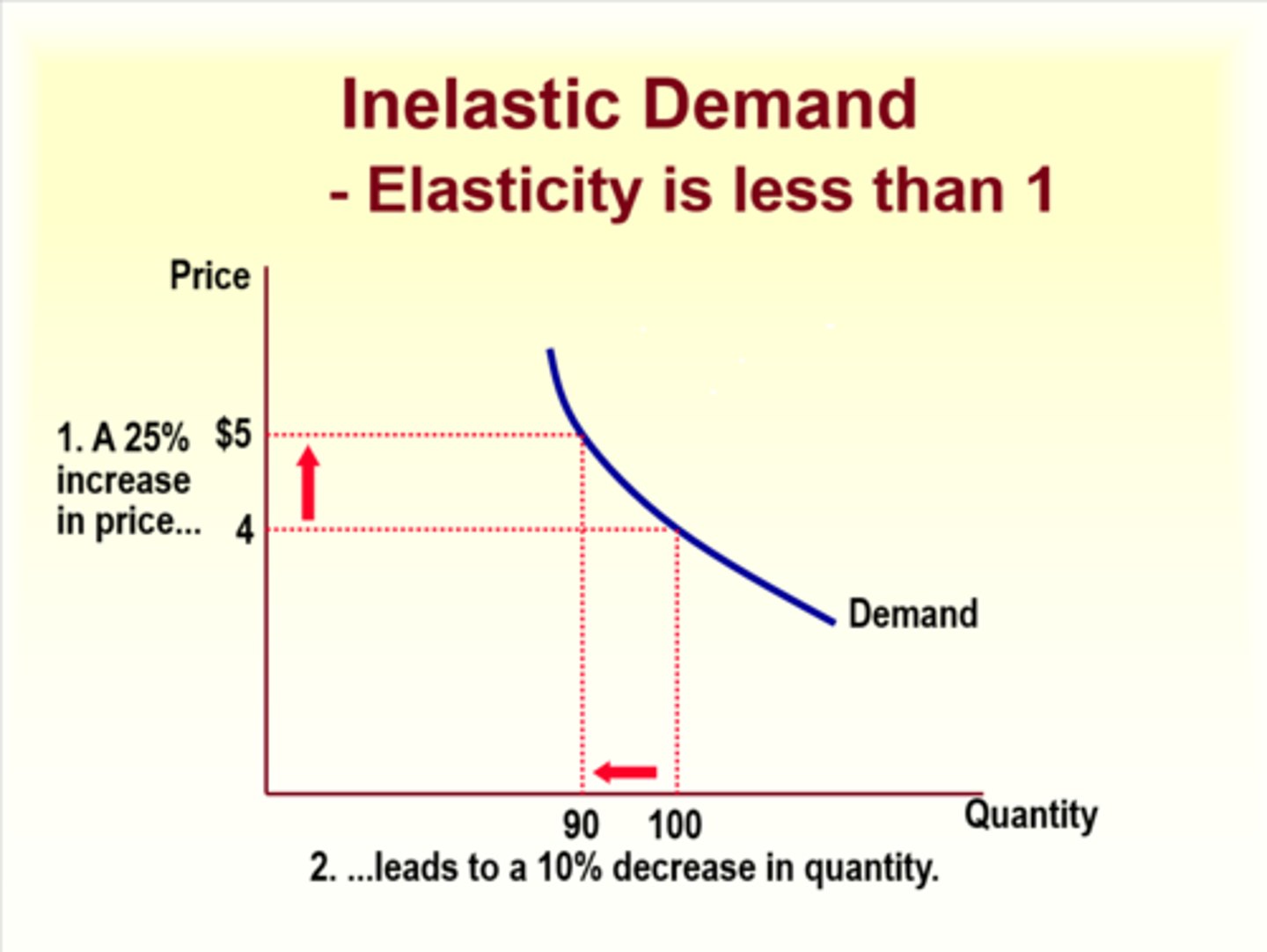

Inelastic Demand

Elasticity is less than 1

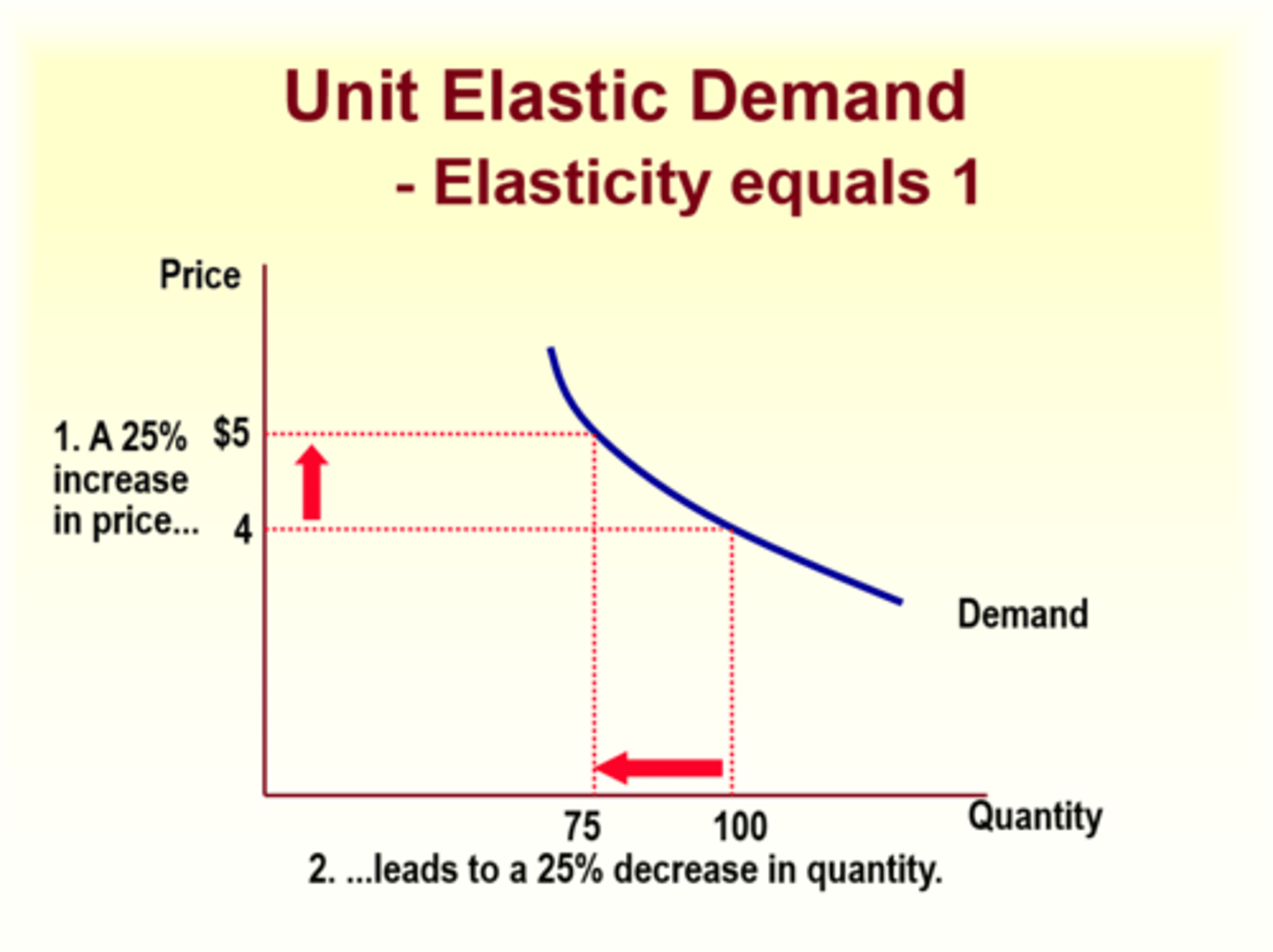

Unit Elastic Demand

Elasticity equals 1

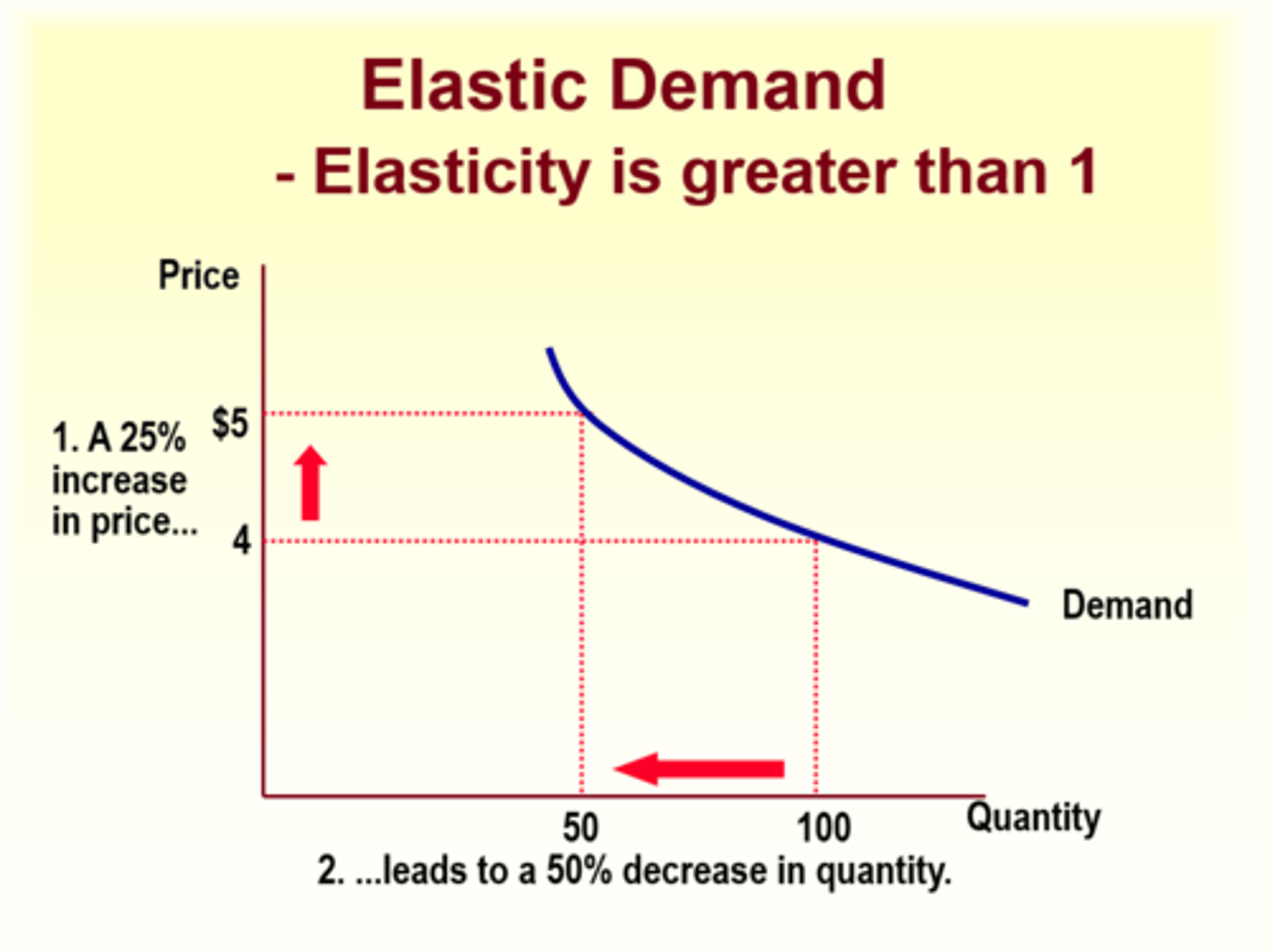

Elastic Demand

Elasticity is greater than 1

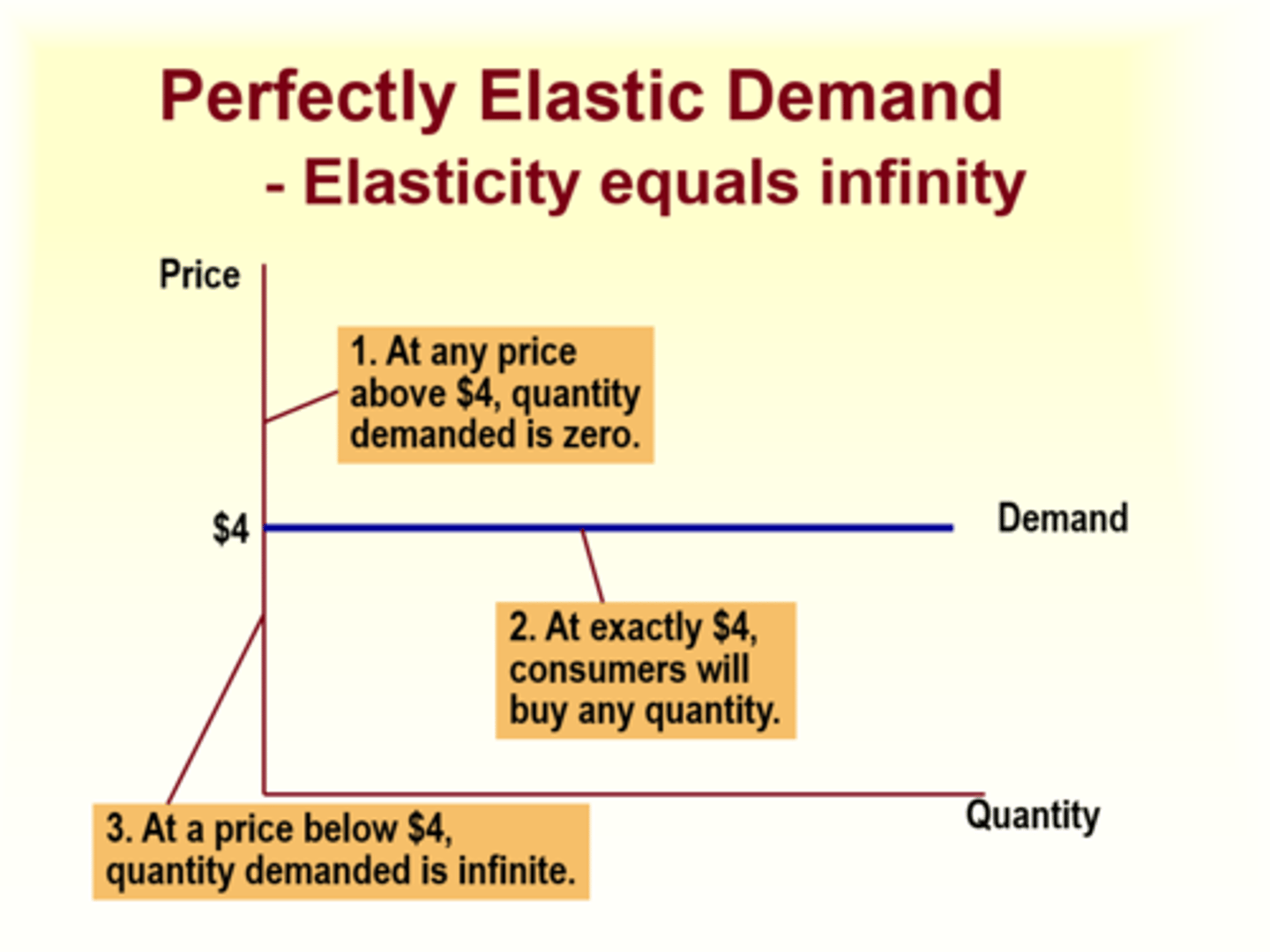

Perfectly Elastic Demand

Elasticity equals infinity

Available Substitutes

The greater the number of substitute products, the greater the elasticity

Time

Elasticity tend to be greater over the long run because consumers have more time to adjust their behavior to the price change

Expenditure Share

Products requiring a large proportion of the consumer's income tend to have greater elasticity

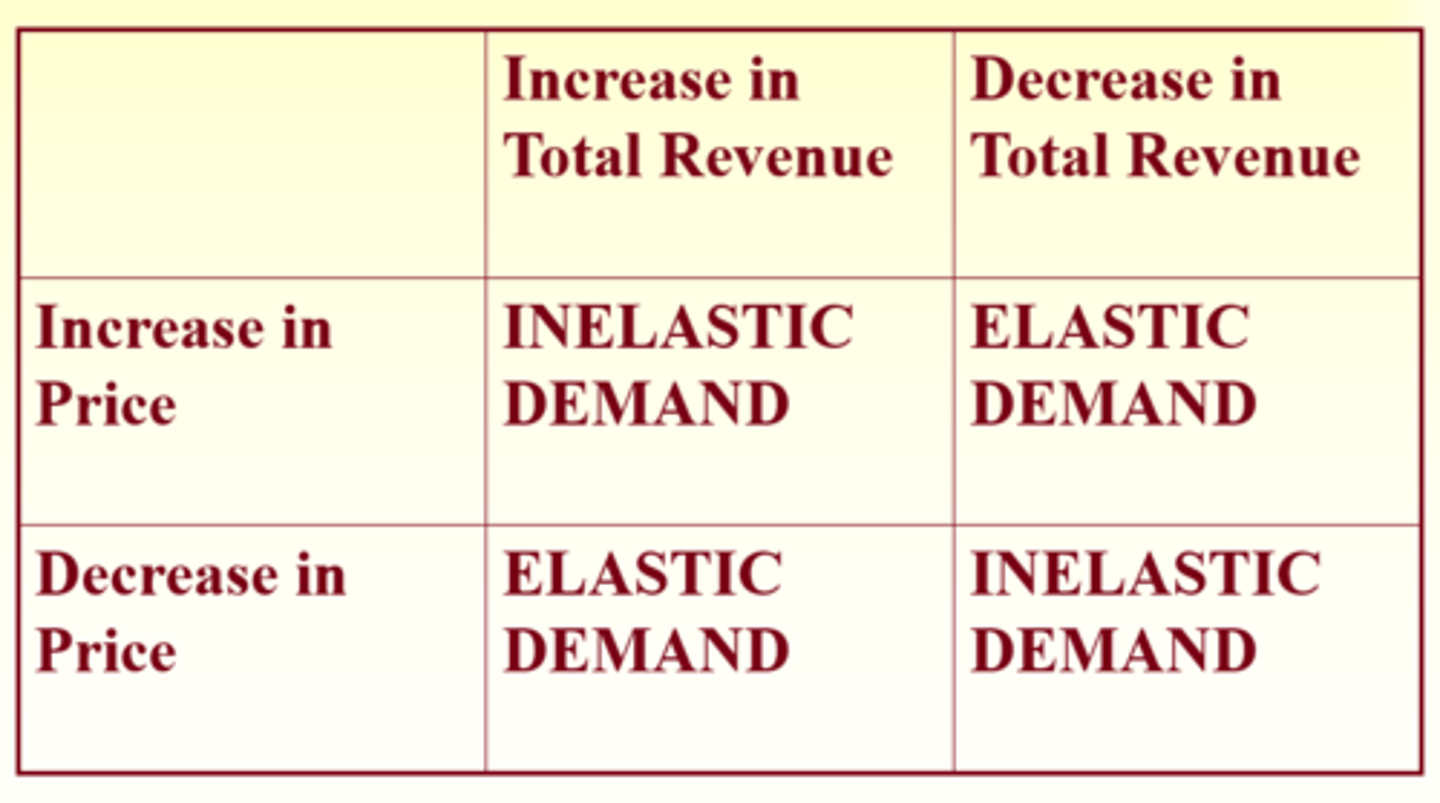

Elasticity and Total Revenue

Total revenue received for a supplier is the price charged times the quantity

Total revenue = total quantity sold * price of good

The Total Revenue Test for Elasticity

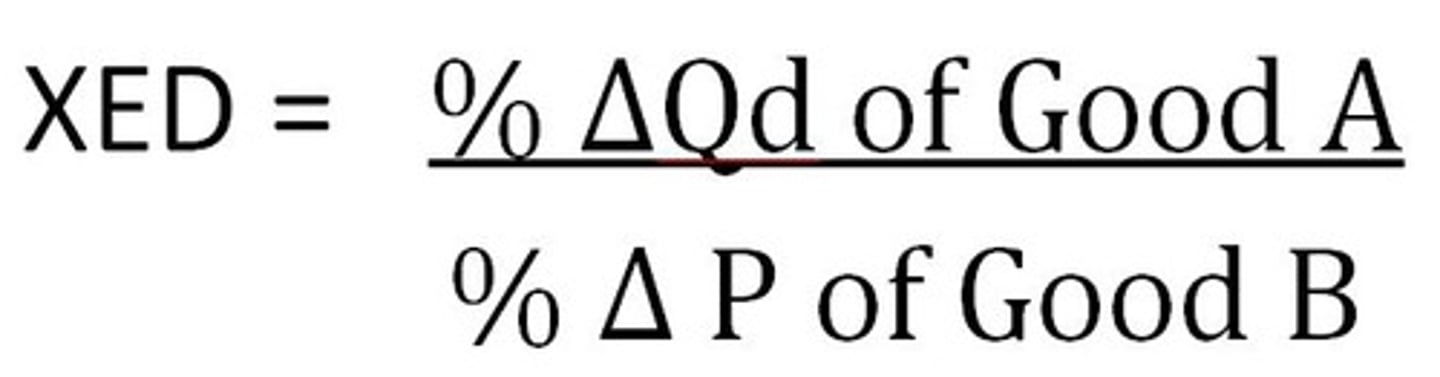

Cross Price Elasticity

The percentage change in the quantity demanded of one good that arises due to a given percentage change of the price of a related good.

- complements E<0 a consumption of a good goes down as the price of a related good goes up (-)

- substitutes E>0 a consumption of a good goes up as the price of a related good goes up (+)

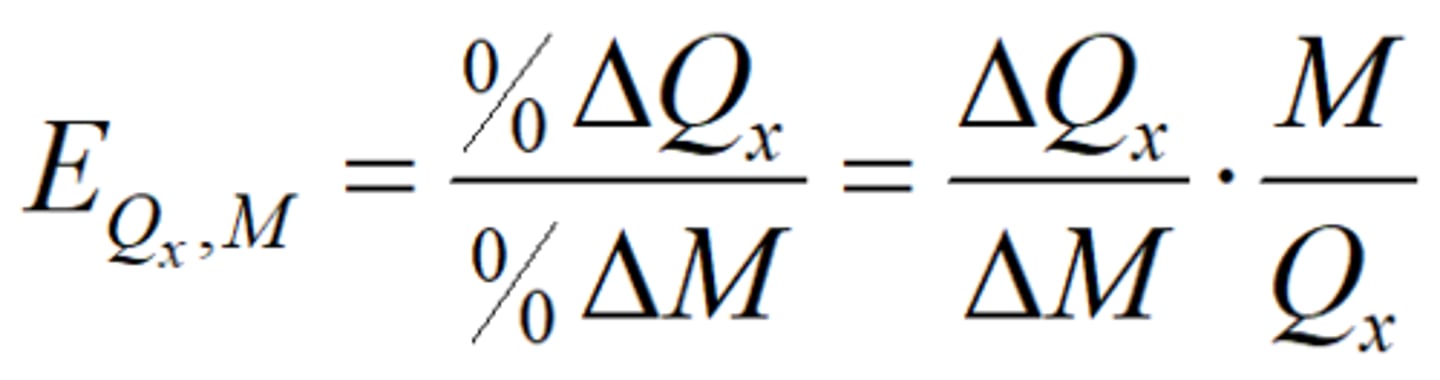

Income Elasticity

The percentage change in quantity demanded that arises due to a given percentage change in income

Inferior goods (E < 0) a consumption of a good goes down as income goes up

Normal goods (E > 0)

Chapter 5

Production Function

A function that defines the maximum amount of output that can be produced with a given set of inputs.

The production function summarizes the available technology.

Short-Run vs. Long-Run Decisions.

Depending on the decision horizon, factors can be divided into fixed and variable factors.

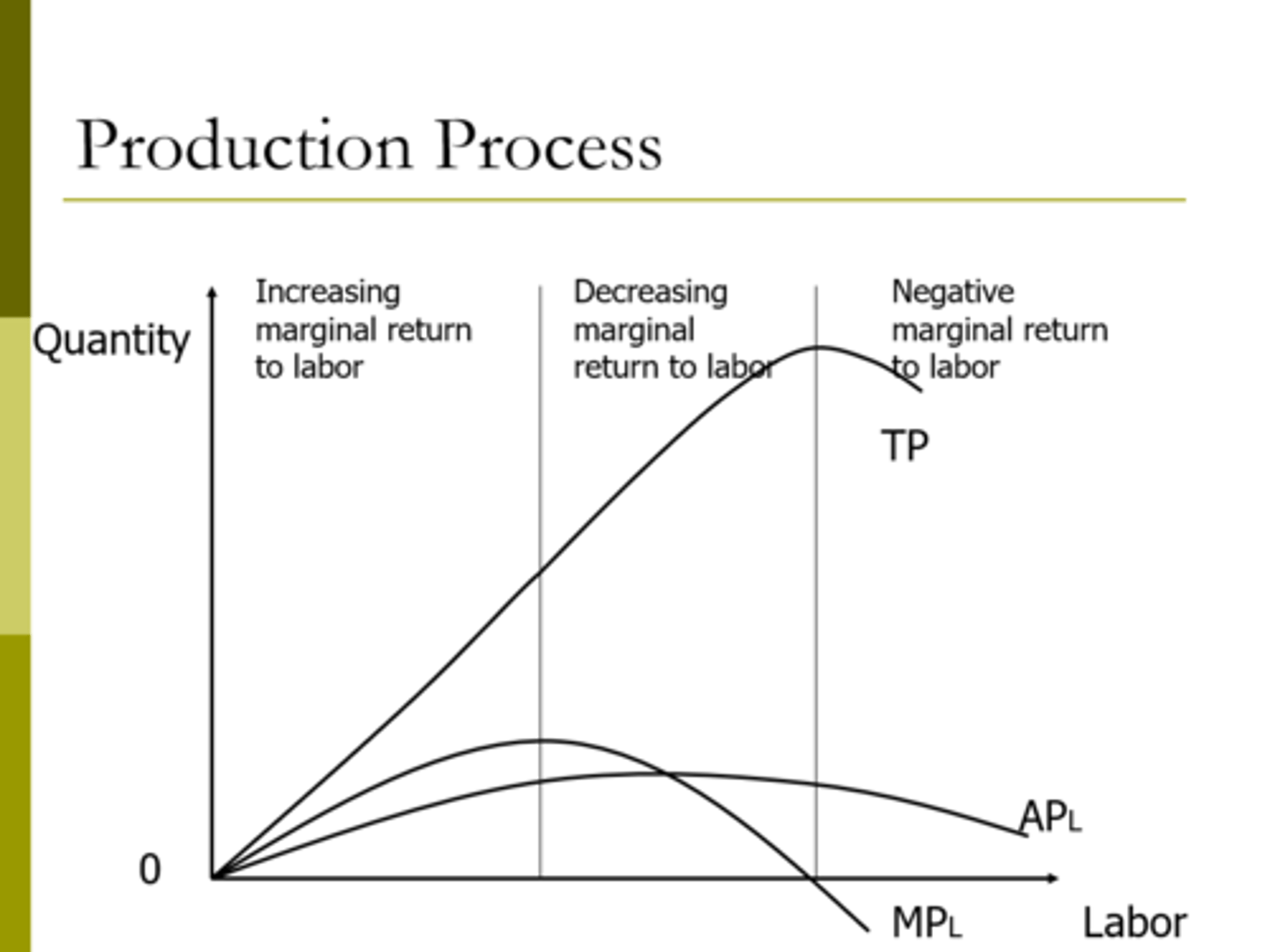

Production Process

Use the Right Level of Inputs

Value marginal product (VMP):

The (monetary) value of the output produced by the last unit of input.

Linear Production Function

Form:

Linear Production Function

Marginal Products:

Cost Function

Cost function relates the output levels to the total cost (the minimum cost).

-Fixed cost (FC): cost of fixed inputs.

- Variable cost (VC): cost of variable inputs.

- Total cost: C(Q) = FC + VC.

Algebraic form of cost function C(Q).

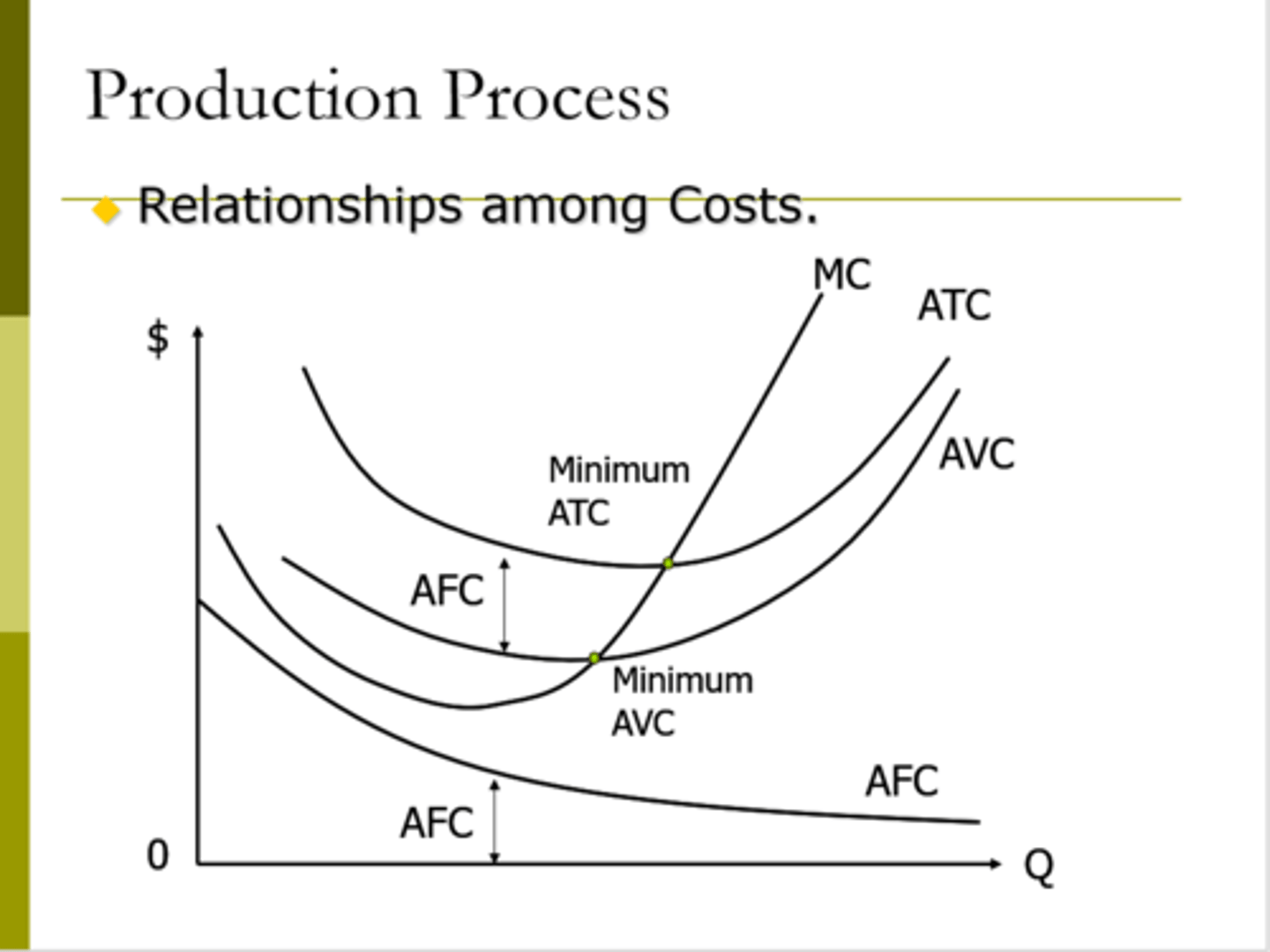

Average and Marginal Costs

Average Fixed Cost: AFC = FC/Q

Average Variable Cost: AVC = VC/Q

Average Total Cost: ATC = C(Q)/Q

Marginal Cost: MC = ∂ C/ ∂ Q

Relationships Among Costs

Chapter 8

Perfect Competition

- Many buyers and sellers

- Homogeneous product

- Perfect information

- No transaction cost

- Free entry and exit

Monopoly

- Single firm serves the "relevant market"

- Most monopolies are "local" monopolies

- The demand for the firm's product is the market demand curve

- The firm has control over the price

- But the price charged affects the quantity demanded of the monopolist's product

Monopolistic Competition

- Numerous buyers and sellers

- Implication: each firm has relatively small market share; each firm must be sensitive to average market price of its product (substitutes of each other’s product); collusion is impossible due to the large number of firms

- Differentiated products

- Implication: Since products are differentiated, each firm faces a downward sloping demand curve. Firms have limited market power.

- Product differentiation

- Free entry and exit

- Implication: Firms will earn zero profits in the long run.

Still learning (2)

You've started learning these terms. Keep it up!